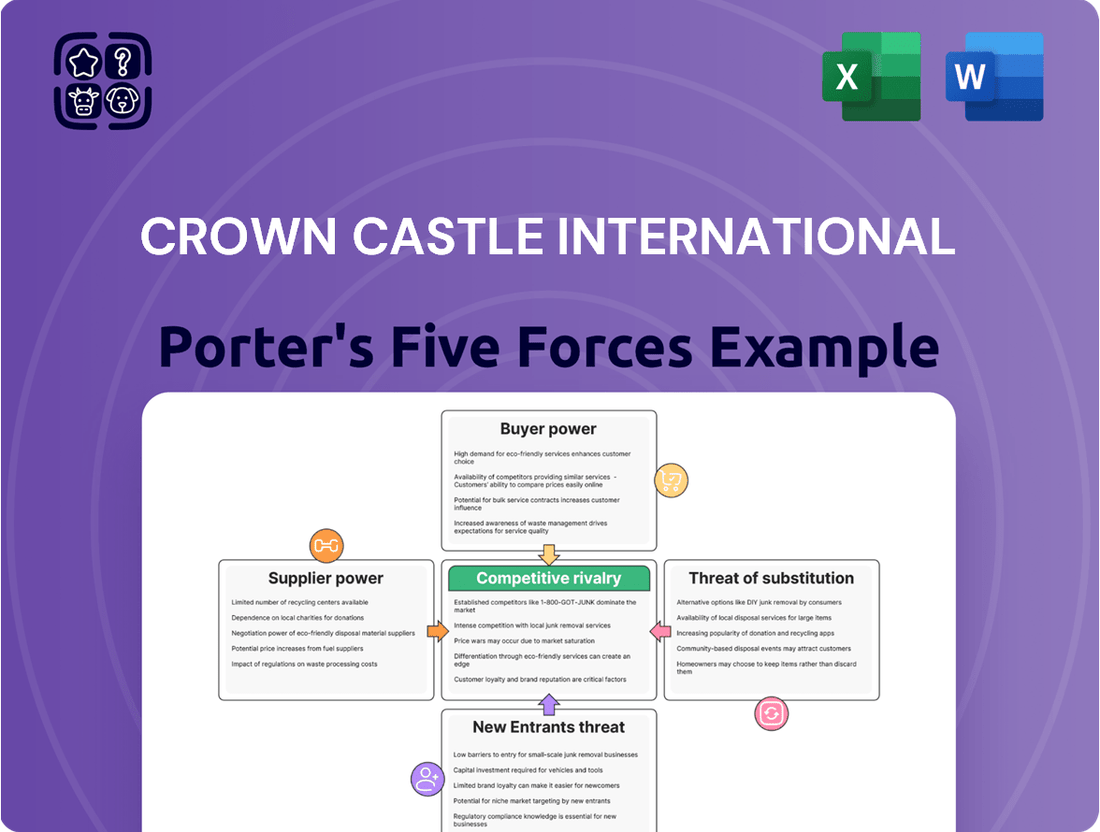

Crown Castle International Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Crown Castle International Bundle

Crown Castle International operates in a dynamic telecom infrastructure landscape, facing moderate buyer power from its diverse customer base and significant rivalry from other tower companies. The threat of new entrants is somewhat mitigated by high capital requirements, but the bargaining power of suppliers for specialized equipment can be a factor.

The complete report reveals the real forces shaping Crown Castle International’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

While Crown Castle operates across a vast network, concentrated land ownership in desirable, high-demand markets can significantly influence supplier bargaining power. Even with many individual landowners, the scarcity of prime cell tower locations means some property owners hold considerable sway during lease negotiations, impacting Crown Castle's site acquisition costs.

For instance, in 2024, Crown Castle's continued expansion and densification efforts mean securing and retaining these optimal sites remains paramount. This reliance on specific, often unique, land parcels grants these property owners leverage, as their sites are critical for network coverage and capacity, making them influential suppliers in Crown Castle's operational framework.

Crown Castle's reliance on a select group of specialized equipment manufacturers for essential tower components and network gear significantly influences supplier bargaining power. These suppliers often possess proprietary technology or offer high-quality products, allowing them to negotiate favorable pricing.

The considerable cost and technical intricacy associated with these specialized components further bolster the suppliers' leverage. For instance, the capital expenditure for advanced antenna systems can run into millions, giving manufacturers with unique, high-performance offerings a strong position in price negotiations with Crown Castle.

The bargaining power of suppliers, particularly concerning skilled labor and construction services, presents a significant factor for Crown Castle International. The construction and maintenance of communication infrastructure, especially for new tower builds and network upgrades, demand specialized expertise. A scarcity of these skilled workers or highly specialized construction firms can directly inflate project costs and prolong development timelines for Crown Castle, thereby affecting operational efficiency.

Regulatory and Permitting Services

Navigating the intricate web of local, state, and federal regulations for tower siting and construction demands specialized legal and consulting expertise. These services are crucial for obtaining necessary approvals, and their efficiency directly influences Crown Castle's deployment timelines. In 2024, the complexity of these permitting processes continues to be a significant factor.

The specialized knowledge required to secure these approvals grants these regulatory and permitting service providers a degree of bargaining power. Their ability to expedite or, conversely, delay the complex approval processes can impact project schedules and associated costs for Crown Castle.

- Specialized Expertise: Firms possess unique legal and consulting skills essential for navigating zoning laws, environmental reviews, and FCC regulations.

- Impact on Deployment: Efficient permitting directly correlates with Crown Castle's ability to quickly deploy new infrastructure, a key competitive advantage.

- Cost Implications: Delays in permitting can lead to increased project costs and missed revenue opportunities, highlighting the suppliers' leverage.

- Market Dynamics: The demand for these specialized services remains robust, particularly with ongoing 5G buildouts and fiber network expansion in 2024.

Utility Providers

Utility providers hold considerable sway over Crown Castle International, primarily because reliable power is fundamental to tower operations. In many regions, these utility companies function as natural monopolies, granting them significant leverage in dictating pricing and service agreements for the electricity supplied to Crown Castle's extensive network of cell towers.

This monopolistic position allows utility companies to exert strong bargaining power. For instance, in 2024, electricity costs represented a notable operating expense for Crown Castle. While specific figures vary by location, the inability to easily switch providers in most service areas means Crown Castle must accept the terms offered, impacting profitability.

- Monopolistic Control: Utility companies often operate as sole providers in specific geographic areas, limiting Crown Castle's ability to negotiate favorable terms.

- Essential Service: Reliable power is non-negotiable for the continuous operation of cell towers, making Crown Castle highly dependent on these providers.

- Cost Impact: Electricity expenses, influenced by utility provider pricing, directly affect Crown Castle's operating margins.

Crown Castle's bargaining power with suppliers is influenced by the concentration of specialized equipment manufacturers and the essential nature of their products. The high capital expenditure and technical complexity of components like advanced antenna systems, often running into millions in 2024, give these manufacturers significant leverage in pricing negotiations.

| Supplier Type | Key Dependencies | Impact on Crown Castle | 2024 Relevance |

|---|---|---|---|

| Landowners (Prime Locations) | Scarcity of desirable cell tower sites | Site acquisition costs, lease negotiations | Continued expansion and densification efforts |

| Equipment Manufacturers | Proprietary technology, high-quality components | Pricing of essential network gear | High capital expenditure for advanced systems |

| Skilled Labor/Construction | Specialized expertise for tower builds/upgrades | Project costs, development timelines | Demand for 5G buildouts |

| Regulatory/Permitting Services | Navigating complex zoning and environmental laws | Deployment timelines, project costs | Ongoing complexity of permitting processes |

| Utility Providers | Reliable electricity supply | Operating expenses, profitability | Electricity costs as a notable operating expense |

What is included in the product

Tailored exclusively for Crown Castle International, analyzing its position within its competitive landscape by dissecting the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes.

Instantly identify and mitigate competitive threats with a dynamic five forces model, allowing for agile strategic adjustments.

Customers Bargaining Power

Crown Castle's customer base is highly concentrated, with major U.S. mobile carriers like AT&T, Verizon, and T-Mobile representing a significant portion of its revenue. This limited number of large clients grants them considerable bargaining power. For example, in 2023, Crown Castle's top 10 customers accounted for approximately 48% of its total revenue, underscoring the influence these carriers wield in negotiations.

Crown Castle's long-term master lease agreements with wireless carriers, typically spanning 10-15 years with annual rent escalators, significantly reduce customer bargaining power. These agreements provide predictable revenue streams but also lock in pricing, making it difficult for Crown Castle to adjust rates outside of contractual provisions. For instance, in 2023, Crown Castle reported that approximately 90% of its revenue came from these long-term contracts, highlighting the stability but also the constraint on immediate price adjustments.

Mobile carriers exhibit significant dependence on Crown Castle's vast tower infrastructure, a critical factor for their service delivery and expansion, particularly with the accelerating 5G deployment. This reliance inherently limits their immediate capacity to switch to alternative providers or invest in developing their own infrastructure due to the prohibitive costs and extended timelines involved.

For instance, the capital expenditure for building a new cell tower can range from $50,000 to $200,000, and establishing a nationwide network would represent a multi-billion dollar undertaking. This substantial barrier to entry effectively anchors carriers to existing infrastructure providers like Crown Castle, thereby diminishing their bargaining power.

Co-location Economics

Crown Castle's co-location strategy, enabling multiple tenants on a single tower, is a cornerstone of its financial success, boosting asset utilization and profitability. However, this reliance on shared infrastructure introduces a significant element of customer bargaining power.

The ability for tenants to co-locate means they have options. If a major tenant decides to consolidate or significantly reduce their presence on a particular tower, it can directly impact Crown Castle's revenue stream for that asset. This leverage is amplified if a tenant has alternative co-location opportunities or can achieve better terms elsewhere.

- Tenant Concentration Risk: A significant portion of Crown Castle's revenue can be tied to a few large wireless carriers. A reduction in spending or consolidation among these key customers can exert considerable downward pressure on pricing and contract renewals.

- Alternative Infrastructure: While Crown Castle operates a vast network, the increasing availability of alternative infrastructure, such as small cells or even private networks, can give customers more options and thus more bargaining power.

- Contractual Terms: The length and terms of existing co-location agreements play a crucial role. As contracts approach renewal, tenants with strong positions can negotiate for more favorable rates, leveraging their existing footprint and the cost of relocating.

Strategic Build-out Decisions

Large mobile carriers, such as Verizon and AT&T, possess a significant bargaining power due to their strategic option to build their own infrastructure. While expensive, this 'build vs. lease' alternative acts as a powerful negotiation tool when dealing with tower companies like Crown Castle. For instance, in 2024, the capital expenditure for deploying new 5G small cells can range from tens of thousands to over a hundred thousand dollars per site, making it a substantial undertaking.

This latent threat allows major customers to push for more favorable lease terms, especially in areas where network densification is critical or where specialized network requirements exist. The sheer scale of these carriers means they can absorb some of the upfront costs if negotiations falter, thereby influencing pricing and contract conditions for tower leases. In 2023, major carriers collectively invested over $50 billion in their networks, highlighting their capacity to pursue alternative infrastructure strategies.

- Customer Bargaining Power: Mobile carriers can build their own infrastructure, reducing reliance on tower companies.

- Costly Alternative: Building infrastructure is capital-intensive, but it remains a viable option for large carriers.

- Negotiation Leverage: This 'build vs. lease' option gives customers significant power in lease negotiations.

- Strategic Importance: The ability to self-build is particularly relevant for network densification and specialized needs.

Crown Castle's bargaining power of customers is moderate, primarily influenced by the concentration of its customer base and the substantial capital required for alternative infrastructure development. While large wireless carriers like AT&T and Verizon represent a significant portion of revenue, their dependence on Crown Castle's extensive tower network and the high cost of building their own infrastructure limit their immediate leverage.

The long-term nature of master lease agreements, typically 10-15 years, provides revenue stability but also restricts Crown Castle's ability to unilaterally adjust pricing. For instance, in 2023, approximately 90% of Crown Castle's revenue was derived from these long-term contracts, indicating a degree of customer lock-in but also limiting pricing flexibility outside of contractual escalators.

The option for carriers to build their own infrastructure, though capital-intensive, serves as a significant negotiation tool. For example, in 2024, deploying new 5G small cells can cost tens of thousands to over a hundred thousand dollars per site, a substantial barrier that anchors many carriers to existing providers like Crown Castle, thus mitigating extreme bargaining pressure.

| Factor | Impact on Customer Bargaining Power | Supporting Data (2023/2024) |

|---|---|---|

| Customer Concentration | High | Top 10 customers accounted for ~48% of revenue. |

| Dependence on Infrastructure | Low | Carriers rely on Crown Castle's extensive tower network for service delivery and 5G deployment. |

| Alternative Infrastructure Cost | Low | Building own infrastructure is capital-intensive (e.g., $50k-$200k per tower). Carriers invested over $50 billion collectively in networks in 2023. |

| Contractual Terms | Moderate | Long-term leases (10-15 years) provide stability but limit immediate pricing adjustments. ~90% of revenue from long-term contracts. |

Same Document Delivered

Crown Castle International Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. This comprehensive Porter's Five Forces analysis for Crown Castle International delves into the competitive landscape, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the telecommunications infrastructure sector. Understanding these forces is crucial for strategic decision-making.

Rivalry Among Competitors

The U.S. tower market is a clear oligopoly, dominated by just a few major publicly traded Real Estate Investment Trusts (REITs). Crown Castle, American Tower, and SBA Communications are the giants here, controlling a significant portion of the market. This limited competition means that when one of these companies makes a move, like offering aggressive pricing for new tenant additions or pushing for site upgrades, the others feel the pressure to respond quickly. This dynamic fuels a high level of rivalry.

The tower industry is characterized by substantial fixed costs for site acquisition, construction, and ongoing maintenance. This necessitates a strong focus on asset utilization.

Companies like Crown Castle International compete fiercely to secure multiple tenants for each tower. Adding another tenant to an existing tower, often referred to as colocation, dramatically boosts profitability because the incremental costs are minimal compared to the revenue generated. For instance, a tower that costs $1 million to build might generate $100,000 annually from a single tenant, but adding a second tenant could bring in an additional $80,000 to $90,000 with very little extra expense.

The ongoing build-out of 5G networks and the resulting densification of infrastructure are creating substantial capital expenditure opportunities for wireless carriers. This robust demand for new cell sites and network upgrades fuels a healthy pipeline of leasing and modification activity for tower companies like Crown Castle. For instance, in 2024, major carriers continued their aggressive 5G deployment, investing billions to expand coverage and capacity.

Site-Specific Competition

While the tower market generally sees a few major players, competition for specific, desirable cell sites can be surprisingly fierce. This is particularly true in densely populated urban and suburban areas where network coverage and capacity are paramount for mobile carriers. Tower companies like Crown Castle are constantly vying for these prime locations to offer the most advantageous terms and sites to their customers.

This hyper-local competition means that for any given urban block or suburban corridor, multiple tower companies might be actively seeking to secure rights to the same rooftops or land parcels. Carriers, in turn, leverage this rivalry to negotiate better lease agreements, ensuring they can deploy their equipment efficiently and cost-effectively.

- Intense Local Competition: Despite market concentration, specific site acquisition can be highly competitive in dense areas.

- Carrier Negotiation Power: Mobile carriers use site competition to secure favorable terms and locations.

- Strategic Site Selection: Tower companies focus on offering optimal locations to meet carrier coverage and capacity needs.

Strategic Shifts and Portfolio Optimization

Crown Castle's strategic pivot to concentrate solely on its U.S. tower portfolio, by divesting its fiber and small cell assets, is a significant development that sharpens competitive rivalry within the core tower market. This decision, announced in early 2024, streamlines Crown Castle's operations and intensifies its focus on maximizing efficiency and market share against established tower rivals like American Tower and SBA Communications.

The divestiture allows Crown Castle to dedicate more resources and strategic attention to its core tower business, potentially leading to more aggressive competition for new tower sites and tenant leases. For instance, Crown Castle's 2023 revenue was approximately $6.5 billion, with a significant portion derived from its tower segment, highlighting the importance of this core operation to its overall financial health and competitive stance.

- Focus on Core Towers: Crown Castle's divestment of fiber and small cells in 2024 signals a concentrated effort to dominate the U.S. tower market.

- Intensified Competition: This strategic shift directly increases rivalry with major tower operators such as American Tower and SBA Communications.

- Efficiency Drive: The move aims to unlock operational efficiencies and bolster market share within the traditional tower infrastructure segment.

- Resource Allocation: Crown Castle can now allocate capital and management attention more effectively to its primary tower assets, potentially leading to aggressive growth strategies.

The U.S. tower market, an oligopoly dominated by Crown Castle, American Tower, and SBA Communications, experiences intense rivalry. This competition is fueled by high fixed costs and the drive for asset utilization, as adding tenants to existing towers significantly boosts profitability with minimal incremental expense. For example, in 2024, the ongoing 5G build-out created substantial capital expenditure opportunities for wireless carriers, intensifying the race among tower companies to secure prime locations and lease agreements.

Crown Castle's 2024 strategic decision to divest its fiber and small cell assets sharpens this rivalry by focusing resources on its core U.S. tower portfolio. This move directly escalates competition with American Tower and SBA Communications, as Crown Castle aims for greater operational efficiency and market share in the traditional tower segment. With 2023 revenues of approximately $6.5 billion, Crown Castle's commitment to its tower business underscores its aggressive stance in securing new sites and tenant leases.

Despite the market's concentrated nature, hyper-local competition for desirable cell sites, especially in urban and suburban areas, remains fierce. This competition empowers mobile carriers to negotiate more favorable lease terms, driving tower companies to strategically select and offer optimal locations to meet carrier coverage and capacity demands.

SSubstitutes Threaten

Emerging satellite technologies, especially Low Earth Orbit (LEO) constellations like Starlink and OneWeb, are rapidly developing direct-to-device connectivity. While currently focused on basic messaging and emergency services, future iterations could offer a viable alternative for certain connectivity needs, particularly in underserved or remote regions.

The threat of these satellite services as substitutes for traditional terrestrial networks is still nascent, but their potential to disrupt is significant. For instance, by mid-2024, Starlink reported over 2.7 million subscribers globally, demonstrating growing consumer adoption of satellite internet. As these services mature and expand their capabilities to include voice and higher data speeds, they could siphon off users who prioritize ubiquitous coverage over maximum bandwidth, impacting Crown Castle's traditional tower rental revenue streams.

The increasing availability of advanced Wi-Fi, particularly Wi-Fi 6E and upcoming Wi-Fi 7, along with the expansion of Fixed Wireless Access (FWA) services, presents a notable threat of substitutes for traditional cellular tower services. These technologies offer high-speed internet connectivity directly to homes and businesses, potentially reducing their reliance on mobile networks for data-intensive tasks.

For instance, FWA, leveraging 5G technology, is increasingly being deployed by carriers as a last-mile solution, directly competing with wired broadband and, by extension, offloading traffic that might otherwise utilize cellular towers. In 2024, the global FWA market is projected for significant growth, with some estimates suggesting it could capture a substantial portion of the broadband market, impacting the demand for mobile data offload from towers.

Technological shifts like network virtualization and Software-Defined Networking (SDN) present a growing threat to Crown Castle International. These innovations enable more efficient utilization of existing network resources, potentially reducing the immediate need for new physical infrastructure. For instance, the global SDN market was valued at approximately $22.5 billion in 2023 and is projected to grow significantly, indicating a substantial move towards software-defined network management.

This increased efficiency means mobile network operators might postpone or scale back their plans for new tower construction. By optimizing capacity and traffic flow through software, they can extend the life and performance of their current network assets. This directly impacts the demand for tower leasing services, as fewer new physical sites may be required to meet capacity demands.

New Antenna and Radio Technologies

Innovations in antenna and radio technologies represent a significant threat of substitutes for Crown Castle International. Advancements like massive MIMO (Multiple-Input Multiple-Output) antennas and more efficient radio hardware can boost the capacity and coverage of existing wireless infrastructure. For instance, 5G networks are leveraging advanced antenna technologies to improve spectral efficiency, potentially allowing carriers to serve more users and higher data volumes from fewer physical locations.

This technological evolution could reduce the need for carriers to build as many new cell sites, directly impacting Crown Castle's core business of tower leasing. If carriers can achieve substantial capacity gains through equipment upgrades on their current sites, their incentive to invest in new tower leases diminishes. In 2024, the ongoing deployment of 5G, particularly mid-band spectrum, relies heavily on these advanced antenna systems to maximize their reach and performance.

- Massive MIMO: Enhances spectral efficiency and capacity, allowing more data transmission from a single site.

- Advanced Radio Technologies: Improve signal processing and power efficiency, extending coverage and reducing interference.

- Impact on Tower Demand: Could decrease the necessity for new tower construction as carriers optimize existing footprints.

- 5G Deployment: Relies on these technologies to meet increasing data demands and network performance expectations in 2024 and beyond.

Private 5G Networks for Enterprises

The rise of private 5G networks presents a significant threat of substitutes for traditional macro tower connectivity services. Enterprises are increasingly adopting these private networks, leveraging technologies like Citizens Broadband Radio Service (CBRS), to create dedicated, high-performance wireless solutions for specific industrial and campus environments. This allows them to bypass public carrier infrastructure for critical applications.

This trend is driven by the need for greater control, enhanced security, and tailored performance that private networks can offer. For instance, in 2024, many manufacturing plants and logistics hubs are exploring or implementing private 5G to support real-time data analytics, autonomous machinery, and enhanced operational efficiency. This directly competes with the connectivity services Crown Castle International might otherwise provide to these enterprises through its tower infrastructure.

The key substitutes here are:

- On-premises private 5G network deployments: Companies building their own cellular networks, often using shared spectrum like CBRS.

- Wi-Fi 6E/7 solutions: Advanced Wi-Fi technologies offering high bandwidth and low latency for indoor or campus-wide connectivity, potentially reducing reliance on cellular for certain use cases.

- Fixed wireless access (FWA) from alternative providers: While often using macro towers, FWA can serve as a substitute for dedicated enterprise mobile connectivity if it offers a more cost-effective or readily available solution.

The threat of substitutes for Crown Castle International's core business of providing wireless infrastructure is multifaceted, encompassing advancements in satellite technology, enhanced Wi-Fi, and private network solutions.

Emerging satellite internet services, such as Starlink, are rapidly expanding their subscriber base, with over 2.7 million users globally by mid-2024, indicating a growing acceptance for alternative connectivity, particularly in remote areas.

Furthermore, advanced Wi-Fi standards like Wi-Fi 6E and Fixed Wireless Access (FWA) are offering robust broadband alternatives, potentially reducing the need for mobile data offload from cellular towers, a trend supported by the projected growth in the FWA market throughout 2024.

The increasing adoption of private 5G networks by enterprises, driven by the desire for greater control and tailored performance, also presents a direct substitute, diverting demand from public carrier infrastructure.

| Substitute Technology | Key Characteristic | Market Trend/Data Point (2024) | Potential Impact on Crown Castle |

|---|---|---|---|

| Satellite Internet (e.g., Starlink) | Ubiquitous coverage, growing capabilities | Over 2.7 million global subscribers (mid-2024) | Siphons users seeking broad coverage over maximum bandwidth. |

| Advanced Wi-Fi (Wi-Fi 6E/7) & FWA | High-speed, direct-to-premises connectivity | Significant projected growth in FWA market. | Reduces reliance on mobile networks for data-intensive tasks. |

| Private 5G Networks | Enterprise-specific control, security, and performance | Increasing adoption in manufacturing, logistics. | Bypasses public carrier infrastructure for critical applications. |

Entrants Threaten

The communications infrastructure market, especially the cell tower segment, demands substantial initial investments. Building a nationwide network of towers, acquiring suitable land, and outfitting them with essential technology requires billions of dollars. This immense capital intensity acts as a significant deterrent, effectively blocking many potential new players from entering the arena and competing on a large scale.

New entrants into the wireless infrastructure sector, such as Crown Castle International operates within, confront substantial regulatory and permitting obstacles. This involves navigating a labyrinth of local, state, and federal requirements, including zoning laws and environmental impact assessments, which are often lengthy and costly. For instance, the process for obtaining permits for new tower construction can take upwards of 12-18 months in many jurisdictions, significantly delaying market entry and increasing upfront capital requirements.

Crown Castle, along with other established players in the U.S. cell tower market, benefits immensely from significant economies of scale. Their extensive network of over 40,000 cell towers allows them to spread fixed costs across numerous tenants, resulting in lower per-site operating expenses. This scale also enables cost-effective co-location of equipment for multiple wireless carriers on a single tower, a practice that new entrants would find difficult and expensive to replicate without substantial upfront capital and a rapid build-out strategy.

Established Customer Relationships and Long-Term Contracts

Major wireless carriers, the primary customers for tower infrastructure, often maintain deep-rooted relationships with established providers like Crown Castle. These relationships are solidified through multi-year master lease agreements, which create significant hurdles for new entrants. The switching costs associated with breaking these long-term contracts are substantial, making it challenging for newcomers to secure the crucial anchor tenants needed to generate reliable revenue and achieve profitability.

These entrenched relationships act as a formidable barrier. For instance, in 2024, the top wireless carriers in the U.S. continued to rely heavily on existing tower portfolios, demonstrating the stickiness of these customer connections. New entrants would need to offer exceptionally compelling value propositions to persuade these major players to diversify their tower access.

- Long-Term Contracts: Wireless carriers are bound by multi-year master lease agreements with incumbent tower companies.

- High Switching Costs: These agreements make it economically disadvantageous for carriers to switch providers.

- Anchor Tenant Dependency: New entrants struggle to attract initial, large tenants essential for revenue.

- Customer Loyalty: Established relationships foster loyalty, further deterring new market participants.

Limited Prime Siting Opportunities

The threat of new entrants for Crown Castle International is significantly mitigated by the scarcity of prime siting opportunities. The most desirable locations for cell towers, those offering optimal coverage and capacity, are already heavily utilized by existing infrastructure. This means new players would struggle to find and secure suitable sites, particularly in densely populated urban areas.

This difficulty in acquiring prime locations directly translates to increased costs and longer lead times for any new competitor looking to establish a presence. For instance, in 2023, the average cost for a new tower lease could range from $500 to $2,000 per month depending on the location and existing infrastructure, a significant barrier for newcomers.

- Limited Availability: Prime cell tower locations are a finite resource, largely occupied by established players like Crown Castle.

- High Acquisition Costs: Securing new sites, especially in competitive markets, involves substantial upfront investment and ongoing lease payments.

- Extended Development Timelines: Navigating zoning regulations, obtaining permits, and constructing new towers can add years to a new entrant's market entry.

- Economies of Scale: Existing operators benefit from established networks and economies of scale, making it harder for new entrants to compete on price and service.

The threat of new entrants in the wireless infrastructure sector, where Crown Castle operates, is considerably low due to immense capital requirements and the difficulty in acquiring prime locations. Established players benefit from significant economies of scale and long-term customer relationships, creating high switching costs for potential anchor tenants.

In 2024, the wireless industry continued to see consolidation and heavy investment in 5G deployment, further solidifying the position of major tower operators. New entrants would face substantial hurdles in replicating the extensive networks and established client bases of companies like Crown Castle, requiring billions in upfront investment and years to gain traction.

The scarcity of desirable tower sites, particularly in urban and suburban areas, means new entrants must contend with higher acquisition costs and longer development timelines. This, combined with the regulatory and permitting complexities, acts as a powerful deterrent, effectively limiting the number of viable new competitors.

| Barrier to Entry | Description | Impact on New Entrants |

|---|---|---|

| Capital Intensity | Building a single tower can cost $50,000 to $250,000+, with nationwide networks costing billions. | Prohibitive for most potential competitors. |

| Economies of Scale | Crown Castle's network of over 40,000 towers allows for cost efficiencies in operations and leasing. | New entrants cannot match per-site cost advantages. |

| Customer Relationships & Switching Costs | Long-term master lease agreements with major carriers create sticky customer bases. | Difficult for new entrants to secure anchor tenants needed for profitability. |

| Site Scarcity | Prime locations are already occupied, making new site acquisition costly and time-consuming. | Increases development costs and delays market entry for newcomers. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Crown Castle International is built upon a foundation of data from their annual reports and SEC filings, supplemented by insights from industry research firms and telecommunications trade publications.