Crown Castle International Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Crown Castle International Bundle

Unlock the strategic potential of Crown Castle International with a comprehensive look at its BCG Matrix. Understand which of their assets are driving growth and which require careful management.

This preview offers a glimpse into Crown Castle's market position, but the full BCG Matrix report provides the detailed quadrant analysis and actionable insights needed to make informed investment decisions and optimize your portfolio.

Don't just guess where Crown Castle's future lies; know it. Purchase the complete BCG Matrix to gain a clear roadmap for capitalizing on their strengths and navigating market challenges.

Stars

Crown Castle's U.S. cell tower segment is a cornerstone of its operations, boasting an impressive portfolio of around 40,000 towers. This substantial footprint places it at the forefront of the American tower industry.

The demand for these towers is robust, fueled by the aggressive build-out and densification of 5G networks by major mobile carriers. This ongoing infrastructure investment directly benefits Crown Castle's core tower rental business.

Looking ahead, the company anticipates sustained growth in this segment. For 2025, Crown Castle projects an organic growth rate of 4.7% in site rental billings, even after accounting for Sprint's network consolidation impacts.

5G network densification is a major growth driver for Crown Castle. The ongoing expansion of 5G across the U.S. means wireless carriers need more cell sites to boost capacity and coverage. This translates directly into increased demand for Crown Castle's towers, with carriers submitting more lease and amendment requests.

In 2024, Crown Castle is seeing this demand materialize. The company is benefiting from the secular trend of rising wireless data usage, which underpins strong growth in its tower business. This strategic positioning allows Crown Castle to capitalize on the infrastructure needs of the evolving wireless landscape.

Crown Castle's strategic decision to divest its fiber and small cell businesses for $8.5 billion signals a clear move to become a pure-play U.S. tower operator. This focus is designed to simplify operations and concentrate on the lucrative tower leasing market.

This strategic realignment is anticipated to boost financial predictability and unlock greater long-term shareholder value by concentrating resources on its core, high-growth tower assets.

Operational Efficiency and Cost Reductions

Crown Castle International has been actively pursuing operational efficiency and cost reductions to bolster its financial standing. In the first quarter of 2025, the company achieved a notable $21 million reduction in Selling, General, and Administrative (SG&A) expenses. This is in addition to a previously announced $10 million annual overhead reduction. These strategic moves are designed to improve profit margins and increase financial flexibility, ultimately supporting the company's bottom line.

The company's commitment to operational excellence is a key driver for maximizing financial results within its tower business segment. By streamlining operations and controlling costs, Crown Castle aims to enhance both revenue generation and profitability.

- SG&A Cost Reduction: $21 million in Q1 2025.

- Annual Overhead Reduction: $10 million.

- Strategic Focus: Enhancing margins and operational flexibility.

- Business Impact: Maximizing top- and bottom-line results in the tower business.

Strong Balance Sheet and Financial Flexibility

Crown Castle's financial position remains robust, even after accounting for the Q1 2025 fiber business divestiture which resulted in a net loss. The company boasts significant financial flexibility, with approximately $5.3 billion available through its revolving credit facility. This liquidity is crucial for managing its debt obligations and maintaining its investment-grade credit ratings.

The company has also adjusted its leverage target to a range of 6.0–6.5x EBITDA. This strategic adjustment underscores their commitment to prudent financial management while still allowing for capital allocation towards strategic growth initiatives. Such financial strength is a key enabler for Crown Castle's ongoing success as a dedicated tower infrastructure provider.

- Financial Flexibility: Approximately $5.3 billion available under its revolving credit facility provides substantial operational and strategic maneuverability.

- Leverage Management: A revised target of 6.0–6.5x EBITDA demonstrates a focus on maintaining a healthy debt-to-earnings ratio.

- Creditworthiness: The strong balance sheet supports the company's investment-grade credit ratings, facilitating access to capital.

- Investment Capacity: Financial strength ensures the ability to fund growth opportunities and strategic investments in its core tower business.

Crown Castle's U.S. tower segment, a significant asset in its portfolio, is positioned as a Star in the BCG Matrix. This is driven by its substantial market share and strong growth prospects within the U.S. wireless infrastructure sector.

The increasing demand for 5G network expansion and densification directly fuels the growth of this segment. Crown Castle's extensive tower footprint allows it to capitalize on these secular trends, leading to consistent revenue generation.

With projected organic growth in site rental billings and a strategic focus on its core tower business, Crown Castle's tower assets are expected to remain high-growth, high-market-share performers.

| Segment | Market Growth | Market Share | BCG Classification |

| U.S. Towers | High | High | Star |

What is included in the product

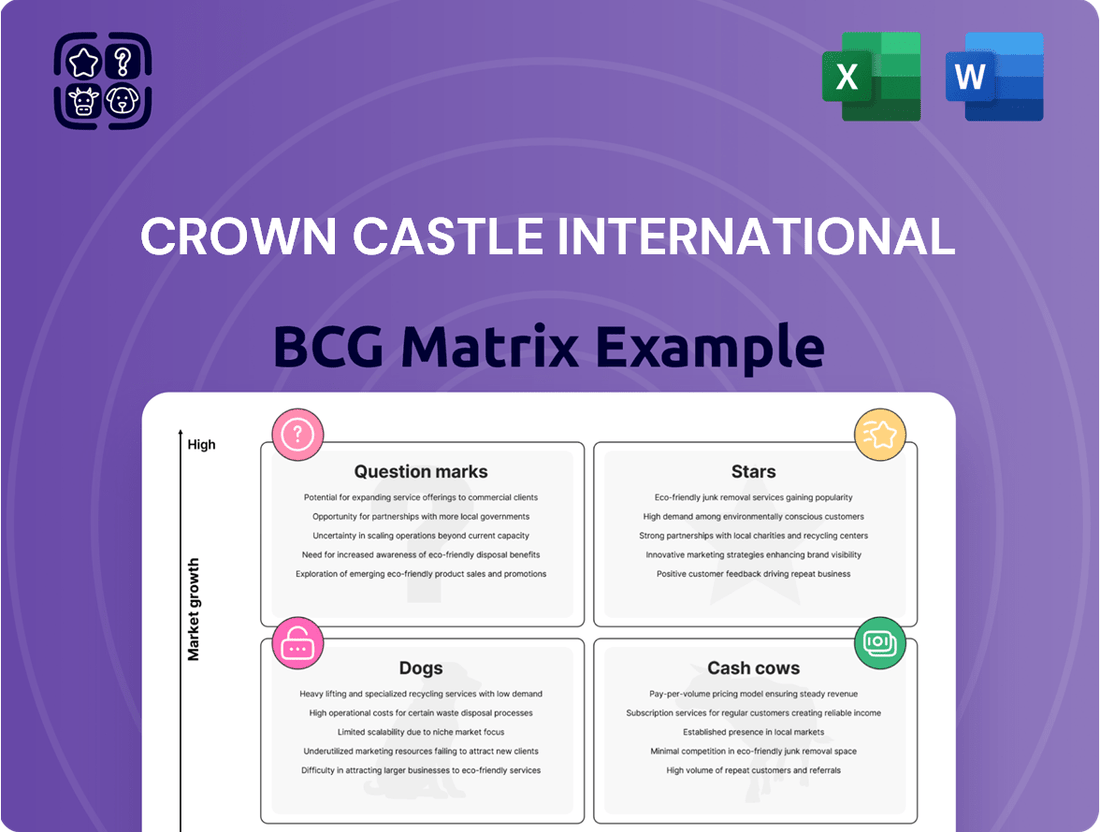

This BCG Matrix overview analyzes Crown Castle's business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

It provides strategic recommendations on investment, holding, or divestment for each segment.

A clear BCG Matrix visualizes Crown Castle's portfolio, easing strategic decision-making by highlighting growth opportunities and areas needing attention.

Cash Cows

Crown Castle's existing tower leases are a classic example of a Cash Cow within the BCG Matrix. These long-term contracts with major wireless carriers provide a highly stable and predictable revenue stream. The company reported approximately 116,000 towers and distributed sites in 2023, with a significant portion underpinned by these lucrative agreements.

The inherent nature of these lease agreements, often spanning many years, results in high profit margins and substantial, consistent cash flow generation for Crown Castle. This stability means that significant ongoing investment in marketing or aggressive expansion for these specific assets is not required, allowing the company to reliably extract cash.

Crown Castle's U.S. tower operations represent a classic cash cow. The U.S. tower market is mature, meaning growth is slower, but the demand for wireless infrastructure remains robust. Crown Castle's substantial market share, estimated to be around 40,000 towers in the U.S. as of early 2024, allows it to generate consistent, predictable revenue streams.

This established dominance means Crown Castle can effectively 'milk' its existing tower assets for cash. The stability of this segment reduces the pressure for heavy capital expenditures on expansion, freeing up resources. For instance, in 2023, Crown Castle reported approximately $3.3 billion in site rental revenue from its U.S. towers, highlighting the significant cash-generating capability of this mature business.

Following the strategic divestiture of its fiber and small cell assets, Crown Castle's remaining site rental revenues, primarily from its extensive tower portfolio, are poised to be a significant cash cow. This core business is characterized by high margins and predictable, recurring income streams, making it a stable foundation for the company's financial performance.

While the company experienced a dip in overall site rental revenues in early 2025 due to the fiber sale and the impact of Sprint's network consolidation, the underlying organic growth within the tower segment remains robust. This resilience underscores the enduring cash-generating power of its tower infrastructure, even amidst these transitional periods.

Infrastructure-as-a-Service Model

Crown Castle's infrastructure-as-a-service model, centered on owning and leasing shared communications infrastructure like cell towers and fiber networks, positions its core tower leasing business as a significant cash cow. This REIT structure inherently generates stable, recurring income from long-term contracts with mobile carriers and internet service providers.

This utility-like predictability in revenue streams is a hallmark of a cash cow. For instance, in 2023, Crown Castle reported total revenue of $6.5 billion, with a substantial portion derived from its tower leasing operations. The company's focus on providing essential infrastructure services ensures consistent demand and cash flow, allowing for reinvestment in growth areas.

- Crown Castle's REIT status fuels predictable, recurring revenue from tower leases.

- Long-term contracts with major carriers provide a stable income base.

- The infrastructure-as-a-service model acts like a utility, ensuring consistent cash generation.

- In 2023, Crown Castle's total revenue reached $6.5 billion, underscoring the scale of its operations.

Reduced Capital Expenditures Post-Divestiture

Crown Castle International's strategic divestiture of its fiber and small cell businesses in 2024 has dramatically lowered its capital expenditure requirements. This move allows for more efficient capital allocation, bolstering the company's financial health.

The reduction in spending means that the remaining tower assets, which are high-performing, can generate even more substantial cash flow. This reinforces their position as cash cows within Crown Castle's portfolio.

- Reduced CapEx: The sale of non-core assets significantly curtails future capital spending needs.

- Enhanced Cash Flow: Focus on tower assets allows for greater cash generation from established, profitable operations.

- Financial Strengthening: Improved financial flexibility supports shareholder returns and debt management.

- Strategic Realignment: The divestiture sharpens Crown Castle's focus on its core, high-margin tower business.

Crown Castle's tower portfolio, particularly in the U.S., functions as a quintessential cash cow. These assets benefit from a mature market with consistent demand and long-term, high-margin lease agreements with major wireless carriers. The company's strategic decision to divest its fiber and small cell assets in 2024 further concentrates its focus on these stable, cash-generating towers.

This focus allows Crown Castle to effectively extract significant cash flow from its existing tower infrastructure without requiring substantial new investment. The predictable nature of these revenue streams, akin to a utility, provides a reliable financial foundation for the company.

In 2023, Crown Castle reported approximately $3.3 billion in site rental revenue from its U.S. towers, a testament to the cash-generating power of this segment. This stability is further enhanced by the company's REIT structure, which is designed to distribute income generated from these assets.

The divestiture of fiber assets in 2024 reduced Crown Castle's capital expenditure needs, allowing more cash to flow from its tower operations. This strategic shift reinforces the cash cow status of its core tower leasing business.

| Segment | 2023 Revenue (Approx.) | Key Characteristic | BCG Matrix Status |

|---|---|---|---|

| U.S. Towers | $3.3 billion (Site Rental) | Mature market, high demand, long-term leases | Cash Cow |

| Fiber & Small Cells (Divested 2024) | N/A (Divested) | Higher growth potential, higher CapEx | Previously Stars/Question Marks |

Preview = Final Product

Crown Castle International BCG Matrix

The Crown Castle International BCG Matrix preview you're viewing is the identical, fully formatted report you will receive immediately after purchase. This means no watermarks, no demo content, and no surprises – just the complete, analysis-ready document designed for strategic decision-making.

Dogs

Sprint cancellations have indeed put a damper on Crown Castle's site rental revenues, acting as a significant drag. This situation reflects a shrinking income source within a segment that's not seeing much growth, largely due to industry consolidation. This aligns perfectly with the characteristics of a 'Dog' in the BCG matrix – a business unit that doesn't generate much cash and isn't a growth engine.

Crown Castle's legacy fiber business, prior to its announced divestiture, was indeed classified as a 'Dog' within its BCG Matrix. This segment faced significant headwinds, marked by a declining revenue contribution and a strategic review prompted by underperformance. Activist investors also voiced concerns, advocating for its sale.

The fiber business was a capital-intensive operation that wasn't delivering commensurate returns. For instance, in 2023, Crown Castle reported that its fiber segment's revenue was approximately $1.3 billion, a slight decrease from the previous year, while capital expenditures in fiber infrastructure remained substantial, highlighting the segment's drag on profitability.

Before its significant restructuring, Crown Castle International was involved in small cell deployments that yielded lower returns. The company's decision to scale back gross capital expenditures and cancel some of these greenfield small cell projects highlights this issue.

These less profitable ventures, if they had persisted, would have acted as a drag on the company's financial performance. They would have tied up valuable capital in opportunities that weren't generating sufficient returns. For instance, in 2023, Crown Castle's capital expenditures were $1.7 billion, and a focus on higher-return projects is crucial for optimizing this investment.

Non-Core Assets from Diversification Strategy

Crown Castle International's strategic shift away from certain diversification efforts likely placed underperforming or non-core assets into the Dogs category of the BCG Matrix. These ventures, possibly including past investments in areas outside of their primary tower infrastructure business, may have drained capital without generating substantial returns or strengthening their market position in their core operations.

The recognition and subsequent divestiture of these assets underscore a focus on optimizing resource allocation towards their more profitable and strategically aligned tower and fiber network businesses. For instance, Crown Castle's 2023 investor day highlighted a renewed emphasis on their core tower and fiber segments, signaling a pruning of less impactful initiatives. In 2023, Crown Castle reported a net loss of $1.1 billion, partly influenced by strategic decisions and asset impairments, which could include the divestiture of such non-core ventures.

- Divested Ventures: Assets from past diversification that did not enhance core tower infrastructure competency.

- Resource Drain: These ventures consumed capital and management attention without significant profit contribution.

- Strategic Realignment: Recent divestitures indicate a move to shed underperforming, non-core holdings.

- Financial Impact: Crown Castle's 2023 net loss of $1.1 billion may reflect costs associated with exiting these less strategic business areas.

Potential for Further Underperforming Contracts

Within Crown Castle International's (CCI) portfolio, assets that consistently underperform, perhaps due to aging infrastructure or unfavorable long-term contract terms, could be considered potential 'Dogs'. These are segments that drain resources without offering substantial future growth prospects. For instance, if a particular market segment, such as a legacy fiber network in a declining urban area, shows diminishing revenue growth and high operational expenses, it would fit this classification.

These underperforming contracts or infrastructure deployments represent opportunities for strategic review. CCI might consider renegotiating terms, investing in modernization to boost efficiency, or, in some cases, divesting these assets to reallocate capital towards more promising ventures. The goal is to enhance the overall profitability and strategic positioning of the company's infrastructure assets.

- Underperforming Contracts: Identify contracts with declining revenue streams or increasing operational costs relative to their contribution.

- Legacy Infrastructure: Assess older network segments that may require significant capital for upgrades or are becoming obsolete.

- Low Growth Potential: Flag infrastructure or markets showing minimal future expansion opportunities or competitive threats.

- Capital Reallocation: Consider divestiture or renegotiation to free up capital for higher-return investments.

Crown Castle's legacy fiber business, prior to its announced divestiture, was a prime example of a 'Dog' in the BCG matrix. This segment faced declining revenues and underperformance, leading to activist investor calls for its sale. In 2023, the fiber segment's revenue was approximately $1.3 billion, a slight decrease from the prior year, while capital expenditures remained substantial, highlighting its drag on profitability.

| Segment | BCG Classification | 2023 Revenue (Approx.) | Strategic Action |

|---|---|---|---|

| Legacy Fiber | Dog | $1.3 Billion | Divestiture announced |

| Underperforming Small Cells | Dog | N/A (part of broader capex) | Scaled back deployments |

Question Marks

Crown Castle's remaining small cell network assets, especially those supporting its core tower business, could be viewed as a Question Mark in the BCG matrix. While 5G densification fuels demand, the substantial investment needed for scaling these assets to achieve a dominant market position in a dynamic tech environment presents a challenge.

Crown Castle's potential investment in new technologies like edge computing or private 5G networks would likely place them in the Question Mark quadrant of the BCG Matrix. These areas offer high growth prospects as the demand for localized data processing and specialized wireless solutions expands. For instance, the edge computing market is projected to grow significantly, with some estimates suggesting it could reach hundreds of billions of dollars by the late 2020s, indicating substantial future revenue potential.

However, these nascent technologies typically have low current market share for Crown Castle, as they represent a diversification beyond their core tower and fiber assets. The capital requirements for developing and deploying such solutions are also substantial, demanding significant upfront investment to build out infrastructure, acquire necessary spectrum, and develop the associated services. This high investment need, coupled with uncertain market adoption rates, solidifies their position as Question Marks requiring careful strategic evaluation.

Crown Castle's strategic partnerships and acquisitions, particularly those targeting adjacent high-growth areas or new technological capabilities, would initially be classified as question marks in the BCG matrix. These ventures demand significant capital outlay and diligent oversight to ensure successful integration and market penetration. For instance, in 2024, Crown Castle continued to invest in fiber expansion, a move that could be seen as building capabilities for future 5G densification and edge computing services, areas with high growth potential but also inherent market uncertainties.

International Market Expansion

Crown Castle's current strategic focus remains firmly on the U.S. market, where it has a well-established infrastructure and customer base. However, any future international market expansion would likely place Crown Castle's ventures into new geographic territories into the 'Question Marks' quadrant of the BCG Matrix.

These potential new markets would represent high-growth opportunities, aligning with the global demand for wireless infrastructure. Yet, Crown Castle would enter these markets with a relatively low market share, necessitating substantial capital infusion and concerted strategic maneuvering to build brand recognition and secure a profitable foothold.

- High Growth Potential: Emerging economies often exhibit rapid increases in mobile data consumption and 5G adoption, creating fertile ground for infrastructure deployment.

- Low Market Share: Entering established or developing international markets means competing with existing players, requiring significant effort to gain traction.

- Capital Intensive: Building new towers, fiber networks, and securing necessary regulatory approvals in foreign countries demands considerable upfront investment.

- Strategic Focus Required: Success hinges on tailored market entry strategies, understanding local regulations, and building strong partnerships.

Optimizing Tower Operations for Enhanced Services

Crown Castle International's efforts to optimize tower operations for enhanced services, such as investing in new technologies and automating existing systems beyond basic leasing, could be classified as a 'Question Mark' within the BCG Matrix. These initiatives hold the potential to significantly improve customer service and operational efficiency, but their market adoption and ultimate revenue generation remain uncertain, necessitating substantial upfront investment to prove their value and capture market share.

For instance, in 2024, Crown Castle continued to explore and pilot new technologies aimed at providing value-added services to its tenants, such as advanced network monitoring and edge computing solutions. While these ventures represent growth opportunities, their return on investment is not yet fully established, placing them in the Question Mark quadrant. The company's 2023 annual report highlighted ongoing R&D spending in these areas, signaling a commitment to innovation despite the inherent market risks.

- Investment in New Technologies: Crown Castle is actively exploring and investing in technologies like AI-driven network optimization and enhanced site management tools to differentiate its service offerings beyond traditional tower leasing.

- Uncertain Market Adoption: While these enhanced services aim to improve customer experience and operational efficiency, the pace of market adoption and the willingness of tenants to pay a premium for them are still being evaluated, creating uncertainty.

- Demonstrating Value and Gaining Share: Significant upfront investment is required to develop, pilot, and market these new services, with the success of gaining market share contingent on effectively demonstrating their tangible benefits to customers.

- Potential for High Growth: If successful, these optimized operations and enhanced services could unlock new revenue streams and solidify Crown Castle's competitive advantage in the evolving telecommunications infrastructure landscape.

Crown Castle's ventures into emerging technologies like private 5G networks and edge computing services are prime examples of 'Question Marks' in the BCG matrix. These areas represent significant growth potential, driven by increasing demand for specialized wireless solutions and localized data processing. For instance, the edge computing market is anticipated to experience substantial growth, with projections indicating it could reach hundreds of billions of dollars by the late 2020s, highlighting a vast future revenue opportunity.

However, Crown Castle currently holds a low market share in these nascent fields, requiring substantial capital investment for infrastructure development, spectrum acquisition, and service creation. This high investment need, coupled with uncertain market adoption rates, firmly places these initiatives in the Question Mark quadrant, demanding careful strategic evaluation and resource allocation.

Crown Castle's strategic investments in fiber expansion, particularly those supporting future 5G densification and edge computing, can also be viewed as Question Marks. While these efforts build capabilities for high-growth areas, they involve considerable capital outlay and face inherent market uncertainties, as seen in their continued fiber investments throughout 2024.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining Crown Castle's financial data, industry research, and official reports to ensure reliable, high-impact insights.