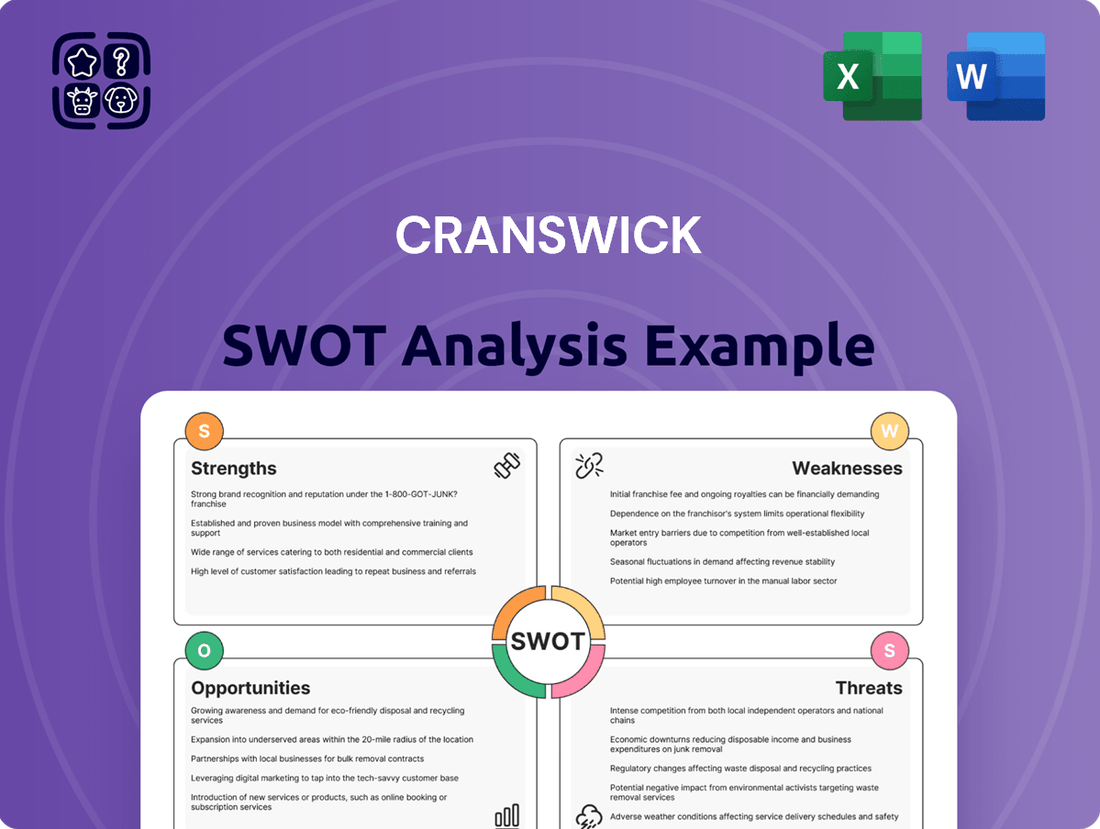

Cranswick SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cranswick Bundle

Cranswick's robust supply chain and strong brand recognition are key strengths, but understanding their potential vulnerabilities and untapped opportunities requires a deeper dive. Our comprehensive SWOT analysis reveals the strategic landscape, offering actionable insights into their market position.

Want the full story behind Cranswick's competitive advantages, potential risks, and future growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Cranswick's integrated farm-to-fork operations are a significant strength, encompassing pig farming, feed milling, and diverse meat product manufacturing. This vertical integration provides robust control over quality, consistency, and costs throughout the production lifecycle, boosting efficiency and resilience.

The company's strategic investments in its pig farming segment have yielded impressive results, with a 14% year-on-year increase in pig production. This expansion has propelled Cranswick to achieve over 55% self-sufficiency in its pig supply, a crucial advantage in managing input costs and ensuring supply chain stability.

Cranswick's financial performance is a significant strength, marked by impressive growth. For the first quarter of 2025, the company reported a 9.7% increase in group revenue, with like-for-like revenue growing by 7.9%. This builds on a record full-year revenue of £2.72 billion and a substantial 14.3% rise in adjusted profit before tax in FY25.

The company's financial resilience is further underscored by its consistent dividend growth, achieving 35 consecutive years of increases. This sustained financial health reflects a strong market standing and adept operational management, providing a solid foundation for future expansion and investor confidence.

Cranswick boasts a robust and varied selection of high-quality meat products, encompassing pork, poultry, and convenient items such as sausages, bacon, and prepared meats. This extensive portfolio is a significant strength, catering to a wide array of consumer preferences and market demands.

The company's strategic emphasis on premium, value-added product lines has proven highly successful, consistently outperforming the broader market. This focus on differentiation and quality allows Cranswick to command better margins and build strong brand loyalty.

Recent strategic acquisitions, including Blakemans, a prominent sausage manufacturer, and JSR Genetics, a key player in pig genetics supply, further bolster Cranswick's product diversity and enhance its integrated production capabilities. These moves strengthen its supply chain and expand its market reach within the premium segment.

Strong Retailer Relationships and Expanding Exports

Cranswick benefits from robust relationships with key UK retailers, evidenced by a notable 10-year sole supply agreement with Sainsbury's for a range of British pork products. This deepens their market penetration and provides a stable revenue stream.

The company has also seen a significant uplift in export revenue, particularly after its Norfolk fresh pork site had its China export license reinstated in December 2024. This development has allowed Cranswick to capitalize on both increased sales volumes and more favorable pricing in international markets.

- Sainsbury's Sole Supply Deal: A 10-year agreement for British pork products.

- China Export License Reinstated: December 2024, boosting international sales.

- Export Revenue Growth: Driven by volume and price increases in overseas markets.

Significant Investment in Capacity and Efficiency

Cranswick's commitment to significant capital expenditure is a key strength, with a record £138 million allocated for FY25. This investment is strategically aimed at boosting production capacity and improving operational efficiencies across its extensive network.

The company is actively expanding its capabilities, particularly in growth areas like poultry and houmous. These investments are designed to solidify its competitive edge and support sustained future growth.

- Record Investment: £138 million invested in FY25 to enhance capacity and efficiency.

- Operational Footprint: Investments span 23 production facilities and farming operations.

- Strategic Focus: Expansion includes key growth areas such as poultry and houmous.

- Future Advantage: These capital expenditures are foundational for long-term competitive positioning.

Cranswick's integrated farm-to-fork model, covering everything from pig farming to finished products, offers exceptional control over quality and costs. This vertical integration, coupled with a 14% year-on-year increase in pig production and over 55% self-sufficiency, provides significant supply chain resilience and cost management advantages.

The company's strong financial performance, with a 9.7% group revenue increase in Q1 2025 and 35 consecutive years of dividend growth, highlights its financial robustness and market confidence. This stability is further enhanced by strategic acquisitions like Blakemans and JSR Genetics, diversifying its product portfolio and strengthening its premium market position.

Cranswick's strategic focus on premium, value-added products and its extensive relationships with UK retailers, including a 10-year sole supply deal with Sainsbury's, are key strengths. The reinstatement of its China export license in December 2024 also opens up significant international growth opportunities, driving both volume and price increases in export markets.

A record capital expenditure of £138 million in FY25 demonstrates Cranswick's commitment to enhancing production capacity and operational efficiency across its 23 facilities. These investments, particularly in growth areas like poultry and houmous, are crucial for maintaining its competitive edge and supporting long-term expansion.

| Metric | FY25 (Record) | Q1 2025 |

|---|---|---|

| Group Revenue | £2.72 billion | +9.7% |

| Like-for-like Revenue | +7.9% | |

| Adjusted Profit Before Tax | +14.3% | |

| Pig Production Increase | +14% (YoY) | |

| Pig Self-Sufficiency | >55% | |

| Capital Expenditure | £138 million | |

| Dividend Growth | 35 consecutive years |

What is included in the product

Delivers a strategic overview of Cranswick’s internal and external business factors, identifying key strengths like brand reputation and market share alongside potential weaknesses and external opportunities and threats.

Offers a clear, actionable framework for identifying and leveraging Cranswick's competitive advantages, thereby alleviating strategic uncertainty.

Weaknesses

Cranswick, like many in the UK food production industry, is vulnerable to the unpredictable nature of raw material and energy prices. These costs have been a significant headwind, with food production expenses climbing by an average of 9.2% in the year leading up to March 2024, directly squeezing profit margins.

The company's operations, which heavily rely on energy for refrigeration and processing, make it particularly susceptible to these market swings. This exposure can lead to increased operational expenses and potentially impact the company's ability to maintain competitive pricing.

Cranswick faces significant headwinds from widespread labor shortages impacting the UK food sector, a challenge intensified by post-Brexit immigration policies. This scarcity directly translates into upward pressure on wages, as companies compete for a shrinking pool of available workers.

Further compounding these issues are rising labor-related costs, including the recent increases in National Insurance Contributions and the National Living Wage. For instance, the National Living Wage saw a substantial jump to £11.44 per hour in April 2024 for those aged 21 and over, adding to operational expenses.

To counter these mounting pressures on its cost base, Cranswick is compelled to accelerate its investment in workforce innovation and automation. Exploring advanced technologies and more efficient operational models becomes crucial for maintaining competitive pricing and profitability in this challenging labor market environment.

Despite robust animal welfare protocols, Cranswick experienced a reputational setback in May 2025 when allegations of mistreatment surfaced at a pig farm. This led to a temporary halt in supplies from key supermarket partners and a notable dip in its share price, highlighting the fragility of brand image in the face of ethical concerns.

The incident underscored the significant reputational risk inherent in animal welfare compliance. Such events can erode consumer confidence and strain crucial retail relationships, particularly as market demand increasingly favors ethically sourced products, impacting Cranswick's brand perception and market standing.

Increasing Regulatory and Compliance Burden

Cranswick faces a growing challenge from the UK food and drink industry's increasingly complex regulatory landscape. New measures like the Extended Producer Responsibility (EPR) scheme for packaging, set to fully transfer household packaging waste costs to producers from October 2025, will undoubtedly increase compliance expenses and administrative workloads for the company.

This evolving regulatory environment presents a significant weakness as Cranswick must continually adapt its operations and invest in new systems to meet these evolving demands. The financial implications of these compliance requirements, particularly the EPR scheme, could impact profitability if not managed efficiently.

- Increased operational costs due to new packaging waste regulations.

- Potential for administrative overhead to manage compliance with evolving legislation.

- Need for ongoing investment in systems and processes to meet regulatory standards.

- Risk of penalties for non-compliance with new food and drink industry regulations.

Reliance on UK Domestic Market Conditions

Cranswick's significant dependence on the UK market presents a notable weakness. Despite efforts to grow its export business, the majority of its revenue still stems from major UK retailers and the domestic food service industry. This concentration makes the company particularly vulnerable to shifts in UK economic conditions, changes in consumer spending habits, and the competitive landscape within its home market. For instance, a slowdown in UK consumer spending, as seen in periods of high inflation, directly impacts Cranswick's sales volumes.

This reliance means that any downturn in the UK economy, such as a recession or a significant change in consumer confidence, can disproportionately affect Cranswick's financial performance. The company's 2024 fiscal year saw continued strength in its UK operations, but the underlying risk of domestic market saturation or economic contraction remains a key consideration. In the fiscal year ending March 2024, Cranswick reported that approximately 85% of its revenue was generated from the UK market, highlighting this concentration.

- Market Concentration: Over 85% of Cranswick's revenue is derived from the UK, exposing it to domestic economic and consumer trends.

- Economic Sensitivity: Fluctuations in UK GDP, inflation, and consumer disposable income directly impact sales and profitability.

- Retailer Dependence: A significant portion of sales are tied to a few major UK grocery retailers, increasing reliance on these key relationships.

- Competitive Pressures: Intense competition within the UK food sector can limit pricing power and market share growth.

Cranswick's significant reliance on a limited number of major UK retailers represents a key weakness. A substantial portion of its revenue is generated from these key partners, creating a dependency that could impact its negotiating power and profitability if these relationships were to deteriorate. This concentration also means that changes in the strategies or performance of these major retailers can have a disproportionate effect on Cranswick's overall business.

Full Version Awaits

Cranswick SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing a genuine preview of the comprehensive report. Unlock the full, detailed insights by completing your purchase.

Opportunities

Consumers are increasingly prioritizing protein in their diets, with a noticeable shift towards natural sources. This trend is a significant tailwind for meat producers like Cranswick, fueling sustained demand for their core products, particularly those in the premium and value-added categories. This is a key opportunity for growth.

Cranswick's premium product lines have consistently demonstrated strong performance, a clear indicator of their ability to meet this evolving consumer demand. Recent business wins in this segment further solidify their position, suggesting a robust pipeline for capitalizing on the growing appetite for high-quality protein. This momentum is expected to continue.

This consumer preference for protein-rich foods directly translates into volume-led growth opportunities across Cranswick's diverse product portfolio. The company is well-equipped to leverage this trend, as evidenced by its strategic focus on expanding its premium offerings and innovating within the protein space. This strategic alignment is crucial for future success.

Cranswick's pet products division is showing robust growth, fueled by its successful collaboration with Pets at Home and a general uptick in consumer spending on pet care. This segment is becoming a key driver for the company.

The company is backing this growth with a substantial £14 million investment to boost capacity and diversify its product offerings at the Lincoln Pet Products facility. This strategic move highlights Cranswick's commitment to capitalizing on the expanding pet food market.

The food manufacturing sector faces persistent labor shortages and escalating wage pressures. Embracing automation presents a significant opportunity for Cranswick to counter these challenges, boost operational efficiency, and strengthen its competitive edge. This strategic shift can lead to more consistent product quality and faster production cycles.

Cranswick's commitment to substantial capital investments, exceeding £200 million in recent years, with a notable portion allocated to automation and capacity expansion, directly addresses this opportunity. These investments are designed to enhance productivity, mitigate the impact of labor scarcity, and refine their manufacturing processes for greater cost-effectiveness.

Further Penetration of Export Markets

The reinstatement of the China export license for Cranswick's Norfolk fresh pork site in December 2024 has already boosted export revenue significantly. This development unlocks opportunities for deeper penetration into high-value international markets, especially in the Far East.

This expansion into markets like China, where demand for quality meat products is strong, offers a chance to diversify Cranswick's revenue streams. It also helps to lessen the company's dependence on the domestic UK market, creating a more resilient business model.

- Export Revenue Growth: Cranswick's export revenue saw a notable increase following the December 2024 China license reinstatement.

- Market Diversification: The move allows for expansion into lucrative Far East markets, reducing reliance on the UK.

- Demand for Premium Products: The strategy capitalizes on the robust demand for premium meat in key international regions.

Strengthening Sustainability and ESG Credentials

Cranswick's commitment to its 'Second Nature Strategy' directly addresses the growing demand for sustainable and ethically produced food. Their ambitious targets, including achieving net-zero emissions by 2040 and ensuring 100% recyclable packaging by 2025, position them favorably in a market increasingly driven by environmental consciousness.

This proactive stance on sustainability offers significant opportunities. By aligning with consumer preferences and anticipating regulatory shifts, Cranswick can bolster its brand image, attract a wider customer base, and forge stronger relationships with retailers who prioritize ethical sourcing and environmental responsibility. For instance, in the fiscal year ending March 2024, Cranswick reported a 6% like-for-like revenue growth, partly attributed to their focus on quality and sustainability, resonating with consumers willing to pay a premium for responsibly produced goods.

- Net-Zero Emissions Target: Aiming for net-zero by 2040 demonstrates a long-term commitment to climate action.

- 100% Recyclable Packaging: The 2025 goal for fully recyclable packaging addresses a key consumer concern regarding plastic waste.

- Enhanced Brand Reputation: Strong ESG credentials can differentiate Cranswick in a competitive market, attracting environmentally aware consumers.

- Attracting Conscious Retailers: Partnerships with retailers focused on sustainability can lead to increased market access and sales volume.

Cranswick is well-positioned to capitalize on the growing global demand for protein, especially premium and value-added meat products. The company's strong performance in these segments, supported by recent business wins, indicates a clear path for continued volume-led growth across its diverse portfolio.

The pet products division presents a significant growth avenue, bolstered by strategic partnerships and increased consumer spending on pet care. Cranswick's investment in expanding capacity and diversifying offerings at its Lincoln facility underscores its commitment to capturing a larger share of this expanding market.

Embracing automation offers a strategic advantage for Cranswick to mitigate labor shortages and rising wage costs in food manufacturing. The company's substantial capital investments, particularly in automation and capacity enhancement, are designed to boost efficiency and cost-effectiveness.

The reinstatement of the China export license for pork in December 2024 has already bolstered export revenue, opening doors to lucrative Far East markets. This diversification reduces reliance on the UK market, creating a more resilient revenue stream.

Cranswick's focus on sustainability, including net-zero emissions by 2040 and 100% recyclable packaging by 2025, enhances its brand reputation. This aligns with consumer preferences and retailer demands for ethically sourced products, potentially driving sales and market access.

Threats

The UK meat sector is a battleground, with Cranswick navigating a landscape crowded by major retailers and other significant food manufacturers all chasing the same customers. This intense rivalry means constant pressure to maintain and grow market share.

Competitors such as Aldi are particularly aggressive, leading in new meat and poultry product launches and highlighting British sourcing and animal welfare standards. This focus directly challenges Cranswick's market position and its ability to set prices, as consumers may be swayed by these competitor offerings.

While the overall demand for protein remains robust, a notable shift is occurring as a segment of consumers actively chooses to reduce meat intake. This trend is driven by various factors including health consciousness, environmental concerns, and ethical considerations, which in turn fuels a rising interest in plant-based protein alternatives. For Cranswick, this presents a challenge to maintain traditional meat sales volumes.

This evolving consumer landscape necessitates strategic agility, requiring Cranswick to potentially adapt its product development pipeline and marketing strategies to cater to these changing preferences. Companies like Cranswick are increasingly exploring opportunities in the burgeoning plant-based sector to diversify their offerings and capture new market share, as evidenced by significant investment in this area across the food industry.

The UK food sector, including Cranswick, faces ongoing threats from supply chain disruptions, fueled by geopolitical tensions and global events. For instance, the conflict in Ukraine in 2024 continued to impact global grain and feed prices, directly affecting the cost of raw materials for pork and poultry producers. This volatility can lead to unpredictable fluctuations in input costs, squeezing profit margins.

Logistical challenges remain a significant concern. In 2024, port congestion and driver shortages, though somewhat eased from previous years, still presented hurdles for efficient transportation of goods. These issues can delay deliveries, increase shipping expenses, and potentially impact product availability for Cranswick's customers, adding to operational costs and affecting supply chain reliability.

Persistent Food Inflation and Consumer Price Sensitivity

Persistent food inflation remains a significant concern, with projections indicating UK food inflation could hover around 4% by the close of 2025. This ongoing price pressure, coupled with heightened consumer sensitivity to costs, poses a threat. Consumers may shift towards more budget-friendly options, including cheaper meat cuts or private label brands, potentially affecting Cranswick's sales of its premium product lines and overall revenue generation.

This trend could manifest in several ways:

- Reduced demand for premium products: Consumers may opt for value-engineered alternatives, impacting sales volumes of higher-margin items.

- Increased competition from private labels: Retailers' own-brand products often offer a lower price point, directly challenging Cranswick's market share.

- Margin pressure: To remain competitive, Cranswick might need to absorb some of these cost increases, potentially squeezing profit margins.

Risk of Animal Disease Outbreaks

The meat industry faces a constant threat from animal disease outbreaks, like Foot and Mouth Disease or Avian Flu. Such events can severely disrupt farming, leading to livestock culling and international trade restrictions, directly impacting production and consumer trust. For Cranswick, a significant outbreak could halt operations and damage its reputation, as seen in past industry-wide challenges.

The economic fallout from animal disease outbreaks can be substantial. For instance, the UK's 2001 Foot and Mouth Disease epidemic cost the agricultural sector an estimated £8 billion, with ripple effects across related industries. Cranswick, as a major player, would be exposed to these market volatilities and potential supply chain interruptions.

- Supply Chain Disruption: Outbreaks can lead to immediate bans on animal movement and product exports, severely limiting Cranswick's ability to source raw materials and distribute finished goods.

- Reputational Damage: Consumer confidence can plummet following disease scares, impacting demand for meat products and potentially affecting Cranswick's brand image.

- Increased Costs: Implementing enhanced biosecurity measures, dealing with potential culls, and navigating complex regulatory environments all add to operational expenses.

Intense competition within the UK meat sector, particularly from aggressive discounters like Aldi, pressures Cranswick's market share and pricing power. Furthermore, a growing consumer shift towards plant-based alternatives, driven by health and environmental concerns, poses a challenge to traditional meat sales volumes.

Supply chain vulnerabilities, including geopolitical tensions impacting feed prices and logistical hurdles like driver shortages, continue to threaten operational efficiency and cost stability. Persistent food inflation, projected to remain around 4% by late 2025, coupled with consumer price sensitivity, could reduce demand for premium products and increase competition from private labels.

The looming threat of animal disease outbreaks, such as Avian Flu or Foot and Mouth Disease, presents significant risks of supply chain disruption, reputational damage, and increased operational costs for Cranswick. The economic impact of such outbreaks can be substantial, as demonstrated by the £8 billion cost of the 2001 Foot and Mouth Disease epidemic to the UK agricultural sector.

SWOT Analysis Data Sources

This Cranswick SWOT analysis is built upon a robust foundation of data, drawing from detailed financial reports, comprehensive market intelligence, and expert industry analysis to provide a well-rounded strategic perspective.