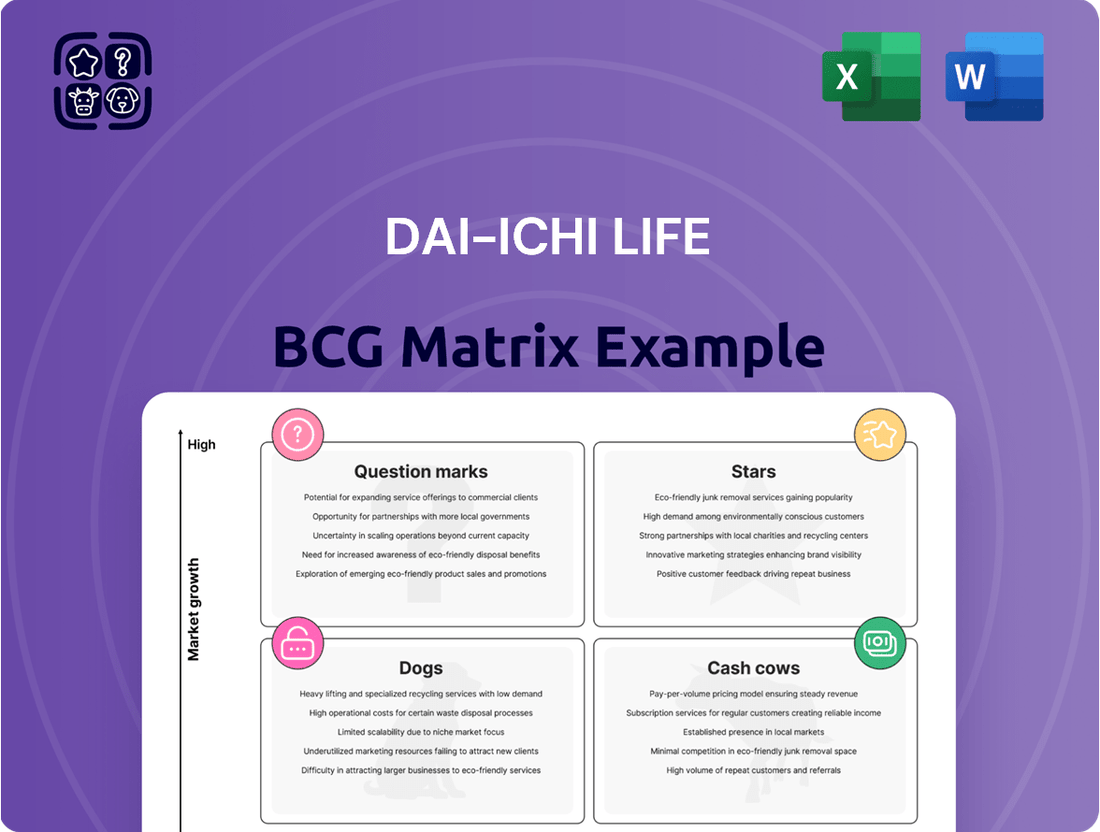

Dai-ichi Life Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dai-ichi Life Bundle

Uncover the strategic positioning of Dai-ichi Life's product portfolio with our comprehensive BCG Matrix analysis. See which offerings are driving growth and which require careful consideration. Purchase the full report for a detailed breakdown of Stars, Cash Cows, Dogs, and Question Marks, along with actionable insights to optimize your investment and product strategy.

Stars

Dai-ichi Life Holdings is aggressively expanding its global insurance operations, targeting a significant portion of its group profit to come from overseas ventures. This strategic push aims for international business to contribute around 40% of the group's total profit, reflecting a clear ambition for global market leadership.

The company is employing a high-growth, high-market-share approach in its international expansion, actively seeking acquisitions in the insurance and asset management sectors. For instance, Dai-ichi Life's acquisition of Protective Life in the United States has been a cornerstone of its international strategy, bolstering its presence in a key market.

Dai-ichi Life's strategic global partnership with Microsoft, announced in late 2023, positions its digital transformation and AI integration efforts squarely in the Stars category. This collaboration aims to accelerate innovation and pivot the company towards becoming a comprehensive insurance services business.

By leveraging advanced AI tools, such as Azure OpenAI Service, Dai-ichi Life is enhancing customer experience and streamlining operations. This focus on making insurance services more convenient and accessible is a key driver for future growth, with significant investments planned in AI-powered solutions throughout 2024 and beyond.

Protective Life Corporation, Dai-ichi Life's US arm, is a robust player expected to boost capital efficiency and profits. This growth is fueled by expanding insurance and annuity sales, strategic acquisitions, and enhanced asset management.

In 2024, Protective Life's contribution to Dai-ichi Life's overseas segment is substantial, positioning it as a key growth engine. The company's focus on increasing sales of insurance and annuity products is a primary driver for its strong performance.

TAL Dai-ichi Life Australia

TAL Dai-ichi Life Australia stands as a robust performer within Dai-ichi Life's global operations, consistently contributing to the group's adjusted profit. Its strategic foothold in the Oceania market underscores its role as a key player in a region experiencing growth, solidifying its position as a market leader.

TAL's financial strength is evident. For the fiscal year ending March 31, 2024, TAL reported a strong underlying profit after tax of AUD 421 million, demonstrating its sustained profitability and operational efficiency. This performance highlights TAL's significant contribution to Dai-ichi Life's international segment.

- Market Leadership: TAL holds a dominant position in the Australian life insurance market, evidenced by its significant market share.

- Profit Contribution: The company consistently delivers substantial profits, making it a vital asset in Dai-ichi Life's overseas portfolio.

- Strategic Importance: TAL's operations in Australia are crucial for Dai-ichi Life's expansion and presence in the growing Oceania region.

- Financial Performance: In FY24, TAL's underlying profit after tax reached AUD 421 million, showcasing its financial health and operational success.

New Product Launches in Domestic Market

Dai-ichi Life's domestic new product launches have demonstrated robust performance, surpassing initial sales expectations in Japan. These innovative products are strategically developed to align with changing consumer preferences, contributing positively to the company's adjusted profit growth.

- Strong Sales Volumes: New product introductions in the domestic market have achieved sales volumes that exceed initial forecasts, indicating successful market penetration.

- Catering to Evolving Needs: The product portfolio is designed to meet the dynamic needs of Japanese consumers, a key driver for their positive reception.

- Contribution to Profitability: These launches are directly contributing to the growth in adjusted profit, reflecting their success in capturing market share within specific, expanding product segments.

Dai-ichi Life's strategic investments in digital transformation and AI integration, particularly through its partnership with Microsoft, firmly place these initiatives in the Stars category. Leveraging advanced AI tools like Azure OpenAI Service, the company aims to revolutionize customer experience and operational efficiency throughout 2024. This forward-thinking approach is designed to accelerate innovation and reposition Dai-ichi Life as a comprehensive insurance services provider.

What is included in the product

This BCG Matrix overview for Dai-ichi Life analyzes its business units across Stars, Cash Cows, Question Marks, and Dogs.

It provides strategic guidance on investment, holding, or divesting each unit based on market share and growth.

The Dai-ichi Life BCG Matrix offers a clear, one-page overview, simplifying complex business unit performance for strategic decision-making.

Cash Cows

Dai-ichi Life's core domestic life insurance business in Japan is a powerful cash cow, forming the bedrock of its financial strength. This segment consistently delivers the bulk of the company's consolidated ordinary revenues, underscoring its importance. For the fiscal year ending March 31, 2024, Dai-ichi Life reported total revenue of ¥10,575.9 billion, with its domestic life insurance operations being the primary contributor.

Established annuity products within Dai-ichi Life's portfolio are prime examples of cash cows. These mature offerings, such as structured settlement annuities and universal life insurance, consistently generate substantial cash flow with minimal growth expectations.

These in-force blocks of business are significant profit contributors. For instance, a strategic reinsurance deal involving Protective Life Corp. in 2023, which reinsured approximately $5 billion in annuity reserves, highlights the considerable value and cash-generating capacity of these established products.

Dai-ichi Life's traditional distribution channels in Japan, a cornerstone of its domestic business, operate as cash cows. This extensive network, cultivated over many years, secures a substantial market share and consistently delivers new policy sales and renewals.

Despite the ongoing digital transformation efforts, these established channels remain the primary engine for the company's Japanese insurance operations. Their mature presence means they benefit from minimal promotional investment, solidifying their status as a reliable revenue generator.

Investment Income from Established Portfolios

Dai-ichi Life's substantial investment portfolio, characterized by its active management for stable returns, functions as a prime cash cow. This income stream is bolstered by dividend-yielding stocks and a diversified array of alternative assets. In 2024, the company reported robust performance in its investment income, with a notable increase in gains from securities sales, reflecting the maturity and effectiveness of these established holdings.

The consistent income generated from these established investment activities requires relatively minimal new capital for maintenance, allowing for efficient deployment of resources. This stability is crucial for funding other strategic initiatives within the company's broader portfolio.

- Stable Income Generation: Income from dividend stocks and alternative assets provides a reliable revenue stream.

- Improved Performance: 2024 saw positive spreads and increased gains on securities sales, enhancing cash cow contributions.

- Low Reinvestment Needs: Established portfolios require minimal new investment for ongoing operations.

Asset Management One (AMO)

Asset Management One (AMO), where Dai-ichi Life Holdings holds substantial voting and economic interest, is a prime example of a Cash Cow within the group's BCG matrix.

AMO consistently generates robust revenue through its established asset management operations. This non-insurance segment delivers predictable fee-based income, bolstering the group's adjusted profit. Its strong market share in asset management underscores its stable and reliable performance.

- AMO's Contribution: In fiscal year 2023, Dai-ichi Life Holdings reported that its consolidated net income attributable to shareholders was ¥305.9 billion, with asset management businesses playing a significant role in this profitability.

- Fee-Based Income Stability: The recurring nature of asset management fees provides a stable revenue stream, insulating AMO from the more cyclical nature of insurance underwriting.

- Market Position: As of early 2024, AMO manages a substantial portion of assets within the Japanese market, indicating a high degree of trust and a dominant presence that supports its Cash Cow status.

- Group Profitability: The consistent earnings from AMO directly contribute to Dai-ichi Life Holdings' overall financial health and its ability to invest in other business segments.

Dai-ichi Life's core domestic life insurance business in Japan is a powerful cash cow, consistently delivering the bulk of the company's consolidated ordinary revenues. For the fiscal year ending March 31, 2024, Dai-ichi Life reported total revenue of ¥10,575.9 billion, with its domestic operations being the primary contributor.

Established annuity products, such as structured settlement annuities and universal life insurance, are prime examples of cash cows, generating substantial cash flow with minimal growth expectations. A strategic reinsurance deal in 2023 involving Protective Life Corp., reinsuring approximately $5 billion in annuity reserves, highlights the considerable value and cash-generating capacity of these established products.

The company's traditional distribution channels in Japan, a cornerstone of its domestic business, also operate as cash cows. This extensive network, cultivated over many years, secures a substantial market share and consistently delivers new policy sales and renewals, remaining the primary engine for the company's Japanese insurance operations.

Dai-ichi Life's substantial investment portfolio, characterized by active management for stable returns, functions as a prime cash cow, bolstered by dividend-yielding stocks and alternative assets. In 2024, the company reported robust performance in its investment income, with increased gains from securities sales, reflecting the effectiveness of these established holdings.

| Business Segment | BCG Category | Key Characteristics | 2024 Revenue Contribution (Approx.) | Growth Outlook |

| Domestic Life Insurance (Japan) | Cash Cow | Mature market, strong brand, established distribution | High (Majority of total revenue) | Low to Stable |

| Established Annuity Products | Cash Cow | Stable cash flow, low reinvestment needs | Significant | Low |

| Investment Portfolio | Cash Cow | Stable returns, dividend income, asset appreciation | Substantial | Moderate |

What You See Is What You Get

Dai-ichi Life BCG Matrix

The Dai-ichi Life BCG Matrix preview you are viewing is the exact, fully formatted report you will receive upon purchase. This document is meticulously crafted to provide strategic insights, featuring comprehensive analysis ready for immediate application in your business planning. You can be confident that no watermarks or demo content will be present in the final version you download.

Dogs

Dai-ichi Life's legacy life insurance products in Japan are facing a challenging environment, with some segments experiencing a noticeable drop in demand. This is largely attributed to shifts in the population, such as an aging society, and a growing preference for more modern, flexible insurance solutions among consumers. For instance, traditional whole life policies, while once popular, may not resonate as strongly with younger generations seeking adaptable coverage.

These older products often fall into the Dogs category of the BCG Matrix, characterized by low market growth and a low relative market share. Maintaining these offerings can be resource-intensive, diverting capital and attention from more promising growth areas. The company has indicated that substantial growth from certain domestic market segments is improbable, reinforcing the need to strategically manage these legacy portfolios.

Within Dai-ichi Life's domestic operations, certain niche segments are showing signs of weakness, fitting the 'dog' category of the BCG matrix. These are areas where products or services haven't resonated strongly with the market, possibly due to a lack of innovation or being out of sync with evolving consumer needs, particularly in light of Japan's demographic shifts.

For instance, traditional life insurance products that lack a strong health and well-being component or fail to address asset formation goals might be struggling. In 2023, the Japanese life insurance industry saw a slight contraction in premium income for some traditional products, with a growing emphasis on savings-linked and health-focused policies, indicating a potential underperformance in segments not adapting to these trends.

Inefficient manual processes and outdated IT systems at Dai-ichi Life, while not direct products, act as significant drains on company resources. These legacy systems, often characterized by slow processing times and a lack of integration, consume substantial operational capital without yielding proportionate returns in efficiency or market responsiveness. For instance, in 2023, many insurance companies reported that a significant portion of their IT budget was still allocated to maintaining legacy systems, hindering investment in more agile, digital solutions.

Non-Strategic or Divested Minor Holdings

In the context of Dai-ichi Life's portfolio, non-strategic or divested minor holdings represent investments that have historically shown weak performance and do not fit with the company's current strategic direction. These might include smaller stakes in businesses that are not core to their long-term growth objectives.

Companies often prune these types of assets to free up capital for more impactful initiatives. For instance, if a particular segment of their business is not yielding significant returns, they might choose to sell off those minor holdings. This allows for a more focused allocation of resources towards areas with higher potential, aligning with a medium-term management plan.

While specific figures for Dai-ichi Life's divested minor holdings are not publicly detailed in a way that fits this categorization, the general principle involves identifying and exiting low-growth, low-market-share entities. This strategic divestment is a common practice to enhance overall portfolio efficiency.

- Underperformance: These holdings typically exhibit consistently below-average financial returns.

- Strategic Misalignment: They do not contribute to or detract from the company's core business strategy and medium-term goals.

- Capital Reallocation: Divesting these assets allows for the redeployment of capital into higher-potential growth areas.

- Portfolio Streamlining: This process helps to simplify the investment portfolio and reduce management complexity.

Certain In-Force Blocks Subject to Reinsurance

Dai-ichi Life's strategic reinsurance of certain in-force blocks through its subsidiary, Protective Life Corp., signals a proactive approach to portfolio management. This move, involving the cession of substantial policy reserves, suggests a deliberate strategy to divest from business segments that may present lower profitability or elevated risk profiles.

The specific blocks ceded, notably structured settlement annuities and universal life insurance, are often characterized by longer durations and potentially less dynamic growth prospects compared to other insurance products. This reallocation of capital aims to optimize the company's overall risk-adjusted returns and enhance its financial flexibility.

In 2024, the global reinsurance market saw significant activity, with companies actively managing their capital and risk exposures. Dai-ichi Life's transaction aligns with this broader industry trend of optimizing in-force business portfolios.

- Protective Life Corp. subsidiary involved in reinsurance.

- Ceded blocks include structured settlement annuities and universal life insurance.

- Transaction indicates a move to offload less profitable or higher-risk business segments.

- Strategic aim to optimize capital allocation and enhance financial flexibility.

Dai-ichi Life's legacy life insurance products, particularly traditional whole life policies, are categorized as Dogs in the BCG Matrix due to low market growth and share. These products require significant resources, diverting capital from more promising ventures, especially as Japan's aging population and preference for flexible solutions reduce demand for older offerings.

The company's domestic operations include niche segments that exhibit weak performance, fitting the Dog profile. This underperformance stems from a lack of innovation or failure to adapt to evolving consumer needs, such as the growing demand for health-focused and savings-linked policies, a trend evident in the slight contraction of some traditional product premiums in the Japanese life insurance industry in 2023.

Inefficient manual processes and outdated IT systems also act as significant drains on Dai-ichi Life's resources, consuming capital without delivering proportionate returns. In 2023, many insurers reported substantial IT budget allocations to maintaining legacy systems, hindering investments in digital solutions.

Dai-ichi Life's strategic reinsurance of certain in-force blocks, like structured settlement annuities and universal life insurance, through Protective Life Corp. in 2024, demonstrates a move away from segments with lower profitability or higher risk. This aligns with a broader industry trend of optimizing portfolios for better capital allocation and financial flexibility.

Question Marks

Dai-ichi Life's venture into new digital insurance services and platforms, including enhanced digital communication and sales support, represents a significant investment in high-growth potential areas. These initiatives, bolstered by a partnership with Microsoft, are designed to offer next-generation insurance solutions.

While these digital services show promise, they are currently in their nascent stages of market acceptance. Substantial capital is being deployed to capture market share and establish profitability, indicating a strategic positioning within the BCG matrix.

Dai-ichi Life's venture into India with a Build-Operate-Transfer (BOT) digitalization incubation plan positions it within a high-growth market. This strategy aims to bolster its global digital capabilities and technology platforms. The Indian market, while promising for digital solutions, currently shows a low market share for Dai-ichi Life's specific offerings in this domain.

This initiative is designed for scalability, with the potential to be replicated in other countries, suggesting high future growth prospects. However, it also entails substantial investment and carries inherent risks, typical of ambitious market entries and technology development.

Dai-ichi Life's strategic push into new business fields, as outlined in their medium-term plan, is designed to diversify revenue streams beyond traditional insurance. The company has set a target for these non-insurance ventures to contribute a substantial share of Group adjusted profit by fiscal year 2030.

Early-stage investments, like the acquisition of Benefit One, a provider of corporate employee benefits, exemplify this strategy. These ventures, alongside partnerships in asset management such as the collaboration with M&G, are characterized by their high growth potential. However, their current contribution to Dai-ichi Life's overall group profit remains relatively low, positioning them as potential stars or question marks within a BCG-like framework.

Alternative Investments in Portfolio Strategy

Dai-ichi Life's strategic inclusion of alternative investments, such as private credit, private equity, infrastructure, and real estate, within its substantial ¥33.9 trillion portfolio signifies a move towards a higher-growth investment trajectory. This diversification aims to capture returns beyond traditional asset classes.

While these alternatives offer the allure of enhanced returns, they inherently carry greater risk and currently represent a smaller segment of the overall portfolio, translating to a lower market share when contrasted with more established fixed-income assets.

- Growth Potential: Alternative investments are being integrated to tap into sectors with higher expected growth rates.

- Risk-Return Profile: These assets typically offer higher potential returns but also come with increased volatility and illiquidity.

- Portfolio Allocation: As of recent reports, alternatives constitute a smaller, though growing, percentage of Dai-ichi Life's total assets under management.

- Market Share Comparison: Their market share remains modest compared to traditional investments like government bonds and corporate debt.

Expansion into Untapped International Regions

Dai-ichi Life's strategic focus on expanding into untapped international regions aligns with the 'Question Mark' quadrant of the BCG Matrix. This indicates a commitment to entering markets with high growth potential but currently low market share, requiring significant investment to build presence and capture future opportunities.

In 2024, Dai-ichi Life continued its global expansion efforts, with a particular emphasis on emerging markets in Southeast Asia and Africa, regions identified as having substantial long-term growth prospects for the insurance sector. These initiatives are designed to diversify revenue streams and reduce reliance on more mature, slower-growing markets.

- Target Markets: Focus on emerging economies in Southeast Asia and Africa with rapidly growing middle classes and increasing demand for financial protection products.

- Investment Strategy: Allocate significant capital for market entry, product development tailored to local needs, and building distribution networks, potentially through partnerships or acquisitions.

- Risk Mitigation: Implement robust risk management frameworks to navigate regulatory complexities, currency fluctuations, and competitive landscapes in these new territories.

- Growth Potential: Aim to transform these 'Question Mark' markets into 'Stars' by achieving critical mass and market leadership over the medium to long term.

Dai-ichi Life's ventures into new digital insurance services and international markets, particularly in emerging economies, represent significant investments with high growth potential but currently low market share. These initiatives, including digital platforms and expansion into Southeast Asia and Africa, are strategically positioned as 'Question Marks' within the BCG framework. The company is allocating substantial capital to capture future market share and establish profitability in these promising, yet undeveloped, territories.

| Initiative | Market Growth Potential | Dai-ichi Life Market Share | Investment Level | BCG Quadrant |

|---|---|---|---|---|

| Digital Insurance Services | High | Low | High | Question Mark |

| India Digitalization Incubation | High | Low | High | Question Mark |

| Emerging Market Expansion (SEA, Africa) | High | Low | High | Question Mark |

BCG Matrix Data Sources

Our Dai-ichi Life BCG Matrix is built on robust financial disclosures, comprehensive market analytics, and expert industry evaluations to provide a clear strategic overview.