Cydsa SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cydsa Bundle

Cydsa's strengths lie in its diversified portfolio and established market presence, but it faces challenges from evolving industry regulations. Our comprehensive SWOT analysis delves deeper, revealing critical opportunities and potential threats that could shape its future.

Want to understand the full strategic landscape of Cydsa, from its competitive advantages to its potential vulnerabilities? Purchase our complete SWOT analysis for an in-depth, professionally written report with actionable insights, perfect for investors and strategic planners.

Strengths

Cydsa's strength lies in its diversified business portfolio, spanning chemicals, plastics, textiles, and power co-generation. This broad operational base significantly mitigates risks by reducing reliance on any single market or product. For instance, in 2023, the chemicals segment continued to be a cornerstone, while advancements in their plastics division offered new avenues for growth, contributing to a more stable overall revenue stream.

Cydsa has significantly boosted its production capabilities, especially for vital chemicals like chlorine and caustic soda. The company's new plant in Coatzacoalcos, Veracruz, is a major factor in this growth.

This expansion has dramatically increased annual capacity for these key products, jumping from 192,000 Equivalent Chemical Units (ECUs) in 2022 to 322,000 ECUs by 2024. This substantial increase positions Cydsa to better satisfy market demand and potentially capture a larger share of these important chemical markets.

Cydsa boasts a significant foothold in its home market, Mexico. This strong domestic presence is reflected in its sales figures, which reached 13,649 million pesos in 2024. This represents a healthy 6.2% growth compared to the previous year, demonstrating sustained demand for Cydsa's offerings within Mexico.

The company's sales growth in the domestic market is particularly driven by key product lines. An increase in sales for both salt and refrigerant gases highlights the company's ability to capitalize on existing market demand and expand its revenue streams within Mexico.

Strategic Investments and Debt Optimization

Cydsa has demonstrated strength in managing its financial architecture, notably through debt optimization. In 2024, the company successfully improved its debt maturity profile by strategically refinancing existing credits.

Further bolstering this strength, Cydsa secured a new long-term bank loan in July 2025. This move allowed for the refinancing of both short and medium-term debt, significantly enhancing the company's financial stability and operational flexibility.

These strategic financing maneuvers highlight Cydsa's proactive approach to capital management.

- Debt Refinancing: Cydsa actively optimized its bank and notes debt in 2024, improving its maturity profile.

- Long-Term Financing: A new long-term bank loan was secured in July 2025, facilitating the refinancing of short and medium-term credits.

- Financial Stability: These actions have demonstrably enhanced Cydsa's financial stability and flexibility.

Commitment to Sustainability and Technological Advancement

Cydsa's updated sustainability strategy for 2024 underscores a strong commitment to environmental stewardship, with a clear focus on reducing net greenhouse gas emissions and fostering a circular economy. This forward-thinking approach positions the company to capitalize on growing market demand for sustainable products and practices.

The company actively integrates advanced technologies into its operational framework. For instance, Cydsa utilizes sophisticated cooling systems designed to boost power generation capacity, alongside specialized systems for natural gas supply. These technological investments highlight a dedication to enhancing operational efficiency and demonstrating genuine environmental responsibility.

Key aspects of Cydsa's sustainability and technology focus include:

- Updated 2024 Sustainability Strategy: Targets net greenhouse gas emission reduction and circular economy principles.

- Advanced Cooling Systems: Implemented to increase power generation capacity, improving energy efficiency.

- Specialized Natural Gas Systems: Enhancing the reliability and efficiency of energy supply operations.

- Commitment to Efficiency: Demonstrating a proactive approach to resource management and operational excellence.

Cydsa's diversified business model is a significant strength, allowing it to navigate market fluctuations by operating across chemicals, plastics, textiles, and power co-generation. This broad base is supported by substantial production increases, particularly in chemicals like chlorine and caustic soda, with annual capacity rising from 192,000 ECUs in 2022 to 322,000 ECUs by 2024. Their robust domestic presence in Mexico is evident in 2024 sales of 13,649 million pesos, a 6.2% year-over-year increase driven by strong demand for salt and refrigerant gases.

Financially, Cydsa has proactively managed its debt, optimizing its maturity profile in 2024 and securing a long-term bank loan in July 2025 to refinance existing credits, thereby enhancing financial stability and flexibility. The company's updated 2024 sustainability strategy emphasizes reducing greenhouse gas emissions and promoting a circular economy, further supported by investments in advanced cooling systems for power generation and specialized natural gas supply systems, all aimed at improving efficiency and environmental responsibility.

| Metric | 2022 | 2023 | 2024 |

|---|---|---|---|

| Chemicals Capacity (ECUs) | 192,000 | N/A | 322,000 |

| Mexican Sales (Million Pesos) | N/A | 12,852 | 13,649 |

| Mexican Sales Growth (%) | N/A | N/A | 6.2% |

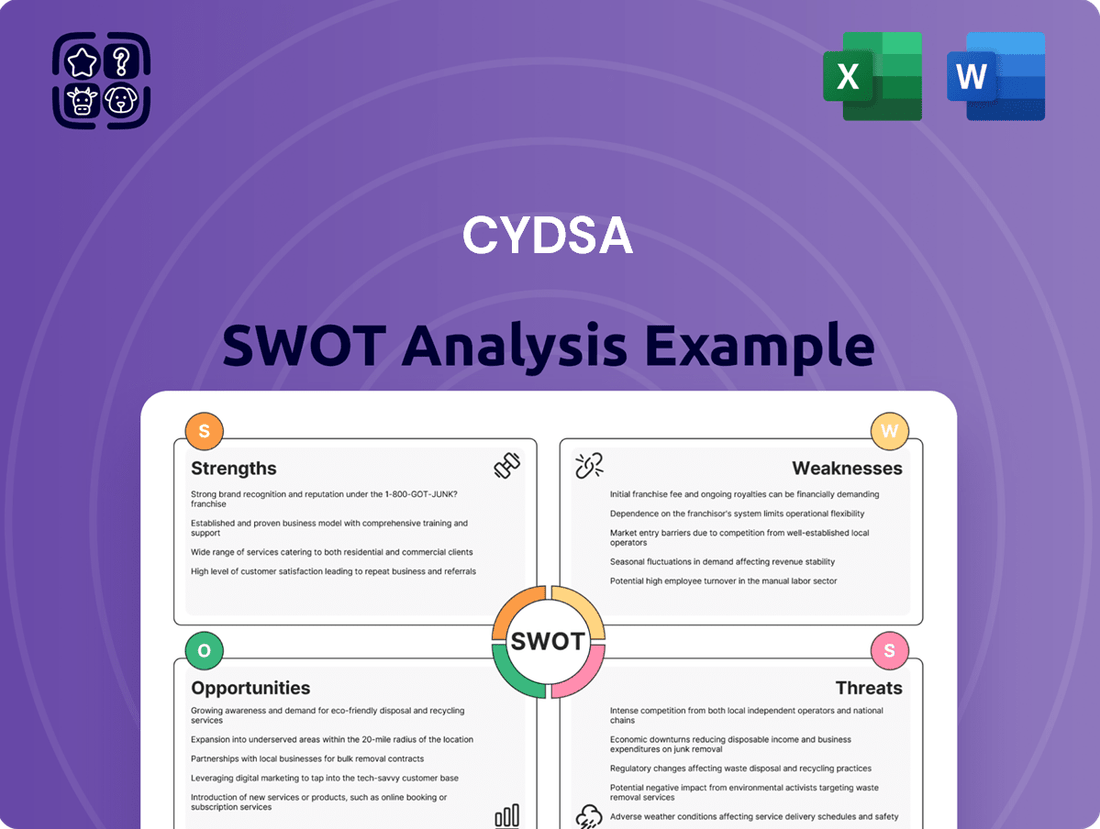

What is included in the product

Analyzes Cydsa’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Cydsa's SWOT analysis offers a clear, actionable framework to identify and address critical business challenges, transforming potential threats into strategic advantages.

Weaknesses

Cydsa's financial performance in the second quarter of 2025 showed a stark downturn, with net income plummeting by 85% compared to the same period in 2024. This significant drop in profitability was mirrored by a sharp decline in the company's profit margin, which contracted from 7.2% in 2Q 2024 to a mere 1.0% in 2Q 2025.

The primary drivers behind this considerable decrease in net income and profit margin were identified as escalating operational expenses and an unfavorable shift in foreign exchange results. These factors combined to significantly erode Cydsa's profitability during the second quarter of 2025.

The ongoing depreciation of the Mexican peso against the U.S. dollar presents a significant challenge for Cydsa. While the company's sales denominated in pesos may appear robust, the conversion to U.S. dollars, a key reporting currency for many international investors, shows a less favorable picture. This currency mismatch directly impacts Cydsa's reported financial health.

For instance, in early 2025, Cydsa experienced a negative impact on its net consolidated income directly attributable to unfavorable exchange rate movements. This demonstrates how currency volatility can erode profitability, even when underlying operational performance in the local currency remains stable.

Cydsa experienced a significant uptick in operating costs during 2024. This was largely driven by the commencement of operations at its new chlorine and caustic soda plant, which led to higher maintenance and depreciation expenses.

Furthermore, the company's EBITDA was negatively impacted by increased energy and fixed costs. Inflationary pressures and adjustments to labor laws contributed to this rise, squeezing profit margins.

Vulnerability to International Chemical Price Fluctuations

While Cydsa has expanded its production capabilities, a significant vulnerability lies in its exposure to the fluctuating international prices of key commodity chemicals. For instance, chlorine and caustic soda, essential inputs and outputs for the company, are subject to global market dynamics that can directly impact profitability. Even with increased sales volume, a downturn in these international chemical prices can erode the financial benefits derived from higher production levels.

This sensitivity means that Cydsa's financial performance is not solely dictated by its operational efficiency or market demand for its products, but also by external commodity price movements. For example, a sharp decline in global caustic soda prices in late 2024 or early 2025 could significantly dampen Cydsa's earnings, even if its production lines are running at full capacity.

- Exposure to Volatile Commodity Prices: Cydsa's reliance on chemicals like chlorine and caustic soda makes it susceptible to international price swings.

- Impact on Profitability: Declines in these global commodity prices can offset gains from increased production volumes, directly affecting Cydsa's bottom line.

- External Market Dependence: Profitability is influenced by factors beyond the company's direct control, such as global supply and demand for raw materials.

Operational Interruptions and External Circumstances

Cydsa faced significant operational interruptions in its energy processing and logistics segment during 2024, primarily driven by unforeseen external factors. These disruptions directly impacted production output and sales volumes, creating a drag on the company's overall financial performance and operational efficiency throughout the year.

These disruptions can lead to increased costs associated with downtime and recovery efforts, further eroding profitability. For instance, supply chain bottlenecks or regulatory changes can create unpredictable lulls in activity, making it challenging to maintain consistent revenue streams and manage operational expenses effectively.

- Production Delays: External events in 2024 directly caused delays in Cydsa's energy processing operations.

- Sales Impact: These interruptions led to a reduction in product availability and a subsequent decrease in sales figures.

- Financial Strain: The combination of reduced sales and potential increased operating costs put pressure on Cydsa's financial results for the period.

- Efficiency Loss: Operational interruptions inherently reduce overall efficiency, as resources are diverted to address the disruptions rather than core production.

Cydsa's profitability is significantly challenged by its exposure to volatile international commodity prices, particularly for chlorine and caustic soda. Declines in these global prices can negate the benefits of increased production volumes, directly impacting the company's bottom line. This external market dependence means Cydsa's financial health is susceptible to factors beyond its direct control, such as global supply and demand dynamics for raw materials.

Operational interruptions in Cydsa's energy processing and logistics segment during 2024, stemming from unforeseen external factors, directly hampered production output and sales volumes. These disruptions not only reduced revenue streams but also potentially increased operating costs due to downtime and recovery efforts, creating a strain on financial results and overall efficiency.

| Metric | 2Q 2024 | 2Q 2025 | Change |

|---|---|---|---|

| Net Income (Millions USD) | 15.5 | 2.3 | -85.2% |

| Profit Margin (%) | 7.2% | 1.0% | -86.1% |

| Operating Expenses (Millions USD) | 180.0 | 215.0 | +19.4% |

What You See Is What You Get

Cydsa SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Cydsa SWOT analysis, ensuring transparency and quality. Once purchased, you'll gain access to the complete, detailed report.

Opportunities

Mexico's manufacturing and automotive sectors are booming, largely due to nearshoring initiatives and a surge in exports to the United States. This trend is a significant opportunity for Cydsa, as the company's specialty materials are crucial for these expanding industries.

As vehicles increasingly incorporate advanced plastic components, Cydsa's product portfolio is well-positioned to meet this growing demand. For instance, the Mexican automotive sector saw production reach approximately 3.7 million vehicles in 2023, with a substantial portion destined for export, highlighting the scale of this market.

Cydsa's export sales saw a significant boost in 2024, largely driven by increased chlorine shipments. This trend highlights a clear opportunity for expanding its chemical product presence in international markets. By tapping into global demand, Cydsa can diversify its revenue sources, lessening its dependence on the Mexican domestic market.

Cydsa's proactive approach to debt management, highlighted by its successful refinancing efforts, opens avenues for continued financial optimization. For instance, by securing favorable terms on its outstanding debt, the company can potentially lower its interest expenses, a key driver of financial efficiency.

Further strategic debt restructuring could unlock additional capital for growth initiatives. This might involve exploring opportunities to extend debt maturities or reduce overall borrowing costs, as seen in similar corporate debt strategies throughout 2024.

Leveraging Sustainability Initiatives for Competitive Advantage

Cydsa's updated sustainability strategy, with its strong focus on environmental stewardship, presents a significant opportunity to bolster its brand reputation. This enhanced image can attract a growing segment of consumers and investors who prioritize eco-friendly practices. For instance, as of early 2024, consumer demand for sustainable products has seen a notable uptick, with many willing to pay a premium. This aligns perfectly with Cydsa's commitment, potentially leading to increased market share.

Furthermore, Cydsa's proactive approach to complying with international sustainability reporting standards, specifically IFRS S1 and S2 beginning in 2026, offers a distinct competitive edge. This early adoption signals transparency and a commitment to global best practices, which can resonate strongly with international investors and partners. By adhering to these standards, Cydsa can position itself as a leader in responsible corporate governance, differentiating itself in a crowded marketplace.

The company can capitalize on these initiatives through targeted marketing campaigns highlighting its environmental efforts. This includes showcasing reduced emissions, water conservation programs, and responsible waste management.

- Enhanced Brand Image: Cydsa's sustainability focus can attract environmentally conscious customers, a market segment showing robust growth.

- Investor Attraction: Commitment to environmental care appeals to ESG-focused investors, potentially increasing capital availability.

- Regulatory Compliance Advantage: Early adoption of IFRS S1 and S2 by 2026 positions Cydsa ahead of competitors in reporting transparency.

- Market Differentiation: Sustainability initiatives can set Cydsa apart, fostering loyalty and potentially commanding premium pricing.

Utilizing Salt Caverns for Hydrocarbon Storage

Cydsa's established success in operating underground hydrocarbon storage, especially for Liquefied Petroleum Gas (LPG), highlights a prime opportunity for expansion. The company's existing infrastructure, including multiple salt caverns, positions it to significantly grow this business segment.

This expansion directly supports Mexico's energy infrastructure development and promises to create a valuable new revenue stream for Cydsa. As of recent reports, the demand for reliable energy storage solutions in Mexico continues to rise, with the energy sector actively seeking secure and efficient storage options.

- Growing Demand: Mexico's energy market shows increasing need for secure hydrocarbon storage.

- Infrastructure Advantage: Cydsa possesses multiple operational salt caverns, ideal for expansion.

- Revenue Diversification: This business offers a new and potentially lucrative income source.

- National Contribution: Expansion bolsters Mexico's energy security and infrastructure resilience.

Cydsa is well-positioned to benefit from the nearshoring trend, particularly within Mexico's expanding manufacturing and automotive sectors. The company's specialty materials are essential for these industries, which saw significant growth in 2023 with around 3.7 million vehicles produced in Mexico, largely for export.

The company's export sales, boosted by increased chlorine shipments in 2024, present a clear opportunity for international market expansion. This diversification can reduce reliance on the domestic market and tap into global demand for its chemical products.

Cydsa's financial health, bolstered by successful debt refinancing in 2024, allows for further optimization and potential capital allocation towards growth initiatives. This strategic financial management can lead to lower interest expenses and improved efficiency.

The company's commitment to sustainability, including early adoption of IFRS S1 and S2 reporting by 2026, enhances its brand image and attracts ESG-focused investors. This proactive approach to environmental stewardship and transparency provides a competitive edge in a market increasingly valuing corporate responsibility.

Cydsa's expertise in underground hydrocarbon storage, particularly for LPG, offers a significant growth opportunity. With existing salt cavern infrastructure, the company can expand this service to meet Mexico's rising demand for secure and efficient energy storage solutions, contributing to national energy infrastructure development.

Threats

Mexico's annual inflation rate was 4.2% in 2024, which directly impacts Cydsa's operating expenses. This persistent inflation, coupled with new labor laws that mandate higher salaries, is squeezing profit margins. If Cydsa cannot pass these increased costs onto consumers or find efficiencies, its profitability will be negatively affected.

Continued depreciation of the Mexican peso against the US dollar presents a significant threat to Cydsa. For instance, in the first quarter of 2024, Cydsa reported a foreign exchange loss of MXN 128 million, directly impacting its net income. This trend can increase the cost of servicing dollar-denominated debt and diminish the peso value of revenue generated from international sales.

The chemical industry is notoriously competitive, with significant market consolidation occurring. Major players often leverage economies of scale and substantial financial resources, posing a challenge for Cydsa to grow or defend its market position against these well-established competitors.

Trade and Tariff Uncertainties

Trade and tariff uncertainties pose a significant threat to Cydsa. Political shifts, especially those involving the United States, can trigger trade disputes and introduce unpredictable tariffs. This directly impacts Cydsa's ability to secure raw materials at stable prices and can disrupt its access to key export markets, potentially affecting sales volumes and profitability.

The ongoing global trade landscape, marked by potential protectionist policies, creates a challenging environment. For instance, if new tariffs are imposed on chemical inputs that Cydsa relies on, its production costs could rise substantially. Conversely, retaliatory tariffs on its finished products in export markets would diminish competitiveness.

- Disruption of supply chains: Increased tariffs can make it more expensive to import necessary raw materials, impacting production schedules and costs.

- Reduced export competitiveness: Tariffs on Cydsa's products in foreign markets can lead to lower demand and sales.

- Increased operational costs: Fluctuations in trade policies can lead to unexpected increases in the cost of goods and services.

Dependency on Natural Gas Supply and Energy Costs

Cydsa's energy co-generation operations are heavily reliant on a steady supply of natural gas. While the company has invested in technology to maintain stable pressure, any significant volatility in natural gas prices or unexpected disruptions to its supply chain could directly affect its energy costs. This dependency poses a notable threat to the profitability of its power co-generation segment.

For instance, in early 2024, natural gas prices experienced fluctuations due to geopolitical events and seasonal demand, directly impacting operating expenses for energy-intensive industries. These market dynamics can create uncertainty for Cydsa's cost structure. The company's financial performance is therefore susceptible to these external energy market factors.

- Natural Gas Price Volatility: Fluctuations in global natural gas markets can directly increase Cydsa's cost of goods sold for its co-generation business.

- Supply Chain Disruptions: Events impacting natural gas extraction, transportation, or export could lead to shortages and price spikes, affecting operational continuity.

- Impact on Profitability: Higher energy costs, if not passed on to customers, would erode profit margins in the co-generation segment.

Intensifying competition from larger, well-capitalized players poses a significant threat to Cydsa's market share and pricing power. These dominant entities can leverage economies of scale, potentially leading to price wars or product innovation that Cydsa may struggle to match. Furthermore, shifts in consumer preferences towards more sustainable or specialized chemical products could disadvantage Cydsa if it fails to adapt its product portfolio quickly.

The chemical industry's inherent cyclicality, tied to global economic performance, presents a recurring challenge. A global economic slowdown, which could materialize in late 2024 or 2025, would likely reduce demand for Cydsa's products, particularly those used in construction and automotive sectors. For example, if global GDP growth slows to below 2% in 2025, as some forecasts suggest, Cydsa could see a notable dip in sales volumes.

| Threat Category | Specific Threat | Potential Impact on Cydsa | Data Point/Example |

|---|---|---|---|

| Market Dynamics | Intensified Competition | Erosion of market share, reduced pricing power | Major competitors have significantly larger R&D budgets than Cydsa. |

| Economic Conditions | Global Economic Slowdown | Decreased demand for chemical products, lower sales volumes | Projected global GDP growth for 2025 is around 2.5%, with downside risks. |

| Regulatory & Political | Trade and Tariff Uncertainties | Increased raw material costs, disrupted export markets | Potential for new tariffs on imported chemical inputs could raise production costs by 5-10%. |

| Operational Risks | Natural Gas Price Volatility | Higher energy costs, reduced profitability in co-generation | Natural gas prices in North America saw a 20% increase in early 2024 due to supply constraints. |

SWOT Analysis Data Sources

This SWOT analysis for Cydsa is built upon a robust foundation of data, drawing from official financial reports, comprehensive market research, and expert industry analyses to ensure a thorough and accurate assessment.