China Resources Land Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Resources Land Bundle

Unlock the comprehensive strategic blueprint of China Resources Land's success with our detailed Business Model Canvas. This in-depth analysis dissects how they master customer relationships, identify key partners, and deliver unparalleled value in the real estate sector. Discover their revenue streams and cost structure to understand their competitive edge.

Ready to gain a competitive advantage? Dive into the full Business Model Canvas for China Resources Land and access all nine building blocks, offering actionable insights into their market-leading strategies. This professionally crafted document is your key to understanding their operational excellence and growth drivers.

See precisely how China Resources Land builds and scales its empire. Our downloadable canvas provides a clear, section-by-section breakdown of their value propositions, revenue streams, and cost structures, perfect for strategic planning or investor presentations. Download the full version to accelerate your own business thinking.

Partnerships

China Resources Land heavily relies on collaborations with local government authorities throughout mainland China. These partnerships are fundamental for acquiring land, obtaining approvals for urban planning, and executing large-scale urban development projects. For example, in 2024, the company continued to leverage these relationships to secure development rights for key urban renewal zones, a strategy that has historically driven its project pipeline.

These government collaborations are indispensable for China Resources Land to secure prime land parcels in desirable locations and to ensure its projects align with municipal development strategies. Such alignment is critical for long-term project success and regulatory compliance. The company’s engagement often extends to comprehensive urban regeneration initiatives, where they work with authorities to improve public infrastructure and amenities, thereby enhancing the value and desirability of their developments.

China Resources Land heavily relies on a robust network of construction companies and contractors to bring its extensive property development projects to life. This includes everything from sprawling residential communities to sophisticated commercial complexes.

These crucial partnerships are essential for guaranteeing that construction is completed on time and to a high standard, meeting all required building codes and quality benchmarks. The efficiency and cost-effectiveness of projects often hinge on the caliber of these construction partners.

For example, in 2023, China Resources Land's total construction expenditure reflected the scale of its operations, with a significant portion allocated to engaging these external construction firms. The careful selection of dependable contractors is a cornerstone of their operational strategy, directly impacting project timelines and budget adherence.

China Resources Land cultivates robust ties with major financial institutions and banks. These partnerships are crucial for securing project financing, obtaining corporate loans, and engaging in capital market activities like bond issuances.

Access to a diverse and cost-effective funding base is paramount for China Resources Land's substantial land reserves and ambitious, large-scale development projects. For example, in 2023, the company successfully issued CNY 1.5 billion in green bonds, demonstrating its ability to tap into various funding channels.

These alliances directly fuel the company's investment capacity and strategic expansion plans across different regions and property types. Such collaborations enable China Resources Land to maintain a healthy liquidity position and pursue growth opportunities effectively.

Retailers and Commercial Tenants

China Resources Land's investment properties, especially its shopping malls and office towers, depend heavily on partnerships with retailers, food and beverage providers, and businesses looking for office space. These tenants are crucial for making its commercial developments dynamic and appealing, which in turn drives customer visits and keeps the spaces occupied, generating steady rental income.

These collaborations are vital for China Resources Land's strategy to create successful commercial hubs. For instance, in 2024, the company continued to focus on attracting a diverse mix of tenants to its mall portfolio, aiming to enhance the overall shopping experience and draw consistent foot traffic. This tenant mix directly influences sales performance and the desirability of the retail locations.

- Tenant Mix Enhancement: China Resources Land actively curates its tenant mix to include a blend of international luxury brands, popular local retailers, and diverse F&B options, ensuring broad customer appeal.

- Occupancy Rates: The company aims for high occupancy rates across its commercial properties, leveraging its strong relationships with tenants to maintain stable rental revenue streams. In 2023, many of its prime mall assets reported occupancy rates exceeding 95%.

- Recurring Rental Income: These partnerships form the backbone of China Resources Land's recurring rental income, providing a predictable revenue source that supports its financial stability and growth.

- Foot Traffic Generation: The presence of sought-after retailers and F&B tenants is a primary driver of foot traffic, which is essential for the success of both the tenants and China Resources Land's own investment properties.

Design and Architectural Firms

China Resources Land’s collaborations with premier design and architectural firms are foundational to developing exceptional urban environments. These partnerships are instrumental in injecting innovative design concepts and embracing sustainable construction methods, thereby elevating the appeal and long-term value of their real estate portfolio.

- Enhancing Property Value: Collaborations with renowned firms like Benoy and RTKL have consistently resulted in award-winning developments, such as the MixC shopping malls, which command premium rents and attract significant foot traffic.

- Innovation in Design: These partnerships allow China Resources Land to integrate cutting-edge architectural trends and smart building technologies, ensuring their projects remain competitive and desirable in evolving markets. For instance, their focus on green building certifications, often guided by these partners, appeals to environmentally conscious tenants and buyers.

- Brand Differentiation: By aligning with top-tier design talent, China Resources Land reinforces its brand image as a developer of high-quality, distinctive properties, setting them apart from competitors.

China Resources Land's ability to secure prime land and navigate complex urban planning is heavily dependent on its partnerships with local government authorities across China. These relationships are crucial for obtaining development rights and approvals, exemplified by their ongoing engagement in urban renewal projects throughout 2024.

The company also relies on a vast network of construction companies and contractors to execute its large-scale property developments. Ensuring timely completion and high-quality standards hinges on the selection of dependable construction partners, a critical factor in managing project timelines and budgets, as seen in their significant construction expenditures in 2023.

Crucial financial partnerships with banks and financial institutions enable China Resources Land to fund its extensive land reserves and ambitious development plans. The successful issuance of CNY 1.5 billion in green bonds in 2023 highlights their capacity to access diverse funding channels, bolstering their investment and expansion capabilities.

Furthermore, attracting and retaining tenants like retailers and businesses is vital for the success of their commercial properties, such as shopping malls and office towers. In 2024, the company continued to focus on curating a diverse tenant mix to drive foot traffic and generate consistent rental income, with many prime mall assets reporting over 95% occupancy in 2023.

| Partnership Category | Key Collaborators | Impact on China Resources Land | Illustrative 2023/2024 Data |

|---|---|---|---|

| Government Authorities | Local Municipal Governments | Land acquisition, project approvals, urban planning alignment | Continued focus on urban renewal zones in 2024 |

| Construction Sector | Construction Companies & Contractors | Project execution, quality control, adherence to timelines | Significant portion of total construction expenditure in 2023 |

| Financial Institutions | Banks, Capital Markets | Project financing, corporate loans, bond issuances | CNY 1.5 billion green bond issuance in 2023 |

| Commercial Tenants | Retailers, F&B Providers, Businesses | Rental income generation, foot traffic, property vibrancy | Over 95% occupancy in prime malls in 2023 |

| Design & Architecture Firms | Renowned Design Studios | Innovative design, sustainable practices, brand differentiation | Development of award-winning MixC malls |

What is included in the product

This Business Model Canvas outlines China Resources Land's integrated approach, focusing on urban development and property management to create vibrant, sustainable communities.

China Resources Land's Business Model Canvas serves as a powerful pain point reliever by providing a clear, one-page snapshot that distills complex strategies into easily digestible components for rapid understanding and decision-making.

This structured approach to visualizing China Resources Land's operations acts as a pain point reliever by streamlining the identification of core business elements, facilitating focused discussions and problem-solving for stakeholders.

Activities

China Resources Land's property development activities are central to its business. This involves the complete journey from understanding market needs to handing over finished properties. They develop a wide range of assets including homes, shopping centers, offices, and hotels. Their aim is to build excellent urban environments for living and working.

In 2024, the company continued its robust development pipeline. For the first half of 2024, China Resources Land reported a contracted sales value of RMB 127.45 billion. This demonstrates their ongoing capability in bringing diverse property projects to market and meeting buyer demand across different segments.

China Resources Land's key activities in investment property operations revolve around the active management and enhancement of its diverse property portfolio. This includes overseeing a network of high-profile MixC shopping malls, modern office buildings, and premium hotels.

Core operational functions involve meticulous leasing management to secure and retain high-quality tenants, fostering strong tenant relationships through dedicated service, and ensuring the upkeep and modernization of properties through proactive maintenance. These efforts are crucial for maximizing rental income streams and preserving the long-term value of its assets.

In 2024, China Resources Land reported significant rental income from its investment properties. For instance, its retail segment, largely driven by the MixC malls, continued to be a strong contributor, with comparable store sales showing robust growth in key cities throughout the first half of the year, reflecting successful tenant mix and operational efficiency.

Strategic asset management is paramount, involving continuous evaluation of market trends, tenant needs, and asset performance to make informed decisions regarding upgrades, repositioning, or potential divestments to optimize the overall portfolio yield and capital appreciation.

China Resources Land, through its subsidiary China Resources Mixc Lifestyle Services, delivers a full suite of property management services. These cover residential, commercial, and mixed-use properties, encompassing facility upkeep, security, cleaning, and community engagement. In 2023, Mixc Lifestyle Services managed over 400 million square meters of property, demonstrating significant scale in its operations.

The company focuses on maintaining high living standards and ensuring operational efficiency for all stakeholders. This commitment is reflected in their 2023 revenue of RMB 20.8 billion from property management services, a notable increase from previous years.

Land Acquisition and Urban Regeneration

China Resources Land's core operations revolve around acquiring new land parcels and driving urban regeneration initiatives. This is crucial for building its development pipeline and solidifying its market position.

These activities demand strategic engagement, including competitive land bidding and intricate negotiations with local government authorities. The goal is to secure prime locations for future growth.

The company focuses on comprehensive planning for integrated urban developments, transforming existing areas into vibrant, functional communities. This often involves a mix of residential, commercial, and public spaces.

For example, in 2024, China Resources Land continued its strategic land acquisition, with significant investments in key economic zones across China. The company actively participated in land auctions, securing several high-potential sites.

- Strategic Land Acquisition: Securing new land parcels through bidding and negotiation is a primary activity.

- Urban Regeneration Projects: Engaging in the redevelopment of existing urban areas is key to expanding the company's footprint.

- Government Negotiations: Building strong relationships and negotiating effectively with local governments is essential for land acquisition.

- Integrated Development Planning: Comprehensive planning for mixed-use urban developments ensures long-term value and market appeal.

Financial Management and Investment

China Resources Land's financial management is a cornerstone of its operations, focusing on efficient capital allocation to fuel its diverse business segments. This includes prudent debt management to maintain a healthy balance sheet and optimize its cost of capital.

The company actively explores new financing avenues to support its growth strategy. Notably, it has been a participant in the Real Estate Investment Trust (REITs) market, demonstrating an interest in diversifying its funding sources and enhancing liquidity.

- Capital Allocation: Strategically deploying capital across property development, commercial operations, and other ventures to maximize returns and support long-term expansion.

- Debt Management: Maintaining a robust credit profile through disciplined borrowing and efficient repayment strategies, ensuring financial stability.

- Financing Avenues: Actively investigating and utilizing innovative financing tools, such as REITs, to access capital and optimize its financial structure.

- Liquidity & Cost of Capital: Ensuring sufficient cash flow for operations and investments while minimizing the overall cost of borrowing.

China Resources Land's property development is a primary activity, encompassing the entire process from market analysis to project handover. They create a variety of properties, including residential, commercial, and hospitality spaces, aiming to build high-quality urban environments. In the first half of 2024, the company achieved contracted sales of RMB 127.45 billion, showcasing their consistent market presence.

Preview Before You Purchase

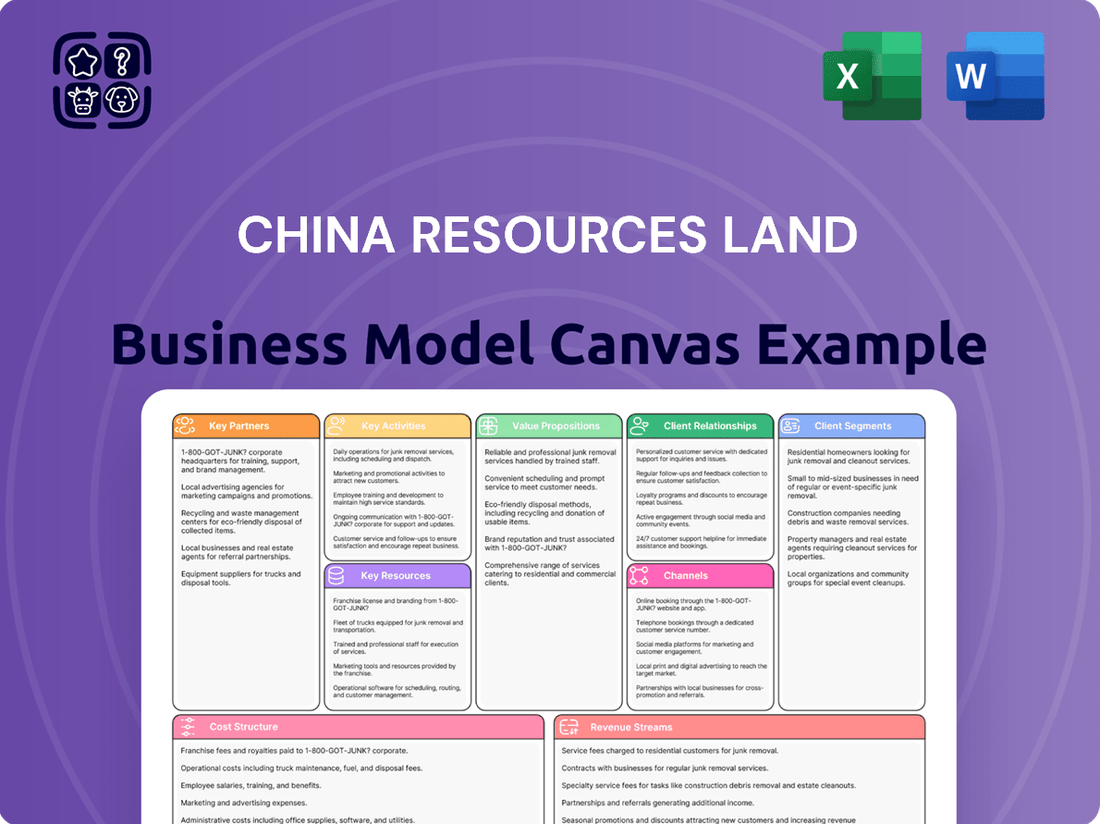

Business Model Canvas

The Business Model Canvas for China Resources Land you're previewing is the actual, complete document you'll receive upon purchase. This isn't a sample or mockup; it's a direct snapshot of the professional, ready-to-use file. Once your order is processed, you'll gain full access to this meticulously crafted canvas, allowing you to immediately leverage its insights for strategic planning and business development.

Resources

China Resources Land boasts an impressive land bank across numerous mainland Chinese cities, ensuring a consistent supply of projects for future growth. This strategic advantage allows them to capitalize on market opportunities and maintain development momentum.

The company's extensive portfolio of premium investment properties, featuring landmark shopping centers and prestigious office buildings, forms a crucial asset base. These properties are key drivers of stable, recurring rental income, contributing significantly to the company's financial stability and cash flow generation.

China Resources Land's financial capital is a cornerstone of its operations, primarily fueled by substantial property sales and consistent rental income. This robust internal generation is complemented by exceptional access to both domestic and international financing channels, a testament to the company's strong market position.

The company's impressive credit ratings, often in the A range or higher, coupled with its state-owned background, significantly reduce borrowing costs. This financial advantage allows China Resources Land to secure capital at favorable rates, enabling strategic investments in new development projects and expansion initiatives.

In 2023, China Resources Land reported total revenue of RMB 230.1 billion, demonstrating its substantial financial capacity. Furthermore, its access to diverse funding sources, including bank loans and bond issuances, underscores its ability to manage large-scale capital requirements for its extensive development pipeline.

China Resources Land's established brand reputation as a leading property developer and operator in China is a significant intangible resource. This strong recognition fosters customer trust and attracts commercial tenants, crucial for its retail and office segments.

The company's market leadership, evidenced by its consistent ranking among top developers, translates into a powerful competitive advantage. For instance, in 2023, China Resources Land maintained its position as a top-tier developer in China, reflecting its sustained market influence and operational excellence.

Skilled Workforce and Management Expertise

China Resources Land's success hinges on its extensive pool of skilled professionals. This includes seasoned urban planners, innovative architects, diligent construction managers, adept leasing specialists, and proficient property managers. Their collective expertise is the bedrock for delivering high-quality projects and maintaining operational excellence across all ventures.

The company's management team brings significant experience in property development, investment strategy, and asset management. This deep understanding allows China Resources Land to navigate complex market dynamics and identify lucrative opportunities, ensuring robust financial performance and sustained growth.

- Skilled Workforce: Employs a vast number of professionals in development, investment, and management roles.

- Expertise Spectrum: Covers urban planning, architecture, construction, leasing, and property management.

- Operational Excellence: Ensures quality project execution and efficient management through experienced personnel.

- Strategic Management: Leverages a management team with profound experience in property development and investment.

Technological Infrastructure and Innovation

China Resources Land’s investment in cutting-edge technological infrastructure is a cornerstone of its business model. This includes a significant commitment to smart building technologies, the Internet of Things (IoT) for enhanced connectivity, and sophisticated integrated management systems. These advancements directly contribute to boosting operational efficiency across their developments.

These technological investments are crucial for improving the overall customer experience, making living and working in their properties more seamless and enjoyable. For instance, by leveraging IoT, they can offer intelligent property management services. In 2024, the company continued to prioritize the rollout of these smart solutions, aiming to further differentiate its offerings in a competitive market.

- Smart Building Technologies: Enhancing energy efficiency and occupant comfort.

- IoT Solutions: Enabling real-time monitoring and predictive maintenance.

- Integrated Management Systems: Streamlining property operations and data analytics.

- Commitment to Intelligent Urban Spaces: Creating sustainable and technologically advanced communities.

China Resources Land's key resources include a vast land bank across China, a substantial portfolio of income-generating properties, and strong financial capital. Their established brand reputation and a highly skilled workforce are also critical intangible assets.

The company actively invests in advanced technology, such as smart building systems and IoT solutions, to enhance operational efficiency and customer experience. This commitment to innovation is a key differentiator in the market.

In 2023, China Resources Land reported RMB 230.1 billion in revenue, showcasing its significant financial strength and ability to access diverse funding sources. Its market leadership, consistently ranked among top developers, further solidifies its competitive position.

| Key Resource | Description | 2023 Impact/Data |

|---|---|---|

| Land Bank | Extensive holdings across numerous Chinese cities | Supports consistent project pipeline |

| Property Portfolio | Premium shopping centers and office buildings | Drives stable rental income |

| Financial Capital | Strong internal generation and access to financing | RMB 230.1 billion revenue; favorable borrowing costs |

| Brand Reputation | Leading developer and operator in China | Fosters customer trust and tenant attraction |

| Skilled Workforce | Professionals in planning, architecture, management, etc. | Ensures quality project execution and operational excellence |

| Technology Infrastructure | Smart building tech, IoT, integrated management systems | Boosts operational efficiency and customer experience; continued 2024 rollout |

Value Propositions

China Resources Land delivers meticulously designed urban residences, emphasizing superior craftsmanship and modern amenities to create comfortable living environments. Their commitment to thoughtful layouts and high-quality construction directly enhances the urban lifestyle for residents.

In 2024, the company continued its focus on quality, with a significant portion of its new projects launched in tier-one and desirable tier-two cities, attracting discerning buyers seeking premium living experiences. This strategy is reflected in their sales performance, where projects offering enhanced living spaces consistently achieve strong market absorption rates.

China Resources Land excels in crafting premium commercial and retail environments, exemplified by its renowned MixC malls. These developments aren't just shopping destinations; they are meticulously designed urban centers offering unparalleled retail experiences, a wide array of dining choices, and sophisticated office spaces.

These world-class properties act as significant commercial hubs, drawing in both prestigious international brands and dynamic businesses seeking prime locations. In 2024, China Resources Land continued to expand its portfolio, with MixC malls consistently reporting strong foot traffic and sales performance, reinforcing their appeal to both consumers and tenants.

China Resources Land excels in developing integrated mixed-use complexes, strategically blending residential, commercial, office, and hospitality spaces. This approach fosters a synergistic environment, enhancing convenience and offering a vibrant urban lifestyle for residents and visitors alike. These projects are designed to meet the diverse and evolving demands of modern city living.

In 2023, China Resources Land continued its focus on these comprehensive developments, with significant projects contributing to its revenue stream. For instance, its substantial investment in urban regeneration and mixed-use projects across tier-1 and key tier-2 cities underscores this strategy. The company reported a significant portion of its operating income stemming from these multifaceted properties.

Reliable and Professional Property Management

China Resources Land's property management arm is a cornerstone of its value proposition, focusing on delivering meticulously maintained properties and exceptionally responsive services. This dedication ensures residents and tenants experience a safe, clean, and well-cared-for environment.

This commitment to professional management directly translates into tangible benefits. It not only bolsters property values but also significantly elevates tenant satisfaction, laying the groundwork for enduring relationships and repeat business. In 2024, the company's property management segment reported a substantial contribution to overall revenue, reflecting the success of its operational excellence.

- Enhanced Property Value: Consistent upkeep and professional management contribute to sustained asset appreciation.

- Tenant Satisfaction: Responsive service and a focus on living environment foster loyalty and reduce turnover.

- Operational Efficiency: Streamlined management processes ensure cost-effectiveness and high service standards.

- Brand Reputation: A reputation for reliable property management strengthens the China Resources Land brand across its portfolio.

Strategic Locations and Sustainable Development

China Resources Land focuses its property development on key urban centers with strong growth potential, aiming to secure prime locations that offer excellent accessibility and long-term value appreciation. In 2024, the company continued to prioritize these high-growth areas, a strategy that has historically proven effective in capturing market demand.

The company's commitment to sustainable development is a core value proposition. This includes adopting green building practices, pursuing recognized green certifications, and integrating energy-efficient designs into its projects. This approach not only appeals to a growing segment of environmentally aware consumers but also aligns with broader urban sustainability goals.

- Strategic Location Focus: Properties are situated in vital urban areas with high growth forecasts, ensuring strong connectivity and potential for future value increases.

- Sustainable Practices: Commitment to green building standards, energy efficiency, and environmental certifications.

- Customer Appeal: Attracts environmentally conscious buyers seeking sustainable living spaces.

- Urban Contribution: Actively contributes to the ecological and economic well-being of the cities in which it operates.

China Resources Land's value proposition centers on creating high-quality urban living and commercial spaces, with a strong emphasis on integrated developments and professional property management. Their strategic focus on prime urban locations and sustainable practices further enhances property value and customer appeal.

| Value Proposition | Description | 2024 Impact/Focus |

|---|---|---|

| Premium Urban Residences | Meticulously designed homes with superior craftsmanship and modern amenities. | Continued focus on tier-one and desirable tier-two cities, driving strong sales for enhanced living spaces. |

| World-Class Commercial & Retail | Creation of vibrant urban centers like MixC malls offering unparalleled retail, dining, and office experiences. | MixC malls consistently reported strong foot traffic and sales, attracting premium brands and businesses. |

| Integrated Mixed-Use Developments | Synergistic blending of residential, commercial, office, and hospitality spaces for enhanced urban convenience. | Significant revenue contribution from these multifaceted properties, reflecting investment in urban regeneration. |

| Exceptional Property Management | Delivering meticulously maintained properties and responsive services to ensure tenant satisfaction and property value. | Substantial revenue contribution from property management, highlighting operational excellence and tenant loyalty. |

| Strategic Location & Sustainability | Development in key urban centers with strong growth potential, incorporating green building practices. | Prioritization of high-growth areas and commitment to energy efficiency appealing to environmentally conscious buyers. |

Customer Relationships

China Resources Land leverages dedicated sales teams to actively engage with potential buyers and tenants, offering personalized guidance throughout the acquisition process. This proactive approach ensures a smooth and informative experience. In 2024, the company continued to emphasize its commitment to customer satisfaction through these specialized teams.

Complementing the sales efforts, robust customer service departments are in place to promptly address inquiries and provide essential post-sale support. This focus on ongoing engagement fosters trust and loyalty. The company reported a customer satisfaction score of 88% in its 2024 customer surveys, reflecting the effectiveness of these support structures.

China Resources Land actively cultivates community engagement within its residential developments, employing a multifaceted approach to build lasting resident relationships. These initiatives are designed to foster a strong sense of belonging and significantly boost resident satisfaction, which in turn drives repeat business and generates valuable positive word-of-mouth referrals.

The company’s loyalty programs are a cornerstone of this strategy, rewarding long-term residents and encouraging continued patronage. For instance, in 2024, China Resources Land reported a notable increase in participation across its various community events, signaling a growing appreciation for these engagement efforts among its customer base.

China Resources Land actively nurtures its tenant relationships within its commercial properties. This involves consistent communication, establishing feedback channels, and providing support for their business development, which is crucial for maintaining high occupancy rates.

In 2024, the company's focus on tenant retention through these proactive measures contributed to a robust occupancy rate across its portfolio. For example, their key shopping malls maintained an average occupancy of over 95%, demonstrating the effectiveness of their relationship management strategies in fostering long-term tenancy.

This approach not only ensures stable rental income but also cultivates a collaborative environment where tenants feel valued and supported, leading to reduced churn and enhanced brand loyalty within their commercial developments.

Digital Platforms and Online Support

China Resources Land actively leverages digital platforms, including online portals and mobile applications, to facilitate customer interactions and provide property information. This approach offers a convenient and accessible way for their tech-savvy customer base to engage with services and information.

The company's digital channels streamline communication for service requests and property inquiries, enhancing the overall customer experience. This focus on online support is crucial for meeting the expectations of a modern consumer.

In 2024, China Resources Land continued to invest in digital transformation, aiming to improve customer engagement. While specific user numbers for their platforms aren't publicly detailed, the broader trend in China's real estate sector shows significant growth in online property searches and digital service utilization.

- Digital Channels: Utilizes online portals, mobile apps, and social media for customer engagement.

- Convenience: Provides easy access to property information and service requests.

- Customer Base: Caters to a growing demographic of tech-savvy property buyers and residents.

- Streamlined Communication: Enhances interaction through accessible digital touchpoints.

Partnerships with Government and Institutional Clients

China Resources Land cultivates enduring, strategic partnerships with government entities and institutional investors. These relationships are cemented through a track record of successful project execution, aligning with national and local development objectives.

These crucial alliances are nurtured via direct dialogue, collaborative joint ventures, and participation in public-private partnerships, ensuring mutual benefit and long-term value creation.

- Government Collaboration: China Resources Land actively engages with various levels of government to secure land, navigate regulatory approvals, and align development projects with urban planning initiatives. This often involves long-term land use agreements and participation in government-led urban renewal projects.

- Institutional Investor Integration: The company partners with institutional investors, such as sovereign wealth funds and large asset managers, through co-investment vehicles and joint ventures. These partnerships provide significant capital for large-scale developments and offer investors access to China's robust real estate market. For instance, in 2024, the company continued to leverage these relationships to fund its expansion into new urban centers and specialized property segments like logistics and healthcare facilities.

- Project Delivery Excellence: A consistent history of delivering high-quality, timely projects is fundamental to maintaining trust and fostering repeat business with these key stakeholders. This focus on operational efficiency and quality assurance reinforces China Resources Land's reputation as a reliable partner.

- Shared Development Vision: Building these relationships involves a shared commitment to sustainable urban development, economic growth, and community well-being. This alignment of goals ensures that projects contribute positively to the broader societal and economic landscape.

China Resources Land actively builds trust with customers through personalized engagement via dedicated sales and service teams, aiming for high satisfaction. In 2024, their customer satisfaction score reached 88%, reflecting successful relationship management.

Community engagement and loyalty programs are key to fostering belonging and repeat business in residential developments. The company saw increased participation in community events in 2024, highlighting growing resident appreciation.

For commercial tenants, consistent communication and feedback channels are vital for retention and high occupancy. In 2024, their major shopping malls maintained over 95% occupancy, underscoring the effectiveness of these tenant relationship strategies.

Digital platforms enhance customer interaction and service access, catering to a tech-savvy base. Continued investment in digital transformation in 2024 aims to further improve customer engagement, aligning with broader industry trends.

Channels

Direct Sales Offices and Showrooms are the cornerstone of China Resources Land's customer engagement, serving as the primary channel for property sales. These physical locations are crucial for allowing potential buyers to immerse themselves in the quality of construction by visiting model units and engaging directly with knowledgeable sales representatives.

Strategically positioned within or proximate to their development sites, these offices and showrooms are designed to maximize accessibility for interested parties. This direct interaction fosters trust and provides a tangible experience of the lifestyle and quality China Resources Land promises.

In 2024, China Resources Land continued to leverage this channel effectively, with sales generated through these physical touchpoints forming a significant portion of their revenue. For instance, their robust sales performance in major cities often correlates with the foot traffic and conversion rates observed in their prime showroom locations.

China Resources Land strategically leverages its official website and prominent online property portals to connect with a vast digital audience. These platforms serve as virtual showrooms, offering comprehensive property details, high-quality imagery, and virtual tours to attract potential buyers. In 2024, the company continued to invest in enhancing these digital channels to streamline the customer journey from initial browsing to booking.

The company's online presence is crucial for lead generation and customer engagement. By providing detailed information on pricing, amenities, and location, China Resources Land aims to capture interest and facilitate direct inquiries. For instance, their website often features interactive maps and downloadable brochures, simplifying the information-gathering process for prospective clients.

These digital avenues are integral to broadening market reach beyond traditional offline methods. By appearing on major real estate platforms, China Resources Land ensures visibility among a diverse range of property seekers actively searching for new homes or investments. This digital footprint is key to their customer acquisition strategy.

China Resources Land collaborates with external real estate agencies and brokers to significantly broaden its sales network and tap into specialized market knowledge. These partnerships are crucial for effective property marketing, identifying potential buyers, and finalizing transactions.

In 2024, the reliance on third-party agencies remained a cornerstone of China Resources Land's sales strategy. For instance, the company's projects in Tier 1 and Tier 2 cities frequently utilized established brokerage firms to reach a wider demographic, contributing to sales volumes that consistently met or exceeded targets in key urban centers.

Targeted Marketing and Advertising Campaigns

China Resources Land leverages extensive marketing and advertising campaigns, utilizing digital, print, and outdoor channels to build brand awareness and promote its diverse property portfolio. These efforts are meticulously designed to reach specific customer segments with messages that resonate with their needs and aspirations.

In 2024, the company continued to invest heavily in digital marketing, recognizing its effectiveness in reaching younger demographics and driving engagement. This includes targeted social media campaigns and content marketing strategies, often featuring virtual property tours and interactive online experiences. Their focus on data analytics allows for precise audience segmentation, ensuring marketing spend is optimized for maximum impact.

- Digital Dominance: Significant allocation towards online advertising, including search engine marketing and social media platforms, to capture prospective buyers.

- Brand Storytelling: Campaigns often emphasize the lifestyle and community aspects of their developments, building an emotional connection with consumers.

- Offline Integration: Strategic use of traditional media like billboards and print advertisements in high-traffic areas to complement digital efforts and reinforce brand presence.

- Customer Segmentation: Tailored messaging for different buyer profiles, from first-time homebuyers to luxury property seekers, ensuring relevance and effectiveness.

Property Exhibitions and Industry Events

China Resources Land actively participates in major property exhibitions and industry events. This strategy is crucial for showcasing their diverse real estate portfolio and engaging directly with a broad audience of potential buyers and investors. For instance, in 2023, the company highlighted its residential, commercial, and mixed-use developments at key national property expos, aiming to drive sales and brand awareness.

These events serve as vital platforms for networking with industry peers, forging strategic partnerships, and staying abreast of market trends and innovations. By being present at these gatherings, China Resources Land can solidify its reputation as a leading developer and explore new business opportunities. Their presence at the 2024 China Real Estate Industry Summit, for example, facilitated discussions on sustainable development and smart city solutions.

- Showcasing Portfolio: Property exhibitions allow China Resources Land to present a comprehensive overview of their residential, commercial, and integrated developments to a wide audience.

- Customer Engagement: Direct interaction at events helps in understanding customer needs, generating leads, and fostering relationships with potential buyers.

- Investor Relations: Industry events provide opportunities to connect with financial institutions and potential investors, showcasing the company's financial performance and growth prospects.

- Industry Networking: Participation fosters collaboration with developers, suppliers, and government bodies, enabling knowledge exchange and strategic alliances.

China Resources Land utilizes property exhibitions and industry events as key channels to directly engage with potential buyers and investors, showcasing their diverse portfolio. These events are crucial for generating leads, building brand awareness, and fostering relationships. In 2024, the company continued its active participation in major national and international property expos, a strategy that has historically contributed significantly to their sales pipeline.

These gatherings offer a unique opportunity to present their latest developments, from high-end residential projects to commercial complexes, to a targeted audience. The company's presence at events like the 2024 China International Import Expo's property section, for example, allowed them to highlight their commitment to quality and innovation.

Furthermore, participation in these events facilitates direct feedback from the market, enabling China Resources Land to refine its offerings and strategies. By actively engaging with customers and industry stakeholders at these events, they reinforce their market position and explore new avenues for growth.

| Event Type | Purpose | 2024 Focus Areas | Impact on Sales |

|---|---|---|---|

| Property Exhibitions | Showcasing Developments, Lead Generation | Residential Projects, Mixed-Use Developments | Direct sales conversion from event attendees. |

| Industry Conferences | Networking, Market Insights, Partnerships | Sustainable Development, Smart City Integration | Indirectly drives future sales through strategic alliances. |

| Investor Roadshows | Attracting Investment, Communicating Performance | Financial Health, Growth Prospects | Securing capital for new projects, enhancing investor confidence. |

Customer Segments

China Resources Land targets urban middle to high-income families who prioritize premium living spaces for personal use. These families are typically found in major metropolitan areas, seeking residences that offer convenience and a high quality of life. Their purchasing decisions are heavily influenced by factors like brand trust and the availability of integrated lifestyle amenities.

In 2024, the demand for quality housing in China's Tier 1 and Tier 2 cities remained robust, with families in these segments actively looking for properties that provide a comprehensive living experience. For instance, the average price per square meter in Beijing's desirable districts continued to be a significant indicator of this segment's purchasing power, often exceeding 70,000 RMB.

This customer segment values not just the physical property but also the surrounding environment, including proximity to reputable schools, healthcare facilities, and retail centers. China Resources Land's strategy focuses on developing projects that embody this holistic approach to urban living, ensuring strong brand loyalty and repeat business from satisfied homeowners.

Businesses seeking premium office and retail space represent a core customer segment for China Resources Land. This group includes a wide array of entities, from large corporations requiring expansive, prestigious headquarters to small and medium-sized enterprises (SMEs) looking for accessible and cost-effective locations. Retail brands, in particular, actively seek out China Resources Land's developments for their strategic positioning and high foot traffic, crucial for driving sales and brand visibility.

For corporations and SMEs, the appeal lies in modern amenities, efficient building management, and the prestige associated with well-located commercial properties. These businesses often prioritize spaces that enhance employee productivity and brand image. In 2024, the demand for high-quality office space remained robust, with companies increasingly focusing on environments that support hybrid work models and employee well-being, a trend China Resources Land's premium developments are designed to accommodate.

Retail businesses, on the other hand, are driven by location and customer accessibility. They seek retail spaces within China Resources Land's integrated developments that offer a strong customer base and excellent visibility. For instance, the company's large-scale shopping malls and mixed-use projects consistently attract leading domestic and international retail brands, drawn by the guaranteed footfall and the synergistic environment created by residential and entertainment components. This segment is vital for the company's retail leasing revenue.

Real estate investors, both individual and institutional, are a key customer segment for China Resources Land. These investors are actively seeking opportunities within China's vast property market. Individual investors often focus on residential units, looking for either consistent rental income or the potential for capital appreciation over time.

Institutional investors, on the other hand, typically target larger commercial assets. This includes significant interest in shopping malls and office buildings, where they can leverage scale and professional management for returns. In 2024, China's real estate market continued to present opportunities, though with evolving dynamics, and investors are closely watching policy shifts and economic indicators. For example, foreign direct investment in China's real estate sector saw fluctuations, reflecting investor sentiment and market conditions.

Hotel Guests and Convention Attendees

China Resources Land's hotel segment caters to a diverse group of guests. This includes business travelers who value convenient locations and efficient services, often found in their integrated developments. Tourists seeking comfortable and well-appointed accommodations also form a significant portion of this customer base.

A key segment comprises attendees of conferences and events hosted within or near China Resources Land's properties. These individuals require quality lodging and access to event facilities.

- Business Travelers: Seeking convenience and premium amenities.

- Tourists: Looking for comfortable and well-located stays.

- Convention & Event Attendees: Requiring seamless accommodation and event access.

In 2024, the hospitality sector saw a strong rebound in business and leisure travel. China Resources Land's hotels, integrated into urban complexes, are well-positioned to capture this demand, leveraging their prime locations and comprehensive service offerings.

Local Governments and Urban Planning Authorities

China Resources Land acts as a crucial partner for local governments and urban planning authorities, undertaking extensive urban regeneration projects and developing new economic zones. Their role as an urban investor and operator means they are instrumental in transforming existing cityscapes and establishing vibrant new communities.

These government bodies frequently engage China Resources Land to spearhead large-scale urban development initiatives, often involving the creation of entirely new urban centers or significant upgrades to existing infrastructure. The company's expertise in integrated development makes them a preferred collaborator for complex, multi-faceted projects.

- Urban Investment Partner: Local governments select China Resources Land for their capacity to invest significant capital into urban infrastructure and development projects, ensuring project viability and timely execution.

- Development Expertise: The company's proven track record in managing complex development cycles, from planning and design to construction and sales, makes them ideal for government-led urban renewal.

- Operational Capabilities: Beyond development, China Resources Land’s operational skills are vital for the long-term success of urban projects, including property management and community building.

- Economic Growth Driver: By partnering with China Resources Land, local authorities aim to stimulate economic growth, create jobs, and enhance the overall livability and attractiveness of their regions.

China Resources Land's customer base is multifaceted, encompassing individuals seeking quality residences, businesses requiring prime commercial spaces, and investors looking for market opportunities. Their hotel operations also cater to a broad spectrum of travelers, from business professionals to tourists.

The company's strategic partnerships with local governments are crucial, positioning them as a key player in urban regeneration and development, driving economic growth and city improvement.

In 2024, the residential market in China's major cities saw continued interest from middle to high-income families valuing integrated lifestyle amenities and brand reputation. Commercial property demand remained strong, with businesses prioritizing modern, well-managed spaces supporting hybrid work models.

| Customer Segment | Key Needs | 2024 Market Context |

|---|---|---|

| Urban Families (Middle-High Income) | Premium living, quality of life, brand trust, integrated amenities | Robust demand in Tier 1/2 cities; average price per sqm in Beijing districts exceeded 70,000 RMB. |

| Businesses (Corporations, SMEs, Retail) | Prestigious office space, efficient management, high foot traffic for retail | Strong demand for quality office space supporting hybrid work; retail brands sought strategic locations. |

| Real Estate Investors (Individual, Institutional) | Rental income, capital appreciation, commercial asset returns | Continued opportunities with evolving market dynamics; FDI in real estate saw fluctuations. |

| Hotel Guests (Business, Leisure, Event Attendees) | Convenience, premium services, comfortable accommodation, event access | Strong rebound in hospitality sector driven by business and leisure travel. |

| Local Governments/Urban Planning Authorities | Urban regeneration, new economic zones, infrastructure development | Partnerships for large-scale urban development initiatives, driving economic growth. |

Cost Structure

China Resources Land's cost structure heavily features land acquisition expenses, particularly for prime sites in major Chinese urban centers. These costs are directly impacted by the competitive real estate market, government land auction dynamics, and the inherent value of the location. For instance, in 2023, the company's significant investments in land reserves underscore this cost center's importance in its expansion strategy.

Construction and development expenses are a major component of China Resources Land's cost structure, directly reflecting the physical creation of their properties. These costs encompass everything from the concrete and steel that form the buildings to the skilled labor and specialized machinery needed for their assembly. Sub-contractor fees are also a significant element, covering specialized services like electrical, plumbing, and HVAC installations.

The variability in these expenses is substantial, driven by the project's scope and ambition. A high-end residential complex will naturally incur higher material and labor costs than a mid-range commercial development. In 2024, China Resources Land continued to manage these significant expenditures, with their total property development costs representing a substantial portion of their overall operational outlay.

China Resources Land incurs significant expenses in managing its diverse property portfolio. These costs encompass the day-to-day operations of shopping malls, office buildings, and hotels, including essential utilities like electricity and water, as well as routine maintenance to ensure facilities remain in top condition.

Staffing is a major component, covering salaries for property managers, maintenance crews, security personnel, and customer service teams across all their commercial and residential properties. Furthermore, marketing and promotional activities for these assets, aimed at attracting tenants and visitors, contribute to the overall operational expenditure.

For residential communities, property management services involve more than just upkeep; they include resident services, security, and communal area maintenance. These ongoing investments are crucial for maintaining property value and tenant satisfaction. For instance, as of the first half of 2024, China Resources Land reported a significant portion of its revenue was channeled back into operational expenses to support its extensive property management network.

Financing and Interest Expenses

China Resources Land's cost structure heavily features financing and interest expenses, reflecting its capital-intensive nature in land acquisition and project development. These costs arise from various financial instruments used to secure the substantial funding required for its extensive operations.

Managing these borrowing costs is paramount to maintaining profitability. The company utilizes a mix of bank loans and corporate bonds to finance its growth, and the interest paid on this debt directly impacts its bottom line. For instance, in 2023, China Resources Land reported significant interest expenses, underscoring the importance of efficient financial management.

- Interest Expense: Costs associated with servicing debt, including loans and bonds.

- Financing Costs: Broader expenses related to raising capital, such as issuance fees.

- Debt Management: Strategies employed to minimize interest burdens and optimize capital structure.

- Profitability Impact: The direct correlation between financing costs and overall net profit.

Marketing, Sales, and Administrative Expenses

China Resources Land's cost structure includes significant outlays for marketing, sales, and administration. These expenses are crucial for driving property sales and maintaining operational efficiency.

Key components of these costs involve extensive advertising campaigns across various media platforms, aiming to reach a broad customer base. Sales commissions paid to agents and the operational costs of maintaining attractive showrooms are also substantial. Furthermore, the company incurs general administrative overhead to support its nationwide operations, including salaries, office expenses, and regulatory compliance.

For instance, during the first half of 2024, China Resources Land reported that its selling, general, and administrative expenses (SG&A) amounted to RMB 12.5 billion, reflecting ongoing investments in market presence and corporate functions. This figure represents a commitment to building brand awareness and ensuring smooth business operations.

- Marketing and Advertising: Costs for brand promotion, digital marketing, and traditional advertising channels.

- Sales Operations: Includes sales commissions, showroom setup and maintenance, and sales team salaries.

- Administrative Overhead: General company operating expenses such as management salaries, office rentals, and IT infrastructure.

- Research and Development: Investments in understanding market trends and developing new property concepts, though often bundled.

China Resources Land's cost structure is dominated by land acquisition, construction, and operational expenses. In the first half of 2024, the company reported significant outlays in these areas, with selling, general, and administrative expenses alone reaching RMB 12.5 billion. Interest expenses also remain a crucial cost component due to the capital-intensive nature of real estate development, impacting overall profitability.

| Cost Category | Key Components | 2023/H1 2024 Significance |

| Land Acquisition | Purchase of land parcels, especially in prime urban areas | A primary driver of capital expenditure; significant investments in land reserves throughout 2023. |

| Construction & Development | Materials, labor, sub-contractor fees, machinery | Represents a substantial portion of operational outlay; costs vary significantly by project scope. |

| Property Management & Operations | Utilities, maintenance, staffing (managers, crews, security), marketing | Ongoing investments to maintain property value and tenant satisfaction; significant revenue channeled into these expenses in H1 2024. |

| Financing & Interest | Interest on loans and bonds, capital raising fees | Directly impacts profitability; significant interest expenses reported in 2023. |

| Sales, Marketing & Administration | Advertising, sales commissions, showrooms, general overhead | Crucial for driving sales and operational efficiency; SG&A was RMB 12.5 billion in H1 2024. |

Revenue Streams

China Resources Land's primary revenue stream is property sales. This includes the sale of residential apartments, commercial office buildings, and retail spaces that the company develops. In 2023, the company's revenue from property sales reached approximately RMB 212.08 billion, underscoring its significance as the largest contributor to its consolidated top line.

China Resources Land generates significant recurring revenue through its rental income from a substantial portfolio of investment properties. This includes prime commercial assets like the high-end MixC shopping malls, modern office buildings, and other strategically located investment properties. These leases provide a stable and predictable income stream, contributing consistently to the company's overall profitability.

As of the first half of 2024, China Resources Land reported rental income of approximately RMB 5.1 billion, showcasing the robust performance of this revenue segment. The company continues to expand its rental property holdings, aiming to increase the contribution of this stable income source to its financial results. This strategy diversifies revenue and enhances the resilience of its business model.

China Resources Land generates revenue through property management fees, a steady income stream derived from servicing residential communities and commercial properties. This is an asset-light business segment that contributes to the company's overall financial stability.

These fees are typically collected on a recurring basis, providing a predictable revenue flow for the company. As China Resources Land continues to expand its property portfolio, this management fee income is expected to grow, reinforcing its position as a reliable revenue source.

Hotel and Hospitality Operations

China Resources Land generates revenue from its hotel and hospitality operations, primarily through the management and operation of hotels integrated within its extensive property developments. This includes income derived from various services offered to guests.

Key revenue components within this segment encompass:

- Room Bookings: Revenue generated from overnight stays in hotel rooms.

- Food and Beverage Sales: Income from restaurants, bars, room service, and banquets.

- Conference and Event Facilities: Earnings from renting out meeting rooms, exhibition spaces, and associated services for corporate events and social gatherings.

This diversified revenue stream significantly contributes to the company's overall financial performance by tapping into the lucrative hospitality market. For instance, in 2023, China Resources Land reported a substantial contribution from its commercial and hotel operations, showcasing the importance of this segment in its business model.

Value-Added Services and Other Business Segments

China Resources Land diversifies its revenue beyond core property development through a suite of value-added services and other business segments. These offerings often stem from its extensive urban development experience and can include specialized urban infrastructure solutions, such as integrated public utilities or smart city components.

The company also leverages an asset-light management model, generating income from property management, leasing, and investment advisory services. This allows them to monetize their expertise and brand without significant capital outlay on new developments. For instance, in 2023, their property management segment demonstrated robust growth, contributing significantly to the overall revenue mix.

- Urban Infrastructure Solutions: Providing integrated services for city development projects.

- Asset-Light Management: Generating revenue from property management, leasing, and advisory.

- Ecosystem Elementary Businesses: Monetizing services that support their core property operations.

- Other Related Services: Expanding into new ventures that leverage core competencies.

China Resources Land's revenue streams are multifaceted, extending beyond primary property sales. The company benefits from substantial recurring income through rental operations, particularly from its high-profile MixC shopping malls and office buildings. Complementing this is revenue generated from property management fees, an asset-light segment that provides consistent cash flow.

| Revenue Stream | Description | 2023 Contribution (Approx. RMB bn) | H1 2024 Contribution (Approx. RMB bn) |

|---|---|---|---|

| Property Sales | Residential, commercial, and retail property sales | 212.08 | N/A |

| Rental Income | Lease income from investment properties (malls, offices) | N/A | 5.10 |

| Property Management Fees | Fees for servicing residential and commercial properties | N/A | N/A |

| Hotel Operations | Revenue from hotel services (rooms, F&B, events) | Significant contribution | N/A |

| Other Services | Urban infrastructure, asset-light management, advisory | Robust growth in property management segment | N/A |

Business Model Canvas Data Sources

The China Resources Land Business Model Canvas is informed by a blend of internal financial statements, extensive market research reports on the Chinese real estate sector, and competitor analysis. These sources provide a comprehensive understanding of customer needs, market opportunities, and the competitive landscape.