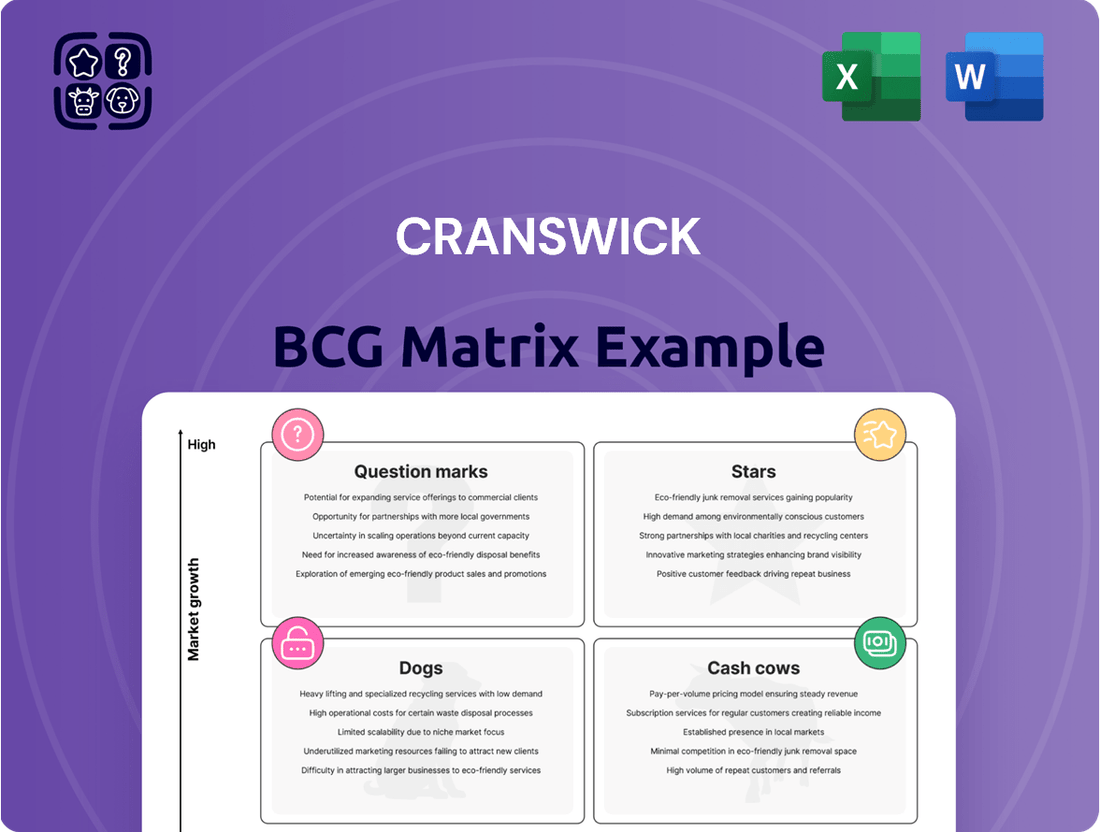

Cranswick Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cranswick Bundle

Uncover the strategic positioning of this company's product portfolio with our insightful BCG Matrix overview. See at a glance which products are driving growth and which may need a closer look.

Ready to transform this high-level view into actionable strategy? Purchase the full BCG Matrix report to gain detailed quadrant analysis, understand market share dynamics, and receive data-driven recommendations for optimizing your investments and product lifecycle management.

Stars

Cranswick's poultry division is a shining example of a Star in their BCG Matrix. In the first half of 2024, this segment saw impressive revenue growth of 16.4%, contributing a substantial 19.5% to the group's overall sales.

This stellar performance is fueled by securing new premium retail contracts and significant strategic capital expenditure. Cranswick invested nearly £50 million to bolster its vertically integrated poultry operations, including a £20 million allocation to expand volume at its East Anglia fresh poultry facility.

The Pet Products division is a standout performer, demonstrating remarkable revenue growth. In the first half of 2024, revenue surged by 71.1%, largely driven by the successful and ongoing expansion of the Pets at Home contract.

Cranswick is backing this success with a substantial commitment, investing an additional £14 million at its Lincoln Pet Products facility. This investment is earmarked for increasing production capacity and diversifying its product offerings, especially after securing new premium own-label business with Pets at Home.

This significant capital injection, coupled with the rapid revenue acceleration, clearly positions the Pet Products division as a high-growth potential business. Cranswick's strategic moves underscore its ambition to capture a leading market share in this expanding sector.

Cranswick's strategic emphasis on premium added-value ranges is a significant driver of its success. This focus is translating into robust volume growth and consistent outperformance across its product lines. For instance, the company reported a 12% increase in revenue for the first half of 2024, with a notable contribution from these premium offerings.

This success is directly linked to new business wins and a deepening collaboration with major retail partners. By aligning closely with what consumers and retailers are seeking, Cranswick is effectively capturing market share in segments that prioritize quality and convenience. This strategic positioning is crucial in today's competitive food industry.

The sustained demand for these higher-margin products firmly places them in the Stars quadrant of the BCG matrix. They represent high-growth, high-market-share offerings, demonstrating Cranswick's ability to innovate and meet evolving consumer preferences for premium food solutions.

Fresh Pork Exports to China

The reinstatement of Cranswick's fresh pork export license to China in December 2024 has significantly boosted revenue. This re-opened market is a key growth driver, with fresh pork export revenue seeing a 10.2% increase in FY2024-25.

Cranswick is capitalizing on this high-growth opportunity by utilizing its robust production capabilities to expand its global reach. The strong demand and volume growth observed in this export channel clearly position it as a Star within the BCG matrix.

- China Export License Reinstated: December 2024

- FY2024-25 Fresh Pork Export Revenue Growth: 10.2%

- Market Status: High-growth opportunity

- Indicative BCG Matrix Category: Star

Integrated Pig Farming Capabilities

Cranswick's integrated pig farming capabilities position it strongly within the BCG matrix. The company has seen an impressive 18% year-on-year increase in pig production during the first half of 2024, solidifying its status as the UK's largest pig farming business. This significant growth, coupled with over 50% self-sufficiency, highlights a core strength.

Strategic moves, including the acquisition of an RSPCA Assured outdoor bred pigs supplier and JSR Genetics, further enhance this integrated model. These acquisitions not only expand capacity but also ensure a high-quality, traceable supply chain, crucial for maintaining market leadership in a vital input sector.

The company's commitment to investment and acquisitions in this area indicates a strategic focus on securing and growing its market share in pig farming. This vertical integration provides a competitive advantage, ensuring control over a critical component of its operations.

- Largest UK Pig Farming Business: Cranswick operates the most extensive pig farming operation in the United Kingdom.

- Significant Production Growth: Achieved an 18% year-on-year increase in pig production in H1 2024.

- High Self-Sufficiency: Maintains over 50% self-sufficiency in its pig production.

- Strategic Acquisitions: Bolstered its supply chain through the acquisition of an RSPCA Assured outdoor bred pigs supplier and JSR Genetics.

The poultry and pet products divisions, alongside the reinstated China pork exports and integrated pig farming operations, represent Cranswick's Stars. These segments exhibit high growth and strong market share, demanding significant investment to maintain their leading positions and capitalize on expanding opportunities. Their performance underscores Cranswick's strategic focus on premium products and vertical integration.

| Division/Segment | H1 2024 Revenue Growth | Contribution to Group Sales | Key Growth Drivers | BCG Matrix Status |

|---|---|---|---|---|

| Poultry | 16.4% | 19.5% | New premium retail contracts, capital expenditure (£50m total, £20m East Anglia facility) | Star |

| Pet Products | 71.1% | N/A (Significant growth driver) | Pets at Home contract expansion, £14m Lincoln facility investment | Star |

| Pork Exports (China) | 10.2% (FY2024-25) | N/A (Key growth driver) | Reinstated export license (Dec 2024), robust production capabilities | Star |

| Integrated Pig Farming | 18% YoY (H1 2024) | N/A (Core strength) | UK's largest producer, >50% self-sufficiency, strategic acquisitions (JSR Genetics) | Star |

What is included in the product

The Cranswick BCG Matrix analyzes each business unit's market share and growth to guide investment decisions.

The Cranswick BCG Matrix visually clarifies portfolio balance, relieving the pain of indecision on resource allocation.

Cash Cows

Cranswick's core UK fresh pork business is a classic cash cow, consistently generating significant revenue. This segment benefits from a strong, established market position, a testament to years of reliable supply and quality products.

The company's strategic advantage is amplified by long-term supply agreements with major retailers. Notably, a ten-year sole supply deal with Sainsbury's for British fresh pork, sausages, premium bacon, and cooked meats locks in substantial demand and ensures predictable cash flow.

Operating in a mature market, this segment's stability is its hallmark. Its high market share and deeply entrenched customer relationships translate into substantial and dependable cash generation, providing the financial bedrock for Cranswick's other ventures.

Cranswick's traditional sausage and bacon products are firmly positioned as Cash Cows within its BCG Matrix. Despite being in mature markets with modest growth, Cranswick commands a strong market share thanks to its well-regarded brands and extensive distribution network. For the fiscal year ending March 2024, Cranswick reported that its pork division, which heavily features these products, continued to be a significant contributor to overall revenue and profitability.

Cranswick's mature convenience food lines, like cooked meats and charcuterie, are prime examples of Cash Cows. These products hold a significant market share within the UK's established convenience food sector.

The consistent consumer demand and robust supply chains for these items translate into predictable, strong cash flow. The UK convenience market itself, while experiencing only modest growth, offers a stable environment for these established offerings.

Established Retailer Partnerships

Cranswick's established retail partnerships are a cornerstone of its Cash Cow status. These long-standing relationships with major UK grocers, built over years, provide a stable and predictable revenue stream.

These comprehensive supply agreements cover a wide array of Cranswick's products, ensuring consistent, high-volume sales. For example, in the fiscal year ending March 2024, Cranswick reported strong performance driven by these key retail accounts, contributing significantly to its overall revenue stability.

- Key Retailer Relationships: Cranswick maintains deep ties with the UK's largest supermarket chains.

- Consistent High-Volume Sales: These partnerships guarantee substantial and ongoing demand for its product range.

- Predictable Cash Generation: The reliability of these established channels translates into dependable cash flow for the business.

Efficient Operational Infrastructure

Cranswick's efficient operational infrastructure, a key component of its Cash Cow strategy within the BCG Matrix, is underpinned by significant, sustained investments in its asset base. This includes expanding factory capacity and enhancing farming operations to boost overall operating efficiencies. For example, Cranswick reported capital expenditure of £142.5 million in the fiscal year ending March 2024, a substantial portion of which was directed towards these core operational improvements.

This well-established and optimized infrastructure is crucial for Cranswick's primary meat processing activities. It enables the company to achieve excellent capacity utilization, which is vital for controlling costs effectively. In fiscal year 2024, Cranswick achieved a strong operating margin of 10.2%, reflecting the benefits of this optimized infrastructure.

The tight cost control facilitated by this infrastructure translates directly into high profit margins and robust free cash flow conversion, particularly within Cranswick's mature product categories. These mature products, generating consistent and predictable cash flows, are the bedrock of the Cash Cow segment, allowing for reinvestment in other business areas or distribution to shareholders.

- Investment in Asset Base: Cranswick's commitment to capital expenditure, such as the £142.5 million spent in FY24, fuels operational efficiency.

- Capacity Utilization: Optimized infrastructure allows for high factory capacity utilization, a hallmark of efficient operations.

- Cost Control: Tight cost management, driven by infrastructure, leads to improved profit margins.

- Cash Flow Generation: Mature product categories benefit from strong free cash conversion, supporting overall financial health.

Cranswick's established pork and convenience food lines are its primary Cash Cows. These products benefit from high market share in mature UK markets, ensuring consistent and substantial cash generation. The company's long-standing relationships with major retailers, such as Sainsbury's, provide a stable demand base, further solidifying their Cash Cow status.

These mature offerings are supported by efficient operational infrastructure, allowing for strong cost control and high profit margins. For instance, Cranswick's pork division, a key contributor to its Cash Cow segment, reported robust performance in the fiscal year ending March 2024, demonstrating the dependable cash flow these products generate.

| Product Category | Market Position | Growth Potential | Cash Generation |

| UK Fresh Pork | High Market Share | Low | High |

| Sausages & Bacon | High Market Share | Low | High |

| Convenience Foods (Cooked Meats, Charcuterie) | Significant Market Share | Low | High |

What You See Is What You Get

Cranswick BCG Matrix

The Cranswick BCG Matrix preview you see is the exact, unwatermarked document you will receive upon purchase, ready for immediate strategic application. This comprehensive report, designed for clarity and actionable insights, will be delivered directly to you, ensuring you have a professional tool for analyzing your business portfolio. You're not just seeing a sample; this is the fully formatted BCG Matrix that will empower your decision-making, offering a robust framework for understanding market share and growth potential. Once purchased, this analysis-ready file is yours to edit, present, and integrate into your business strategy without any further modifications needed.

Dogs

Undifferentiated standard meat products, like basic fresh pork or beef cuts, represent a segment where Cranswick likely faces significant price competition. These items often lack a strong brand premium or unique selling proposition, making market share highly sensitive to cost.

In the mature and low-growth UK fresh meat market, these products would probably hold a smaller share for Cranswick compared to its more specialized, branded offerings. They might generate minimal profit margins, potentially becoming cash traps if investment is required to maintain even a modest market position.

Legacy or niche product lines, like Cranswick's older pork sausage varieties, often represent items with declining demand. These products typically occupy a small sliver of the market, which itself might be shrinking. For instance, in 2024, while the overall processed meat market shows resilience, specific traditional segments have seen a year-over-year decline of 2-3% in volume.

These products, while perhaps historically significant, are now consuming resources such as manufacturing capacity and marketing spend without generating substantial returns. Cranswick, like many food producers, must carefully manage these items, as they can become a drag on profitability if not actively pruned or revitalized.

Underperforming smaller acquisitions within Cranswick, while not a primary focus, can represent "Dogs" in the BCG Matrix. These are typically non-core businesses or product lines that haven't integrated well or found significant market footing. They often have a low market share in slow-growing sectors, demanding considerable management effort for meager returns.

Commodity-Driven Products with Volatile Margins

Commodity-driven products, such as basic pork or chicken cuts, often fall into the Dogs category for Cranswick. These items are characterized by intense competition and a lack of significant differentiation, leading to thin and unpredictable profit margins. For instance, in 2024, the fresh pork market experienced considerable price volatility due to factors like feed costs and global supply dynamics, directly impacting Cranswick’s profitability in this segment.

In these highly competitive, low-growth commodity markets, Cranswick might hold a relatively smaller market share. This positions these products as potential Dogs within the BCG Matrix. The company's focus on value-added products and branded offerings means that pure commodity items may not receive the same strategic investment, further reinforcing their "Dog" status.

- Low Margin Sensitivity: Products like unbranded chicken breasts can see margins shrink rapidly with even minor shifts in raw material costs.

- Market Share Challenges: Cranswick may face stiff competition from larger, more integrated players in basic meat processing.

- Limited Growth Potential: The demand for undifferentiated commodity meats is generally stable but not expected to see significant expansion.

- Strategic Re-evaluation: These products might be candidates for divestment or a reduced strategic focus to reallocate resources to more promising areas.

Non-Strategic By-Products with Limited Value-Add

These represent products or by-products within Cranswick's portfolio that don't align with their core strategy of premium, value-added offerings. They exist in a market with minimal growth potential and hold a small slice of that market. For instance, if Cranswick had a line of basic, unbranded meat offcuts with little consumer appeal, these would fit this category.

Such items typically generate very low revenue due to their limited demand and low processing value. In 2024, for example, if these non-strategic by-products accounted for less than 1% of Cranswick's total revenue, it would clearly indicate their minor financial contribution and lack of strategic importance.

- Low Market Share: These offerings capture a negligible portion of their respective markets.

- Limited Growth Potential: The segments they operate in are not expanding.

- Minimal Revenue Generation: Their contribution to overall sales is insignificant.

- Lack of Strategic Alignment: They do not support Cranswick's focus on premium and value-added products.

Dogs in Cranswick's BCG Matrix likely encompass basic, unbranded meat products and legacy lines with declining demand. These segments are characterized by low market share in slow-growing markets, offering minimal profit margins and potentially draining resources. For instance, in 2024, the market for undifferentiated pork cuts saw price pressures, impacting profitability for companies like Cranswick in this space.

These products often require significant management attention for meager returns, making them candidates for divestment or a reduced strategic focus. Cranswick's emphasis on value-added and branded offerings further reinforces the "Dog" status of these commodity-like items, which may represent less than 1% of total revenue.

The strategic challenge lies in managing these products efficiently, perhaps by minimizing investment or exploring divestment to reallocate capital to more promising growth areas within the portfolio.

These products are characterized by low market share and operate within industries that exhibit minimal growth. Their contribution to overall revenue is often insignificant, and they do not align with Cranswick's strategic focus on premium, value-added products.

| BCG Category | Cranswick Example | Market Growth | Market Share | Profitability | Strategic Implication |

|---|---|---|---|---|---|

| Dogs | Unbranded Pork Cuts / Legacy Sausage Lines | Low | Low | Low / Negative | Divest or Minimize Investment |

Question Marks

Cranswick's £25 million investment in a new houmous and dips facility at Worsley positions this venture as a Question Mark in the BCG matrix. This strategic move aims to tap into the high-growth convenience foods sector, specifically the dips segment, which saw a global market value of approximately $12.5 billion in 2023 and is projected to grow further.

Currently, Cranswick holds a low or emerging market share in this category, necessitating substantial marketing and distribution investments to build brand awareness and consumer loyalty. The success of this facility hinges on its ability to capture significant market share and transition from a Question Mark to a Star, a common challenge for companies entering established or rapidly expanding markets.

Beyond the significant resurgence in pork exports to China, Cranswick is actively investigating emerging niche markets. These markets, though currently small in terms of Cranswick's sales volume, present considerable future growth opportunities for its premium meat products.

For instance, while precise figures for these nascent markets are proprietary, Cranswick's 2024 annual report highlighted increased investment in market research and development for regions in Southeast Asia and Eastern Europe. These areas are showing growing demand for high-quality protein, aligning with Cranswick's product strengths.

Entering these developing markets requires a strategic, long-term approach, involving substantial initial investment in building brand awareness, establishing distribution channels, and potentially adapting product offerings to local preferences. The potential reward, however, is the establishment of a strong foothold in markets poised for significant expansion in the coming years.

Cranswick is actively exploring highly innovative food-to-go concepts, positioning them as potential stars within their portfolio. These are novel offerings still in the nascent stages of consumer acceptance, indicating significant future growth potential but currently holding a low market share. This strategic focus aligns with the UK's booming food-to-go market, which saw a substantial increase in value in 2023, driven by convenience and evolving consumer habits.

Strategic Diversification into New Protein Sources (e.g., specific plant-based offerings)

Cranswick's strategic diversification into new protein sources, such as plant-based alternatives, would likely position these ventures as Stars or Question Marks within a BCG matrix framework. The global alternative protein market is experiencing robust growth, projected to reach $162 billion by 2030, according to Bloomberg Intelligence. This rapid expansion signifies a high-growth market where Cranswick's entry, even with significant investment, would likely begin with a low market share.

Developing and launching specific plant-based or cultivated meat products would require substantial research and development, alongside aggressive marketing to gain traction in a competitive landscape. These new offerings would operate in a high-growth sector with considerable potential, but Cranswick's initial market penetration would be minimal, necessitating significant investment to capture market share. This aligns with the characteristics of a Question Mark, requiring careful analysis of future potential versus current investment needs.

- Market Growth: The global plant-based food market is projected to grow significantly, with some estimates suggesting a compound annual growth rate (CAGR) of over 10% in the coming years.

- Investment Needs: Significant capital would be required for R&D, production scaling, and marketing to establish a foothold in this burgeoning sector.

- Competitive Landscape: Cranswick would enter a market with established players and emerging innovators, demanding differentiation and strong value propositions.

- Potential for Stars: Successful penetration and market share growth could transition these ventures from Question Marks to Stars, generating substantial revenue in the future.

Integration of Recently Acquired Blakemans into Broader Distribution Channels

The acquisition of Blakemans in May 2025, a specialist in foodservice sausages, is a strategic move by Cranswick to tap into a rapidly expanding market segment. This integration presents an opportunity to leverage Blakemans' existing foodservice distribution network.

However, the challenge lies in integrating Blakemans' product range into Cranswick's wider distribution channels, particularly in retail or other nascent markets where Cranswick's presence is currently minimal. This expansion into new territories for Blakemans' products classifies it as a Question Mark within the BCG Matrix.

- Strategic Focus: Cranswick must decide whether to invest heavily in expanding Blakemans' reach into new retail channels or focus on solidifying its position in the foodservice sector.

- Market Potential: The foodservice sector experienced robust growth in 2024, with projections indicating continued expansion, making it a key area for Cranswick's development.

- Investment Required: Significant investment will be needed to build brand awareness and distribution infrastructure for Blakemans' products in any new channels Cranswick chooses to pursue.

- Risk Assessment: The success of integrating Blakemans into broader channels hinges on Cranswick's ability to adapt its marketing and sales strategies to different consumer bases and competitive landscapes.

Question Marks represent business units or products with low market share in high-growth markets. Cranswick's investment in a new houmous facility and exploration of niche export markets exemplify these. These ventures require careful consideration regarding future investment to determine if they can become Stars or if they should be divested.

The success of these Question Marks hinges on Cranswick's ability to increase market penetration and leverage market growth. For example, the plant-based food sector, a potential Question Mark area for Cranswick, is projected to grow at a CAGR exceeding 10% in the coming years, highlighting the high-growth aspect.

Significant capital investment is crucial for R&D, scaling production, and marketing to establish a foothold in these competitive, high-growth sectors. The acquisition of Blakemans also falls into this category, requiring strategic decisions on expanding its reach beyond the foodservice sector.

Cranswick's strategic approach to these Question Marks will involve assessing their potential to capture market share and become future revenue generators, balancing the need for investment against the potential returns in rapidly evolving markets.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable insights.