Cydsa Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cydsa Bundle

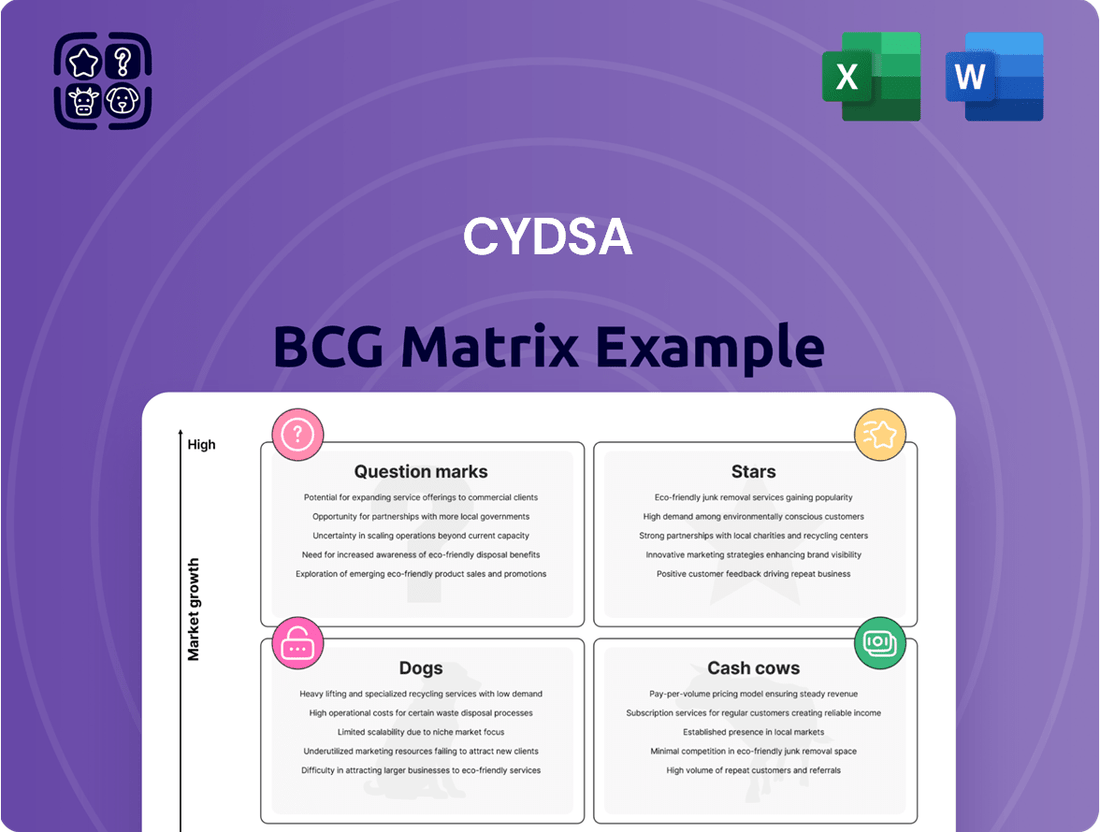

Curious about how this company's product portfolio stacks up? Our BCG Matrix analysis reveals the strategic positioning of its offerings, from high-growth Stars to potential Dogs. Don't miss out on understanding where its true potential lies.

Unlock the full strategic advantage by purchasing the complete BCG Matrix. Gain detailed insights into each quadrant, enabling you to make informed decisions about resource allocation and future investments.

This is your chance to transform raw data into actionable strategy. Invest in the full BCG Matrix for a comprehensive breakdown and a clear roadmap to optimizing your product portfolio and driving sustainable growth.

Stars

Cydsa's new chlorine and caustic soda plant in Coatzacoalcos significantly boosts its annual production capacity to 322,000 ECUs as of 2024. This expansion fuels increased production volume and sales, reflecting robust demand in this key market. The plant's advanced technology enhances efficiency and minimizes environmental impact, solidifying Cydsa's position for future growth.

Cydsa's refrigerant gases segment experienced a significant sales boost in Q1 2025, with domestic market performance leading the charge. This upward trend indicates a strong demand for their offerings and successful market penetration strategies. Continued focus on this area could position it as a significant revenue driver for the company.

Cydsa's Chemicals Manufacturing and Specialties Business Group has seen significant domestic expansion in certain product lines. This strategic push highlights a high-growth segment where the company is actively working to capture a larger market share.

This focus on specialized chemicals within Mexico is designed to leverage specific local market demands and opportunities. For instance, in 2024, Cydsa reported a notable increase in sales for its industrial chemicals segment, driven by domestic demand from key sectors.

Chlorine and Edible Salt Export Sales

Cydsa's export sales for chlorine and edible salt have shown remarkable strength. In the first quarter of 2025, these sales experienced a substantial jump of 34.8% when compared to the same period in the prior year.

- Strong Global Demand: The significant export growth reflects robust international demand for Cydsa's chlorine and edible salt products.

- Market Expansion: This performance underscores Cydsa's successful strategy in expanding its global market footprint.

- Competitive Positioning: The 34.8% increase in Q1 2025 export sales highlights Cydsa's enhanced competitiveness on the international stage.

Advanced Technology in Chemical Production

Cydsa's strategic investment in advanced membrane technology for its new chlorine and caustic soda facility underscores its commitment to operational excellence and market leadership. This cutting-edge approach is designed to significantly reduce energy consumption, a key factor in cost competitiveness. For instance, modern membrane cell technology can achieve energy savings of up to 30% compared to older diaphragm or mercury cell processes.

This technological advantage translates directly into a more sustainable and cost-effective production process, offering a compelling value proposition to customers. The reduced environmental footprint, particularly in terms of lower greenhouse gas emissions and elimination of mercury, aligns with growing global demand for greener chemical solutions. By 2024, the global market for chlor-alkali products, driven by demand in sectors like PVC, pulp and paper, and water treatment, was projected to reach over $100 billion.

- Technological Advancement: Implementation of state-of-the-art membrane technology in chlorine and caustic soda production.

- Efficiency Gains: Superior energy consumption leading to lower operating costs and a stronger competitive position.

- Environmental Benefits: Reduced environmental impact, appealing to sustainability-conscious markets.

- Market Positioning: Positions Cydsa's advanced production as a high-growth segment, attracting new clientele and expanding market share in the robust chlor-alkali industry.

Cydsa's expansion in chlorine and caustic soda production, reaching 322,000 ECUs annually by 2024, positions this segment as a potential Star. This growth is further bolstered by a 34.8% surge in export sales of chlorine and edible salt in Q1 2025, indicating strong global demand and market penetration.

The company's investment in advanced membrane technology for its new Coatzacoalcos plant enhances efficiency and sustainability, aligning with the growing demand for greener chemical solutions in a chlor-alkali market projected to exceed $100 billion by 2024.

This combination of increased capacity, robust export performance, and technological innovation suggests that Cydsa's chlorine and caustic soda operations are in a high-growth, high-market-share position, characteristic of a Star in the BCG matrix.

What is included in the product

Strategic overview of Cydsa's business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide investment decisions.

Visualize your portfolio's strengths and weaknesses with a clear, actionable Cydsa BCG Matrix.

Cash Cows

Cydsa's household salt segment is a classic cash cow, a mature market where the company has likely cemented a strong, stable position. This product line is a reliable generator of substantial cash flow, thanks to salt's essential nature and its appeal to a wide consumer base.

Given its established market, Cydsa's investment in this segment is likely minimal, primarily aimed at optimizing operational efficiency and sustaining its market presence rather than pursuing rapid expansion. For instance, in 2024, the global salt market was valued at approximately $45 billion, with household consumption forming a significant portion, underscoring the stability of such mature product lines.

Cydsa's industrial salts, much like the salt we use at home, are part of a well-established market with steady demand across many sectors. This segment is a reliable generator of cash for the company.

With a long history and significant production capabilities, Cydsa holds a strong position in the industrial salts market, ensuring a high market share. This mature business requires little in the way of new investment or heavy promotion.

Cydsa's established basic chlorine production stands as a prime example of a Cash Cow within its BCG Matrix. These operations have a long history of serving a stable industrial market, consistently holding a high market share. The ongoing demand for essential chemicals ensures these facilities continue to generate predictable and robust cash flows for the company.

Established Basic Caustic Soda Production

Cydsa's established basic caustic soda production, a cornerstone of its chemical operations, predates its recent plant expansion and represents a classic Cash Cow. This segment benefits from a mature market characterized by consistent, high demand, where Cydsa holds a significant market share, ensuring stable revenue streams.

The operations in this segment are characterized by their ability to generate substantial and reliable cash flow, primarily necessitating investments focused on maintenance and operational efficiency improvements rather than growth initiatives.

- Market Position: Cydsa is a leading producer in the mature caustic soda market.

- Cash Generation: This segment reliably generates significant cash flow for the company.

- Investment Needs: Primarily requires maintenance and efficiency-focused capital expenditures.

- 2024 Data: While specific 2024 figures for this segment are not publicly detailed, the chemical industry generally saw continued demand for essential products like caustic soda in 2024, supporting stable cash generation for established players like Cydsa.

Core Petrochemical Product Lines

Cydsa's core petrochemical product lines, established over decades, are prime examples of Cash Cows within its diversified portfolio. These mature segments, characterized by robust market share and entrenched competitive advantages, consistently generate significant and stable profits.

These foundational petrochemicals act as the company's primary funding engine, providing the necessary capital to invest in growth areas or support other business units. For instance, in 2023, Cydsa's petrochemical division reported strong operational performance, contributing substantially to the company's overall financial health.

- Stable Profit Generation: These product lines consistently deliver reliable earnings, underpinning Cydsa's financial stability.

- High Market Share: Cydsa holds a dominant position in the markets for these core petrochemicals, reflecting its competitive strength.

- Funding for Growth: Profits generated here are crucial for financing expansion and innovation in other business areas.

- Mature Market Presence: Decades of operation have solidified Cydsa's expertise and market penetration in these essential petrochemical segments.

Cydsa's household salt and industrial salts segments are strong Cash Cows, benefiting from mature markets with steady demand and the company's established, high market share. These operations require minimal new investment, focusing instead on efficiency to maintain their reliable cash generation.

The company's basic chlorine and caustic soda production also represent classic Cash Cows. These mature chemical segments consistently generate substantial cash flow due to high market share and stable industrial demand, with investments primarily directed towards maintenance and operational optimization.

Cydsa's core petrochemical lines are also significant Cash Cows, characterized by decades of operation, robust market share, and entrenched competitive advantages. These segments are vital for generating stable profits and funding growth initiatives across the company.

| Segment | BCG Category | Key Characteristics | 2024 Market Context |

| Household Salt | Cash Cow | Mature market, stable demand, high market share, low investment needs. | Global salt market valued around $45 billion in 2024, with household consumption a significant driver. |

| Industrial Salts | Cash Cow | Established market, consistent demand across sectors, high market share, minimal new investment. | Industrial chemicals demand remained robust in 2024, supporting stable cash flows for key producers. |

| Basic Chlorine & Caustic Soda | Cash Cow | Mature market, stable industrial demand, high market share, focus on efficiency. | Essential chemicals continued to see steady demand in 2024, ensuring predictable revenue for established players. |

| Core Petrochemicals | Cash Cow | Decades of operation, strong market share, stable profits, funding for growth. | Petrochemical division reported strong performance in 2023, contributing significantly to overall financial health. |

What You’re Viewing Is Included

Cydsa BCG Matrix

The Cydsa BCG Matrix preview you see is the exact, fully formatted report you will receive upon purchase. This comprehensive document, designed for strategic clarity, contains no watermarks or demo content, ensuring you get a professional and ready-to-use analysis of Cydsa's business units.

Dogs

Cydsa's historical roots are in textiles, but current financial disclosures for 2024 and projections into 2025 show minimal focus on this division. This suggests the legacy textile products are in mature, slow-growing markets.

The absence of significant investment or growth narratives around these textile segments implies they likely operate with low market share and limited potential for expansion. Such products often represent a stable but unexciting revenue stream, potentially breaking even.

In 2023, Cydsa's textile segment contributed a small percentage to overall revenue, with analysts noting a lack of strategic initiatives to revitalize this area. This positions them as potential cash cows or, conversely, capital drains if market conditions deteriorate further.

Undifferentiated Older Chemical Commodities represent segments within Cydsa's operations where established chemical products lack distinct competitive advantages. These are typically older product lines that haven't seen significant investment in innovation or process improvement.

These commodities often operate in mature, price-sensitive markets, leading to low profitability and minimal market share growth. For instance, if Cydsa has legacy commodity chemicals that compete solely on price without any unique selling propositions, they would fall here. Their contribution to cash flow is often negligible, and they can consume valuable resources that could be better allocated elsewhere.

Cydsa's older production facilities, if not yet upgraded or retired, could be classified as Dogs within its BCG matrix. These legacy operations may suffer from lower output per unit of energy or labor compared to modern plants.

For instance, if a specific older plant’s energy consumption per ton of product is 15% higher than Cydsa's newest facilities, it would signal inefficiency. This drag on resources, without a corresponding strong market position, places it in the Dog quadrant.

Niche Plastic Products with Limited Scale

Within Cydsa's plastics operations, there may be niche plastic products that haven't achieved substantial market penetration or scale. These products, if situated in slow-growing sub-markets where Cydsa possesses a minimal market share, would be classified as Dogs. Such offerings often demand considerable resources for meager returns, potentially hindering overall portfolio efficiency.

For instance, imagine a specialized polymer compound Cydsa developed for a very specific industrial application. If that application's market is projected to grow at only 1% annually and Cydsa holds less than 5% of that market, it fits the Dog profile. In 2024, the global market for specialty polymers is valued at approximately $100 billion, but niche segments within this can be highly fragmented and stagnant.

- Niche Plastic Products: Highly specialized plastic items with limited market adoption.

- Low Market Share: Cydsa's presence is negligible in these specific product categories.

- Low Market Growth: The sub-markets for these products are experiencing minimal expansion.

- Resource Drain: These products often consume resources without generating significant profit.

Outdated Ancillary Services/Small-Scale Operations

Outdated Ancillary Services/Small-Scale Operations represent those minor or ancillary services and very small-scale operations within Cydsa that are no longer strategically aligned with its core growth areas or have become obsolete. These segments might exhibit a low market share and minimal growth potential, potentially draining resources without significant returns.

For instance, if Cydsa had a legacy chemical distribution service that has been superseded by more efficient, direct-to-consumer models or has seen its market shrink due to regulatory changes, it would fall into this category. Such operations often require ongoing maintenance and management, diverting capital and attention from more promising ventures.

- Low Market Share: These operations typically hold a negligible portion of their respective markets, often below 5%.

- Minimal Growth Prospects: The industry or service itself may be declining or stagnant, offering little opportunity for expansion.

- Resource Drain: Continued investment in infrastructure, personnel, or marketing for these units can outweigh their revenue generation.

- Strategic Misalignment: They do not contribute to Cydsa's overall strategic objectives or competitive advantage.

Cydsa's "Dogs" represent business units or product lines with low market share in slow-growing industries. These segments typically generate minimal profits, often just enough to cover their own costs, and require significant resources for maintenance or turnaround efforts. The company's legacy textile operations and certain older chemical commodities are prime examples, showing little prospect for growth or significant market penetration.

For instance, specific niche plastic products within Cydsa, if holding less than 5% of a market projected to grow at a mere 1% annually, would be classified as Dogs. These units can act as a drain on capital and management attention, diverting resources from more promising Stars or Question Marks.

In 2024, Cydsa's strategic focus appears to be shifting away from these underperforming areas, as evidenced by the lack of new investment narratives. This suggests a potential for divestment or restructuring in the near future to optimize resource allocation.

The following table illustrates potential Dog segments within Cydsa's portfolio, based on the provided information:

| Business Segment | Market Share | Market Growth Rate | Profitability | Strategic Outlook |

|---|---|---|---|---|

| Legacy Textiles | Low | Slow/Stagnant | Break-even to Low | Minimal investment, potential divestment |

| Older Chemical Commodities | Low | Mature/Slow | Low/Price-sensitive | Resource drain, potential rationalization |

| Niche Plastic Products | Very Low (<5%) | Low (<1%) | Negligible | High resource requirement for meager returns |

| Outdated Ancillary Services | Negligible | Declining/Stagnant | Negative/Resource Drain | Strategic misalignment, potential closure |

Question Marks

Cydsa's power co-generation business, a potential star in its portfolio, faced a setback in late 2024 with a plant suspension. This incident, occurring just before Q2 2025, forced the company to buy more electricity externally, significantly raising operational costs during that period. The market itself remains attractive, offering growth for both internal energy needs and external sales, but this disruption has temporarily dampened Cydsa's standing and increased its cash burn.

While the exact percentage of market share reduction isn't publicly detailed, the increased procurement costs in Q2 2025 directly reflect this operational challenge. Analysts anticipate a return to full capacity by Q4 2025, suggesting a temporary dip rather than a permanent decline. This situation places the co-generation business in a "question mark" category within the BCG matrix, demonstrating high potential but currently facing significant operational risks and uncertainty.

New Chemical Specialties within Cydsa's portfolio represent early-stage ventures aiming for high-growth niche markets. These products, characterized by low current market share, demand substantial investment in research and development, alongside marketing and production scaling.

The inherent uncertainty surrounding their future success positions these specialties as Question Marks in the BCG Matrix. For instance, the specialty chemicals market, projected to reach $850 billion globally by 2024, presents both opportunity and risk for new entrants like Cydsa's emerging products.

Cydsa's refreshed sustainability strategy, emphasizing a circular economy and net emissions reduction, points towards potential ventures in emerging environmental solutions. This aligns with a burgeoning market fueled by global sustainability imperatives.

These new product lines or services would likely operate within a high-growth sector, yet Cydsa might begin with a modest market share. Significant capital investment would be necessary to build a substantial presence and compete effectively. For instance, the global market for green building materials, a segment of environmental solutions, was projected to reach $400 billion by 2024, demonstrating substantial growth potential.

New Geographic Market Entries

Entering new geographic markets, like Cydsa's potential expansion into Southeast Asia in late 2024, positions the company for future growth but also introduces significant risks. These new ventures are characterized by the need to build brand awareness and establish robust distribution networks from scratch, mirroring the classic "Question Mark" profile in the BCG Matrix.

For example, Cydsa's reported export sales growth of 15% in 2023 highlights their increasing international reach, but these new market entries represent a distinct challenge. The investment required for market research, regulatory compliance, and initial marketing campaigns can be substantial, impacting short-term profitability.

- High Growth Potential: New markets offer untapped customer bases and the opportunity to diversify revenue streams.

- Low Market Share: Initial market share in these new territories will likely be minimal as Cydsa establishes its presence.

- Significant Investment: Capital will be needed for market penetration, including marketing, sales infrastructure, and potentially local partnerships.

- Strategic Importance: Successful entry into these markets can provide a crucial competitive advantage and long-term revenue growth.

Hydrocarbons Processing and Underground Storage of LP Gas

Cydsa's Hydrocarbons Processing and Underground Storage of LP Gas business unit fits the Question Mark category if it's a relatively new venture or in a phase of aggressive expansion within a burgeoning energy infrastructure market. Despite the market's growth, Cydsa may not yet command a leading position, necessitating significant capital infusion to capitalize on its full potential.

This segment's placement as a Question Mark highlights its high growth potential coupled with Cydsa's current uncertain market share. For instance, the global LPG market was valued at approximately $280 billion in 2023 and is projected to grow, indicating a favorable industry trend. However, Cydsa's specific market penetration in this specialized area would determine its position within the BCG matrix.

- Market Growth: The global liquefied petroleum gas (LPG) market is experiencing robust growth, driven by increasing demand for clean energy and its versatility in various applications, from residential heating to industrial processes. Projections suggest continued expansion through 2030.

- Investment Needs: Developing and expanding underground storage facilities for LP Gas requires substantial upfront capital for geological surveys, construction, and safety infrastructure. Cydsa would need to commit significant resources to establish a strong competitive foothold.

- Competitive Landscape: While the market is growing, it may also be competitive, with established players and new entrants vying for market share. Cydsa's ability to differentiate its services and secure long-term contracts will be crucial.

- Strategic Importance: This segment is strategically important for Cydsa as it taps into a critical component of the energy supply chain, potentially offering stable, long-term revenue streams if market position is successfully established.

Question Marks represent business units with high growth potential but low current market share. These require significant investment to capture market opportunities, and their future success is uncertain.

Cydsa's ventures in new chemical specialties and expansion into Southeast Asia exemplify this category, demanding substantial capital for R&D, market penetration, and brand building.

The company's power co-generation business, despite its market attractiveness, currently faces operational challenges, placing it in a similar uncertain, high-potential position.

Similarly, the hydrocarbons processing and underground storage of LP Gas unit, while operating in a growing market, requires significant investment to establish a strong competitive position.

| Business Unit | Market Growth | Current Market Share | Investment Needs | BCG Category |

|---|---|---|---|---|

| Power Co-generation | High | Uncertain (temporarily impacted) | High (for operational recovery) | Question Mark |

| New Chemical Specialties | High | Low | Very High (R&D, scaling) | Question Mark |

| Southeast Asia Expansion | High | Low | High (market entry costs) | Question Mark |

| Hydrocarbons Processing & LP Gas Storage | High | Uncertain | High | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.