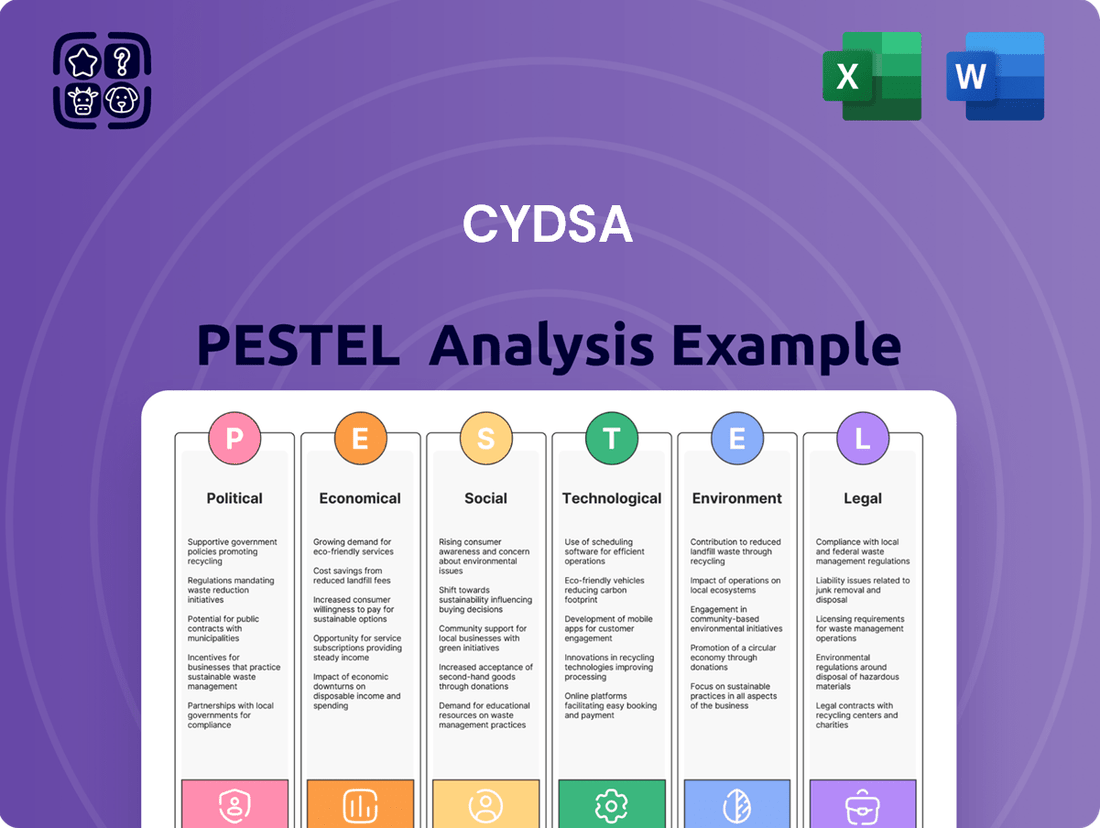

Cydsa PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cydsa Bundle

Unlock the full potential of your Cydsa strategy with our comprehensive PESTLE analysis. Dive deep into the political, economic, social, technological, legal, and environmental factors that are shaping Cydsa's present and future. Gain a critical understanding of the external forces at play and how they can be leveraged for competitive advantage. Download the complete analysis now and equip yourself with the insights needed to make informed, strategic decisions.

Political factors

Mexico's political landscape is currently characterized by a notable concentration of power, which presents a potential risk of arbitrary decision-making. This trend could translate into a more volatile regulatory environment for businesses, especially those operating in strategic sectors such as energy. For instance, the ongoing debates and policy shifts surrounding the energy sector in recent years highlight this potential for regulatory uncertainty.

The United States-Mexico-Canada Agreement (USMCA) is slated for a comprehensive review in late 2025 and early 2026. Any significant alterations or a failure to reach a consensus during this review could potentially dampen foreign direct investment into the region.

The evolving political landscape, particularly the upcoming US presidential election in late 2024, introduces a layer of uncertainty. A shift in US leadership could signal a rise in protectionist policies, potentially leading to new tariffs that would directly impact trade flows and Cydsa's operations within North America.

Mexico's 2024-2025 energy reforms are a significant political shift, heavily favoring state-owned CFE. These changes are designed to ensure CFE maintains a dominant position, targeting at least 54% control over electricity dispatched to the national grid.

This policy direction could limit opportunities for private companies in electricity generation and co-generation sectors, impacting market dynamics and investment strategies within the energy industry.

Regulatory Environment Centralization

The shift towards a centralized National Energy Commission (CNE) in 2024, absorbing functions from the former National Hydrocarbons Commission (CNH) and Energy Regulatory Commission (CRE), signals a significant change in Mexico's energy sector governance. This move, intended to create a more unified approach, has led to discussions regarding the potential impact on regulatory independence and the fostering of a competitive market environment. For instance, the CNH previously oversaw upstream oil and gas activities, approving exploration and production contracts, while the CRE regulated electricity and gas pipeline tariffs. The consolidation aims to simplify these processes.

This centralization, effective from early 2024, has raised questions about the CNE's direct reporting line to the executive branch, potentially influencing its autonomy in decision-making. Analysts are closely watching how this new structure will affect the transparency of regulatory processes and the overall health of market competition within the energy industry. The government's stated goal is to improve efficiency and coordination.

Key implications of this regulatory restructuring include:

- Potential impact on independent oversight: Concerns exist that direct executive reporting may reduce the CNE's autonomy compared to its predecessor bodies.

- Market competition effects: The centralization's influence on fair competition and the ease of market entry for new players is under scrutiny.

- Streamlining versus transparency: While intended to streamline energy regulation, the balance between efficiency gains and maintaining robust transparency mechanisms is crucial.

Judicial System Reforms

Mexico's proposed judicial reforms, slated for potential implementation including the election of federal judges in 2025, introduce a significant element of political risk. This shift could lead to a more politicized judiciary, potentially impacting the impartiality and predictability of legal rulings. For businesses operating within Mexico, this raises concerns about legal certainty and the consistent application of laws, which are crucial for investment and operational planning.

The intertwining of the legal and political spheres as a result of these reforms could create an environment where judicial decisions are influenced by political considerations rather than purely legal precedent. This dynamic may deter foreign investment, as the perceived risk of arbitrary legal outcomes increases. For instance, a study by the World Bank in 2023 highlighted that countries with less independent judiciaries often experience lower levels of foreign direct investment.

- Politicization of the Judiciary: The election of federal judges in 2025 could introduce political patronage and bias into the judicial system.

- Erosion of Legal Certainty: Businesses may face unpredictable legal outcomes, hindering long-term strategic planning and investment.

- Impact on Foreign Investment: Increased political influence in the judiciary could deter foreign direct investment due to perceived higher risk.

Mexico's political landscape presents several key factors for Cydsa to consider, particularly concerning regulatory shifts and trade agreements. The upcoming US presidential election in late 2024 could introduce protectionist policies, potentially impacting trade flows. Furthermore, the USMCA review in late 2025/early 2026 poses a risk to foreign direct investment if significant changes occur.

Mexico's energy sector reforms are a significant political development, with the government aiming for state-owned CFE to control at least 54% of electricity dispatched to the national grid by 2024-2025. This centralization of energy regulation under the National Energy Commission (CNE) from early 2024, absorbing functions from CNH and CRE, could affect market competition and regulatory independence.

Proposed judicial reforms in Mexico, with potential implementation including the election of federal judges in 2025, introduce political risk. This could lead to a more politicized judiciary, potentially impacting legal certainty and deterring foreign investment, as indicated by studies showing lower FDI in countries with less independent judiciaries.

| Political Factor | Description | Potential Impact on Cydsa | Key Dates/Data |

|---|---|---|---|

| US Election | Potential shift in US trade policy | Risk of new tariffs, impacting North American trade | Late 2024 |

| USMCA Review | Comprehensive review of the trade agreement | Dampened foreign direct investment if consensus fails | Late 2025 / Early 2026 |

| Energy Reforms | Centralization of energy regulation under CNE | Limited opportunities for private energy companies | Effective early 2024; CFE target 54% grid control (2024-2025) |

| Judicial Reforms | Potential election of federal judges | Increased political risk, reduced legal certainty, lower FDI | Potential implementation 2025 |

What is included in the product

This Cydsa PESTLE analysis meticulously examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic direction.

A Cydsa PESTLE analysis provides a structured framework to identify and understand external factors impacting the business, thereby alleviating the pain of strategic uncertainty and enabling more informed decision-making.

Economic factors

Mexico's economic growth is expected to be modest in 2024 and 2025, with many predictions being lowered, suggesting a period of slow progress. This deceleration is largely due to decreased investment and a slowdown in consumer spending within Mexico.

For instance, the Bank of Mexico's Q1 2024 survey of private sector economists indicated a median GDP growth forecast of 2.1% for 2024, a slight decrease from earlier expectations. This subdued outlook impacts businesses like Cydsa by potentially limiting market expansion and increasing competition for consumer spending.

Inflationary pressures in Mexico are anticipated to linger, potentially exceeding the Bank of Mexico's target range. This persistence is largely attributed to ongoing wage increases, which continue to fuel demand. For instance, in early 2024, inflation hovered around 4.5%, a figure notably above the 3% target.

The elevated interest rate environment, maintained by the Bank of Mexico to combat inflation, has demonstrably cooled economic activity. By mid-2024, the benchmark interest rate stood at 11.00%, a level that significantly dampens both consumer spending and business investment, thereby slowing the overall pace of economic growth.

Exchange rate volatility significantly impacts Cydsa. For instance, during periods of Mexican peso depreciation against the US dollar, such as seen in late 2023 and early 2024, the cost of imported raw materials and machinery for Cydsa's operations increases. This directly affects their cost of goods sold and can squeeze profit margins.

Furthermore, any dollar-denominated debt held by Cydsa becomes more expensive to service when the peso weakens. This can strain cash flow and necessitate adjustments to financial strategies, potentially impacting investment decisions and overall financial health. For example, a 10% depreciation of the peso could translate to a similar percentage increase in the peso cost of servicing foreign currency debt.

Foreign Direct Investment (FDI) Trends

Mexico has seen a surge in Foreign Direct Investment (FDI) during the first half of 2024, with nearshoring proving to be a major catalyst. This influx is particularly beneficial for manufacturing sectors where Cydsa operates, as companies look to establish or expand operations closer to North American markets. For instance, Mexico attracted approximately $20.7 billion in FDI in the first quarter of 2024, a significant increase compared to previous periods.

However, potential investors are closely monitoring Mexico's political and regulatory landscape. Concerns regarding policy stability and the ease of doing business could temper future investment decisions, despite the current positive momentum. This uncertainty poses a risk for sustained FDI inflows, impacting sectors reliant on foreign capital.

- FDI in Mexico (Q1 2024): $20.7 billion recorded, driven by nearshoring.

- Impact on Manufacturing: Cydsa's sector is a primary beneficiary of this investment trend.

- Key Risk Factor: Political and regulatory uncertainties could hinder future FDI growth.

- Sectoral Focus: Manufacturing and automotive industries are leading recipients of FDI.

Manufacturing Sector Performance

The Mexican manufacturing sector faced a deceleration in 2024, mirroring a similar trend observed in US manufacturing production. This slowdown was partly attributed to global economic uncertainties impacting demand.

Despite this short-term deceleration, the persistent nearshoring trend continues to solidify Mexico's position as a key manufacturing hub. This shift is expected to drive significant long-term growth opportunities for the sector.

- Manufacturing Output Dip: Mexico's manufacturing industrial production index saw a slight contraction in early 2024 compared to the previous year.

- Nearshoring Momentum: FDI in manufacturing, particularly from North American companies, remained strong through 2024, indicating sustained confidence in Mexico's production capabilities.

- Sectoral Variations: While automotive and electronics manufacturing showed resilience, other sub-sectors experienced more pronounced slowdowns.

Mexico's economic growth is projected to be moderate in 2024 and 2025, with forecasts indicating a slowdown due to reduced investment and consumer spending. Inflation remains a concern, with rates in early 2024 around 4.5%, above the Bank of Mexico's 3% target, influenced by wage pressures. High interest rates, at 11.00% by mid-2024, are deliberately dampening economic activity to control inflation.

The manufacturing sector, crucial for Cydsa, experienced a slowdown in early 2024, mirroring global trends. However, nearshoring continues to bolster Mexico's manufacturing appeal, attracting substantial Foreign Direct Investment (FDI). For example, Q1 2024 saw $20.7 billion in FDI, with manufacturing and automotive sectors being key beneficiaries, though political uncertainties could impact future inflows.

| Economic Indicator | 2024 Projection/Actual | 2025 Projection | Key Factor |

|---|---|---|---|

| GDP Growth | ~2.1% (Median forecast Q1 2024) | Modest growth expected | Decreased investment, consumer spending slowdown |

| Inflation Rate | ~4.5% (Early 2024) | Lingering pressure above target | Wage increases |

| Benchmark Interest Rate | 11.00% (Mid-2024) | Likely to remain elevated | Combating inflation |

| FDI Inflows (Q1 2024) | $20.7 billion | Continued strong inflows anticipated | Nearshoring |

Same Document Delivered

Cydsa PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Cydsa PESTLE analysis covers all key external factors influencing the company's operations and strategy. You'll gain immediate access to this detailed report, providing valuable insights for your business decisions.

Sociological factors

While Mexico's disposable income has been on an upward trend, consumer spending saw a minor contraction of 0.5% in the first quarter of 2025. This shift directly impacts companies like Cydsa, whose diverse portfolio, including textiles and chemicals, relies heavily on consumer purchasing power and market demand.

Formal sector employment in Mexico has seen modest gains, yet it lags behind international benchmarks, underscoring the persistent need for enhanced workforce skills. This situation directly impacts sectors like manufacturing, which are increasingly reliant on a proficient labor pool to integrate advanced technologies and streamline operations.

In 2023, Mexico's formal employment rate stood at approximately 58.7%, a slight increase from previous years but still indicating a significant portion of the workforce operating informally. For industries like manufacturing, which contributed over 30% to Mexico's GDP in 2023, this skills gap can hinder productivity and competitiveness in adopting Industry 4.0 solutions.

Mexico's ongoing urbanization and industrialization are significant drivers for Cydsa. As more people move to cities and industries expand, the demand for essential materials like chemicals, petrochemicals, and textile components naturally rises, directly benefiting Cydsa's core business segments.

For instance, Mexico's urban population has been steadily increasing, with projections indicating continued growth. This demographic shift fuels demand for construction materials, consumer goods, and manufactured products, all of which rely on the chemical and petrochemical inputs that Cydsa supplies.

Growing Sustainability Awareness

There's a noticeable surge in consumer demand for environmentally conscious products across Mexico, prompting companies like Cydsa to adopt greener manufacturing processes. This societal trend directly impacts how products are designed, where materials are sourced, and the overall efficiency of operations.

This growing awareness translates into tangible market shifts. For instance, a 2024 survey indicated that over 60% of Mexican consumers are willing to pay a premium for sustainable goods, a significant increase from previous years. This puts pressure on manufacturers to innovate and integrate eco-friendly solutions.

- Increased Consumer Demand: Over 60% of Mexican consumers prioritize sustainability in purchasing decisions as of 2024.

- Product Development Impact: Companies are redesigning products to be more resource-efficient and less wasteful.

- Supply Chain Scrutiny: There's greater emphasis on ethical and environmentally sound sourcing of raw materials.

- Operational Strategy Shifts: Businesses are investing in cleaner energy and waste reduction technologies to meet evolving expectations.

Corporate Social Responsibility and ESG

Mexican companies, including Cydsa, are increasingly embedding Environmental, Social, and Governance (ESG) principles into their operations. This shift is propelled by a combination of stricter environmental regulations and a growing demand from consumers and investors for more sustainable business practices. For instance, by 2024, Mexico's National Institute of Statistics and Geography (INEGI) reported a significant uptick in companies disclosing their ESG performance, indicating a clear trend towards greater transparency and accountability.

This commitment extends to tangible investments in areas like ecosystem restoration and nature-based solutions. Cydsa's own initiatives in water management and sustainable resource utilization exemplify this trend. Such actions not only address environmental concerns but also enhance corporate reputation and stakeholder trust, vital for long-term success in the current market landscape. The company's focus on these areas aligns with the broader national agenda for sustainable development, aiming to balance economic growth with ecological preservation.

The drive towards ESG is also influenced by global financial markets, where sustainable investments are gaining considerable traction. Investors are increasingly scrutinizing companies based on their ESG credentials, making it a critical factor in capital allocation decisions. By 2025, it's projected that ESG-focused funds will represent a substantial portion of managed assets, underscoring the financial imperative for companies like Cydsa to prioritize these aspects.

- Regulatory Push: Stricter environmental laws in Mexico are compelling companies to adopt more sustainable operational models.

- Consumer Demand: A growing segment of Mexican consumers actively seeks out and supports businesses with strong ESG commitments.

- Investor Expectations: Global and local investors are increasingly integrating ESG factors into their valuation and investment strategies, impacting access to capital.

- Nature-Based Investments: Companies are channeling resources into ecological restoration and sustainable solutions as a core part of their social responsibility.

Societal shifts in Mexico are significantly influencing business operations and consumer behavior, directly impacting companies like Cydsa. A growing preference for sustainable and ethically produced goods, coupled with increased awareness of environmental issues, is reshaping market demands and corporate strategies. This trend is further amplified by a rising emphasis on Environmental, Social, and Governance (ESG) principles, driven by both consumer expectations and investor scrutiny.

The Mexican labor market, while experiencing modest growth in formal employment, faces challenges related to workforce skills, particularly in sectors requiring advanced technological integration. This skills gap can affect productivity and competitiveness, especially as industries like manufacturing, a significant contributor to Mexico's GDP, aim to adopt Industry 4.0 solutions. Urbanization and industrial expansion, however, continue to fuel demand for Cydsa's core products in chemicals and textiles.

| Sociological Factor | Description | Impact on Cydsa | Data Point/Trend |

|---|---|---|---|

| Consumer Preferences | Growing demand for sustainable and eco-friendly products. | Drives product innovation and greener manufacturing processes. | Over 60% of Mexican consumers willing to pay a premium for sustainable goods (2024). |

| Workforce Skills | Need for enhanced skills in formal sector employment. | Potential impact on productivity and adoption of new technologies. | Formal sector employment rate ~58.7% (2023), lagging international benchmarks. |

| Urbanization | Increasing urban population and industrialization. | Boosts demand for chemicals, petrochemicals, and textile components. | Continued upward trend in Mexico's urban population growth. |

| ESG Awareness | Emphasis on Environmental, Social, and Governance practices. | Influences corporate strategy, investment, and stakeholder relations. | Significant uptick in companies disclosing ESG performance (INEGI, 2024). |

Technological factors

Industry 4.0 adoption is a significant technological driver for Cydsa. Mexico's manufacturing sector, where Cydsa operates its chemical and textile businesses, is increasingly integrating automation and robotics. For instance, by 2024, the World Economic Forum identified several Mexican industrial sites as having advanced manufacturing capabilities, indicating a broader trend of embracing smart factory technologies.

These advancements, including the use of AI and big data analytics, are crucial for Cydsa to boost operational efficiency and remain competitive in the global market. Companies are investing heavily in these areas; a 2023 report by the Inter-American Development Bank highlighted that adoption of advanced manufacturing technologies in Latin America, including Mexico, was accelerating, with a focus on improving productivity and quality control.

The push for energy efficiency is accelerating, with technologies like the Internet of Things (IoT), smart sensors, and Artificial Intelligence (AI) playing a starring role in optimizing industrial processes. These advancements allow companies to fine-tune resource use and significantly cut down on energy consumption. For instance, in 2024, the global IoT market in manufacturing alone was projected to reach over $280 billion, highlighting the widespread adoption of these efficiency-driving tools.

Cydsa is actively embracing these trends, demonstrating a commitment to innovation. Their investment in new membrane technology for their chlorine and caustic soda plant is a prime example. This strategic move is specifically designed to enhance energy efficiency, a critical factor in the chemical industry where energy costs can be substantial. This investment aligns with broader industry trends, as chemical companies globally are investing billions in upgrading facilities for greater sustainability and cost-effectiveness.

Biotechnology's advancement is a key technological driver for Cydsa, offering pathways to more eco-friendly chemical and textile production. This includes developing bio-based feedstocks and biodegradable materials, reducing reliance on fossil fuels and minimizing waste. For instance, the global industrial biotechnology market was valued at approximately $102.4 billion in 2023 and is projected to reach $218.7 billion by 2030, indicating substantial growth and investment in these sustainable solutions.

Renewable Energy Integration

The manufacturing sector is seeing a significant surge in investment and adoption of renewable energy sources like solar and wind power. This transition is driven by a desire to move away from fossil fuels, cut down on energy expenses, and enhance environmental credentials, which directly affects Cydsa's power co-generation operations.

Globally, renewable energy capacity additions are breaking records. For instance, the International Energy Agency (IEA) reported that in 2023, global renewable capacity grew by an unprecedented 50%, reaching over 510 gigawatts (GW). This trend is expected to continue, with projections indicating that renewables will account for over 90% of global electricity capacity expansion in the coming years, reaching an estimated 7,300 GW by 2028.

- Increased Investment: Global investment in clean energy reached $1.7 trillion in 2023, a new record, with a significant portion directed towards renewables and grid infrastructure.

- Cost Reductions: The levelized cost of electricity (LCOE) for solar PV and onshore wind has fallen dramatically over the past decade, making them increasingly competitive with traditional energy sources.

- Corporate PPA Growth: Many large corporations are signing Power Purchase Agreements (PPAs) directly with renewable energy developers to secure clean electricity and hedge against volatile energy prices.

- Policy Support: Government incentives and supportive policies worldwide, such as tax credits and renewable portfolio standards, continue to accelerate the deployment of renewable energy technologies.

Digitalization of Supply Chains

The ongoing digitalization of supply chains is fundamentally reshaping how businesses manage their operations, with significant implications for cross-border logistics and asset tracking. This technological shift offers Cydsa substantial avenues for innovation, aiming to boost visibility, operational efficiency, and the overall resilience of its vast supply network. For instance, by 2024, the global supply chain management market was projected to reach over $34 billion, underscoring the investment and growth in this sector.

Cydsa can leverage these advancements to gain real-time insights into inventory levels, shipment statuses, and potential disruptions. Technologies like IoT sensors for asset tracking and AI-powered demand forecasting are becoming crucial for optimizing inventory and reducing lead times. In 2023, companies adopting advanced digital supply chain solutions reported an average of 15% improvement in on-time delivery rates.

- Enhanced Visibility: Implementing digital platforms allows for end-to-end tracking of goods, from raw material sourcing to final delivery.

- Increased Efficiency: Automation of processes, such as order processing and customs documentation, can significantly reduce operational costs and human error.

- Improved Resilience: Real-time data analytics enable proactive identification and mitigation of supply chain disruptions, such as port congestion or geopolitical events.

Technological advancements are driving significant shifts in Cydsa's operating environment, particularly in manufacturing efficiency and sustainability. The increasing adoption of Industry 4.0 technologies, including AI and big data analytics, is enhancing operational performance. For instance, a 2023 report noted accelerating adoption of advanced manufacturing in Latin America, boosting productivity.

Biotechnology's progress offers Cydsa opportunities for eco-friendly production, such as bio-based feedstocks. The industrial biotechnology market was valued at approximately $102.4 billion in 2023, showing substantial growth in sustainable solutions. Furthermore, the digitalization of supply chains is improving visibility and efficiency, with companies adopting these solutions seeing up to a 15% improvement in on-time delivery rates in 2023.

| Technological Trend | Impact on Cydsa | Supporting Data (2023-2024) |

| Industry 4.0 / Automation | Increased operational efficiency, competitiveness | Mexico's manufacturing sector embracing smart factory tech; Latin America adoption accelerating |

| Biotechnology | Eco-friendly production, reduced reliance on fossil fuels | Global industrial biotechnology market ~$102.4 billion (2023) |

| Digital Supply Chains | Enhanced visibility, efficiency, resilience | Companies adopting digital solutions saw ~15% improvement in on-time delivery (2023) |

Legal factors

Mexico's environmental regulations require permits for air emissions, water usage, and waste management, overseen by SEMARNAT and ASEA. This legal structure directly impacts industrial operations, including those of companies like Cydsa, by dictating compliance standards and operational procedures. Failure to adhere can result in significant fines and operational disruptions.

Furthermore, a new mandate for sustainability reporting is slated for implementation beginning in 2025. This will likely increase transparency requirements for companies, potentially influencing investor relations and corporate strategy as Cydsa navigates these evolving legal landscapes.

Mexico's regulatory landscape for chemicals, particularly under CICOPLAFEST, has seen recent amendments affecting pesticide, fertilizer, and toxic substance controls. These changes influence how chemicals are classified, verified, and exported, requiring careful attention from businesses operating in or trading with Mexico.

While a comprehensive, overarching chemical management regulation is still being finalized, companies must navigate and comply with existing sector-specific legislation. This dual approach means staying informed about both the evolving framework and the established rules is crucial for seamless operations and avoiding compliance issues.

Recent energy reforms enacted in Mexico during 2024 and 2025 have significantly reshaped the nation's power sector, with a clear legislative preference for state-owned entities. This strategic shift directly impacts the operational environment for private co-generation facilities.

These legislative changes could introduce substantial challenges for companies like Cydsa, potentially affecting their co-generation agreements and overall market access. The new framework may also influence the cost and availability of energy, a critical factor for industrial operations.

Waste Management Laws

Mexican legislation mandates strict protocols for managing hazardous and non-hazardous waste, emphasizing recycling and reduced landfill dependency. Cydsa's operations must adhere to these evolving environmental standards, impacting its manufacturing and waste disposal strategies.

Compliance is not merely a legal obligation but a critical component of operational efficiency and corporate responsibility. For instance, Mexico's General Law for Ecological Balance and Environmental Protection (LGEEPA) sets the framework for waste management, with specific regulations for hazardous materials.

Key legal factors influencing Cydsa include:

- Hazardous Waste Regulations: Strict rules govern the generation, transportation, treatment, and disposal of hazardous waste, with potential fines for non-compliance.

- Recycling and Circular Economy Initiatives: Government push for increased recycling rates and circular economy principles could lead to new mandates or incentives for waste reduction and material reuse.

- Environmental Impact Assessments: New or expanded facilities may require comprehensive environmental impact assessments, ensuring waste management plans meet legal requirements.

Labor Laws and Minimum Wage

Successive increases in Mexico's minimum wage, including the January 2024 adjustment which raised it to MXN 248.93 daily in most of the country, directly impact industrial companies like Cydsa by increasing their labor costs. Potential further adjustments under the current administration necessitate careful financial planning to absorb these rising expenses.

These labor law changes require businesses to adapt their budgeting and operational strategies to account for the escalating cost of employing a workforce.

- Minimum wage in Mexico for 2024: MXN 248.93 daily (general zone).

- Minimum wage in the Northern Border Free Zone for 2024: MXN 374.89 daily.

- Impact on operational costs for labor-intensive industries.

- Need for strategic financial forecasting to manage wage increases.

Mexico's legal framework for environmental protection, particularly concerning emissions and waste management, demands strict adherence from industrial entities like Cydsa. The recent energy reforms of 2024-2025, favoring state-owned entities, could also present operational and cost challenges for private co-generation facilities. Furthermore, evolving sustainability reporting mandates expected from 2025 will likely increase transparency requirements for companies.

Amendments to chemical control legislation, such as those affecting pesticides and toxic substances under CICOPLAFEST, necessitate careful compliance regarding classification, verification, and export. While a comprehensive chemical management regulation is still in development, companies must navigate existing sector-specific rules. Labor laws, including the January 2024 minimum wage increase to MXN 248.93 daily, directly impact operational costs and require strategic financial planning.

| Legal Factor | Description | Impact on Cydsa | Relevant Data/Dates |

|---|---|---|---|

| Environmental Regulations | Permits for air emissions, water usage, waste management; SEMARNAT and ASEA oversight. | Dictates compliance standards, operational procedures; risk of fines for non-adherence. | Ongoing; Sustainability reporting mandate expected from 2025. |

| Chemical Control | Amendments to pesticide, fertilizer, and toxic substance controls under CICOPLAFEST. | Influences chemical classification, verification, and export processes. | Recent amendments; Sector-specific legislation compliance. |

| Energy Reforms | Legislative preference for state-owned entities in the power sector. | Potential challenges for co-generation facilities, affecting agreements and market access. | Enacted in 2024-2025. |

| Labor Laws | Minimum wage adjustments. | Increases labor costs, requiring financial planning and adaptation of operational strategies. | January 2024: MXN 248.93 daily (general zone). |

Environmental factors

Mexico's commitment to the Paris Agreement, aiming to cut greenhouse gas emissions, directly impacts industrial players like Cydsa. The national push for decarbonization requires companies to adopt strategies that lower their carbon footprint, influencing operational costs and investment priorities. For instance, Mexico's updated Nationally Determined Contribution (NDC) targets a 35% reduction in non-carbon dioxide greenhouse gas emissions by 2030 compared to business-as-usual scenarios.

New water laws are expected, framing clean water as a basic human right, which will significantly impact how water basins are managed. This shift means companies, including those in sectors like chemicals where Cydsa operates, will likely face stricter requirements for reporting their water consumption and adopting more efficient water usage strategies. For instance, in 2023, many regions saw increased scrutiny on industrial water discharge, with fines levied for non-compliance, indicating a trend towards greater accountability.

Mexico's industrial sector is increasingly prioritizing waste reduction and recycling. This push is driven by a growing adoption of circular economy principles, which focus on keeping materials in use for as long as possible. For instance, by 2024, Mexico's National Institute of Statistics and Geography (INEGI) reported a significant increase in companies implementing formal waste management programs, with over 60% of large enterprises having such initiatives in place.

These circular economy models are crucial for businesses like Cydsa, as they aim to reintegrate used materials back into production cycles. This not only minimizes waste but also enhances resource efficiency, potentially lowering operational costs. In 2025, the Mexican government announced new incentives for companies demonstrating significant progress in material reuse, offering tax credits for investments in closed-loop systems and advanced recycling technologies.

Pollution Control and Reporting

Cydsa operates under strict environmental regulations, particularly concerning air pollution from its industrial processes and the management of hazardous waste. These mandates necessitate rigorous, ongoing monitoring and detailed reporting to governmental environmental agencies. For instance, in 2024, Mexico's Secretariat of Environment and Natural Resources (SEMARNAT) continued to enforce emission standards for key industrial pollutants, with fines for non-compliance potentially reaching millions of pesos. Cydsa's commitment to continuous compliance is crucial for minimizing its ecological footprint and avoiding significant financial penalties.

Ensuring adherence to these environmental standards involves substantial investment in pollution control technologies and robust internal reporting systems. Cydsa must demonstrate proactive management of its environmental responsibilities. Key aspects of this include:

- Regular emissions testing and data submission to SEMARNAT.

- Implementing advanced waste treatment and disposal protocols.

- Investing in cleaner production technologies to reduce pollutant generation.

- Maintaining transparent and accurate environmental impact assessments.

Renewable Energy Adoption

Mexican manufacturers are increasingly embracing renewable energy sources like solar and wind power as a key strategy to shrink their environmental impact and cut energy expenses. This shift is fundamental to sustainable manufacturing and is evolving into a significant competitive differentiator.

By 2024, Mexico's renewable energy capacity saw substantial growth, with solar photovoltaic alone reaching over 10 GW. This expansion is driven by both government incentives and private sector investment, aiming to meet sustainability targets and leverage falling technology costs.

The adoption of renewables offers tangible benefits:

- Reduced Operational Costs: Companies can achieve significant savings on electricity bills, especially with fluctuating fossil fuel prices.

- Enhanced Brand Image: Demonstrating a commitment to sustainability appeals to environmentally conscious consumers and business partners.

- Energy Security: On-site renewable generation can provide greater stability and independence from grid disruptions.

- Regulatory Compliance: Proactive adoption positions companies favorably for evolving environmental regulations and carbon pricing mechanisms.

Mexico's environmental regulations are becoming increasingly stringent, pushing companies like Cydsa to invest in cleaner technologies and robust waste management. The nation's commitment to decarbonization, evidenced by its updated Nationally Determined Contribution (NDC) targeting a 35% reduction in non-CO2 greenhouse gas emissions by 2030, directly influences industrial operations and investment strategies. Furthermore, anticipated new water laws, framing clean water as a basic human right, will necessitate stricter water usage reporting and efficiency measures for all industrial players.

| Environmental Factor | Impact on Cydsa | Relevant Data/Trend (2023-2025) |

|---|---|---|

| Greenhouse Gas Emissions Reduction | Requires investment in lower-carbon processes and potentially higher operational costs. | Mexico's NDC aims for a 35% reduction in non-CO2 GHG emissions by 2030. |

| Water Management Regulations | Stricter reporting and efficiency mandates for water consumption and discharge. | Increased scrutiny on industrial water discharge in 2023 led to fines for non-compliance. |

| Waste Reduction & Circular Economy | Opportunities for cost savings and resource efficiency through material reuse. | Over 60% of large Mexican enterprises had formal waste management programs by 2024; incentives for reuse in 2025. |

| Air Pollution & Hazardous Waste | Mandatory monitoring, reporting, and investment in pollution control technologies. | SEMARNAT continued enforcing emission standards in 2024, with potential fines in millions of pesos for non-compliance. |

| Renewable Energy Adoption | Opportunities for reduced operational costs and enhanced brand image. | Mexico's solar photovoltaic capacity exceeded 10 GW by 2024, driven by incentives and falling technology costs. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Cydsa is built upon a robust foundation of data from official government publications, reputable financial institutions like the IMF and World Bank, and leading market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting Cydsa.