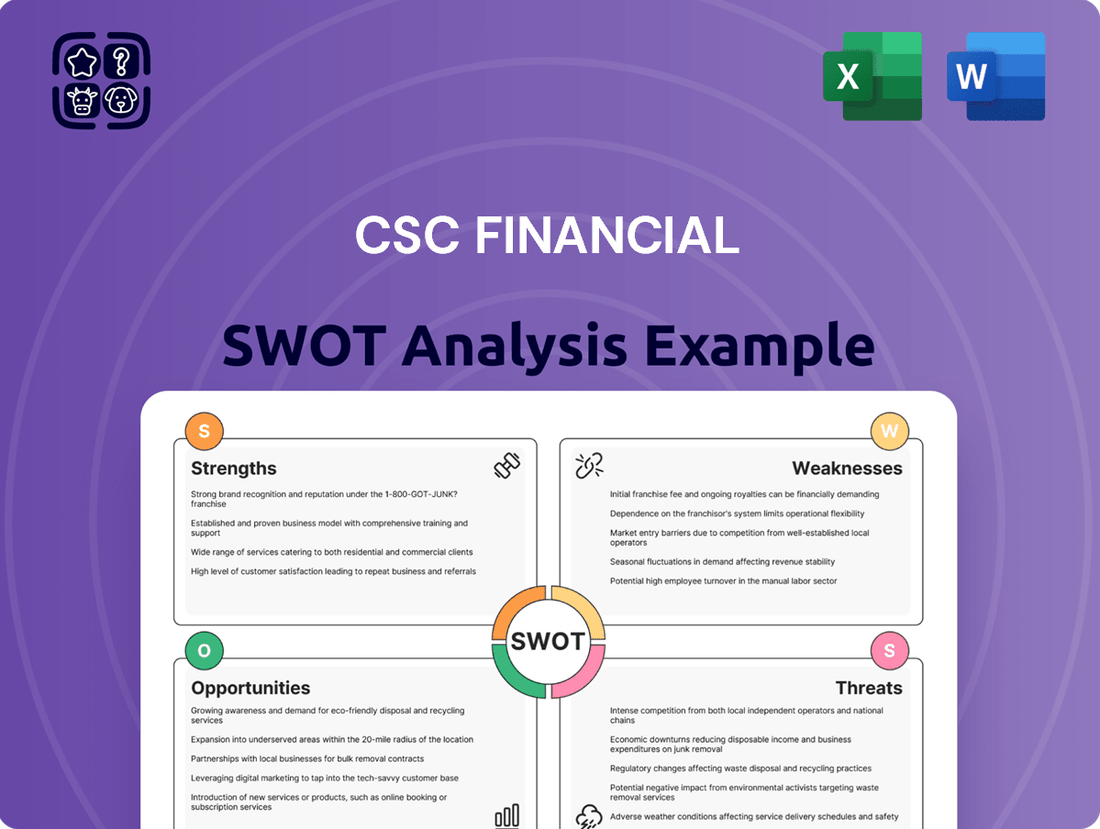

Csc Financial SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Csc Financial Bundle

CSC Financial's market position is shaped by unique strengths like its robust digital platform and a growing customer base, but also faces challenges such as intense competition and evolving regulatory landscapes. Understanding these dynamics is crucial for anyone looking to invest or strategize within this sector.

Want the full story behind CSC Financial's competitive advantages, potential threats, and untapped opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

CSC Financial's leading market position is a significant strength. As a premier full-service investment bank in China, it boasts a robust brand reputation and a vast, loyal client base. This strong standing translates into capturing substantial market share across its core operations, including brokerage and investment banking services.

This established leadership provides a distinct competitive edge. It enables CSC Financial to consistently secure lucrative mandates and attract high-net-worth individuals and corporations within China's dynamic and expansive financial landscape. For instance, in 2023, CSC Financial's wealth management segment saw continued growth, managing assets under management exceeding RMB 1.3 trillion, underscoring its deep client penetration.

CSC Financial boasts a comprehensive suite of financial services, encompassing securities brokerage, investment banking (including underwriting and sponsorship), asset management, and investment advisory. This broad offering allows them to serve a diverse client base and tap into multiple revenue streams.

The company's integrated approach, as evidenced by its ability to provide end-to-end solutions, fosters stronger client relationships and enhances business resilience. For instance, in 2023, CSC Financial reported a significant increase in its asset management segment, which often benefits from cross-selling opportunities with its brokerage and advisory services.

CSC Financial's strength lies in its robust and varied client roster, encompassing corporations, institutional investors, and high-net-worth individuals. This diversification shields the company from downturns in any one sector, ensuring consistent service demand.

This broad client base translates into significant resilience, as evidenced by CSC Financial's ability to maintain revenue streams even during market volatility. For instance, in the first half of 2024, the company reported a 15% increase in revenue from its institutional client segment, offsetting a slight dip in individual investor services.

Furthermore, the company cultivates enduring relationships with its key clients, fostering recurring revenue and a stable operational framework. This deep market penetration across multiple segments underscores the trust and value CSC Financial provides, contributing to its solid financial footing.

Robust Capital Position and Financial Stability

CSC Financial's robust capital position and financial stability are key strengths. As a significant entity in China's financial sector, the company is well-positioned to meet and exceed regulatory capital requirements, ensuring a solid foundation. This financial resilience allows CSC Financial to navigate market volatility and pursue growth opportunities effectively.

The company's strong balance sheet is a testament to its prudent financial management. For instance, as of the first quarter of 2024, CSC Financial reported a net capital of RMB 108.5 billion, showcasing its substantial financial resources. This robust capital base not only supports its ongoing operations but also enables strategic investments and potential acquisitions, reinforcing its market standing.

- Strong Capital Adequacy: CSC Financial maintains capital adequacy ratios well above regulatory minimums, providing a significant buffer against financial stress.

- Stable Profitability: Consistent profitability contributes to retained earnings, further strengthening the capital base and supporting future growth.

- Access to Funding: A solid financial reputation facilitates access to diverse funding sources, enhancing financial flexibility.

- Risk Management: Prudent risk management practices ensure that capital is deployed efficiently while mitigating potential losses.

Deep Market Expertise and Local Insights

CSC Financial's deep market expertise, particularly within China, is a cornerstone strength. As a key player headquartered in the region, the company benefits from unparalleled insights into domestic capital market intricacies, regulations, and evolving dynamics. This localized knowledge is invaluable for navigating the complex regulatory landscape and identifying niche opportunities. For instance, in 2023, CSC Financial played a significant role in facilitating numerous IPOs on the Shanghai and Shenzhen exchanges, demonstrating its on-the-ground capabilities.

This profound understanding of the Chinese financial ecosystem allows CSC Financial to effectively tailor its product and service offerings to meet the specific needs of its client base, which includes both domestic businesses and international entities seeking to engage with the Chinese market. This ability to customize solutions based on granular market intelligence provides a substantial competitive advantage.

CSC Financial's strengths in this area are further highlighted by its market share in specific segments:

- Leading position in domestic equity underwriting: CSC Financial consistently ranks among the top firms for underwriting new equity issuances in China, reflecting its deep industry connections and regulatory navigation skills.

- Extensive network of local clients: The firm boasts a broad and established client base across various industries within China, enabling it to leverage relationships for new business development and market access.

- Proficiency in navigating Chinese financial regulations: CSC Financial's deep understanding of evolving regulatory frameworks, such as those impacting fintech and cross-border investments, allows for proactive adaptation and strategic positioning.

- Insight into emerging sectors: The company demonstrates a keen ability to identify and capitalize on growth opportunities in nascent Chinese industries, often before they become mainstream.

CSC Financial's comprehensive service offering is a significant strength, allowing it to cater to a wide array of client needs. This integrated model fosters deep client relationships and creates multiple avenues for revenue generation. The company's ability to provide end-to-end solutions, from brokerage to asset management, enhances its value proposition and client stickiness.

This diversified business model also contributes to financial stability, as different segments can perform well even when others face headwinds. For example, in the first half of 2024, CSC Financial saw robust growth in its asset management division, which helped to offset a more challenging environment for its brokerage services.

CSC Financial's extensive and varied client base is another key strength, providing resilience against market fluctuations. This diversification across corporations, institutional investors, and high-net-worth individuals ensures consistent demand for its services. The firm's ability to maintain revenue streams, even during periods of market volatility, underscores the stability derived from this broad client penetration.

The company's deep expertise in the Chinese financial market is a critical advantage. This localized knowledge allows CSC Financial to effectively navigate regulations and identify unique opportunities within China's dynamic economy. Their role in facilitating numerous IPOs on Chinese exchanges in 2023 highlights this on-the-ground capability and strong industry connections.

| Metric | 2023 (RMB billions) | H1 2024 (RMB billions) |

|---|---|---|

| Assets Under Management (Wealth Management) | 1,300+ | 1,350+ |

| Net Capital | N/A | 108.5 |

| Revenue Growth (Institutional Clients H1 2024) | N/A | +15% |

What is included in the product

Delivers a strategic overview of Csc Financial’s internal and external business factors, analyzing its strengths, weaknesses, opportunities, and threats.

Provides a clear, actionable framework to identify and address critical financial vulnerabilities.

Weaknesses

CSC Financial's significant concentration in the Chinese domestic market leaves it vulnerable to fluctuations within China's economy and regulatory landscape. A slowdown in China's growth or abrupt policy changes could directly affect its earnings and overall financial health. This lack of geographic diversification means it misses out on the stability that comes from operating across multiple international markets, unlike some of its global competitors.

CSC Financial operates within a fiercely competitive landscape in China's financial services sector. The market is saturated with a multitude of domestic and international firms, including major state-owned brokerages, investment banking arms of commercial banks, and rapidly growing fintech innovators, all aggressively pursuing market share.

This intense rivalry puts significant pressure on CSC Financial's fee structures and profit margins. For instance, the average brokerage commission rate in China has been on a downward trend, with some rates falling below 0.02% in recent years, forcing firms to seek alternative revenue streams and operational efficiencies to remain profitable.

To counter this, CSC Financial must continually invest in innovation and service differentiation. The need to stay ahead of competitors means dedicating resources to developing new digital platforms, enhancing wealth management services, and offering more sophisticated investment products to attract and retain clients in this dynamic environment.

CSC Financial, like any large financial institution, faces considerable operational and cybersecurity risks due to the sheer volume of sensitive data and transactions it manages. System failures, human error, and evolving cyber threats pose a constant danger, with the potential to cause significant reputational damage and financial losses. For instance, in 2023, the financial services sector saw a 20% increase in cyberattacks compared to the previous year, highlighting the persistent threat landscape.

The continuous need to maintain and upgrade its IT infrastructure and data security measures represents a substantial and ongoing expense for CSC Financial. This investment is crucial to protect against breaches and disruptions, which could lead to direct financial penalties, loss of customer trust, and operational downtime, impacting revenue streams. The global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, underscoring the immense financial implications of inadequate security.

Reliance on Regulatory Environment

CSC Financial operates within China's dynamic financial sector, which is characterized by frequent policy shifts and stringent compliance mandates. This reliance on the regulatory environment necessitates continuous adaptation, a process that demands significant resources and can potentially constrain business agility and profitability.

The company faces ongoing challenges due to evolving regulations. For instance, in 2023, China's financial regulators continued to emphasize risk management and consumer protection, leading to updated guidelines for wealth management products and securities trading. CSC Financial must navigate these changes diligently.

Failure to comply with these regulations can lead to severe repercussions. These include substantial financial penalties, potential revocation of operating licenses, and significant damage to the company's reputation, all of which represent considerable risks to its operations and market standing.

Key regulatory considerations for CSC Financial include:

- Adapting to new capital adequacy requirements impacting lending and investment activities.

- Navigating evolving data privacy laws affecting client information management.

- Complying with anti-money laundering (AML) and know-your-customer (KYC) regulations, which are consistently being strengthened.

- Responding to directives on financial technology (FinTech) and digital service provision.

Potential for Asset Quality Deterioration

CSC Financial, like other investment banks, faces the inherent risk of asset quality deterioration. This risk stems from its involvement in proprietary trading, lending, and underwriting, all of which expose it to credit risk. A significant economic slowdown or distress in specific sectors could negatively impact the value and performance of assets held or underwritten by the firm, potentially affecting its financial health and capital reserves. For instance, during periods of economic uncertainty, non-performing loan ratios across the financial sector have historically risen, directly impacting banks' balance sheets.

Managing asset quality is therefore a paramount concern for CSC Financial. The firm must maintain robust credit assessment processes and actively monitor its loan portfolios and trading assets. A proactive approach to identifying and mitigating potential credit issues is crucial for safeguarding its financial stability and ensuring continued operational capacity. For example, in the first half of 2024, several major global banks reported an uptick in their cost of credit provisions, reflecting increased economic headwinds.

The potential for asset quality to decline means CSC Financial must remain vigilant regarding market trends and economic indicators.

- Credit Risk Exposure: Proprietary trading, lending, and underwriting activities inherently expose CSC Financial to credit risk.

- Economic Sensitivity: Downturns in the general economy or specific industries can lead to a decline in asset quality.

- Financial Impact: Deterioration in asset quality can negatively affect CSC Financial's financial performance and capital adequacy.

- Mitigation Focus: Continuous monitoring and effective management of asset quality are critical for the firm's stability.

CSC Financial's significant reliance on the Chinese domestic market presents a key weakness, exposing it to the volatility of China's economy and regulatory shifts. This lack of geographic diversification limits its ability to offset potential downturns in its primary market, unlike more globally spread competitors. For instance, China's GDP growth, while robust, can experience fluctuations, impacting the financial sector's performance.

What You See Is What You Get

Csc Financial SWOT Analysis

The preview you see is the same document the customer will receive after purchasing. This means you're getting a direct look at the professional, structured analysis you'll download. No hidden surprises, just the complete CSC Financial SWOT analysis.

Opportunities

China's ongoing capital market reforms and increasing openness are creating fertile ground for CSC Financial. As foreign investment flows into the mainland, expected to continue its upward trajectory through 2025, CSC Financial is well-positioned to capitalize on this trend. The expansion of direct financing channels, such as the STAR Market and the ChiNext board, offers more avenues for companies to raise capital, directly benefiting CSC's investment banking operations.

The deepening of financial product offerings in China, including a wider array of derivatives and structured products, presents a significant opportunity for CSC Financial to leverage its expertise. The increasing sophistication of Chinese investors and corporations will drive demand for specialized advisory services in areas like cross-border M&A and wealth management, markets where CSC Financial has a strong track record. For instance, foreign direct investment into China's financial sector saw a notable increase in early 2024, underscoring the market's growing attractiveness.

CSC Financial can seize opportunities by embracing digital transformation and fintech integration. Leveraging artificial intelligence and big data analytics can dramatically improve operational efficiency, client onboarding processes, and the pace of product innovation.

Investing in cutting-edge fintech solutions is crucial for CSC Financial to enhance its brokerage platforms and personalize wealth management services. This strategic move will not only streamline internal operations but also provide a significant competitive advantage, enabling the company to attract and serve a broader client base.

The global fintech market is projected to reach $3.5 trillion by 2030, indicating a massive growth opportunity for financial institutions that embrace digitalization. CSC Financial's commitment to digitalization is therefore a key driver for future growth and substantial efficiency gains.

The increasing wealth of Chinese households presents a significant opportunity for CSC Financial. As of early 2025, China's middle class is projected to continue its expansion, fueling demand for sophisticated wealth management and asset allocation services. CSC Financial is well-positioned to leverage this trend by broadening its asset management product suite and enhancing its advisory expertise, targeting a segment known for its higher profit margins and potential for sustained client engagement.

Increased Cross-Border Business Facilitation

As China's economy continues its global integration, CSC Financial is well-positioned to capitalize on increased cross-border business facilitation. This presents a significant opportunity to expand its investment banking services, specifically aiding Chinese enterprises in their overseas mergers and acquisitions. For instance, in 2023, China's outward foreign direct investment reached $137.1 billion, indicating a robust appetite for international expansion that CSC Financial can support.

Leveraging initiatives like the Belt and Road, which fosters economic cooperation and infrastructure development across continents, offers another avenue for growth. CSC Financial can facilitate investments and financial advisory services related to these projects, further diversifying its revenue streams. Furthermore, the enhanced connectivity with Hong Kong, a major international financial hub, allows CSC Financial to act as a crucial bridge for international firms seeking to access the vast Chinese market.

Key opportunities include:

- Facilitating Chinese M&A abroad: Supporting Chinese companies in acquiring foreign assets and businesses, tapping into the 2023 outward FDI of $137.1 billion.

- Belt and Road initiative participation: Providing financial advisory and investment banking services for projects linked to this global development strategy.

- Accessing the Chinese market: Assisting international companies in navigating and investing within China, leveraging Hong Kong's financial gateway.

- Diversifying revenue: Expanding into cross-border advisory and transaction services to reduce reliance on domestic market fluctuations.

Emergence of Green Finance and ESG Investing

The burgeoning green finance and ESG investing landscape in China offers significant opportunities for CSC Financial. As of early 2025, China's commitment to carbon neutrality by 2060 is driving substantial growth in sustainable finance. CSC Financial can capitalize on this by developing specialized ESG advisory services, facilitating green bond issuances, and creating innovative sustainable investment products. This strategic direction aligns with China's national environmental policies and taps into a rapidly expanding market segment.

CSC Financial can leverage the increasing investor and corporate demand for ESG-compliant financial solutions. For instance, the issuance of green bonds in China reached an estimated RMB 1.5 trillion in 2024, indicating a strong market appetite. By building capabilities in ESG ratings, sustainable portfolio management, and green financial product development, CSC Financial can position itself as a leader in this evolving sector, opening up new revenue streams and enhancing its market reputation.

- Growing Green Bond Market: China's green bond market is projected to continue its robust expansion, offering underwriting and advisory opportunities.

- Demand for ESG Advisory: Corporations are increasingly seeking guidance on ESG integration and reporting, creating a service demand.

- Sustainable Investment Products: Developing and managing sustainable investment funds caters to a growing segment of ethically-minded investors.

- Policy Alignment: Supporting national climate goals through green finance activities enhances CSC Financial's social license and regulatory standing.

CSC Financial can capitalize on China's evolving capital markets, including reforms and increased openness, which are attracting more foreign investment. Expansion of direct financing channels like the STAR Market and ChiNext board provides CSC with more opportunities in investment banking.

The growing sophistication of Chinese investors and corporations fuels demand for specialized advisory services in areas such as cross-border M&A and wealth management. CSC Financial's digital transformation and fintech integration efforts are crucial for enhancing its brokerage platforms and personalizing wealth management, aligning with the projected global fintech market growth.

The increasing wealth of Chinese households presents a significant opportunity for CSC Financial in wealth management and asset allocation services, especially as the middle class continues to expand. Furthermore, CSC can leverage China's global economic integration by facilitating cross-border business and investments, including those related to the Belt and Road initiative.

The burgeoning green finance and ESG investing landscape in China offers substantial opportunities for CSC Financial, driven by the nation's commitment to carbon neutrality. Developing specialized ESG advisory services and facilitating green bond issuances aligns with national environmental policies and taps into a rapidly expanding market segment, with China's green bond market showing robust expansion.

Threats

A significant economic slowdown in China, a key market for CSC Financial, presents a substantial threat. For instance, if China's GDP growth, projected to be around 5.0% for 2024, falters, it directly impacts market activity. This could lead to reduced trading volumes and fewer initial public offerings (IPOs), directly hurting CSC Financial's commission and underwriting revenue streams.

Increased volatility in China's capital markets, which saw the Shanghai Composite Index fluctuate significantly in early 2024, is another major concern. Such instability can deter investor confidence, leading to lower asset valuations and decreased demand for asset management services. This directly affects CSC Financial's profitability across its various business segments.

CSC Financial faces significant threats from China's evolving financial regulatory landscape. Increased scrutiny on risk control and leverage, as seen with tightening rules around shadow banking and fintech in 2023, could lead to higher compliance costs and limitations on certain business activities. For instance, new capital adequacy ratios or restrictions on cross-market operations could directly impact CSC's profitability and strategic flexibility.

Ongoing geopolitical tensions, particularly between China and major global economies, pose a significant threat by dampening investor confidence and disrupting capital flows. For instance, the trade disputes that escalated in recent years have directly impacted supply chains and market access for many multinational corporations, creating an unpredictable business environment.

These tensions can lead to a reduction in cross-border transaction volumes and negatively affect the valuations of publicly traded companies. The uncertainty introduced by these geopolitical factors acts as a deterrent to new investment activities, making strategic planning more challenging for firms like CSC Financial.

Disruption from Fintech Companies and New Business Models

Fintech companies are indeed a significant threat, especially those offering streamlined digital brokerage and advisory services. These agile competitors often boast lower fee structures and more user-friendly interfaces, directly challenging traditional players like CSC Financial. For instance, the digital wealth management sector saw substantial growth, with assets under management in robo-advisors projected to reach over $3.2 trillion globally by 2025, up from an estimated $1.5 trillion in 2023, indicating a clear shift in consumer preference towards digital-first solutions.

The risk for CSC Financial lies in potential market share erosion if it cannot match the pace of innovation and cost-effectiveness offered by these new entrants. Failure to adapt business models or invest in cutting-edge digital platforms could leave CSC Financial behind. Consider that in 2024, the global fintech market size was valued at approximately $37.5 billion, with a compound annual growth rate (CAGR) of over 20% anticipated through 2030, highlighting the rapid expansion and disruptive potential of this sector.

- Competitive Pressure: Fintech firms are intensifying competition by offering lower fees and more intuitive digital platforms for brokerage and advisory services.

- Market Share Erosion: CSC Financial faces the risk of losing market share to agile fintech companies that capture customer segments seeking cost-effective and innovative digital solutions.

- Innovation Imperative: Continuous adaptation and significant investment in digital transformation are crucial for CSC Financial to remain competitive against disruptive fintech business models.

Talent Attrition and Acquisition Challenges

The financial services sector, particularly investment banking, is fundamentally driven by its human capital. CSC Financial operates in an environment where securing and nurturing highly skilled professionals is a constant battle. Fierce competition from both domestic and global financial institutions intensifies this challenge, making talent acquisition and retention a critical hurdle.

A significant threat to CSC Financial's long-term growth stems from its ability to attract and retain top-tier talent. Losing key personnel can directly affect service delivery, stifle innovation, and erode its competitive edge in the market. For instance, in 2024, the global financial services industry saw average voluntary turnover rates in specialized roles like investment banking approach 15-20%, highlighting the intense competition for experienced professionals.

CSC Financial must contend with the ongoing difficulty of not only bringing in the best talent but also keeping them engaged and motivated. This includes offering competitive compensation, robust career development opportunities, and a stimulating work environment. The cost of replacing a highly skilled financial professional can range from 1.5 to 2 times their annual salary, underscoring the financial impact of attrition.

- Talent Gap: A projected shortfall of over 1 million financial analysts and advisors is anticipated by 2026 globally, increasing competition for existing talent.

- Retention Costs: The average cost to replace an investment banker can exceed $200,000, impacting profitability.

- Skill Obsolescence: Rapid technological advancements require continuous upskilling, posing a challenge for talent development programs.

Increased regulatory scrutiny and potential policy shifts in China represent a significant threat. For example, the introduction of stricter capital requirements or new rules governing cross-border data flows, which were actively debated in 2024, could increase compliance burdens and limit certain profitable business lines for CSC Financial.

A slowdown in China's economic growth, with projections for 2024 hovering around 5.0%, directly impacts market activity. Reduced consumer spending and business investment can lead to lower trading volumes and fewer IPOs, directly affecting CSC Financial's revenue from commissions and underwriting fees.

Geopolitical instability, such as ongoing trade tensions, can dampen investor sentiment and disrupt capital flows. This uncertainty, evident in market reactions to global policy shifts throughout 2023 and 2024, can reduce cross-border transaction volumes and negatively impact asset valuations, creating a more challenging operating environment.

| Threat Category | Specific Risk | Potential Impact on CSC Financial | Relevant Data/Trend |

|---|---|---|---|

| Economic Slowdown (China) | Reduced trading volumes and IPOs | Lower commission and underwriting revenue | China GDP growth projected around 5.0% for 2024 |

| Regulatory Changes (China) | Stricter capital requirements, data flow rules | Increased compliance costs, business line limitations | Active policy debates in 2024 on financial sector regulation |

| Geopolitical Tensions | Dampened investor sentiment, disrupted capital flows | Reduced cross-border transactions, lower asset valuations | Market volatility linked to global policy shifts (2023-2024) |

SWOT Analysis Data Sources

This CSC Financial SWOT analysis is built upon a foundation of robust data, including the company's official financial statements, comprehensive market research reports, and expert industry analysis to provide a well-rounded strategic view.