Csc Financial Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Csc Financial Bundle

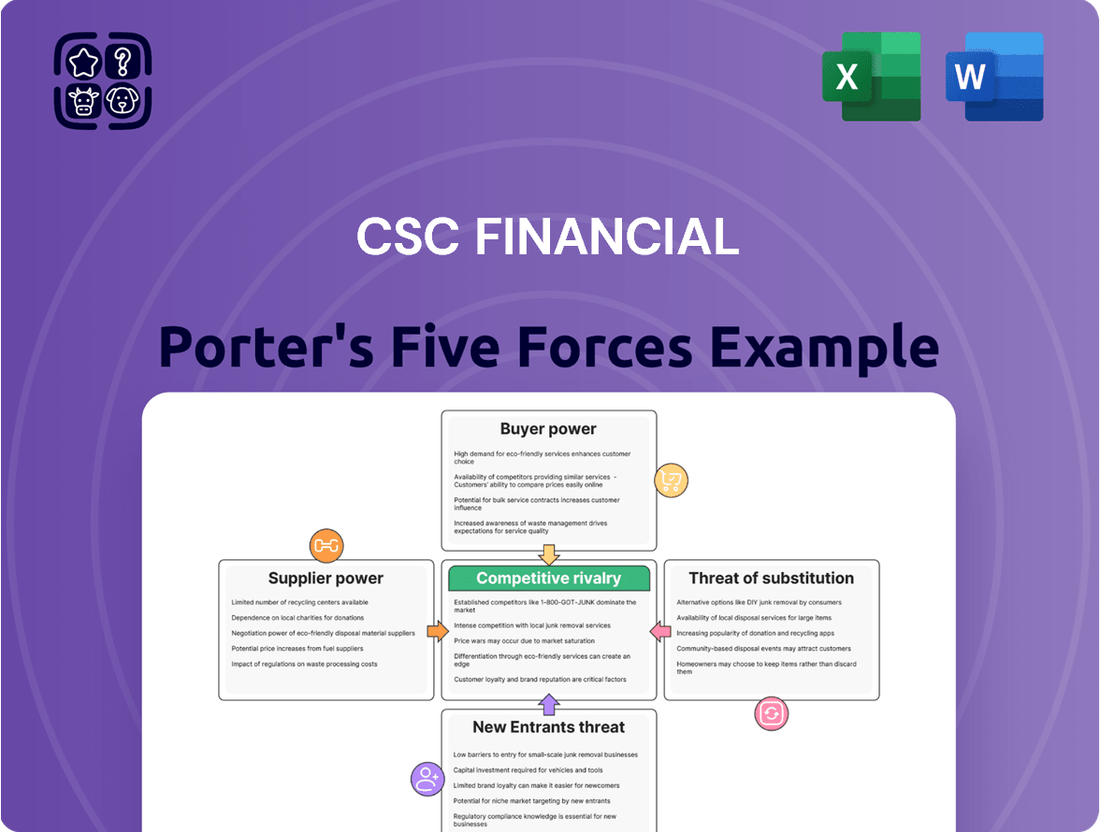

Understanding the competitive landscape is crucial for Csc Financial's success. Our Porter's Five Forces analysis delves into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Csc Financial’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The specialized nature of investment banking services, encompassing complex financial modeling, underwriting, and advisory, creates a significant need for highly skilled professionals. This demand for top-tier talent, especially in dynamic markets like China, empowers employees with niche expertise.

In 2023, the average compensation for investment bankers in Shanghai, a key financial hub, saw an uptick, reflecting the intense competition for experienced professionals. This increased compensation, often including substantial bonuses and equity, directly translates to higher operational costs for firms such as CSC Financial.

Investment banks like CSC Financial depend heavily on specialized technology for everything from trading to staying compliant. Think of the software that powers stock trades or the systems that keep client data secure. These aren't off-the-shelf items; they're complex solutions.

The companies that provide these critical financial technologies are often few and far between. This limited competition means they can hold significant sway over pricing and the terms of service. For CSC Financial, this reliance means they have less room to negotiate when these essential tech providers set their rates.

In 2024, the financial services sector saw a significant increase in spending on technology, with cybersecurity and data analytics being major drivers. For instance, global spending on financial technology was projected to reach hundreds of billions of dollars, highlighting the essential nature of these inputs and the leverage held by their providers.

The bargaining power of suppliers is significantly influenced by CSC Financial's reliance on specialized market data and information services. Access to real-time market data, financial news, and in-depth research is absolutely critical for an investment bank's core functions, from executing trades to providing strategic advice. Providers like Bloomberg and Refinitiv hold considerable sway because their data is both indispensable and proprietary.

This dependence means CSC Financial often has to accept the pricing and service terms dictated by these key information providers. For instance, Bloomberg's terminal subscription fees can represent a substantial operational cost, highlighting the supplier's leverage. In 2023, the global financial data market was valued at over $30 billion, underscoring the scale and importance of these services.

Influence of Regulatory Bodies

Regulatory bodies, though not direct suppliers in the traditional sense, wield significant influence over investment banks like CSC Financial. For instance, the China Securities Regulatory Commission (CSRC) sets the operational rules, licensing, and compliance standards that CSC Financial must adhere to. These mandates directly affect CSC Financial's operating expenses and strategic choices, demonstrating the indirect but substantial power of these entities.

The CSRC's decisions on crucial aspects such as capital adequacy ratios, permissible business activities, and market entry conditions for foreign firms are paramount. In 2023, China continued to refine its capital markets regulations, impacting how financial institutions operate and manage risk. For example, ongoing discussions and potential adjustments to capital requirements for investment banks can directly alter the cost of capital and the feasibility of certain business lines for CSC Financial.

- Regulatory Framework Impact: Decisions by bodies like the CSRC on licensing, capital requirements, and business scope directly shape CSC Financial's operational costs and strategic flexibility.

- Compliance Imperative: Adherence to regulations is non-negotiable, granting regulators considerable indirect leverage over the firm's activities and profitability.

- Market Access and Conditions: CSRC's policies on market access and the overall regulatory environment for investment banking activities in China are critical determinants of CSC Financial's competitive landscape.

Cost of Capital and Funding Sources

Investment banks like CSC Financial rely heavily on capital, making financial institutions and debt markets powerful suppliers. The cost of this capital, influenced by interest rates and lending terms, directly impacts CSC Financial's profitability and strategic flexibility. For instance, in early 2024, the Federal Reserve maintained its benchmark interest rate in the 5.25%-5.50% range, reflecting a higher cost of borrowing for financial firms compared to periods of lower rates.

The bargaining power of these capital providers is substantial, as they can dictate the terms under which funds are made available. This can affect CSC Financial’s capacity for underwriting, proprietary trading, and expanding its service offerings. Higher borrowing costs can squeeze margins, particularly for activities requiring significant leverage.

- Capital Dependency: CSC Financial requires substantial capital for core operations like underwriting and trading.

- Supplier Influence: Major financial institutions and debt markets hold significant power through interest rates and lending terms.

- Profitability Impact: The cost of capital directly affects CSC Financial's profitability and its ability to invest in growth.

- Market Conditions: Interest rate environments, such as the Fed's 5.25%-5.50% range in early 2024, shape the bargaining power of capital suppliers.

CSC Financial's reliance on specialized technology and market data providers grants these suppliers significant bargaining power. Limited competition among providers of essential financial software and proprietary data means CSC Financial has less leverage in negotiating terms and pricing, directly impacting operational costs.

| Supplier Type | Impact on CSC Financial | 2024 Data/Trend |

|---|---|---|

| Technology Providers | High dependency on specialized software; limited vendor options increase costs. | Global fintech spending projected to rise significantly; cybersecurity and data analytics are key drivers. |

| Market Data Services | Indispensable for trading and advisory; proprietary data creates supplier leverage. | Global financial data market valued over $30 billion in 2023; terminal fees are a substantial cost. |

What is included in the product

This analysis unpacks the competitive forces impacting CSC Financial, examining the threat of new entrants, the power of buyers and suppliers, the intensity of rivalry, and the threat of substitutes.

Effortlessly identify and mitigate competitive threats by visually mapping the intensity of each Porter's Five Force.

Customers Bargaining Power

CSC Financial's institutional clients, such as large corporations and investment funds, are highly sophisticated. They possess deep financial expertise and readily available market data, allowing them to thoroughly understand service costs and competitive alternatives. This knowledge empowers them to negotiate effectively, particularly for services like underwriting and asset management.

The ability of these clients to access and interpret vast amounts of financial information significantly reduces information asymmetry. This level playing field means they are less reliant on CSC Financial for basic market insights, thereby strengthening their position to demand better pricing and service terms. For instance, in 2024, institutional investors were increasingly leveraging AI-driven analytics platforms, providing them with real-time valuation data that further enhanced their negotiation power.

For standardized financial services like basic securities brokerage, customers often face low switching costs. The rise of numerous online platforms and fintech solutions means individuals can easily transfer their accounts to competitors offering lower fees or superior user experiences. This accessibility for clients to move their assets puts direct pressure on CSC Financial to remain competitive in its pricing and service delivery for these commoditized offerings.

CSC Financial, like many in the investment banking sector, likely sees a significant portion of its revenue generated by a select group of major corporate clients and affluent individuals. For instance, in 2023, the top 10 clients for many large financial institutions accounted for over 30% of their advisory fees.

This concentration means that a single large client, particularly one seeking intricate investment banking services, holds considerable sway. Losing even one such client could noticeably affect CSC Financial's top line, empowering these key accounts to negotiate for customized solutions and more favorable pricing structures.

Client Ability to Diversify Service Providers

Clients, particularly large corporations, frequently utilize multiple investment banks for a range of services, including accessing capital markets or seeking advisory. This diversification strategy is driven by the desire for competitive pricing and to mitigate the risk associated with dependency on a single financial institution. For instance, in 2024, major corporations often engaged several banks for syndicated loans or M&A advisory to ensure the best terms.

This widespread practice of diversifying service providers significantly amplifies the collective bargaining power of clients. When clients can easily switch or divide business among various investment banks, they gain leverage in negotiating fees and service levels. CSC Financial, therefore, faces constant pressure to deliver exceptional value and demonstrate its competitive edge to win and maintain client relationships.

- Client Diversification: Large corporations actively use multiple investment banks for various financial services, including capital raising and advisory.

- Competitive Bidding: Engaging several providers encourages competitive bids, driving down costs and improving service quality for the client.

- Reduced Reliance: Spreading business across different firms lessens a single bank's influence and reduces client dependency.

- Increased Bargaining Power: The ability to diversify directly translates to greater negotiating leverage for clients in the financial services sector.

Price Sensitivity in Commoditized Services

In commoditized financial services such as basic brokerage or general asset management, where offerings are largely indistinguishable, price sensitivity among customers is a significant driver. Individual investors and smaller institutional clients frequently prioritize lower fees, making them highly responsive to price differences. This dynamic compels firms like CSC Financial to meticulously manage their cost structures and potentially accept reduced profit margins on these services to maintain a competitive edge.

The pressure from price-sensitive customers in commoditized segments is evident across the financial industry. For instance, the average expense ratio for actively managed equity mutual funds in the US was around 0.67% in 2024, a figure that continues to be scrutinized by investors seeking lower-cost alternatives. This highlights the constant need for financial service providers to offer competitive pricing to attract and retain clients in these less differentiated markets.

- Price Sensitivity: Customers in commoditized financial services are highly attuned to fees and costs.

- Low Differentiation: Services like basic brokerage and general asset management offer few unique selling propositions.

- Competitive Pressure: Firms must optimize costs to offer competitive pricing, potentially impacting margins.

- Industry Trend: The drive for lower expense ratios in funds reflects this customer price sensitivity.

CSC Financial's institutional clients, being sophisticated and well-informed, possess significant bargaining power due to their deep understanding of service costs and available alternatives. This is amplified by their ability to leverage advanced analytics, as seen in 2024 with institutional investors utilizing AI platforms for real-time valuation data, enhancing their negotiation leverage.

For standardized services, low switching costs empower customers to easily move to competitors, pressuring CSC Financial on pricing and service quality. The concentration of revenue among a few large clients further bolsters their negotiation strength, as losing even one can impact the firm's performance. For example, in 2023, the top 10 clients for many large financial institutions represented over 30% of their advisory fees.

Clients frequently diversify their relationships with multiple investment banks, a strategy that intensified in 2024 for services like syndicated loans and M&A advisory to secure better terms. This practice collectively increases client bargaining power, forcing CSC Financial to consistently offer superior value to retain business.

| Factor | Impact on CSC Financial | Example/Data (2024 unless specified) |

|---|---|---|

| Client Sophistication & Data Access | High bargaining power due to informed decision-making | AI-driven analytics used by institutional investors for real-time valuations |

| Low Switching Costs (Standardized Services) | Pressure on pricing and service delivery for commoditized offerings | Easy transferability of accounts to fintech platforms with lower fees |

| Client Concentration | Significant leverage for key clients; potential impact of client loss | Top 10 clients accounted for >30% of advisory fees for large institutions (2023) |

| Client Diversification Strategy | Amplified collective bargaining power; need for competitive differentiation | Corporations engaging multiple banks for syndicated loans and M&A advisory |

What You See Is What You Get

Csc Financial Porter's Five Forces Analysis

This preview showcases the complete CSC Financial Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the financial sector. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring full transparency and immediate utility for your strategic planning.

Rivalry Among Competitors

CSC Financial operates within a crowded Chinese investment banking sector, featuring a multitude of domestic competitors. This includes major state-owned securities firms, brokerages linked to commercial banks, and a host of smaller, independent entities. The sheer volume of these players creates a highly competitive environment, driving intense rivalry for market share across all financial services.

This intense competition translates into constant pressure for CSC Financial to enhance its service offerings and find unique ways to stand out. For instance, in 2023, the total revenue for China's securities industry reached approximately RMB 1.7 trillion, a figure that reflects the scale of the market but also the fierce competition among participants for a slice of that revenue.

Major global investment banks are increasingly active in China, bringing international expertise and sophisticated financial products. This presence intensifies competition for CSC Financial, especially in large cross-border transactions and premium advisory services. For instance, in 2023, international banks played a significant role in many of China's outbound M&A deals, showcasing their capabilities and market penetration.

Many core financial services, like basic securities brokerage and simple asset management, are becoming increasingly similar, almost like commodities. This means companies often end up competing primarily on price, which can really squeeze their profits. For instance, in 2023, the average expense ratio for actively managed equity mutual funds in the U.S. hovered around 0.72%, a figure that has seen steady declines over the years due to this pressure.

Because these fundamental services offer little in the way of unique features, firms are driven to compete fiercely on fees and commissions. This aggressive pricing strategy can significantly erode profit margins for companies like CSC Financial. It's a constant battle to attract and retain clients when the core offering is easily replicated by competitors.

To navigate this intense price competition, CSC Financial must strategically pivot towards offering more value-added services and cultivating specialized expertise. By focusing on areas where they can truly differentiate, such as sophisticated financial planning, personalized wealth management, or niche investment strategies, they can command higher fees and build stronger client loyalty, moving away from the commoditized core.

High Exit Barriers

High exit barriers in the investment banking sector, including CSC Financial's market, significantly influence competitive rivalry. These barriers stem from substantial capital requirements, the need for specialized regulatory licenses, and the deep-rooted client relationships that are crucial for success. For instance, in 2024, the cost of compliance and technology infrastructure for a full-service investment bank continues to be in the hundreds of millions of dollars, making it difficult for firms to divest.

Consequently, many firms remain in the market even when facing profitability challenges. This reluctance to exit means that even underperforming entities can persist, contributing to ongoing intense competition rather than a natural market consolidation. This sustained rivalry can pressure profit margins for all players, including CSC Financial.

- Substantial Capital Investment: Operating as a full-service investment bank necessitates significant ongoing capital deployment for technology, talent, and market access.

- Regulatory Hurdles: Obtaining and maintaining necessary licenses and approvals across various jurisdictions is a complex and costly process, creating a barrier to entry and exit.

- Client Relationship Lock-in: The long-term, trust-based relationships investment banks build with clients are difficult and time-consuming to replicate, making it challenging for new entrants and for existing firms to leave without losing valuable business.

- Industry Persistence: The combination of these factors encourages firms to endure market downturns, leading to sustained competition rather than efficient market exit.

Intense Competition for Key Mandates (IPO, M&A)

The competition for significant investment banking mandates, including IPOs, M&A, and debt offerings, is fierce. Financial institutions aggressively pursue these lucrative deals by highlighting their historical successes, specialized industry knowledge, and extensive client relationships. CSC Financial actively competes for these high-stakes assignments against both seasoned industry players and emerging, aggressive firms.

In 2024, the global M&A market saw a notable increase in activity, with deal values reaching hundreds of billions of dollars, underscoring the intense battle for advisory roles. Similarly, the IPO market, while fluctuating, continued to present significant opportunities for banks to secure lead underwriting positions.

- Mandate Competition: Investment banks fiercely compete for IPO, M&A, and bond underwriting mandates.

- Key Differentiators: Firms leverage track record, industry expertise, and distribution networks to win mandates.

- CSC Financial's Position: CSC Financial is a constant contender against established and ambitious rivals for these deals.

- Market Dynamics (2024): The global M&A market experienced significant deal volume, highlighting the competitive landscape for advisory services.

Competitive rivalry within CSC Financial's operating environment is exceptionally high, fueled by a vast number of domestic players and increasing international presence. This intense competition, particularly for lucrative mandates like IPOs and M&A, forces firms to differentiate through expertise and client relationships rather than solely on price for commoditized services.

The sheer volume of financial institutions in China, ranging from large state-owned entities to smaller independent firms, creates a crowded marketplace. This dynamic is further amplified by global investment banks actively participating in China's financial sector, intensifying the battle for market share and premium advisory roles.

In 2023, China's securities industry generated approximately RMB 1.7 trillion in revenue, illustrating the substantial market size but also the fierce competition for these earnings. This environment pressures firms like CSC Financial to innovate and offer specialized, value-added services to stand out from the commoditized core offerings.

The persistence of firms in the market, partly due to high exit barriers such as substantial capital requirements and regulatory licensing, ensures sustained rivalry. For instance, in 2024, the ongoing costs for technology and compliance for investment banks remain in the hundreds of millions of dollars, making divestment challenging and contributing to a crowded competitive landscape.

SSubstitutes Threaten

Corporations, particularly those with strong credit ratings and established market presence, are increasingly exploring direct financing avenues. For instance, in 2024, the volume of corporate bond issuances directly placed with institutional investors saw a notable uptick, bypassing traditional underwriting entirely for certain tranches.

This shift is fueled by advancements in financial technology and evolving regulatory landscapes that simplify direct access to capital markets. Companies are leveraging platforms that connect them directly with a broad investor base, reducing reliance on intermediaries.

The ability for corporations to raise capital directly represents a significant substitute threat to investment banks like CSC Financial. This trend directly erodes the demand for traditional underwriting and advisory services, which are core revenue streams for such financial institutions.

The rise of fintech platforms and robo-advisors presents a significant threat of substitutes for CSC Financial. These digital alternatives, like Betterment and Wealthfront, offer automated investment management and financial planning at a fraction of the cost of traditional advisors. For instance, robo-advisors typically charge annual management fees around 0.25%, compared to the 1% or more often seen with human advisors. This cost advantage, coupled with user-friendly interfaces and 24/7 accessibility, attracts a growing segment of investors, particularly millennials and Gen Z, who are comfortable with digital solutions.

Large corporations are increasingly building robust in-house corporate finance departments. These internal teams can manage mergers and acquisitions, raise capital, and oversee treasury functions, directly substituting the advisory services offered by firms like CSC Financial. For instance, many Fortune 500 companies now have substantial finance departments capable of handling complex deals without external investment banks.

Alternative Wealth Management Providers

Traditional commercial banks, insurance companies, and independent wealth management firms present a significant threat of substitutes for CSC Financial's core asset management and investment advisory services. These competitors often leverage extensive branch networks and integrated financial product suites, appealing to a broad client base seeking convenience and a one-stop financial solution. For instance, many large banks in 2024 continued to expand their wealth management divisions, aiming to capture a larger share of the affluent market by offering a comprehensive suite of services beyond just investment advice.

Clients may gravitate towards these alternative providers if they prioritize a holistic financial planning approach that encompasses banking, insurance, and investment management under one roof. This integrated offering can simplify financial management for individuals and families. In 2024, the trend of banks acquiring or expanding their wealth management capabilities continued, with some major institutions reporting substantial growth in assets under management in these segments, indicating client preference for consolidated financial relationships.

- Broadened Service Offerings: Competitors like major banks and insurance companies provide a wider array of financial products, including loans, mortgages, and insurance policies, which can be attractive to clients seeking consolidated financial relationships.

- Client Convenience: Established branch networks and digital platforms offered by these substitutes can enhance client accessibility and convenience, potentially drawing clients away from specialized investment banks.

- Holistic Financial Planning: Many alternative providers emphasize comprehensive financial planning, integrating investment management with retirement planning, estate planning, and tax advisory services, appealing to clients who prefer a unified approach.

- Market Presence: In 2024, the wealth management arms of large commercial banks collectively managed trillions of dollars in assets, demonstrating their significant market penetration and ability to attract and retain a substantial client base.

Decentralized Finance (DeFi) and Blockchain Technology

The rise of decentralized finance (DeFi) and blockchain technology presents a significant, albeit still developing, threat of substitutes to traditional financial services. These platforms offer alternative avenues for capital raising and asset exchange, potentially disintermediating established players.

While still in its early stages, the total value locked (TVL) in DeFi protocols reached a peak of over $170 billion in late 2021, demonstrating substantial user adoption and capital commitment. By mid-2024, despite market fluctuations, DeFi continues to represent a growing alternative for financial transactions and investments.

- Decentralized Capital Formation: DeFi protocols allow for peer-to-peer lending and borrowing, bypassing traditional banks.

- Alternative Asset Trading: Blockchain enables the tokenization of assets, creating new markets for trading.

- Reduced Intermediary Costs: The removal of intermediaries in DeFi can lead to lower transaction fees.

- Transparency and Accessibility: Blockchain's inherent transparency can foster greater trust and broader access to financial tools.

The threat of substitutes for CSC Financial is multifaceted, encompassing direct financing, fintech alternatives, in-house corporate capabilities, traditional financial institutions, and emerging decentralized finance (DeFi). These substitutes challenge CSC's core revenue streams by offering cost-effective, convenient, or more integrated financial solutions.

Fintech platforms and robo-advisors, with fees around 0.25% annually, directly compete with traditional advisory services. In 2024, large banks continued to expand their wealth management divisions, managing trillions in assets and offering a holistic financial planning approach that includes banking and insurance.

Corporations increasingly bypass intermediaries for direct financing, evidenced by a notable uptick in direct bond placements in 2024. Furthermore, the growing adoption of DeFi protocols, despite market volatility, offers alternative capital formation and asset trading, potentially disintermediating established financial players.

| Substitute Type | Key Features | Impact on CSC Financial | 2024 Data/Trend |

| Fintech/Robo-Advisors | Lower fees (e.g., 0.25% vs. 1%+) | Erodes demand for traditional advisory | Growing adoption by younger investors |

| In-house Corporate Finance | Handles M&A, capital raising internally | Reduces need for external investment banking services | Prevalent in Fortune 500 companies |

| Traditional Banks/Insurers | Integrated services (banking, insurance, investments) | Attracts clients seeking consolidated relationships | Continued expansion of wealth management arms |

| Decentralized Finance (DeFi) | Peer-to-peer lending, tokenized assets | Offers alternative capital formation and trading | Continued growth in Total Value Locked (TVL) |

Entrants Threaten

The financial industry in China, especially investment banking, is heavily regulated, with authorities like the China Securities Regulatory Commission (CSRC) mandating extensive licenses and approvals. These rigorous regulatory requirements create substantial barriers for new companies attempting to enter the market, making it both challenging and lengthy to set up operations. CSC Financial, having navigated these complexities, benefits from its established compliance and existing licenses.

Establishing a full-service investment bank like CSC Financial requires an enormous amount of capital. This is needed for everything from the physical infrastructure and advanced technology to meeting strict regulatory capital adequacy ratios. For instance, in 2024, major investment banks reported Tier 1 capital ratios well above regulatory minimums, often exceeding 15%, showcasing the scale of investment required.

New entrants face a significant hurdle in securing such substantial funding, making it a powerful deterrent. The sheer volume of capital needed to compete effectively means that only well-established or exceptionally well-funded entities could realistically consider entering this market.

CSC Financial's existing robust capital base, bolstered by its operations and profitability, provides a strong competitive advantage. This financial strength allows CSC to invest in growth, technology, and talent, creating a barrier that new players would find extremely difficult to overcome.

In the financial services sector, especially for firms like CSC Financial involved in investment banking, a strong reputation and established trust are absolutely critical. Clients, particularly large corporations and wealthy individuals, gravitate towards firms with a history of success and well-known brands. Building this level of credibility from the ground up presents a significant hurdle for any new competitor.

Difficulty in Attracting and Retaining Top Talent

The investment banking industry, including firms like CSC Financial, is fundamentally built on specialized human capital. This means that attracting and keeping experienced bankers, analysts, and traders is crucial for success. Newcomers face a significant hurdle here, as established players often have the resources to offer highly competitive compensation packages, clear career advancement paths, and access to lucrative deal flow, making it difficult for new entrants to lure away top talent.

Established firms possess deeply ingrained networks and a wealth of collective expertise that are incredibly difficult for new entrants to replicate quickly. In 2024, the demand for skilled financial professionals remained high, with many roles in investment banking experiencing significant competition. For instance, a report from a leading financial recruitment firm indicated that the average bonus for junior investment bankers in major financial centers saw an increase of 5-10% compared to the previous year, reflecting the intense battle for talent.

- Talent Acquisition Costs: New entrants face higher recruitment fees and signing bonuses to attract experienced professionals away from established institutions.

- Retention Challenges: Existing firms leverage strong corporate culture, extensive training programs, and long-term incentive plans to retain their valuable employees.

- Skill Gaps: The specialized nature of investment banking means that a deep bench of talent with specific deal experience and client relationships is essential, which new firms lack.

- Reputational Advantage: Firms with a proven track record and strong brand recognition inherently have an easier time attracting talent compared to unknown entities.

Strong Network Effects and Client Relationships

CSC Financial benefits from strong network effects and established client relationships, acting as a significant barrier to new entrants. These deep-seated connections are vital for securing new business and distribution channels.

New companies entering the market would need substantial investment and time to replicate CSC Financial's extensive industry networks and client loyalty. For instance, in 2024, the financial services sector continued to see consolidation, with many smaller firms struggling to gain market share against established players with strong client bases.

- Entrenched Client Relationships: CSC Financial's existing client base provides a significant competitive advantage, making it difficult for newcomers to attract and retain customers.

- Extensive Industry Networks: The firm's deep connections within the financial industry are crucial for securing mandates and accessing distribution channels, a difficult feat for new entrants.

- High Barrier to Entry: Building comparable networks and client trust requires considerable time and capital, effectively deterring potential competitors.

The threat of new entrants in China's financial services sector, particularly for investment banking operations like those of CSC Financial, is significantly mitigated by substantial barriers. These include stringent regulatory licensing, immense capital requirements, the need for established reputation and trust, and the critical importance of specialized human capital and extensive industry networks. These factors collectively make it exceedingly difficult and costly for new players to gain a foothold and compete effectively.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for CSC Financial leverages data from their official annual reports, investor presentations, and regulatory filings (e.g., SEC filings). We also incorporate insights from reputable financial news outlets and industry-specific market research reports.