Crown Castle International Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Crown Castle International Bundle

Unlock the strategic blueprint behind Crown Castle International's success with our comprehensive Business Model Canvas. This detailed analysis reveals their core customer segments, key revenue streams, and essential partnerships that drive their infrastructure dominance. Gain actionable insights into how they create and deliver value in the telecommunications sector.

Ready to dissect Crown Castle International's winning formula? Our full Business Model Canvas provides a clear, section-by-section breakdown of their value proposition, cost structure, and competitive advantages. Download this essential tool to inform your own strategic planning and competitive analysis.

Partnerships

Crown Castle's most significant relationships are with major mobile carriers such as Verizon, AT&T, and T-Mobile. These collaborations are built on long-term lease agreements, allowing these carriers to utilize space on Crown Castle's towers. This infrastructure is vital for their wireless network deployment and expansion, directly addressing the ever-growing demand for data services.

Crown Castle International relies heavily on specialized tower construction and maintenance contractors to manage its vast infrastructure. Key partners like MasTec, Inc., and Goodman Networks are crucial for building new towers, performing routine maintenance, and executing upgrades to support evolving communication needs.

These strategic alliances ensure Crown Castle’s nearly 115,000 towers remain in optimal condition and are equipped to handle the demands of 5G and future technologies. In 2024, the company continued to leverage these relationships to maintain its competitive edge in the distributed antenna system and small cell markets.

Crown Castle's ability to operate and expand its network hinges on its crucial partnerships with real estate property owners and managers. These collaborations are essential for securing the physical locations needed for its extensive infrastructure, including cell towers and small cells.

The company actively engages with private landowners and municipalities to establish lease agreements, granting access to prime real estate. As of the end of 2023, Crown Castle's portfolio included leases for more than 40,000 private land locations and over 5,500 municipal properties, underscoring the scale of these vital relationships.

Technology Equipment Manufacturers

Crown Castle's strategic alliances with leading technology equipment manufacturers, including names like Ericsson, Nokia, and CommScope, are fundamental to its business model. These partnerships are crucial for ensuring that the diverse wireless communication technologies deployed across Crown Castle's extensive infrastructure are fully compatible and up-to-date.

These collaborations are not merely about sourcing equipment; they actively support the seamless integration and deployment of the newest wireless technologies onto Crown Castle's existing network of towers and fiber. This proactive engagement allows Crown Castle to stay at the forefront of technological advancements, facilitating the rollout of services like 5G and beyond.

- Ericsson, Nokia, and CommScope are key technology partners, ensuring access to cutting-edge wireless equipment.

- These partnerships facilitate the **deployment of new technologies**, such as 5G, on Crown Castle's infrastructure.

- Collaborations guarantee **equipment compatibility** and the continuous integration of the latest advancements in wireless communication.

Wireless Infrastructure Service Providers

Crown Castle collaborates with more than 75 wireless infrastructure service providers. These partnerships are crucial for delivering a full spectrum of services, encompassing infrastructure management and the deployment of small cell solutions.

These collaborations are vital for optimizing the operational efficiency and expanding the market reach of Crown Castle's extensive network infrastructure. By leveraging these relationships, Crown Castle can more effectively manage and deploy its assets across the country.

- Extensive Network: Over 75 service providers are engaged.

- Service Scope: Partnerships cover infrastructure management and small cell solutions.

- Efficiency Gains: These relationships enhance operational effectiveness.

- Market Reach: Collaborations expand the availability of Crown Castle's services.

Crown Castle's key partnerships are essential for its operational success and expansion. Major mobile carriers like Verizon, AT&T, and T-Mobile rely on Crown Castle's towers for their network deployment, forming the backbone of wireless communication. These relationships are solidified through long-term lease agreements, directly addressing the escalating demand for data services.

| Partner Type | Key Partners | Role | Impact |

|---|---|---|---|

| Mobile Carriers | Verizon, AT&T, T-Mobile | Lease tower space for network deployment | Enables wireless network expansion and data service delivery |

| Infrastructure Services | MasTec, Inc., Goodman Networks | Tower construction and maintenance | Ensures infrastructure integrity and upgrades for new technologies |

| Technology Manufacturers | Ericsson, Nokia, CommScope | Provide and integrate wireless equipment | Facilitates deployment of 5G and ensures technology compatibility |

| Real Estate | Private landowners, Municipalities | Provide locations for towers and small cells | Secures physical sites for extensive infrastructure development |

What is included in the product

This Business Model Canvas outlines Crown Castle's strategy of owning, operating, and leasing shared telecommunications infrastructure, focusing on recurring revenue from wireless carriers and fiber customers.

It details customer segments, channels, and value propositions, reflecting real-world operations for presentations and funding discussions.

Crown Castle International's Business Model Canvas provides a clear, one-page snapshot that simplifies complex infrastructure strategies, alleviating the pain of understanding their vast network and service offerings.

Activities

Crown Castle's primary activity is building and managing its extensive network of shared communications infrastructure, mainly cell towers. This involves acquiring land, constructing towers, and maintaining them to ensure reliable service for tenants.

As of the end of 2024, Crown Castle owned and operated a significant portfolio of over 42,957 towers across the United States. This vast network is the backbone of their business, providing essential connectivity for wireless carriers and other communication providers.

The management aspect includes leasing space on these towers to multiple customers, a strategy that maximizes revenue from each asset. This shared infrastructure model is key to their profitability and market position.

Crown Castle's core activity revolves around leasing available space on its extensive network of towers to various wireless service providers and mobile carriers. This is the fundamental pillar of their site leasing strategy.

The colocation model is key, allowing multiple tenants to share the same tower infrastructure. This efficiency not only benefits Crown Castle by maximizing revenue per asset but also provides a cost-effective solution for customers looking to expand their wireless footprint.

In 2024, Crown Castle continued to benefit from this model, with over 40,000 towers and significant fiber miles, enabling them to serve a broad customer base and facilitate network densification essential for 5G deployment.

Crown Castle is deeply involved in making wireless networks denser and better, especially as 5G rolls out. This means they're working to make their existing towers work even better and building new ones where they're needed most to handle all the extra data people are using.

In 2024, Crown Castle continued to invest heavily in these network upgrades. Their strategy focuses on optimizing their vast portfolio of over 80,000 cell towers and 115,000 miles of fiber cable to support the increasing bandwidth demands of 5G and future wireless technologies.

Operational Efficiency and Cost Management

Crown Castle International is actively pursuing operational efficiency and cost management, particularly after its strategic divestiture of certain fiber and small cell assets. This focus aims to streamline operations and reduce overall overhead.

Key initiatives contributing to this effort include staffing reductions and office consolidations, designed to create a leaner organizational structure. Furthermore, the company is investing in process automation to enhance productivity and minimize manual intervention.

For instance, in the first quarter of 2024, Crown Castle reported a significant reduction in operating expenses, partly attributable to these efficiency drives. The company's commitment to cost management is evident as it navigates its evolving business portfolio.

- Streamlined Operations: Post-divestiture, the company is optimizing its remaining infrastructure and service delivery processes.

- Cost Reduction Initiatives: Actions like staffing adjustments and office closures are directly impacting overhead expenses.

- Process Automation: Implementing technology to automate tasks is a key strategy for improving efficiency and reducing labor costs.

- Financial Impact: These efforts are expected to contribute positively to the company's bottom line by lowering operating expenditures.

Capital Allocation and Financial Management

Crown Castle's key activities center on meticulously managing its financial resources. This includes strategic debt reduction to strengthen its balance sheet, a clear dividend policy to reward shareholders, and disciplined capital expenditures aimed at expanding its fiber and small cell networks. The company's focus is on optimizing free cash flow generation, a critical metric for its business model.

In 2024, Crown Castle is expected to continue its emphasis on efficient capital deployment. The company's strategy aims to enhance shareholder returns by balancing growth investments with financial prudence.

- Debt Management: Crown Castle actively manages its debt obligations, seeking to optimize its capital structure and reduce borrowing costs.

- Dividend Policy: The company maintains a dividend policy designed to provide consistent returns to its investors, reflecting its commitment to shareholder value.

- Capital Expenditures: Strategic investments in its network infrastructure, including fiber optic cables and small cells, are a core activity to support future growth and service demand.

- Free Cash Flow Optimization: A primary objective is to maximize free cash flow, which is then allocated towards debt reduction, dividends, and reinvestment in the business.

Crown Castle's key activities revolve around the leasing of space on its extensive tower network to wireless carriers and other communication providers. This includes managing the acquisition, construction, and maintenance of over 42,957 towers across the United States as of the close of 2024. The company also focuses on expanding its fiber and small cell networks to support the growing demand for 5G and increased data usage.

Operational efficiency and cost management are critical. Following strategic divestitures, Crown Castle is streamlining operations through initiatives like staffing reductions and office consolidations, aiming to improve productivity and reduce overhead. Process automation is also a key focus to enhance efficiency.

Financial management is paramount, with activities including strategic debt reduction, maintaining a clear dividend policy for shareholders, and disciplined capital expenditures. The company prioritizes optimizing free cash flow generation, which is then used for debt reduction, dividends, and reinvestment.

| Activity Area | Key Actions | 2024 Focus/Data |

|---|---|---|

| Infrastructure Management | Acquire, build, and maintain cell towers | Operated over 42,957 towers; investing in network upgrades for 5G |

| Site Leasing & Colocation | Lease tower space to multiple tenants | Maximizing revenue through shared infrastructure model |

| Network Expansion | Deploy fiber and small cells | Supporting densification and increased bandwidth demands |

| Operational Efficiency | Streamline processes, reduce costs | Staffing reductions, office consolidations, process automation |

| Financial Management | Manage debt, pay dividends, control capex | Focus on debt reduction and free cash flow optimization |

Preview Before You Purchase

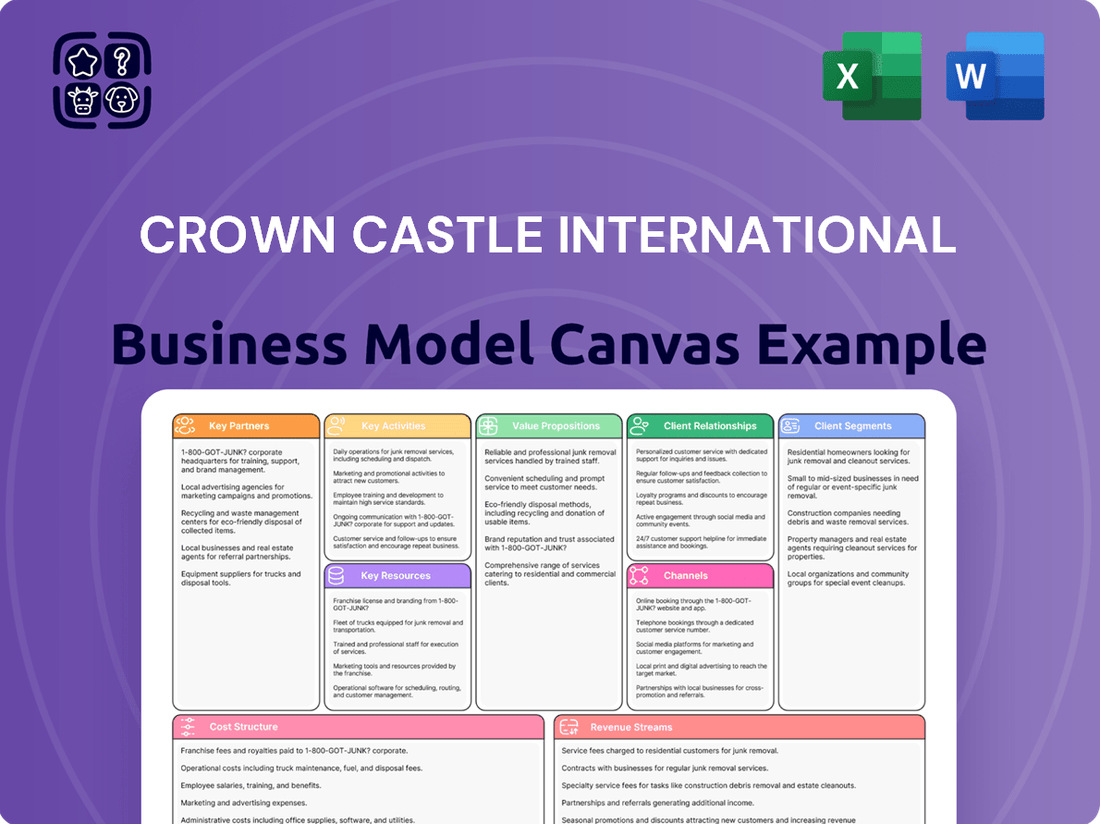

Business Model Canvas

The Crown Castle International Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means you're seeing a direct representation of the comprehensive analysis of Crown Castle's operations, including key partners, activities, resources, value propositions, customer relationships, channels, customer segments, cost structure, and revenue streams. You can be assured that the purchased file will be identical in content and structure, providing you with a complete and ready-to-use resource.

Resources

Crown Castle's extensive tower portfolio, numbering around 40,000 sites across the U.S., is its cornerstone asset, forming the backbone of wireless connectivity. This vast network is strategically positioned to serve the growing demand for mobile data and 5G deployment.

This significant infrastructure enables Crown Castle to offer essential services to major wireless carriers, providing them with access to prime locations for their antennas. As of late 2023, the company continued to expand its footprint, demonstrating ongoing investment in this critical resource.

Crown Castle's fiber optic cable network, spanning approximately 115,000 miles as of early 2024, remains a vital asset even with strategic divestitures. This extensive infrastructure underpins its tower operations, ensuring robust connectivity for its distributed antenna systems (DAS) and small cells, which are essential for meeting increasing mobile data demands.

The fiber network is not just a support system; it's a key enabler of high-speed data transmission, crucial for 5G deployment and future network enhancements. Crown Castle's continued investment in this network highlights its strategic importance in providing dense and reliable connectivity solutions across its markets.

Crown Castle's skilled workforce is a cornerstone, boasting expertise in telecommunications infrastructure, engineering, operations, and client relations. This deep knowledge is critical for the efficient deployment, ongoing maintenance, and seamless delivery of their services, ensuring network reliability for their customers.

In 2024, Crown Castle highlighted its investment in its people, recognizing that specialized skills in areas like fiber optic network construction and small cell technology are essential for staying ahead. The company's commitment to training and development ensures its teams possess the cutting-edge knowledge required to manage complex infrastructure projects and evolving technological landscapes.

Long-Term Lease Agreements

Crown Castle's long-term lease agreements with major mobile carriers are the bedrock of its revenue generation. These agreements, often spanning 10-15 years, provide a highly predictable and stable income stream, underpinning the company's financial stability and ability to invest in its infrastructure. For example, in 2024, Crown Castle reported substantial recurring revenue directly tied to these essential customer relationships.

These extensive contracts offer a robust foundation for Crown Castle's ongoing expansion and strategic development. The visibility into future cash flows allows for confident capital allocation towards network densification and the acquisition of new sites, crucial for meeting the ever-increasing demand for wireless data. This predictable revenue is key to their growth strategy.

- Anchor Tenancy: Long-term leases with major carriers act as anchor tenants, ensuring consistent occupancy and revenue.

- Revenue Predictability: These agreements provide a reliable and forecastable revenue stream, reducing financial volatility.

- Infrastructure Investment: The stability allows Crown Castle to confidently invest in expanding and upgrading its network infrastructure.

- Customer Retention: The lengthy nature of these contracts fosters strong customer loyalty and reduces churn.

Financial Capital and Investment Capabilities

Crown Castle's financial capital and investment capabilities are foundational to its business model, enabling it to acquire, build, and maintain its extensive portfolio of communications infrastructure. This robust financial footing allows for significant capital deployment, crucial for staying ahead in a rapidly evolving industry.

The company’s access to substantial credit facilities and its proven investment capabilities are key differentiators. These resources directly fuel its strategic growth initiatives, including the expansion of its fiber network and the deployment of small cells, which are vital for supporting 5G and future wireless technologies.

- Access to Capital: Crown Castle maintained significant financial flexibility. As of the first quarter of 2024, the company reported total debt of approximately $20.4 billion, demonstrating its capacity to leverage debt financing for growth initiatives.

- Investment in Infrastructure: The company consistently invests billions annually in network expansion and upgrades. For example, in 2023, Crown Castle invested roughly $2.6 billion in capital expenditures, primarily focused on fiber construction and small cell deployments.

- Strategic Acquisitions: Its financial strength allows for opportunistic acquisitions that enhance its network density and market reach. These investments are crucial for maintaining its competitive advantage and meeting increasing customer demand for wireless capacity.

Crown Castle's key resources are its vast physical infrastructure, including around 40,000 towers and 115,000 miles of fiber optic cable as of early 2024. These assets form the backbone for wireless communication services. Its long-term lease agreements with major wireless carriers provide a predictable and substantial revenue stream, ensuring financial stability.

| Key Resource | Description | 2023/2024 Data Points |

| Tower Portfolio | Extensive network of approximately 40,000 towers across the U.S. | Core asset for wireless carrier antenna placement. |

| Fiber Optic Network | Approximately 115,000 miles of fiber optic cable. | Supports tower operations, DAS, and small cells for 5G. |

| Long-Term Leases | Agreements with major mobile carriers, typically 10-15 years. | Generate predictable recurring revenue, underpinning financial stability. |

| Skilled Workforce | Expertise in telecommunications infrastructure, engineering, and operations. | Essential for network deployment, maintenance, and client relations. |

| Financial Capital | Access to substantial credit facilities and investment capabilities. | Enabled approximately $2.6 billion in capital expenditures in 2023. |

Value Propositions

Crown Castle is essential for mobile carriers looking to build out their wireless networks, especially with the growing demand for 5G. They provide the physical infrastructure, like cell towers and small cells, that these carriers need to operate and expand their services.

The company’s extensive network of over 115,000 miles of fiber and 40,000 cell towers across the U.S. is a key asset. This infrastructure is vital for the densification required by 5G, allowing for faster speeds and lower latency by placing more antennas closer together.

In 2024, Crown Castle continued to invest heavily in its fiber and small cell networks, recognizing the ongoing need for robust wireless infrastructure. This investment directly supports the deployment of 5G technology, enabling enhanced mobile broadband and new enterprise applications.

Crown Castle's cost-effective shared infrastructure is a cornerstone of their business model. By allowing multiple tenants, like wireless carriers, to colocate their equipment on a single tower, they drastically reduce the need for each company to build its own separate infrastructure. This shared approach directly translates into lower costs for their customers, making it a significantly more economical solution for expanding network coverage.

This efficiency is a major draw. In 2024, the demand for wireless data continues to surge, pushing carriers to densify their networks. Crown Castle's shared infrastructure allows them to deploy new sites and upgrades much faster and at a fraction of the cost compared to traditional builds. For instance, a single tower can support numerous antennas and small cells, accommodating the evolving needs of 5G and future wireless technologies without requiring extensive, individual construction projects for each carrier.

Crown Castle's extensive geographic coverage, particularly its vast network of over 40,000 cell towers across the United States, is a cornerstone of its value proposition. This allows customers, such as major wireless carriers, to efficiently expand their network footprints and reach a significantly broader user base without the capital expenditure of building their own infrastructure.

Reliability and Scalability of Infrastructure

Crown Castle provides robust and adaptable telecommunications infrastructure, crucial for meeting the ever-growing demand for data. This inherent reliability ensures that customers experience consistent and high-quality network performance, even as usage escalates.

The company’s infrastructure is designed for scalability, allowing it to seamlessly accommodate future increases in data traffic and connectivity needs. This forward-thinking approach guarantees sustained capacity for its diverse client base.

- Infrastructure Reliability: Crown Castle's network uptime consistently exceeds 99.9%, a critical factor for wireless carriers and businesses reliant on uninterrupted connectivity.

- Scalability for Demand: The company actively invests in expanding its fiber and small cell networks, anticipating and supporting the projected 5G data traffic growth, which is expected to more than double by 2026.

- Capacity Assurance: By offering flexible solutions, Crown Castle ensures its customers have the necessary bandwidth and infrastructure to support their evolving operational requirements and user demands.

Expertise in Infrastructure Management and Support

Crown Castle offers specialized expertise in managing and supporting its extensive network of cell towers and fiber optic cables. This allows their customers, primarily wireless carriers and businesses, to outsource the complexities of infrastructure maintenance and operations. By entrusting Crown Castle with these critical functions, clients can concentrate on developing and delivering their core services, such as mobile connectivity and data transmission.

This value proposition is crucial for customers needing a reliable network backbone without the capital expenditure and operational burden of owning and managing such assets. For instance, in 2024, the demand for robust wireless infrastructure continues to surge with the rollout of 5G, making expert management a key differentiator.

- Network Reliability: Crown Castle's expertise ensures high uptime and performance for customer networks.

- Operational Efficiency: Clients reduce their operational costs and complexity by outsourcing infrastructure management.

- Focus on Core Business: This allows customers to dedicate resources to innovation and service delivery.

- Scalability: Crown Castle's managed services can adapt to evolving customer needs and network growth.

Crown Castle’s extensive network of over 115,000 miles of fiber and 40,000 cell towers across the U.S. provides essential wireless infrastructure for mobile carriers, particularly for 5G deployment. Their shared infrastructure model significantly lowers costs for customers by allowing multiple tenants to colocate equipment on a single site, a critical advantage as wireless data demand surges in 2024.

The company's value proposition centers on providing reliable, scalable, and geographically diverse telecommunications infrastructure. By offering managed services, Crown Castle allows clients to outsource infrastructure complexities, enabling them to focus on their core business operations and service delivery, a crucial benefit for carriers expanding 5G capabilities.

| Value Proposition Element | Description | Customer Benefit | 2024 Relevance |

|---|---|---|---|

| Extensive Network Access | Over 40,000 cell towers and 115,000 miles of fiber across the U.S. | Efficient network expansion, broad user reach, reduced capital expenditure for carriers. | Supports the densification required for 5G, enabling faster speeds and lower latency. |

| Shared Infrastructure Cost Savings | Multiple tenants colocate on single sites. | Drastically lower costs for carriers compared to building individual infrastructure. | Makes network upgrades and new site deployments more economical as wireless data demand grows. |

| Expert Infrastructure Management | Outsourced maintenance and operations of towers and fiber. | Clients can focus on core services, reduce operational burden and costs. | Crucial for carriers navigating the complexities of 5G rollout and network evolution. |

Customer Relationships

Crown Castle assigns dedicated account management teams to its key mobile carrier clients. This approach is crucial for building and sustaining robust, long-term partnerships. These teams act as a direct liaison, ensuring that the specific and often complex network requirements of these major customers are met with precision and efficiency.

By providing responsive support and developing customized solutions, Crown Castle's dedicated account managers help carriers navigate their evolving network infrastructure needs. This focus on personalized service strengthens customer loyalty and positions Crown Castle as a vital partner in the carriers' ongoing expansion and technological advancements.

Crown Castle prioritizes long-term relationships, often securing multi-year master lease agreements with its clients. This strategy fosters stability and shared advantages within the dynamic telecommunications sector.

In 2023, Crown Castle reported that approximately 98% of its total revenue was derived from recurring sources, largely due to these extended agreements, highlighting the strength of its customer partnerships.

Crown Castle offers robust technical support, assisting customers with the integration and ongoing performance of their equipment on its extensive network of towers and fiber. This hands-on approach ensures that clients can maximize the utilization of Crown Castle's infrastructure.

Operational collaboration is key, with Crown Castle working alongside customers to streamline deployments and troubleshoot any issues that arise. This partnership is crucial for maintaining the high availability and efficiency that businesses rely on for their wireless and wired communications.

Solution-Oriented Engagement

Crown Castle's customer relationships are fundamentally solution-oriented, focusing on addressing the critical network expansion and densification needs of wireless carriers and other communication companies. They actively partner with clients to pinpoint the most effective locations and setups for deploying their essential infrastructure.

This collaborative approach ensures that customers can efficiently scale their networks to meet growing demand. For instance, in 2024, Crown Castle continued to invest heavily in its fiber network, a key component in enabling these densification solutions. Their efforts are geared towards making network deployment seamless and effective for their clients.

- Site Identification: Crown Castle assists customers in finding optimal locations for small cells and other network equipment, considering factors like coverage gaps and population density.

- Configuration Expertise: They provide guidance on the best configurations for equipment placement to maximize performance and minimize interference.

- Network Densification Support: The company's infrastructure is designed to facilitate the addition of more cell sites, crucial for improving capacity and speed in urban and suburban areas.

- Strategic Partnerships: Building long-term relationships by offering tailored solutions that align with customers' evolving network strategies and deployment timelines.

High Renewal Rates and Customer Retention

Crown Castle's infrastructure business naturally fosters high customer retention. This is clearly demonstrated by their strong tower lease renewal rates, a key indicator of customer satisfaction and reliance on their essential network infrastructure.

- Tower Lease Renewals: Crown Castle consistently achieves high renewal rates on its tower leases, typically exceeding 95%, reflecting the sticky nature of its customer relationships.

- Customer Reliance: The critical nature of wireless communication infrastructure means customers, primarily wireless carriers, have significant incentives to renew their leases rather than incur the substantial costs and disruptions of relocating.

- Long-Term Contracts: Leases are often long-term, providing a stable revenue stream and reinforcing customer loyalty as contracts extend over many years.

Crown Castle's customer relationships are built on providing essential infrastructure solutions and maintaining long-term partnerships, primarily with wireless carriers. They act as a strategic partner, offering dedicated account management and robust technical support to ensure clients can effectively deploy and manage their network equipment.

| Customer Relationship Aspect | Description | Supporting Data/Fact |

|---|---|---|

| Dedicated Account Management | Key clients are assigned dedicated teams to manage their specific network needs and foster long-term partnerships. | Crucial for meeting complex requirements of major mobile carriers. |

| Solution-Oriented Approach | Focus on addressing network expansion and densification needs through collaborative site identification and configuration. | 2024 investments in fiber network facilitate seamless client deployments. |

| High Customer Retention | Characterized by strong tower lease renewal rates and long-term contracts, indicating customer reliance and satisfaction. | Tower lease renewal rates consistently exceed 95%. |

| Recurring Revenue Model | The majority of revenue stems from recurring sources, largely due to extended agreements. | Approximately 98% of total revenue was recurring in 2023. |

Channels

Crown Castle's direct sales and business development teams are crucial for securing long-term partnerships with major mobile carriers and large enterprise clients. These teams focus on building strong relationships and negotiating complex, multi-year contracts for tower leases and fiber connectivity. In 2024, Crown Castle continued to leverage these teams to expand its footprint and revenue streams by securing new deals and renewals.

Crown Castle's online portals and customer platforms are crucial for streamlining operations. These digital tools allow customers to easily manage their leases, access vital technical specifications, and submit service requests, all contributing to smoother communication and enhanced operational efficiency.

Crown Castle leverages industry conferences and trade shows as a key channel to directly engage with potential clients, demonstrating its comprehensive fiber and small cell network solutions. These events are crucial for networking, allowing the company to connect with telecommunications providers, tower companies, and enterprise clients seeking robust infrastructure.

In 2024, Crown Castle's presence at major telecom events like Mobile World Congress and TowerXchange Meetups provided significant opportunities to highlight its expanding network footprint and advanced technology offerings. Such participation directly supports lead generation and partnership development, vital for its growth strategy in the dynamic wireless infrastructure sector.

Referral Networks and Strategic Alliances

Crown Castle leverages its extensive referral networks and strategic alliances within the telecommunications sector to uncover new business prospects and broaden its customer reach. These partnerships are crucial for staying ahead in a dynamic market.

By collaborating with key players, Crown Castle can access a wider array of potential clients and understand emerging market needs more effectively. This proactive approach fuels growth and strengthens its market position.

- Referral Networks: Building strong relationships with tower owners, equipment manufacturers, and service providers creates a continuous flow of potential new tenant opportunities.

- Strategic Alliances: Partnerships with mobile network operators (MNOs) and internet service providers (ISPs) are fundamental for securing long-term leases and expanding the fiber network.

- Market Expansion: Alliances with companies in adjacent industries, like utilities or public safety, can open doors to new infrastructure deployment projects.

Investor Relations and Public Communications

Investor Relations and Public Communications are crucial for Crown Castle International. While their primary audience is the investment community, these channels significantly shape how potential and existing customers perceive the company.

By transparently sharing Crown Castle's financial health, strategic vision, and industry leadership, the company builds confidence. This confidence can translate into stronger customer relationships and a competitive edge, as clients see a stable and forward-thinking partner. For instance, Crown Castle's 2024 investor presentations often highlight their significant capital expenditures in network expansion, demonstrating a commitment to future growth that reassures both investors and large enterprise clients.

- Demonstrates Stability: Regular financial reporting and shareholder updates, like those provided in quarterly earnings calls, showcase Crown Castle's consistent performance and financial resilience, assuring customers of their long-term viability.

- Communicates Strategic Direction: Publicly outlining expansion plans and technology investments, such as their focus on 5G infrastructure in 2024, signals to customers that Crown Castle is a proactive leader invested in meeting future connectivity demands.

- Builds Industry Credibility: Participating in industry forums and issuing press releases about network buildouts and partnerships reinforces Crown Castle's position as a key player, enhancing trust among potential business clients.

- Attracts and Retains Business: A strong public image, bolstered by positive investor sentiment and clear communication of value, indirectly supports customer acquisition and retention by presenting Crown Castle as a reliable and innovative service provider.

Crown Castle's direct sales and business development teams are pivotal for securing long-term agreements with major mobile carriers and large enterprise clients. These teams are instrumental in building robust relationships and negotiating complex, multi-year contracts for tower leases and fiber connectivity. In 2024, Crown Castle continued to leverage these dedicated teams to expand its market presence and revenue streams through the acquisition of new deals and renewals, underscoring their importance in driving business growth.

Online portals and customer platforms are essential for streamlining Crown Castle's operations, enabling clients to manage leases, access technical specifications, and submit service requests efficiently. This digital infrastructure enhances communication and operational effectiveness, supporting a seamless customer experience. The company's commitment to digital tools was evident in 2024 with ongoing enhancements to these platforms to further improve user interaction and service delivery.

Crown Castle actively participates in industry conferences and trade shows, serving as a crucial channel to directly engage with potential clients and showcase its comprehensive fiber and small cell network solutions. These events are vital for networking, connecting the company with telecommunications providers, tower companies, and enterprise clients seeking advanced infrastructure. In 2024, participation in events like Mobile World Congress allowed Crown Castle to highlight its expanding network footprint and technological advancements, directly supporting lead generation and partnership development in the fast-evolving wireless infrastructure sector.

Strategic alliances and referral networks are key channels for Crown Castle to identify new business opportunities and broaden its customer reach within the telecommunications industry. These collaborations are fundamental for maintaining a competitive edge and understanding evolving market demands. By fostering partnerships with key industry players, Crown Castle gains access to a wider client base and deeper market insights, fueling its growth and reinforcing its market position.

Investor relations and public communications, while primarily targeting the investment community, significantly influence how potential and existing customers perceive Crown Castle. Transparent sharing of financial health, strategic direction, and industry leadership builds confidence, which in turn strengthens customer relationships and provides a competitive advantage. For example, Crown Castle's 2024 investor presentations highlighted substantial capital expenditures in network expansion, signaling a commitment to future growth that reassures both investors and large enterprise clients.

Customer Segments

Major Mobile Network Operators (MNOs) like Verizon, AT&T, and T-Mobile are Crown Castle's core clientele. These giants lease significant tower space to expand their wireless network reach across the United States, forming the backbone of Crown Castle's revenue. In 2023, these MNOs continued to drive demand for small cells and fiber, essential for 5G deployment.

Internet Service Providers (ISPs) are a key customer segment for Crown Castle, leveraging their extensive fiber and small cell networks to extend broadband and wireless internet services. This partnership is crucial for ISPs aiming to reach underserved areas or boost capacity in high-demand urban environments. For instance, Crown Castle's 2024 capital expenditures are heavily focused on expanding their fiber footprint, directly benefiting ISPs looking to deploy their services more effectively.

Broadcast and media companies are key clients, utilizing Crown Castle's extensive network of towers to transmit radio and television signals. These companies rely on this infrastructure for essential content distribution, making them a stable revenue source.

In 2024, the media and entertainment industry continued its reliance on robust broadcast infrastructure, with companies actively seeking reliable tower access to reach their audiences. Crown Castle's offerings are vital for this sector’s operational continuity and expansion.

Government and Public Safety Agencies

Government and public safety agencies rely heavily on Crown Castle's extensive network infrastructure. This includes their fiber and small cell networks, which are crucial for maintaining uninterrupted communication for emergency responders and various public services. In 2024, Crown Castle continued to invest in expanding its footprint to meet the growing demand for reliable connectivity in these critical sectors.

These entities utilize Crown Castle's assets for a range of essential functions:

- Emergency Services Communication: Ensuring first responders have consistent and robust communication capabilities, especially during critical incidents.

- Public Administration Networks: Supporting the operational needs of government offices and public services that require secure and reliable data transmission.

- Smart City Initiatives: Providing the backbone for connected infrastructure in public safety applications, such as traffic management and surveillance systems.

- Disaster Preparedness: Offering resilient communication solutions that can withstand adverse conditions and maintain connectivity when it's needed most.

Other Telecommunications and Technology Companies

This segment encompasses a broad array of telecommunications and technology firms beyond the major carriers. These companies, including specialized wireless providers, IoT solution developers, and emerging tech firms, rely on Crown Castle's infrastructure for their unique network needs. For instance, a company developing a new 5G-enabled smart city application might lease fiber optic lines and small cells to connect sensors and data hubs across urban areas.

Crown Castle's extensive network of towers, fiber, and small cells provides essential connectivity for these diverse technology players. In 2024, the demand for robust, flexible infrastructure continues to grow as more businesses integrate advanced technologies. These customers often require tailored solutions, such as dedicated fiber routes or specific tower locations, to support their innovative projects and expand their service offerings.

Key characteristics of this customer segment include:

- Specialized Network Requirements: Firms needing specific bandwidth, low latency, or coverage for niche applications like private wireless networks or advanced data analytics.

- Scalability Needs: Technology companies experiencing rapid growth often require infrastructure that can easily scale with their expanding user base and service portfolio.

- Innovation Focus: Businesses at the forefront of technological advancement, such as those in AI, virtual reality, or autonomous systems, depend on reliable, high-capacity connectivity.

- Geographic Reach: Companies looking to deploy services across multiple markets benefit from Crown Castle's broad national footprint.

Crown Castle's customer base is diverse, primarily serving major Mobile Network Operators (MNOs) like Verizon, AT&T, and T-Mobile, who are crucial for expanding wireless networks. Internet Service Providers (ISPs) also leverage Crown Castle's fiber and small cell networks for broadband expansion, with 2024 capital expenditures focused on this growth. Broadcast and media companies rely on Crown Castle's towers for signal transmission, ensuring stable revenue streams, while government and public safety agencies utilize the infrastructure for critical communications. The company also serves a broad range of other technology firms, including specialized wireless providers and IoT developers, who require flexible and scalable solutions for their innovative projects.

| Customer Segment | Key Needs Addressed | 2024 Focus/Activity |

|---|---|---|

| Major MNOs | Network expansion, 5G deployment | Continued demand for small cells and fiber |

| ISPs | Broadband expansion, reaching underserved areas | Fiber footprint expansion |

| Broadcast/Media | Signal transmission, content distribution | Reliable tower access for audience reach |

| Government/Public Safety | Emergency communication, public administration networks | Investment in expanding footprint for critical sectors |

| Other Tech Firms | Specialized connectivity, scalability, innovation support | Tailored solutions for advanced technology projects |

Cost Structure

Crown Castle International incurs substantial operating expenses for maintaining its extensive network of over 115,000 cell towers and related infrastructure. These costs are critical for ensuring the reliability and functionality of their assets.

Key expenses include regular site maintenance, which encompasses physical upkeep and repairs to ensure tower integrity and safety. Additionally, utility costs for powering the equipment at each site represent a significant ongoing expenditure. Ground leases, payments made to property owners for the land on which towers are situated, are also a major component of infrastructure maintenance costs.

In 2023, Crown Castle reported approximately $1.3 billion in site rental revenue, with a significant portion of this flowing back into the operational costs of managing and maintaining these sites. While specific figures for infrastructure maintenance alone are not always broken out distinctly, these categories collectively represent a substantial portion of their overall operating expenses.

Selling, General, and Administrative (SG&A) expenses for Crown Castle include significant costs related to corporate overhead, essential administrative functions, dedicated sales and marketing initiatives, and overall staffing. These are crucial for managing a vast network of infrastructure and customer relationships.

In recent periods, Crown Castle has actively pursued strategies to optimize its SG&A. This includes implementing operational efficiencies and, notably, undertaking staffing reductions. For instance, in the first quarter of 2024, the company reported SG&A expenses of $311 million, a decrease from $327 million in the same period of 2023, reflecting these cost-saving efforts.

As a Real Estate Investment Trust (REIT), Crown Castle International significantly relies on debt financing to acquire and develop its extensive portfolio of cell towers and fiber networks. This substantial debt load directly translates into considerable interest expenses, a key component of its cost structure.

For instance, in the first quarter of 2024, Crown Castle reported interest expense of approximately $317 million. Managing this debt effectively and maintaining an optimal leverage ratio is a critical financial strategy for the company, directly impacting its profitability and ability to generate shareholder returns.

Capital Expenditures (CapEx)

Crown Castle's capital expenditures are primarily directed towards building new infrastructure and upgrading existing assets. This includes the construction of new cell towers, modifying current ones, and acquiring the land beneath these towers to secure long-term operational control. These investments are crucial for expanding their network capacity and improving service quality for their customers.

The company anticipates that its net capital expenditures will range between $150 million and $250 million annually following the divestiture of its fiber business. This ongoing investment strategy reflects a commitment to maintaining and growing its core tower and small cell portfolio, ensuring it remains a leading provider of shared wireless infrastructure.

- Infrastructure Development: Funding for new tower construction and the acquisition of land rights.

- Technology Enhancements: Investments in systems and processes to improve operational efficiency and service delivery.

- Post-Fiber Sale Outlook: Projected annual net capital expenditures of $150 million to $250 million.

- Strategic Focus: Continued investment in core tower and small cell assets.

Property Lease Expenses and Site Rents

Crown Castle International's cost structure is heavily influenced by property lease expenses and site rents, representing a substantial ongoing operational outlay. These costs are directly tied to the company's extensive network of cell towers and related infrastructure, which are often situated on land leased from a diverse range of lessors, including private property owners and various municipal entities.

These recurring lease payments are a critical component of Crown Castle's operating expenses, directly impacting its profitability. The company's ability to manage and negotiate these lease agreements is therefore fundamental to its financial performance. For instance, as of the first quarter of 2024, Crown Castle reported significant capital expenditures, a portion of which is allocated to securing and maintaining these crucial site leases.

- Lease Agreements: Crown Castle enters into long-term lease agreements for tower sites, often with escalating rent clauses.

- Landowner Diversity: Leases are secured from private individuals, corporations, and government bodies, each with unique terms and conditions.

- Municipal Leases: Agreements with municipalities for tower locations on public land can involve specific fees and regulatory requirements.

- Ongoing Costs: These lease payments are a consistent and significant expense, essential for maintaining access to critical infrastructure locations.

Crown Castle's cost structure is dominated by operating expenses, including site maintenance, utilities, and ground leases for its extensive cell tower network. Selling, General, and Administrative (SG&A) expenses are also significant, though efforts are underway to optimize these costs. The company's reliance on debt financing results in substantial interest expenses, and capital expenditures are directed towards infrastructure development and upgrades.

| Expense Category | Q1 2024 (Millions USD) | Q1 2023 (Millions USD) | Key Drivers |

|---|---|---|---|

| Site Rental Revenue | N/A (Reported annually) | 1,300 (2023 Annual) | Lease payments from tower tenants |

| Site Maintenance & Operations | Significant portion of operating expenses | Significant portion of operating expenses | Physical upkeep, utilities, ground leases |

| Selling, General & Administrative (SG&A) | 311 | 327 | Corporate overhead, staffing, sales & marketing |

| Interest Expense | 317 | N/A (Q1 2024 specific) | Debt financing for acquisitions and development |

| Net Capital Expenditures (Projected Post-Fiber Divestiture) | 150-250 (Annual) | N/A | New tower construction, upgrades, land acquisition |

Revenue Streams

Crown Castle's main income comes from renting out space on its cell towers. Mobile carriers and other companies pay to put their equipment on these towers, creating a steady and predictable revenue flow. This is largely thanks to long-term contracts that lock in income, with the company anticipating around 4.7% organic growth in this area for 2025.

Crown Castle's Services and Other Revenues segment encompasses a range of offerings beyond core tower leasing. This includes crucial site development, installation, and ongoing support services for customer equipment deployed on their extensive fiber and small cell infrastructure. These services are vital for ensuring seamless operations and maximizing the utility of Crown Castle's assets for their clients.

In 2024, Crown Castle continues to see robust demand for these ancillary services, driven by the ongoing expansion of 5G networks and the increasing complexity of wireless deployments. While specific segment breakdowns for 2024 are still emerging, the company's historical performance indicates that these services contribute a meaningful, albeit smaller, portion to overall revenue, complementing their primary leasing income.

Crown Castle International generates revenue from co-location and amendment fees, which represent a significant portion of their organic growth. These fees are collected when new tenants add their equipment to existing towers or when current tenants expand their footprint by adding more equipment.

In 2024, these recurring revenue streams are crucial for Crown Castle's financial performance. For instance, the company reported substantial growth in its site rental revenues, which are directly tied to these co-location and amendment activities, demonstrating the consistent demand for tower space and network expansion.

Straight-Lined Revenues

Crown Castle International recognizes revenue from its tower leases on a straight-line basis. This means that the total expected revenue over the lease term is spread out evenly, regardless of how cash payments are actually structured. For instance, if a lease agreement spans ten years with a total expected revenue of $1 million, Crown Castle will recognize $100,000 in revenue each year, even if the annual cash payments fluctuate.

This accounting method provides a smoother, more predictable revenue stream for investors to analyze. In 2023, Crown Castle's total revenue was approximately $11.9 billion, with a significant portion derived from these long-term lease agreements. The straight-line approach helps to align revenue recognition with the economic benefit derived from the asset over its useful life.

- Predictable Revenue Recognition: Ensures consistent revenue reporting over the life of long-term contracts.

- Alignment with Asset Usage: Matches revenue recognition with the period the infrastructure is utilized by tenants.

- Investor Clarity: Simplifies financial analysis by presenting a stable revenue profile.

(Post-Divestiture) Focus on Tower-Centric Revenues

Following its significant divestiture of fiber and small cell assets, Crown Castle International is now heavily focused on its tower portfolio for revenue generation. This strategic shift aims to unlock greater value from its core infrastructure business.

The company's primary revenue streams are now derived from long-term lease agreements with wireless carriers for space on its towers. These agreements typically include annual rent escalations, providing a predictable and recurring revenue base. Crown Castle's 2023 annual report indicated that approximately 90% of its revenue came from its tower segment.

- Tower Leasing: The core revenue driver, generating recurring income from wireless carriers for tower space.

- Colocation Services: Revenue from adding additional tenants to existing towers, increasing site utilization and profitability.

- Discretionary Capital Projects: Revenue from tenant-driven modifications or upgrades to tower infrastructure.

- Ancillary Services: Minor revenue from services like power and access related to tower usage.

Crown Castle's revenue model is predominantly built on long-term tower leases, supplemented by co-location and amendment fees. These recurring income streams are bolstered by annual rent escalations, ensuring a stable financial outlook. The company anticipates approximately 4.7% organic growth in its tower leasing segment for 2025, underscoring the resilience of this core business.

In 2024, Crown Castle's financial performance continues to be shaped by the robust demand for its tower infrastructure. The company's focus on its tower portfolio, following strategic divestitures, highlights the critical role of these assets in its revenue generation strategy. Approximately 90% of Crown Castle's revenue in 2023 was attributed to its tower segment.

| Revenue Stream | Description | 2023 Data (Approx.) |

|---|---|---|

| Tower Leasing | Long-term rental of space on cell towers to wireless carriers. | ~90% of total revenue |

| Co-location & Amendment Fees | Fees from adding new tenants or expanding existing tenant equipment on towers. | Significant contributor to organic growth |

| Services and Other Revenues | Site development, installation, and support for customer equipment. | Smaller, but meaningful portion of revenue |

Business Model Canvas Data Sources

The Crown Castle International Business Model Canvas is constructed using a blend of internal financial reports, operational data, and extensive market research. These sources provide a comprehensive view of customer segments, revenue streams, and cost structures.