Crown Castle International Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Crown Castle International Bundle

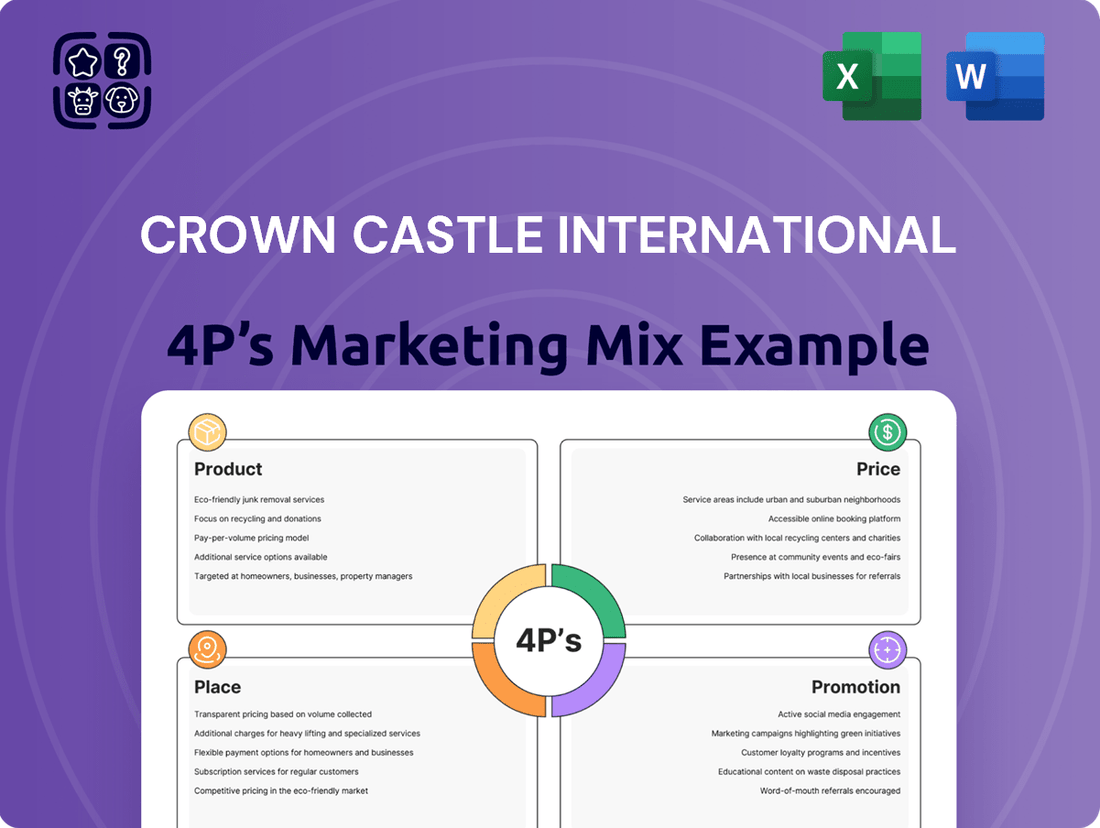

Discover how Crown Castle International leverages its product offerings, pricing strategies, extensive network reach (place), and targeted promotions to dominate the telecommunications infrastructure market. This analysis unpacks the synergy between their 4Ps.

Uncover the strategic brilliance behind Crown Castle International's marketing mix. From their robust product portfolio to their precise pricing and expansive distribution, understand the core elements driving their industry leadership.

Ready to gain a competitive edge? This in-depth 4Ps analysis of Crown Castle International provides actionable insights into their product, price, place, and promotion strategies, empowering your own strategic planning.

Product

Crown Castle's core offering is access to shared communications infrastructure, predominantly its extensive network of cell towers. This infrastructure is crucial for mobile carriers and other businesses to build out and grow their wireless networks. The company is strategically positioning itself as a pure-play U.S. tower operator after divesting its fiber and small cell operations, a move anticipated to conclude by mid-2026.

Crown Castle's flagship product is its extensive portfolio of approximately 40,000 cell towers strategically located across the United States. These towers are the backbone of modern wireless communication, essential for providing reliable network coverage and the capacity needed to handle the ever-growing demand for data. As of early 2024, Crown Castle continues to see robust leasing activity, fueled by major wireless carriers investing heavily in 5G network expansion and the densification of their existing infrastructure.

Historically, Crown Castle provided access to small cell networks, vital for boosting wireless coverage in busy urban centers and increasing network capacity. This segment was a key part of their strategy to support the rollout of 5G technology.

As of late 2023, Crown Castle had deployed tens of thousands of small cell nodes, either operational or under contract, demonstrating their significant footprint in this area. These deployments were critical for enhancing network performance in densely populated locations.

While Crown Castle is in the process of divesting its small cell business, this segment played a crucial role in their portfolio by offering essential infrastructure for wireless carriers seeking to improve their 5G capabilities and overall network density.

Fiber Optic Cable (Pre-Divestiture)

Before its strategic divestiture, Crown Castle International leased extensive fiber optic cable networks. These networks were crucial for connecting small cells and facilitating high-capacity, low-latency data transmission, forming a foundational element for 5G network expansion.

The fiber infrastructure played a vital role in Crown Castle's pre-divestiture product offering, directly supporting the burgeoning demand for advanced wireless services. This segment of their business was key to enabling seamless connectivity for a growing number of distributed antenna systems and small cell sites.

- Network Reach: Crown Castle's fiber footprint prior to divestiture comprised thousands of route miles, primarily in dense urban areas.

- Key Applications: Essential for 5G small cell backhaul, enterprise connectivity, and public safety networks.

- Market Position: A significant provider of fiber infrastructure underpinning wireless and wireline services.

Infrastructure Services

Crown Castle's Infrastructure Services, beyond just providing physical cell towers and fiber networks, offer crucial support functions. These include site development, ensuring new locations are ready for deployment, and expert installation services that streamline the setup process for their clients, primarily mobile network operators.

These value-added services are designed to maximize the utility and operational efficiency of Crown Castle's infrastructure. For instance, their maintenance programs ensure network uptime, a critical factor for carriers looking to augment and upgrade their networks to meet growing demand.

In 2024, Crown Castle highlighted its commitment to these services, with a significant portion of its capital expenditure focused on expanding its fiber footprint and enhancing its existing tower assets to support 5G deployment. This strategic investment underscores the integral role these services play in their overall offering, enabling seamless network evolution for their customers.

Key aspects of Crown Castle's Infrastructure Services include:

- Site Development: Preparing locations for new infrastructure.

- Installation Services: Expert setup of equipment on towers and within networks.

- Maintenance and Support: Ensuring ongoing operational integrity and uptime.

- Network Augmentation: Facilitating upgrades and expansions for mobile carriers.

Crown Castle's primary product is access to its vast network of approximately 40,000 U.S. cell towers, a critical asset for mobile carriers expanding their 5G networks. This core offering is complemented by a significant, though divesting, portfolio of small cell nodes and fiber optic cable networks, essential for dense urban coverage and high-capacity data transmission. The company's strategic focus is on its tower business, aiming to streamline operations and enhance shareholder value by exiting non-core segments.

| Product Segment | Description | 2024/2025 Relevance |

|---|---|---|

| U.S. Towers | Approximately 40,000 cell towers providing wireless network infrastructure. | Core business, driving 5G deployment and network densification for major carriers. Expected continued strong leasing activity. |

| Small Cells (Divesting) | Tens of thousands of deployed small cell nodes and associated fiber. | Historically crucial for 5G in urban areas; divestiture expected by mid-2026, impacting future revenue streams from this segment. |

| Fiber Networks (Divesting) | Extensive fiber optic cable networks, primarily in dense urban areas. | Supported small cell backhaul and enterprise connectivity; divestiture will reshape the company's infrastructure service offerings. |

What is included in the product

This analysis provides a comprehensive breakdown of Crown Castle International's 4Ps marketing mix, detailing their product offerings, pricing strategies, distribution channels, and promotional activities.

It's designed for professionals seeking to understand Crown Castle International's market positioning and competitive strategies through real-world examples and data.

Simplifies Crown Castle's marketing strategy by clearly outlining their 4Ps, alleviating the pain of complex analysis for stakeholders.

Provides a concise, actionable overview of Crown Castle's 4Ps, solving the problem of information overload for busy executives.

Place

Crown Castle's place, its physical footprint, is a cornerstone of its marketing mix, covering every major U.S. market. This extensive network of towers, small cells, and fiber optic cable ensures ubiquitous access to critical communications infrastructure for its clients.

By owning and operating over 40,000 cell towers and approximately 115,000 route miles of fiber in 2024, Crown Castle provides a robust platform for mobile carriers to deploy their networks nationwide. This vast geographic reach is essential for supporting the increasing demand for wireless data and the ongoing rollout of 5G technology.

Crown Castle's direct leasing model is central to its strategy, offering wireless carriers and other clients long-term access to its extensive network of towers and fiber infrastructure. This approach fosters a direct, efficient relationship for deploying and managing critical network equipment.

In 2024, Crown Castle reported that approximately 90% of its revenue comes from these long-term leasing agreements, highlighting the model's stability and predictability. This direct engagement allows for streamlined operations and a deeper understanding of customer needs, facilitating tailored solutions for network expansion and densification.

Crown Castle's placement strategy is all about picking the best spots for their cell towers and network infrastructure. They focus on busy city areas and places where people use a lot of data. This ensures their network can handle demand and reach more users effectively.

In 2024, Crown Castle continued to expand its footprint, particularly in dense urban environments. The company's strategy prioritizes locations that support 5G densification, a key driver for future revenue. Their extensive fiber network also plays a crucial role, connecting these strategic tower locations and enabling higher bandwidth services.

Integrated Infrastructure Solutions

Crown Castle's historical integrated infrastructure solutions, encompassing towers, small cells, and fiber, offered a seamless 'place' strategy. This synergy allowed for comprehensive connectivity by combining these assets, facilitating efficient network expansion and service delivery across various customer needs and environments.

While Crown Castle has been divesting some of its fiber and small cell assets, the prior integrated approach was a key differentiator. This allowed them to offer bundled solutions that were more than the sum of their parts, providing customers with end-to-end connectivity options. For instance, in 2023, Crown Castle reported approximately 115,000 miles of fiber passed, showcasing the scale of their past integrated network capabilities.

- Integrated Network Synergy: Towers, small cells, and fiber worked in concert to deliver comprehensive connectivity solutions.

- Efficient Expansion: The integrated model supported streamlined network build-outs and service deployment.

- Customer Value: Bundled offerings provided customers with end-to-end network capabilities, enhancing service delivery.

- Strategic Evolution: While focusing on core tower assets, the historical integration highlights a past strength in offering diverse infrastructure solutions.

Customer-Centric Access

Crown Castle's 'Place' strategy centers on making their infrastructure incredibly accessible and convenient for their customers, primarily wireless carriers and enterprise clients. Their objective is to ensure that clients can readily deploy and scale their networks with minimal friction.

This focus on customer-centric access is evident in their extensive network of cell towers, small cells, and fiber optic cable, strategically located in high-density urban and suburban areas where demand for wireless services is greatest. For instance, as of Q1 2024, Crown Castle operated approximately 117,000 cell towers and a significant fiber footprint across the top 100 U.S. markets, facilitating rapid deployment for their customers.

- Extensive Network Footprint: Operates over 117,000 cell towers and a vast fiber network, ensuring proximity to customer demand centers.

- Strategic Location: Infrastructure is concentrated in top U.S. markets, optimizing coverage and deployment speed for wireless carriers.

- Scalability and Efficiency: Streamlined logistics and deployment processes allow for quick network expansion and upgrades, meeting evolving customer needs.

- Fiber Integration: The company's fiber backbone complements its tower assets, offering a comprehensive solution for 5G and future wireless technologies.

Crown Castle's "Place" strategy is defined by its extensive and strategically located network infrastructure across the United States. This physical presence, encompassing towers, small cells, and fiber, ensures clients have access to critical communication pathways where demand is highest.

By owning and operating a vast network, including approximately 117,000 cell towers and a significant fiber footprint as of Q1 2024, Crown Castle offers unparalleled reach. This infrastructure is concentrated in the top 100 U.S. markets, facilitating efficient deployment for wireless carriers.

Their approach prioritizes accessibility and scalability, allowing clients to readily deploy and expand their networks. This customer-centric placement strategy is crucial for supporting the ongoing rollout of 5G and the increasing demand for wireless data.

| Infrastructure Type | Quantity (as of Q1 2024) | Key Markets |

|---|---|---|

| Cell Towers | ~117,000 | Top 100 U.S. Markets |

| Fiber Miles | Significant Footprint | Major Urban & Suburban Areas |

| Small Cells | Extensive Deployment | Dense Urban Environments |

Full Version Awaits

Crown Castle International 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Crown Castle International's 4Ps (Product, Price, Place, Promotion) is fully complete and ready for your immediate use. You'll gain valuable insights into their marketing strategy without any hidden elements.

Promotion

Crown Castle International actively engages investors and financial professionals by showcasing its compelling value proposition. This is primarily achieved through robust investor relations, featuring detailed earnings calls, strategic presentations, and transparent SEC filings, all designed to attract and retain vital capital.

These communications consistently highlight Crown Castle's strong financial performance and clear strategic objectives, alongside its insightful market outlook. For instance, in Q1 2024, the company reported total revenue of $1.9 billion, demonstrating its consistent financial health and growth trajectory.

Crown Castle actively engages in major industry conferences, showcasing its expertise on topics like 5G advancements and the growing need for robust wireless networks. This presence solidifies their role as a leader and essential collaborator within the telecommunications sector.

Crown Castle's direct sales approach to mobile carriers and internet service providers is crucial for building lasting partnerships. This involves deeply understanding their evolving network demands and showcasing how Crown Castle's extensive fiber and small cell infrastructure can facilitate their growth and adoption of new technologies.

In 2024, Crown Castle reported that its capital expenditures for network deployments were approximately $1.7 billion, highlighting the significant investment in infrastructure designed to meet these direct customer needs and foster long-term relationship development.

Focus on 5G Enablement

Crown Castle prominently features its role in facilitating the 5G revolution as a core promotional theme. Their messaging underscores that their extensive network of towers is indispensable for the increased density and enhanced performance demanded by 5G and future wireless advancements.

The company's promotional efforts directly link their infrastructure to the successful deployment of next-generation networks. This focus highlights the critical need for their distributed tower assets to support the substantial build-out required for 5G's full capabilities.

- 5G Rollout Support: Crown Castle's towers are central to the ongoing expansion of 5G coverage across the United States.

- Network Densification: Their infrastructure is vital for adding the numerous small cells and antennas needed to improve 5G performance and capacity.

- Future Technology Enablement: The company positions itself as a key enabler for emerging wireless technologies beyond current 5G applications.

Operational Excellence and Reliability

Crown Castle emphasizes its dedication to operational excellence and reliability as core strengths. This focus translates into consistent network performance, crucial for their clients in the telecommunications and technology sectors.

The company's commitment to dependability is a significant factor in fostering long-term customer relationships. By ensuring high uptime and responsive service, Crown Castle builds trust with businesses that rely on their infrastructure.

- Network Uptime: Crown Castle targets and often achieves over 99.9% network uptime across its fiber and small cell networks.

- Customer Service: Dedicated account management and rapid response teams are integral to their customer support model.

- Infrastructure Investment: Continued investment in network modernization and maintenance underpins their reliability promise.

- Operational Efficiency: Streamlined processes and advanced monitoring tools contribute to efficient service delivery.

Crown Castle's promotional strategy heavily emphasizes its critical role in enabling the 5G revolution and future wireless advancements. They highlight how their extensive network of towers and distributed infrastructure is indispensable for the increased density and enhanced performance required by 5G, positioning themselves as a key partner for mobile carriers and internet service providers.

The company actively participates in industry conferences, sharing insights on 5G deployment and the growing demand for robust wireless networks, thereby solidifying its leadership position. This outreach is complemented by strong investor relations, utilizing detailed earnings calls and SEC filings to showcase financial performance and strategic direction, as evidenced by their Q1 2024 revenue of $1.9 billion.

Crown Castle's promotional messaging consistently links their infrastructure to the successful deployment of next-generation networks, stressing the necessity of their assets for the substantial build-out needed for 5G's full capabilities. Their commitment to operational excellence and network reliability, often exceeding 99.9% uptime, further reinforces their value proposition to clients.

| Promotional Focus | Key Message | Supporting Data/Activity |

|---|---|---|

| 5G Enablement | Indispensable for 5G density and performance | Participation in industry conferences, highlighting 5G build-out needs |

| Investor Relations | Strong financial performance and strategic clarity | Q1 2024 Revenue: $1.9 billion; detailed earnings calls and SEC filings |

| Operational Excellence | Reliability and high network uptime | Targeting >99.9% network uptime; emphasis on infrastructure investment for modernization |

Price

Crown Castle's pricing strategy heavily relies on long-term leasing agreements for its extensive network of cell towers and fiber optic infrastructure. These contracts are the bedrock of their revenue, offering a predictable and stable income flow that spans many years, mirroring the enduring nature of telecommunications assets.

These agreements are typically structured with escalators, ensuring revenue growth over the contract's life. For instance, in 2023, Crown Castle reported that approximately 90% of its total revenue was generated from these long-term contracts, with an average remaining lease term of around six years for its towers. This demonstrates a strong commitment from customers to secure access to Crown Castle's critical infrastructure.

Crown Castle International focuses on organic revenue growth, primarily driven by increased site rental billings. This growth stems from both new customer acquisitions and expanded activity from existing tenants on their extensive tower portfolio.

For the year 2025, the company projects its core organic revenue growth for the tower segment to be between 4.5% and 4.7%. This forecast specifically excludes the anticipated impact of Sprint's network consolidation, providing a clearer view of underlying business performance.

Crown Castle's capital allocation directly influences its pricing by aiming for optimal returns on its extensive infrastructure investments. The company's strategy for 2024 and 2025 focuses on reining in non-essential spending, prioritizing projects with demonstrably higher profit potential to boost overall financial performance.

Dividend Policy and Shareholder Value

Crown Castle's dividend policy is a key component of its financial strategy, directly influencing shareholder value. The company's recent dividend adjustment reflects a commitment to a more disciplined capital allocation, balancing immediate returns with long-term growth objectives and financial health.

This strategic shift aims to enhance shareholder returns by optimizing the use of capital. For instance, Crown Castle's dividend per share has seen adjustments to support its broader financial goals.

- Dividend Payout Ratio: Crown Castle's payout ratio is closely monitored as an indicator of its commitment to returning capital to shareholders.

- Dividend Growth: The company's history of dividend increases, where applicable, signals confidence in its future earnings and cash flow generation.

- Reinvestment Strategy: A portion of earnings is reinvested back into the business for network expansion and technological upgrades, aiming for sustainable future dividend growth.

- Debt Management: The dividend policy is also considered alongside the company's debt reduction targets, ensuring a balanced approach to financial management.

Competitive Market Factors

Crown Castle's pricing strategy is deeply intertwined with the competitive landscape of the U.S. wireless infrastructure sector. While its Real Estate Investment Trust (REIT) status provides a stable foundation, market forces significantly influence asset valuations and rental rates.

The value attributed to Crown Castle's extensive portfolio of cell towers and small cells is not static; it's a dynamic reflection of robust market demand for wireless connectivity. This demand, fueled by escalating data consumption, directly impacts the pricing power Crown Castle can exert.

Key factors influencing Crown Castle's pricing include:

- Strategic Location Value: The premium placed on cell tower sites in densely populated or high-demand areas, crucial for network coverage and capacity.

- Market Demand Dynamics: The ongoing need for expanded 5G networks and increased data speeds directly supports higher leasing rates.

- Competitive Benchmarking: Pricing is also informed by what competitors charge for similar infrastructure access in comparable markets.

- Long-Term Growth Prospects: Anticipated future growth in data usage and the rollout of new wireless technologies underpin the long-term value and pricing of its assets.

Crown Castle's pricing is fundamentally tied to its long-term lease agreements, providing predictable revenue streams. For 2025, the company anticipates 4.5% to 4.7% organic revenue growth in its tower segment, excluding Sprint's network consolidation impacts, underscoring the stability derived from these contracts.

The value of Crown Castle's infrastructure, particularly its cell towers in high-demand locations, directly influences its pricing power. This is further supported by the increasing demand for 5G network expansion and higher data speeds, which allows for premium leasing rates.

| Pricing Factor | Description | Impact on Crown Castle |

| Long-Term Leases | Contracts for tower and fiber access | Provides stable, predictable revenue |

| Organic Growth | Increased site rental billings | Drives revenue from new and existing tenants |

| Market Demand | Need for 5G and data capacity | Supports higher leasing rates |

| Location Value | Sites in dense, high-demand areas | Commands premium pricing |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Crown Castle International is built upon a foundation of verified, up-to-date information. We meticulously review SEC filings, investor presentations, and official company reports to understand their product offerings, pricing strategies, distribution networks, and promotional activities.