Csc Financial Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Csc Financial Bundle

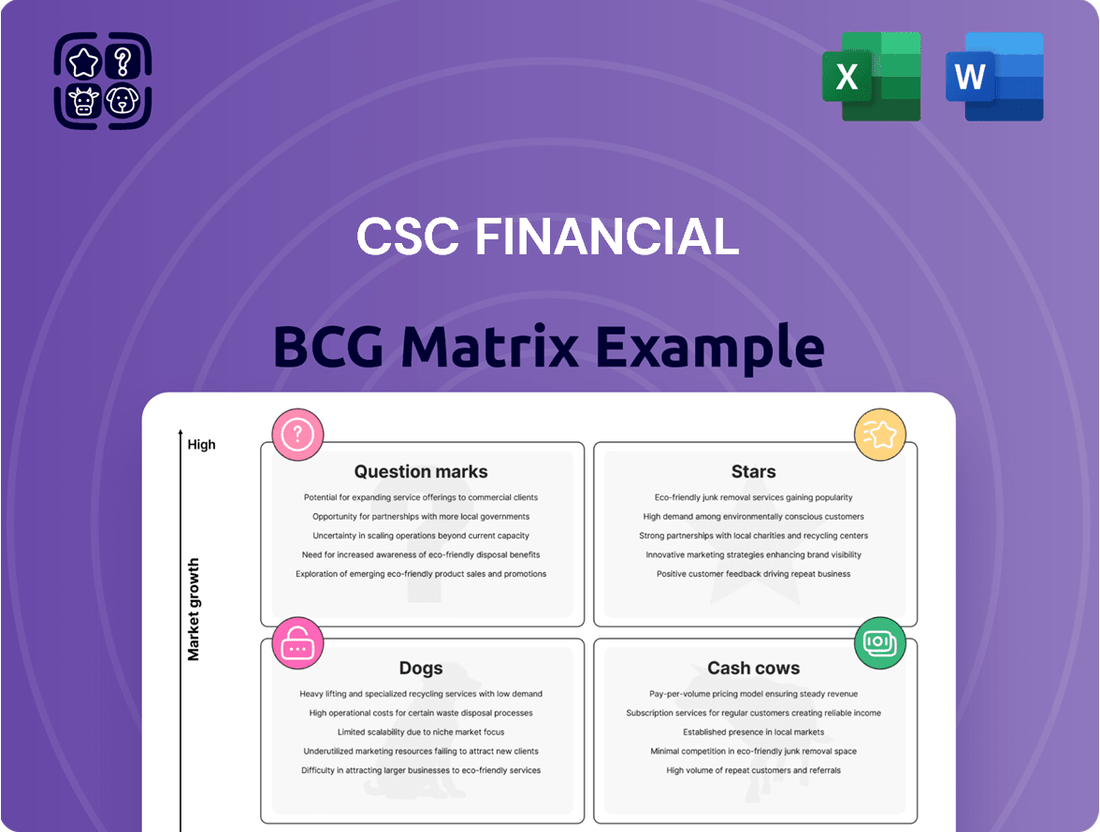

Unlock the strategic potential of Csc Financial's product portfolio with this insightful BCG Matrix preview. See at a glance which offerings are driving growth and which may require a closer look. Purchase the full BCG Matrix for a comprehensive analysis, including detailed quadrant placements and actionable strategies to optimize your investments and product development.

Stars

CSC Financial has cemented its position as a powerhouse in China's investment banking landscape, consistently securing a significant number of equity financing and IPO underwriting deals. In 2024, the firm distinguished itself by leading in the sheer volume of IPOs underwritten and ranking strongly in the total underwriting value within the A-share market.

CSC Financial's securities brokerage arm is on a serious growth trajectory, largely fueled by its successful online customer acquisition strategies. The company reported a remarkable 63% year-on-year surge in new clients during 2024. This impressive expansion also saw a five-year peak in the number of high-net-worth individuals joining their platform, signaling robust market penetration.

High-performing proprietary trading at CSC Financial is a key driver of its success, as evidenced by its significant revenue contribution to the Q1 2025 financial results. This segment is characterized by strong performance, likely indicating a high market share within its niche.

While precise proprietary trading market share figures are not publicly disclosed, the segment's substantial profit generation, especially within a generally upward trending market, points to its high-growth, high-share status. The positive trajectory of China's equity market throughout 2025 further bolsters the outlook for this business unit.

Strategic Emerging Industry Investments

CSC Financial, through its subsidiary China Securities Investment Co., Ltd., is strategically positioning itself in high-growth sectors. In 2024, the company committed RMB600 million across 19 investments, targeting industries identified as key to national development and future economic expansion.

These investments are focused on emerging industries that are expected to drive significant market growth and technological advancement. By aligning with national strategies, CSC Financial aims to secure early-mover advantages and foster long-term value creation as these sectors mature.

- Investment Focus: Strategic emerging industries aligned with national development priorities.

- 2024 Commitment: RMB600 million allocated to 19 distinct investments.

- Strategic Objective: Capitalize on future market leadership in high-growth sectors.

Expanding Digital Financial Services

The digital financial services sector is booming, with the financial industry actively embracing digital solutions. CSC Financial is positioned to lead this charge, enhancing its digital services to cater to modern customer needs and streamline operations. This strategic expansion into digital financial services is projected to yield substantial growth, mirroring the broader market trends.

The global digital payments market, for instance, was valued at approximately $2.5 trillion in 2023 and is anticipated to reach over $6.5 trillion by 2029, showcasing the immense potential. CSC Financial's focus here aligns with this trajectory.

- Digital Transformation: The financial sector is undergoing a profound digital shift, impacting everything from customer interaction to back-office processes.

- Meeting Evolving Expectations: Customers increasingly expect seamless, convenient, and personalized digital financial experiences.

- Efficiency Gains: Digitalization offers opportunities to reduce operational costs and improve the speed and accuracy of financial transactions.

- High Growth Potential: Investments in digital financial services are characterized by rapid market expansion and the adoption of new technologies.

Stars represent business units with high market share in high-growth industries. CSC Financial's proprietary trading operations, benefiting from a generally upward trending market in 2025, demonstrate characteristics of a Star. The firm's strategic investments in emerging industries, aligned with national development, also position these ventures as potential Stars, poised for significant future expansion and market leadership.

| Business Unit | Market Growth | Market Share | BCG Category |

|---|---|---|---|

| Proprietary Trading | High | High (Implied) | Star |

| Strategic Investments (Emerging Industries) | High | Low to High (Developing) | Potential Star |

What is included in the product

Strategic evaluation of CSC Financial's product portfolio, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

Actionable recommendations for investment, divestment, or maintenance based on market growth and relative market share.

Provides a clear visual of business unit performance, easing the pain of strategic decision-making.

Cash Cows

CSC Financial's established securities brokerage network, boasting 319 branches across mainland China as of recent reports, functions as a classic Cash Cow. This extensive physical footprint allows them to capture a significant share of traditional brokerage services, leading to stable, recurring fee-based income from a loyal customer base.

The low need for additional promotional investment in these mature markets further solidifies its Cash Cow status. This network generates consistent revenue streams, providing a reliable source of funds that can be reinvested in other areas of the business, such as growth-oriented ventures or research and development.

As of the close of 2024, CSC Financial's large asset management portfolio held RMB494.9 billion in total assets under custody. This substantial figure, covering collective, single, and specialized products, highlights its strong position in a mature market.

This scale signifies a dominant market share, generating consistent and predictable revenue. These mature offerings require minimal investment for growth, acting as reliable cash generators for the company.

CSC Financial's robust institutional client services act as a significant cash cow. The company boasts a substantial and active institutional client base, with 18,665 active clients recorded in 2024, reflecting a healthy 16% year-on-year growth.

This strong client engagement, particularly within the prime brokerage sector, ensures a consistent and substantial revenue stream. The company's second-place ranking in the industry for public funds under custody further solidifies its position in a stable, high-value market segment that reliably generates considerable cash flow.

Dominant Fixed Income Underwriting and Market Making

CSC Financial's dominance in fixed income underwriting and market making positions it as a cash cow. In 2024, the company secured a top-five ranking for government bond futures and credit bond market-making on the Shanghai Stock Exchange. This mature market, characterized by high entry barriers, ensures consistent and significant revenue streams, leveraging CSC Financial's deep expertise and established market presence.

The company's strong performance in these segments is a testament to its robust infrastructure and seasoned trading desks. Such activities are vital for generating stable profits, as demonstrated by the consistent demand for liquidity and execution services in China's rapidly growing bond markets.

- Government Bond Futures: Top 5 market maker on the Shanghai Stock Exchange in 2024.

- Credit Bond Market Making: Among the top 5 market makers on the Shanghai Stock Exchange in 2024.

- Market Maturity: Operates in a well-established market with significant barriers to entry.

- Revenue Generation: Provides reliable and substantial income due to established expertise and market share.

Comprehensive Research and Advisory Services

CSC Financial's comprehensive research and advisory services represent a significant Cash Cow within its BCG Matrix. In 2024, the firm demonstrated its commitment to this area by publishing an impressive 5,966 research reports, with 706 specifically distributed in Hong Kong. This high volume of output underscores the depth and breadth of their analytical capabilities.

This foundational service acts as a stable revenue generator, consistently contributing to CSC Financial's overall financial health. It also plays a crucial role in nurturing and strengthening relationships with existing clients. By providing valuable insights and expert guidance, these services reinforce CSC Financial's position as a trusted advisor in a well-established segment of the financial services market.

- 2024 Research Reports Published: 5,966

- 2024 Research Reports Distributed in Hong Kong: 706

- Role in BCG Matrix: Cash Cow

- Key Functions: Stable revenue generation, client relationship reinforcement

CSC Financial's asset management division, holding RMB494.9 billion in assets under custody as of 2024, exemplifies a Cash Cow. This segment benefits from high market share in a mature industry, demanding minimal reinvestment for sustained, predictable revenue generation.

The company's extensive securities brokerage network, with 319 branches in mainland China, also functions as a Cash Cow. This established infrastructure generates stable, recurring income from a loyal customer base with low promotional expenditure needs.

Furthermore, CSC Financial's strong institutional client services, serving 18,665 active clients in 2024, contribute significantly to its Cash Cow status. This segment, particularly prime brokerage, provides consistent and substantial cash flow due to its high value and stable market position.

| Business Segment | 2024 Data Point | BCG Matrix Classification | Revenue Characteristic |

|---|---|---|---|

| Asset Management | RMB494.9 billion AUM | Cash Cow | Stable, predictable |

| Securities Brokerage Network | 319 branches | Cash Cow | Recurring fee-based |

| Institutional Client Services | 18,665 active clients | Cash Cow | Consistent, substantial |

Delivered as Shown

Csc Financial BCG Matrix

The BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase, ensuring no surprises and immediate usability for your strategic planning needs.

Rest assured, the BCG Financial BCG Matrix you see here is the complete, unwatermarked report that will be delivered instantly after your purchase, ready for immediate application in your business analysis.

This preview accurately represents the final BCG Financial BCG Matrix document you will acquire, providing a clear, professional, and analysis-ready tool for your strategic decision-making processes.

What you're previewing is the identical BCG Financial BCG Matrix report that will be yours after purchase, offering a comprehensive and expertly crafted resource for evaluating your business portfolio.

Dogs

Outdated niche advisory services, those catering to shrinking or stagnant market segments that haven't kept pace with client needs, often fall into the dog category of the BCG matrix. These services can drain resources without yielding substantial revenue or demonstrating future growth prospects. For instance, a financial advisory firm still heavily reliant on faxed client documents and manual data entry for legacy retirement planning services, while the market shifts towards digital onboarding and AI-driven financial planning, would likely fit this description. Such services typically possess a low market share within their specialized, yet unexpanding, niche.

Inefficient legacy technology platforms are the 'dogs' in the financial services BCG matrix. These are the outdated IT systems that drain resources without offering significant returns or growth potential. Think of them as the old cash registers in a world of sophisticated point-of-sale systems.

Before widespread digital transformation, many financial institutions relied on these legacy systems. They were often expensive to maintain, struggled to keep up with increasing transaction volumes (lacked scalability), and couldn't easily connect with newer, more agile financial technologies. This made them a hindrance rather than a help.

By 2024, the cost of maintaining legacy IT systems remains a significant burden for many organizations. For instance, reports indicate that a substantial portion of IT budgets, sometimes exceeding 70%, is still allocated to simply keeping these older systems running, diverting funds from innovation and growth initiatives.

Within CSC Financial's expansive network, some regional branches might be classified as dogs. These are locations that struggle with client acquisition and revenue generation, even as the broader brokerage business grows. For instance, a branch in a mature, low-growth market with a declining customer base would fit this description.

These underperforming branches often exhibit a low market share within their specific geographic areas. Despite efforts, they may not be attracting new clients or retaining existing ones effectively. This stagnation can be a sign of deeper issues, such as intense local competition or a mismatch between the branch's offerings and local demand.

As of early 2024, reports indicated that while CSC Financial's overall revenue saw a healthy increase, a small percentage of its physical locations were contributing disproportionately less. These underperforming branches represent a drain on resources, potentially impacting the company's overall profitability and requiring strategic review.

Non-Strategic Minor Overseas Ventures

Non-strategic minor overseas ventures are those small international projects that haven't really taken off. Think of them as little experiments abroad that didn't quite hit the mark, failing to build a strong presence or make a profit in their new markets. These ventures often continue to drain resources without adding much to the company's bigger picture growth or strategic goals.

These types of ventures can be a drain on company resources. For instance, a company might have invested millions in a small manufacturing plant in Southeast Asia that, by 2024, was only operating at 30% capacity and showing consistent losses. Such operations require continued capital infusion for maintenance and overhead, yet they contribute minimally to overall revenue or market share expansion.

- Low Market Share: These ventures typically hold a very small slice of the foreign market they operate in, often single digits.

- Lack of Profitability: Despite investments, these operations consistently fail to generate profits, often incurring net losses year after year.

- Minimal Strategic Impact: They do not align with or contribute to the core strategic objectives of the parent company, offering little in terms of competitive advantage or future growth potential.

- Resource Drain: Continued investment in these ventures diverts capital and management attention away from more promising opportunities.

Traditional, High-Cost Client Outreach Methods

Traditional, high-cost client outreach methods often fall into the "dog" category of the BCG Matrix. These strategies, which might include extensive direct mail campaigns or costly in-person events without a strong digital follow-up, struggle to achieve significant market share in terms of effective client acquisition. Their reliance on older, less efficient tactics places them in a low-growth segment of the marketing landscape.

These methods typically exhibit low conversion rates when contrasted with more modern, digital approaches. For instance, while direct mail might have a response rate of around 1% to 2%, digital marketing channels like targeted social media ads can achieve significantly higher engagement. The sheer cost per acquisition for these traditional methods can be prohibitive, especially for smaller firms or those operating in highly competitive markets.

- High Cost, Low ROI: Direct mail campaigns in 2024 can cost upwards of $1.00 per piece, with response rates often below 2%, leading to a customer acquisition cost (CAC) that is difficult to justify.

- Declining Effectiveness: The effectiveness of print advertising and cold calling has diminished, with studies showing a continued downward trend in consumer engagement with these channels year-over-year.

- Limited Scalability: Scaling traditional outreach methods is often resource-intensive and slow, unlike the rapid scalability offered by digital marketing platforms.

Dogs in the CSC Financial BCG Matrix represent offerings with low market share and low growth potential. These are typically products or services that are no longer competitive or have been superseded by newer, more innovative solutions. By 2024, many legacy software systems within financial institutions, for example, fall into this category, requiring significant maintenance costs without generating substantial returns.

These "dogs" often consume resources that could be better allocated to more promising areas. Consider a specific example: a niche advisory service focused on a declining industry, such as print media advertising, would likely have a very small market share and face negative or stagnant growth. In 2024, such services might represent less than 1% of a financial firm's total revenue while demanding a disproportionate amount of operational support.

The strategic implication for dogs is often divestment or a complete overhaul. Failing to address these underperforming assets can hinder overall company performance. For instance, a regional branch of CSC Financial in a shrinking town might exhibit low revenue and a declining client base, making it a prime candidate for closure or consolidation by mid-2024.

A table illustrating these characteristics can provide clarity:

| Category | Market Share | Market Growth | Examples | Strategic Action |

|---|---|---|---|---|

| Dogs | Low | Low | Legacy IT systems, Outdated advisory services, Underperforming branches | Divest, Harvest, or Restructure |

Question Marks

CSC Financial's new fintech and AI initiatives are positioned within the burgeoning digital transformation landscape of financial services. The global fintech market is projected to reach $33.5 trillion by 2030, showcasing immense growth potential. These ventures, while operating in a high-growth area, likely represent a nascent market share for CSC Financial, necessitating significant investment to capture a larger portion of this expanding market.

CSC Financial’s intensified focus on targeted cross-border M&A advisory, especially in less traditional markets, presents a potential question mark. While China's outbound M&A is expected to rebound in 2025, particularly towards emerging markets, CSC's market share in these developing cross-border niches is likely still growing.

Emerging ESG investment products from CSC Financial are positioned in a rapidly expanding market, driven by growing global and domestic emphasis on environmental, social, and governance factors. For instance, the global sustainable investment market reached an estimated $35.3 trillion in assets under management by the end of 2022, according to the Global Sustainable Investment Alliance.

While the market's growth potential is significant, CSC Financial's new ESG-themed products would likely start with a relatively modest market share. This is common for new entrants as they focus on building investor recognition and establishing a track record. For example, many specialized ESG ETFs launched in recent years have seen substantial inflows but still represent a fraction of the overall ETF market.

Expansion into Untapped Regional Markets (Domestic)

CSC Financial's expansion into untapped domestic regional markets positions these ventures as potential stars within its BCG matrix. While the company boasts a strong national footprint, targeting underserved or rapidly developing areas within China means entering markets with high growth potential but a currently low market share for CSC. This strategy necessitates significant investment to build brand recognition and capture local leadership.

For instance, consider the rapid economic development in China's western regions. By 2024, many of these provinces are projected to see GDP growth exceeding the national average, creating fertile ground for financial services. CSC's tailored offerings, perhaps focusing on digital banking solutions or specialized SME financing, could tap into this nascent demand.

- Targeting High-Growth, Low-Share Markets: CSC Financial's strategy focuses on regions within China experiencing rapid economic expansion but where its current market penetration is minimal.

- Strategic Investment for Leadership: Significant capital allocation is required to establish a strong presence, build brand loyalty, and achieve market leadership in these new domestic territories.

- Tailored Service Offerings: Success hinges on developing financial products and services that specifically address the unique needs and growth drivers of these underserved regional economies.

- Potential for Star Status: These ventures, if successful in capturing market share amidst high growth, have the potential to evolve into Stars, contributing significantly to CSC Financial's overall portfolio performance.

Specialized Private Equity Fund Launches

CSC Financial's strategy of launching specialized private equity funds, especially those focused on emerging sectors within the dynamic Asia Pacific region, positions them in a high-growth area. The private capital market in Asia Pacific, notably including China, has seen significant expansion, with private equity and venture capital at the forefront. For instance, in 2023, Asia Pacific private equity fundraising reached approximately $150 billion, demonstrating sustained investor interest.

These thematic funds, targeting nascent industries or niche investment approaches, tap into areas with substantial future potential. While the initial asset under management (AUM) for such specialized funds might be lower compared to broader market funds, their focused strategy allows for potentially higher returns as these targeted sectors mature. This approach aligns with the BCG Matrix's concept of targeting Stars – high-growth, high-market-share potential, even if market share is currently small.

- Targeting High-Growth Nascent Industries: Funds focused on areas like AI development, sustainable technology, or advanced biotechnology in Asia Pacific are entering markets with projected CAGR exceeding 20% in the coming years.

- Low Initial AUM, High Potential Growth: Specialized funds often start with smaller capital commitments, but their success is tied to the rapid scaling of their chosen niche, aiming to capture significant market share as the sector matures.

- Asia Pacific's Private Capital Surge: The region's private equity and venture capital deal value in 2023 exceeded $200 billion, indicating a strong appetite for innovative and specialized investment opportunities.

- Strategic Alignment with BCG Matrix: By concentrating on emerging sectors, CSC Financial is essentially identifying and investing in potential 'Stars' that, if successful, can become dominant players in their respective fields.

CSC Financial's ventures into fintech and AI, along with its targeted cross-border M&A advisory, represent areas with significant growth potential but also inherent uncertainties regarding CSC's current market penetration. The company's expansion into underserved domestic regional markets and its launch of specialized private equity funds are strategically positioned to capture future growth, aligning with the potential to develop 'Stars' within its portfolio.

| Initiative | Market Growth Potential | CSC's Current Market Share | BCG Classification (Potential) | Key Considerations |

|---|---|---|---|---|

| Fintech & AI Initiatives | High (Global fintech market projected $33.5T by 2030) | Nascent/Growing | Question Mark / Star | Requires significant investment to capture market share. |

| Targeted Cross-Border M&A | Rebounding (China outbound M&A expected to rise) | Likely Growing in Niches | Question Mark | Success depends on market penetration in less traditional markets. |

| Emerging ESG Products | High (Global sustainable investment $35.3T AUM by 2022) | Modest/Growing | Question Mark / Star | Building investor recognition and track record is crucial. |

| Untapped Domestic Regional Markets | High (Western China GDP growth exceeding national average in 2024) | Low | Star | Requires investment for brand recognition and local leadership. |

| Specialized Private Equity Funds (Asia Pacific) | High (Asia Pacific PE fundraising ~$150B in 2023) | Low Initial AUM, High Potential | Star | Success tied to rapid scaling of chosen niche sectors. |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive financial statements, detailed market research reports, and official industry data to provide an accurate strategic overview.