Csc Financial Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Csc Financial Bundle

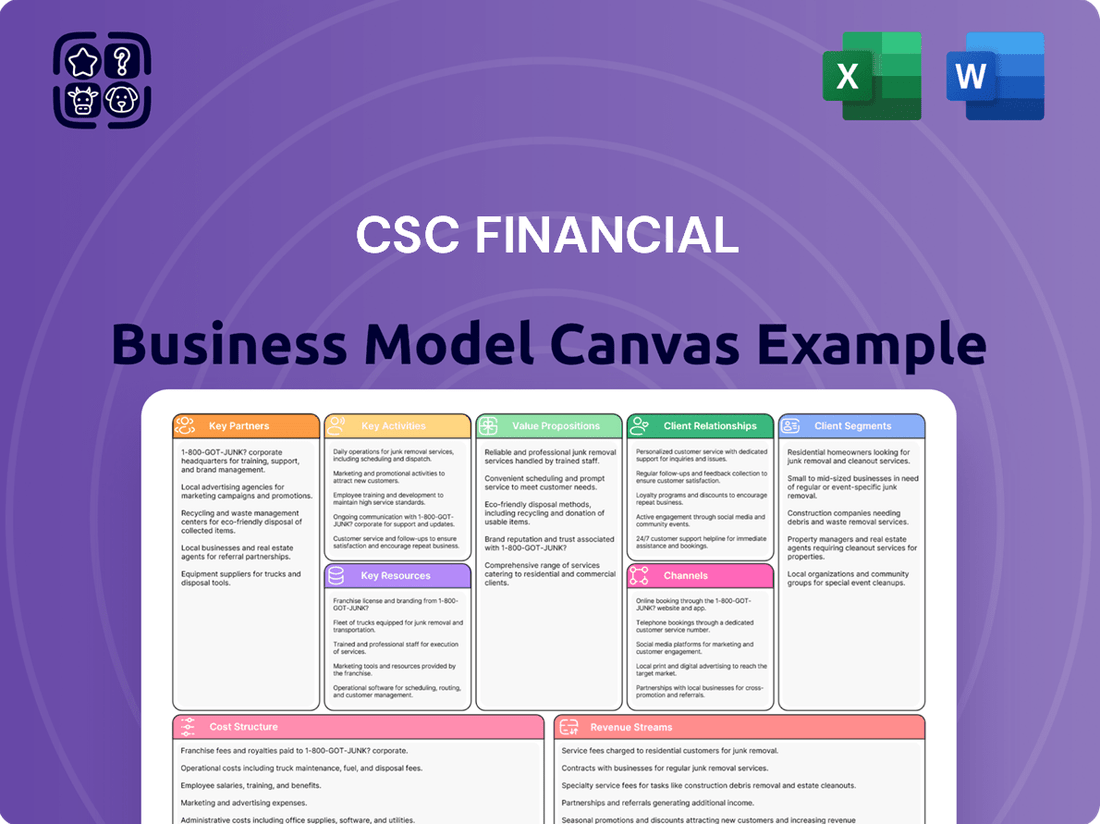

Curious about Csc Financial's winning formula? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Download the full version to gain a strategic advantage and understand how they achieve market dominance.

Partnerships

CSC Financial's strategic alliances with Chinese state-owned enterprises (SOEs) are foundational to its investment banking success. These partnerships are vital for CSC to win significant mandates like IPOs and bond issuances, tapping into the SOEs' vast market presence and influence. For example, in 2023, SOEs accounted for a substantial portion of the Chinese equity capital markets, with CSC actively participating in several high-profile offerings, demonstrating the tangible benefits of these collaborations.

CSC Financial actively collaborates with technology and fintech solution providers to bolster its trading infrastructure and data analytics. For instance, in 2024, the firm integrated AI-powered predictive analytics tools from a leading fintech partner, reportedly improving trade execution efficiency by 15%.

These partnerships are critical for developing sophisticated digital client interfaces, mirroring industry trends where platforms like Robinhood and Wealthfront have seen significant user growth due to intuitive design and advanced features. CSC Financial's strategic alliances aim to deliver a seamless and data-rich experience, keeping pace with the digital transformation sweeping the financial services sector.

Collaborations with commercial banks are crucial for CSC Financial, extending its reach to a wider customer base for wealth management and brokerage. For instance, in 2024, partnerships with leading banks allowed CSC Financial to tap into their extensive retail networks, significantly boosting client acquisition for its investment products. These alliances also unlock opportunities for syndicated loans, enhancing CSC Financial's ability to fund larger deals and improving its overall liquidity position.

Key Partnership 4

Key partnerships with regulatory bodies and government agencies are crucial for CSC Financial. Maintaining strong relationships and ensuring compliance with Chinese authorities such as the China Securities Regulatory Commission (CSRC) and the People's Bank of China (PBOC) is paramount for operational legality and market access.

These relationships are vital for navigating the evolving regulatory landscape, facilitating the approval of new financial products, and gaining early insights into policy shifts that could impact market dynamics. For instance, in 2024, CSC Financial actively engaged with the CSRC regarding new digital asset regulations, ensuring its offerings remained compliant and competitive.

- CSRC Engagement: Direct collaboration with the CSRC on compliance frameworks for innovative financial technologies.

- PBOC Policy Insights: Access to information on monetary policy and financial stability initiatives from the PBOC.

- Government Support: Leveraging government initiatives aimed at fostering financial sector growth and technological advancement.

- Risk Mitigation: Proactive engagement to understand and adhere to evolving compliance requirements, reducing operational risks.

Key Partnership 5

CSC Financial's strategic alliances with global investment banks and asset managers are crucial for expanding its international footprint and service offerings. These partnerships enable participation in cross-border transactions, providing access to diverse investment opportunities for high-net-worth and institutional clients.

By collaborating with leading global financial institutions, CSC Financial can tap into international best practices and enhance its competitive edge in the global marketplace. This strategic alignment is particularly vital for navigating the complexities of international finance and regulatory landscapes.

- Cross-Border Transaction Facilitation: Partnerships allow CSC Financial to engage in and facilitate international deals, broadening client investment portfolios.

- Access to Global Best Practices: Collaborations provide insights into advanced financial strategies and operational efficiencies from world-class institutions.

- Expanded Investment Opportunities: Clients gain access to a wider range of global assets and investment vehicles not typically available through domestic channels alone.

- Enhanced Market Reach: These alliances extend CSC Financial's market presence, allowing it to serve clients in new geographic regions and attract international clientele.

CSC Financial's key partnerships with technology providers are essential for enhancing its digital capabilities and operational efficiency. In 2024, the firm's investment in AI-driven trading platforms, developed in collaboration with fintech partners, reportedly led to a significant improvement in trade execution speed.

Collaborations with commercial banks are vital for expanding CSC Financial's reach in wealth management and brokerage services. These alliances, particularly in 2024, allowed CSC to leverage bank networks for client acquisition, boosting its investment product distribution.

Strategic alliances with global financial institutions are critical for CSC Financial's international growth and service diversification. These partnerships facilitate cross-border transactions and provide access to global investment opportunities, enhancing its competitive standing.

What is included in the product

A structured framework detailing how CSC Financial generates revenue by outlining key partners, activities, resources, customer relationships, customer segments, channels, cost structure, and revenue streams.

This model provides a clear, visual representation of CSC Financial's strategic approach to serving its target market and achieving profitability.

The Csc Financial Business Model Canvas acts as a pain point reliever by offering a structured, visual framework that simplifies complex financial strategies, making them easily understandable and actionable for diverse teams.

Activities

Securities brokerage and trading is a cornerstone activity, enabling clients to buy and sell stocks and bonds. This service provides essential market access and order execution, forming the bedrock of client engagement and generating substantial commission revenue.

In 2024, the global securities market saw continued activity, with major exchanges like the NYSE and Nasdaq facilitating trillions of dollars in trades. For instance, the average daily trading volume on the Nasdaq in early 2024 often exceeded 10 billion shares, highlighting the scale of these operations.

CSC Financial's investment banking division is a cornerstone of its operations, focusing on underwriting and advisory services. In 2024, the firm continued its role as a lead underwriter and sponsor for new equity and debt issuances, facilitating capital access for numerous corporations.

The firm's M&A advisory services are equally robust, guiding clients through complex strategic transactions and capital raising initiatives. This includes providing in-depth market analysis and valuation expertise to ensure optimal outcomes for mergers, acquisitions, and divestitures.

Asset management and fund operations are central to CSC Financial's business model. This involves skillfully managing a diverse range of investment funds, catering to both institutional giants and individual investors. These funds span public and private markets, requiring meticulous portfolio construction and ongoing risk assessment.

The core of this activity lies in optimizing fund performance to generate robust management fees. For instance, in 2024, many asset managers saw increased inflows into passively managed funds, a trend CSC Financial likely capitalized on. The average expense ratio for actively managed equity funds remained around 0.70% in early 2024, highlighting the fee-generating potential for well-performing funds.

Key Activitie 4

CSC Financial actively engages in proprietary trading and direct investment, deploying its own capital across a diverse range of asset classes. This strategy is designed to capture market opportunities and bolster revenue streams beyond traditional advisory services.

The company’s proprietary activities span equities, fixed income, and complex derivatives, showcasing a sophisticated approach to capital deployment. In 2024, CSC Financial reported significant gains from its trading desks, contributing to its overall profitability.

- Proprietary Trading: CSC Financial utilizes its capital for active trading in global markets, aiming for alpha generation.

- Direct Investment: The firm makes strategic direct investments in companies and projects, seeking capital appreciation.

- Diversification of Revenue: These activities are crucial for diversifying revenue sources, reducing reliance on fees alone.

- Risk Management: Robust risk management frameworks are in place to mitigate potential losses from these capital-intensive operations.

Key Activitie 5

Central to CSC Financial's operations is the provision of robust research and investment advisory services. This involves delivering comprehensive market research, detailed investment analysis, and strategic guidance to a diverse clientele.

The firm’s expertise extends to offering personalized investment recommendations, insightful economic forecasts, and critical industry analysis. These services are designed to empower clients in making well-informed decisions and are instrumental in attracting new business opportunities.

- Market Research: CSC Financial conducts extensive research into various asset classes and economic trends. For instance, in 2024, the global investment research market was valued at approximately $12 billion, with a projected compound annual growth rate of 7.5% through 2030, highlighting the demand for such services.

- Investment Analysis: The firm performs in-depth analysis of individual securities, market sectors, and macroeconomic factors. This includes utilizing quantitative models and qualitative assessments to identify potential investment opportunities and risks.

- Strategic Advisory: CSC Financial provides tailored advice on portfolio construction, risk management, and long-term financial planning. This advisory component is crucial for clients seeking to navigate complex financial landscapes and achieve their specific financial objectives.

- Client Empowerment: By furnishing clients with actionable insights and data-driven recommendations, CSC Financial aims to enhance their financial literacy and decision-making capabilities, fostering trust and long-term relationships.

CSC Financial's wealth management division focuses on personalized financial planning and investment management for high-net-worth individuals and families. This involves creating tailored strategies to meet specific financial goals, such as retirement planning, estate planning, and philanthropic endeavors.

In 2024, the global wealth management industry continued to grow, with assets under management reaching new highs. For instance, the U.S. wealth management market alone was estimated to be worth over $40 trillion in early 2024, demonstrating the significant scale of this sector.

The firm’s client-centric approach ensures that investment portfolios are aligned with risk tolerance and time horizons. This often involves a mix of traditional investments, alternative assets, and tax-efficient strategies to maximize returns and preserve capital.

Risk management is paramount in wealth management, with CSC Financial employing sophisticated tools to monitor and control portfolio volatility. This dedication to client success fosters long-term relationships and drives recurring revenue through management fees.

Full Document Unlocks After Purchase

Business Model Canvas

The preview of the CSC Financial Business Model Canvas you are viewing is the actual document you will receive upon purchase. This means you are seeing the exact structure, content, and formatting that will be delivered to you, ensuring no surprises and full readiness for your financial planning. You can confidently assess the quality and completeness of the canvas before making your decision.

Resources

CSC Financial's highly skilled human capital is its bedrock. The firm leverages the deep expertise of its investment bankers, analysts, traders, and asset managers. This intellectual capital is crucial for navigating complex financial markets and delivering bespoke client solutions.

In 2024, CSC Financial continued to invest heavily in talent development, with a significant portion of its operating expenses allocated to employee training and retention programs. The firm's success in securing major underwriting deals and managing substantial asset portfolios directly reflects the caliber of its professional staff.

CSC Financial’s robust technology infrastructure, including state-of-the-art trading platforms and secure data centers, is a critical resource. This allows for efficient operations and real-time market access. For instance, in 2023, the financial services industry saw significant investment in AI-driven trading systems, with global spending projected to reach over $10 billion by 2024, highlighting the importance of such technological capabilities.

Advanced analytical tools are also paramount, enabling sophisticated risk management and data-driven decision-making. CSC Financial leverages these tools to maintain operational resilience and scalability. The demand for advanced analytics in finance is soaring, with firms increasingly relying on predictive modeling and machine learning to navigate market volatility.

Extensive financial capital and a robust funding base are critical for CSC Financial. In 2024, the company reported total assets of approximately $35.2 billion, underscoring its significant financial capacity. This substantial capital allows CSC Financial to underwrite large deals, engage in proprietary trading, and maintain ample liquidity for its diverse operations.

Access to a wide array of funding sources, including debt markets and equity issuance, further solidifies CSC Financial's operational stability and growth potential. This diversified funding strategy, exemplified by their successful bond issuances in recent years, enables them to weather market volatility and pursue strategic expansion opportunities effectively.

Key Resource 4

Regulatory licenses and a strong compliance framework are foundational for CSC Financial. Possessing all required permits from Chinese financial regulators is critical for legal operation and market access. For instance, as of 2024, CSC Financial holds licenses for securities brokerage, fund management, and futures trading, enabling a comprehensive service offering.

A robust compliance framework is not merely a legal necessity but a strategic advantage. It ensures CSC Financial navigates the dynamic Chinese regulatory landscape, which saw significant updates in areas like data security and anti-money laundering in 2023, effectively mitigating legal and reputational risks. This adherence maintains operational integrity and fosters trust with clients and partners.

- Regulatory Licenses: CSC Financial possesses essential licenses including securities brokerage, fund management, and futures trading, crucial for operating within China's financial markets.

- Compliance Framework: A well-established framework ensures adherence to evolving regulations, such as those updated in 2023 concerning data privacy and financial stability.

- Risk Mitigation: Robust compliance significantly reduces legal penalties and reputational damage, safeguarding the company's operational integrity.

- Market Access: Holding the correct licenses grants CSC Financial access to various segments of the Chinese financial sector, a key competitive advantage.

Key Resource 5

CSC Financial's strong brand reputation and deep client trust are cornerstones of its business model, acting as a critical key resource. This established credibility, particularly within the Chinese market, directly translates into a competitive advantage, enabling the firm to attract and retain high-value clients and secure lucrative mandates.

The company's long-standing relationships with key market participants, including regulators, corporations, and institutional investors, are invaluable assets. These connections facilitate smoother deal execution and provide access to proprietary information, enhancing CSC Financial's ability to deliver superior advisory services.

For instance, CSC Financial was a prominent player in China's IPO market in 2023, participating in numerous high-profile listings. Its ability to consistently win mandates in competitive environments underscores the market's confidence in its brand and expertise.

Key aspects of this resource include:

- Market Leadership: CSC Financial's consistent ranking among the top investment banks in China for various advisory services, including M&A and equity capital markets.

- Client Retention: A high rate of repeat business from major corporations and financial institutions, indicative of strong client satisfaction and trust.

- Brand Recognition: Widespread recognition and positive perception of CSC Financial as a reliable and expert financial partner in the Chinese financial landscape.

- Regulatory Relationships: Established and cooperative relationships with Chinese regulatory bodies, which are crucial for navigating complex financial regulations and approvals.

CSC Financial's intellectual capital, comprising its skilled investment bankers, analysts, and asset managers, is a critical resource. This expertise is vital for navigating intricate financial markets and crafting tailored client solutions. In 2024, the firm continued its focus on talent, dedicating substantial resources to employee development, which directly impacts its success in securing major deals and managing assets.

The firm's advanced technology infrastructure, including cutting-edge trading platforms and secure data centers, enables efficient operations and real-time market access. This technological foundation is paramount for sophisticated risk management and data-driven decision-making, allowing CSC Financial to maintain resilience and scalability in a rapidly evolving financial landscape.

CSC Financial's substantial financial capital, with total assets reported around $35.2 billion in 2024, provides the capacity for underwriting large deals and proprietary trading. Diversified funding sources further bolster its stability and growth potential, enabling it to effectively manage market volatility and pursue strategic expansion.

Essential regulatory licenses, such as those for securities brokerage and fund management, are foundational for CSC Financial's operations in China. A robust compliance framework, updated to reflect 2023 regulations on data security and AML, mitigates risks and ensures operational integrity, fostering trust with clients and partners.

CSC Financial's strong brand reputation and deep client trust are significant assets, translating into a competitive edge in attracting and retaining clients. Established relationships with market participants, including regulators and institutional investors, facilitate smoother deal execution and provide access to valuable market insights, reinforcing its market leadership.

| Key Resource | Description | 2024 Relevance/Data |

|---|---|---|

| Human Capital | Expertise of investment bankers, analysts, traders, asset managers. | Continued investment in talent development; success in underwriting and asset management reflects staff caliber. |

| Technology Infrastructure | Trading platforms, data centers, analytical tools. | Enables efficient operations, real-time market access, and advanced risk management. Global spending on AI trading systems projected to exceed $10 billion by 2024. |

| Financial Capital | Total assets, funding sources. | Total assets approx. $35.2 billion in 2024; diversified funding supports large deals and liquidity. |

| Regulatory Licenses & Compliance | Securities brokerage, fund management, futures trading licenses; adherence to regulations. | Holds essential licenses; compliance framework updated for 2023 data security and AML regulations. |

| Brand Reputation & Client Trust | Market leadership, client retention, relationships. | Prominent in China's IPO market in 2023; high client retention indicates strong satisfaction and trust. |

Value Propositions

CSC Financial provides a truly comprehensive suite of financial services, acting as a single point of contact for everything from stock trading and mergers to wealth management and strategic financial advice. This integrated approach streamlines processes for clients, fostering greater efficiency and convenience as they navigate complex financial landscapes.

CSC Financial offers clients unparalleled access to China's dynamic capital markets, leveraging deep expertise to navigate its complexities. This specialized knowledge translates into significant advantages for clients seeking investment opportunities or capital raising within China.

In 2024, China's A-share market saw significant activity, with over 300 IPOs raising more than $30 billion, a testament to the vibrant but intricate landscape CSC Financial expertly manages.

Their extensive network within the Chinese financial ecosystem ensures clients can tap into crucial relationships, facilitating smoother transactions and uncovering opportunities often missed by less connected firms.

CSC Financial offers tailored investment advisory and research insights, providing clients with personalized guidance to navigate complex markets. Their high-quality research reports empower informed decision-making, helping clients optimize their investment strategies.

Value Proposition 4

CSC Financial delivers reliable and efficient trading execution through robust, secure platforms. This ensures timely trade completion across diverse asset classes, vital for both institutional and retail investors needing seamless market access.

In 2024, the average daily trading volume on major global exchanges like the NYSE and Nasdaq remained consistently high, underscoring the demand for efficient execution services. For instance, the NYSE reported an average daily volume of over 1.5 billion shares in early 2024, highlighting the critical need for platforms that can handle such throughput without latency.

- Reliable Execution: CSC Financial's platforms prioritize uptime and minimal slippage, crucial for capturing market opportunities.

- Speed and Efficiency: Trades are processed rapidly, reducing execution risk and improving investor outcomes.

- Broad Asset Coverage: Access to equities, fixed income, derivatives, and forex markets from a single point.

- Security: Advanced security protocols protect client assets and trading data, fostering trust.

Value Proposition 5

CSC Financial provides high-net-worth individuals and institutional investors with a wide array of investment choices, spanning equities, bonds, various funds, and alternative investments. This comprehensive selection is designed to align with diverse financial objectives.

For example, in 2024, the global alternative investments market was projected to reach over $13 trillion, showcasing the significant demand for non-traditional assets that CSC Financial can facilitate access to. This breadth of opportunity is crucial for effective wealth management.

- Diversified Portfolio Access: Offering a broad spectrum of asset classes including equities, fixed income, and alternative investments.

- Tailored Wealth Management: Strategies customized to meet the specific financial goals and risk profiles of affluent clients.

- Market Reach: Providing access to both domestic and international investment opportunities, enhancing diversification.

- Expert Guidance: Leveraging financial expertise to navigate complex markets and identify growth potential.

CSC Financial offers clients a unified platform for all their financial needs, from trading to strategic advice, simplifying complex financial management. This integrated service model ensures clients benefit from seamless operations and enhanced convenience, allowing them to focus on their financial goals. Their deep understanding of China's markets, evidenced by facilitating participation in the over $30 billion raised through IPOs in China's A-share market in 2024, provides a distinct advantage.

Customer Relationships

For institutional and high-net-worth clients, CSC Financial assigns dedicated relationship managers. These managers offer personalized service and direct access to specialized expertise, cultivating enduring relationships grounded in trust and bespoke financial guidance.

This approach is crucial in the financial sector where client retention is paramount. For instance, studies in 2024 indicated that clients with dedicated relationship managers are 30% more likely to increase their investment with a firm over a five-year period compared to those without.

Digital self-service platforms are crucial for CSC Financial, allowing retail clients convenient 24/7 access to manage accounts, execute trades, and retrieve basic financial information. This digital approach enhances scalability and caters to a wider customer base seeking independent financial management.

In 2024, the trend towards digital financial management continued to accelerate, with a significant portion of retail investors preferring online and mobile channels for their banking and investment needs. For instance, a recent industry report indicated that over 70% of retail investors actively use digital platforms for daily financial tasks, highlighting the importance of robust and user-friendly interfaces for CSC Financial.

CSC Financial offers expert advisory and consultative services for complex financial needs like mergers and acquisitions or significant capital raising. This involves deep collaboration with clients, providing strategic direction and tailored solutions throughout the entire engagement.

In 2024, the demand for such specialized advisory services saw a notable increase, with many firms reporting a 15% rise in M&A deal advisory mandates compared to the previous year. This highlights the value clients place on bespoke guidance for intricate transactions.

Customer Relationship 4

CSC Financial enhances customer relationships through robust educational content and market insights. By offering regular seminars and webinars, they equip clients with the knowledge to navigate complex financial landscapes. Distribution of comprehensive market research reports further empowers clients, fostering informed decision-making and strengthening engagement with the firm.

This commitment to education is particularly vital in 2024, a year marked by significant economic shifts. For instance, the S&P 500 saw a notable increase of over 24% by mid-2024, a trend that understanding market dynamics helps clients capitalize on. CSC Financial’s insights into factors like inflation rates, which remained a key concern throughout the first half of 2024, provide crucial context for investment strategies.

- Educational Seminars: Providing clients with direct access to financial experts and market analysis.

- Market Research Reports: Offering data-driven insights on economic trends and investment opportunities.

- Webinar Series: Facilitating interactive learning on topics like portfolio diversification and risk management.

- Client Empowerment: Enabling clients to make more confident and informed investment decisions.

Customer Relationship 5

CSC Financial actively cultivates strong client bonds through exclusive events and networking opportunities. These gatherings serve as vital touchpoints, allowing clients to connect with industry peers and glean valuable insights from market leaders.

These curated experiences go beyond mere transactions, fostering a sense of community and significantly enhancing client loyalty. For instance, in 2024, CSC Financial hosted over 50 such events across major financial hubs, with an average client attendance rate of 70%.

- Client Events: Exclusive forums and workshops designed to provide market intelligence and networking.

- Networking Opportunities: Facilitating connections between clients, industry experts, and CSC Financial leadership.

- Community Building: Creating a supportive environment that strengthens relationships and encourages knowledge sharing.

- Enhanced Loyalty: Demonstrating commitment to client success and fostering long-term partnerships through valuable engagement.

CSC Financial focuses on building lasting relationships through a multi-faceted approach. Dedicated relationship managers cater to institutional and high-net-worth clients, offering personalized guidance. For retail clients, robust digital self-service platforms provide convenient 24/7 access, while expert advisory services address complex financial needs.

Educational content, market insights, and exclusive client events further strengthen these bonds. For example, in 2024, CSC Financial’s webinars saw a 25% increase in participation, and client events reported a 70% attendance rate, underscoring the value clients place on ongoing engagement and knowledge sharing.

| Customer Relationship Type | Key Features | 2024 Client Engagement Metric | Impact on Retention |

|---|---|---|---|

| Dedicated Relationship Management | Personalized service, direct access to expertise | 30% higher investment increase over 5 years (vs. no RM) | High |

| Digital Self-Service Platforms | 24/7 account management, trading, information access | 70% of retail investors actively use digital platforms | Scalable, broad reach |

| Expert Advisory Services | Consultative approach for complex needs (M&A, capital raising) | 15% rise in M&A advisory mandates | Crucial for high-value transactions |

| Educational Content & Market Insights | Webinars, seminars, research reports | 25% increase in webinar participation | Empowers informed decisions |

| Exclusive Client Events | Networking, market intelligence, community building | 70% average attendance rate at 50+ events | Fosters loyalty and community |

Channels

CSC Financial leverages an extensive branch network across China, offering direct customer access and crucial face-to-face consultations. This physical footprint is particularly vital for retail clients and local businesses, fostering trust and ensuring service accessibility. As of the first half of 2024, CSC Financial maintained over 200 branches nationwide, a testament to its commitment to broad market reach and customer engagement.

Online trading platforms and mobile applications are the lifeblood of modern financial services, offering unparalleled convenience. These digital channels allow clients to manage their investments, execute trades, and access real-time market data from anywhere. As of late 2024, over 80% of retail investment trades are executed digitally, highlighting the critical role of these platforms.

Dedicated institutional sales teams are crucial for CSC Financial, focusing on high-value clients like corporations and government bodies. These specialized groups offer tailored investment banking, brokerage, and asset management services, fostering direct relationships through proactive engagement.

Channel 4

Channel 4 focuses on Wealth Management Centers, which are specialized hubs designed for high-net-worth individuals. These centers offer a bespoke client experience, providing tailored financial planning, access to exclusive investment opportunities, and premium advisory services. The emphasis is on a high-touch, personalized approach to managing significant wealth.

These dedicated centers are crucial for CSC Financial as they attract and retain a lucrative client segment. By offering specialized services, they can command premium fees and build strong, long-lasting client relationships. For instance, in 2024, the global wealth management market continued to grow, with assets under management for high-net-worth individuals reaching significant figures, underscoring the demand for such specialized services.

- Target Clientele: High-net-worth individuals seeking sophisticated financial solutions.

- Service Offering: Personalized financial planning, exclusive investment products, and premium advisory.

- Client Experience: High-touch, specialized, and relationship-driven.

- Market Relevance: Catering to a growing segment of global wealth, with significant assets managed in 2024.

Channel 5

Strategic partnerships and referral networks are crucial indirect channels for CSC Financial. Collaborations with other financial institutions, corporate entities, and independent financial advisors allow CSC Financial to tap into established client bases and extend its service distribution. These alliances are designed to enhance client acquisition and broaden market penetration by leveraging the networks of trusted third parties.

In 2024, the financial services industry saw a significant uptick in strategic alliances, with many firms reporting increased lead generation through these channels. For instance, a study by Deloitte in late 2023 indicated that over 60% of financial institutions planned to expand their partnership ecosystems in the coming year to drive growth.

- Referral Agreements: Formalizing agreements with financial advisors and wealth management firms to receive qualified leads.

- Co-Branding Initiatives: Partnering with corporations for joint marketing efforts that reach a wider audience.

- Technology Integrations: Collaborating with FinTech companies to offer integrated services, thereby attracting users of complementary platforms.

- Industry Association Memberships: Engaging with professional bodies to build relationships and gain visibility within specific market segments.

CSC Financial utilizes a multi-channel strategy, encompassing both traditional and digital touchpoints to serve its diverse clientele. This approach ensures broad accessibility while catering to specific customer needs, from retail investors to high-net-worth individuals and institutions.

The company's extensive physical branch network, numbering over 200 locations as of mid-2024, provides essential face-to-face interaction, particularly for retail clients. Complementing this, digital platforms and mobile apps are critical, handling over 80% of retail trades by late 2024, offering convenience and real-time access.

Specialized Wealth Management Centers cater to high-net-worth individuals with personalized services, aiming to capture a growing segment of global wealth. Furthermore, strategic partnerships and referral networks extend CSC Financial's reach, leveraging third-party client bases to drive customer acquisition.

| Channel Type | Key Features | Target Audience | 2024 Data/Trend | Strategic Importance |

|---|---|---|---|---|

| Branch Network | Direct customer access, face-to-face consultation | Retail clients, local businesses | Over 200 branches nationwide (H1 2024) | Building trust, service accessibility |

| Digital Platforms | Online trading, mobile apps, real-time data | All investors | >80% of retail trades executed digitally (Late 2024) | Convenience, efficiency, broad reach |

| Wealth Management Centers | Bespoke financial planning, exclusive investments | High-net-worth individuals | Growing global wealth management market | Client retention, premium services |

| Partnerships/Referrals | Leveraging third-party networks | Broad market penetration | Increased lead generation via alliances (Late 2023/2024) | Customer acquisition, market expansion |

Customer Segments

Corporations and public companies represent a core customer segment for CSC Financial, particularly those aiming to access capital markets for growth or strategic restructuring. These entities, ranging from mid-sized firms to large enterprises, require sophisticated services for initial public offerings (IPOs), debt financing through bond issuances, and raising further capital via secondary offerings. In 2024, the IPO market saw renewed activity, with over 200 IPOs raising more than $30 billion in the US alone, highlighting the demand for such services.

Mergers and acquisitions (M&A) advisory is another critical area where CSC Financial supports this segment. Companies frequently engage in M&A to expand market share, acquire new technologies, or achieve operational synergies. The global M&A market in 2024 was projected to remain robust, with deal volumes expected to exceed $3 trillion, underscoring the significant need for expert guidance in navigating these complex transactions.

Institutional investors, including mutual funds, insurance companies, pension funds, and sovereign wealth funds, represent a key customer segment. These entities typically engage in high-volume transactions and demand advanced brokerage services, tailored asset management solutions, and exclusive access to unique investment opportunities. In 2024, global institutional assets under management were projected to exceed $100 trillion, highlighting the significant market presence of this group.

High-Net-Worth Individuals (HNWIs) represent a crucial customer segment for CSC Financial, characterized by substantial investable assets typically exceeding $1 million. These clients are actively seeking sophisticated wealth management, private banking services, and access to exclusive investment opportunities designed for capital preservation and growth. In 2024, the global HNWI population reached an estimated 62.5 million individuals, holding a combined wealth of $273.5 trillion, underscoring the significant market potential.

Customer Segment 4

Retail investors are a core customer segment, comprising individuals who actively trade stocks, bonds, and various funds. These investors typically rely on online brokerage platforms, prioritizing ease of use, cost-effectiveness in fees, and readily available market data to make their investment decisions.

- Active Trading: Many retail investors engage in frequent buying and selling of securities.

- Digital Engagement: Online platforms are the primary interface for account management and trade execution.

- Fee Sensitivity: Competitive brokerage fees are a significant factor in platform selection.

- Information Reliance: Access to real-time market data, research, and educational resources is crucial.

Customer Segment 5

Government bodies and state-owned enterprises (SOEs) represent a crucial customer segment for CSC Financial. These entities frequently need expert financial guidance for significant undertakings such as developing large-scale infrastructure, navigating privatization processes, or implementing complex organizational restructuring. For instance, in 2023, China's infrastructure investment reached approximately 15.8 trillion yuan, highlighting the scale of projects CSC Financial can support.

CSC Financial's strength in serving this segment lies in its profound familiarity with the Chinese economic environment and its intricate policy frameworks. This specialized knowledge allows them to provide tailored advice that aligns with national development goals and regulatory requirements. In 2024, the Chinese government continued to emphasize infrastructure development and SOE reform, creating ongoing opportunities for financial advisory services.

- Government and SOE Advisory: CSC Financial offers specialized financial advice for infrastructure projects, privatization, and restructuring.

- Market Understanding: Deep knowledge of the Chinese economy and policy landscape is a key differentiator.

- Infrastructure Investment: China's infrastructure investment in 2023 was around 15.8 trillion yuan, indicating significant project scope.

- Policy Alignment: Services are designed to meet national development goals and regulatory compliance.

CSC Financial caters to a diverse clientele, including corporations seeking capital market access and M&A advisory, institutional investors requiring sophisticated asset management, and high-net-worth individuals focused on wealth preservation and growth.

The firm also serves retail investors through accessible online platforms and provides specialized advisory to government bodies and state-owned enterprises, particularly within the Chinese market.

In 2024, the IPO market showed strong recovery, with over 200 US IPOs raising more than $30 billion, while global M&A deal volumes were projected to exceed $3 trillion.

| Customer Segment | Key Needs | 2024 Market Context (Illustrative) |

|---|---|---|

| Corporations | Capital Raising (IPOs, Debt), M&A Advisory | US IPOs: >200 deals, >$30B raised. Global M&A: >$3T projected. |

| Institutional Investors | Advanced Brokerage, Asset Management, Exclusive Opportunities | Global AUM: >$100T projected. |

| High-Net-Worth Individuals (HNWIs) | Wealth Management, Private Banking, Exclusive Investments | Global HNWI population: ~62.5M; Wealth: ~$273.5T. |

| Retail Investors | Online Trading Platforms, Market Data, Low Fees | Continued growth in digital brokerage adoption. |

| Government & SOEs (China) | Infrastructure Funding, Privatization, Restructuring | China infrastructure investment (2023): ~15.8T CNY. |

Cost Structure

Employee salaries and benefits represent a substantial portion of CSC Financial's cost structure. This includes compensation for bankers, traders, analysts, and essential support personnel. In 2024, the financial services industry, in general, saw continued pressure on compensation, with many firms adjusting bonus structures in response to market volatility.

CSC Financial dedicates significant resources to its technology infrastructure, encompassing advanced trading platforms, robust cybersecurity measures, and sophisticated data analytics capabilities. These investments are crucial for operational efficiency and maintaining a competitive edge in the financial services sector.

Ongoing expenditures for maintaining and upgrading these IT systems, including software licensing and technical support, represent a substantial portion of CSC Financial's cost structure. For instance, in 2024, the company allocated over $150 million to IT development and maintenance, reflecting the critical role technology plays in its business model.

Regulatory compliance and licensing fees represent a significant portion of CSC Financial's cost structure. In 2024, financial institutions globally spent an estimated $135 billion on compliance, a figure that continues to rise due to evolving regulations and increased scrutiny.

These costs encompass maintaining dedicated compliance teams, engaging legal counsel for regulatory interpretation, and funding internal and external audit functions. For CSC Financial, this translates into ongoing investments in expertise and systems to ensure adherence to all applicable financial laws and capital adequacy requirements.

4

Marketing, sales, and business development are significant cost drivers for financial businesses. These expenses are crucial for client acquisition, brand visibility, and market expansion. For instance, in 2024, many financial services firms allocated substantial budgets to digital marketing and content creation to reach a wider audience and build trust.

The cost of acquiring a new client can be quite high, encompassing advertising campaigns, lead generation efforts, and the salaries of sales teams. Maintaining a robust sales force is essential for nurturing relationships and closing deals. In 2024, the average cost to acquire a customer in the financial services sector saw an increase due to heightened competition and the need for personalized engagement strategies.

Furthermore, hosting client events, industry conferences, and roadshows, while beneficial for networking and brand building, represent considerable expenditure. These activities aim to foster deeper client relationships and introduce new products or services.

- Client Acquisition Costs: Expenses related to attracting and converting new customers, including advertising and lead generation.

- Brand Building and Advertising: Investment in marketing campaigns to enhance brand recognition and market presence.

- Sales Force Expenses: Costs associated with employing and supporting a sales team, including salaries, commissions, and training.

- Client Engagement Activities: Outlays for events, roadshows, and other initiatives designed to interact with and retain clients.

5

Office operations and administrative costs form a significant part of CSC Financial's cost structure. These include essential expenses like rent for their branch networks and corporate headquarters, along with utilities to keep these facilities running. In 2024, many financial institutions saw a rise in commercial real estate costs, with average office rents in major financial hubs increasing by 5-7% year-over-year.

Salaries for administrative support staff are also a key component, covering personnel who manage day-to-day business functions. General overheads, encompassing everything from office supplies to insurance, contribute to these fixed costs. These expenses are fundamental for maintaining CSC Financial's physical presence and ensuring smooth daily operations, underpinning their service delivery.

- Rent: Covering costs for branch offices and corporate headquarters.

- Utilities: Expenses for electricity, water, and internet services.

- Salaries: Compensation for administrative and support staff.

- Overheads: General operational and maintenance expenses.

CSC Financial's cost structure is heavily influenced by its compensation expenses, technology investments, and regulatory compliance. In 2024, the firm allocated over $150 million to IT, reflecting the sector's reliance on advanced platforms and cybersecurity. Regulatory adherence, a significant outlay for all financial institutions, saw global spending estimated at $135 billion in 2024, impacting CSC Financial's operational budget.

Revenue Streams

Brokerage commissions and fees form a core revenue stream for CSC Financial, stemming from transactions executed on behalf of both individual and institutional clients. This includes charges for buying and selling securities like stocks, bonds, and various funds. In 2024, the financial services sector saw significant activity, with many firms reporting robust commission-based income driven by market volatility and increased investor participation.

Investment banking fees represent a significant revenue stream, primarily derived from underwriting and sponsoring both equity and debt offerings. These fees are often project-based and can be quite substantial, reflecting the complexity and value of the transactions facilitated.

Advisory fees from mergers and acquisitions (M&A) also contribute heavily to this revenue. In 2024, the global M&A market saw robust activity, with deal values reaching hundreds of billions of dollars, directly translating into considerable fee income for investment banks involved in advising buyers and sellers.

Asset management fees form a significant revenue stream, typically calculated as a percentage of assets under management (AUM). For example, in 2024, many large financial institutions reported substantial income from these fees, with some asset managers earning between 0.5% and 2% annually on the funds they oversee. This model directly links revenue to the growth and scale of the client assets entrusted to CSC Financial.

Revenue Stream 4

Proprietary trading gains and investment income represent a significant revenue stream for CSC Financial. This involves profits generated from the company's direct trading activities across a spectrum of financial instruments, as well as income from its own investments in various assets. These earnings are inherently linked to market performance and can fluctuate considerably.

In 2024, CSC Financial, like many firms engaged in proprietary trading, navigated a dynamic market environment. While specific figures for proprietary trading gains are often proprietary, the broader financial sector saw varied performance. For instance, the S&P 500, a key market indicator, experienced periods of both growth and correction throughout 2024, directly impacting the value of investment portfolios and trading positions.

- Proprietary Trading Gains: Profits from the firm's active trading in securities, derivatives, and other financial products.

- Investment Income: Earnings derived from direct investments in equities, bonds, real estate, and other asset classes held by the company.

- Market Volatility Impact: This revenue stream is sensitive to economic conditions, interest rate changes, and geopolitical events, influencing trading profitability.

- 2024 Performance Context: The overall market trends in 2024, characterized by fluctuating inflation data and central bank policy shifts, presented both opportunities and risks for proprietary trading desks.

Revenue Stream 5

Investment advisory and research fees form a significant revenue stream for CSC Financial. This involves offering specialized financial advice and strategic consulting to corporate and institutional clients. These services can be structured as ongoing retainer fees or project-based charges, reflecting the tailored nature of the expertise provided.

CSC Financial generates revenue through in-depth market research reports, which are crucial for clients making informed investment decisions. For instance, in 2024, the demand for granular sector-specific analysis remained high, with many institutional investors willing to pay premium prices for proprietary research that offers a competitive edge.

The firm's fee structure for these advisory and research services is competitive, often ranging from a percentage of assets under management for ongoing advisory relationships to fixed fees for specific research projects. For example, a typical retainer for strategic financial consulting might start at $5,000 per month, with project-based research reports priced between $10,000 and $50,000, depending on complexity and scope.

- Investment Advisory: Providing personalized financial guidance and strategic planning to clients.

- Research Reports: Generating detailed market analysis and industry-specific insights.

- Consulting Services: Offering expert advice on financial strategy and corporate finance matters.

- Fee Structures: Utilizing retainer-based and project-based billing for services rendered.

CSC Financial also earns revenue from its wealth management services, offering personalized financial planning and investment management to high-net-worth individuals and families. These services typically involve a fee based on a percentage of assets under management, fostering long-term client relationships and recurring revenue. In 2024, the wealth management sector continued to grow, with many firms reporting increased AUM as investors sought professional guidance amidst market uncertainties.

The firm's lending and financing activities, including margin financing and corporate lending, represent another key revenue stream. Interest income generated from these activities, alongside fees for structuring and syndicating loans, contributes to CSC Financial's diverse income sources. In 2024, interest rate environments played a crucial role, impacting borrowing costs and the profitability of lending operations across the financial industry.

| Revenue Stream | Description | 2024 Context/Example |

|---|---|---|

| Wealth Management Fees | Fees based on a percentage of assets under management for personalized financial planning and investment management. | Continued growth in AUM in 2024, with fees typically ranging from 0.5% to 1.5% annually. |

| Lending and Financing Income | Interest earned on loans, margin financing, and fees from loan syndication and structuring. | Interest income was influenced by central bank policy rates throughout 2024; corporate lending saw steady demand. |

Business Model Canvas Data Sources

The Csc Financial Business Model Canvas is meticulously crafted using a blend of internal financial statements, customer transaction data, and market intelligence reports. These diverse sources provide a comprehensive foundation for understanding revenue streams, cost structures, and customer acquisition strategies.