China Resources Land PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Resources Land Bundle

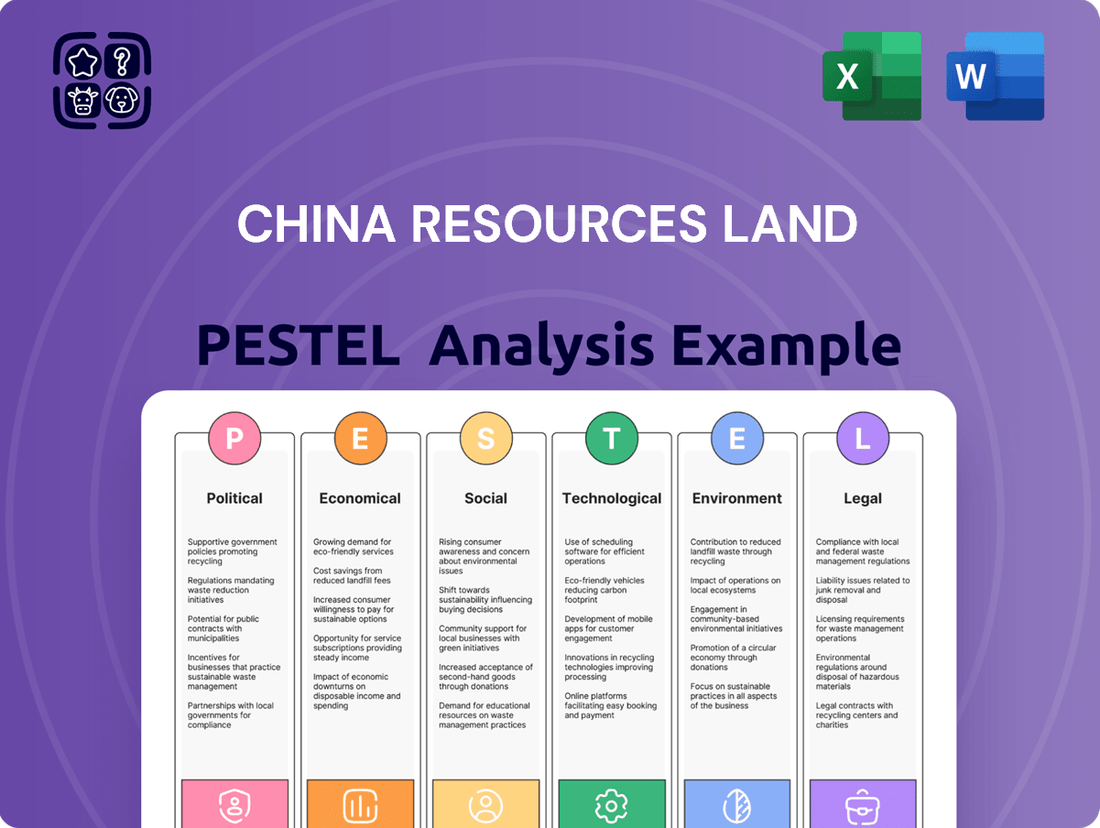

Gain a critical understanding of the external factors shaping China Resources Land's trajectory. Our PESTLE analysis delves into the political stability, economic growth, social shifts, technological advancements, environmental regulations, and legal frameworks impacting the company. Unlock actionable insights to refine your market approach and anticipate future challenges and opportunities.

This comprehensive PESTLE analysis is your essential tool for navigating the complex landscape affecting China Resources Land. Whether you're an investor, strategist, or market analyst, understanding these external forces is paramount. Purchase the full version for a deep dive into the data and expert commentary that will empower your decision-making.

Political factors

China's government is actively pursuing policies in 2025 to stabilize its real estate market and counter the ongoing downturn. These measures aim to re-energize housing demand by lowering mortgage rates and reducing down payment requirements, alongside a relaxation of previous purchase restrictions in many cities.

A key objective of these interventions is to unlock demand, particularly for first-time homebuyers and those looking to upgrade their residences. The government is also prioritizing the resolution of unfinished housing projects through dedicated financing coordination mechanisms, seeking to restore confidence in the sector.

China's government is actively steering urban development by prioritizing the optimization of city layouts and land utilization. A key initiative involves urban renewal projects, focusing on revitalizing older districts and upgrading substandard housing, directly impacting the demand for construction and property development services.

The nation has set an ambitious target to integrate 250 million people into urban areas by 2025, with a long-term vision of achieving 75-80% urbanization by 2035. This surge in urban population necessitates significant investment in housing, infrastructure, and public services, creating substantial opportunities for companies like China Resources Land.

China Resources Land (CR Land) operates under the umbrella of China Resources Holdings, a significant state-owned enterprise (SOE). This affiliation grants CR Land preferential access to capital and aligns its development strategies with national economic objectives, a crucial advantage in China's property market. For instance, SOEs often receive more favorable loan terms, as seen in the broader SOE sector where credit availability remained robust even during periods of tighter monetary policy in 2023.

The Chinese government's ongoing push for improved corporate governance among SOEs directly influences CR Land's operational structures and transparency requirements. This includes adherence to stricter financial reporting standards and board oversight mechanisms, which were further emphasized in directives issued throughout 2024. Such reforms aim to enhance efficiency and accountability, ensuring state-owned assets are managed effectively and in line with public interest.

Land Supply and Allocation Policies

China's government implements stringent land supply and allocation policies, emphasizing quality over quantity in commercial housing development. This approach aims to curb excessive urban expansion and foster more sustainable growth. For instance, in 2024, authorities continued to prioritize the redevelopment of existing urban areas and the efficient use of underutilized land, such as converting former industrial sites for residential or commercial purposes.

These policies actively encourage the revitalization of existing land resources, promoting the conversion of inefficient land use. This can involve brownfield redevelopment or upgrading existing infrastructure to support new projects. The focus on maximizing the utility of current land holdings directly impacts the availability and cost of land for developers like China Resources Land.

Rural land-use policies are also evolving, with a growing emphasis on sustainable development and secure land tenure. While these policies aim to benefit rural communities, they can indirectly influence the availability of land for urban expansion by regulating its conversion and use. For example, initiatives promoting agricultural land protection might limit the amount of rural land that can be easily reallocated for urban development projects in 2024 and 2025.

- Strict Commercial Housing Controls: Policies in 2024 and 2025 continue to limit the pace of new commercial housing construction, prioritizing quality and affordability.

- Land Resource Utilization: There's an increasing governmental push to optimize existing land, encouraging the redevelopment of underutilized or inefficiently used urban spaces.

- Rural Land Policy Impact: Evolving rural land regulations, focusing on sustainability and stable tenure, can affect the land pipeline for urban development.

- Government Land Auctions: The availability and pricing of land parcels through government auctions remain a critical factor, influenced by these overarching allocation policies.

Economic Stimulus and Fiscal Policies

China's central government is actively implementing moderately loose monetary policies and bolstering stimulus measures designed to invigorate domestic demand and stabilize the crucial real estate sector. This strategic approach includes the issuance of local government special-purpose bonds, with funds earmarked for critical investment construction, land acquisitions, and importantly, the purchase of existing unsold housing inventory. These fiscal injections are specifically intended to ease the financial burdens faced by real estate developers and contribute to price stabilization within the market.

The impact of these policies is evident in the continued issuance of local government special-purpose bonds. For instance, in the first half of 2024, local governments issued over 2 trillion yuan in special-purpose bonds, a significant portion of which is directed towards infrastructure and real estate-related projects. This financial support directly benefits companies like China Resources Land by creating a more stable operating environment and potentially increasing demand for their properties through government-backed acquisition programs.

- Monetary Policy Stance: China's central bank has maintained a moderately loose monetary policy, signaling a supportive stance for economic growth.

- Fiscal Stimulus Measures: The government is utilizing fiscal tools, including special-purpose bonds, to directly stimulate investment and address market imbalances.

- Real Estate Market Support: Specific policies are in place to facilitate the acquisition of unsold housing, aiming to reduce developer inventory and stabilize property prices.

- Bond Issuance Data: Over 2 trillion yuan in special-purpose bonds were issued by local governments in H1 2024, with real estate and infrastructure being key beneficiaries.

China's government is actively working to stabilize its real estate market in 2024-2025, implementing policies to boost demand through lower mortgage rates and relaxed purchase restrictions. These initiatives aim to support first-time buyers and those looking to upgrade, while also resolving unfinished projects to restore market confidence. The government's focus on urban development and renewal projects directly fuels demand for developers like China Resources Land, as the nation targets significant urbanization by 2035.

What is included in the product

This PESTLE analysis examines how China Resources Land's operations are influenced by political stability, economic growth, social trends, technological advancements, environmental regulations, and legal frameworks within the Chinese market.

It provides actionable insights for strategic decision-making by identifying key external forces and their potential impact on the company's future performance.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors affecting China Resources Land.

Helps support discussions on external risk and market positioning during planning sessions by clearly outlining the political, economic, social, technological, legal, and environmental influences on China Resources Land.

Economic factors

The Chinese real estate market experienced considerable headwinds in 2024, with notable declines in housing prices and overall sales volume. For instance, total sales for major developers saw a contraction. This downturn has been attributed to a combination of factors including regulatory adjustments and broader economic uncertainties.

Looking ahead to 2025, analysts anticipate a period of stabilization rather than a robust, widespread recovery. Lingering economic uncertainties and subdued consumer confidence are expected to temper demand, making a significant rebound unlikely in the near term.

Despite these sector-wide challenges, China Resources Land demonstrated resilience. The company reported impressive revenue growth in 2024, outperforming many of its peers. This performance underscores its strong market position and effective strategy amidst a difficult economic climate.

China's economic trajectory in 2025 is anticipated to see a GDP growth of 4.7%, as per CBRE's projections, bolstered by supportive stimulus measures. This indicates a slight moderation from the estimated 5.0% growth in 2024, with a general consensus pointing towards a 4.0% growth rate for 2025, though forecasts vary due to market dynamics.

The stability of China's real estate market is a critical determinant for broader economic health, directly influencing aggregate demand and the pace of consumption growth throughout 2024 and into 2025.

Chinese authorities have actively adjusted interest rates and mortgage policies to bolster the property market. In early 2024, for instance, the People's Bank of China (PBOC) guided banks to lower mortgage rates. Many cities subsequently reduced their lower limits for first-time homebuyer mortgage rates.

These policy shifts aim to reduce the financial strain on individuals and spur demand for housing. By making mortgages more accessible and affordable, the government intends to stimulate purchasing activity, with expectations that these measures will continue to improve the attractiveness of property assets in 2025.

Consumer Confidence and Household Debt

Consumer confidence in China remains subdued, exacerbated by household debt levels that have climbed past 60% of GDP. This financial strain directly impacts the property market, as potential buyers, concerned about economic stability, hesitate to commit to new or existing home purchases. Despite government initiatives aimed at bolstering the market, lingering uncertainty continues to dampen buyer sentiment.

China Resources Land's strategic diversification provides a crucial buffer against these headwinds. The company benefits significantly from its substantial rental income streams, which are currently performing robustly. This stable revenue source helps to offset the volatility often seen in property sales, a common challenge for developers in the current economic climate.

- Household debt in China exceeded 60% of GDP as of early 2024.

- Economic uncertainty continues to suppress consumer willingness to invest in real estate.

- China Resources Land's diverse revenue, including rental income, offers resilience.

- Policy measures to support the housing market have had limited immediate impact on buyer confidence.

Investment Property Revenue Growth

China Resources Land's investment property division is demonstrating robust growth, a key economic factor influencing its overall performance. The rental income from this segment saw a notable increase of 13.5% year-on-year in the second quarter of 2025. This surge highlights the division's increasing importance to the company's financial health, now representing a substantial part of the total revenue.

This strategic emphasis on recurring income streams, rather than solely relying on property development sales, is a significant move. It offers a more predictable and stable financial foundation, which is particularly valuable in the often-cyclical property market. This diversification strategy helps to mitigate risks associated with market fluctuations.

- 13.5% Year-on-year rental income growth in Q2 2025.

- Significant Revenue Contribution from investment properties.

- Strategic Pivot towards stable, recurring income.

- Enhanced Financial Stability through diversification.

China's economic growth is projected to moderate in 2025, with forecasts centering around 4.0% to 4.7% GDP expansion, reflecting a cautious outlook. Despite government efforts to stimulate the property market through lower mortgage rates and policy adjustments initiated in early 2024, consumer confidence remains subdued. This hesitancy is partly due to elevated household debt levels, which surpassed 60% of GDP by early 2024, directly impacting purchasing power and willingness to invest in real estate.

China Resources Land's financial performance in 2024 and early 2025 demonstrates a strategic advantage through its diversified revenue streams, particularly its investment property division. This segment experienced a robust 13.5% year-on-year increase in rental income during the second quarter of 2025, highlighting its growing contribution to overall revenue and providing a crucial stabilizing element against the volatility in property sales.

| Economic Indicator | 2024 Projection/Actual | 2025 Projection |

|---|---|---|

| China GDP Growth | ~5.0% | 4.0% - 4.7% |

| Household Debt to GDP | >60% (early 2024) | Continued High Levels |

| China Resources Land Rental Income Growth (Q2 2025 YoY) | N/A | 13.5% |

Preview the Actual Deliverable

China Resources Land PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive China Resources Land PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic outlook. Examine the detailed insights and actionable intelligence that will equip you for informed decision-making. The content and structure shown in the preview is the same document you’ll download after payment, providing a complete and professional overview.

Sociological factors

China's urbanization continues its brisk pace, with the rate hitting approximately 67% by the close of 2024. This trend is expected to see further acceleration, with projections indicating a rise to 75-80% by 2035. This massive migration of hundreds of millions from rural areas to urban centers fuels a significant and ongoing demand for residential and commercial properties.

China Resources Land, with its extensive operations spanning numerous cities across mainland China, is directly positioned to capitalize on this demographic shift. The company's development projects, from residential communities to commercial complexes, align perfectly with the needs arising from this rapid urban expansion, creating a substantial market opportunity.

Chinese consumers are increasingly prioritizing high-quality urban living and commercial spaces that reflect contemporary lifestyles. This trend is evident in a growing demand for mixed-use developments, smart home technologies, and properties equipped with premium amenities. For instance, by 2024, surveys indicated a significant rise in consumer willingness to pay a premium for integrated living, working, and leisure environments.

China Resources Land's strategic emphasis on developing sophisticated, high-quality projects directly addresses these evolving consumer preferences. Their developments often feature integrated retail, office, and residential components, alongside smart building features and advanced resident services, aligning with the desire for convenience and modern living standards. This focus has been a key driver of their market positioning and sales performance in the 2024-2025 period.

China's government is heavily focused on increasing affordable housing options, especially for new urban dwellers, young individuals, and migrant workers. This includes significant investment in upgrading older urban areas and renovating rundown housing structures. For instance, by the end of 2023, China had completed renovations for over 52,000 dilapidated residential buildings, benefiting millions of residents.

China Resources Land's business approach must consider these social housing mandates. Aligning development projects with government goals, such as contributing to affordable housing stock or participating in urban regeneration schemes, could prove beneficial. In 2024, the government pledged to build or renovate 6.7 million affordable housing units, a clear signal of the direction for real estate developers.

Lifestyle Trends and Urban Living Quality

China's urbanization is increasingly guided by a people-centered approach, focusing on improving the quality of life for its residents. This means urban development is prioritizing enhanced living conditions, better public services, and upgraded infrastructure over sheer expansion. For instance, by late 2023, China had over 660 million permanent urban residents, a figure that continues to grow, underscoring the significance of quality of life improvements in these areas.

China Resources Land’s strategic focus on developing high-quality urban living spaces directly supports this national social objective. Their projects aim to create integrated communities that offer more than just housing, incorporating green spaces, convenient amenities, and improved accessibility. This aligns with a growing societal demand for healthier and more fulfilling urban lifestyles, which are becoming key differentiators in the property market.

- People-Centered Urbanization: Shift from quantity to quality in urban development, focusing on resident welfare.

- Improved Living Conditions: Emphasis on better housing, public services, and essential infrastructure.

- Growing Urban Population: Over 660 million permanent urban residents by the end of 2023, highlighting the scale of urban living.

- China Resources Land's Alignment: Commitment to creating high-quality, integrated urban spaces that meet evolving lifestyle demands.

Regional Disparities in Urbanization

China's urbanization isn't a one-size-fits-all approach; there's a clear regional differentiation. Less-developed interior regions are seeing accelerated urbanization efforts, often centered around county towns. This strategic push aims to create local employment and improve access to services, potentially opening up new development opportunities for China Resources Land beyond the established first-tier cities.

This trend means China Resources Land might need to adjust its expansion strategy to tap into the growth potential of a broader spectrum of city tiers, including emerging hubs in the interior. For instance, the government's 14th Five-Year Plan (2021-2025) emphasizes coordinated regional development, which includes boosting infrastructure and public services in less developed areas. This could translate into increased demand for residential and commercial properties in these regions.

- Regional Focus: Government policies are prioritizing urbanization in less-developed interior provinces, aiming to balance economic growth.

- County Town Development: A significant aspect involves strengthening county towns to serve as local economic and service centers, creating new urban clusters.

- Investment Opportunities: This shift suggests that China Resources Land could find growth by diversifying its project portfolio to include mid-tier and smaller cities in these developing regions.

- Economic Impact: By 2023, China's urbanization rate reached 66.16%, with a notable increase in the proportion of urban residents in central and western regions, indicating progress in this balanced development strategy.

The Chinese government is actively promoting a people-centered urbanization strategy, prioritizing improved quality of life, better public services, and enhanced infrastructure over mere expansion. By the end of 2023, China had over 660 million permanent urban residents, a figure that continues to climb, emphasizing the importance of quality urban living. China Resources Land's focus on developing integrated, high-quality communities directly aligns with this societal demand for healthier and more fulfilling urban lifestyles.

Furthermore, there's a noticeable regional differentiation in urbanization efforts, with less-developed interior regions seeing accelerated development centered around county towns. This strategy aims to foster local employment and improve service access, presenting new growth avenues for China Resources Land beyond major metropolitan areas. The government's 14th Five-Year Plan (2021-2025) specifically targets coordinated regional development, including infrastructure boosts in these less developed areas, which is projected to increase property demand.

| Sociological Factor | Description | Implication for China Resources Land | Relevant Data (2023-2025) |

|---|---|---|---|

| Urbanization Pace | Continued migration from rural to urban areas. | Sustained demand for residential and commercial properties. | Urbanization rate reached 66.16% by end of 2023; projected to exceed 70% by 2025. |

| Consumer Preferences | Growing demand for high-quality, mixed-use developments and modern amenities. | Opportunity to differentiate through premium, integrated projects. | Surveys in 2024 showed increased willingness to pay for integrated living, working, and leisure environments. |

| Government Housing Policies | Focus on affordable housing and urban regeneration. | Need to align projects with government mandates; potential for participation in urban renewal. | Pledged to build/renovate 6.7 million affordable housing units in 2024; over 52,000 dilapidated buildings renovated by end of 2023. |

| Regional Development | Prioritization of urbanization in less-developed interior regions and county towns. | Potential for expansion into new, emerging urban centers. | 14th Five-Year Plan emphasizes coordinated regional development; increased urban population in central/western regions by 2023. |

Technological factors

Technological factors are significantly shaping China's property sector. The PropTech market in China is booming, fueled by widespread urbanization and the increasing adoption of digital tools. This trend is expected to continue, with projections indicating substantial market expansion from 2024 through 2035. Analysts anticipate a compound annual growth rate of approximately 20% during this period.

This robust growth in PropTech offers China Resources Land valuable opportunities. By integrating these emerging technologies, the company can enhance its property development processes and improve the efficiency of its property management services. For instance, AI-powered analytics can optimize building operations, while smart home technologies can increase tenant satisfaction and property value.

Government initiatives like China's New Urbanization Plan (introduced in 2014 and evolving) actively promote smart city development, driving significant investment in related technologies. This creates a fertile ground for real estate developers like China Resources Land to offer innovative, tech-enabled solutions. For instance, by 2023, China's smart city market was estimated to be worth over $25 billion, with continued strong growth projected.

There's a clear trend towards integrated platforms that streamline property management, leasing processes, and data analytics. These solutions appeal to both developers and end-users by enhancing operational efficiency and enabling data-driven decision-making, a crucial factor in the competitive real estate landscape. In 2024, smart building technology adoption in commercial real estate saw a 15% increase year-over-year.

Technological advancements are significantly reshaping China's real estate sector, from initial design to final construction. Innovations are streamlining processes, boosting efficiency, and improving the overall quality of built environments.

The integration of robotics and artificial intelligence (AI) is becoming more prevalent. This is partly a response to escalating labor costs, which in China’s construction industry have seen steady increases, making automation a more attractive proposition. For instance, by 2023, the average wage for construction workers in major Chinese cities had risen substantially, encouraging investment in automated solutions.

These technologies, including automated bricklaying machines and drone-based site monitoring, enhance precision and reduce human error, leading to safer and more efficient construction sites. The adoption of Building Information Modeling (BIM) is also a key trend, enabling better project management and reducing waste throughout the development lifecycle.

Digital Property Management Systems

Digital property management systems are becoming indispensable for enhancing operational efficiency and resource allocation within China's real estate sector. These technologies streamline tasks like tenant management, rent collection, and maintenance, directly impacting profitability and sustainability. China Resources Land leverages these advancements as part of its broader strategy to optimize its diverse property portfolio.

The adoption of digital tools contributes to better asset utilization, a key component of China Resources Land's asset-light management services. For instance, by mid-2024, real estate technology adoption rates in China were reported to be significantly increasing, with over 60% of large developers implementing integrated digital platforms for property operations. This digital transformation allows for more responsive management and improved tenant experiences.

- Increased Efficiency: Digital systems automate routine tasks, reducing administrative overhead and freeing up resources for strategic initiatives.

- Enhanced Tenant Experience: Online portals and mobile apps facilitate seamless communication, service requests, and payment processing for tenants.

- Data-Driven Decision Making: Real-time data analytics provide insights into property performance, enabling more informed operational and investment decisions.

- Sustainability Improvements: Digital tools can monitor and optimize energy consumption, waste management, and water usage within properties.

Green Building Technologies and Materials

Technological advancements are significantly shaping the real estate sector in China, particularly in green building. There's a growing emphasis on materials and systems that reduce carbon footprints and improve energy efficiency. This includes innovations like green roofs, heat-reflective roofing, and even roofing that incorporates solar panels to generate electricity.

The Chinese government is actively pushing for the adoption of these advanced technologies. They are accelerating research and promoting solutions aimed at energy conservation and carbon reduction within the construction industry. This policy direction directly influences developers like China Resources Land.

China Resources Land has set ambitious targets in response to these trends. The company aims for 50% of its new developments to achieve green building standards by the end of 2024. This commitment reflects a strategic alignment with both government mandates and market demand for sustainable properties.

- Focus on Low-Carbon Materials: Increased demand for materials like recycled steel, sustainable timber, and low-VOC (volatile organic compound) paints.

- Energy-Efficient Systems: Adoption of advanced HVAC systems, smart building management, and high-performance insulation.

- Renewable Energy Integration: Growing use of solar photovoltaic (PV) systems in roofing and building facades.

- Government Support: Policies encouraging green building certification and offering incentives for energy-efficient construction projects.

Technological advancements are fundamentally reshaping China's property sector, driving efficiency and innovation. The PropTech market is expanding rapidly, with projections indicating continued growth through 2035. This technological surge presents significant opportunities for companies like China Resources Land to enhance development and management processes.

The integration of AI and robotics is becoming more common in construction, partly due to rising labor costs. Building Information Modeling (BIM) is also a key trend, improving project management and reducing waste. By mid-2024, over 60% of large Chinese developers were implementing integrated digital platforms for property operations, highlighting the widespread adoption of these tools.

| Technology Trend | Impact on China Resources Land | Market Data/Projections |

| PropTech Adoption | Enhances property development, management efficiency, and tenant satisfaction. | China's PropTech market projected to grow at ~20% CAGR (2024-2035). |

| AI & Robotics in Construction | Addresses rising labor costs, improves precision, and site safety. | Steady increase in construction worker wages in major Chinese cities by 2023. |

| Digital Property Management | Streamlines operations, improves resource allocation, and enhances asset utilization. | Over 60% of large developers using integrated digital platforms (mid-2024). |

| Green Building Technology | Supports sustainability goals and meets increasing market demand for eco-friendly properties. | China Resources Land aims for 50% of new developments to meet green building standards by end of 2024. |

Legal factors

China's real estate sector operates under comprehensive land management laws and regulations that define land use rights. These policies are crucial for developers like China Resources Land, directly impacting land acquisition and project planning.

A significant aspect is the strict control over converting arable land for development. For instance, China's Central Government has repeatedly emphasized protecting its 1.8 billion mu (approximately 1.2 million square kilometers) of arable land, meaning developers must navigate stringent approval processes for any land conversion, potentially limiting available land for new projects.

Furthermore, urban development strategies often prioritize the secondary utilization of land. This includes redeveloping restricted or abandoned construction sites, encouraging efficient land use and potentially offering opportunities for brownfield development rather than greenfield expansion.

These legal frameworks shape the supply and cost of land, influencing China Resources Land's development pipeline and profitability. Adherence to these land use rights laws and urban planning guidelines is paramount for sustainable growth.

China Resources Land must navigate a landscape of increasingly stringent construction permits and building standards. By 2025, new urban buildings across China are mandated to adhere to green building standards, a move that necessitates compliance with evolving regulations and the acquisition of specific permits for these eco-friendly practices.

This regulatory push is accelerating the development of ultra-low and nearly zero energy consumption buildings. For instance, some regions are already implementing even higher energy-saving standards, placing additional pressure on developers like China Resources Land to innovate and invest in sustainable construction technologies to meet these benchmarks.

Foreign entities looking to invest in Chinese real estate, especially for purposes beyond personal use, typically must establish a foreign-invested enterprise (FIE). This requirement stems from regulations designed to manage foreign participation in the sector. For instance, in 2024, China's State Administration of Foreign Exchange (SAFE) continued to emphasize scrutiny over cross-border capital flows, including real estate investments, to maintain financial stability.

Individual foreign buyers are generally restricted to acquiring a single residential property for their own occupancy, and this is often contingent on meeting specific residency or employment criteria within China. These rules aim to curb speculative buying and prioritize domestic housing needs. Data from 2023 indicated that while foreign direct investment in China's property sector saw fluctuations, regulatory frameworks remained a key determinant of market access.

These legal stipulations directly impact how international companies, including those like China Resources Land, can structure partnerships or joint ventures involving real estate development and acquisition. Navigating these rules is crucial for securing foreign capital and expertise in the Chinese property market. The evolving regulatory landscape in 2024 continues to shape the feasibility and structure of such cross-border collaborations.

Environmental Protection Laws and Green Building Regulations

China's commitment to environmental protection is evident in its 'Green Building Action Plan,' aiming to boost sustainable construction practices. This initiative is further supported by the ongoing development of a Zero Carbon Building Standard, signaling a strong push towards decarbonization in the real estate sector. Provincial authorities play a crucial role in translating national goals into actionable local regulations, ensuring that environmental standards are adapted to regional needs and capabilities.

These evolving regulations directly impact developers like China Resources Land by shaping design, construction methodologies, and material sourcing. The government is also actively deploying financial incentives and subsidies to encourage green building development, making sustainable projects more economically viable and attractive. For instance, by the end of 2023, over 3.4 billion square meters of green building space had been certified across China, demonstrating significant market adoption and regulatory momentum.

- Green Building Action Plan: A national strategy promoting energy efficiency and sustainability in construction.

- Zero Carbon Building Standard: Under development to set new benchmarks for low-emission buildings.

- Provincial Regulations: Tailored environmental rules implemented by local governments.

- Incentives and Subsidies: Financial support mechanisms encouraging the adoption of green building practices.

- Market Adoption: Over 3.4 billion square meters of green building space certified by end of 2023.

Property Financing and Debt Management Policies

Government policies are actively shaping the property financing landscape in China, with initiatives like the 'White List' lending program designed to shore up developers and prevent defaults. This program, along with broader efforts to ensure the timely delivery of housing projects, aims to stabilize the sector.

The real estate financing coordination mechanism has been instrumental, approving substantial loan volumes to support developers navigating financial pressures. For instance, by early 2024, this mechanism had facilitated approvals for over 1.3 trillion yuan in financing for approximately 3,300 projects nationwide, underscoring its significant role.

- White List Program: Aims to provide targeted financial support to eligible developers and projects.

- Financing Coordination Mechanism: Facilitates loan approvals, with over 1.3 trillion yuan approved for around 3,300 projects by early 2024.

- Housing Project Delivery: Policies focus on ensuring the completion of pre-sold homes, mitigating social and financial risks.

- Debt Default Prevention: The overarching legal and policy framework seeks to prevent systemic risks stemming from property company debt issues.

China's legal framework for real estate development, particularly concerning land use and environmental standards, significantly influences China Resources Land's operations. Strict regulations on converting arable land and the push for green building standards by 2025 necessitate compliance and investment in sustainable technologies, impacting project feasibility and costs.

Foreign investment in Chinese real estate is tightly regulated, requiring foreign-invested enterprises and often limiting individual foreign buyers to a single residential property for occupancy. These rules, with scrutiny on cross-border capital flows continuing in 2024, shape how international firms can engage with the market.

Government policies, like the 'White List' program and financing coordination mechanisms, actively aim to stabilize the property market by supporting developers and ensuring project completion. By early 2024, over 1.3 trillion yuan in financing had been approved for around 3,300 projects, showcasing the scale of intervention.

| Legal Area | Key Regulations/Initiatives | Impact on China Resources Land | Relevant Data/Statistics |

| Land Use | Land management laws, arable land protection | Limits land acquisition, impacts project planning, influences land costs | Arable land protected: 1.8 billion mu |

| Construction Standards | Green building standards, ultra-low energy consumption building mandates | Requires investment in sustainable technologies, adherence to evolving building codes | Mandatory green building standards for new urban buildings by 2025 |

| Foreign Investment | FIE requirements, restrictions on foreign buyers | Affects structuring of partnerships and capital acquisition | Scrutiny on cross-border capital flows in 2024 |

| Environmental Regulations | Green Building Action Plan, Zero Carbon Building Standard | Shapes design, construction methods, material sourcing; incentivizes green development | Over 3.4 billion sqm green building space certified by end of 2023 |

| Property Financing | 'White List' program, financing coordination mechanism | Aims to stabilize sector, support developer liquidity, ensure project delivery | Over 1.3 trillion yuan financing approved for ~3,300 projects by early 2024 |

Environmental factors

China has set an ambitious target, mandating that all new urban buildings achieve green building standards by 2025. This directive signifies a crucial shift, moving the focus from mere energy consumption to a more comprehensive approach centered on carbon footprint reduction. A key development in this area is the ongoing drafting of a Zero Carbon Building Standard, which will further guide the industry toward net-zero emissions.

China Resources Land is actively aligning with these national environmental objectives and the growing market appetite for sustainable properties. The company has strategically committed to ensuring that 50% of its new developments will meet established green building standards by the close of 2024. This proactive stance not only demonstrates corporate responsibility but also positions them favorably in a market increasingly valuing eco-friendly construction.

China's commitment to reaching peak carbon emissions by 2030 and carbon neutrality by 2060 is a significant driver for the construction sector. An action plan is in place to accelerate energy conservation and carbon reduction, focusing on ultra-low energy consumption buildings and improved operational energy management.

China Resources Land is actively addressing these environmental shifts by developing comprehensive climate risk impact action plans. These plans are structured across short-term (2024-2025), medium-term, and long-term horizons, ensuring a strategic approach to sustainability and regulatory compliance.

China's environmental policies are increasingly focused on sustainable land use, with strict regulations aimed at preserving farmland and limiting its conversion for non-agricultural development. This includes significant investment in high-quality farmland construction and the restoration of eroded land, a crucial aspect of national food security. For instance, by the end of 2023, China had implemented a national action plan to protect cultivated land, aiming to maintain over 1.2 billion mu of arable land, a key metric for land use control.

These stringent environmental regulations directly influence property developers like China Resources Land by impacting land availability and dictating development strategies. The emphasis on rural environmental protection and the restoration of degraded land means developers must navigate more complex permitting processes and potentially face higher costs for land acquisition and development in designated conservation areas. This shift necessitates a greater focus on integrated urban-rural planning and potentially encourages development in less environmentally sensitive zones.

Waste Management and Circular Economy

China is actively pushing for a circular economy, which means more focus on reusing and recycling materials. This is a significant shift for industries like construction, where waste is a major byproduct. New regulations are encouraging companies to be more efficient with resources and cut down on waste. For instance, by the end of 2023, China had implemented over 100 laws and regulations related to resource conservation and environmental protection.

The government is also backing state-owned enterprises that are spearheading circular economy projects. This suggests a serious commitment to making these practices a standard. For a property developer like China Resources Land, this transition means they'll likely need to adapt how they source building materials and manage construction waste. They might find themselves needing to use more recycled content or finding new ways to dispose of or repurpose demolition debris.

The implications for China Resources Land are several:

- Sourcing Changes: Expect increased demand and potentially higher costs for recycled construction materials as regulations tighten on virgin resource use.

- Waste Disposal Costs: Traditional landfilling will likely become more expensive, pushing developers to invest in on-site recycling or partnerships for waste repurposing.

- Innovation Opportunities: Companies that embrace circular economy principles early could gain a competitive edge through more sustainable and cost-effective operations.

- Compliance Burden: Adhering to new waste management and resource efficiency standards will require updated operational procedures and potentially new technologies.

Environmental Impact Assessments and Compliance

China Resources Land, like all major developers, faces increasing pressure to conduct thorough environmental impact assessments (EIAs) for new projects. This isn't just a formality; it's a critical step to ensure compliance with evolving environmental regulations. For instance, in 2023, China's Ministry of Ecology and Environment continued to emphasize stricter enforcement of environmental protection laws, impacting project approvals and operational standards across the real estate sector.

The national push for green development and ecological protection mandates that companies like China Resources Land embed environmental considerations from the earliest stages of project planning right through to construction and ongoing operations. This proactive approach is essential for maintaining regulatory adherence and demonstrating responsible development practices. By integrating sustainable design principles and waste management strategies, they aim to minimize their ecological footprint and align with China's broader environmental goals, such as achieving carbon neutrality by 2060.

- Regulatory Scrutiny: Increased government oversight on environmental performance for all new construction projects.

- Green Building Standards: Growing adoption of national and international green building certifications, influencing material selection and energy efficiency.

- Ecological Protection Zones: Restrictions on development within or near ecologically sensitive areas, requiring careful site selection and mitigation plans.

- Waste Management: Stricter regulations on construction waste disposal and recycling.

China's commitment to environmental sustainability is a major influence. The nation aims for all new urban buildings to meet green building standards by 2025, with a focus on reducing carbon footprints, not just energy consumption. This is further supported by the development of a Zero Carbon Building Standard. China Resources Land is aligning with these goals, targeting 50% of its new developments to meet green building standards by the end of 2024.

The country's broader environmental objectives, including peak carbon emissions by 2030 and carbon neutrality by 2060, drive the construction sector towards energy conservation and carbon reduction. This includes promoting ultra-low energy consumption buildings and better operational energy management, prompting China Resources Land to develop climate risk action plans for various time horizons.

Stringent regulations on sustainable land use and the protection of cultivated land, with a goal to maintain over 1.2 billion mu of arable land by the end of 2023, directly impact developers. These rules necessitate careful site selection and potentially higher development costs in conservation areas, pushing for integrated urban-rural planning.

Furthermore, China's push for a circular economy, encouraging material reuse and recycling, significantly affects the construction industry. By the end of 2023, over 100 laws and regulations supported resource conservation and environmental protection, requiring companies like China Resources Land to adapt their material sourcing and waste management practices.

| Environmental Factor | China's Target/Regulation | Impact on China Resources Land | Key Data Point |

|---|---|---|---|

| Green Building Standards | All new urban buildings by 2025 | Commitment to 50% of new developments meeting standards by end of 2024 | 50% target for 2024 |

| Carbon Neutrality Goal | By 2060 | Development of climate risk impact action plans (short, medium, long-term) | National goal for 2060 |

| Land Use Protection | Maintain >1.2 billion mu of arable land | Navigating complex permitting, potential higher costs in conservation areas | 1.2 billion mu target |

| Circular Economy | Encouraging reuse and recycling (over 100 laws by end of 2023) | Adapting material sourcing and waste management; potential for increased use of recycled materials | 100+ related laws/regulations |

PESTLE Analysis Data Sources

Our PESTLE analysis for China Resources Land is grounded in data from official Chinese government agencies, including the National Bureau of Statistics and Ministry of Housing and Urban-Rural Development, alongside reports from international financial institutions like the IMF and World Bank.