Dai-ichi Life Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dai-ichi Life Bundle

Uncover the strategic brilliance behind Dai-ichi Life's success with our comprehensive Business Model Canvas. This detailed breakdown reveals their customer relationships, revenue streams, and key resources, offering invaluable insights for any aspiring business leader. Download the full canvas to gain a competitive edge and accelerate your own strategic planning.

Partnerships

Dai-ichi Life Holdings actively partners with financial institutions like banks and asset management firms. These collaborations are crucial for broadening their product reach and strengthening their investment expertise. For example, their strategic alliance with M&G, a prominent international savings and investments company, aims to penetrate private markets and tap into the Japanese and Asian markets.

Dai-ichi Life's strategic alliances with technology and digital solution providers are fundamental to its ongoing digital transformation. These collaborations are designed to bolster the company's internal digital expertise, streamline operations, and elevate the overall customer journey through cutting-edge technology.

A significant undertaking in this area is the multi-year partnership with Capgemini to establish a Global Capability Center in India. This center is specifically geared towards developing advanced software, leveraging AI and data analytics, and bolstering cybersecurity measures, all critical components for modernizing financial services.

Dai-ichi Life frequently collaborates with healthcare and wellness providers to create comprehensive health and well-being programs. These partnerships are crucial for offering integrated solutions that go beyond standard insurance, promoting preventative care and a healthier lifestyle for policyholders.

For instance, in 2024, many insurers are expanding their digital health offerings, partnering with telehealth platforms and wellness app providers. These alliances allow for the seamless integration of health monitoring, personalized wellness advice, and access to medical professionals, enhancing the overall value proposition for customers seeking holistic health management.

Employee Benefits Providers

Dai-ichi Life is actively broadening its reach beyond traditional insurance, with a keen focus on corporate benefits. This strategic pivot is evident in their acquisition of Benefit One, a prominent Japanese provider of employee benefits. This move is designed to foster significant synergies and tap into a wider customer pool by delivering integrated employee welfare solutions.

The integration of Benefit One into Dai-ichi Life's ecosystem allows for the cross-selling of insurance products to corporate clients and their employees, while simultaneously offering enhanced benefits packages. This partnership is crucial for Dai-ichi Life's ambition to become a more holistic financial services group.

- Acquisition of Benefit One: Dai-ichi Life acquired Benefit One, a leading Japanese corporate benefits provider, in a strategic move to expand its non-insurance offerings.

- Synergy Creation: The partnership aims to create synergies by bundling insurance products with comprehensive employee welfare programs, enhancing customer value.

- Customer Base Expansion: By offering integrated benefits, Dai-ichi Life seeks to attract and retain a broader corporate client base and their employees.

Reinsurance Companies

Strategic reinsurance agreements are crucial for insurance companies like Dai-ichi Life to manage risk and boost profitability. These partnerships allow for the transfer of a portion of insurance liabilities to another insurer, thereby optimizing capital allocation.

A prime example of this strategy in action is Protective Life Corporation, Dai-ichi Life's U.S. subsidiary. In 2024, Protective Life entered into a significant reinsurance agreement with Resolution Life Group Holdings Ltd. This deal, which involves ceding substantial policy reserves, is designed to enhance Protective Life's financial soundness and capital efficiency.

- Strategic Reinsurance: Enables capital optimization and profitability enhancement for insurers.

- Protective Life's Agreement: In 2024, Protective Life (Dai-ichi Life's U.S. subsidiary) partnered with Resolution Life Group Holdings Ltd.

- Transaction Details: The agreement involves ceding policy reserves, aiming to improve financial soundness and capital efficiency.

Dai-ichi Life's key partnerships extend to financial institutions, technology providers, and healthcare entities. These collaborations are vital for expanding product distribution, enhancing digital capabilities, and offering integrated health solutions. The acquisition of Benefit One in 2023, a major player in corporate benefits, exemplifies their strategy to broaden service offerings and create cross-selling opportunities.

Strategic reinsurance agreements are also critical for risk management and capital efficiency. For instance, in 2024, Protective Life, Dai-ichi Life's U.S. subsidiary, entered a significant reinsurance deal with Resolution Life Group Holdings Ltd., ceding substantial policy reserves to bolster financial soundness.

| Partner Type | Example Partner | Purpose | Impact |

| Financial Institutions | M&G | Product reach, investment expertise | Penetrate private markets |

| Technology Providers | Capgemini | Digital transformation, AI, analytics | Modernize financial services |

| Healthcare Providers | Telehealth platforms | Integrated health programs | Promote preventative care |

| Corporate Benefits | Benefit One (Acquired 2023) | Expand non-insurance offerings | Synergies, customer base expansion |

| Reinsurance | Resolution Life Group Holdings Ltd. (Protective Life) | Risk management, capital efficiency | Enhance financial soundness |

What is included in the product

Dai-ichi Life's Business Model Canvas outlines its strategy for providing life insurance and financial services by focusing on customer needs, leveraging diverse distribution channels, and building strong customer relationships.

The model details key partners, activities, and resources essential for delivering value propositions to individual and corporate customers, while managing cost structures and revenue streams.

The Dai-ichi Life Business Model Canvas offers a structured approach to identify and address customer pains by clearly defining value propositions and customer segments.

It provides a visual framework to pinpoint areas where Dai-ichi Life can alleviate customer challenges through tailored products and services.

Activities

Underwriting and policy management are central to Dai-ichi Life's operations, involving meticulous risk assessment and precise pricing for its diverse range of life insurance, annuity, and financial products. This process ensures the company can offer competitive yet sustainable coverage.

Dai-ichi Life's expertise extends to managing policies from issuance through their entire lifecycle, encompassing efficient claims processing and seamless policy renewals. This commitment to comprehensive management underpins customer trust and long-term relationships.

In 2024, Dai-ichi Life continued to refine its underwriting processes, leveraging advanced data analytics to improve risk selection. The company maintained a strong solvency position, with its consolidated risk-based capital ratio remaining robust, reflecting the effectiveness of its policy management strategies.

Investment management is a cornerstone for Dai-ichi Life, involving the strategic allocation of its significant asset base. This includes making calculated investments across diverse asset classes such as equities, fixed income securities, and real estate to drive financial growth and stability.

Dai-ichi Life actively oversees a substantial portfolio, which stood at ¥33.9 trillion as of the fiscal year ending March 2024. This robust management involves not only traditional investments but also the strategic incorporation of alternative investments to enhance overall portfolio returns and optimize risk-adjusted performance.

Dai-ichi Life actively pursues product development and innovation to stay ahead in the dynamic insurance and financial services landscape. A key focus for 2024 and beyond involves enhancing their offerings in asset formation and succession planning, areas of increasing importance for customers seeking long-term financial security.

This commitment to innovation is reflected in their strategic efforts to broaden their product portfolio and sharpen the competitive edge of existing offerings. For instance, by the end of fiscal year 2023, Dai-ichi Life reported a significant increase in new business premiums, underscoring the market's positive reception to their evolving product suite.

Sales and Distribution

Dai-ichi Life's sales and distribution activities focus on effectively marketing its insurance products. This includes leveraging a robust network of professional financial advisors who provide personalized guidance to clients.

The company is also expanding its digital channels to reach a broader customer base, including both individual and corporate clients. This dual approach aims to enhance accessibility and customer engagement.

In 2024, Dai-ichi Life reported a significant increase in new business premiums, with a particular emphasis on the growth of its digital sales channels. This strategic integration of physical and online touchpoints is designed to drive sales performance back to, and beyond, pre-pandemic levels.

Key aspects of their sales and distribution strategy include:

- Advisor Network: Maintaining and growing a strong base of trained and professional financial advisors.

- Digital Transformation: Investing in and expanding online platforms for product sales and customer service.

- Omnichannel Approach: Seamlessly integrating real and digital channels to offer a consistent customer experience.

- Product Diversification: Offering a range of insurance products tailored to various client needs, supported by effective sales strategies.

Global Expansion and M&A

Dai-ichi Life actively pursues mergers and acquisitions to bolster its global footprint. This strategy is crucial for expanding beyond its core Japanese market and tapping into new growth opportunities. The company has demonstrated a commitment to this by allocating substantial capital for overseas ventures.

Significant investments are earmarked for acquiring businesses within the insurance and asset management sectors internationally. The focus is particularly on regions exhibiting robust economic growth, indicating a strategic approach to market selection. For example, in 2023, Dai-ichi Life completed the acquisition of a significant stake in an Australian wealth management firm, a move aimed at strengthening its presence in the Asia-Pacific region.

- Global Expansion Strategy: Dai-ichi Life prioritizes expanding its operations into international markets to diversify revenue streams and achieve sustainable growth.

- Mergers and Acquisitions Focus: The company actively seeks strategic mergers and acquisitions as a primary vehicle for this global expansion, targeting companies that complement its existing capabilities or offer access to new customer segments.

- Investment in High-Growth Regions: Significant capital is dedicated to acquiring insurance and asset management businesses in regions identified as having high growth potential, aiming to capitalize on emerging market dynamics.

- 2024 Outlook: For 2024, Dai-ichi Life has signaled continued aggressive pursuit of M&A opportunities, with a particular emphasis on North America and Southeast Asia, aiming to further solidify its international market position.

Dai-ichi Life's key activities revolve around underwriting and managing insurance policies, ensuring accurate risk assessment and efficient claims processing. Investment management is also critical, involving strategic allocation of assets across various classes to drive growth and stability, with a portfolio valued at ¥33.9 trillion as of March 2024. The company actively pursues product innovation, focusing on areas like asset formation and succession planning, which has contributed to a notable increase in new business premiums. Furthermore, Dai-ichi Life emphasizes sales and distribution through a strong advisor network and expanding digital channels, aiming for an omnichannel approach to enhance customer engagement and sales performance.

Global expansion through mergers and acquisitions is a significant activity, with strategic investments in high-growth regions. For 2024, the company is targeting opportunities in North America and Southeast Asia to solidify its international market position.

| Key Activity | Description | 2024 Focus/Data |

|---|---|---|

| Underwriting & Policy Management | Risk assessment, pricing, policy lifecycle management | Refined processes with advanced data analytics; robust solvency |

| Investment Management | Strategic asset allocation across equities, fixed income, real estate | Portfolio valued at ¥33.9 trillion (FY ending March 2024) |

| Product Development & Innovation | Enhancing offerings in asset formation and succession planning | Increased new business premiums; positive market reception |

| Sales & Distribution | Leveraging advisor networks and digital channels | Growth in digital sales channels; strong increase in new business premiums |

| Mergers & Acquisitions | Global expansion through strategic acquisitions | Targeting North America and Southeast Asia for further M&A |

Delivered as Displayed

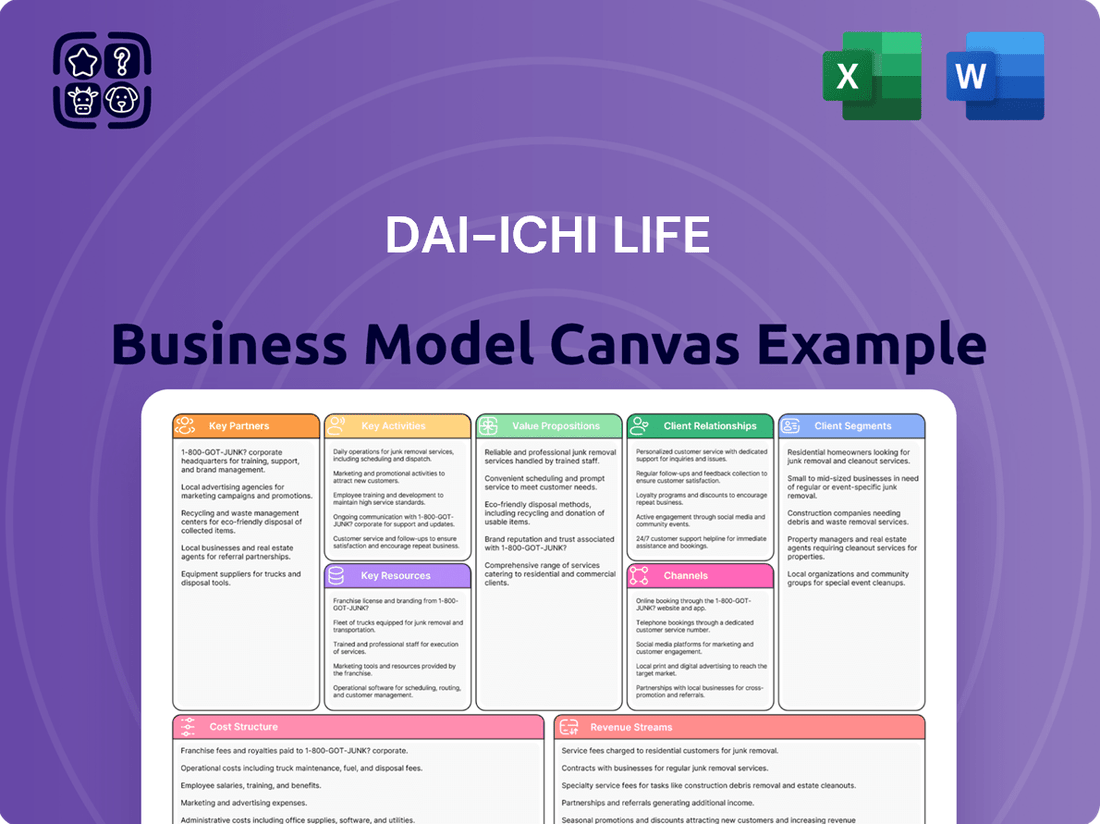

Business Model Canvas

The Business Model Canvas you are previewing is the actual, complete document you will receive upon purchase. This is not a sample or a mockup, but a direct representation of the finalized file, ensuring you know exactly what you are getting. Upon completing your order, you will gain full access to this same comprehensive Business Model Canvas, ready for immediate use and customization.

Resources

Dai-ichi Life's substantial financial capital, comprising policyholder funds and shareholder equity, is crucial for its underwriting capacity and investment endeavors. This financial strength underpins the company's ability to offer a wide range of insurance products and manage risk effectively.

The company actively manages a vast investment portfolio, which stood at ¥33.9 trillion as of the fiscal year ending March 2024. This diversified portfolio is strategically managed to generate stable income, supporting both operational needs and long-term growth objectives.

Dai-ichi Life's skilled workforce, encompassing professional advisors, actuaries, investment managers, and IT specialists, is fundamental to its success in product development, sales, and operational efficiency. This human capital is a core asset, driving innovation and customer engagement.

In 2024, Dai-ichi Life reported a significant investment in its sales force, aiming to bolster its distribution network and enhance customer service. The company's focus on employee satisfaction directly translates into a more motivated and effective team, crucial for navigating the competitive insurance landscape.

Dai-ichi Life's technology infrastructure and digital platforms are the backbone of its operations, enabling efficient processing and a superior customer journey. These systems are crucial for leveraging data analytics to inform strategic decisions and enhance service delivery.

The company is actively pursuing digital transformation, a key component of its 2025 strategy. This includes significant investments in hybrid cloud environments and automation technologies to streamline processes and improve responsiveness.

In 2024, Dai-ichi Life continued to prioritize these investments, aiming to bolster its data analytics capabilities. For instance, they are enhancing their customer relationship management (CRM) systems and exploring AI-driven insights to personalize offerings and improve risk assessment.

Brand Reputation and Trust

Dai-ichi Life's brand reputation is a cornerstone of its business model, built on a legacy of trust and reliability since its founding in 1902. This long-standing commitment fosters deep customer loyalty in the insurance sector, where trust is paramount. The company actively cultivates these relationships through personalized service, ensuring clients feel valued and secure.

This emphasis on trust translates into tangible benefits. For instance, Dai-ichi Life's consistent performance and customer-centric approach have contributed to its strong market position. In 2023, the company reported robust financial results, underscoring the market's confidence in its brand.

Key aspects of Dai-ichi Life's brand reputation include:

- Long History and Stability: Established in 1902, providing a deep sense of security to policyholders.

- Customer-Centric Approach: Focus on personalized service to build and maintain long-term relationships.

- Reliability and Trust: A core value in the insurance industry, reinforced by consistent operational performance.

- Financial Strength: Demonstrated through strong financial results, such as its reported solvency ratios, which bolster public confidence.

Global Network of Subsidiaries and Affiliates

Dai-ichi Life's extensive global network of subsidiaries and affiliates is a cornerstone of its business model, granting it significant market access and invaluable local expertise. This expansive reach allows the company to tap into diverse customer bases and understand regional nuances, which is crucial for effective product development and marketing. For instance, as of fiscal year 2023, Dai-ichi Life's overseas businesses contributed a substantial portion of its operating profit, underscoring the importance of this global footprint.

This international presence also serves to diversify risk, shielding the company from over-reliance on any single market. By operating in various countries, Dai-ichi Life can mitigate the impact of economic downturns or regulatory changes in one region. The company has been actively focused on expanding its overseas operations, a strategy that has paid dividends in terms of growth and stability. In 2024, continued investment in these international markets is expected to further bolster its competitive position.

- Market Access: Operates in key international markets, providing access to a broader customer base and revenue streams.

- Local Expertise: Leverages local knowledge for tailored product offerings and effective market penetration.

- Risk Diversification: Reduces dependence on any single geographic market, enhancing financial resilience.

- Strategic Expansion: Continues to grow its overseas operations, a key driver of future profitability and stability, with significant contributions noted in fiscal year 2023 and ongoing strategic focus in 2024.

Dai-ichi Life's Key Resources are a blend of financial might, intellectual capital, and technological prowess. Its substantial financial assets, including ¥33.9 trillion in investments as of March 2024, enable robust underwriting and strategic growth. The company's human capital, from actuaries to advisors, drives innovation and customer engagement, with a notable 2024 investment in its sales force to enhance service and reach. Furthermore, its advanced technology infrastructure, including ongoing digital transformation efforts and AI-driven CRM enhancements, underpins operational efficiency and personalized customer experiences.

| Resource Category | Specific Asset/Capability | Fiscal Year End March 2024 Data | Strategic Importance |

|---|---|---|---|

| Financial Capital | Total Investment Portfolio | ¥33.9 trillion | Underwriting capacity, income generation, growth funding |

| Human Capital | Skilled Workforce (Actuaries, Advisors, IT) | Not specified, but focus on sales force investment in 2024 | Product development, sales, operational efficiency, customer engagement |

| Technology & Infrastructure | Digital Platforms & Data Analytics Capabilities | Ongoing investment in hybrid cloud and automation, CRM enhancement | Operational efficiency, customer journey, strategic decision-making, personalized offerings |

Value Propositions

Dai-ichi Life offers a robust suite of life insurance and annuity products designed to safeguard individuals and families. These include term life, whole life, and endowment policies, providing financial security against life's uncertainties. For instance, in fiscal year 2023, Dai-ichi Life's total revenue reached ¥10.4 trillion, underscoring its significant market presence and capacity to deliver on its protection promises.

Dai-ichi Life crafts financial strategies that evolve with you. They offer personalized insurance and wealth-building plans designed to meet your specific needs, whether you're focused on protecting your family, growing your assets, or planning for future generations.

This customer-centric approach ensures that as your life changes, your financial solutions do too. For example, in 2024, Dai-ichi Life continued to see strong demand for flexible life insurance products that can be adjusted as family structures and financial goals shift.

Dai-ichi Life leverages its extensive global network to provide international clients with a unique combination of worldwide best practices and deep local market insights. This dual approach ensures that solutions offered are not only globally competitive but also highly relevant and effective within specific regional contexts.

The company's strategic expansion of its global footprint is a testament to this value proposition. As of early 2024, Dai-ichi Life has solidified its presence in key markets across Asia, North America, and Europe, demonstrating a commitment to serving a diverse international clientele.

Innovative and Digitally-Enabled Services

Dai-ichi Life is actively enhancing customer interactions through its commitment to innovative and digitally-enabled services. This focus aims to deliver modern, convenient, and efficient experiences by leveraging digital platforms and advanced technologies. By embracing digital transformation, the company is streamlining its operations and integrating AI and data solutions to better serve its clientele.

The company’s digital transformation initiatives are designed to optimize internal processes and improve customer engagement. For instance, Dai-ichi Life has been investing in digital tools to simplify policy management and claims processing, making these interactions more user-friendly. This strategic shift reflects a broader industry trend towards digitalization, where companies are prioritizing seamless online experiences.

Key aspects of Dai-ichi Life's digitally-enabled services include:

- Enhanced Customer Experience: Providing intuitive digital platforms for policy inquiries, updates, and claims submission, offering 24/7 accessibility.

- Operational Efficiency: Implementing AI and data analytics to automate tasks, reduce processing times, and improve accuracy across various business functions.

- Personalized Service Delivery: Utilizing data insights to offer tailored product recommendations and financial advice, catering to individual customer needs.

- Digital Innovation Investment: Allocating resources to explore and adopt emerging technologies, ensuring services remain cutting-edge and competitive in the evolving market landscape.

Stable and Reliable Investment Management

Dai-ichi Life assures policyholders of responsible and strategic management of their premiums. This is achieved through a robust investment portfolio designed for stable returns and long-term financial soundness. In 2024, the company continued to strategically adjust its investment portfolio to navigate evolving market conditions, a key element in maintaining its value proposition.

The company's commitment to stable and reliable investment management is a cornerstone of its business model. This involves meticulous oversight and active adjustments to investment strategies. For instance, Dai-ichi Life's asset management arm actively seeks to balance risk and reward, a critical factor in delivering consistent performance for policyholders.

- Robust Portfolio Management: Dai-ichi Life maintains a diversified investment portfolio to mitigate risks and enhance stability.

- Strategic Market Navigation: The company actively adjusts its investment strategies to adapt to changing economic landscapes and market dynamics.

- Long-Term Financial Soundness: A primary objective is ensuring the long-term financial health and security of policyholder assets.

- Focus on Stable Returns: The investment approach prioritizes consistent, predictable returns over speculative gains.

Dai-ichi Life provides comprehensive life insurance and annuities, offering financial security through products like term and whole life policies. In fiscal year 2023, the company's total revenue was ¥10.4 trillion, demonstrating its substantial market reach and ability to fulfill protection commitments.

Customer Relationships

Dai-ichi Life cultivates deep client loyalty through its personalized advisor-based service. This model leverages a robust network of professional advisors who provide tailored consultations and continuous support. In 2024, Dai-ichi Life continued to emphasize this high-touch approach, aiming to build enduring relationships by understanding and addressing individual client needs with precision.

Dai-ichi Life is enhancing customer relationships through robust digital self-service options. Customers can conveniently manage policies, access vital information, and engage with the company via user-friendly digital platforms. This digital focus complements the valuable support provided by their traditional advisor network, ensuring a seamless experience.

The company is committed to an integrated approach, blending real and digital channels to elevate the overall customer journey. This strategy aims to provide flexibility and accessibility, meeting diverse customer preferences in policy management and interaction. For instance, in 2024, Dai-ichi Life reported a significant increase in digital policy inquiries, highlighting the growing reliance on these platforms.

Dai-ichi Life focuses on building robust relationships with its corporate clients by offering tailored employee benefits, group insurance, and financial solutions. This involves understanding each company's unique needs to deliver value and foster long-term partnerships.

The strategic acquisition of Benefit One in 2023, for instance, was a significant move to broaden Dai-ichi Life's reach within the corporate sector. This acquisition is expected to enhance their ability to serve a larger and more diverse corporate customer base, providing a wider array of services and benefits management capabilities.

By integrating Benefit One's expertise, Dai-ichi Life aims to strengthen its position as a comprehensive provider for corporate employee well-being and financial security. This expansion aligns with their strategy to deepen engagement and offer more integrated solutions to businesses, ultimately driving growth and client retention.

Customer Education and Financial Literacy

Dai-ichi Life actively engages in customer education, focusing on financial planning and insurance product understanding. This commitment aims to empower individuals to make sound financial decisions, fostering trust and long-term loyalty.

In 2024, Dai-ichi Life continued its robust outreach programs. For instance, their online financial literacy portal saw a 15% increase in user engagement compared to the previous year, offering resources on retirement planning and investment strategies. This focus on education directly supports customer retention and product adoption.

- Financial Planning Seminars: Conducted over 50 in-person and virtual seminars throughout 2024, reaching more than 10,000 participants.

- Digital Resources: Launched an updated series of explainer videos on life insurance policies, achieving over 500,000 views by the end of 2024.

- Personalized Guidance: Provided one-on-one financial consultations to over 5,000 customers, addressing specific needs and enhancing product suitability.

- Customer Testimonials: Feedback indicated that 85% of participants in educational programs felt more confident in managing their finances after attending.

Proactive Customer Support and Claims Handling

Dai-ichi Life prioritizes proactive customer support, especially during critical life events, ensuring claims are handled efficiently and with empathy. This approach builds significant trust and satisfaction.

- Claims Efficiency: The company focuses on swift and accurate claims processing, aiming to reduce customer stress during difficult times.

- Empathetic Engagement: Support staff are trained to provide compassionate assistance, recognizing the sensitive nature of insurance claims.

- Proactive Outreach: Dai-ichi Life actively reaches out to policyholders who may be experiencing life-changing events, offering guidance and support before a claim is even filed.

- High Settlement Ratios: In 2023, Dai-ichi Life Insurance Japan reported a claims settlement ratio of 98.5%, demonstrating a strong commitment to fulfilling its promises and fostering customer loyalty.

Dai-ichi Life fosters enduring customer relationships through a blend of personalized advisory services and accessible digital platforms. This dual approach ensures clients receive tailored guidance and convenient self-service options, enhancing overall satisfaction and loyalty. The company's commitment to customer education, exemplified by a 15% increase in digital engagement with their financial literacy portal in 2024, further strengthens these bonds by empowering informed decision-making.

| Customer Relationship Strategy | Key Initiatives | 2024 Impact/Data |

|---|---|---|

| Personalized Advisor-Based Service | Tailored consultations and continuous support | High-touch approach maintained to build enduring relationships. |

| Digital Self-Service Enhancement | Online policy management and information access | Significant increase in digital policy inquiries reported. |

| Integrated Channel Approach | Blending real and digital channels for customer journey | Enhanced flexibility and accessibility for diverse customer preferences. |

| Corporate Client Solutions | Tailored employee benefits and group insurance | Acquisition of Benefit One to expand corporate reach and services. |

| Customer Education & Empowerment | Financial planning and product understanding resources | 15% year-over-year increase in user engagement on financial literacy portal. |

| Proactive Customer Support | Efficient and empathetic claims handling during life events | 98.5% claims settlement ratio reported by Dai-ichi Life Insurance Japan in 2023. |

Channels

Dai-ichi Life heavily relies on its direct sales force and professional advisors as a cornerstone for distributing its life insurance and financial products. This channel allows for personalized consultations, fostering deep client relationships built on trust and tailored advice.

The company is actively investing in strengthening this sales structure, recognizing its critical role in client acquisition and retention. For instance, in the fiscal year ending March 2024, Dai-ichi Life reported a significant portion of its new business premiums originated through its agency channels, underscoring the channel's importance.

Dai-ichi Life leverages digital platforms and online portals to offer customers convenient access to product information, policy management, and customer service. This digital-first approach caters to an increasingly tech-savvy customer base, streamlining interactions and enhancing user experience.

The company is actively pursuing a strategy of integrating its physical and digital channels, aiming to create a seamless omnichannel experience. This integration ensures that customers can transition smoothly between online and offline touchpoints, receiving consistent and efficient service. For instance, in 2024, Dai-ichi Life reported a significant increase in digital policy inquiries, demonstrating the growing reliance on these platforms.

Dai-ichi Life actively engages in bank assurance partnerships, a crucial distribution channel. These collaborations allow the company to offer its life insurance products through the extensive branch networks of partner banks, tapping into a pre-established customer base and the inherent trust consumers place in their banking institutions.

This strategic alliance is particularly effective in reaching a broad demographic. For instance, in many Asian markets, banks are primary financial touchpoints for individuals and families, making them ideal conduits for insurance sales. While specific 2024 figures for Dai-ichi Life's bank assurance revenue are not yet fully disclosed, the segment consistently contributes a significant portion of overall sales for major life insurers globally, often representing 30-50% of new business premiums.

Corporate Sales and Employee Benefits

Dai-ichi Life actively engages corporate clients through specialized sales teams, providing tailored group insurance and comprehensive employee benefit programs. This strategic approach ensures businesses can offer robust support to their workforce.

The acquisition of Benefit One in 2021 significantly bolstered this channel, expanding Dai-ichi Life's reach and capabilities in the employee benefits market. This move allows for more integrated and advanced solutions for corporate partners.

- Corporate Sales Teams: Dedicated professionals focus on building relationships with businesses to offer group life, health, and savings plans.

- Employee Benefit Programs: Comprehensive packages designed to enhance employee well-being and retention, including wellness initiatives and financial planning.

- Benefit One Integration: The acquisition has enabled a broader suite of services, from cafeteria plans to welfare programs, catering to diverse corporate needs.

- Market Penetration: In 2023, Dai-ichi Life reported a substantial increase in new corporate contracts, reflecting the growing demand for integrated employee benefit solutions.

International Subsidiaries and Affiliates

Dai-ichi Life leverages its extensive network of international subsidiaries and affiliates to distribute a wide array of insurance and financial products across diverse global markets. This strategy allows for tailored product offerings that align with local regulatory frameworks and distinct customer preferences, ensuring relevance and market penetration.

The company's global footprint is substantial, with a clear emphasis on expanding its international operations. As of fiscal year 2023, Dai-ichi Life's overseas segment contributed significantly to its overall revenue, demonstrating the success of its international expansion strategy.

- Global Reach: Operates in key markets including the United States, Australia, India, and Southeast Asia through subsidiaries like Protective Life Corporation and Dai-ichi Life Insurance (Vietnam) Limited.

- Product Diversification: Offers a broad spectrum of life insurance, annuities, and asset management services, adapted to the specific needs of each international market.

- Regulatory Adaptation: Successfully navigates varying insurance regulations and compliance standards in each country of operation, ensuring adherence and market access.

- Market Penetration: Aims to capture market share by understanding and responding to local consumer behavior and economic conditions, fostering growth in emerging and developed economies.

Dai-ichi Life utilizes a multi-channel approach to reach its diverse customer base. Direct sales through its professional advisor network remain a core strength, emphasizing personalized service and trust. Complementing this, digital platforms offer convenience and accessibility for policy management and information, with a growing trend in online inquiries seen in 2024.

Strategic partnerships, particularly in bank assurance, are vital for tapping into established customer bases and leveraging existing trust. Furthermore, dedicated corporate sales teams cater to businesses, offering tailored employee benefit programs, a segment significantly strengthened by the acquisition of Benefit One, which saw a substantial increase in new corporate contracts in 2023.

The company's international presence, with operations in markets like the US, Australia, and India, allows for localized product offerings and market penetration, with overseas segments contributing significantly to overall revenue in fiscal year 2023.

| Channel | Key Characteristics | 2023/2024 Data/Insights |

|---|---|---|

| Direct Sales Force/Advisors | Personalized consultations, deep client relationships, tailored advice. | Significant portion of new business premiums originated through agency channels (FY ending March 2024). |

| Digital Platforms | Convenient access to product info, policy management, customer service. | Reported significant increase in digital policy inquiries (2024). |

| Bank Assurance | Partnerships with banks to distribute products through their branch networks. | Consistently contributes a significant portion of new business premiums globally (often 30-50%). |

| Corporate Sales | Tailored group insurance and employee benefit programs for businesses. | Substantial increase in new corporate contracts (2023); Benefit One acquisition enhanced capabilities. |

| International Operations | Distribution through subsidiaries in key global markets. | Overseas segment contributed significantly to overall revenue (FY 2023). |

Customer Segments

Individual Life Insurance Policyholders represent the bedrock of Dai-ichi Life's customer base. This segment encompasses a wide array of individuals, from young professionals securing their future to families seeking financial security and retirees planning for their later years. They are driven by a fundamental need for personal protection, wealth accumulation, and dependable retirement income streams.

In 2024, the life insurance industry continued to see strong demand, with new annualized premium income for individual life insurance in the US reaching approximately $100 billion. This highlights the persistent value individuals place on life insurance for its dual role in providing a safety net and acting as a savings vehicle.

High Net Worth Individuals (HNWIs) represent a crucial customer segment for Dai-ichi Life, seeking advanced financial planning and wealth management services. These clients often require sophisticated insurance solutions designed for complex estate planning and the meticulous building of a lasting legacy. Dai-ichi Life's strategic focus includes growing its presence in markets with a significant concentration of affluent individuals.

Dai-ichi Life actively serves corporate clients by offering comprehensive group life insurance and employee benefits programs tailored to their workforce's needs. This segment is crucial for expanding its reach and providing essential financial security to employees across various industries.

The strategic acquisition of Benefit One in 2023, a leading provider of employee welfare services, underscores Dai-ichi Life's commitment to strengthening its presence in the corporate sector. This move allows the company to offer a more integrated suite of services, enhancing its value proposition to businesses seeking holistic employee support solutions.

Pension and Annuity Seekers

Pension and annuity seekers represent a core customer segment for Dai-ichi Life, individuals prioritizing financial security and a predictable income during their retirement years. These customers are actively searching for financial products designed to provide a consistent stream of income, with annuities being a primary focus.

Dai-ichi Life addresses this need by offering a robust selection of annuity products, a key component of its comprehensive retirement planning solutions. For instance, in 2024, the global annuity market continued to show resilience, with a growing demand for guaranteed income options as individuals plan for longer lifespans.

- Steady Retirement Income: Customers seek reliable income streams to cover living expenses post-employment.

- Annuity Products: Dai-ichi Life provides various annuity options tailored to different risk appetites and income needs.

- Long-Term Financial Planning: This segment focuses on long-term security and wealth preservation for retirement.

- Market Trends: In 2024, there was a notable increase in interest for fixed annuities due to stable interest rate environments.

International Markets and Diverse Demographics

Dai-ichi Life actively serves a broad customer base across various international markets. This includes individuals and families in regions like India and Southeast Asia, each presenting distinct demographic profiles and evolving insurance needs. For instance, in India, a rapidly growing economy with a young population, the demand for life insurance is driven by increasing disposable incomes and a greater awareness of financial security. By 2024, India's life insurance penetration rate was still relatively low compared to developed nations, indicating significant growth potential.

The company tailors its offerings to these diverse demographics, recognizing that needs vary significantly. In Southeast Asia, for example, Dai-ichi Life addresses the requirements of both emerging middle classes seeking protection and wealth accumulation, and more mature markets with established financial planning practices. This global reach is a cornerstone of their expansion strategy, aiming to capture market share in high-growth regions.

Dai-ichi Life's international presence is further shaped by differing regulatory environments. Navigating these diverse landscapes requires adaptability in product design, distribution channels, and compliance. The company's expansion into markets like India and Vietnam in recent years highlights its commitment to understanding and integrating into local economic and social structures. As of early 2024, Dai-ichi Life Holdings reported substantial contributions from its international operations to its overall financial performance, underscoring the strategic importance of these diverse customer segments.

- Global Reach: Serving customers in numerous countries, including key growth markets like India and Southeast Asia.

- Demographic Diversity: Catering to varied age groups, income levels, and cultural expectations across its international customer base.

- Regulatory Adaptation: Tailoring business models to comply with distinct legal and financial frameworks in each operating region.

- Market Potential: Leveraging the significant growth opportunities presented by developing economies with increasing demand for insurance products.

Dai-ichi Life's customer segments are broadly categorized into individual policyholders, high-net-worth individuals, corporate clients, and pension/annuity seekers, alongside a significant international customer base in regions like India and Southeast Asia.

The company's strategy involves catering to diverse needs, from basic life protection for individuals to sophisticated wealth management for HNWIs and comprehensive benefits for employees. In 2024, the global life insurance market continued to demonstrate robust growth, particularly in emerging economies, reflecting a sustained demand for financial security products.

Dai-ichi Life's expansion is driven by identifying and serving these distinct customer groups, adapting its offerings to local market conditions and regulatory landscapes. The acquisition of Benefit One in 2023 further solidified its position in the corporate benefits sector, enhancing its value proposition to businesses.

| Customer Segment | Key Needs | Dai-ichi Life Offering Focus | 2024 Market Insight |

|---|---|---|---|

| Individual Policyholders | Life protection, wealth accumulation, retirement income | Term life, whole life, savings-linked products | Continued strong demand for dual-purpose savings and protection products. |

| High Net Worth Individuals | Estate planning, legacy building, advanced wealth management | Sophisticated life insurance solutions, wealth management services | Growing demand for tailored solutions to preserve and transfer wealth. |

| Corporate Clients | Employee benefits, group life insurance, welfare services | Group life policies, employee assistance programs | Increased focus on holistic employee well-being solutions. |

| Pension & Annuity Seekers | Guaranteed retirement income, financial security | Annuities, retirement planning services | Resilient demand for guaranteed income options amid longer lifespans. |

| International Markets (e.g., India, SE Asia) | Protection, wealth creation, financial literacy | Affordable insurance, tailored savings plans | Significant growth potential due to young populations and rising incomes. |

Cost Structure

Policyholder benefits and claims payouts represent the most significant cost for Dai-ichi Life, a fundamental aspect of its insurance operations. These payouts cover a range of events, including death benefits, disability claims, maturity payouts for savings-oriented policies, and surrender values when policyholders terminate their contracts early.

In 2023, Dai-ichi Life reported total benefits and claims paid out of approximately ¥3.7 trillion (roughly $25 billion USD at current exchange rates). This substantial figure underscores the core function of an insurer: fulfilling its promises to policyholders and their beneficiaries.

Dai-ichi Life's operating and administrative expenses are crucial for its day-to-day functioning. These costs encompass everything from employee salaries and benefits to the rent for its numerous offices and the utilities that keep them running. In 2024, like many large corporations, Dai-ichi Life would be heavily invested in its human capital, with personnel costs representing a significant portion of its overhead.

The company's commitment to operational efficiency means it actively seeks ways to streamline these expenditures. This includes optimizing marketing spend for maximum impact and managing general administrative overhead through effective resource allocation. For instance, in the fiscal year ending March 31, 2024, Dai-ichi Life reported substantial operating expenses, reflecting the scale of its global operations and ongoing investments in technology and talent.

Dai-ichi Life incurs significant sales and distribution costs, primarily driven by commissions paid to its extensive network of agents and advisors. These costs are essential for reaching a broad customer base and are a key investment in their sales structure. For instance, in fiscal year 2023, Dai-ichi Life reported operating expenses of ¥2,575.5 billion, a portion of which directly relates to these distribution efforts.

Investment Management Costs

Investment management costs are a significant component of Dai-ichi Life's operational expenses, encompassing fees paid to external asset managers, costs associated with investment research, and various trading expenses. These outlays are crucial for effectively managing the company's vast investment portfolio to generate returns.

In 2024, Dai-ichi Life has been actively increasing its strategic investments, particularly in areas like technology and overseas markets, which likely translates to higher investment management costs as the portfolio grows and diversifies. The company aims to optimize these costs while pursuing growth opportunities.

- External Asset Management Fees: Payments to third-party firms for managing portions of Dai-ichi Life's assets.

- Research and Due Diligence: Expenses incurred for analyzing potential investments and market trends.

- Trading and Transaction Costs: Fees associated with buying and selling securities within the investment portfolio.

- Strategic Investment Allocation: Increased spending in 2024 on new growth areas, impacting overall management expenditure.

Technology and Digital Transformation Investments

Dai-ichi Life's commitment to technology and digital transformation represents a significant cost driver within its business model. This includes substantial investments in developing, maintaining, and upgrading its IT infrastructure, ensuring robust digital platforms, and bolstering cybersecurity measures. The company is also actively investing in automation tools to streamline operations and enhance efficiency.

These expenditures are crucial for Dai-ichi Life as it accelerates its digital transformation journey. For example, in fiscal year 2023, the company allocated approximately ¥361.5 billion (around $2.4 billion USD at current exchange rates) towards IT and digital initiatives, a notable increase from previous years, reflecting the strategic importance placed on these areas.

- IT Infrastructure: Ongoing costs for servers, data centers, cloud services, and network maintenance are essential for operational continuity.

- Digital Platform Development: Investments in customer-facing portals, mobile applications, and data analytics platforms to improve user experience and service delivery.

- Cybersecurity: Significant spending on advanced security systems, threat detection, and data protection to safeguard sensitive customer information.

- Automation Tools: Funding for robotic process automation (RPA) and artificial intelligence (AI) solutions to automate routine tasks and improve operational efficiency.

Dai-ichi Life's cost structure is dominated by policyholder benefits and claims, a direct reflection of its core insurance business. In fiscal year 2023, these payouts reached approximately ¥3.7 trillion. Operating and administrative expenses, including personnel costs and office overhead, are also significant, with investments in talent and technology a key focus for 2024. Sales and distribution costs, largely commissions for its agent network, and investment management fees for its vast portfolio are other major expenditures.

| Cost Category | FY2023 (Approx.) | Key Drivers |

|---|---|---|

| Policyholder Benefits & Claims | ¥3.7 trillion | Death benefits, disability claims, maturity payouts, surrender values |

| Operating & Administrative Expenses | ¥2,575.5 billion (Total Operating Expenses) | Personnel costs, office rent, utilities, technology investments |

| Sales & Distribution Costs | Included in Operating Expenses | Commissions to agents and advisors |

| Investment Management Costs | Ongoing | External asset management fees, research, trading costs |

| Technology & Digital Initiatives | ¥361.5 billion | IT infrastructure, platform development, cybersecurity, automation |

Revenue Streams

Insurance premiums represent Dai-ichi Life's bedrock revenue stream, generated from the regular payments policyholders make for life insurance and annuity products. This fundamental income source underpins the company's financial stability and growth.

In fiscal year 2023, Dai-ichi Life reported significant revenue from its insurance operations, with total revenue reaching ¥10,034.5 billion. This highlights the substantial contribution of premiums to the company's overall financial performance.

Dai-ichi Life generates substantial revenue from its diverse investment portfolio. This includes income from interest on bonds, dividends from stocks, and rental income from real estate holdings. In the fiscal year ending March 31, 2024, Dai-ichi Life reported investment income and gains as a significant contributor to its overall earnings, reflecting the strategic management of its assets.

Dai-ichi Life generates significant income from asset management services, both for its own insurance policyholders and through external partnerships. This fee-based revenue is crucial, especially as the company diversifies into non-insurance businesses. For instance, in fiscal year 2023, Dai-ichi Life's asset management segment contributed substantially to its overall profitability, reflecting the growing importance of this income stream.

Reinsurance Income

Dai-ichi Life generates revenue through reinsurance income, which involves ceding a portion of its insurance risks to other companies. This strategy not only transfers risk but also enhances profitability and capital efficiency. For instance, Protective Life, a subsidiary of Dai-ichi Life, entered into a significant reinsurance agreement with Resolution Life in 2024, transferring approximately $2.7 billion of its annuity business. This move is expected to free up capital for Protective Life, allowing for more strategic deployment and potentially boosting future earnings.

This income stream is crucial for managing the company's overall risk exposure and optimizing its balance sheet. By sharing risk, Dai-ichi Life can maintain a stronger financial position, enabling it to underwrite more business and pursue growth opportunities. The 2024 transaction with Resolution Life underscores the active management of Dai-ichi Life's portfolio through reinsurance, aiming for improved financial performance.

- Reinsurance Income: Revenue generated by transferring a portion of Dai-ichi Life's insurance liabilities to reinsurers.

- Risk Management: A key function of reinsurance is to mitigate the impact of large or unexpected claims.

- Capital Efficiency: Reinsurance allows Dai-ichi Life to reduce the amount of capital it needs to hold against certain risks, improving its return on capital.

- Protective Life's 2024 Deal: The reinsurance of $2.7 billion in annuity business by Protective Life with Resolution Life exemplifies this revenue stream's application.

Fees from Non-Insurance Businesses

Dai-ichi Life is actively generating revenue from services that extend beyond its core insurance offerings. This diversification is a key strategic pillar, aiming to broaden the company's income sources and reduce reliance on traditional insurance products.

Specifically, the company earns fees from managing corporate benefits programs, providing financial advisory services, and offering other specialized financial solutions to a wider client base. This expansion into non-insurance domains represents a deliberate effort to capture new market opportunities.

- Corporate Benefits Programs: Revenue is derived from administering and providing financial wellness solutions for employee benefit plans.

- Financial Advisory Services: Fees are collected for offering personalized financial planning and investment advice to individuals and corporations.

- Other Financial Services: This includes income from asset management, credit services, or other complementary financial products developed to meet diverse customer needs.

Dai-ichi Life's revenue streams are multifaceted, extending beyond traditional insurance premiums to include significant income from investments and asset management services. The company also strategically utilizes reinsurance to manage risk and enhance capital efficiency, while actively diversifying into non-insurance related financial services.

| Revenue Stream | Description | Fiscal Year 2023/2024 Data Point |

|---|---|---|

| Insurance Premiums | Regular payments from policyholders for life insurance and annuities. | Total revenue reached ¥10,034.5 billion in FY2023. |

| Investment Income & Gains | Returns from bonds, stocks, and real estate holdings. | A significant contributor to overall earnings in FY ending March 31, 2024. |

| Asset Management Fees | Fees earned from managing assets for policyholders and external clients. | Substantially contributed to profitability in FY2023. |

| Reinsurance Income | Revenue from transferring insurance risks to other companies. | Protective Life reinsured $2.7 billion of annuity business in 2024. |

| Non-Insurance Services | Fees from corporate benefits programs and financial advisory. | Diversification into new market opportunities. |

Business Model Canvas Data Sources

The Dai-ichi Life Business Model Canvas is informed by a blend of internal financial statements, customer demographic data, and actuarial projections. This comprehensive approach ensures each component of the canvas is grounded in empirical evidence and strategic foresight.