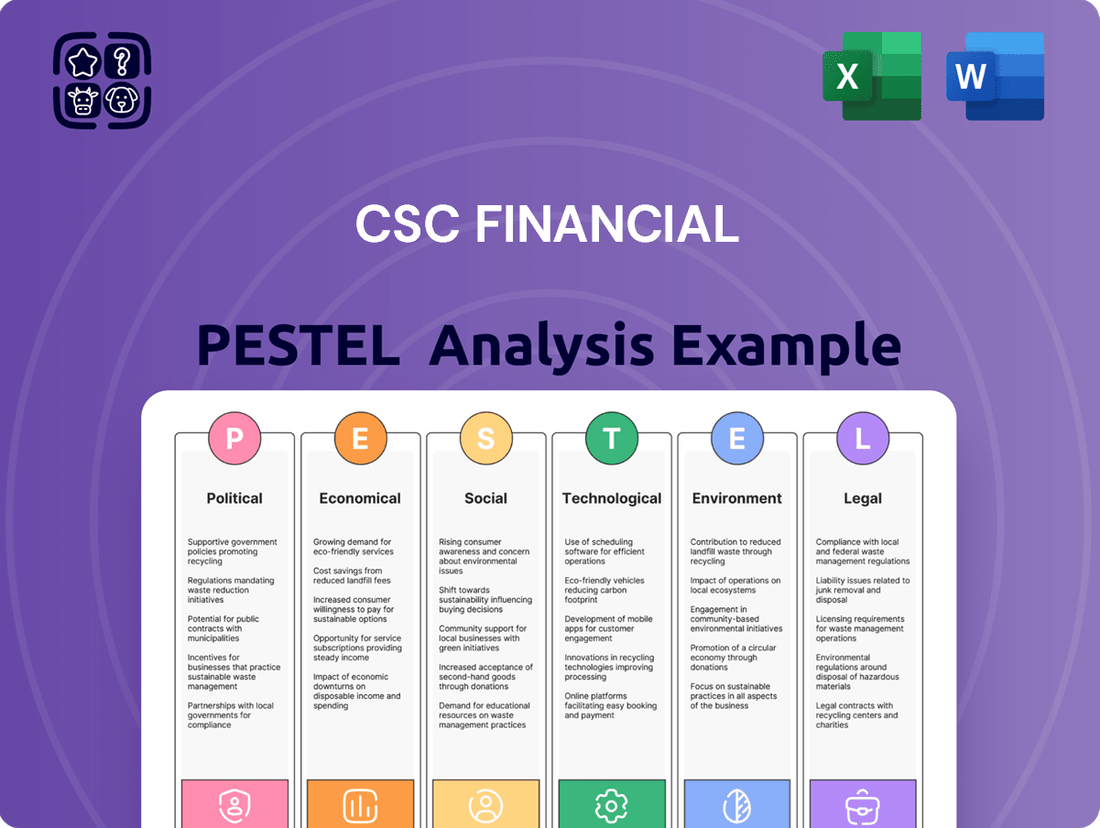

Csc Financial PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Csc Financial Bundle

Navigate the complex external landscape affecting Csc Financial with our comprehensive PESTLE analysis. Understand the critical political, economic, social, technological, legal, and environmental factors shaping its trajectory. Unlock actionable insights to inform your investment decisions and strategic planning. Download the full report now for a competitive edge.

Political factors

The Chinese government's influence on CSC Financial is profound, with policies directly shaping the financial landscape. For instance, the People's Bank of China's monetary policy adjustments, such as interest rate changes in 2024, directly affect borrowing costs and investment returns for CSC Financial and its clients.

Recent regulatory emphasis on capital market development, including initiatives to boost foreign investment in China's stock exchanges, presents both opportunities and compliance challenges for CSC Financial. The China Securities Regulatory Commission (CSRC) actively guides market reforms, impacting areas like IPO regulations and trading mechanisms.

Ensuring financial stability is a key government objective, leading to stricter oversight of financial institutions like CSC Financial. This focus on risk management and systemic stability, reinforced by regulations introduced in late 2023 and early 2024, necessitates robust compliance frameworks and strategic adaptation for CSC Financial.

China's commitment to capital market reforms, targeting a competitive and inclusive market by 2035, directly impacts CSC Financial. Stricter IPO controls and enhanced supervision of listed companies, as part of this push, present both opportunities for new business and the imperative to adapt to evolving regulatory landscapes.

The promotion of long-term institutional investment, a key reform pillar, could significantly boost market liquidity and stability. For CSC Financial, this translates to potential growth in asset management and advisory services, aligning with the government's objective to foster a more robust financial ecosystem.

China's National Financial Regulatory Administration (NFRA) and other key regulators are heavily focused on bolstering financial stability and proactively managing risks, especially within the crucial real estate sector and among smaller financial institutions. This heightened regulatory scrutiny means CSC Financial must ensure its risk management protocols and investment approaches are fully aligned with these national objectives to maintain compliance and avoid contributing to broader systemic vulnerabilities.

ESG Policy Integration

China's commitment to ESG is accelerating, with the People's Bank of China actively promoting green finance. By the end of 2023, outstanding green loans reached RMB 13.4 trillion, a 23% increase year-on-year, highlighting the growing demand for sustainable financial products.

CSC Financial must align its offerings with these policies, potentially developing expertise in areas like climate risk assessment and sustainable investment funds to capture market share. Failure to adapt could lead to missed opportunities and regulatory challenges as ESG compliance becomes more stringent.

- Green Bond Market Growth: China's green bond issuance surpassed RMB 300 billion in 2023, indicating a robust market for ESG-linked debt.

- Sustainability Reporting: New guidelines are pushing companies towards greater transparency, requiring CSC Financial to enhance its data analysis capabilities for ESG reporting.

- Climate Risk Focus: The Chinese government is increasingly emphasizing climate risk management within the financial sector, necessitating CSC Financial to integrate these considerations into its advisory services.

Geopolitical Tensions and Trade Policies

Geopolitical tensions and evolving trade policies represent a significant external force impacting CSC Financial. For instance, the ongoing trade disputes between major global economies, including potential tariff adjustments affecting key trading partners of China, can create volatility in international financial markets. This directly influences investor sentiment and the flow of capital, which are crucial for an investment bank's operations.

These global dynamics can directly affect CSC Financial's international business segments and its ability to facilitate cross-border transactions. For example, in 2024, the International Monetary Fund (IMF) projected global growth to be around 3.2%, a figure susceptible to downward revisions due to escalating geopolitical risks. Such shifts can impact foreign direct investment and M&A activity, core areas for investment banks.

- Trade Policy Uncertainty: Fluctuations in tariffs and trade agreements can alter supply chains and market access, impacting the profitability of companies CSC Financial serves.

- Investor Sentiment: Heightened geopolitical risks, such as regional conflicts or major power competition, often lead to risk aversion, reducing appetite for cross-border investments.

- Regulatory Changes: Evolving trade policies can also trigger changes in financial regulations and capital controls, affecting international banking operations and compliance costs.

- Market Volatility: Geopolitical events in 2024 have demonstrated a clear link to increased market volatility, with indices like the MSCI World experiencing significant swings based on geopolitical developments.

Government policies significantly shape CSC Financial's operational environment. For instance, the People's Bank of China's monetary policy, including interest rate adjustments in 2024, directly impacts borrowing costs and investment returns for the firm and its clients.

Regulatory reforms aimed at strengthening capital markets, such as those encouraging foreign investment, create both opportunities and compliance burdens. The China Securities Regulatory Commission (CSRC) actively guides market evolution, influencing areas like IPO rules and trading mechanisms.

China's drive for financial stability, reinforced by regulations from late 2023 and early 2024, necessitates robust risk management and strategic adaptation from CSC Financial to meet stricter oversight.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Csc Financial, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying potential threats and opportunities within Csc Financial's operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, streamlining strategic discussions by highlighting key external factors impacting CSC Financial.

Economic factors

China's projected economic growth of approximately 5% for both 2024 and 2025 is a significant driver for CSC Financial. This robust expansion directly impacts the vitality of China's capital markets and fuels the demand for a wide array of financial services.

A stable economic climate is paramount for fostering investor confidence and encouraging robust business activity. These conditions are absolutely essential for CSC Financial's core operations, including its brokerage, investment banking, and asset management divisions, as they rely on a predictable and supportive market environment to thrive.

The People's Bank of China's (PBOC) monetary policy, including interest rate adjustments, directly influences CSC Financial's operational costs and revenue streams. For instance, a reduction in the benchmark lending rate by the PBOC, such as the one observed in early 2024, lowers the cost of funds for banks, potentially improving net interest margins for CSC Financial's lending operations.

Changes in reserve requirement ratios also play a crucial role. A decrease in these ratios, like the cuts implemented in late 2023 and early 2024, injects more liquidity into the banking system, which can boost lending activity and create opportunities for CSC Financial's investment banking and asset management divisions.

These policy shifts by the PBOC significantly impact market sentiment and investment decisions across China. Lower interest rates can encourage borrowing and investment, positively affecting CSC Financial's wealth management and brokerage businesses, while also influencing the valuation of its fixed-income portfolio.

China's capital markets experienced a notable slowdown in IPO activity through 2023 and into early 2024, with Shanghai and Shenzhen exchanges seeing a significant drop in new listings compared to previous years. For instance, the Shanghai Stock Exchange's STAR Market, a key venue for tech IPOs, saw a substantial decrease in fundraising volume. This directly impacts CSC Financial's investment banking segment, as lower IPO volumes translate to reduced underwriting and sponsorship fees.

However, there are positive signals for a potential revival in 2025. Analysts anticipate a rebound in IPO issuance, driven by supportive government policies aimed at boosting domestic capital markets and encouraging innovation. This expected surge in deals would provide a much-needed boost to CSC Financial's revenue streams from investment banking services, including underwriting, M&A advisory, and brokerage commissions.

Real Estate Market Conditions

The real estate sector in China continues to present considerable headwinds, impacting financial institutions like CSC Financial. Policy interventions, such as the urban real estate financing coordination mechanisms introduced in late 2023, aim to stabilize the market by facilitating project financing. However, persistent developer defaults and weak buyer sentiment remain key concerns, with property sales in major cities showing a significant decline year-on-year through early 2024.

CSC Financial’s business, particularly its investment banking and advisory services, is directly influenced by these real estate market dynamics. The bank's exposure to real estate-related financing, whether through direct lending, securitization, or underwriting, faces increased risk in a downturn. For instance, the value of collateral tied to real estate projects could diminish, affecting loan performance and the bank's capital adequacy.

- Developer Debt Defaults: Several major Chinese developers have defaulted on their debt obligations in recent years, creating ripple effects across the financial system.

- Property Sales Slump: Year-on-year declines in property sales in key Chinese cities have been observed, indicating a contraction in market activity.

- Policy Support Measures: The government has implemented measures like reducing down payment ratios and mortgage rates to stimulate demand and support developers.

- Impact on Financial Institutions: These conditions can lead to increased non-performing loans and reduced fee income for financial services firms involved in real estate transactions.

Wealth Accumulation and Investment Trends

The accumulation of household wealth is a significant driver for the financial services sector. In the first quarter of 2024, U.S. household net worth reached a record $156.4 trillion, a 2.4% increase from the previous quarter. This growth fuels demand for asset management and investment advisory services as individuals seek to grow and preserve their capital.

Institutional investors and high-net-worth individuals are increasingly shaping investment trends. For instance, global assets under management (AUM) for institutional investors were projected to exceed $100 trillion by the end of 2024. CSC Financial's success hinges on its capacity to adapt to evolving investment preferences, such as a potential pivot towards fee-based advisory models and a broader offering of diversified investment products.

- Household net worth in the U.S. reached $156.4 trillion in Q1 2024.

- Global institutional AUM is expected to surpass $100 trillion by year-end 2024.

- Demand for fee-based advisory services is rising among affluent investors.

- Diversification across asset classes remains a key strategy for wealth preservation.

China's economic trajectory, with projected growth around 5% for 2024-2025, directly fuels CSC Financial's business by expanding capital markets and increasing demand for financial services. A stable economic environment is crucial for investor confidence and business activity, underpinning CSC Financial's core operations.

The People's Bank of China's monetary policies, including interest rate adjustments and reserve requirement ratio changes, significantly influence CSC Financial's costs and revenues, impacting lending and investment opportunities.

A slowdown in China's IPO market through early 2024 negatively affected CSC Financial's investment banking fees, though a projected 2025 rebound driven by supportive policies offers potential revenue growth.

The real estate sector's challenges, marked by developer defaults and declining property sales, create risks for CSC Financial's financing and advisory services, potentially increasing non-performing loans.

| Economic Factor | 2024 Projection/Data | 2025 Projection | Impact on CSC Financial |

| China GDP Growth | ~5% | ~5% | Drives demand for financial services |

| IPO Activity | Slowdown in early 2024 | Expected rebound | Affects investment banking fees |

| Real Estate Market | Headwinds, policy support | Ongoing stabilization efforts | Increases risk for real estate financing |

Preview Before You Purchase

Csc Financial PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of CSC Financial details Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It offers a strategic overview for informed decision-making.

Sociological factors

China's demographic landscape is undergoing a significant transformation, marked by a shrinking and aging population. By 2024, China's working-age population is projected to continue its decline, while the proportion of elderly citizens is on the rise, leading to a higher dependency ratio. This shift directly influences savings rates, as fewer workers support a growing number of retirees, and alters consumption patterns, with increased demand for healthcare and services tailored to seniors.

Consequently, CSC Financial must strategically adapt its product development and client engagement. The company should focus on expanding its wealth management and pension offerings to meet the growing needs of an aging demographic that may prioritize financial security and capital preservation. Understanding the evolving financial behaviors of older, potentially more risk-averse clients will be crucial for CSC Financial's sustained growth and market relevance in the coming years.

Chinese investors are becoming increasingly savvy, with a growing demand for sophisticated financial products. This trend is particularly evident among high-net-worth individuals who are seeking more complex investment strategies and personalized advisory services. For CSC Financial, this presents a significant opportunity to cater to this evolving investor base.

Data from 2024 indicates a notable rise in financial education initiatives across China, contributing to this enhanced investor sophistication. CSC Financial can capitalize on this by developing and promoting tailored investment solutions, such as alternative investments or structured products, and by providing accessible educational resources to further empower its clients. This approach will be key to attracting and retaining a discerning clientele in the competitive financial landscape.

China's rapid urbanization continues to reshape its economic landscape, with major cities like Shanghai and Beijing experiencing significant population growth and economic concentration. This trend creates distinct regional economic disparities, meaning financial needs and service demands vary greatly across the country. For CSC Financial, understanding these differences is crucial for strategic expansion and service customization.

The gap between developed coastal regions and less developed inland areas presents both challenges and opportunities. For instance, while Tier 1 cities boast high disposable incomes and sophisticated financial service demands, emerging second and third-tier cities offer substantial growth potential with evolving financial needs. CSC Financial must tailor its branch network strategy and product offerings to effectively tap into these diverse markets, considering that by early 2024, over 65% of China's population resides in urban areas, a figure projected to climb further.

Changing Consumer Preferences for Financial Services

Consumers increasingly favor digital channels for managing their finances, driven by a desire for speed and accessibility. This trend is particularly pronounced among younger demographics, with a significant portion of Gen Z and Millennial consumers preferring mobile banking apps over traditional branch visits. For instance, a late 2024 survey indicated that over 70% of individuals aged 18-34 primarily use digital platforms for banking transactions.

This shift necessitates that financial institutions like CSC Financial prioritize investments in robust digital infrastructure and intuitive user interfaces. Meeting these evolving expectations is crucial for customer retention and attracting new clientele in a competitive landscape. The demand for seamless, on-demand financial solutions is reshaping client interaction models across the industry.

- Digital Adoption: Over 60% of global banking customers reported using mobile banking apps in 2024, a figure expected to rise.

- Preference for Convenience: Consumers are willing to switch providers for better digital experiences, with ease of use being a top factor.

- Personalization: There's a growing expectation for personalized financial advice and product offerings delivered through digital touchpoints.

Social Trust and Ethical Considerations

Public trust in financial institutions remains a critical factor, especially following periods of market instability. For CSC Financial, maintaining high ethical standards is paramount to fostering client loyalty and navigating regulatory landscapes. A recent survey in late 2024 indicated that nearly 60% of consumers consider a company's ethical practices when choosing financial services, a significant increase from previous years.

CSC Financial must actively demonstrate transparency in its operations and uphold strong governance principles. This includes clear communication about fees, investment strategies, and risk management. By prioritizing client-centric services, such as personalized advice and responsive support, the company can solidify its reputation and build enduring relationships.

- Public Trust: Over 55% of consumers report being more cautious about financial institutions' ethical conduct in 2024 compared to 2023.

- Ethical Practices: CSC Financial's commitment to ethical conduct directly impacts client retention, with studies showing a 20% higher retention rate for firms perceived as highly ethical.

- Regulatory Scrutiny: Increased focus on financial misconduct means robust governance is not just good practice, but essential for avoiding penalties.

- Client-Centricity: Implementing transparent fee structures and personalized financial planning can enhance customer satisfaction and trust.

Societal attitudes towards wealth and investment are evolving in China, with a growing emphasis on financial literacy and long-term planning. By 2024, there's a noticeable shift towards valuing financial education, particularly among younger generations eager to understand and manage their investments effectively.

This evolving mindset presents CSC Financial with a prime opportunity to enhance its educational outreach and advisory services. Tailoring offerings to meet the increasing demand for sophisticated, yet understandable, investment guidance will be key to capturing market share and building client loyalty.

The increasing awareness of environmental, social, and governance (ESG) factors is also influencing investment decisions. Investors, especially younger ones, are increasingly seeking out financial products and companies that align with their personal values. CSC Financial needs to integrate ESG considerations into its product development and client communication strategies to remain competitive and attract this growing segment of socially conscious investors.

Technological factors

FinTech innovation is rapidly reshaping China's financial landscape, with advancements in AI, blockchain, cloud computing, and big data driving significant change. CSC Financial needs to fully embrace this digital transformation to boost efficiency and client satisfaction.

By integrating these technologies, CSC Financial can develop cutting-edge services like AI-powered investment advice and seamless digital payment platforms, keeping pace with evolving market demands.

The increasing reliance on digital platforms within financial services makes robust cybersecurity and data security absolutely critical for CSC Financial. This means continuous investment in advanced security infrastructure to safeguard sensitive client information and maintain trust.

Compliance with evolving data security laws, such as the Network Data Regulations and the Banking and Insurance Institutions Data Security Management Measures, is non-negotiable. Failure to adhere can lead to significant penalties and reputational damage, impacting client retention and market standing.

The financial sector is rapidly embracing artificial intelligence and automation. These technologies are key to streamlining operations, improving how financial institutions assess risk, and delivering more tailored client experiences. For instance, by mid-2024, many firms were reporting significant cost reductions through automated back-office functions.

CSC Financial can harness AI for a range of critical functions. This includes employing algorithmic trading for faster and more efficient transactions, automating compliance checks to ensure adherence to regulations, and offering personalized wealth management advice. These applications directly contribute to enhanced operational efficiency and a superior quality of service for clients.

Big Data Analytics

Big data analytics is revolutionizing how financial institutions operate. The capacity to gather, process, and understand vast amounts of information offers critical insights into market shifts, customer preferences, and potential risks. For CSC Financial, this means sharper investment choices, more effective marketing campaigns, and improved fraud prevention.

The financial services industry is increasingly leveraging big data. For instance, by mid-2024, a significant portion of financial firms were actively investing in advanced analytics platforms to gain a competitive edge. These investments are driven by the clear benefits of data-driven decision-making, which can lead to improved operational efficiency and profitability.

CSC Financial can harness big data in several key areas:

- Market Trend Analysis: Identifying emerging investment opportunities and understanding sector performance through real-time data processing.

- Customer Behavior Profiling: Tailoring financial products and services to individual client needs based on their transaction history and preferences.

- Risk Management Enhancement: Proactively identifying and mitigating financial risks, including credit risk and operational vulnerabilities, through predictive modeling.

- Fraud Detection Improvement: Implementing sophisticated algorithms to detect and prevent fraudulent activities, thereby protecting both the company and its clients.

Blockchain Technology and Digital Assets

Blockchain technology and the emergence of digital assets, including central bank digital currencies (CBDCs) like China's e-CNY, are poised to significantly alter financial landscapes. By mid-2024, several countries were actively piloting or researching CBDCs, indicating a serious global push towards digital fiat. CSC Financial must closely track these advancements, as they could streamline transaction processes and introduce novel asset management paradigms.

Exploring blockchain's potential for CSC Financial could unlock opportunities in areas such as enhanced security for transactions, the implementation of automated smart contracts for greater efficiency, and the creation of new digital asset classes. The global market for blockchain technology was projected to reach hundreds of billions of dollars by 2025, underscoring its growing economic importance.

- Transaction Security: Blockchain's distributed ledger offers inherent security features, reducing fraud risk.

- Smart Contracts: Automation of agreements can lead to faster settlement and reduced operational costs.

- Digital Asset Innovation: Potential for tokenizing real-world assets and creating new investment opportunities.

- CBDC Integration: Adapting to or leveraging central bank digital currencies for future payment systems.

Technological advancements, particularly in AI and big data, are fundamentally changing financial services. By mid-2024, many financial institutions reported substantial operational efficiencies and cost savings through automation, with AI-driven risk assessment and personalized client experiences becoming increasingly common. CSC Financial must leverage these tools for competitive advantage.

The integration of AI for algorithmic trading, compliance automation, and wealth management advice can significantly boost CSC Financial's operational efficiency and client service quality. Similarly, big data analytics offers critical insights for market trend analysis, customer profiling, and enhanced risk management, leading to sharper investment decisions and improved fraud prevention.

Blockchain technology and digital assets, including China's e-CNY, present new avenues for transaction security, smart contract implementation, and digital asset innovation. With the global blockchain market projected for significant growth by 2025, CSC Financial's exploration of these areas is crucial for future-proofing its operations and identifying novel investment opportunities.

| Technology | Key Applications for CSC Financial | Market Trend/Projection (as of mid-2024/early 2025) |

|---|---|---|

| Artificial Intelligence (AI) | Algorithmic trading, automated compliance, personalized wealth management | Widespread adoption for operational efficiency; significant cost reduction reported by firms |

| Big Data Analytics | Market trend analysis, customer behavior profiling, risk management, fraud detection | Increased investment in analytics platforms for competitive edge; data-driven decision-making driving profitability |

| Blockchain & Digital Assets | Transaction security, smart contracts, digital asset innovation, CBDC integration | Global blockchain market projected for substantial growth; active piloting of CBDCs worldwide |

Legal factors

CSC Financial navigates a complex web of securities laws in China, impacting its brokerage, underwriting, and asset management activities. The introduction of the National Nine Articles (NNA) in 2024 signifies a key regulatory shift, demanding stringent adherence to maintain operational licenses and market integrity.

CSC Financial must navigate stringent Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations, demanding robust internal controls and thorough client due diligence. Failure to comply can lead to significant penalties, with the Financial Crimes Enforcement Network (FinCEN) in the US levying substantial fines; for example, in 2023, several financial institutions faced multi-million dollar penalties for AML deficiencies.

These regulations necessitate continuous investment in compliance systems and employee training to ensure the accurate reporting of suspicious transactions. The global AML market was valued at approximately $2.5 billion in 2023 and is projected to grow, reflecting the increasing complexity and enforcement of these rules across jurisdictions.

China's legislative landscape concerning data privacy and cybersecurity has intensified significantly. The Data Security Law (DSL), Personal Information Protection Law (PIPL), and Network Data Regulations, all enacted or significantly updated in recent years, establish rigorous standards for how data is collected, processed, and moved across borders. For instance, the PIPL, effective November 1, 2021, introduced rules similar to GDPR, impacting how companies handle personal information.

CSC Financial must meticulously adhere to these evolving regulations to safeguard client data and mitigate substantial legal and financial penalties. Non-compliance can lead to severe fines; under the PIPL, violations can result in penalties of up to 50 million yuan or 5% of the previous year's annual turnover. Navigating these complex requirements is paramount for maintaining trust and operational integrity.

Financial Holding Company Regulations

As a significant financial institution, CSC Financial operates under a stringent regulatory environment, particularly concerning financial holding companies. These regulations, designed to enhance stability and oversight of large, diversified financial groups, directly impact CSC Financial's operational framework and strategic planning. For instance, the Dodd-Frank Wall Street Reform and Consumer Protection Act in the United States, enacted in 2010 and continually refined, imposes enhanced prudential standards on systemically important financial institutions (SIFIs), which could include entities like CSC Financial depending on its size and interconnectedness.

These rules often mandate specific capital adequacy ratios, liquidity requirements, and risk management practices across all of CSC Financial's business segments. For example, the Basel III framework, which began implementation in 2013 and continues to evolve, sets international standards for bank capital, liquidity, and leverage. By mid-2024, global banks were still adapting to the finalization of Basel III, known as Basel IV, which further tightens capital requirements, particularly for trading books and operational risk. CSC Financial must therefore ensure its capital structure and risk mitigation strategies align with these evolving global benchmarks.

- Capital Requirements: Financial holding companies often face higher capital adequacy ratios than standalone entities, impacting their ability to deploy capital and leverage.

- Risk Management Frameworks: Regulations necessitate robust, enterprise-wide risk management systems to monitor and control risks across diverse financial activities.

- Corporate Structure: Oversight bodies may influence how CSC Financial structures its subsidiaries and business lines to prevent contagion and ensure resolvability.

- Compliance Costs: Adhering to these complex regulations incurs significant operational and technological costs for institutions like CSC Financial.

Competition Law and Anti-Monopoly Measures

China's evolving competition laws, including anti-monopoly measures, directly shape CSC Financial's operational landscape. These regulations are crucial for managing market share, pricing, and potential mergers and acquisitions. Failure to comply can lead to significant penalties and operational constraints, impacting CSC Financial's strategic growth and competitive standing within the Chinese financial sector.

The State Administration for Market Regulation (SAMR) is the primary enforcer of these laws. In 2023, SAMR continued to actively investigate and penalize companies for anti-competitive practices, reinforcing the need for stringent adherence. For instance, fines for monopolistic behavior can reach up to 10% of a company's previous year's revenue, a substantial risk for any financial institution.

- Mergers & Acquisitions Scrutiny: CSC Financial must navigate increased regulatory review for M&A activities to ensure they do not stifle competition.

- Pricing and Dominance: Anti-monopoly rules target unfair pricing strategies and the abuse of dominant market positions.

- Compliance Costs: Adherence requires ongoing investment in legal counsel and robust internal compliance frameworks.

- Market Access: Regulations can influence how CSC Financial accesses and operates within various financial market segments.

CSC Financial operates under China's evolving securities laws, with the National Nine Articles (NNA) introduced in 2024 imposing stricter compliance for its brokerage and asset management activities. The company must also adhere to robust Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations, facing significant penalties for non-compliance, as evidenced by multi-million dollar fines levied by entities like FinCEN in 2023.

Environmental factors

China's ambitious pledge for carbon neutrality by 2060 is a powerful catalyst for green finance, directly impacting CSC Financial. This national imperative fuels a surge in green bond issuance and sustainable investment products, creating new avenues for growth and investor engagement.

CSC Financial's proactive engagement in green bond underwriting and the provision of green loans demonstrates a strategic alignment with these environmental objectives. In 2023 alone, the green bond market in China saw robust growth, with issuance reaching significant figures, underscoring the increasing demand for sustainable financial solutions.

This focus on green finance not only supports national environmental goals but also positions CSC Financial to attract a growing segment of ESG-focused investors. The global trend towards sustainable investing saw trillions of dollars managed under ESG mandates in 2024, a trend expected to accelerate, benefiting financial institutions like CSC that are actively participating in this space.

New mandatory ESG disclosure rules, starting in 2024, now require publicly traded companies to report extensively on their environmental footprint, particularly carbon emissions. This means CSC Financial, being a listed company itself and advising others, needs to adhere to these stringent reporting requirements and help its clients navigate them effectively.

For instance, the European Union's Corporate Sustainability Reporting Directive (CSRD), which phased in for large listed companies in 2024, mandates detailed reporting on environmental matters, with a significant focus on Scope 1, 2, and increasingly Scope 3 emissions. CSC Financial's ability to accurately report its own environmental impact and provide expert guidance on Scope 3 emissions, which can represent a substantial portion of a company's total footprint, will be crucial for compliance and client trust.

CSC Financial must proactively address escalating climate-related risks, encompassing both physical threats like extreme weather and transition risks stemming from policy shifts and technological advancements. By 2024, the financial sector is increasingly scrutinizing these factors, with many institutions integrating climate risk into their core financial modeling.

Integrating environmental risk management into CSC Financial's investment portfolios and lending operations is critical. For instance, the European Central Bank's 2024 climate stress tests revealed that banks could face significant losses from physical risks, highlighting the need for robust assessment.

Resource Scarcity and Sustainable Operations

Growing concerns about resource scarcity are pushing financial institutions like CSC Financial to prioritize sustainable operations. This means actively reducing their environmental impact. For instance, the financial sector is increasingly looking at ways to lower its carbon footprint, with many firms setting targets for emissions reduction.

CSC Financial can adopt several practical strategies to address this. Implementing energy-efficient technologies in its offices, for example, can significantly cut down on electricity consumption. A 2024 report indicated that companies focusing on energy efficiency saw operational cost reductions averaging 15%.

Waste reduction is another key area. This involves minimizing paper usage through digitization and implementing robust recycling programs. Furthermore, promoting sustainable procurement means choosing suppliers who also demonstrate a commitment to environmental responsibility, ensuring that CSC Financial's entire value chain aligns with its sustainability goals.

Here are some key areas for CSC Financial:

- Energy Efficiency: Investing in LED lighting and smart building management systems.

- Waste Management: Implementing comprehensive recycling and composting programs, and promoting digital document management.

- Sustainable Procurement: Developing policies to favor suppliers with strong environmental credentials.

- Resource Optimization: Exploring circular economy principles within its operational framework.

Reputational Risk from Environmental Non-Compliance

Failure to meet environmental standards or adhere to green finance regulations can severely damage CSC Financial's reputation and erode investor trust. For instance, in 2024, companies facing significant environmental fines often saw their stock prices drop by an average of 5-10% within weeks of the announcement. This highlights the direct financial impact of environmental non-compliance.

CSC Financial needs to actively demonstrate environmental responsibility and clearly communicate its sustainability initiatives. This proactive approach is crucial for building and maintaining confidence among stakeholders. A 2025 survey indicated that over 70% of institutional investors consider a company's environmental performance a key factor in their investment decisions.

- Reputational Damage: Non-compliance can lead to negative media coverage and public backlash, impacting brand image.

- Loss of Investor Confidence: Investors increasingly prioritize ESG (Environmental, Social, and Governance) factors, with a growing divestment from non-compliant firms.

- Increased Scrutiny: Regulators and activist groups are intensifying their focus on environmental practices across the financial sector.

- Operational Disruptions: Environmental penalties can include fines and operational restrictions, directly affecting profitability.

CSC Financial must navigate evolving environmental regulations and growing investor demand for sustainable practices. China's 2060 carbon neutrality goal drives green finance, impacting CSC's green bond underwriting and sustainable product development. Mandatory ESG disclosures from 2024 require detailed reporting on environmental footprints, including carbon emissions, directly affecting CSC and its client advisory services.

Climate-related risks, both physical and transitional, are increasingly integrated into financial modeling by institutions, as evidenced by the European Central Bank's 2024 climate stress tests. Resource scarcity concerns also push for sustainable operations, with financial firms setting emissions reduction targets. Failure to meet environmental standards can incur significant reputational damage and financial penalties, with companies facing environmental fines seeing stock price drops averaging 5-10% in 2024.

| Environmental Factor | Impact on CSC Financial | 2024/2025 Data/Trend |

|---|---|---|

| Carbon Neutrality Goals | Drives green finance, new product development | China's 2060 goal fuels green bond market growth. |

| ESG Disclosure Requirements | Compliance and advisory services for clients | Mandatory ESG reporting from 2024, including Scope 1, 2, and 3 emissions. |

| Climate Risk Management | Integration into investment and lending | ECB climate stress tests in 2024 highlight significant potential losses from physical risks. |

| Resource Scarcity & Sustainability | Operational efficiency and supply chain focus | Growing investor preference for companies with strong environmental performance (70%+ institutional investors in 2025). |

| Environmental Compliance | Reputational and financial risk mitigation | Companies with environmental fines saw stock drops of 5-10% in 2024. |

PESTLE Analysis Data Sources

Our CSC Financial PESTLE Analysis is built on a robust foundation of data from leading financial institutions, government reports, and respected industry publications. We meticulously gather insights on economic trends, regulatory changes, and technological advancements to ensure comprehensive and accurate analysis.