Cydsa Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cydsa Bundle

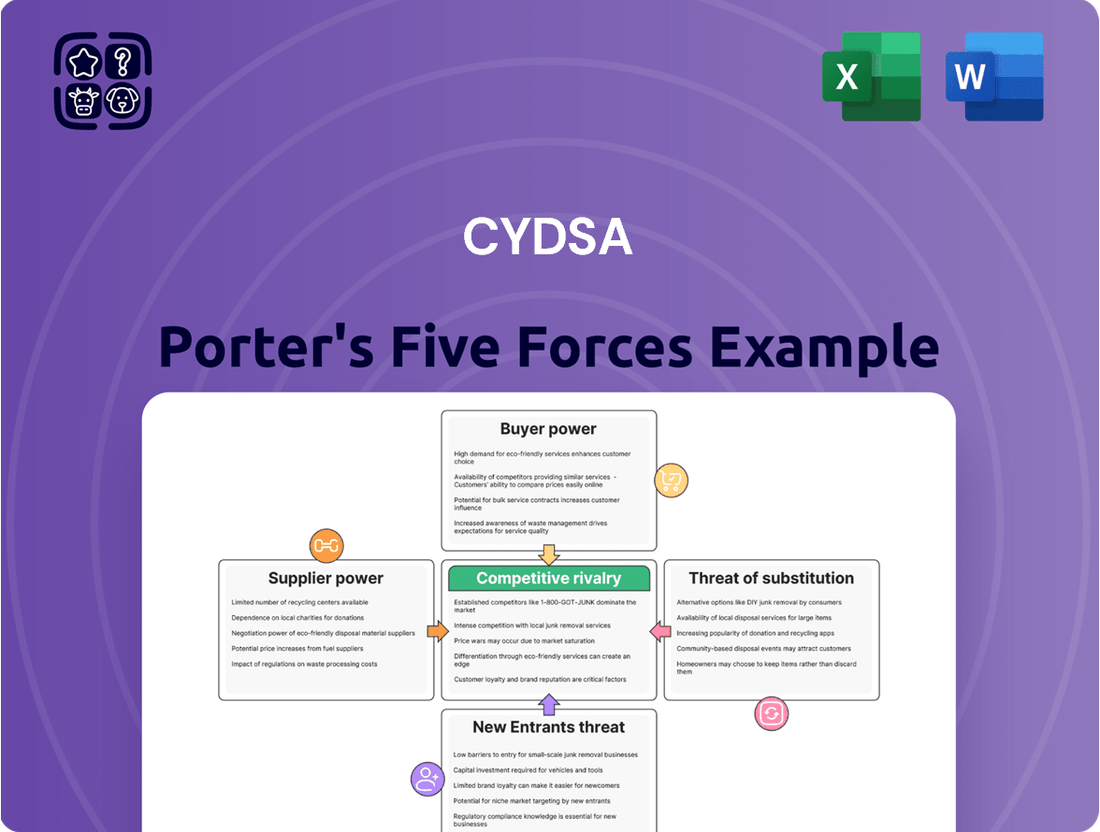

Understanding the competitive landscape is crucial for any business, and Cydsa's industry is no exception. Our Porter's Five Forces analysis delves into the intricate web of forces shaping Cydsa's market, from the bargaining power of buyers and suppliers to the threat of new entrants and substitutes, and the intensity of rivalry. This comprehensive examination reveals the underlying dynamics that dictate profitability and strategic positioning within Cydsa's sector.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Cydsa’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Cydsa's broad manufacturing base, spanning chemicals, petrochemicals, textiles, and energy, inherently ties it to a wide array of raw materials. The cost and accessibility of these essential inputs, such as chlorine, caustic soda, natural gas for energy production, and various textile fibers, directly impact the bargaining power of its suppliers.

Disruptions in global commodity markets or domestic supply chains, exemplified by past issues with Pemex's reliability for chemical feedstocks, can significantly amplify supplier leverage. For instance, in early 2024, natural gas prices in Mexico saw volatility, impacting Cydsa's energy costs and giving gas suppliers more sway.

Cydsa's bargaining power of suppliers is significantly influenced by the concentration of its suppliers. If Cydsa relies on a few large, established suppliers for critical raw materials, such as specialized chemicals or unique energy inputs, these suppliers gain considerable leverage. This is especially true when alternative sources are scarce, allowing suppliers to dictate terms and potentially increase prices.

For instance, in 2024, the global market for certain high-purity industrial chemicals, essential for Cydsa's operations, saw consolidation among key producers. This concentration means that a smaller number of entities control a larger share of the supply, thereby enhancing their bargaining position. A fragmented supplier base, conversely, would dilute this power, making it easier for Cydsa to negotiate favorable terms.

The ease with which Cydsa can change its suppliers significantly impacts supplier bargaining power. If it's difficult and costly for Cydsa to switch, current suppliers gain an advantage. For instance, in 2024, the chemical industry, where Cydsa operates, often involves specialized raw materials requiring extensive testing and qualification. This process can take months and incur substantial costs, making switching suppliers a significant hurdle.

High switching costs, such as those involving investments in new equipment to process different raw materials or the need to re-certify products with regulatory bodies, would strengthen the position of Cydsa's existing suppliers. Conversely, if Cydsa can readily find alternative suppliers offering comparable materials with minimal disruption or expense, its own bargaining power increases, allowing for more favorable pricing and terms.

Threat of Forward Integration

Suppliers might strengthen their position by hinting at forward integration, meaning they could start manufacturing Cydsa's products themselves, effectively becoming rivals. This threat, though less likely in highly specialized sectors like certain chemicals or energy, can still impact how Cydsa negotiates with its suppliers, particularly for more standard inputs.

For instance, if a key supplier of a basic chemical feedstock used by Cydsa were to consider building its own downstream processing capabilities, it could leverage this potential move to secure more favorable terms from Cydsa. This is especially true if Cydsa's reliance on that specific feedstock is high and switching suppliers is costly or time-consuming.

The bargaining power of suppliers is also influenced by the threat of forward integration, which can be seen as a strategic lever. While specific instances for Cydsa might not be publicly detailed, the general principle applies across industries: a supplier's ability to enter the customer's market can significantly shift negotiation dynamics.

- Supplier Threat: Suppliers can increase their leverage by threatening to integrate forward into Cydsa's production.

- Competitive Landscape: This potential move transforms suppliers into direct competitors, altering market dynamics.

- Negotiation Impact: The possibility of forward integration can influence pricing and terms for raw materials and inputs.

- Industry Specificity: While less common in highly specialized chemical production, it remains a consideration for commoditized inputs.

Uniqueness of Inputs

The uniqueness of inputs significantly bolsters supplier bargaining power. When Cydsa relies on highly specialized chemicals or proprietary technologies with few viable alternatives, these suppliers gain considerable leverage. This situation allows them to dictate higher prices and more advantageous terms for their products or services.

For instance, if Cydsa's production processes are dependent on a specific patented catalyst developed by a single supplier, that supplier's bargaining power is exceptionally high. This dependency means Cydsa has limited options for sourcing the same critical input elsewhere, forcing them to accept the supplier's conditions.

- Supplier Leverage: Dependence on unique inputs grants suppliers greater control over pricing and terms.

- Limited Substitutes: The absence of readily available alternatives for specialized raw materials or technologies strengthens the supplier's position.

- Price Sensitivity: Cydsa may face higher costs if its core operations hinge on inputs from a sole or limited number of suppliers.

- Contractual Dependence: Long-term contracts for unique inputs can lock Cydsa into unfavorable arrangements if supplier power is not carefully managed.

The bargaining power of Cydsa's suppliers is a critical factor, especially given its diverse manufacturing operations. When suppliers provide essential, undifferentiated raw materials or when Cydsa's switching costs are high, these suppliers can command better terms.

In 2024, the concentration of suppliers for key petrochemical feedstocks remained a significant driver of supplier leverage for Cydsa. For example, the limited number of producers for certain specialized polymers used in Cydsa's textile division allowed these suppliers to maintain strong pricing power throughout the year.

The cost of switching suppliers for Cydsa's critical inputs, such as energy or specialized chemicals, often proves substantial. This difficulty in changing suppliers, due to requalification processes or the need for new equipment, directly enhances the bargaining power of existing suppliers, enabling them to dictate terms and prices more effectively.

The threat of forward integration by suppliers, while not always overt, can subtly influence negotiations. If a supplier of a commodity chemical feedstock were to consider expanding into downstream products similar to Cydsa's, it could leverage this potential move to secure more favorable terms for its raw material sales.

| Factor | Impact on Cydsa | Example (2024) |

|---|---|---|

| Supplier Concentration | Increases supplier leverage | Limited producers of specialized polymers for textiles |

| Switching Costs | Strengthens existing supplier position | High costs for requalifying chemical inputs |

| Uniqueness of Inputs | Grants suppliers greater control | Patented catalysts essential for production processes |

| Forward Integration Threat | Can influence negotiation dynamics | Potential for feedstock suppliers to enter downstream markets |

What is included in the product

This analysis delves into the five competitive forces impacting Cydsa, offering insights into industry rivalry, the bargaining power of buyers and suppliers, threats from new entrants and substitutes, all to inform strategic decision-making.

Effortlessly identify and address competitive threats with a visual breakdown of Porter's Five Forces, simplifying complex market dynamics into actionable insights.

Customers Bargaining Power

Cydsa's broad customer base, spanning diverse industries like chemicals, plastics, textiles, and power co-generation, significantly reduces the bargaining power of any single customer. This diversification means that even if one industry faces a downturn or a major client demands lower prices, Cydsa's overall revenue stream remains relatively stable, lessening its dependence on any particular segment.

Customer concentration significantly impacts bargaining power. If a few major clients represent a large chunk of Cydsa's revenue in any given market, they gain leverage to negotiate better pricing and terms. For instance, if a handful of industrial users purchase the majority of Cydsa's chlorine, they can push for discounts.

Cydsa's recent performance highlights a diverse customer base, which generally dilutes individual customer bargaining power. The company's growth in domestic salt and refrigerant gas sales, coupled with increased output from new chlorine and caustic soda facilities, suggests a wider distribution network and a reduced reliance on any single buyer. This broad reach is a positive indicator for managing customer leverage.

The costs and complexities customers face when moving from Cydsa to a competitor directly impact their ability to negotiate. If Cydsa's offerings are deeply embedded in a customer's operations or provide unique advantages, these switching costs would be substantial, thereby diminishing customer leverage.

For instance, if Cydsa's chemical products are critical components in a client's manufacturing process, requiring extensive retooling or reformulation to substitute, the switching costs are high. This makes customers less likely to demand lower prices or better terms, as the effort and expense of switching outweigh the potential benefits.

Conversely, if Cydsa's products are more standardized and readily available from multiple suppliers, like basic industrial chemicals, customers can switch with minimal disruption. In such scenarios, customers possess greater bargaining power, frequently pressing for competitive pricing and favorable contract terms.

Customer Price Sensitivity

Customer price sensitivity is a significant factor for Cydsa, especially in industries where competition is fierce or profit margins are already thin. When customers have many alternatives or are operating under financial pressure, they tend to push harder for lower prices.

Cydsa's financial performance in early 2025 highlights this sensitivity. For instance, the company reported a decrease in net income for both the first and second quarters of 2025. A portion of this decline was attributed to rising financial expenses, which can put added pressure on Cydsa to maintain competitive pricing to offset these increased costs and retain its customer base.

- Increased competition often leads to customers seeking better deals.

- Tight profit margins for customers amplify their focus on price.

- Cydsa's Q1 and Q2 2025 net income decrease, partly due to higher financial expenses, underscores the importance of price competitiveness.

- Financial pressure on customers directly translates to increased bargaining power for lower prices.

Threat of Backward Integration by Customers

Customers possess the potential to engage in backward integration, a move that would allow them to produce chemicals, textiles, or energy internally. This capability directly diminishes their dependence on Cydsa. For instance, a large textile manufacturer might explore producing its own dyes or chemicals, thereby bypassing Cydsa's supply chain.

While the substantial capital outlay and specialized knowledge required for such integration present a barrier, the mere threat can serve as a potent bargaining tool for major clients. This is especially true in industries like chemicals and petrochemicals, where the scale of operations makes backward integration a more feasible, albeit complex, consideration. In 2024, the global chemical industry saw significant investment in vertical integration strategies by major downstream players looking to secure raw material supply and control costs.

- Customer Integration Threat: Large customers in sectors like chemicals and textiles may consider producing inputs themselves, reducing reliance on Cydsa.

- Capital and Expertise Barriers: Implementing backward integration demands considerable financial investment and specialized operational knowledge.

- Bargaining Power Leverage: The possibility of backward integration empowers significant customers to negotiate better terms with Cydsa.

- Industry Trends: In 2024, major players in chemical-intensive industries actively explored vertical integration to enhance supply chain resilience and cost control.

Cydsa's diverse customer base across chemicals, plastics, and textiles generally limits individual customer bargaining power. However, if a few large clients dominate sales in a specific market, they gain leverage for better pricing, as seen with potential discounts from major chlorine purchasers. The company's 2025 financial performance, showing reduced net income partly due to higher financial expenses, emphasizes the need for competitive pricing to retain customers.

When customers face high switching costs due to Cydsa's products being integral to their operations, their ability to negotiate lower prices diminishes. Conversely, if Cydsa's offerings are standardized and easily substituted, customers gain more power to demand favorable terms. The threat of backward integration by large customers, while costly and complex, remains a bargaining tool, especially in industries like chemicals where such strategies were explored by major players in 2024 to secure supply and control costs.

| Factor | Impact on Cydsa | Supporting Data/Observation |

| Customer Diversification | Lowers individual customer bargaining power | Broad customer base across chemicals, plastics, textiles, power |

| Customer Concentration | Increases bargaining power for dominant clients | Potential leverage for major chlorine buyers |

| Switching Costs | High costs reduce customer negotiation power | Products critical to client manufacturing processes |

| Product Standardization | Low costs increase customer negotiation power | Basic industrial chemicals easily substituted |

| Customer Price Sensitivity | High sensitivity leads to greater price pressure | Cydsa's Q1/Q2 2025 net income decline linked to financial expenses, necessitating competitive pricing. |

| Backward Integration Threat | Potential leverage for large clients | Feasible in chemicals/petrochemicals; explored by industry players in 2024. |

Preview Before You Purchase

Cydsa Porter's Five Forces Analysis

This preview shows the exact, professionally analyzed document you'll receive immediately after purchase, detailing Cydsa's competitive landscape through Porter's Five Forces. You'll gain immediate access to this comprehensive report, offering actionable insights into industry rivalry, buyer and supplier power, threat of new entrants, and substitute products. Rest assured, there are no surprises or placeholders; what you see is precisely what you get, fully formatted and ready for your strategic planning.

Rivalry Among Competitors

The Mexican chemical and textile sectors are characterized by a blend of established domestic companies and significant international participants, creating a competitive environment where Cydsa navigates alongside major players. In specific market segments, Cydsa faces direct competition from large entities such as Alfa and Celanese Mexicana, companies with substantial market share and resources.

This dynamic landscape is further intensified by the presence of numerous multinational corporations that bring global expertise and scale, alongside a multitude of smaller domestic firms, contributing to a vibrant and challenging competitive arena. For instance, in 2023, the Mexican chemical industry saw substantial activity, with major players reporting varied financial performances, reflecting the intense competition; Celanese Mexicana, a key competitor, reported revenues in the billions of USD for its Mexican operations, underscoring the scale of competition Cydsa faces.

The chemical industry in Mexico is poised for expansion, with the specialty chemicals segment anticipated to grow at a compound annual growth rate (CAGR) of 4.1% between 2025 and 2030. This positive outlook extends to the broader chemical industry, which is expected to see an average growth of 5% annually over the next decade. Such growth within these sectors can naturally fuel more intense competition as businesses strive to capture a larger piece of the expanding market.

In the basic chemicals sector, where products are often seen as interchangeable, intense price competition is the norm. Cydsa is actively working to move beyond this by expanding into more valuable market segments for its salt products. This strategic shift aims to carve out a niche where its offerings are less susceptible to direct price wars.

Furthermore, Cydsa's focus on developing and offering the newest generation of refrigerant gases is a clear indicator of its differentiation strategy. By providing cutting-edge products, the company seeks to enhance customer service and broaden its appeal beyond basic commodity offerings, thereby mitigating some of the pressures of intense rivalry.

Despite these efforts, it's important to acknowledge that for a significant portion of its product line, differentiation may remain challenging. This inherent characteristic of the industry means that Cydsa likely still faces considerable rivalry from competitors who can easily replicate or undercut its offerings in less specialized areas.

Exit Barriers

High exit barriers can trap even struggling companies in an industry, intensifying competition. These barriers might include specialized equipment that's hard to sell, lengthy contracts that must be honored, or substantial costs associated with laying off employees. For Cydsa, with its wide range of operations and significant physical assets in Mexico, the costs and complexities of exiting any one of its business segments could be considerable, potentially keeping less profitable units active and contributing to ongoing rivalry.

Cydsa's diversified portfolio, spanning chemicals, packaging, and water treatment, presents a scenario where exiting one area might not be straightforward. For instance, the chemical division likely involves specialized production facilities and ongoing supply chain commitments. In 2024, the company's reported revenues indicate the scale of its operations, with its chemical segment being a significant contributor. The challenge for Cydsa, and for competitors in similar diversified industries, is managing these embedded costs and commitments when market conditions deteriorate.

- Specialized Assets: Cydsa's chemical plants and packaging machinery represent significant capital investments that may have limited resale value outside their current use, creating a barrier to exit.

- Long-Term Contracts: The company likely engages in long-term supply or service agreements, obligating it to continue operations even if profitability wanes.

- Employee Severance Costs: Significant workforce reductions across its various Mexican facilities would incur substantial severance packages, adding to exit expenses.

- Interconnected Operations: In some cases, Cydsa's business units might be interdependent, making the complete closure of one unit more complex than a simple divestiture.

Strategic Alliances and Acquisitions

Competitors frequently form strategic alliances or pursue acquisitions to bolster their market position, achieve greater operational efficiencies through economies of scale, or broaden their product offerings. This activity significantly reshapes the competitive environment, intensifying rivalry among players.

For instance, in Mexico's burgeoning renewable energy sector, significant investments have been channeled into strategic partnerships and mergers, indicating a trend towards consolidation and enhanced competitive pressure. Similarly, other chemical companies have been actively expanding their operations and market reach through strategic moves.

- Strategic Alliances: Competitors may collaborate to share resources, technology, or market access, thereby increasing their collective strength and competitive threat.

- Acquisitions: Companies acquire rivals to gain market share, eliminate competition, or achieve synergistic benefits, leading to a more concentrated industry structure.

- Market Impact: These actions can lead to increased pricing pressure, innovation races, and a higher barrier to entry for new participants, directly impacting the intensity of rivalry.

- Sector Example: Investments in Mexico's renewable energy sector, including acquisitions by major energy firms in 2023 and early 2024, demonstrate how strategic consolidation can heighten competition.

Competitive rivalry within the Mexican chemical and textile sectors is substantial, featuring established domestic firms like Alfa and international giants such as Celanese Mexicana. The industry's growth, projected at 4.1% for specialty chemicals and 5% overall annually for the next decade, fuels this intense competition as companies vie for market share. Cydsa's strategy to move into higher-value segments for its salt products and introduce advanced refrigerant gases aims to differentiate itself from competitors focused on basic, price-sensitive chemicals.

High exit barriers, including specialized assets and long-term contracts, can keep less profitable operations running, thus prolonging competitive pressure. Additionally, strategic alliances and acquisitions by competitors, as seen in Mexico's renewable energy sector in 2023-2024, further consolidate market power and intensify rivalry.

SSubstitutes Threaten

For Cydsa's chemical products, the threat of substitutes is significant. Alternative chemical compounds or entirely different processes can often achieve similar end results, potentially at a lower cost or with improved environmental profiles. This means customers aren't necessarily locked into Cydsa's specific chemical solutions.

In the textiles sector, Cydsa faces substitutes in the form of natural fibers like cotton or wool, as well as various other synthetic materials. The Mexican textile market, a key area for Cydsa, is experiencing a notable shift towards sustainable and eco-friendly options. For instance, the demand for organic cotton and recycled polyester is growing, directly challenging traditional synthetic fiber suppliers.

The attractiveness of substitute products hinges on their price-to-performance ratio. When alternatives deliver similar or better results for less money, the threat they pose escalates significantly.

For Mexico's textile sector, this is starkly illustrated by the influx of lower-cost clothing imports. For example, in 2024, the cost of manufacturing apparel in China remained substantially lower than in Mexico, driven by differences in labor costs and production scale.

This price disparity means that consumers and businesses can often opt for imported goods without a noticeable compromise in quality, directly impacting the demand for domestically produced textiles and pressuring profit margins.

Technological advancements are a significant threat to Cydsa's co-generation business by introducing and improving substitute energy sources. For instance, the rapidly falling costs of solar photovoltaic (PV) technology, which saw global installed capacity reach over 1,500 GW by the end of 2023, directly competes with traditional co-generation.

Furthermore, innovations in battery storage systems, with costs declining by over 90% in the last decade, make intermittent renewables like solar and wind more reliable and thus more attractive alternatives. These advancements can reduce the demand for the electricity and heat Cydsa provides, impacting its market position.

Customer Propensity to Substitute

Customer willingness to switch to substitutes is a key factor in assessing competitive pressure. This propensity is shaped by a variety of elements, including how loyal customers are to existing brands, their perception of the risk involved in changing suppliers, and how aware they are of alternative options available in the market.

In industrial sectors, the decision to switch from one supplier or product to another is rarely a casual one. It typically involves a thorough evaluation process, often necessitating significant investment in new equipment, training, or process adjustments. For instance, a chemical manufacturer switching from one supplier to another might need to recalibrate its production lines, impacting efficiency and output during the transition.

Cydsa's established market position and its history of building strong, long-term relationships with its clientele can serve as a significant buffer against the threat of substitutes. This deep-rooted trust and proven track record often make customers hesitant to explore alternatives, especially when the perceived benefits of switching do not clearly outweigh the costs and risks.

Factors influencing customer propensity to substitute for Cydsa:

- Brand Loyalty: Cydsa's established reputation for quality and reliability fosters strong customer loyalty.

- Switching Costs: The financial and operational investments required for customers to change chemical suppliers can be substantial, deterring casual switching.

- Awareness of Alternatives: While awareness exists, the perceived value proposition of substitutes must be compelling enough to overcome inertia and risk aversion.

- Risk Perception: Industrial customers often perceive a higher risk in switching to less-proven suppliers, especially for critical chemical inputs.

Regulatory and Environmental Factors

Regulatory shifts and mounting environmental concerns can significantly accelerate the adoption of substitute products or services. For instance, Mexico's intensified focus on sustainability and clean energy initiatives, particularly prominent in 2024, is actively steering consumer and industrial demand away from conventional energy sources and certain chemical manufacturing processes. This trend favors greener alternatives.

The Mexican government's commitment to reducing carbon emissions, as evidenced by its updated climate targets for 2030, directly impacts industries reliant on fossil fuels or less sustainable chemical inputs. Companies failing to adapt risk losing market share to those offering environmentally compliant solutions.

- Regulatory Push: Government policies promoting renewable energy and circular economy principles create a more favorable environment for substitutes.

- Consumer Demand: Growing public awareness of environmental issues in 2024 is driving preferences towards eco-friendly products and services.

- Industry Adaptation: Businesses are increasingly investing in R&D for sustainable alternatives to meet regulatory demands and market expectations.

The threat of substitutes for Cydsa's products is considerable across its business segments. In chemicals, alternative compounds or processes can offer similar outcomes, often at a lower cost or with better environmental credentials, meaning customers aren't tied to Cydsa's offerings. For textiles, natural fibers and other synthetics compete directly, with a growing demand for sustainable options like organic cotton in Mexico challenging traditional synthetic fiber suppliers.

The appeal of substitutes is largely determined by their price-performance ratio; if alternatives deliver comparable or superior results for less money, the threat intensifies. This is evident in Mexico's textile market, where lower-cost imports, such as apparel from China in 2024 due to significant labor cost advantages, can be chosen by consumers without a noticeable drop in quality, impacting domestic demand and Cydsa's margins.

Technological advancements also pose a threat, particularly to Cydsa's co-generation business. The decreasing cost of solar PV technology, with global capacity exceeding 1,500 GW by the end of 2023, and improvements in battery storage systems, which have seen costs drop over 90% in the past decade, make renewable energy a more viable and attractive substitute for traditional energy sources.

Customer willingness to switch is influenced by brand loyalty, switching costs, and awareness of alternatives. For industrial clients, changing suppliers often involves substantial investment in new equipment or process adjustments, making them hesitant unless the benefits of switching clearly outweigh these costs and risks. Cydsa's established relationships and reputation for reliability help mitigate this threat, as customers may perceive a higher risk in adopting less proven alternatives.

Regulatory shifts and environmental concerns can accelerate the adoption of substitutes. Mexico's focus on sustainability and clean energy in 2024 is driving demand away from conventional energy and certain chemical processes, favoring greener alternatives. Government initiatives to reduce carbon emissions, such as updated climate targets for 2030, pressure industries to adapt, benefiting companies offering environmentally compliant solutions.

| Sector | Substitute Example | Key Driver | Impact on Cydsa | 2024 Data Point |

|---|---|---|---|---|

| Chemicals | Alternative chemical compounds/processes | Cost, Environmental Profile | Reduced demand for specific Cydsa chemicals | N/A (General Trend) |

| Textiles | Organic cotton, Recycled polyester | Sustainability Demand | Competition for market share in Mexican textiles | Growing demand for eco-friendly fibers |

| Co-generation | Solar PV, Wind energy with battery storage | Falling technology costs, Reliability | Decreased demand for Cydsa's electricity/heat | Global solar PV capacity > 1,500 GW (end of 2023) |

| Textiles (Imports) | Lower-cost imported apparel | Price Disparity | Pressure on domestic production and profit margins | Chinese apparel manufacturing cost significantly lower than Mexico |

| Renewable Energy | Advancements in battery storage | Cost Reduction | Increased attractiveness of intermittent renewables | Battery storage costs down >90% in last decade |

Entrants Threaten

The chemical, petrochemical, textile, and energy co-generation sectors are notoriously capital-intensive. Companies need deep pockets to fund plants, machinery, and essential infrastructure, creating a formidable hurdle for newcomers.

For instance, Cydsa's substantial investment in a new chlorine and caustic soda facility in Coatzacoalcos, boosting its production capacity, underscores the significant financial commitment involved. This high barrier to entry effectively deters potential competitors from entering these markets.

Established players in the chemical industry, including Cydsa, benefit significantly from economies of scale. This means they can produce goods at a much lower cost per unit due to their large-scale operations in production, purchasing raw materials in bulk, and efficient distribution networks. For example, in 2024, major chemical manufacturers often reported fixed costs spread over millions of tons of output, leading to substantial cost advantages.

New companies entering the market would find it incredibly challenging to match these cost efficiencies. Without the established infrastructure and high production volumes, a new entrant would face considerably higher per-unit costs, making it difficult to compete on price with incumbents like Cydsa. This cost disadvantage acts as a significant barrier to entry.

Establishing robust distribution networks for chemicals, textiles, and energy is a significant hurdle for newcomers. Cydsa's extensive operations, serving customers in over 15 countries and boasting more than 20 subsidiaries across 9 cities, highlight the substantial investment and time required to build such a system.

Government Policy and Regulations

Government policies and regulations significantly impact the threat of new entrants in Mexico's chemical and energy sectors. Strict environmental regulations, licensing requirements, and trade policies can create substantial barriers. For instance, Mexico's commitment to enhancing its chemical industry and boosting domestic petrochemical production is tempered by ongoing regulations concerning specific chemicals, making market entry more complex.

The energy sector, in particular, is navigating a dynamic regulatory landscape. New environmental standards and operational permits are crucial considerations for any new player. In 2024, the Mexican government continued to emphasize sustainable practices and safety protocols within these industries, requiring new entrants to demonstrate robust compliance frameworks from the outset.

- Environmental Compliance: New entrants must adhere to evolving environmental protection laws, which can involve significant capital investment in pollution control technology.

- Licensing and Permits: Obtaining necessary operating licenses and permits from various government agencies is a time-consuming and often costly process.

- Trade Policies: Import/export regulations and tariffs on raw materials and finished products can affect the cost structure and competitiveness of new chemical and energy ventures.

- Energy Sector Reforms: Ongoing regulatory changes in the energy sector, including those related to renewable energy and hydrocarbon production, create uncertainty and compliance challenges for new entrants.

Proprietary Technology and Expertise

Cydsa's extensive history and diversified business model have allowed it to develop and accumulate proprietary technologies and specialized expertise across its various operational segments. This deep well of knowledge acts as a significant deterrent to new entrants. For instance, Cydsa's commitment to innovation is evident in its new chlorine and caustic soda plant, which incorporates advanced technologies designed for highly efficient energy consumption and minimal environmental impact. This focus on cutting-edge processes and intellectual property creates a substantial barrier for any potential competitor looking to enter the market.

These accumulated assets, including patents and unique operational know-how, translate into higher initial investment requirements and a steeper learning curve for newcomers. Cydsa's established track record in areas like sustainable chemical production demonstrates a level of operational mastery that is difficult and costly to replicate quickly. This technological advantage directly impacts the threat of new entrants by increasing the cost and risk associated with market entry.

- Proprietary Technology: Cydsa's investment in advanced manufacturing processes, such as those in its chlorine and caustic soda operations, creates a technological moat.

- Specialized Expertise: Decades of operation have fostered deep understanding and skillsets within Cydsa's workforce, which are not easily transferable or replicable.

- Intellectual Property: Patents and trade secrets related to efficient production and environmental control further solidify Cydsa's competitive position.

- High Entry Costs: The need for new entrants to match Cydsa's technological capabilities and operational scale significantly raises the barrier to entry.

The threat of new entrants for Cydsa is significantly low due to several substantial barriers. High capital requirements for chemical and energy plants, as seen in Cydsa's major investments, demand immense financial backing, deterring many potential newcomers. Furthermore, established players like Cydsa leverage economies of scale, achieving lower per-unit costs through large-scale operations and bulk purchasing, which new entrants struggle to match.

Building extensive distribution networks, as Cydsa has across 15 countries, represents another considerable hurdle. Government regulations and licensing in sectors like chemicals and energy also add complexity and cost for new market participants. For instance, in 2024, stringent environmental compliance and safety protocols remained critical for any new venture in Mexico's industrial landscape.

Cydsa's proprietary technologies and accumulated specialized expertise create a further barrier, requiring significant investment and time for replication. This technological and operational advantage, exemplified by their advanced chlorine and caustic soda plant, effectively raises the cost and risk for potential competitors, solidifying Cydsa's market position.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Cydsa is built upon a foundation of robust data, including Cydsa's own annual reports, industry-specific market research from firms like Statista and IBISWorld, and relevant government regulatory filings.