China Resources Land Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Resources Land Bundle

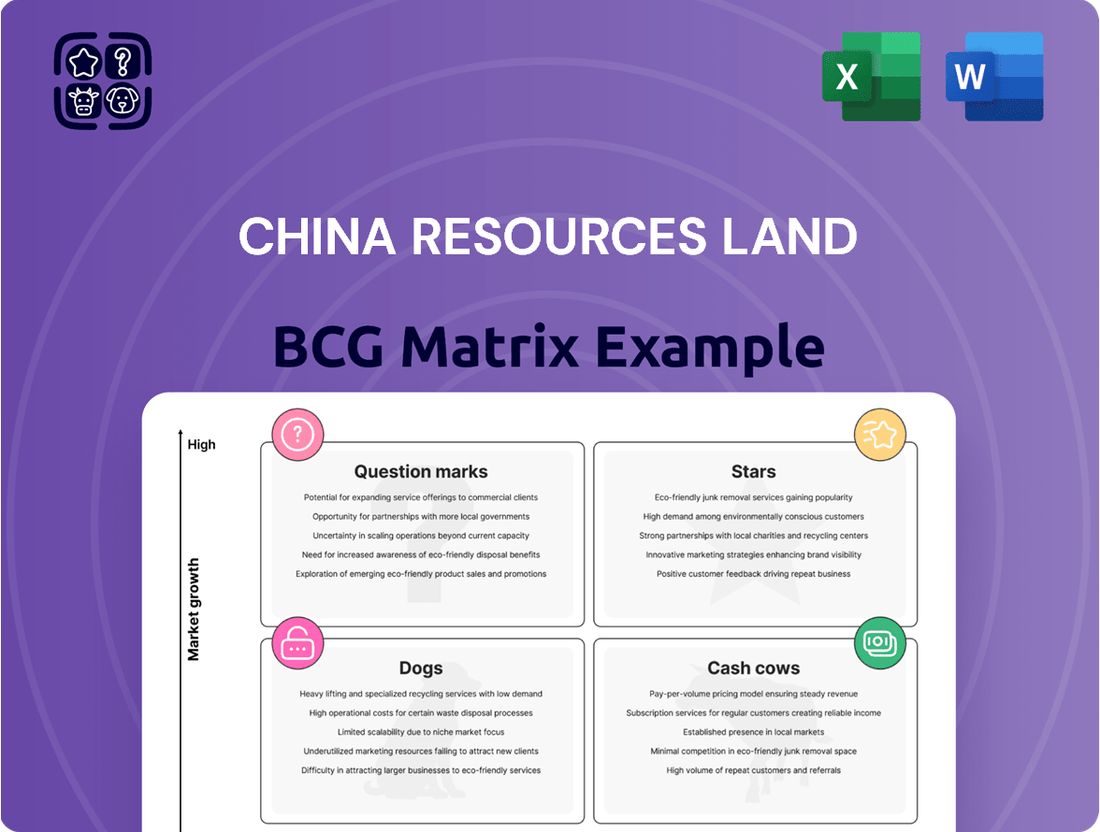

Curious about China Resources Land's strategic positioning? Our BCG Matrix preview offers a glimpse into how their diverse portfolio might be categorized. Are their prime developments Stars, generating significant revenue, or are some projects more like Cash Cows, providing stable income?

Understanding these dynamics is crucial for any investor or competitor. This brief look hints at the power of a full analysis, revealing which ventures demand more investment and which are simply coasting.

Don't settle for speculation; get the complete picture. Purchase the full China Resources Land BCG Matrix for a detailed quadrant-by-quadrant breakdown and actionable insights.

This comprehensive report will equip you with the knowledge to make informed decisions about where to focus capital and strategic attention. Unlock the full potential of your understanding by investing in the complete strategic roadmap.

Stars

China Resources Land's premium residential developments in Tier-1 cities like Beijing and Shanghai are firmly placed in the Stars category. These locations benefit from sustained demand and higher average selling prices, contributing to robust profit margins for CR Land. The company's strategic land acquisition, with 94% of its 2024 land bank concentrated in Tier 1 and Tier 2 cities, underscores its commitment to these high-growth markets.

The MixC branded mixed-use complexes are China Resources Land's star assets, especially those situated in prime urban locations. These developments are not just shopping destinations; they are integrated urban hubs that draw significant customer traffic and command premium rental rates. For instance, in 2023, CR Land's retail portfolio, heavily featuring The MixC, achieved a total retail sales value of RMB 138.5 billion, with rental income also showing robust growth.

These complexes act as powerful urban landmarks, attracting high footfall and sought-after premium tenants, which translates into substantial retail sales and rental income for CR Land. The company's ambitious strategy to launch five to six new retail projects annually up to 2028 underscores the continued growth trajectory and strategic emphasis placed on this segment. This expansion plan is expected to further solidify The MixC's position as a market leader.

China Resources Land's urban regeneration and renewal projects are a significant growth driver, benefiting from strong government backing for urban improvement. These initiatives are crucial for enhancing city living and infrastructure across China.

Such ventures demand meticulous planning and substantial capital, but the rewards are considerable. They reshape urban environments, creating prime commercial and residential districts. In 2024, China's urbanization rate reached approximately 65.04%, highlighting the ongoing demand for such development.

High-End Office Buildings in Emerging Business Districts

Developing and operating high-end office buildings in emerging business districts is a key strategy for China Resources Land (CR Land). This allows the company to tap into the demand from burgeoning industries and expanding businesses in China's major urban centers. These premium properties, featuring modern amenities and strategic locations, can secure higher rental income and stable, long-term tenants, bolstering both market presence and revenue growth.

The office sector, while experiencing some headwinds, sees strong performance in well-appointed, centrally located buildings. This segment is directly supported by China's continuous urbanization and robust economic expansion. For instance, in 2024, prime office rents in Tier 1 cities like Beijing and Shanghai remained resilient, with vacancy rates in top-tier buildings often staying below 5%, indicating sustained demand for quality space.

- Market Focus: Targeting growth industries and expanding corporations in newly developed business hubs.

- Revenue Driver: Premium assets with modern facilities attract higher rents and stable, quality tenants.

- Growth Catalyst: Benefiting from China's ongoing urbanization and economic development trends.

- 2024 Performance: Prime office rents in key cities demonstrated resilience, with low vacancy in top-tier properties.

Strategic Expansion into High-Potential Emerging Urban Clusters

China Resources Land's strategic push into emerging urban clusters, often fueled by robust government investment and infrastructure upgrades, positions these areas as potential Stars in their BCG matrix. These burgeoning economic hubs are demonstrating growth rates exceeding those of established tier-one cities, offering CR Land a prime opportunity to capture new market demand.

Leveraging its established brand reputation and considerable financial resources, CR Land is well-equipped to rapidly secure substantial market share in these developing urban centers. This targeted approach not only diversifies the company's portfolio but also allows for agile entry into new growth corridors while carefully managing associated risks.

- Emerging Cluster Growth: In 2024, key emerging urban clusters in China, such as Chengdu and Chongqing, continued to show strong economic growth, with GDP increases often surpassing the national average. For instance, Chengdu's GDP grew by approximately 6.2% in the first three quarters of 2024.

- CR Land's Market Penetration: CR Land's investment in these regions reflects a strategy to capitalize on this growth, aiming to replicate its success in mature markets by offering high-quality residential and commercial developments.

- Government Stimulus Impact: Government initiatives, including significant infrastructure spending on high-speed rail and urban transit in these clusters, enhance their attractiveness and accessibility, directly benefiting real estate developers like CR Land.

China Resources Land's premium residential developments in Tier-1 cities and its MixC branded mixed-use complexes represent its Stars. These assets benefit from high demand, strong rental income, and substantial retail sales, with CR Land's retail portfolio achieving RMB 138.5 billion in total retail sales value in 2023.

The company's strategic land bank, with 94% in Tier 1 and Tier 2 cities as of 2024, supports these Star assets. Furthermore, CR Land's commitment to launching five to six new retail projects annually up to 2028 reinforces the growth potential of its mixed-use developments.

Emerging urban clusters, supported by government investment and infrastructure upgrades, are also positioned as Stars. These regions, like Chengdu which saw a 6.2% GDP increase in the first three quarters of 2024, offer significant growth opportunities for CR Land's high-quality developments.

| Asset Category | Market Position | Key Performance Indicators (2023/2024 Data) | Growth Drivers |

|---|---|---|---|

| Premium Residential (Tier-1 Cities) | Star | High average selling prices, robust profit margins. 94% of 2024 land bank in Tier 1/2 cities. | Sustained demand in major urban centers. |

| The MixC Mixed-Use Complexes | Star | RMB 138.5 billion total retail sales value (2023). Premium rental income. | High footfall, sought-after premium tenants, expansion of 5-6 new projects annually. |

| Emerging Urban Clusters Developments | Star | Emerging clusters like Chengdu show strong GDP growth (e.g., 6.2% in Q1-Q3 2024). | Government investment, infrastructure upgrades, CR Land's market penetration strategy. |

What is included in the product

This BCG Matrix overview provides strategic insights into China Resources Land's business units, highlighting which to invest in, hold, or divest.

It streamlines strategic decisions by visually identifying underperforming assets, relieving the pain of resource misallocation.

Cash Cows

Established 'The MixC' shopping malls, particularly those with a long operational history and high occupancy, are considered cash cows for China Resources Land. These mature assets provide a consistent and significant stream of rental income.

Their strong brand recognition and established market position mean that ongoing capital expenditure for promotion is relatively low, further boosting their cash-generating ability. In 2024, CR Land reported an 8.4% increase in retail rental income, with healthy occupancy costs, confirming the robust cash flow from these properties.

China Resources Land's prime investment properties, such as long-term leased office buildings, act as significant cash cows. These assets are situated in established business districts, ensuring consistent rental income with high occupancy rates and extended lease terms. This stability translates into predictable cash flows, minimizing the need for substantial new capital injections. In 2024, the company's recurring income businesses are projected to contribute a substantial share of its net profit, underscoring the critical role of these properties in its financial performance.

China Resources Land's fully developed residential communities represent significant cash cows. These mature, often sold-out developments now primarily generate revenue through consistent property management fees and ancillary community services. This segment, expertly handled by China Resources Mixc Lifestyle Services, provides a stable, recurring income stream, reflecting a high market share in its established operational areas.

Property Management Services (CR Mixc Lifestyle)

The property management services, largely carried out by China Resources Mixc Lifestyle Services Limited, represent a crucial cash cow for CR Land. This segment thrives on an asset-light approach, consistently delivering stable, high-margin recurring revenue. Its success is directly tied to CR Land's vast portfolio of completed properties, which provides a ready and extensive customer base with efficient, low acquisition costs. In 2024, recurring income, with property management being a key component, contributed a substantial 40% to CR Land's core net profit, underscoring its vital role as a powerful cash generator.

- Asset-Light Model: Focuses on services rather than ownership, leading to higher margins and lower capital intensity.

- Stable Recurring Revenue: Property management fees provide predictable income streams, reducing financial volatility.

- Synergy with CR Land Portfolio: Leverages CR Land's extensive property developments for a built-in client base and cost efficiencies.

- Significant Profit Contribution: Accounted for 40% of CR Land's core net profit in 2024, highlighting its cash-generating power.

Strategic Rental Housing Portfolio

China Resources Land's strategic rental housing portfolio functions as a cash cow, generating a stable, predictable income stream. This segment caters to varied residential needs, offering a reliable revenue source less susceptible to the volatility of the sales market. By focusing on long-term leases, CR Land enhances its recurring income base, bolstering financial resilience.

- Stable Revenue: Rental housing provides consistent income from occupancy, unlike project-based sales.

- Reduced Market Volatility: Long-term leases insulate revenue from short-term real estate market fluctuations.

- Recurring Income Growth: This segment contributes significantly to CR Land's expanding recurring income profile.

China Resources Land's established shopping malls, like 'The MixC' brand, are prime examples of cash cows. These mature assets, with strong brand recognition, consistently generate significant rental income. In 2024, CR Land saw an 8.4% increase in retail rental income, showcasing the robust cash flow from these well-positioned properties.

| Asset Type | Key Characteristics | Cash Flow Generation | 2024 Relevance |

| 'The MixC' Shopping Malls | Mature, high occupancy, strong brand | Consistent rental income, low promotion costs | 8.4% increase in retail rental income |

| Prime Office Buildings | Established districts, long leases, high occupancy | Predictable, stable rental income | Significant contribution to net profit |

| Developed Residential Communities | Mature, sold-out developments | Recurring revenue from property management | Expertly managed by CR Mixc Lifestyle Services |

| Property Management Services | Asset-light, high margin, extensive client base | Stable, recurring, high-margin revenue | 40% of CR Land's core net profit |

| Rental Housing Portfolio | Long-term leases, caters to varied needs | Stable, predictable income, reduced market volatility | Expands recurring income profile |

What You See Is What You Get

China Resources Land BCG Matrix

The China Resources Land BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This comprehensive report, designed for strategic insight, contains no watermarks or demo content, ensuring you get a professional and actionable analysis. You can confidently use this preview as an accurate representation of the final, ready-to-deploy BCG Matrix for China Resources Land that will be yours to edit and present.

Dogs

China Resources Land's portfolio likely includes legacy assets in stagnant regions. These are typically older commercial or residential properties in lower-tier cities experiencing weak demand and oversupply. Occupancy rates are often low, maintenance costs are high, and these assets might even be bleeding cash, hindering capital deployment for more promising ventures.

In 2024, several lower-tier Chinese cities continued to grapple with property market slowdowns. For instance, property sales in some of these regions saw year-on-year declines, making it harder for older developments to attract tenants or buyers. This market environment directly impacts the performance of legacy assets, as seen by potential drops in rental yields below 3% in certain less desirable urban areas.

Residential projects with slow sales and substantial unsold inventory in oversupplied markets, or those facing weak buyer sentiment, would be categorized as Dogs within the China Resources Land BCG Matrix. These assets represent a drain on capital, requiring ongoing maintenance and marketing expenditures without yielding adequate returns, and their market value is likely to decline further.

For instance, in late 2023 and early 2024, several Tier 3 and Tier 4 cities in China grappled with elevated housing inventory levels. Data from sources like the China Index Academy indicated that the average inventory-to-sale ratio in these less developed urban areas remained stubbornly high, often exceeding 15 months of supply, a clear indicator of market saturation.

While China Resources Land predominantly operates in Tier 1 and Tier 2 cities, any project within their portfolio that experiences prolonged sluggish sales and a build-up of unsold units due to localized oversupply or economic headwinds would be classified as a Dog. Such properties would require careful management to minimize losses and potential divestment strategies.

Within China Resources Land's (CR Land) extensive property portfolio, certain hotel assets might be categorized as Dogs. These underperforming hotels, burdened by outdated facilities, suboptimal locations, or fierce market competition, struggle to generate consistent profits. For instance, if a hotel acquired in the early 2000s in a secondary city faces new, modern competition and has not undergone significant upgrades, it could exemplify this category.

These hotels require substantial investment for modernization, yet their growth prospects and ability to capture greater market share remain uncertain. In 2024, CR Land continues its strategic expansion, including a notable partnership with Hyatt, aiming to enhance its hospitality offerings. However, older, less strategically positioned hotels that haven't kept pace with evolving guest expectations or market trends can act as a financial burden, diverting resources from more promising ventures.

Small-Scale, Non-Core Ventures Without Scalability

Small-scale, non-core ventures without scalability within China Resources Land's portfolio might include niche urban renewal projects or experimental mixed-use developments that haven't demonstrated significant market penetration or revenue growth. These are often characterized by limited geographic reach and a lack of a replicable business model, making them difficult to scale effectively. For instance, a small boutique residential project in a secondary city that struggled to attract buyers might fall into this category. In 2024, such ventures represent a small fraction of CR Land's overall development pipeline, with management increasingly focused on core residential and commercial properties in tier-one and tier-two cities. Data from their 2024 interim report indicated that while the majority of revenue came from large-scale, established developments, a handful of these smaller, non-core projects reported negative or negligible net profit contributions.

- Limited Market Share: These ventures typically hold a very small percentage of their respective niche markets, often below 1%.

- Low Profitability: Many of these projects struggle to achieve profitability, with some reporting losses in 2024.

- Resource Drain: They can consume significant management time and capital relative to their financial returns.

- Lack of Strategic Alignment: Their objectives and operational scope often diverge from CR Land's primary strategic focus on large-scale, integrated developments.

Land Banks in Deteriorating or Speculative Markets

Land banks in deteriorating or speculative markets represent a challenge for China Resources Land (CR Land). While CR Land typically targets resilient cities, any land acquired in markets that were once speculative but have since seen significant downturns could fall into this category. These holdings often experience prolonged development delays and substantial value depreciation.

Such land banks tie up considerable capital, presenting a drag on resources without clear prospects for profitable development, especially if the economic climate remains unfavorable. For instance, if CR Land acquired land in a city experiencing a sharp economic contraction in 2024, the potential for future returns diminishes significantly.

- Capital Immobilization: Land banks in declining markets represent frozen assets, consuming capital that could be deployed elsewhere for more promising returns.

- Development Hurdles: Prolonged economic downturns or shifts in demand can lead to extensive delays in project initiation and completion, increasing holding costs.

- Value Erosion: Speculative markets that deteriorate often see sharp declines in property values, impacting the book value of these land assets.

- Risk Mitigation: CR Land's strategy aims to minimize exposure to these volatile markets, but historical acquisitions may still present challenges.

Dogs in China Resources Land's portfolio are assets with low market share and low growth prospects, often requiring significant resources without generating substantial returns. These can include older residential projects in less desirable locations experiencing weak demand, or underperforming hotel assets lacking modern amenities. Small, non-core ventures that haven't achieved scalability or profitability also fit this description, as do land banks in markets that have experienced economic contraction. In 2024, CR Land's focus remains on strengthening its core offerings, making these 'Dog' assets a point of strategic review to minimize capital drain.

| Asset Type | Potential Issues | 2024 Market Context | Financial Impact |

|---|---|---|---|

| Legacy Residential Projects | Low occupancy, high maintenance | Slowing sales in lower-tier cities | Negative cash flow, value depreciation |

| Underperforming Hotels | Outdated facilities, poor location | Increased competition, evolving guest expectations | Low occupancy rates, high renovation costs |

| Non-Core Ventures | Lack of scalability, low profitability | Limited market penetration, negative profit contribution | Resource drain on management and capital |

| Deteriorating Land Banks | Capital immobilization, development hurdles | Economic contraction in specific regions | Value erosion, prolonged holding costs |

Question Marks

China Resources Land's strategic push into smart city developments and digital real estate integration, often termed PropTech, positions them in high-growth sectors with substantial future potential. These ventures, while promising, are in their early stages, meaning CR Land's current market share in these rapidly evolving segments might be relatively small. Significant capital expenditure is a prerequisite for building a dominant presence and proving the scalability of these innovative projects.

For instance, CR Land's commitment to intelligent building management systems and IoT integration in new developments aims to enhance operational efficiency and tenant experience. By 2024, the global smart city market was valued at over $750 billion, with PropTech investments reaching new heights. CR Land's focus here aligns with a trend of increasing digitalization across the real estate sector, signaling a move towards more technologically advanced and data-driven urban environments.

China Resources Land's expansion into burgeoning tier-2 cities, while promising for future growth, presents a classic "question mark" scenario in the BCG matrix. These markets are attractive due to their rapid urbanization and increasing disposable incomes, mirroring the growth trajectory seen in many Chinese cities. For instance, cities like Chengdu and Chongqing have consistently ranked among China's top tier-2 economic hubs, demonstrating robust GDP growth rates often exceeding 7% annually in recent years, as of 2024 data.

The challenge lies in the intense competition already present. Established local developers often possess deep market knowledge, strong relationships with local governments, and existing brand loyalty, making it difficult for CR Land to quickly gain significant market share. This necessitates substantial upfront investment in securing prime land parcels, extensive marketing campaigns to build brand recognition, and aggressive sales strategies to compete effectively.

For CR Land, success in these markets hinges on its ability to differentiate its offerings, whether through superior product quality, innovative design, or integrated community services. The potential reward is high, with these cities expected to continue their economic expansion, but the risk of not capturing sufficient market share, leading to underperforming investments, is equally significant.

China Resources Land (CR Land) is exploring specialized property types such as senior living and co-living spaces to tap into China's evolving demographic and lifestyle demands. These sectors offer significant growth potential, driven by an aging population and changing urban living preferences. For instance, the number of people aged 65 and above in China reached over 210 million by the end of 2023, highlighting the demand for senior care facilities.

While these segments represent promising avenues for CR Land, their market share within these relatively nascent Chinese markets may still be modest. Success in these areas necessitates substantial investment in market research to understand specific consumer needs, dedicated product development to create appealing offerings, and robust branding strategies to build recognition and trust. This investment is crucial for scaling operations and achieving profitability in these specialized niches.

Pilot Projects for Green and Ultra-Low Energy Buildings

China Resources Land's pilot projects for green and ultra-low energy buildings are positioned as potential Stars within the BCG framework. These initiatives are actively pursuing sustainability and ESG goals, tapping into a sector with significant future market potential. For instance, in 2024, the company continued to invest in these advanced building technologies, aiming to set new benchmarks in energy efficiency.

The market for green buildings is expanding rapidly, fueled by increasing environmental awareness and supportive government policies in China. These pilot projects, while promising, face the typical challenges of a high-growth sector. Their current profitability and widespread market adoption may still be developing, requiring considerable upfront investment to establish market presence and achieve scale.

- High Growth Potential: Driven by strong environmental regulations and consumer demand for sustainable living spaces.

- Innovation Focus: CR Land is investing in advanced technologies for energy efficiency and reduced environmental impact.

- Market Uncertainty: While the sector is growing, widespread adoption and immediate profitability of ultra-low energy solutions are still evolving.

- Investment Requirements: Significant initial capital is needed for R&D, pilot implementations, and market education to achieve economies of scale.

Asset-Light Management Business Expansion Beyond Core Offerings

China Resources Land's (CR Land) foray into asset-light management, particularly beyond its established property management services, presents potential Question Mark characteristics. While its core property management is a strong Cash Cow, venturing into new, diverse ecosystem-based businesses or expanding third-party management services outside its traditional portfolio introduces higher risk and requires significant investment. These new avenues, though offering substantial growth prospects, necessitate dedicated resources for business development and client acquisition to carve out meaningful market share.

For instance, CR Land’s strategic expansion into integrated commercial operations or property technology (PropTech) solutions could be viewed through a Question Mark lens. These initiatives, while aligning with broader industry trends and potentially unlocking new revenue streams, demand considerable upfront capital for research, development, and market penetration. Early indicators from 2024 suggest a heightened focus on digitalization within the property management sector, with companies investing heavily in smart building technologies and tenant experience platforms. CR Land's success in these nascent areas will hinge on its ability to adapt, innovate, and effectively compete against established players and agile startups.

- Growth Potential: New asset-light ventures offer the possibility of high returns if market adoption is strong.

- Investment Needs: Significant capital is required for developing new business models and acquiring customers.

- Market Uncertainty: The success of expanding into diverse ecosystem businesses or third-party services is not guaranteed.

- Competitive Landscape: CR Land faces competition from both traditional property managers and innovative tech-focused companies in these new areas.

China Resources Land's expansion into emerging tier-2 cities and specialized property types like senior and co-living spaces represent classic Question Marks in the BCG matrix. These ventures exhibit high growth potential due to urbanization and demographic shifts, as seen in the over 210 million individuals aged 65+ in China by the end of 2023. However, they require substantial investment to overcome intense competition and establish market share in these relatively nascent segments.

The company's focus on smart city developments and PropTech also falls into the Question Mark category. While the global smart city market exceeded $750 billion in 2024, CR Land's market share in these early-stage, technologically driven sectors is likely modest. Significant capital is necessary to prove scalability and build a dominant presence in this rapidly evolving landscape.

BCG Matrix Data Sources

Our China Resources Land BCG Matrix is constructed using a blend of financial statements, industry reports, and market analysis to provide a comprehensive view of their business units' performance and potential.