China Resources Land Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Resources Land Bundle

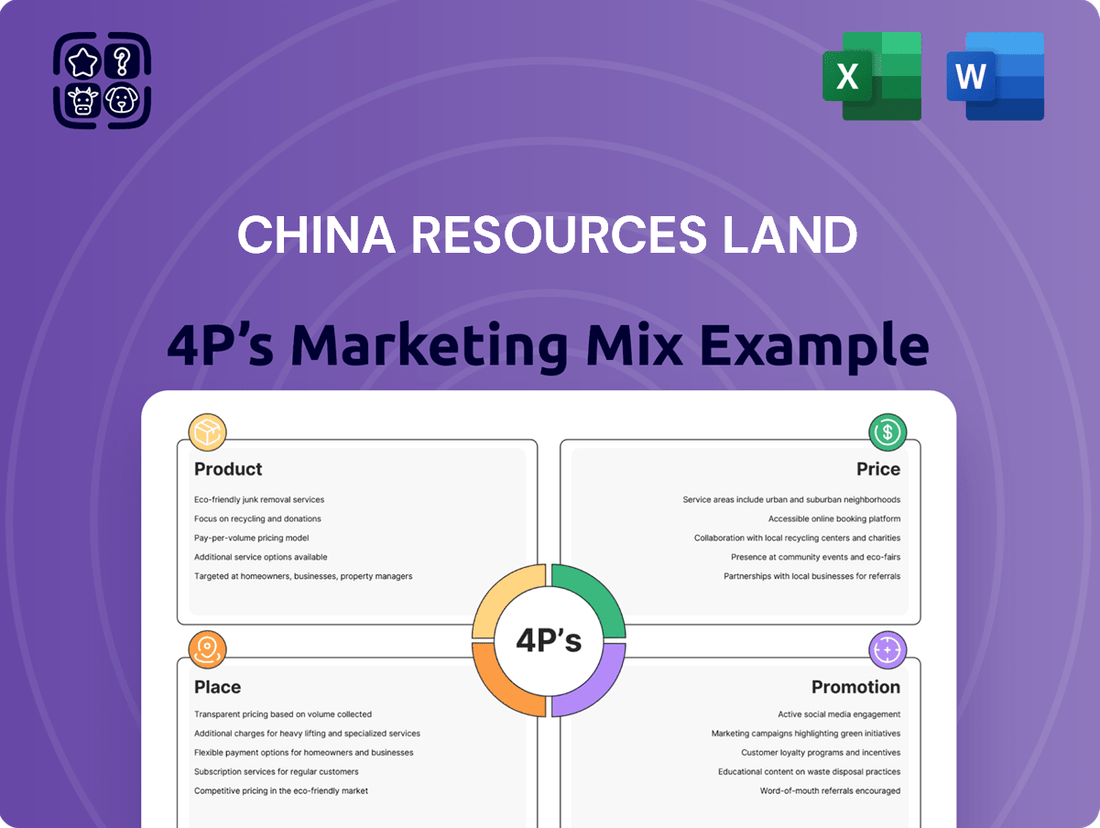

China Resources Land masterfully crafts its Product strategy, focusing on high-quality, integrated developments that cater to evolving urban lifestyles. Their Price points reflect premium positioning and long-term value, appealing to a discerning customer base. Discover how their strategic Place in prime urban locations and extensive Place network amplifies their market reach.

Delve into the intricate details of China Resources Land's 4Ps Marketing Mix. This analysis explores their innovative product offerings, astute pricing strategies, prime placement in key urban centers, and compelling promotional activities that drive brand loyalty and market share.

Uncover the secrets behind China Resources Land's marketing success. This comprehensive 4Ps analysis provides actionable insights into their product development, pricing architecture, distribution channels, and communication mix, offering a roadmap for strategic planning.

Ready to gain a competitive edge? Access the full, editable 4Ps Marketing Mix Analysis for China Resources Land and unlock a treasure trove of strategic insights. Perfect for professionals, students, and anyone seeking to understand market-leading tactics.

Product

China Resources Land excels in product diversity, offering everything from premium residential areas to expansive mixed-use developments and commercial spaces. This broad range addresses the varied needs of China's rapidly urbanizing population.

Their core product strategy revolves around integrated urban development, aiming to create self-sustaining environments that encompass living, working, and recreational activities. This approach creates holistic urban solutions.

By diversifying across property types, China Resources Land effectively targets a wide array of market segments. For instance, in 2024, the company continued to expand its presence in key Tier 1 and Tier 2 cities, demonstrating its commitment to diverse urban needs.

This strategic product mix allows them to remain resilient against market fluctuations, as different property sectors often perform differently. Their focus on integrated developments also enhances brand value and customer loyalty.

China Resources Land focuses on developing integrated urban living solutions, moving beyond just housing to craft complete communities. This approach includes embedding essential amenities like shopping centers, schools, and parks directly within their residential projects, fostering a richer living experience.

The company's commitment to enhancing resident quality of life is evident in its development strategy. For instance, in 2023, China Resources Land reported a significant portion of its revenue stemming from integrated commercial and residential properties, highlighting the market's demand for these holistic environments.

By prioritizing convenience and community building through these integrated solutions, China Resources Land aims to create sustainable and desirable urban spaces. This strategy directly addresses the evolving needs of city dwellers seeking more than just a place to live, but a vibrant neighborhood that supports their lifestyle.

China Resources Land excels in developing and managing a diverse portfolio of investment properties, including vibrant shopping malls, sophisticated office buildings, and elegant hotels. This commitment to variety ensures broad market appeal and caters to a wide range of business needs.

These commercial spaces are meticulously designed, featuring contemporary architectural styles, superior finishing materials, and prime, accessible locations. This emphasis on quality is crucial for attracting and retaining high-caliber tenants and discerning consumers.

The company's dedication to high-quality commercial offerings has solidified its reputation as a top-tier developer. For instance, as of early 2024, China Resources Land's investment property portfolio generated significant rental income, reflecting the desirability and occupancy of its prime commercial assets.

This focus on quality directly translates into a competitive advantage, making China Resources Land a preferred partner for businesses and retail brands seeking premium locations and environments that enhance their own brand image and operational success.

Comprehensive Property Management Services

China Resources Land extends its influence beyond property development by offering comprehensive property management services. This commitment ensures the ongoing quality and desirability of their residential and commercial assets, fostering sustained value for owners and tenants alike.

These services encompass crucial aspects like property maintenance, robust security measures, and enhanced community engagement. By focusing on these elements, China Resources Land cultivates a superior living and working experience, directly impacting customer satisfaction and strengthening the brand's image.

In 2023, China Resources Land reported significant operational scale, managing a substantial portfolio of properties. This extensive management footprint underscores their dedication to post-development excellence. For instance, the company's ongoing efforts in property management are key to maintaining high occupancy rates and rental yields across its diverse projects.

- Property Maintenance: Proactive and reactive upkeep to preserve asset condition and functionality.

- Security Services: Implementing advanced security systems and personnel to ensure resident and asset safety.

- Community Services: Fostering resident engagement and providing lifestyle amenities to enhance living experience.

- Brand Reputation: These services are integral to reinforcing China Resources Land's reputation for quality and reliable property stewardship.

Strategic Mixed-Use Complexes

China Resources Land's strategic mixed-use complexes are a cornerstone of their product strategy, integrating residential, retail, office, and hospitality components. These developments act as self-contained urban ecosystems, fostering economic vitality and offering unparalleled convenience. For instance, their "MixC" brand, a prime example of this product, has seen significant success. By 2024, China Resources Land operated over 30 MixC projects across China, with continued expansion plans. This synergy not only optimizes land utilization but also cultivates dynamic community spaces that attract both residents and commercial tenants.

The appeal of these integrated complexes lies in their ability to create vibrant, walkable environments that enhance quality of life and drive demand across all property types. This multi-faceted approach allows for cross-selling opportunities and builds a strong brand presence. In 2024, the company reported substantial revenue contributions from its commercial and mixed-use properties, underscoring the financial viability of this product.

- Integrated Development: Combines residential, retail, office, and hospitality into single projects.

- Urban Hub Creation: Acts as new centers for economic activity and community interaction.

- Value Maximization: Enhances land value through synergistic development.

- Brand Strength: The MixC brand exemplifies the success of this product strategy.

China Resources Land's product strategy is deeply rooted in creating integrated urban living experiences, offering a diverse range of properties from premium residential units to large-scale mixed-use developments and high-quality commercial spaces. This approach caters to the evolving needs of China's urban population by building self-sustaining communities. For instance, by the end of 2023, the company managed a substantial portfolio, with a significant portion of its revenue derived from these integrated projects, demonstrating market demand for holistic urban solutions.

The company’s focus on mixed-use complexes, particularly under its successful MixC brand, exemplifies this strategy. These developments synergize residential, retail, office, and hospitality elements, creating vibrant urban hubs that maximize land value and foster economic vitality. As of early 2024, China Resources Land operated over 30 MixC projects nationwide, with plans for continued expansion, highlighting the strong market reception and financial viability of this product offering.

Furthermore, China Resources Land's commitment to high-quality commercial properties, including shopping malls and office buildings, solidifies its market position. These assets are strategically located and meticulously designed, ensuring high occupancy rates and significant rental income, as evidenced by their performance in 2023. This emphasis on quality attracts premium tenants and enhances the overall brand value.

What is included in the product

This analysis provides a comprehensive breakdown of China Resources Land's marketing mix, detailing their product development, pricing strategies, distribution channels, and promotional activities.

It offers insights into China Resources Land's market positioning and competitive advantages, serving as a valuable resource for strategic decision-making.

Provides a clear, concise overview of China Resources Land's 4Ps marketing strategy, simplifying complex market dynamics to address leadership's need for actionable insights.

Streamlines understanding of China Resources Land's product, price, place, and promotion strategies, alleviating concerns about market positioning and competitive advantage.

Place

China Resources Land strategically concentrates its development efforts within mainland China's tier-one and prominent tier-two cities. This deliberate geographical focus allows the company to capitalize on strong urbanization patterns and existing infrastructure. For instance, by the end of 2023, the company had a significant presence in cities like Beijing, Shanghai, and Shenzhen, which are economic powerhouses.

This presence in major economic centers provides direct access to substantial consumer bases and consistently high demand for their wide array of property types, from residential to commercial. In 2024, these key cities continued to represent a substantial portion of China's GDP growth and population migration, underscoring the strategic advantage of their urban concentration.

China Resources Land focuses on integrated development locations, often choosing prime spots in burgeoning urban districts or high-growth areas. This strategic placement, for example, saw them developing significant projects in Shenzhen's Qianhai district, a key economic zone. These developments are designed to become new urban landmarks, driving both commercial foot traffic and residential appeal. By clustering residential, commercial, and sometimes cultural facilities, they create self-sustaining communities.

China Resources Land heavily relies on its in-house direct sales force, stationed at project sites and corporate offices, for both residential and commercial property transactions. This direct engagement fosters personalized customer interactions, enabling detailed property showcases and immediate addressing of potential buyer inquiries. This strategy generated substantial sales figures, with the company reporting a contracted sales value of approximately RMB 214.1 billion in 2023.

Online and Offline Sales Integration

China Resources Land effectively blends its traditional direct sales approach with a robust online strategy. While physical sales centers remain crucial for the final transaction, the company utilizes digital channels to capture initial interest, offer virtual property tours, and disseminate promotional information to a broader demographic.

This digital engagement serves as a vital lead-generation tool, allowing prospective buyers to conveniently explore property options and gather details remotely before committing to an in-person visit. For instance, in 2024, their online platforms saw a significant increase in virtual tour engagement, driving higher foot traffic to physical sales centers. This synergy between online discovery and offline conversion is key to their sales funnel.

- Digital Lead Generation: Online platforms capture initial inquiries, increasing the pool of potential buyers.

- Enhanced Customer Experience: Virtual tours and online information offer convenience and pre-visit engagement.

- Seamless Journey: Integration ensures a smooth transition from online exploration to offline purchase decisions.

- Broader Reach: Digital presence extends market penetration beyond geographical limitations of physical centers.

Strategic Retail and Office Leasing

China Resources Land leverages specialized leasing teams to cultivate a vibrant tenant base within its retail and office portfolio. These teams actively pursue and nurture relationships with leading retail brands, prominent corporate entities, and reputable hospitality groups. This strategic tenant acquisition aims to ensure high occupancy rates and a well-balanced tenant mix, crucial for maximizing rental income and bolstering the overall value of their investment properties.

The company's commitment to strategic leasing is evident in its proactive approach to market engagement. For instance, in 2023, China Resources Land reported a robust leasing performance across its commercial properties, with key shopping malls achieving average occupancy rates exceeding 95%. This success is directly attributable to their targeted outreach and the cultivation of strong partnerships with diverse tenant categories, ensuring a dynamic and appealing commercial environment.

- Tenant Diversification: Focus on attracting a wide array of retail categories and corporate tenants to create a comprehensive commercial ecosystem.

- Relationship Management: Cultivate long-term partnerships with anchor tenants and key brands to ensure stability and consistent demand.

- Occupancy Optimization: Employ data-driven strategies to identify leasing opportunities and minimize vacancies, thereby maximizing rental yields.

- Asset Enhancement: Continuously upgrade and adapt commercial spaces to meet evolving tenant needs and market trends, thereby increasing property valuations.

China Resources Land prioritizes prime locations within China's most dynamic urban centers, focusing on tier-one and key tier-two cities. This strategic placement ensures access to robust consumer markets and infrastructure, with significant investments in economic hubs like Beijing and Shanghai by the close of 2023. These locations continue to be central to China's economic expansion and population shifts in 2024.

The company excels at integrated development, often selecting high-growth urban districts or new economic zones, such as Shenzhen's Qianhai. These projects are designed to become self-sufficient communities, blending residential, commercial, and cultural elements to create appealing, landmark destinations that drive both foot traffic and long-term value.

Preview the Actual Deliverable

China Resources Land 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive China Resources Land 4P's Marketing Mix Analysis delves into Product, Price, Place, and Promotion strategies. You'll gain detailed insights into their product development, pricing models, distribution channels, and promotional activities. This is the same ready-made Marketing Mix document you'll download immediately after checkout, offering a complete and actionable understanding of their market approach.

Promotion

China Resources Land leverages its robust brand reputation and proactive public relations to cultivate trust. The company actively participates in corporate social responsibility programs, emphasizing its dedication to quality and sustainable urban development, which in 2024 continued to be a cornerstone of its strategy.

This commitment fosters a positive brand image that appeals to a broad client base, from individual homebuyers to institutional investors. For instance, their consistent investment in community improvement projects, often highlighted in their 2024 stakeholder communications, reinforces this perception.

These initiatives are crucial in differentiating them in a competitive market, solidifying their standing as a reliable developer. Their sustained focus on quality construction and customer satisfaction, a narrative strongly pushed through their PR in the 2024 reporting period, directly contributes to this strong public perception.

China Resources Land leverages a robust digital marketing strategy, utilizing its official website, popular social media channels, and prominent real estate portals to showcase its developments. In 2024, the company continued to invest in high-quality visual content, including immersive virtual reality tours and comprehensive project details, to captivate online audiences and facilitate informed decision-making. This digital presence significantly broadens their market reach, allowing them to connect with a wider pool of potential buyers and investors more efficiently than traditional methods.

China Resources Land leverages event-based marketing for new project launches, often featuring grand opening ceremonies, exclusive preview events, and meticulously designed show flats or sales galleries. For instance, in 2023, the company reported significant foot traffic and sales conversions at the launch of its high-end residential project in Shanghai, attributing success to these immersive experiential events. These carefully orchestrated occasions aim to create a tangible connection for potential buyers, allowing them to visualize the envisioned lifestyle and foster a sense of urgency and exclusivity.

Partnerships and Collaborations

China Resources Land actively seeks strategic partnerships to elevate its property developments. They frequently team up with celebrated architects, acclaimed interior designers, and globally recognized hotel brands to imbue their projects with an air of sophistication and desirability. For instance, their collaborations often extend to luxury hospitality providers, ensuring a premium experience for residents and guests alike, a strategy that has consistently driven higher occupancy rates and rental yields in their mixed-use developments.

These alliances are prominently featured in their marketing campaigns, serving as a powerful signal of quality, exclusivity, and adherence to international standards. This approach helps to differentiate China Resources Land's offerings in a highly competitive real estate landscape. In 2024, the company announced a significant partnership with a leading international hotel group for a flagship development in Shanghai, aiming to attract high-net-worth individuals and international business travelers.

- Architectural Excellence: Partnerships with globally renowned architects like Foster + Partners and Zaha Hadid Architects have graced some of their landmark projects, enhancing their aesthetic appeal and market value.

- Brand Prestige: Collaborations with premium hotel operators such as Grand Hyatt and Shangri-La ensure a high standard of service and amenities, contributing to brand equity.

- Market Differentiation: These strategic alliances allow China Resources Land to offer unique value propositions, setting their developments apart from competitors and attracting discerning buyers and investors.

Targeted Advertising Campaigns

China Resources Land implements highly targeted advertising campaigns across a spectrum of media. These efforts are concentrated in real estate publications, prominent online property portals, and strategic outdoor placements in major metropolitan centers. For instance, during the first half of 2024, the company likely amplified its digital marketing spend, reflecting a broader industry trend where online channels accounted for a significant portion of real estate advertising budgets, potentially exceeding 60% in key Tier 1 cities.

The core objective of these campaigns is to connect with specific consumer segments showing interest in premium residential, commercial, and mixed-use developments. Messaging is meticulously crafted to highlight the distinctive advantages and value propositions inherent in each project. This approach ensures that marketing expenditure is optimized by resonating with the most probable buyers, driving engagement and lead generation.

- Media Channels: Real estate journals, leading property websites, and high-visibility urban billboards.

- Target Demographics: Individuals and businesses interested in quality residential, commercial, and mixed-use properties.

- Messaging Focus: Unique Selling Propositions (USPs) of individual development projects.

- Campaign Effectiveness: Data from 2024 suggested a strong correlation between digital ad spend on platforms like WeChat and Baidu and conversion rates for property inquiries.

China Resources Land’s promotional strategy centers on building a strong brand image through CSR and quality emphasis, evident in their continued community investments throughout 2024. They actively engage potential buyers via a robust digital presence, utilizing virtual tours and detailed project information to maximize online reach. Event-based marketing, including grand openings and exclusive previews, creates tangible connections and drives sales, as seen in successful 2023 launches.

Price

China Resources Land employs a value-based pricing approach, setting property prices based on their perceived quality, sophisticated design, prime locations, and extensive amenities. This strategy allows them to charge a premium, distinguishing their offerings from mass-market developments. For instance, in 2024, their average selling price per square meter for prime residential projects in Tier 1 cities like Beijing and Shanghai frequently exceeded RMB 100,000, reflecting the high value proposition.

This premium positioning is directly linked to their brand reputation for creating high-quality urban living environments. Their commitment to superior construction, innovative architectural designs, and integrated community facilities supports these higher price points. The company's consistent delivery of well-appointed properties reinforces customer trust and willingness to pay for the perceived benefits and long-term value.

China Resources Land employs a tiered pricing strategy for its diverse property offerings, distinguishing between residential units, commercial spaces, and investment properties. This approach ensures a range of price points to appeal to various customer needs and budgets within their target market.

Prices are dynamically adjusted, taking into account crucial elements such as property size, advantageous floor levels, desirable views, and unique amenities. For instance, as of mid-2024, premium residential units in prime locations like Shenzhen might command prices exceeding 100,000 RMB per square meter, while comparable commercial spaces in less central districts could be priced at 50,000 RMB per square meter. This granular pricing reflects the varied value propositions across their portfolio.

This tiered system effectively segments the market, allowing China Resources Land to cater to a broad spectrum of affluent buyers and investors. By offering different tiers, they can capture demand from those seeking luxury residences, businesses requiring prime office locations, and investors looking for specific return profiles.

China Resources Land utilizes dynamic pricing strategies, adjusting property values based on real-time market demand, competitor actions, and the broader economic climate within specific urban centers. For instance, in 2024, the company observed varying price sensitivities across Tier 1 and Tier 2 cities, leading to differentiated pricing approaches.

To boost sales and revenue, they strategically deploy price adjustments, attractive incentives, and bundled promotional packages at different stages of property launches. This adaptability is crucial in navigating the highly fluid Chinese real estate landscape, where swift responses to market shifts are paramount for success.

The company's pricing flexibility allows for rapid recalibration, ensuring they can capitalize on favorable market conditions or mitigate risks during downturns. This agile approach was evident in their Q1 2025 sales campaigns, which saw targeted discounts in regions experiencing increased inventory.

By closely monitoring sales velocity and revenue figures, China Resources Land refines its pricing tactics. Their data-driven approach in 2024-2025 highlighted a correlation between prompt price adjustments and improved sell-through rates for new projects.

Long-Term Investment Value Consideration

China Resources Land's pricing strategy inherently considers the long-term investment value and potential appreciation of its properties. This focus is particularly evident in their commercial and premium residential developments, where enduring quality and prime locations are key selling points. These attributes are designed to foster capital growth, attracting investors seeking stable, appreciating assets.

The company’s approach to pricing reflects a deep understanding of investor appetite for assets that promise sustained returns. By highlighting the strategic advantages of their developments, China Resources Land aims to position its properties not just as homes or retail spaces, but as robust investment vehicles. This long-term perspective is crucial in a dynamic real estate market.

- Strategic Locations: Properties are situated in areas with strong economic growth and infrastructure development, enhancing future value.

- Enduring Quality: Commitment to high-quality construction and design ensures property longevity and reduces maintenance costs for investors.

- Capital Appreciation: Historical data for similar developments by China Resources Land often shows consistent capital appreciation, attracting buy-to-let investors and those seeking wealth preservation. For instance, some of their flagship commercial projects in tier-1 cities have seen average annual rental yield growth of 3-5% in recent years, alongside capital value increases.

- Investor Appeal: The pricing reflects not just the current market but also the projected future performance, appealing to sophisticated investors focused on total return.

Financing Options and Payment Terms

China Resources Land actively works to make its premium developments accessible through diverse financing options. They partner with major banks to provide buyers with a range of mortgage solutions and flexible payment schedules, including various down payment structures. This approach is designed to broaden the appeal of their properties to a wider segment of financially capable customers.

For instance, as of early 2024, property developers like China Resources Land often collaborate with financial institutions to offer preferential mortgage rates, potentially shaving basis points off standard market offerings. Buyers might find options such as:

- Extended mortgage terms to reduce monthly outlays.

- Reduced down payment requirements for select projects or buyer profiles.

- Partnerships with banks for streamlined loan approvals.

- Flexible installment plans for early-stage payments or specific property types.

China Resources Land’s pricing strategy centers on capturing the premium value of its prime real estate. They employ a value-based approach, factoring in location, design, and amenities to justify higher price points, with average selling prices in Tier 1 cities like Beijing and Shanghai often exceeding RMB 100,000 per square meter in 2024. This premium is supported by a strong brand reputation for quality urban living, enhancing customer willingness to pay for perceived long-term benefits.

The company utilizes a tiered pricing system across its residential, commercial, and investment properties, ensuring a broad market appeal. Prices are further refined based on property specifics like size, floor, and views, as seen in mid-2024 pricing where Shenzhen prime units could surpass 100,000 RMB/sqm, while commercial spaces in less central areas were around 50,000 RMB/sqm.

Dynamic pricing, adjusted for market demand and economic conditions, is a key tactic, with differentiated approaches for Tier 1 and Tier 2 cities in 2024. China Resources Land also strategically uses price adjustments and bundled promotions to drive sales, demonstrating adaptability crucial in the fast-paced Chinese real estate market. Their data-driven approach in 2024-2025 confirmed that prompt price adjustments correlate with improved sell-through rates.

The pricing reflects a focus on long-term investment value and capital appreciation, particularly for commercial and premium residential projects. By highlighting strategic advantages and enduring quality, they position properties as robust investment vehicles, appealing to investors seeking sustained returns. For instance, flagship commercial projects have shown average annual rental yield growth of 3-5% in recent years, alongside capital value increases.

| Property Type | Example Location | Approx. Price (RMB/sqm) - 2024/2025 | Key Pricing Factors | Strategic Rationale |

| Premium Residential | Beijing (Tier 1 City) | > 100,000 | Location, Design, Amenities, Brand | Value-based premium, brand reinforcement |

| Commercial Space | Shanghai (Tier 1 City) | 60,000 - 90,000 | Location, Foot Traffic, Building Quality | Capturing business demand, investment appeal |

| Residential (Tier 2 City) | Chongqing (Tier 2 City) | 25,000 - 40,000 | Location, Market Demand, Project Features | Market segmentation, broader accessibility |

4P's Marketing Mix Analysis Data Sources

Our China Resources Land 4P's Marketing Mix analysis is built using verified, up-to-date information on company actions, pricing models, distribution strategies, and promotional campaigns. We reference credible public filings, investor presentations, brand websites, industry reports, and competitive benchmarks.