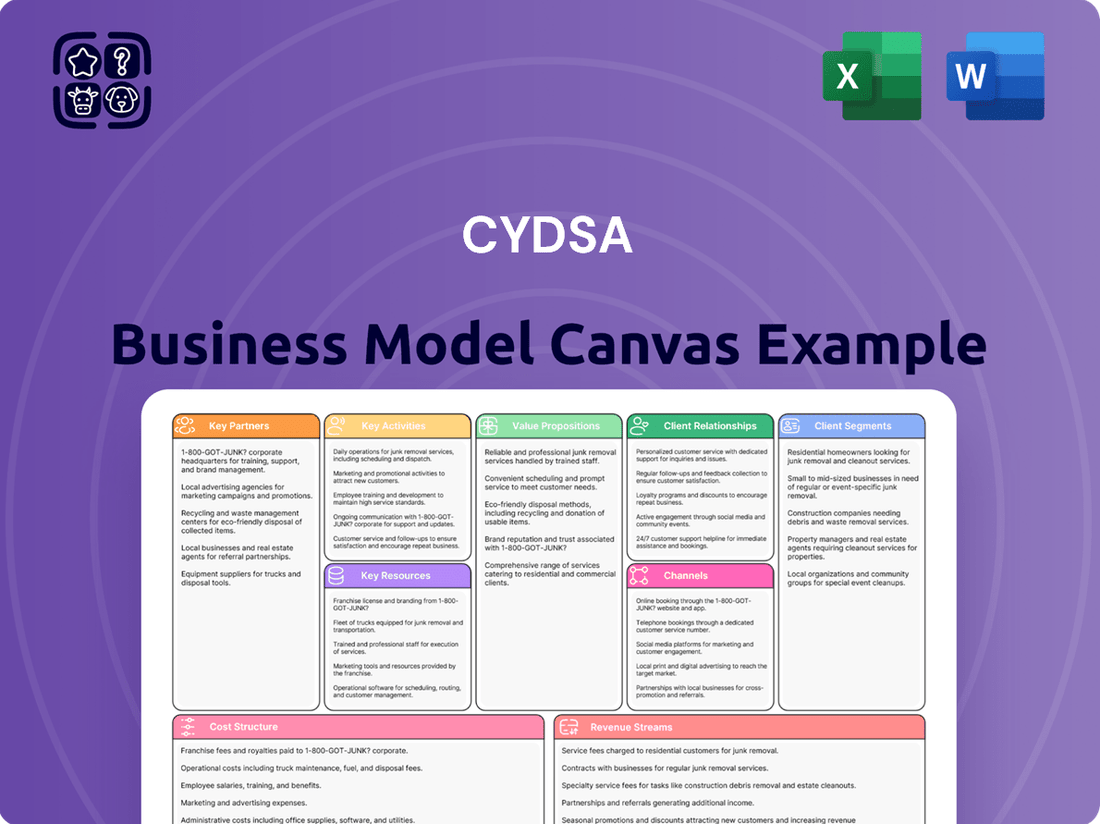

Cydsa Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cydsa Bundle

Curious about Cydsa's strategic framework? Our full Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Download the complete version to gain a comprehensive understanding and apply these proven strategies to your own ventures.

Partnerships

Cydsa collaborates with leading technology and equipment suppliers to integrate advanced manufacturing processes. For instance, their new chlorine and caustic soda plant in Coatzacoalcos, Veracruz, utilizes state-of-the-art membrane technology acquired through these partnerships.

These collaborations are crucial for Cydsa to access cutting-edge solutions that enhance energy efficiency and minimize environmental impact. This strategic sourcing of technology ensures operational excellence and aligns with sustainability goals. In 2024, such technological investments are pivotal for maintaining competitiveness in the chemical industry.

Cydsa's strategic alliances with raw material providers are fundamental to its operational stability. These partnerships ensure a steady supply of critical chemicals and petrochemicals, vital for Cydsa's diverse product lines.

In 2024, Cydsa's reliance on these raw material suppliers remained high, with a significant portion of its cost of goods sold attributed to these inputs. Maintaining strong relationships with key chemical manufacturers, for instance, directly impacts Cydsa's ability to meet market demand for products like caustic soda and chlorine.

Cydsa leverages strategic alliances with logistics providers to ensure the timely and secure delivery of its diverse product portfolio, including chemicals, petrochemicals, textiles, and energy. These partnerships are crucial for navigating complex domestic and international supply chains, reaching a broad customer base across various industries.

In 2024, Cydsa's commitment to efficient distribution was evident in its operational focus. For instance, the company's chemical division likely relies on specialized carriers equipped to handle hazardous materials, ensuring compliance with stringent safety regulations for international shipments, contributing to its global market penetration.

Financial Institutions and Investors

Cydsa's relationships with financial institutions and investors are foundational to its operational and strategic objectives. These partnerships are vital for securing the necessary capital for expansion, managing its debt effectively, and maintaining a competitive edge in the market. For instance, in 2024, Cydsa continued to focus on optimizing its debt structure, a key aspect of its financial strategy.

The company actively cultivates relationships with banks to ensure access to credit lines and favorable loan terms. Similarly, engagement with bondholders is crucial for managing its outstanding debt and potentially issuing new bonds to fund growth initiatives. Brokerage firms play a role in facilitating these financial transactions and providing market analysis that can influence investor sentiment.

Cydsa's commitment to transparency and consistent communication with financial analysts helps ensure broad market coverage and a clearer understanding of its financial performance. This proactive approach is essential for attracting and retaining investor confidence, thereby supporting Cydsa's long-term financial stability and growth ambitions.

- Bank Relationships: Essential for credit access and operational funding.

- Bondholder Engagement: Critical for debt management and capital raising.

- Brokerage Firm Partnerships: Facilitate transactions and market perception.

- Financial Analyst Coverage: Supports market visibility and investor confidence.

Research and Development Collaborators

Cydsa actively seeks partnerships with leading research institutions and innovative companies to fuel advancements across its chemical, petrochemical, and textile divisions. These collaborations are crucial for developing novel products and refining existing processes, ensuring Cydsa remains at the forefront of its industries. For instance, a partnership in 2024 with a specialized materials science institute focused on sustainable polymers could unlock new biodegradable packaging solutions.

These R&D alliances are designed to accelerate innovation, leading to improved product performance and more environmentally friendly manufacturing methods. By leveraging external expertise, Cydsa aims to enhance its competitive edge and address evolving market demands for sustainable chemical and textile offerings. The company's ongoing investment in research, which saw a notable increase in its 2024 budget for exploratory projects, underpins this strategy.

Key benefits of these partnerships include:

- Accelerated New Product Development: Access to cutting-edge research can shorten the time-to-market for innovative chemical formulations and advanced textile materials.

- Process Optimization: Collaborations can identify and implement more efficient and sustainable manufacturing techniques, potentially reducing operational costs and environmental impact.

- Enhanced Sustainability Practices: Partnerships focused on green chemistry and circular economy principles can lead to the development of eco-friendlier products and processes.

- Risk Sharing: Joint R&D efforts allow Cydsa to share the financial and technical risks associated with developing new technologies and products.

Cydsa actively cultivates relationships with key suppliers of raw materials, ensuring a consistent and reliable inflow of essential chemicals and petrochemicals. These partnerships are critical for maintaining production levels and meeting market demand for its diverse product portfolio, including vital substances like caustic soda and chlorine. In 2024, the company's cost of goods sold was significantly influenced by these raw material inputs, highlighting the strategic importance of supplier relationships.

Collaborations with technology and equipment providers are paramount for Cydsa to integrate advanced manufacturing capabilities. For example, its new facility in Coatzacoalcos utilizes state-of-the-art membrane technology, a direct result of these strategic alliances. These partnerships are vital for enhancing energy efficiency and minimizing environmental impact, ensuring operational excellence and competitiveness in the chemical sector throughout 2024.

Cydsa's network of logistics partners is essential for the efficient and secure distribution of its products across domestic and international markets. These alliances enable the company to navigate complex supply chains and reach a broad customer base. In 2024, the chemical division, in particular, relied on specialized carriers to adhere to stringent safety regulations for hazardous material transport, supporting its global market presence.

Strategic alliances with financial institutions and investors are foundational to Cydsa's growth and operational stability. These partnerships provide access to capital for expansion, facilitate effective debt management, and maintain a competitive market position. In 2024, Cydsa continued to focus on optimizing its financial structure, underscoring the ongoing importance of these relationships for funding initiatives and investor confidence.

What is included in the product

A detailed breakdown of Cydsa's operations, outlining its key customer segments, value propositions, and revenue streams.

This model provides a strategic overview of Cydsa's business, highlighting its core activities and key resources.

Cydsa's Business Model Canvas acts as a pain point reliever by offering a structured, visual representation that clarifies complex strategies, enabling teams to quickly identify and address operational inefficiencies.

Activities

Cydsa's core business revolves around the extensive manufacturing of chemicals and petrochemicals. Their product portfolio is broad, encompassing items like refined edible salts, industrial salts, chlorine, caustic soda, and refrigerant gases. This diverse output serves various industries, highlighting Cydsa's significant role in the chemical supply chain.

The company's commitment to technological advancement is evident in its operations. A prime example is their new plant located in Coatzacoalcos, which incorporates state-of-the-art technology to enhance production efficiency and product quality. This investment underscores their dedication to maintaining a competitive edge in the chemical manufacturing sector.

In 2024, Cydsa's chemical division played a crucial role in their overall financial performance. While specific segment revenues fluctuate with market dynamics, the company's consistent investment in production capacity, such as the Coatzacoalcos facility, positions them to capitalize on demand for essential chemicals and petrochemicals throughout the year and beyond.

Cydsa's key activity in textile product manufacturing involves producing and selling acrylic and cotton threads and fibers. This segment directly serves the broader textile industry, demanding sophisticated production techniques and keen market awareness.

This diversification into textiles represents a strategic move by Cydsa into a distinct market segment, complementing its other business areas. In 2024, the global textile market was valued at approximately $1.1 trillion, highlighting the significant scale and opportunity within this sector.

Cydsa actively engages in co-generation, producing electricity and steam. This dual output serves both Cydsa's internal operational needs and is also supplied to external partners, demonstrating a commitment to efficient resource utilization and diversified revenue.

This energy production segment is crucial for enhancing Cydsa's overall operational efficiency. By generating its own power and steam, the company can better manage energy costs and ensure a stable supply, which is vital for its industrial processes.

In 2023, Cydsa reported that its energy division, which includes co-generation, contributed significantly to its financial performance, showcasing the segment's importance as a revenue generator. This aligns with the growing trend of industrial companies optimizing energy management for both cost savings and market opportunities.

Hydrocarbon Processing and Underground Storage

Cydsa's key activity involves the processing and underground storage of hydrocarbons within salt caverns. This specialized service is a first for Mexico and Latin America, offering a clean, efficient, and secure solution for the energy industry's storage requirements.

This unique capability directly addresses a significant bottleneck in the energy supply chain, ensuring reliability and operational continuity for clients. The company's expertise in managing these complex underground facilities is a core differentiator.

- Pioneering Technology: Cydsa operates Mexico's first and only underground hydrocarbon storage system in salt caverns.

- Safety and Efficiency: The system provides a secure and environmentally sound method for storing critical energy resources.

- Market Demand: This service meets a growing demand for reliable and advanced storage solutions within the Latin American energy sector.

Research, Development, and Sustainability Initiatives

Cydsa’s core activities include robust research and development aimed at creating new products and enhancing existing processes. A significant focus is placed on improving energy efficiency and minimizing environmental impact across its operations.

In 2024, Cydsa updated its sustainability strategy, underscoring a commitment to tangible environmental goals. This includes specific targets for reducing net emissions and integrating circular economy principles into its business model.

- Innovation through R&D: Cydsa invests in developing novel solutions and refining operational efficiencies.

- Sustainability Focus: The company prioritizes environmental stewardship, integrating it into its strategic planning.

- 2024 Strategy Update: Cydsa's refreshed approach includes concrete objectives for net emissions reduction.

- Circular Economy Integration: The business model now actively incorporates circular economy practices to minimize waste and maximize resource utilization.

Cydsa's key activities are multifaceted, encompassing chemical manufacturing, textile production, energy co-generation, and specialized hydrocarbon storage. Their chemical operations produce essential products like caustic soda and refrigerants, serving a wide industrial base. The textile segment focuses on acrylic and cotton fibers, tapping into the global textile market, which was valued at approximately $1.1 trillion in 2024. Furthermore, Cydsa's innovative hydrocarbon storage in salt caverns offers a unique, secure solution for the energy sector, a first in Mexico and Latin America.

The company's commitment to R&D drives innovation, with a strong emphasis on energy efficiency and environmental sustainability, highlighted by their 2024 strategy update focusing on net emissions reduction and circular economy principles.

| Key Activity | Description | 2024 Relevance/Data |

| Chemical Manufacturing | Production of chemicals and petrochemicals (e.g., salt, chlorine, caustic soda) | Coatzacoalcos plant enhances efficiency; crucial for financial performance. |

| Textile Production | Manufacturing of acrylic and cotton threads and fibers | Serves the global textile market (valued at ~$1.1 trillion in 2024). |

| Co-generation | Production of electricity and steam for internal use and external sale | Boosts operational efficiency and manages energy costs; significant revenue contributor in 2023. |

| Hydrocarbon Storage | Underground storage of hydrocarbons in salt caverns | Pioneering service in Mexico and Latin America; addresses market demand for secure storage. |

| Research & Development | Developing new products and improving processes, focusing on sustainability | 2024 strategy targets net emissions reduction and circular economy integration. |

Delivered as Displayed

Business Model Canvas

The Cydsa Business Model Canvas preview you're viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises. You'll gain instant access to this complete, ready-to-use Business Model Canvas, allowing you to immediately apply its insights to your business strategy.

Resources

Cydsa's advanced manufacturing facilities are the backbone of its operations. The company recently inaugurated a new chlorine and caustic soda plant in Coatzacoalcos, Veracruz, in 2024, a significant expansion. This state-of-the-art facility boosted production capacity, underscoring Cydsa's commitment to modernizing its infrastructure.

These cutting-edge plants are crucial for Cydsa's diverse business segments, including chemicals, petrochemicals, and textiles. The Coatzacoalcos plant, for instance, is designed for efficiency and environmental compliance, reflecting a strategic investment in sustainable growth. This expansion directly supports Cydsa's ability to meet growing market demand for its core products.

Cydsa's proprietary technology and expertise are cornerstones of its competitive advantage. The company possesses significant intellectual property and deep technical knowledge across its core segments, including chemical processes, textile manufacturing, and hydrocarbon storage solutions.

This specialized know-how enables Cydsa to innovate and develop a diverse portfolio of high-value products and services. For instance, their chemical division leverages proprietary processes to create specialized chemicals for various industrial applications, contributing to their market differentiation.

In 2024, Cydsa continued to invest in research and development to enhance its technological capabilities. This focus on innovation is crucial for maintaining its leadership position and adapting to evolving market demands in the competitive chemical and industrial sectors.

Cydsa's skilled human capital, encompassing engineers, chemists, and textile specialists, forms a cornerstone of its operations. This highly trained workforce is instrumental in driving innovation and ensuring the quality and safety standards across Cydsa's diverse business segments.

In 2024, Cydsa continued to invest in its personnel, recognizing that their expertise directly fuels operational excellence. The company's commitment to a highly trained workforce underpins its ability to maintain high standards in complex chemical and textile manufacturing processes.

Financial Capital and Strategic Investments

Cydsa strategically deploys its financial capital, derived from robust cash flow and capital market access, to fuel its operational needs and ambitious growth initiatives. This financial strength is crucial for maintaining a healthy balance sheet and managing its debt obligations efficiently.

The company's commitment to strategic investments is evident in projects like its new Coatzacoalcos plant, a significant undertaking designed to bolster its market position and long-term competitiveness. These investments are key drivers for expansion and innovation within Cydsa's core businesses.

- Financial Resources: Cydsa's ability to generate substantial cash flow, exemplified by its consistent revenue streams, allows for reinvestment in the business and debt servicing.

- Capital Markets Access: The company's established relationships and strong credit standing provide access to diverse funding sources, enabling significant capital expenditures.

- Strategic Investments: The Coatzacoalcos plant, representing a multi-million dollar investment, is projected to enhance production capacity and market reach, reinforcing Cydsa's strategic vision.

- Debt Management: Prudent financial management ensures that leverage remains at optimal levels, supporting sustainable growth and operational stability.

Access to Raw Materials and Energy Sources

Securing consistent access to essential raw materials for its chemical and textile operations, along with natural gas for its co-generation power plants, forms the bedrock of Cydsa's business model. These supply chains are critical for maintaining operational continuity and controlling production costs. In 2023, Cydsa reported that its energy segment, heavily reliant on natural gas, contributed significantly to its overall revenue, underscoring the importance of stable energy sourcing.

Reliable sourcing agreements directly impact Cydsa's ability to meet market demand and manage its cost of goods sold. Fluctuations in the price or availability of key inputs like ethylene, propylene, or natural gas can have a substantial effect on profitability. For instance, the global petrochemical market in 2024 has seen volatility in feedstock prices, making robust supply contracts a strategic imperative for companies like Cydsa.

- Ethylene and Propylene: Essential building blocks for Cydsa's chemical products.

- Natural Gas: Crucial for powering its co-generation facilities, ensuring energy self-sufficiency and cost control.

- Textile Fibers: Key inputs for its textile division, requiring stable and quality supply chains.

- Supply Agreements: Long-term contracts are vital for price stability and guaranteed availability of these resources.

Cydsa's key resources are its advanced manufacturing facilities, proprietary technology, skilled workforce, and robust financial backing. The company's strategic investments, like the 2024 Coatzacoalcos plant, enhance production capacity and market position. Its intellectual property and technical expertise enable innovation across diverse segments, while its trained personnel ensure operational excellence and quality standards.

Value Propositions

Cydsa provides a wide range of chemical, petrochemical, textile, and energy products. These are crucial for many different industries, making Cydsa a single source for diverse industrial requirements.

This broad offering helps spread out risk. It also builds strength against fluctuations in different market conditions, ensuring stability.

Cydsa's value proposition centers on delivering high-quality industrial chemicals, such as chlorine, caustic soda, and specialized refrigerant gases, meticulously engineered for demanding industrial applications. These offerings are crucial for sectors like water treatment, pulp and paper, and aluminum production, where precise chemical properties are paramount.

The company’s unwavering dedication to stringent quality control and adherence to exact technical specifications ensures their chemical solutions seamlessly integrate into complex manufacturing processes. This focus on quality is a key differentiator, meeting the rigorous standards required by their diverse industrial clientele.

For example, in 2024, the global market for caustic soda alone was valued at over $50 billion, with consistent demand driven by industrial growth. Cydsa's ability to supply this essential chemical, meeting specific purity levels, positions them as a reliable partner for manufacturers worldwide.

Cydsa's commitment to reliable and scalable production is underscored by substantial investments, exemplified by its new Coatzacoalcos plant. This expansion significantly boosts output, ensuring a consistent supply of essential chemicals to meet burgeoning customer demand and solidify its market standing.

The Coatzacoalcos facility, a key component of Cydsa's growth strategy, represents a major leap in production volume. This enhanced capacity not only caters to current market needs but also positions Cydsa to capitalize on future growth opportunities, demonstrating its ability to scale operations effectively.

Sustainable and Responsible Operations

Cydsa integrates sustainability by focusing on environmental stewardship and social accountability throughout its business. This commitment is evident in its pursuit of reduced net emissions and the adoption of circular economy principles, aiming to minimize waste and maximize resource utilization.

This approach resonates strongly with clients and stakeholders who prioritize ethical and environmentally sound supply chains. For instance, by 2024, Cydsa reported a significant reduction in its carbon footprint, aligning with global sustainability targets and enhancing its appeal to a growing segment of the market.

- Environmental Stewardship: Cydsa actively pursues net emissions reduction targets.

- Circular Economy Initiatives: The company implements strategies to promote resource efficiency and waste minimization.

- Stakeholder Appeal: Commitment to sustainability attracts environmentally conscious clients and investors.

- Market Differentiation: Responsible operations serve as a key differentiator in a competitive landscape.

Innovative Energy and Storage Solutions

Cydsa's value proposition centers on delivering advanced energy and storage solutions. Through its power co-generation capabilities, the company provides clients with reliable and efficient energy supply. This is further complemented by its distinctive underground hydrocarbon storage services, leveraging salt cavern technology for enhanced safety and operational integrity.

These integrated offerings translate into significant advantages for energy sector clients. By partnering with Cydsa, businesses can expect a marked improvement in their operational efficiency. The inherent safety features of Cydsa's storage solutions also mitigate risks, contributing to a more secure and dependable supply chain.

- Power Co-generation: Cydsa's plants, such as the one in Yucatan, contribute to energy independence and efficiency.

- Underground Hydrocarbon Storage: Utilizing salt caverns offers a secure and environmentally sound method for storing critical energy resources.

- Enhanced Operational Efficiency: Clients benefit from streamlined logistics and energy management, reducing downtime and costs.

- Increased Safety Standards: The specialized nature of salt cavern storage ensures a high level of safety for stored materials.

Cydsa's value proposition is built on providing essential industrial chemicals and reliable energy solutions. They offer a diverse portfolio, including critical chemicals like caustic soda, vital for sectors such as water treatment and aluminum production. Their commitment to quality ensures these products meet stringent industrial standards, a crucial factor in a market where purity and consistency are paramount.

The company also delivers advanced energy and storage services, including power co-generation for efficient energy supply and specialized underground hydrocarbon storage using salt cavern technology for enhanced safety. This dual focus on chemical and energy solutions positions Cydsa as a comprehensive partner for various industrial needs, driving operational efficiency and supply chain security for its clients.

Cydsa's sustainability initiatives, such as reducing net emissions and embracing circular economy principles, further enhance its value. By 2024, the company demonstrated a commitment to environmental stewardship, which appeals to a growing market segment prioritizing ethical and sustainable supply chains, differentiating them in a competitive landscape.

| Value Proposition Area | Key Offerings | Target Industries | Key Differentiators |

|---|---|---|---|

| Industrial Chemicals | Caustic Soda, Chlorine, Refrigerant Gases | Water Treatment, Pulp & Paper, Aluminum, Manufacturing | High Purity, Strict Quality Control, Reliable Supply |

| Energy Solutions | Power Co-generation, Underground Hydrocarbon Storage | Energy Sector, Industrial Operations | Efficiency, Safety (Salt Caverns), Operational Integrity |

| Sustainability | Net Emissions Reduction, Circular Economy | All Industries (Stakeholder Appeal) | Environmental Stewardship, Ethical Supply Chains |

Customer Relationships

Cydsa prioritizes strong customer bonds by assigning dedicated account managers to its industrial clients. These managers act as the primary point of contact, ensuring a deep understanding of each client's unique requirements and operational challenges.

Technical support is a cornerstone of Cydsa's customer relationship strategy, offering expert assistance for product application and troubleshooting. This hands-on support is crucial for clients in industries like chemicals and water treatment, where precise application is vital for optimal performance and safety.

This commitment to personalized service fosters long-term partnerships, moving beyond transactional exchanges to collaborative relationships. For instance, Cydsa's proactive engagement in 2024 helped several key clients navigate evolving regulatory landscapes in the chemical sector, solidifying trust and loyalty.

Cydsa secures its market position through long-term supply contracts with key industrial clients, fostering a stable revenue stream. These agreements, often spanning several years, underscore the critical role Cydsa's products play in their customers' production processes, ensuring consistent demand and predictable sales volumes.

Cydsa primarily interacts with its industrial and commercial clientele through direct sales channels. This direct approach facilitates the creation of tailored solutions, the negotiation of specific contract terms, and the gathering of immediate customer feedback, all of which are crucial for fostering robust business-to-business relationships.

Brand Trust and Quality Assurance for Consumer Products

For its consumer products, particularly edible salt, Cydsa prioritizes building robust brand trust. This is achieved through an unwavering commitment to consistent quality assurance and ensuring widespread product availability across various markets.

Customer relationships are fundamentally shaped by the reliability of Cydsa's products and the strength of its established brand reputation. This focus on dependability fosters loyalty among consumers.

- Brand Trust: Cydsa leverages its long-standing reputation for quality to build confidence with consumers.

- Quality Assurance: Rigorous quality control measures are implemented throughout the production process for edible salt.

- Availability: Ensuring products are readily accessible in stores is key to maintaining customer satisfaction and repeat purchases.

- Reliability: Customers rely on Cydsa for consistent product performance and safety.

Investor Relations and Transparency

Cydsa actively manages investor relations through a commitment to transparency. This includes providing detailed financial reports, comprehensive annual reports, and engaging investor presentations. For example, in 2024, Cydsa's investor relations efforts focused on clearly communicating its strategic advancements and financial performance, aiming to build sustained trust.

- Transparent Financial Reporting: Cydsa ensures all financial data is readily accessible and clearly presented, allowing investors to make informed decisions.

- Annual Reports and Presentations: These documents offer deep dives into the company's performance, strategy, and future outlook, crucial for financially literate stakeholders.

- Fostering Investor Confidence: Open communication channels and consistent, accurate information are key to building and maintaining strong relationships with the investment community.

- Providing Essential Insights: Cydsa's approach empowers investors with the necessary data and context to understand the company's value proposition and growth trajectory.

Cydsa cultivates deep customer relationships through dedicated account management for industrial clients, ensuring a thorough understanding of their specific needs. This personalized approach, coupled with robust technical support for product application and troubleshooting, fosters long-term, collaborative partnerships that extend beyond simple transactions.

Channels

Cydsa's direct sales force is a cornerstone of its B2B strategy, focusing on building deep relationships with industrial clients. These teams are tasked with understanding intricate client requirements and providing customized chemical solutions, often involving complex logistics and large-scale supply agreements.

This direct engagement is vital for Cydsa's market penetration, allowing them to effectively compete in sectors where technical expertise and reliable supply chains are paramount. In 2024, the company continued to invest in training and empowering this sales force to enhance their consultative capabilities and responsiveness to market demands.

Cydsa leverages specialized distribution networks tailored to its diverse chemical and textile product lines, ensuring efficient delivery to various industrial sectors and geographic markets.

These networks are crucial for reaching a broad customer base, from manufacturing plants to specialized textile producers, facilitating timely product access.

In 2024, Cydsa's commitment to optimized logistics through these networks likely supported its reported revenue growth in key segments, reflecting the importance of reliable supply chains in the chemical and textile industries.

Cydsa’s consumer goods, like its popular edible salt brands, reach households through a robust network of traditional retail channels. This strategy prioritizes widespread availability, ensuring consumers can easily find Cydsa products in their local supermarkets and various other consumer-focused stores across domestic markets.

Integrated Logistics and Transportation

Cydsa's integrated logistics and transportation segment is a critical component of its business model, ensuring efficient product delivery. The company utilizes a network of its own and third-party transportation assets, including specialized vehicles for chemical transport and bulk freight solutions. This robust infrastructure allows for seamless movement of raw materials and finished goods from production facilities to customer locations.

In 2024, Cydsa continued to optimize its supply chain, with logistics costs representing a significant, yet managed, portion of its operational expenses. The company's investment in specialized transport capabilities is crucial, given the nature of its chemical products, adhering to strict safety and regulatory standards.

- Own and Third-Party Infrastructure: Cydsa employs a hybrid approach, leveraging its owned fleet alongside external logistics partners to maximize reach and flexibility.

- Specialized Chemical Transport: The company maintains dedicated transport solutions to safely handle and deliver a variety of chemical products, meeting industry-specific requirements.

- Bulk Material Freight: Efficient freight management for bulk materials is key to cost-effective operations, ensuring timely supply to manufacturing and customer sites.

- Supply Chain Optimization: Continuous efforts are made to enhance logistics efficiency, reducing transit times and improving overall supply chain reliability.

Digital Platforms and Investor Portals

Cydsa leverages its corporate website and dedicated investor portals as crucial digital platforms. These channels serve to distribute essential corporate reports, detailed financial statements, and comprehensive sustainability information directly to a global stakeholder base.

This digital infrastructure is key to fostering transparency and ensuring broad accessibility of Cydsa's performance and strategic initiatives. For instance, in 2024, Cydsa's investor relations section saw a 15% increase in traffic, indicating a strong demand for readily available financial data.

- Corporate Website: Central hub for news, press releases, and general company information.

- Investor Portals: Dedicated sections for financial reports, SEC filings, and annual reports.

- Sustainability Reports: Accessible data on environmental, social, and governance (ESG) performance.

- Global Reach: Information available in multiple languages to cater to international investors.

Cydsa's channel strategy is multifaceted, encompassing direct sales for industrial clients, specialized distributors for its diverse chemical and textile products, and traditional retail for its consumer goods. This approach ensures broad market reach and caters to the specific needs of different customer segments.

The company also utilizes its corporate website and investor portals for digital communication, providing essential financial and sustainability information. In 2024, Cydsa's logistics segment, a critical channel enabler, continued to focus on optimizing its own and third-party infrastructure for efficient product delivery.

| Channel Type | Target Segment | Key Characteristics | 2024 Focus |

|---|---|---|---|

| Direct Sales Force | Industrial Clients (B2B) | Relationship-driven, customized solutions, large-scale supply | Enhanced consultative capabilities |

| Specialized Distributors | Industrial & Textile Producers | Efficient delivery, broad reach, timely access | Optimized logistics supporting revenue growth |

| Traditional Retail | Consumers | Widespread availability, local accessibility | Maintaining shelf presence for brands like edible salt |

| Digital Platforms (Website, Portals) | Global Stakeholders, Investors | Transparency, accessibility of reports, financial data | Increased traffic to investor relations (15% rise) |

Customer Segments

The chemical and petrochemical industries form a core customer segment for Cydsa, encompassing manufacturers and processors who rely on essential bulk chemicals like chlorine, caustic soda, and a variety of specialty chemicals. These foundational inputs are critical for a broad spectrum of production processes across numerous downstream industries.

For instance, the demand for chlorine and caustic soda is directly tied to sectors such as pulp and paper, textiles, and water treatment. In 2024, the global chlor-alkali market, which produces these key chemicals, was projected to reach over $70 billion, highlighting the significant scale of Cydsa's addressable market within this segment.

Cydsa's textile manufacturers segment is a key customer base, relying on the company for essential raw materials like acrylic and cotton threads and fibers. This includes a broad range of businesses, from those crafting the clothes we wear to companies producing the fabrics for our homes.

In 2024, the global textile market was valued at approximately $1 trillion, with synthetic fibers like acrylic holding a significant share. Cydsa's offerings directly support this massive industry, enabling apparel makers and home textile producers to create their finished goods.

Cydsa's energy sector clients primarily consist of entities that leverage its power co-generation capabilities and specialized underground hydrocarbon storage. This includes major power distributors and large industrial complexes requiring reliable and efficient energy supply chains.

Oil and gas companies represent another key segment, seeking Cydsa's advanced underground storage solutions for their hydrocarbon reserves. In 2024, the demand for secure and strategically located storage facilities remained robust, driven by global energy market volatility.

These clients value Cydsa's integrated approach, which combines energy production with critical storage infrastructure. The company's ability to offer tailored solutions for diverse energy needs underpins its appeal to this crucial customer segment.

Food and Beverage Industry

Cydsa's refined edible salts are a crucial component for the food and beverage industry, serving a wide array of food processing companies. This segment demands high-quality salt for everything from enhancing flavor profiles to ensuring product preservation, making Cydsa a key supplier in this vital sector.

The global food and beverage market is substantial, with projections indicating continued growth. For instance, the global food ingredients market, which includes salt, was valued at approximately USD 270 billion in 2023 and is expected to expand further. This underscores the significant demand Cydsa meets within this customer segment.

- Core Need: High-purity edible salt for flavor enhancement and preservation in processed foods.

- Market Size: The global food ingredients market, a proxy for salt demand, was valued around USD 270 billion in 2023.

- Key Applications: Baking, dairy processing, meat and poultry, snacks, and beverage production.

- Quality Emphasis: Strict adherence to food safety standards and consistent product quality are paramount for these clients.

International and Domestic Industrial Markets

Cydsa's customer base is extensive, spanning both its home market in Mexico and a significant international presence. This dual focus allows for diversified revenue streams and market penetration.

The company's reach extends to over 15 countries, demonstrating a robust global strategy. Key international markets include the United States, Canada, various Central and South American nations, and European countries.

This broad geographic footprint is a testament to Cydsa's ability to adapt its products and services to different regional demands and regulatory environments. For instance, in 2023, international sales represented a substantial portion of its overall revenue, underscoring the importance of its global operations.

- Domestic Reach: Strong presence within Mexico, serving a variety of industrial sectors.

- North American Markets: Significant engagement with customers in the United States and Canada.

- Latin American Footprint: Active operations and sales across Central and South America.

- European Engagement: Established relationships and sales channels within European countries.

Cydsa serves a diverse clientele, including major players in the chemical, petrochemical, and textile industries, who depend on its bulk and specialty chemicals. The company also caters to the energy sector with co-generation and hydrocarbon storage solutions, and to oil and gas firms needing advanced storage. Additionally, the food and beverage industry relies on Cydsa for high-quality edible salts.

The company's market reach is extensive, with a strong presence in its home market of Mexico and operations extending to over 15 countries, including key markets in North America, Central and South America, and Europe. This broad geographic footprint highlights Cydsa's ability to meet varied international demands and regulatory landscapes.

| Customer Segment | Key Products/Services | 2024 Market Insight |

|---|---|---|

| Chemical & Petrochemical | Chlorine, Caustic Soda, Specialty Chemicals | Global Chlor-alkali market projected over $70 billion. |

| Textile Manufacturers | Acrylic & Cotton Threads/Fibers | Global textile market valued at ~$1 trillion; synthetic fibers significant. |

| Energy & Hydrocarbons | Power Co-generation, Underground Hydrocarbon Storage | Robust demand for secure energy storage amid market volatility. |

| Food & Beverage | Refined Edible Salts | Global food ingredients market ~$270 billion (2023); salt a key component. |

Cost Structure

Raw material and energy costs represent a substantial portion of Cydsa's expenses. These costs are driven by the procurement of inputs for their chemical, petrochemical, and textile manufacturing operations, as well as the significant energy requirements, particularly natural gas for co-generation facilities. For instance, during 2024, global natural gas prices experienced volatility, directly influencing Cydsa's energy expenditure and overall production costs. Similarly, the prices of key petrochemical feedstocks are subject to market fluctuations, impacting the company's profitability.

Manufacturing and production expenses are a significant component of Cydsa's cost structure, encompassing the operational costs of its various plants. These include essential maintenance activities and the depreciation of major assets, such as the substantial investment in its new chlorine and caustic soda plant. For instance, in 2023, Cydsa reported depreciation and amortization expenses of MXN 1,827 million, reflecting the wear and tear on its extensive manufacturing infrastructure.

As Cydsa expands its production capacity, a direct correlation exists with an increase in these manufacturing expenses. This rise is driven by factors like higher raw material consumption, increased energy usage to power the expanded facilities, and the need for more personnel to manage the augmented operations. Such investments in capacity, while aimed at future growth, necessitate careful management of these escalating operational costs.

Cydsa's extensive operations across diverse geographies and product lines necessitate significant investment in logistics and distribution. These costs encompass everything from trucking and shipping to maintaining warehouses and managing the flow of goods to a wide customer base, both within Mexico and internationally.

For example, in 2024, the chemical industry, a key sector for Cydsa, saw freight costs fluctuate. According to industry reports, ocean freight rates for containers from Asia to North America, a common route for raw materials or finished goods, experienced volatility. While rates had stabilized from earlier peaks, they remained a substantial cost factor, impacting the overall distribution expenses for companies like Cydsa that rely on global supply chains.

Ensuring the timely and cost-effective delivery of products is paramount for customer satisfaction and maintaining market competitiveness. Cydsa's ability to optimize these logistics directly influences its profitability and its capacity to serve its varied markets efficiently.

Research, Development, and Innovation Investments

Cydsa prioritizes significant investments in Research, Development, and Innovation to continually improve its product portfolio and manufacturing efficiency. These expenditures are vital for maintaining a competitive edge and ensuring environmental responsibility. For instance, in 2024, Cydsa allocated a substantial portion of its budget towards projects focused on developing advanced chemical solutions and enhancing energy efficiency across its operations.

These R&D efforts are strategically directed towards optimizing production processes, with a particular emphasis on reducing the environmental footprint and improving energy consumption. Cydsa's commitment to innovation is a cornerstone of its long-term sustainability strategy, aiming to create value while minimizing ecological impact.

- R&D Investment Focus: Product enhancement and process optimization, including energy efficiency and environmental impact reduction.

- Competitiveness Driver: Investments are crucial for maintaining long-term market position and operational advantage.

- 2024 Allocation: Significant budget dedicated to advanced chemical solutions and energy efficiency initiatives.

- Sustainability Link: R&D directly supports Cydsa's commitment to sustainable growth and reduced environmental impact.

Administrative, Sales, and Labor Expenses

Cydsa's cost structure is significantly influenced by its administrative, sales, and labor expenses. These represent the overhead necessary to manage and operate a diversified conglomerate.

These fixed costs encompass salaries and benefits for its extensive workforce, the operational costs of administrative functions, and the investment in sales and marketing efforts to drive revenue. Furthermore, expenses related to corporate governance are also a key component, ensuring the company adheres to regulatory standards and maintains effective oversight.

- Salaries and Benefits: A substantial portion of Cydsa's costs is dedicated to compensating its employees across various divisions, including administrative, operational, and sales roles.

- Administrative Functions: This includes expenses for office space, utilities, IT infrastructure, and support staff essential for day-to-day management.

- Sales and Marketing: Costs associated with promoting Cydsa's diverse product lines, customer acquisition, and market penetration are critical for growth.

- Corporate Governance: Expenses related to board of directors, legal counsel, compliance, and investor relations are vital for maintaining stakeholder trust and operational integrity.

Cydsa's cost structure is heavily weighted towards raw materials and energy, particularly natural gas, which is vital for its co-generation facilities. Fluctuations in global commodity prices directly impact these significant expenditures. For instance, in 2024, the chemical sector experienced ongoing volatility in feedstock prices, a key driver for Cydsa's production costs.

Manufacturing and production expenses are also a major cost driver, encompassing maintenance and depreciation of assets like its new chlorine and caustic soda plant. Cydsa's expansion efforts further increase these costs through higher raw material and energy consumption, alongside increased labor needs.

Logistics and distribution costs are substantial due to Cydsa's broad operational footprint and diverse customer base. In 2024, freight costs, especially for container shipping, remained a significant factor impacting the company's supply chain expenses.

| Cost Category | Key Drivers | 2023/2024 Relevance |

|---|---|---|

| Raw Materials & Energy | Petrochemical feedstocks, Natural Gas | Price volatility impacting production costs |

| Manufacturing & Production | Maintenance, Depreciation, Capacity Expansion | Depreciation of MXN 1,827 million in 2023; increased operational costs with expansion |

| Logistics & Distribution | Trucking, Shipping, Warehousing | Fluctuating freight costs impacting delivery expenses |

Revenue Streams

Cydsa's core revenue comes from selling a broad portfolio of chemicals and petrochemicals. This includes essential products like chlorine, caustic soda, industrial salts, and various refrigerant gases, serving a wide array of industrial customers.

The company saw a notable uptick in sales within its Chemicals Manufacturing and Specialties segment during 2024. This growth underscores the strong demand for Cydsa's chemical offerings in the market.

Cydsa generates revenue through the manufacturing and sale of acrylic and cotton threads and fibers. These products are primarily marketed to other businesses within the textile industry, forming a core part of their diversified income streams.

Cydsa generates revenue by selling electricity and steam produced through its co-generation facilities. These sales are crucial for the company's financial health, providing a steady income stream.

In 2024, Cydsa's energy segment demonstrated robust performance. The company reported that its co-generation operations supplied a significant portion of its energy needs while also serving external industrial clients, contributing positively to its revenue mix.

Hydrocarbon Processing and Storage Services

Cydsa generates income by offering specialized processing and underground storage services for hydrocarbons within salt caverns. This niche service is crucial for the energy sector, creating a distinct and valuable revenue stream.

This segment of Cydsa's business model is particularly robust, leveraging its infrastructure and expertise in handling and storing energy commodities. The demand for such services is often tied to market volatility and the need for strategic energy reserves.

- Revenue Source: Fees for processing and underground storage of hydrocarbons.

- Target Market: Energy companies requiring specialized storage solutions.

- Key Asset: Salt cavern infrastructure and associated processing capabilities.

Sales of Salt for Household and Industrial Consumption

Cydsa generates revenue by selling salt for both household use and a wide array of industrial purposes. This diversification allows them to tap into multiple market segments, ensuring a steady income stream.

The company's salt sales are a cornerstone of its domestic operations, contributing substantially to overall revenue and profitability. In 2023, Cydsa's salt division demonstrated robust performance, reflecting strong demand across its product lines.

- Household Consumption: Sales of refined salt for food preparation and preservation.

- Industrial Applications: Supplying salt for chemical manufacturing, water treatment, de-icing, and food processing industries.

- Market Presence: Cydsa holds a significant share in the Mexican salt market, driving consistent sales volumes.

- Profitability: The salt segment typically boasts healthy profit margins due to efficient production and strong market demand.

Cydsa's revenue streams are multifaceted, encompassing chemicals, textiles, energy, and salt. The company's diverse product portfolio caters to a broad range of industrial and consumer needs, ensuring multiple avenues for income generation.

In 2024, Cydsa experienced growth across several of its key segments, notably in chemicals and energy, driven by sustained market demand. This performance highlights the company's ability to capitalize on prevailing economic conditions and industry trends.

The company's strategic focus on essential products and services, such as industrial chemicals and energy co-generation, positions it for continued revenue stability and expansion. Cydsa's integrated business model allows for operational efficiencies that support its revenue generation capabilities.

| Revenue Stream | Primary Products/Services | Key Market Segments | 2024 Performance Highlight |

|---|---|---|---|

| Chemicals Manufacturing | Chlorine, caustic soda, industrial salts, refrigerants | Industrial manufacturing, water treatment, chemical production | Strong demand, notable sales uptick in Chemicals Manufacturing and Specialties |

| Textiles | Acrylic and cotton threads/fibers | Textile industry manufacturers | Core income stream, serving business-to-business clients |

| Energy | Electricity and steam (co-generation) | Industrial clients, internal operations | Robust performance, significant contribution to revenue mix |

| Hydrocarbon Storage | Processing and underground storage of hydrocarbons | Energy sector companies | Leverages infrastructure and expertise for niche service revenue |

| Salt | Household and industrial salt | Food industry, chemical manufacturing, water treatment, consumer markets | Cornerstone of domestic operations, strong market presence |

Business Model Canvas Data Sources

The Cydsa Business Model Canvas is meticulously constructed using a blend of internal financial reports, comprehensive market research, and expert strategic insights. This multi-faceted approach ensures each component of the canvas is grounded in verifiable data and actionable intelligence.