Crown Castle International PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Crown Castle International Bundle

Unlock critical insights into Crown Castle International's operational environment with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, technological advancements, environmental regulations, and social trends are shaping the telecom infrastructure giant's future. Equip yourself with actionable intelligence to navigate market complexities and identify strategic opportunities.

Don't get left behind – gain a competitive advantage by understanding the macro-environmental forces impacting Crown Castle International. Our expertly crafted PESTLE analysis provides a clear roadmap of the external factors influencing their success. Purchase the full version now for immediate access to this vital strategic resource.

Political factors

Federal and state government initiatives are a significant driver for Crown Castle's business, particularly those focused on expanding broadband access and accelerating 5G deployment. Programs like the Broadband Equity, Access, and Deployment (BEAD) program, which allocated $42.45 billion in funding, directly stimulate demand for the tower and fiber infrastructure that Crown Castle provides. This government investment creates a more stable and predictable demand environment, fostering new opportunities for network buildouts across the country.

The regulatory environment, particularly Federal Communications Commission (FCC) policies, significantly shapes wireless infrastructure development. FCC actions on spectrum allocation and tower siting directly impact the availability and placement of sites for Crown Castle's customers. For instance, the FCC's ongoing efforts to streamline permitting for small cells, as seen in recent initiatives aiming to reduce local government review times, could accelerate network expansion for carriers, benefiting Crown Castle's business model.

International trade policies, including tariffs and geopolitical tensions, can directly affect the supply chain for telecommunications equipment, influencing the cost and availability of components crucial for network upgrades. For instance, ongoing trade disputes between major economic powers in 2024 could lead to increased import duties on essential network hardware, impacting the capital expenditures of wireless carriers. This, in turn, might indirectly dampen demand for Crown Castle's tower leasing and fiber solutions as carriers adjust their expansion plans due to higher equipment costs.

Local Zoning and Permitting

Local zoning and permitting are critical political factors influencing Crown Castle's operations. Municipalities across the US have diverse regulations regarding cell tower and small cell deployment, creating a complex and often lengthy approval process. For instance, in 2023, the average time for obtaining permits for new cell sites could extend for several months, impacting deployment timelines and capital expenditure efficiency.

These varying regulations present both challenges and opportunities. While some cities offer streamlined processes, others impose significant hurdles, including aesthetic requirements, distance restrictions, and community input mandates. Crown Castle actively engages with local governments to advocate for more predictable and efficient permitting, recognizing that standardized approvals can significantly accelerate network densification, a key component of their business model.

- Varying Municipal Regulations: Differences in local zoning laws and permitting requirements across thousands of municipalities create operational complexities for Crown Castle's nationwide network expansion.

- Impact on Deployment Speed: Lengthy or restrictive permitting processes can delay the deployment of new cell sites and small cells, directly affecting revenue generation and network build-out targets.

- Advocacy for Standardization: Crown Castle, along with industry groups, lobbies for more uniform and expedited local approval processes to facilitate faster network densification and improve capital efficiency.

Political Stability and Investment Climate

The United States' political stability is a cornerstone for long-term investment in critical infrastructure like Crown Castle's cell towers and fiber networks. A predictable regulatory landscape, characterized by consistent government policies, directly encourages substantial capital expenditure from mobile carriers and internet service providers, who are Crown Castle's primary customers. For instance, the FCC's ongoing efforts to streamline permitting processes for small cell deployments, as seen in recent initiatives throughout 2024, directly benefit infrastructure providers by reducing deployment times and costs.

Changes in administration or legislative priorities can present both risks and opportunities for the telecom sector. For example, shifts in broadband deployment funding priorities or tax policies could impact the pace of network buildouts. The Infrastructure Investment and Jobs Act, passed in late 2021 and continuing to influence spending in 2024-2025, has allocated significant funds towards expanding broadband access, creating a favorable environment for companies like Crown Castle that support this expansion.

- Stable Political Environment: A consistent U.S. political climate reduces uncertainty, making it more attractive for Crown Castle and its clients to commit to long-term infrastructure investments.

- Regulatory Predictability: Clear and stable regulations, such as those governing tower siting and spectrum allocation, foster confidence and facilitate capital deployment by telecommunications companies.

- Government Initiatives: Federal and state programs aimed at expanding broadband access, like the BEAD program (Broadband Equity, Access, and Deployment), directly stimulate demand for Crown Castle's services.

- Policy Shifts: Potential changes in tax laws, net neutrality regulations, or infrastructure spending priorities could alter the investment landscape for the telecom industry.

Government support for broadband expansion, like the BEAD program's $42.45 billion in funding, directly fuels demand for Crown Castle's infrastructure. Regulatory actions from the FCC, such as streamlining small cell permitting, accelerate network buildouts for carriers. However, varying local zoning laws and permitting processes across municipalities create deployment complexities and delays, impacting efficiency.

| Political Factor | Impact on Crown Castle | 2024/2025 Data/Trend |

|---|---|---|

| Government Broadband Initiatives | Stimulates demand for towers and fiber. | BEAD program funding ($42.45B) continues to drive infrastructure investment. |

| Regulatory Environment (FCC) | Affects spectrum allocation and site placement. | Ongoing FCC efforts to simplify small cell siting expected to boost deployment. |

| Local Zoning & Permitting | Creates operational complexity and deployment delays. | Permitting times can still range from months to over a year depending on the municipality. |

| Political Stability & Policy Shifts | Influences long-term investment and carrier CapEx. | Infrastructure Investment and Jobs Act (2021) continues to shape broadband spending through 2025. |

What is included in the product

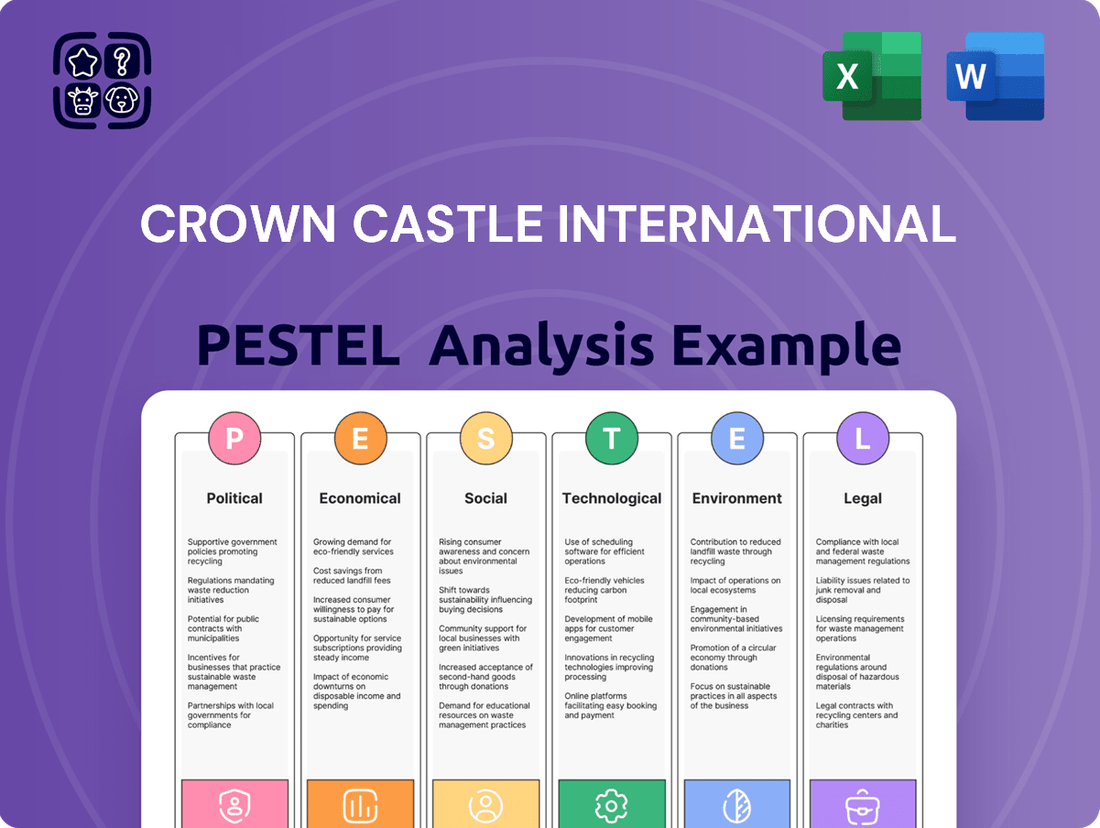

This PESTLE analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal forces influencing Crown Castle International's operations and strategic positioning.

It provides a comprehensive understanding of the external landscape, highlighting key trends and potential impacts for informed decision-making.

A concise PESTLE analysis for Crown Castle International provides actionable insights, relieving the pain point of navigating complex external factors by offering a clear roadmap for strategic decision-making.

Economic factors

The interest rate environment significantly impacts Crown Castle, a real estate investment trust (REIT) with a capital-intensive business model. Rising interest rates increase the cost of debt financing for new infrastructure projects and refinancing existing debt, potentially squeezing profitability and hindering growth initiatives.

For instance, if the Federal Reserve maintains its target for the federal funds rate around the 5.25%-5.50% range seen in late 2023 and into 2024, Crown Castle's borrowing costs will remain elevated. This directly affects the company's ability to fund its extensive network build-outs and acquisitions at favorable terms.

The insatiable appetite for data and seamless connectivity is a powerful economic engine driving Crown Castle's growth. As smartphone penetration continues its upward trajectory, reaching an estimated 87% of the U.S. population by the end of 2024, the demand for wireless data explodes. This isn't just about calls and texts anymore; it's about the constant streaming of high-definition video, the reliance on cloud-based services for both personal and business operations, and the increasing adoption of IoT devices.

This escalating data consumption directly translates into a need for more robust network infrastructure. Crown Castle is perfectly positioned to capitalize on this trend, as carriers require more cell towers and small cells to handle the increased traffic and ensure reliable coverage. The expansion of fiber networks is also critical for supporting these wireless deployments, further solidifying Crown Castle's role as a key infrastructure provider in this data-driven economy.

Inflation directly impacts Crown Castle's operational costs, including rising expenses for labor, utilities, and essential maintenance for its extensive fiber and tower infrastructure. For instance, the U.S. Consumer Price Index (CPI) saw significant increases throughout 2023 and into early 2024, directly affecting these input costs.

The company's ability to manage its margins hinges on its lease agreements, many of which have built-in escalators, and its capacity to pass on increased operating expenses to its customers. This contractual structure provides some buffer against inflationary pressures on profitability for its long-term contracts, but sustained high inflation could still erode margins if cost increases outpace contractual adjustments.

Economic Growth and Capital Expenditure by Tenants

The overall health of the U.S. economy significantly impacts the capital expenditure plans of Crown Castle's key tenants, primarily mobile carriers and internet service providers. When the economy is robust, these companies are more inclined to invest in network upgrades and expansion to meet growing consumer and business demand.

Strong economic growth directly translates into increased demand for Crown Castle's shared infrastructure, such as small cells and fiber networks. For instance, in 2023, major U.S. carriers continued substantial network investments, with AT&T reporting capital expenditures of approximately $24.5 billion and Verizon around $19.3 billion, much of which supports 5G buildouts and fiber expansion.

- Tenant Investment Cycles: The investment cycles of mobile carriers and ISPs are a direct driver of Crown Castle's revenue. Increased spending by these tenants on 5G deployment, network densification, and broadband expansion fuels demand for tower leases, small cell deployments, and fiber solutions.

- Economic Indicators and CapEx: Positive economic indicators, such as GDP growth and low unemployment, often correlate with higher tenant capital expenditures. This suggests a direct link between broader economic performance and the need for enhanced communication infrastructure.

- 5G Rollout Pace: The ongoing 5G rollout is a major catalyst for tenant capital expenditure. As carriers accelerate their 5G network buildouts, they require more distributed antenna systems (DAS) and small cell sites, which are core offerings for Crown Castle.

- Fiber Expansion Demand: Beyond wireless, the demand for high-speed internet is driving significant fiber optic network expansion. Tenants are investing heavily in fiber to support fixed wireless access and backhaul for their wireless networks, creating opportunities for Crown Castle's fiber services.

Competition within Telecom Infrastructure

Competition in the telecom infrastructure sector is robust, with Crown Castle operating alongside other major tower companies like American Tower and SBA Communications. The market also sees competition from fiber providers and emerging small cell and distributed antenna system (DAS) providers, intensifying pressure on pricing and contract terms. This dynamic environment necessitates strategic differentiation for Crown Castle to maintain its market share and profitability.

The competitive intensity directly impacts Crown Castle's ability to command favorable lease rates and contract durations. For instance, the ongoing build-out of 5G networks fuels demand for tower space, but also attracts new entrants and encourages existing competitors to expand their footprints. Crown Castle's strategy often involves securing long-term contracts and focusing on high-demand urban and suburban markets to mitigate these pressures.

- Market Share Dynamics: While Crown Castle is a leading player in the US, its market share can be influenced by the aggressive expansion strategies of competitors, particularly in areas with high projected 5G data consumption.

- Pricing Power: Increased competition can lead to downward pressure on recurring revenue per site, forcing Crown Castle to offer more competitive pricing to secure and retain tenants.

- Emerging Alternatives: The rise of private wireless networks and alternative infrastructure solutions presents a long-term competitive threat, potentially reducing reliance on traditional tower infrastructure in certain enterprise applications.

The demand for wireless data, driven by increasing smartphone penetration and data-intensive applications, is a primary economic driver for Crown Castle. This trend necessitates more cell towers and small cells, directly benefiting Crown Castle's infrastructure business. For example, U.S. mobile data traffic is projected to grow significantly, with annual growth rates expected to remain in the double digits through 2025, underscoring the sustained need for network capacity.

Interest rates remain a critical economic factor. Elevated interest rates, such as the Federal Reserve's target range of 5.25%-5.50% in early 2024, increase Crown Castle's cost of capital for new infrastructure development and debt refinancing. This can impact profitability and the feasibility of expansion projects.

Inflationary pressures continue to affect operational costs for Crown Castle, including labor, utilities, and maintenance. While lease escalators provide some protection, sustained high inflation could still strain margins if cost increases outpace contractual adjustments. The U.S. CPI has shown persistent elevated levels, impacting these input costs throughout 2023 and into 2024.

| Economic Factor | Impact on Crown Castle | Relevant Data/Trend (2024-2025) |

|---|---|---|

| Data Demand | Drives need for towers/small cells | U.S. mobile data traffic projected double-digit annual growth through 2025. |

| Interest Rates | Increases cost of capital | Federal Funds Rate target range of 5.25%-5.50% (early 2024). |

| Inflation | Raises operational costs | Persistent elevated CPI levels impacting labor, utilities, maintenance. |

Preview Before You Purchase

Crown Castle International PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Crown Castle International delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction.

Sociological factors

Ongoing urbanization and rising population density are critical drivers for Crown Castle's business, directly fueling the demand for network densification. As more people move into cities, the need for robust and high-capacity wireless networks intensifies, making small cells and fiber optic infrastructure essential. This trend creates concentrated demand centers for connectivity, which Crown Castle is strategically positioned to serve.

In 2024, it's estimated that over 60% of the world's population lives in urban areas, a figure projected to climb. This demographic shift means that population concentrations are becoming more pronounced, directly influencing where Crown Castle invests in new infrastructure. These dense urban environments represent key markets where the demand for seamless, high-speed data transmission is paramount, aligning perfectly with Crown Castle's service offerings.

The widespread adoption of remote work and digital lifestyles, accelerated by events in recent years, has fundamentally reshaped societal behavior. This shift directly translates to a heightened demand for consistent, high-speed internet connectivity, as more individuals rely on it for their professional lives, education, and leisure activities.

Online education platforms and digital entertainment services have seen substantial growth, necessitating robust home and mobile internet access. For instance, the global online education market was valued at approximately $300 billion in 2023 and is projected to reach over $600 billion by 2027, underscoring the sustained need for reliable digital infrastructure.

This sustained increase in data consumption, driven by these sociological trends, directly supports the long-term demand for Crown Castle's infrastructure. As more people work, learn, and entertain themselves online, the need for the cell towers and fiber networks that Crown Castle provides becomes increasingly critical for seamless connectivity.

Public acceptance significantly impacts Crown Castle's infrastructure deployment. Community resistance, often termed NIMBYism, can arise from aesthetic concerns regarding cell towers or perceived health risks, slowing down site acquisition and development. For instance, in 2024, numerous local zoning boards across the US reviewed proposals for new small cell installations, with some communities enacting stricter aesthetic guidelines or outright moratoriums, directly affecting project timelines and costs for Crown Castle.

Crown Castle actively manages these sociological factors through community outreach programs and engagement with local stakeholders. They aim to address concerns proactively by highlighting the essential nature of their infrastructure for connectivity and economic development. By working collaboratively with municipalities, they seek to find mutually agreeable solutions that balance community preferences with the need for improved wireless coverage, a strategy crucial for their 2025 expansion plans.

Digital Divide and Inclusion Initiatives

Societal focus on bridging the digital divide is creating significant opportunities for Crown Castle. As governments and private entities invest in digital inclusion, there's a growing demand for network expansion into previously underserved communities. This push for universal high-speed internet access directly aligns with Crown Castle's strategy of deploying small cells and fiber to meet the increasing data demands of connected populations.

Government initiatives are actively funding broadband expansion projects, which can directly benefit Crown Castle's business model. For instance, the U.S. government's Broadband Equity, Access, and Deployment (BEAD) program, with its substantial allocation of $42.45 billion, is designed to bring reliable internet to unserved and underserved areas, often requiring new infrastructure deployment. This creates a favorable environment for Crown Castle to partner on or benefit from these expansion efforts, extending its network reach and customer base.

- Digital Inclusion Funding: The U.S. government's BEAD program alone represents a massive investment in expanding broadband access, directly creating demand for infrastructure like that provided by Crown Castle.

- Underserved Market Growth: As more communities gain access, the potential subscriber base for wireless carriers, and thus demand for Crown Castle's network assets, expands significantly.

- Partnership Opportunities: Government grants and private sector commitments to digital inclusion often involve public-private partnerships, offering Crown Castle avenues for new deployments and revenue streams.

Shifting Consumer Behavior and Expectations

Consumers increasingly expect instant, high-speed connectivity for everything from streaming high-definition video to engaging in real-time augmented reality experiences. This demand directly fuels the need for robust network infrastructure, pushing Crown Castle's customers, like mobile carriers, to invest heavily in expanding their 5G and fiber networks. The sheer volume of data generated by these connected activities necessitates continuous upgrades and densification of wireless and wired networks.

The proliferation of Internet of Things (IoT) devices, smart home technology, and sophisticated mobile applications is fundamentally altering user behavior, creating a constant demand for more bandwidth and lower latency. For instance, the average smartphone data consumption in the US reached approximately 16.4 gigabytes per month in late 2024, a significant increase from previous years, highlighting this trend.

Crown Castle's infrastructure, including its extensive portfolio of cell towers and fiber optic networks, is critical in enabling its customers to meet these escalating consumer demands. By providing the physical backbone for wireless and wired communication, Crown Castle allows mobile operators and broadband providers to deliver the seamless, always-on connectivity that modern consumers have come to expect.

- Increased Data Consumption: U.S. mobile data traffic is projected to grow at a compound annual growth rate (CAGR) of over 20% through 2028, driven by video streaming and advanced applications.

- IoT Growth: The number of connected IoT devices globally is expected to surpass 29 billion by 2027, requiring significant network capacity.

- 5G Adoption: As 5G networks expand, consumer reliance on high-speed mobile connectivity for data-intensive tasks like cloud gaming and remote work intensifies.

- Fiber Demand: Residential fiber broadband subscriptions in the US saw a substantial increase in 2024, reflecting a preference for reliable, high-speed internet.

Societal expectations for constant, high-speed connectivity are increasing, driving demand for Crown Castle's infrastructure. Consumers anticipate seamless data access for streaming, gaming, and remote work, pushing wireless carriers to invest in network densification. This trend is amplified by the growing adoption of 5G technology and the proliferation of Internet of Things (IoT) devices, all of which require robust network capacity.

The global IoT market is projected to reach over $1.5 trillion by 2025, indicating a massive increase in connected devices that rely on wireless networks. In the US, average mobile data usage climbed to approximately 16.4 GB per month by late 2024, a clear indicator of escalating consumer demand for data-intensive applications and services.

Crown Castle's extensive network of cell towers and fiber optic cables is crucial for meeting these evolving consumer demands. By providing the essential physical infrastructure, Crown Castle enables its customers, such as mobile network operators, to deliver the reliable, high-performance connectivity that modern users expect, directly supporting their network expansion and upgrade strategies.

| Sociological Factor | Impact on Crown Castle | Supporting Data (2024/2025) |

| Increasing Data Consumption | Drives demand for network densification and fiber expansion. | US mobile data usage ~16.4 GB/month (late 2024). Projected US mobile data traffic CAGR >20% through 2028. |

| IoT Proliferation | Requires greater network capacity and lower latency. | Global IoT devices expected >29 billion by 2027. |

| 5G Adoption | Increases reliance on high-speed mobile connectivity. | Continued expansion of 5G networks globally, driving demand for small cell deployments. |

| Digital Lifestyles | Heightened demand for consistent, high-speed internet for work, education, and leisure. | Online education market projected to exceed $600 billion by 2027. |

Technological factors

The ongoing rollout and advancement of 5G technology represent a significant tailwind for Crown Castle. This evolution necessitates a denser network infrastructure, directly boosting demand for the company's small cell sites and extensive fiber optic network.

By 2024, the U.S. had seen substantial 5G spectrum auctions and initial deployments, laying the groundwork for increased small cell installations. Crown Castle's strategy is to capitalize on this by providing the essential infrastructure for carriers to expand their 5G coverage, particularly in urban and suburban areas where densification is most critical.

This technological shift translates into a sustained growth opportunity for Crown Castle's core assets, as carriers require more distributed antenna systems and fiber backhaul to support the higher bandwidth and lower latency of 5G. The company's existing footprint and ongoing investments in fiber position it to benefit from this long-term trend.

Continuous innovation in small cell technology is making these solutions increasingly compact and power-efficient. These advancements are crucial for urban and suburban environments where space and energy consumption are key considerations.

The improved flexibility and reduced footprint of modern small cells directly enhance Crown Castle's capacity to assist its clients in expanding their wireless networks. For instance, the increasing demand for 5G services, which often rely on denser small cell deployments, underscores the importance of these technological leaps.

Fiber optic networks are the backbone of modern data transmission, crucial for backhauling data from the increasing number of cell towers and small cells. This infrastructure also directly serves enterprise and residential customers with high-speed internet. Crown Castle's substantial fiber footprint, encompassing approximately 90,000 route miles of fiber across the top U.S. markets as of early 2024, positions it to benefit significantly from this ongoing buildout.

The relentless growth in data traffic, driven by 5G deployment and increasing video consumption, necessitates continuous fiber expansion. This demand ensures a sustained need for network upgrades and new fiber builds to maintain and improve service quality. Crown Castle's strategic investments in fiber are therefore well-aligned with this fundamental technological requirement, allowing them to capitalize on the demand for increased bandwidth and lower latency.

Emerging Technologies (IoT, Edge Computing)

The proliferation of the Internet of Things (IoT) and the increasing adoption of edge computing are significant technological drivers for Crown Castle International. These advancements demand robust, low-latency network infrastructure to handle the massive data generated by connected devices and localized processing. For instance, the IoT market is projected to reach over $1.5 trillion by 2027, with billions of devices coming online, each requiring reliable connectivity.

Edge computing, which brings data processing closer to the source of data generation, further amplifies this need. This shift necessitates more distributed network infrastructure, including small cells and fiber, to support the high bandwidth and ultra-low latency requirements. Crown Castle's extensive fiber network and strategically located cell towers are well-positioned to be the foundational backbone for these evolving technological landscapes.

Crown Castle's infrastructure is critical for enabling the seamless operation of technologies like autonomous vehicles, smart cities, and advanced industrial automation. These applications rely on real-time data processing and immediate communication, making high-density, high-capacity networks essential. As of late 2024, the demand for 5G deployment, a key enabler for these technologies, continues to surge, with carriers investing billions to expand coverage and capacity.

- IoT Growth: The global IoT market is expected to exceed $1.5 trillion by 2027, driving significant demand for network capacity.

- Edge Computing Needs: Edge computing requires low latency and high bandwidth, necessitating network densification.

- Fiber Investment: Crown Castle's fiber-to-the-tower strategy directly supports the bandwidth and connectivity demands of emerging technologies.

- 5G Enablement: The ongoing expansion of 5G networks, crucial for IoT and edge applications, relies heavily on infrastructure like Crown Castle's.

Network Virtualization and Software-Defined Networks

The ongoing shift towards network virtualization, including Open RAN and vRAN, is fundamentally changing how wireless networks are built and managed. These software-centric approaches allow for greater flexibility and efficiency, potentially impacting Crown Castle's traditional infrastructure model.

While these technologies can reduce reliance on proprietary hardware, they may also increase the demand for dense fiber networks and distributed small cell sites to support the localized processing power required. This could mean a recalibration of demand, moving from large, centralized tower deployments to a more dispersed infrastructure strategy.

For instance, the 2024 outlook suggests continued investment in 5G, which often benefits from these virtualized architectures. Crown Castle's strategy, therefore, needs to adapt to this evolving landscape, balancing its core tower business with the growing need for fiber and small cell solutions to maintain its competitive edge in the infrastructure space.

- Network Virtualization: Trends like Open RAN and vRAN are enabling more flexible and cost-effective wireless network deployments, potentially altering hardware dependencies.

- Software-Defined Networks (SDN): SDN allows for centralized control of network resources, which could influence the management and utilization of physical infrastructure.

- Infrastructure Demand Shift: These technological advancements may lead to increased demand for distributed small cells and fiber optic networks, potentially impacting the traditional tower space.

- 5G Investment: Continued investment in 5G infrastructure in 2024 and beyond necessitates an adaptive strategy that incorporates these new network architectures.

The ongoing expansion of 5G networks, a key driver for Crown Castle, continues to accelerate. By early 2024, U.S. carriers had committed billions to 5G spectrum and infrastructure, directly fueling demand for small cells and fiber backhaul. This trend is projected to intensify, with further spectrum auctions and deployment plans expected through 2025, necessitating more distributed network elements.

The proliferation of the Internet of Things (IoT) and the rise of edge computing are also significant technological factors. By 2027, the global IoT market is anticipated to surpass $1.5 trillion, with billions of connected devices requiring robust network support. Edge computing, which processes data closer to its source, further accentuates the need for low-latency, high-bandwidth infrastructure, a core offering of Crown Castle.

Network virtualization technologies like Open RAN and vRAN are reshaping wireless infrastructure. While these software-centric approaches can alter hardware needs, they also increase the reliance on dense fiber networks and distributed small cells. Crown Castle's substantial fiber footprint, approximately 90,000 route miles as of early 2024, is crucial for supporting these evolving network architectures and the increasing data traffic they generate.

| Technological Factor | Impact on Crown Castle | Supporting Data/Trend |

| 5G Network Expansion | Increased demand for small cells and fiber backhaul | Billions invested in 5G spectrum and infrastructure by U.S. carriers (early 2024) |

| IoT Growth | Higher demand for network capacity and connectivity | Global IoT market projected to exceed $1.5 trillion by 2027 |

| Edge Computing | Need for low-latency, high-bandwidth distributed infrastructure | Edge computing requires localized processing, amplifying demand for small cells and fiber |

| Network Virtualization (Open RAN/vRAN) | Potential shift in hardware demand, increased need for fiber and small cells | These technologies rely on distributed processing, necessitating robust fiber networks |

Legal factors

Zoning and permitting regulations at federal, state, and local levels significantly impact Crown Castle's ability to site and construct communications infrastructure. The Federal Communications Commission's (FCC) 'shot clock' rules, for instance, aim to expedite the review process for small cell deployments, setting deadlines for local authorities. However, varying local ordinances and potential requirements for environmental reviews or historical preservation can still introduce delays, affecting deployment timelines and costs throughout 2024 and into 2025.

The Federal Communications Commission's (FCC) spectrum allocation decisions are a cornerstone of legal factors influencing wireless carriers, and by extension, Crown Castle. These decisions, including auctioning and reallocating spectrum bands, directly shape carriers' investment in network buildouts and their subsequent need for tower and fiber infrastructure.

For instance, the FCC's aggressive C-band auction in 2021 generated over $81 billion, signaling a significant shift towards mid-band spectrum for 5G deployment. This legal framework incentivizes carriers to expand their networks, driving demand for Crown Castle's assets to house the necessary equipment.

The legal implications of different spectrum bands also matter. Millimeter wave spectrum, while offering high capacity, requires denser network deployments due to its shorter range, potentially increasing demand for small cells and fiber connections provided by Crown Castle.

Crown Castle International, as a Real Estate Investment Trust (REIT), must adhere to strict legal and tax compliance regulations. This involves distributing at least 90% of its taxable income annually to shareholders, which impacts its financial structure and ability to retain earnings for growth. For instance, in 2023, Crown Castle reported a total revenue of $3.4 billion, with a significant portion subject to these distribution requirements.

Changes in tax laws, such as potential modifications to corporate tax rates or specific REIT provisions, could directly influence Crown Castle's profitability and the attractiveness of its dividends to investors. The company's ability to maintain its REIT status is crucial for its valuation and investor appeal, making regulatory shifts a key consideration.

Environmental Regulations and Compliance

Crown Castle International operates under a complex web of environmental laws affecting its tower construction and maintenance. These regulations mandate strict adherence to land use policies, often requiring extensive environmental impact assessments before new sites can be developed. For instance, compliance with the National Environmental Policy Act (NEPA) and state-level equivalents can add significant time and expense to projects, as seen in the lengthy permitting processes for new tower deployments.

Wildlife protection laws, such as the Migratory Bird Treaty Act, also play a crucial role, necessitating measures to prevent bird collisions with towers. Furthermore, regulations concerning emissions, particularly from backup generators at cell sites, require careful management and reporting. In 2023, the company continued to invest in environmental compliance, with capital expenditures allocated towards ensuring all new and existing infrastructure met evolving environmental standards across its operational footprint.

- Land Use Compliance: Adherence to zoning laws and environmental impact assessments for new tower sites.

- Wildlife Protection: Implementing measures to mitigate risks to migratory birds and other wildlife.

- Emissions Control: Managing and reporting emissions from operational equipment, including backup generators.

- Permitting Processes: Navigating federal, state, and local environmental permits, which can impact project timelines and costs.

Contractual Agreements and Lease Laws

Crown Castle International's operations are heavily influenced by the legal framework surrounding its extensive network of cell towers and fiber optic infrastructure. The enforceability of long-term contracts with wireless carriers and property owners is paramount, providing a degree of revenue predictability. These agreements typically include clauses for rent escalation, ensuring that Crown Castle's income keeps pace with inflation or market rates, a critical factor for long-term financial planning.

Property laws and contract law principles are the bedrock of Crown Castle's business model. Rights of way, essential for deploying fiber and accessing tower sites, are legally secured through these agreements. For instance, in 2023, Crown Castle reported that approximately 90% of its tower leases were long-term, with an average remaining term of around 17 years, highlighting the stability derived from these legally binding contracts. This legal underpinning is crucial for investor confidence and the company's ability to secure financing for future growth.

- Contractual Stability: Crown Castle's revenue is largely secured by long-term lease agreements with wireless carriers, providing a predictable income stream.

- Rent Escalation Clauses: These provisions within contracts ensure that rental income increases over time, often tied to inflation or market adjustments, protecting purchasing power.

- Rights of Way: Legal agreements grant Crown Castle the necessary rights to access and maintain its distributed antenna systems (DAS) and small cell sites, crucial for network deployment.

- Legal Framework Reliance: The company's financial health is directly tied to the enforceability of these contracts and adherence to property and contract laws across various jurisdictions.

Crown Castle's ability to deploy infrastructure is subject to evolving zoning and permitting regulations at all government levels, potentially causing project delays and cost increases throughout 2024 and into 2025. The Federal Communications Commission (FCC) plays a critical role through spectrum allocation decisions, directly influencing carriers' network expansion and their demand for Crown Castle's assets. Furthermore, as a REIT, the company must comply with strict distribution requirements, impacting its financial flexibility and growth strategies.

| Legal Factor | Impact on Crown Castle | 2024/2025 Relevance |

| Zoning & Permitting | Affects site acquisition, deployment timelines, and costs. | Ongoing need to navigate diverse local regulations for small cell and tower expansion. |

| Spectrum Allocation (FCC) | Drives carrier investment in network buildouts, influencing demand for infrastructure. | Continued 5G buildout and potential future spectrum auctions will shape infrastructure needs. |

| REIT Compliance | Mandates distribution of taxable income, impacting retained earnings for growth. | Maintaining REIT status is crucial for investor appeal and financial structure. |

Environmental factors

Climate change poses a significant threat to Crown Castle's extensive network of cell towers and fiber optic cables. Increased frequency and intensity of extreme weather events like hurricanes and floods can directly damage this physical infrastructure, leading to service disruptions and costly repairs. For instance, the National Oceanic and Atmospheric Administration (NOAA) reported that in 2023, the U.S. experienced 28 separate billion-dollar weather and climate disasters, underscoring the growing risk.

To counter these risks, Crown Castle must prioritize resilient infrastructure design and robust maintenance strategies. This includes fortifying towers against high winds, protecting underground fiber lines from flooding, and implementing wildfire mitigation measures in vulnerable areas. Such investments in network hardening and disaster preparedness are crucial for ensuring service continuity and minimizing financial losses associated with climate-related events.

Crown Castle's operations, encompassing cell towers, small cells, and data centers, inherently involve significant energy consumption, contributing to its carbon footprint. The company is actively pursuing strategies to mitigate this impact, focusing on renewable energy sourcing and enhancing energy efficiency across its infrastructure. For instance, in 2023, Crown Castle reported a 15% reduction in Scope 1 and Scope 2 greenhouse gas emissions compared to its 2019 baseline, demonstrating progress in its sustainability efforts.

Key initiatives include investments in energy-efficient equipment upgrades for its tower sites and data centers, alongside exploring power purchase agreements for renewable energy. These efforts are crucial as investor and societal expectations for corporate environmental responsibility continue to rise, with a growing emphasis on transparent reporting of sustainability metrics and tangible progress in reducing emissions.

Crown Castle International prioritizes sustainable practices in its infrastructure development. This includes minimizing environmental disruption during site selection and construction, managing waste effectively, and incorporating eco-friendly materials. For instance, in 2023, the company reported a 15% reduction in construction waste sent to landfills across its projects.

These initiatives are crucial for Crown Castle's environmental stewardship and maintaining its social license to operate. By focusing on sustainable siting and construction, the company aims to reduce its ecological footprint and build trust with communities and stakeholders. Their commitment is reflected in ongoing efforts to meet and exceed environmental regulations and industry best practices.

E-Waste Management and Recycling

Crown Castle, as a major player in telecommunications infrastructure, faces environmental scrutiny regarding the e-waste generated from network upgrades and equipment refreshes. The sheer volume of discarded antennas, cables, and other electronic components necessitates robust management strategies. For instance, the global e-waste generated reached an estimated 62 million tonnes in 2020 and is projected to grow, highlighting the scale of the challenge.

Crown Castle is committed to responsible disposal and recycling practices for its old infrastructure. This includes partnering with certified e-waste recyclers who adhere to strict environmental and data security standards. Their initiatives focus on maximizing material recovery and minimizing landfill impact, aligning with broader corporate sustainability goals.

Effective e-waste management directly contributes to a circular economy by recovering valuable materials like copper, aluminum, and precious metals from discarded equipment. This not only reduces the need for virgin resource extraction, thereby lowering energy consumption and pollution, but also supports sustainable supply chains. For example, the value of raw materials in global e-waste was estimated at $57 billion in 2019, underscoring the economic and environmental benefits of proper recycling.

- E-Waste Volume: Global e-waste is a growing concern, with an estimated 53.6 million metric tons generated in 2019, projected to reach 74.0 million metric tons by 2030.

- Recycling Partnerships: Crown Castle collaborates with certified e-waste recycling facilities to ensure responsible processing of decommissioned network equipment.

- Circular Economy Impact: Recovering materials from e-waste reduces reliance on new resource extraction, conserving energy and minimizing pollution.

- Resource Value: The valuable metals and materials contained within e-waste represent a significant resource that can be reintroduced into manufacturing processes.

Community Aesthetics and Visual Impact

The visual impact of telecommunications infrastructure on community aesthetics is a significant environmental consideration for Crown Castle. Efforts to mitigate this include developing camouflaged towers that blend into natural surroundings and strategically placing small cell units to minimize their visibility in urban and suburban areas. For instance, in 2024, Crown Castle continued its focus on aesthetic integration, with specific projects in scenic regions prioritizing designs that reduce visual disruption. Addressing these concerns is crucial for gaining public acceptance and facilitating the site acquisition process, which is vital for network expansion.

Public perception of tower aesthetics can directly influence regulatory approvals and community support. By investing in discreet designs and engaging with local communities to address visual concerns, Crown Castle aims to foster positive relationships. This proactive approach helps in securing permits and maintaining goodwill, which is essential for long-term operational success. The company’s 2025 strategic plans continue to emphasize this commitment to minimizing aesthetic impact as a core component of its environmental stewardship.

- Aesthetic Mitigation: Crown Castle actively employs camouflaging techniques for towers and discreet integration of small cell technology to reduce visual clutter.

- Community Engagement: Addressing visual pollution concerns is a key strategy for enhancing public acceptance and streamlining site acquisition, a process critical for network growth.

- 2024-2025 Focus: The company's ongoing investments in visually unobtrusive infrastructure highlight a commitment to environmental responsibility and community relations.

Crown Castle's infrastructure is vulnerable to climate change impacts, with extreme weather events in 2023 causing 28 billion-dollar disasters in the U.S., according to NOAA. The company is investing in resilient infrastructure and disaster preparedness to mitigate damage and ensure service continuity.

The company's commitment to sustainability is evident in its 2023 report of a 15% reduction in Scope 1 and 2 greenhouse gas emissions compared to 2019. This was achieved through energy efficiency upgrades and renewable energy sourcing, reflecting growing investor and societal expectations for environmental responsibility.

Crown Castle is addressing the environmental impact of e-waste, with global e-waste projected to reach 74 million metric tons by 2030. They partner with certified recyclers to manage decommissioned equipment, aiming to recover valuable materials and contribute to a circular economy.

To minimize visual impact, Crown Castle is employing camouflaged towers and discreet small cell designs, a focus that continued into 2024 and will remain a priority in 2025. This approach is crucial for community acceptance and facilitating network expansion.

| Environmental Factor | Impact on Crown Castle | Mitigation Strategy | Relevant Data/Initiative |

|---|---|---|---|

| Climate Change & Extreme Weather | Infrastructure damage, service disruptions | Resilient design, disaster preparedness | 28 U.S. billion-dollar weather disasters in 2023 (NOAA) |

| Energy Consumption & Emissions | Carbon footprint | Renewable energy, energy efficiency | 15% GHG emission reduction (Scope 1 & 2) vs. 2019 (2023) |

| E-Waste Management | Environmental pollution, resource depletion | Certified recycling, circular economy principles | Global e-waste projected to reach 74M metric tons by 2030 |

| Visual Impact of Infrastructure | Community acceptance, site acquisition challenges | Camouflaged towers, discreet small cells | Ongoing focus in 2024-2025 for aesthetic integration |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Crown Castle International is built upon a comprehensive review of publicly available financial reports, regulatory filings, and industry-specific market research. We also incorporate data from reputable news outlets and economic indicators to ensure a well-rounded understanding of the macro-environmental factors influencing the company.