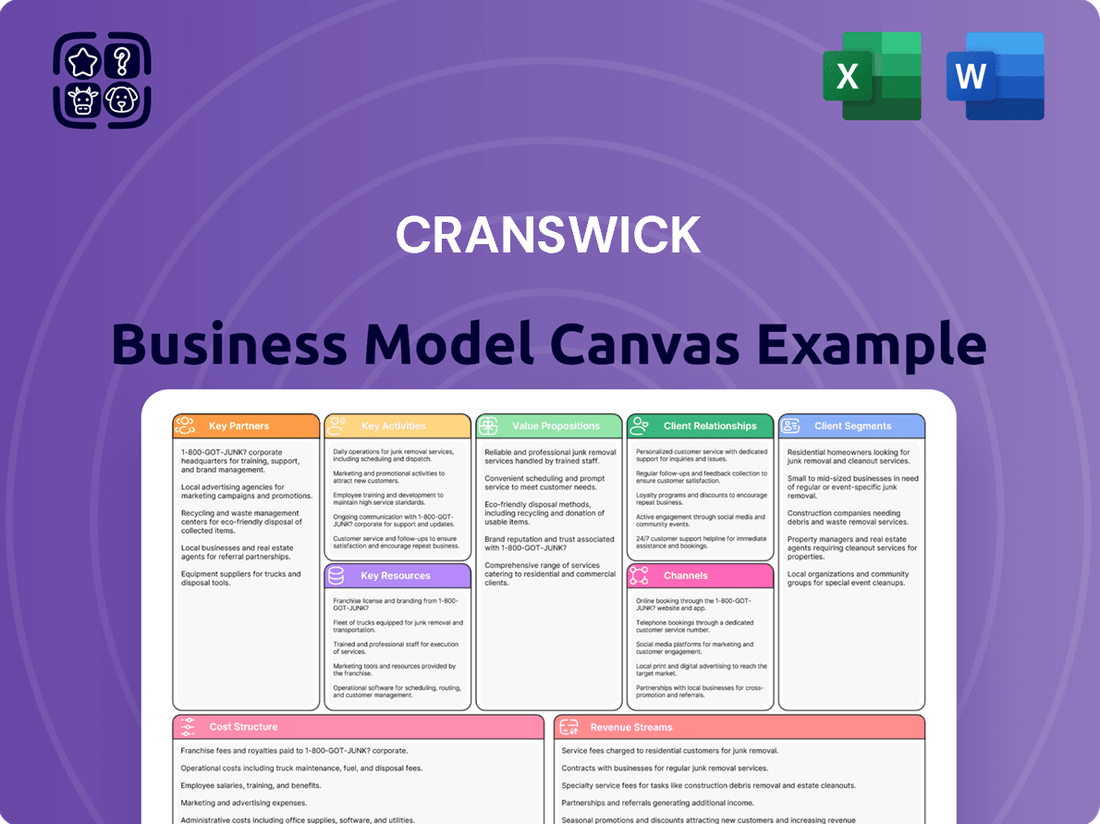

Cranswick Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cranswick Bundle

Discover the strategic framework behind Cranswick's impressive market position with our comprehensive Business Model Canvas. This detailed breakdown illuminates how they connect with customers, manage resources, and generate revenue, offering invaluable lessons for any business. Unlock this strategic blueprint to gain actionable insights and elevate your own business strategy.

Partnerships

Cranswick cultivates vital relationships with major UK retailers like Sainsbury's, securing consistent product flow and broad market access for its diverse food offerings.

These strategic alliances are fundamental to distributing Cranswick's extensive portfolio of meat and convenience foods across the nation.

In a recent development, Cranswick has broadened its retail footprint by partnering with Pets at Home, establishing a supply agreement for their premium own-label pet food segment.

Cranswick's integrated supply chain relies heavily on strategic partnerships with farming and genetics suppliers. A prime example is their acquisition of JSR Genetics in February 2025, a move designed to secure vital pig farming operations and advanced genetic solutions, ultimately driving cost-effective production.

These collaborations are crucial for maintaining stringent quality control and upholding high welfare standards throughout the entire livestock lifecycle, from the farm right through to the final product. This commitment to an end-to-end approach ensures consistency and traceability for consumers.

The company's ongoing investment in its farming operations directly supports increased pig production volumes and fosters continuous improvements in overall productivity. This strategic investment underpins their ability to meet growing market demand efficiently.

Cranswick’s food service sector clients represent a crucial segment, with the company supplying a broad array of UK food service providers. These partnerships are vital for meeting the specific needs of the catering and hospitality industries for a variety of meat products.

The strategic acquisition of Blakemans in May 2025 significantly bolsters this area. Blakemans, a prominent sausage manufacturer, specifically targets the foodservice sector, enhancing Cranswick's capabilities and market penetration within this demanding environment.

This expansion into foodservice allows Cranswick to diversify its revenue streams beyond traditional retail channels. It solidifies the company's position as a key supplier across multiple facets of the food industry, catering to both institutional and commercial clients.

Packaging and Ingredient Suppliers

Cranswick’s strategic alliances with packaging and ingredient suppliers are fundamental to its operational success and sustainability objectives. Collaborations with firms like Coveris are crucial for pioneering advanced and eco-friendly packaging, reinforcing Cranswick's dedication to environmental stewardship. For instance, in 2024, Cranswick continued to invest in sustainable packaging initiatives, aiming to reduce plastic usage by 10% across its product lines by 2026.

These partnerships ensure a consistent and high-quality supply of essential ingredients, underpinning the integrity of Cranswick's broad product range. Reliable sourcing directly impacts product quality and consumer trust, a critical factor in the competitive food industry. In the fiscal year ending March 2024, Cranswick reported that over 95% of its key ingredients were sourced from suppliers meeting stringent ethical and quality standards.

- Supplier Collaboration for Innovation: Partnerships with packaging specialists like Coveris drive the development of innovative and sustainable packaging solutions, a key focus for Cranswick's environmental goals.

- Ingredient Quality Assurance: Stable relationships with ingredient providers guarantee the consistency and superior quality of Cranswick's diverse product offerings.

- Operational Efficiency and Sustainability: These supplier relationships are vital for optimizing operational workflows and achieving Cranswick’s broader sustainability targets, such as reducing waste and carbon footprint.

Industry Bodies and Sustainability Initiatives

Cranswick actively engages with key industry bodies and sustainability initiatives, underscoring its commitment to responsible practices. As a founding signatory of The Food Business Charter, Cranswick aligns with a commitment to uphold high standards in food safety, ethical sourcing, and environmental stewardship across the sector. This collaboration is crucial for driving collective progress on shared challenges.

Furthermore, Cranswick's involvement in The UK Soy Manifesto highlights its dedication to ensuring that soy, a critical ingredient, is sourced sustainably and deforestation-free. By joining such initiatives, Cranswick not only reinforces its own sustainability goals but also contributes to broader systemic change within the agricultural supply chain. These partnerships are vital for addressing complex issues like deforestation and improving animal welfare.

These collaborations allow Cranswick to leverage collective action to tackle systemic challenges. For instance, by working with other industry leaders through these charters and manifestos, Cranswick can influence and improve practices related to deforestation and animal welfare across the entire food supply chain, not just within its own operations.

The company’s commitment is further evidenced by its participation in various sustainability forums and working groups. In 2024, Cranswick continued to report on its progress against sustainability targets, with specific metrics on waste reduction and carbon emissions being key performance indicators. For example, the company aimed to reduce its Scope 1 and 2 greenhouse gas emissions by 40% by 2030 against a 2019 baseline, with interim progress reported throughout 2024.

Cranswick's key partnerships extend to essential suppliers of packaging and ingredients, ensuring both operational efficiency and sustainability. Collaborations with firms like Coveris are pivotal for developing advanced, eco-friendly packaging solutions, aligning with Cranswick's 2024 environmental targets to reduce plastic usage.

These alliances also guarantee a consistent supply of high-quality ingredients, crucial for maintaining product integrity and consumer trust. In the fiscal year ending March 2024, over 95% of Cranswick's key ingredients were sourced from suppliers meeting stringent ethical and quality standards.

Furthermore, engagement with industry bodies like The Food Business Charter and The UK Soy Manifesto demonstrates a commitment to sector-wide improvements in food safety, ethical sourcing, and sustainability, including deforestation-free soy sourcing.

What is included in the product

A detailed, pre-written business model canvas for Cranswick, outlining customer segments, channels, and value propositions to reflect real-world operations and strategic plans.

Provides a structured framework to systematically address and alleviate business challenges.

Helps pinpoint and resolve operational inefficiencies by visualizing key business elements.

Activities

Cranswick's core activities revolve around the meticulous management of its pig and poultry farming operations. This encompasses everything from advanced genetics and in-house feed milling to the actual rearing of livestock, showcasing a deeply integrated approach.

This vertical integration, a strategic advantage further bolstered by acquisitions such as JSR Genetics, is fundamental to maintaining Cranswick's commitment to high animal welfare standards and ensuring complete traceability throughout its supply chain.

The company consistently channels investment into its farming infrastructure and practices, a strategy that directly translates into increased production volumes and ongoing improvements in operational efficiency, as evidenced by their sustained growth in output.

Cranswick's core activity revolves around the sophisticated processing and production of a diverse range of high-quality meat products. This includes everything from fresh pork and artisanal sausages to bacon, ready-to-eat cooked meats, and fresh poultry, all manufactured across their extensive network of production sites.

The company's commitment to meeting escalating consumer demand is evident in its ongoing strategic investments aimed at enhancing both the capacity and technological capabilities of its factories. For instance, in the fiscal year ending March 2024, Cranswick reported a significant increase in revenue, driven in part by volume growth in its pork and poultry segments, showcasing the impact of these investments on their operational output.

Cranswick's product development and innovation are central to its strategy, with a strong emphasis on creating new premium and added-value food ranges. This includes expanding into dynamic markets such as plant-based alternatives and pet food, reflecting shifting consumer demands.

The company's commitment to research and development ensures it stays ahead of evolving consumer preferences for healthier, more convenient food solutions. This focus directly fuels robust volume growth, particularly within its higher-margin premium product lines.

In the fiscal year ending March 2024, Cranswick reported a 9.6% increase in revenue to £2.4 billion, with its premium and added-value products playing a significant role in this growth, demonstrating the commercial success of their innovation efforts.

Supply Chain and Logistics Management

Cranswick's key activities revolve around managing an efficient 'farm to fork' supply chain. This involves meticulous oversight of sourcing raw materials, overseeing production processes, maintaining optimal warehousing, and ensuring timely distribution to a diverse customer base. The company's ability to manage these interconnected stages is fundamental to its operational success.

Optimizing logistics is a crucial component, covering both extensive domestic UK deliveries and burgeoning international export operations. This logistical prowess ensures product freshness and availability across different markets, a vital aspect of maintaining customer satisfaction and market share.

Recent developments underscore the significance of this activity. For instance, the reinstatement of export licenses, such as the one for the Norfolk pork site to export to China, directly impacts Cranswick's global reach and revenue potential. This highlights how crucial supply chain management is for accessing and serving international markets.

- Farm to Fork Integration: Cranswick manages the entire supply chain from farm sourcing to final delivery, ensuring quality control at every stage.

- Logistics Optimization: The company focuses on efficient logistics for both domestic UK distribution and international exports, a critical factor for timely delivery and cost management.

- Export License Management: Securing and maintaining export licenses, like the recent China export license for their Norfolk pork site, is a vital activity enabling access to key global markets.

- Sourcing and Production Oversight: Cranswick's core activities include the careful sourcing of agricultural products and the efficient management of its diverse production facilities.

Sales, Marketing, and Export Operations

Cranswick’s core activities center on winning new business and nurturing existing relationships with retail and foodservice clients. This includes a significant focus on expanding their reach into international export markets, a key driver of growth.

Effective marketing of Cranswick’s premium brands and its broad product portfolio is crucial for stimulating demand across all channels. This strategic marketing effort underpins their ability to capture market share.

The company’s export operations are a notable success, evidenced by strong revenue contributions. This performance reflects not only an increase in the volume of goods sold internationally but also the success of their pricing strategies in global markets.

- New Business Acquisition: Actively pursuing and securing new contracts with retail and foodservice partners.

- Relationship Management: Maintaining and deepening ties with established customers to ensure repeat business and loyalty.

- Export Market Development: Strategically growing presence and sales in international territories.

- Brand and Product Marketing: Implementing campaigns to highlight the quality and diversity of Cranswick’s offerings.

Cranswick's key activities are deeply rooted in its integrated 'farm to fork' model, encompassing everything from sophisticated pig and poultry farming, including genetics and feed milling, to the meticulous processing and production of a wide array of high-quality meat products. This vertical integration ensures quality control and traceability throughout the supply chain, a strategy reinforced by strategic acquisitions like JSR Genetics. The company consistently invests in its farming infrastructure and production facilities to enhance capacity, efficiency, and technological capabilities, directly contributing to increased output and revenue growth.

Innovation and product development are central to Cranswick's operations, focusing on premium and added-value food ranges, including ventures into plant-based alternatives and pet food to meet evolving consumer demands. This commitment to research and development fuels volume growth, particularly in higher-margin product lines. Furthermore, Cranswick excels in managing its complex logistics, optimizing both domestic UK distribution and international exports to ensure product freshness and market availability. The company actively pursues new business, nurtures client relationships, and markets its brands effectively to drive sales across all channels. A crucial aspect of their growth strategy involves developing export markets, as demonstrated by strong revenue contributions from international sales.

| Key Activity | Description | Recent Performance/Data |

|---|---|---|

| Farm to Fork Integration | Managing the entire supply chain from sourcing to delivery, ensuring quality and traceability. | Integral to maintaining high animal welfare standards and product integrity. |

| Production & Processing | Manufacturing diverse meat products, including fresh pork, sausages, bacon, and poultry. | Fiscal year ending March 2024 revenue increased 9.6% to £2.4 billion, driven by volume growth in pork and poultry. |

| Product Innovation | Developing premium, added-value ranges and exploring new markets like plant-based foods. | Premium and added-value products significantly contributed to the FY24 revenue growth. |

| Logistics & Export | Optimizing distribution for UK and international markets, including securing export licenses. | Reinstatement of export licenses, such as for the Norfolk pork site to China, enhances global market access. |

| Sales & Marketing | Acquiring new business and marketing premium brands to retail and foodservice clients. | Strong revenue contributions from export operations reflect successful market development and pricing strategies. |

Full Document Unlocks After Purchase

Business Model Canvas

The Cranswick Business Model Canvas preview you are currently viewing is an exact replica of the document you will receive upon purchase. This means there are no hidden surprises; you'll get the complete, professionally structured file exactly as you see it now. Once your order is processed, you'll gain full access to this ready-to-use Business Model Canvas, allowing you to immediately begin strategizing and refining your business plan.

Resources

Cranswick's extensive production facilities, encompassing 23 factories and farming operations throughout the UK, form the backbone of its integrated supply chain. This significant asset base is fundamental to their ability to control quality and manage costs from farm to fork.

Recent capital expenditures underscore a commitment to modernizing and expanding these operations. For example, investments in the Hull poultry sites and the Lincoln Pet Products site are designed to boost production capacity and operational efficiency, ensuring they can meet growing market demand.

These state-of-the-art facilities are not just buildings; they represent Cranswick's core production capability. Their strategic location and advanced technology allow for streamlined processes, contributing directly to the company's competitive advantage in the food manufacturing sector.

Cranswick's integrated farming operations are a cornerstone of its business model, directly owning and managing extensive pig and poultry farms. This vertical integration, bolstered by strategic acquisitions such as JSR Genetics, ensures a consistent and traceable supply of premium raw materials.

This direct control allows Cranswick to meticulously manage animal welfare standards and drive genetic improvements, leading to more cost-effective production cycles. The company’s capacity to manage nearly one million pigs on the ground highlights the sheer scale of its farming resources and operational expertise.

Cranswick's skilled workforce, including their renowned food heroes and experienced management, is a cornerstone of their success. This human capital is vital for their operations, from farming to processing and customer engagement, directly contributing to the company's consistent positive performance.

The company actively invests in developing its talent, evidenced by programs like the 'Operations Talent Programme' and structured graduate intake. This commitment ensures a steady flow of skilled individuals ready to contribute to Cranswick's growth and innovation.

In 2024, Cranswick continued to emphasize its people, recognizing that expertise in areas like food safety, supply chain management, and product development is critical. This focus on a dedicated and expert team underpins their ability to adapt and thrive in the competitive food industry.

Proprietary Brands and Product Portfolio

Cranswick's proprietary brands, such as Bodega, Woodall's, and Simply Sausages, are a cornerstone of their business. This diverse portfolio allows them to target a wide array of consumer tastes and needs across different market segments. The consistent outperformance of their premium added-value product lines underscores the significant value and consumer trust associated with these established brands.

The company's intellectual capital is deeply embedded in its extensive product range, which spans fresh pork, poultry, and added-value items. This breadth of offering, coupled with strong brand recognition, is a key competitive advantage. For instance, Cranswick reported robust sales growth in their added-value segment, demonstrating the market's positive reception to their innovation and brand strength.

- Brand Strength: Cranswick's portfolio includes well-established brands like Bodega, Woodall's, and Simply Sausages, fostering strong consumer recognition and loyalty.

- Product Diversification: A wide range of fresh and added-value products caters to varied consumer preferences, enhancing market penetration.

- Premium Performance: The continuous outperformance of premium added-value ranges highlights the success of their brand strategy and product development.

- Intellectual Capital: This strong brand and product portfolio represents significant intellectual capital, enabling Cranswick to command premium pricing and maintain market share.

Robust Financial Capital and Funding

Cranswick's robust financial capital is a cornerstone of its business model, evidenced by significant ongoing investment in its asset base and strategic acquisitions. For instance, in the fiscal year ending March 2024, the company reported capital expenditure of £372.4 million, underscoring its commitment to enhancing its operational capabilities and driving future returns. This substantial investment reflects a proactive approach to maintaining and expanding its competitive edge.

The company benefits from committed unsecured facilities, offering substantial headroom to comfortably manage future growth initiatives and day-to-day operational requirements. This financial flexibility is crucial for navigating market dynamics and pursuing growth opportunities without undue constraint. It provides a stable foundation for long-term planning and execution.

This inherent financial strength directly enables sustained capital expenditure, a key driver for enhancing returns and facilitating business expansion. Cranswick’s consistent investment in its infrastructure and strategic growth areas, such as its £1.1 billion revenue from fresh pork in FY24, showcases how this financial robustness translates into tangible business development and market presence.

- Financial Health: Strong balance sheet supporting significant capital investment.

- Funding Flexibility: Committed unsecured facilities provide ample room for growth and operations.

- Investment Strategy: Sustained capital expenditure drives returns and business expansion, with FY24 capex at £372.4 million.

- Revenue Generation: Achieved £1.1 billion in fresh pork revenue in FY24, demonstrating the impact of financial backing on core business performance.

Cranswick’s key resources include its extensive physical assets, human capital, intellectual property in brands and products, and strong financial backing. These elements are interconnected, enabling the company to maintain its integrated supply chain and drive growth.

The company’s 23 production facilities and farming operations are central to its ability to control quality and costs. This infrastructure is continuously enhanced through strategic capital expenditures, such as those at Hull and Lincoln, boosting efficiency and capacity.

Cranswick’s workforce, from farmers to management, is a vital resource, with ongoing investment in talent development ensuring a skilled team. This human capital is crucial for innovation and operational excellence in a competitive market.

The company’s intellectual capital is represented by its strong portfolio of brands like Bodega and Woodall's, which have demonstrated consistent outperformance, particularly in premium added-value segments.

Financial strength, demonstrated by £372.4 million in capital expenditure in FY24 and £1.1 billion in fresh pork revenue, provides the foundation for sustained investment and expansion.

| Key Resource | Description | FY24 Data/Example |

|---|---|---|

| Physical Assets | 23 production facilities & farming operations | Investments in Hull & Lincoln sites |

| Human Capital | Skilled workforce & management | Operations Talent Programme |

| Intellectual Capital | Proprietary brands & product range | Bodega, Woodall's, Simply Sausages |

| Financial Capital | Strong balance sheet & funding | £372.4m Capex; £1.1bn Fresh Pork Revenue |

Value Propositions

Cranswick provides consumers with premium quality meat products, ensuring freshness and added value. A core part of this offering is the robust traceability system, which tracks products from the farm all the way to the consumer's plate.

This farm-to-fork transparency guarantees customers are aware of the product's origin, the animal welfare standards followed, and the overall safety of their food. This focus on provenance and ethical sourcing directly addresses the growing consumer demand for natural protein sources and higher-end food options.

In 2024, the UK market for premium food products continued to show resilience, with consumers willing to pay more for perceived quality and ethical assurances. Cranswick's investment in its supply chain, including advanced traceability technology, supports this value proposition and contributes to its market standing.

Cranswick's diverse and innovative product range is a cornerstone of its business model, offering consumers everything from pork and poultry to convenient meal solutions and pet food. This broad portfolio is designed to meet varied tastes and capitalize on emerging dietary preferences, such as the growing demand for plant-based alternatives. For instance, in the fiscal year ending March 2024, Cranswick reported a strong performance, with total revenue reaching £2.2 billion, a testament to the appeal of their varied offerings.

The company actively develops innovative, added-value products that resonate with modern consumers. This focus on innovation, coupled with a commitment to quality across all categories, directly fuels new business wins. The ability to consistently deliver a compelling and evolving product selection allows Cranswick to secure and expand its relationships with key retail partners, driving sales growth and market share.

Cranswick's commitment to sustainability, including rigorous animal welfare standards and a pledge to eliminate deforestation-linked soy from its supply chains, resonates strongly with an increasing segment of consumers and retail partners who prioritize ethical and environmental considerations. This focus directly addresses growing market demand for responsibly produced food. For instance, in 2024, Cranswick continued to invest in initiatives aimed at reducing its carbon footprint, aligning with broader industry goals for environmental stewardship.

Reliable and Scalable Supply

Cranswick's integrated supply chain, a cornerstone of its business model, ensures a dependable and scalable flow of products. This robust infrastructure allows them to consistently meet the high demands of major retailers and foodservice partners, fostering strong, long-term relationships built on trust and reliability.

Their commitment to high fulfillment rates, often exceeding 98%, underscores their operational excellence. This consistent performance means partners can be confident in product availability, minimizing stock-outs and supporting their own operational continuity. For instance, in the fiscal year ending March 2024, Cranswick reported strong sales figures, reflecting the market's confidence in their supply capabilities.

- Integrated Supply Chain: From farm to fork, Cranswick controls key stages, ensuring quality and consistency.

- Significant Production Capacity: Investments in state-of-the-art facilities enable large-scale output to meet diverse customer needs.

- High Fulfillment Rates: Demonstrating operational efficiency and a commitment to partner satisfaction.

- Long-Term Supply Agreements: Securing consistent demand and reinforcing their position as a reliable supplier.

Customer-Centric Partnership Approach

Cranswick's customer-centric partnership approach is built on deep collaboration with its retail and foodservice partners. This isn't just about supplying products; it's about co-creating value. For instance, in 2024, Cranswick reported a significant increase in new business wins directly attributable to these tailored solutions, demonstrating the tangible impact of this strategy.

By actively engaging with customers to understand evolving preferences, especially the growing demand for premium and ethically sourced options, Cranswick strengthens its market position. This collaborative product development ensures that offerings resonate with consumer trends, driving sustained relationships and repeat business. The company's focus on listening to customer needs fuels innovation and loyalty.

- Strategic Alignment: Cranswick works closely with major retailers and foodservice providers to align product development with their specific market needs and consumer demands.

- Collaborative Innovation: Joint product development initiatives with key partners in 2024 led to the successful launch of several new premium product lines, boosting sales and market share.

- Customer Demand Focus: The company prioritizes understanding and responding to customer demand for high-quality, differentiated products, reinforcing long-term partnerships.

- Relationship Sustainability: This partnership model is designed to foster enduring relationships, evidenced by a high retention rate among Cranswick's top-tier clients.

Cranswick offers premium, traceable meat products, emphasizing farm-to-fork transparency and ethical sourcing to meet consumer demand for quality and provenance. This commitment is supported by significant investments in supply chain technology, ensuring food safety and animal welfare standards are met.

The company's broad and innovative product portfolio, encompassing pork, poultry, and convenient meals, caters to diverse consumer preferences, including the rise of plant-based options. This adaptability fuels new business wins and strengthens relationships with retail partners.

Cranswick's dedication to sustainability, such as reducing its carbon footprint and eliminating deforestation-linked soy, appeals to ethically conscious consumers and partners. Their integrated supply chain ensures product consistency and reliability, evidenced by high fulfillment rates, which are crucial for major retailers and foodservice providers.

A customer-centric approach, fostering collaboration and co-creating value with partners, drives strategic alignment and innovation. This focus on understanding evolving consumer demands, particularly for premium and ethically produced goods, solidifies long-term relationships and market position.

| Value Proposition | Description | Key Supporting Fact (2024 Data) |

|---|---|---|

| Premium Quality & Traceability | Farm-to-fork transparency, ethical sourcing, and guaranteed freshness. | Continued investment in advanced traceability technology to meet consumer demand for provenance. |

| Diverse & Innovative Product Range | Catering to varied tastes and emerging dietary trends with a broad portfolio. | Total revenue reached £2.2 billion in the fiscal year ending March 2024, reflecting strong appeal of diverse offerings. |

| Sustainability & Ethical Standards | Commitment to animal welfare and environmental stewardship. | Ongoing investment in initiatives to reduce carbon footprint, aligning with industry environmental goals. |

| Integrated & Reliable Supply Chain | Ensuring consistent product flow and high fulfillment rates for partners. | High fulfillment rates, often exceeding 98%, demonstrate operational excellence and partner confidence. |

| Customer-Centric Partnerships | Collaborative approach with retailers and foodservice for co-created value. | Significant increase in new business wins in 2024 attributed to tailored solutions and collaborative product development. |

Customer Relationships

Cranswick fosters long-term strategic partnerships with major UK retailers, a cornerstone of its business model. A prime example is its ten-year supply agreement with Sainsbury's, demonstrating a commitment to enduring collaboration.

These deep relationships go beyond simple transactions, involving close joint efforts in developing product ranges and aligning supply chain operations for mutual benefit. This collaborative approach ensures that Cranswick’s offerings meet evolving consumer demands and retailer expectations.

Such strategic agreements provide significant stability and a predictable revenue stream, forming a robust foundation for sustained business growth and investment in future capabilities. For instance, in the fiscal year ending March 2024, Cranswick reported revenue of £2.4 billion, partly driven by these strong, stable customer relationships.

Cranswick prioritizes a closer alignment with its key retail partners through dedicated account management. This collaborative approach ensures their specific business needs are met proactively, fostering strong working relationships that are crucial for securing new business wins.

Cranswick maintains customer relationships by prioritizing quality assurance and compliance. This includes rigorous food safety protocols and a strong commitment to animal welfare. In 2024, following increased attention, the company enhanced its animal welfare procedures, incorporating independent reviews led by expert veterinarians to bolster customer confidence and uphold high standards.

Innovation and Value-Added Solutions

Cranswick actively collaborates with customers to drive sector-leading innovation, focusing on premium, value-added product lines. This customer-centric approach involves deeply understanding evolving consumer trends and proactively developing new offerings that precisely meet market demand.

This commitment to innovation is evident in Cranswick's recent successes. For instance, their cooked and prepared poultry operations have successfully onboarded new premium retail business, directly reflecting their ability to translate market insights into tangible product development and customer partnerships.

- Customer Collaboration: Cranswick works hand-in-hand with retail partners to co-create innovative product solutions.

- Trend Responsiveness: The company actively monitors and responds to consumer shifts, particularly towards premium and convenient options.

- Product Development: Investment in R&D and operational flexibility allows for the rapid introduction of new, value-added ranges.

- Market Penetration: Successful onboarding of new premium retail accounts showcases the appeal and effectiveness of their innovative offerings.

Export Market Relationship Building

Cranswick prioritizes rebuilding and reinforcing relationships within international markets. A prime example is the successful reinstatement of the China export license for its Norfolk fresh pork facility, demonstrating a commitment to re-establishing vital trade links.

This strategic focus involves diligently navigating complex regulatory landscapes and cultivating robust, dependable distribution networks to ensure consistent market access and product flow.

- Re-established China Export License: The Norfolk fresh pork site regained its export license to China, a critical market.

- Navigating Regulations: Cranswick actively manages international compliance to secure and maintain market access.

- Distribution Channel Development: Building reliable supply chains is key to serving export customers effectively.

- Revenue Growth: Strong export performance, such as the 2023/24 financial year reporting a 10% increase in export revenue to £527 million, underscores the success of these relationship-building efforts and the emergence of new opportunities in markets like Japan and South Korea.

Cranswick's customer relationships are built on deep collaboration and a commitment to quality, driving innovation and stable revenue. Their strategic partnerships with major UK retailers, like Sainsbury's, involve joint product development and supply chain alignment. This approach ensures they meet evolving consumer needs and retailer expectations, as evidenced by their £2.4 billion revenue in the fiscal year ending March 2024.

| Customer Relationship Aspect | Description | Supporting Data/Example |

|---|---|---|

| Strategic Partnerships | Long-term agreements with key UK retailers | Ten-year supply agreement with Sainsbury's |

| Collaborative Innovation | Joint product development and trend responsiveness | Onboarding new premium retail business in cooked and prepared poultry |

| Quality & Compliance Focus | Rigorous food safety and enhanced animal welfare standards | Independent reviews of animal welfare procedures in 2024 |

| International Market Re-engagement | Rebuilding trade links and navigating regulations | Regained China export license for Norfolk fresh pork facility; 10% export revenue growth to £527 million in FY23/24 |

Channels

Cranswick's primary route to market involves direct supply agreements with major UK supermarkets and grocery chains. This channel is crucial for their fresh pork, poultry, and value-added convenience food offerings, focusing on securing prominent shelf space for both Cranswick's own brands and retailer-specific own-label products.

In the fiscal year ending March 2024, Cranswick highlighted robust volume growth within this direct supply channel. This performance was attributed to successfully securing new business with key retail partners and a strong alignment with their evolving product demands and strategic objectives.

Cranswick's food service distribution channel is a vital component, reaching establishments like restaurants, catering services, and other food manufacturers. This segment is strengthened by strategic acquisitions, such as Blakemans, a key player in supplying sausages to the foodservice industry.

This distribution network enables Cranswick to effectively serve a broad spectrum of commercial kitchens and institutional clients, ensuring their products are readily available where demand is high.

Cranswick's international export networks are a vital and expanding revenue stream, reaching key markets in Europe, the United States, and Southeast Asia, with China being a particularly significant destination. The company's export revenue saw a substantial boost following the reinstatement of its China export license in December 2024, demonstrating the critical importance of this market.

Successfully operating within these international channels necessitates a deep understanding and adherence to diverse international trade regulations, ensuring compliance and smooth market access. Furthermore, the establishment and maintenance of resilient and efficient logistics are paramount to guarantee timely delivery and product integrity across continents.

Specialty and Premium Retailers

Cranswick strategically partners with specialty and premium retailers to access discerning customer bases. A prime example is their collaboration with Pets at Home for their pet food division, a move that has demonstrably enhanced reach into premium pet care segments. This channel is critical for tapping into niche markets exhibiting robust growth trajectories.

The expansion of the Pets at Home partnership has been a significant driver for Cranswick's pet product segment. For instance, in the fiscal year ending March 2024, Cranswick reported a substantial increase in revenue from its pet division, partly attributable to the successful integration and ongoing rollout within this key retail channel. This underscores the channel's importance in capturing value from specialized consumer demands.

- Partnership with Pets at Home: A key channel for Cranswick's premium pet food offerings, targeting consumers seeking high-quality products.

- Revenue Growth Driver: The ongoing rollout within Pets at Home has directly contributed to increased revenue in the pet product category, with the segment showing strong year-on-year growth in recent financial reports.

- Niche Market Focus: This channel allows Cranswick to effectively serve specialized consumer segments that value premium and differentiated products, fostering brand loyalty and market share in high-potential areas.

Company Website and Investor Communications

Cranswick's company website and dedicated investor communications are vital for disseminating financial performance and strategic updates. These platforms offer a direct line to stakeholders, providing access to annual reports, interim statements, and press releases. For instance, in their fiscal year ending March 2024, Cranswick reported revenue of £2.3 billion, with their website serving as the primary source for detailed breakdowns of this performance.

These channels are instrumental in fostering transparency and upholding strong corporate governance. They host essential information such as:

- Financial Reports: Detailed annual and interim financial statements are readily available, offering insights into revenue, profit margins, and capital expenditure.

- News and Announcements: Real-time updates on company developments, market performance, and strategic initiatives keep stakeholders informed.

- Sustainability and ESG Information: Cranswick utilizes these platforms to communicate its commitment to environmental, social, and governance factors, a key consideration for many investors in 2024.

Cranswick's channels are diverse, encompassing direct supermarket supply, food service, international exports, and partnerships with specialty retailers. These routes ensure broad market penetration for their fresh pork, poultry, convenience foods, and pet food divisions. The company's fiscal year ending March 2024 saw significant growth across these channels, driven by new business wins and strategic expansions.

| Channel | Key Focus | 2024 Performance Highlight |

|---|---|---|

| Direct Supermarket Supply | Major UK retailers, own-label and branded products | Robust volume growth, securing new business |

| Food Service | Restaurants, catering, institutions (e.g., Blakemans) | Strengthened by acquisitions, broad commercial kitchen reach |

| International Exports | Europe, US, Southeast Asia (esp. China) | Boosted by China export license reinstatement (Dec 2024) |

| Specialty Retailers | Premium segments (e.g., Pets at Home for pet food) | Drove substantial revenue increase in pet division |

| Digital & Investor Relations | Company website, financial reports, ESG updates | Key for transparency; FY24 revenue £2.3 billion reported |

Customer Segments

Major UK grocery retailers represent a cornerstone customer segment for Cranswick, demanding substantial volumes of consistently high-quality fresh and processed meat products. These supermarket giants, including Tesco, Sainsbury's, and Asda, rely on Cranswick for a significant portion of their pork, poultry, and convenience food offerings.

Cranswick's strategy with these partners centers on securing long-term supply agreements, ensuring reliability and predictable demand. Meeting the exceptionally stringent quality and safety standards set by these major retailers is paramount, often involving rigorous auditing and compliance processes.

In 2024, the UK grocery market saw continued pressure on consumer spending, yet major retailers maintained their dominance. Cranswick's ability to provide value and quality, evidenced by its strong relationships with these key players, underpins its significant market share within this segment.

Food service providers, a crucial customer segment for Cranswick, include a broad spectrum of businesses like restaurants, hotels, and institutional caterers. These clients require a wide variety of meat products, often in bulk or tailored formats to meet diverse culinary demands. Cranswick’s strategic acquisition of Blakemans in 2023, a significant player in the foodservice market, directly addresses and strengthens its position within this expanding sector.

Cranswick actively engages with international distributors and importers across key global markets, including Europe and the United States. A significant focus is placed on South East Asia, with China representing a particularly important growth area for their premium British meat products.

These international partners seek to source high-quality, traceable meat from Cranswick to meet the demand for premium offerings in their domestic markets. The company's commitment to export growth is a central pillar of its business strategy, driving significant revenue streams from these relationships.

In the fiscal year ending March 2024, Cranswick reported a substantial increase in its export sales, which now represent a significant portion of its overall revenue. This growth underscores the success of its strategy to build strong partnerships with international distributors.

Pet Food Retailers

Cranswick's pet food retailers represent a key customer segment, notably through strategic alliances such as their collaboration with Pets at Home. This partnership highlights a focus on delivering premium and specialized pet nutrition products, catering to a growing market demand for high-quality pet food options.

The success of Cranswick's pet food offerings underscores a broader trend: consumers are increasingly investing in specialized nutrition for their pets. This segment thrives on providing products that meet specific dietary needs and preferences.

- Strategic Partnerships: Cranswick leverages relationships with major pet retailers like Pets at Home to reach its target market effectively.

- Premium Product Focus: The segment emphasizes high-quality, often premium, pet food, aligning with rising consumer spending on pet well-being.

- Market Responsiveness: The strong performance in this segment reflects Cranswick's ability to capitalize on the expanding consumer demand for specialized pet nutrition.

End Consumers (indirectly through retail)

Cranswick's ultimate customer base comprises end consumers, primarily in the UK and expanding into international markets. These consumers are actively seeking high-quality, natural, and convenient meat and food products that offer added value.

The company's strategic focus on delivering premium quality, convenience, and sustainable choices directly addresses evolving consumer preferences. This approach resonates with a growing demand for natural protein sources.

- Consumer Preference: Growing demand for premium, natural, and convenient meat products.

- Market Reach: Primarily the UK, with increasing international presence.

- Key Drivers: Focus on quality, sustainability, and added value in food offerings.

Cranswick's customer segments are diverse, ranging from major UK grocery retailers like Tesco and Sainsbury's, who demand high volumes of consistently quality products, to food service providers such as restaurants and hotels requiring tailored meat solutions.

The company also actively cultivates international distributors, particularly in Europe and Asia, to supply premium British meat. Furthermore, Cranswick's strategic partnerships with pet food retailers, exemplified by its work with Pets at Home, cater to the growing demand for specialized pet nutrition.

Ultimately, Cranswick serves end consumers who prioritize quality, natural ingredients, and convenience in their food choices, with a strong presence in the UK and expanding international reach.

| Customer Segment | Key Characteristics | 2024 Relevance |

|---|---|---|

| Major UK Grocery Retailers | High volume, consistent quality, stringent standards | Core revenue driver, focus on long-term agreements |

| Food Service Providers | Variety, bulk/tailored formats, diverse culinary needs | Growing segment, strengthened by acquisitions like Blakemans |

| International Distributors | Premium, traceable products, expanding global reach | Significant export growth, key focus on Asia |

| Pet Food Retailers | Premium, specialized nutrition, growing pet well-being market | Strategic alliances, capitalizing on consumer spending on pets |

| End Consumers | Quality, natural, convenience, sustainability | Primary market, evolving preferences driving product development |

Cost Structure

Raw material procurement, primarily livestock like pigs and poultry, along with essential feed, represents a substantial cost for Cranswick. In the fiscal year ending March 2024, the company's cost of sales was £2.3 billion, a significant portion of which is directly attributable to these raw materials.

Cranswick’s strategy of vertical integration, exemplified by its ownership of breeding operations such as JSR Genetics, is designed to gain better control over these procurement costs and ensure a consistent supply chain. This integration helps mitigate some of the volatility associated with fluctuating commodity prices.

The direct impact of global commodity market shifts on feed ingredients and livestock prices is a constant factor influencing Cranswick’s bottom line. For instance, increased grain prices in late 2023 and early 2024 would have directly pressured their feed costs, impacting overall profitability.

Cranswick's manufacturing and processing operating costs are substantial, stemming from the operation of 23 production facilities. These expenses encompass critical areas like energy consumption, labor wages for its workforce exceeding 11,000 employees, ongoing maintenance, and general factory overheads. The company is actively investing in capital expenditure to boost efficiency and incorporate more automation.

Maintaining tight cost control and ensuring excellent capacity utilization are paramount for Cranswick in effectively managing these significant operating expenses. For instance, in the fiscal year ending March 2024, Cranswick reported a 7.1% increase in revenue to £2.4 billion, demonstrating their ability to scale production while managing costs.

Cranswick's logistics and distribution expenses are a significant component of its cost structure. These costs encompass the entire journey of their products, from the farms where they are sourced to the factories for processing, and finally to their diverse customer base including retailers, foodservice operators, and international markets. Key expenditures here include fuel for their transport fleet, ongoing maintenance for these vehicles, and the operational costs of warehousing facilities.

In 2024, Cranswick's commitment to expanding its export markets, evidenced by the reinstatement of export licenses, directly impacts these costs. While this move is geared towards revenue growth, it necessitates increased spending on shipping and navigating complex customs procedures, adding to the overall logistics budget.

Capital Expenditure and Investment Costs

Cranswick’s commitment to growth and operational excellence is evident in its significant capital expenditure. The company consistently invests in expanding its production capacity, upgrading existing facilities, and acquiring complementary businesses. For instance, the acquisition of Blakemans significantly bolstered its portfolio and operational footprint.

This strategic investment is reflected in its financial performance, with a record capital spend of £138 million reported in FY2025. This substantial outlay underscores the ongoing efforts to enhance capabilities and drive efficiency across its diverse operations.

- Capital Expenditure: Cranswick’s investment strategy focuses on capacity expansion and capability enhancement.

- FY2025 Investment: The company recorded a significant capital spend of £138 million in the fiscal year 2025.

- Strategic Acquisitions: Investments include strategic acquisitions, such as Blakemans, to broaden market reach and operational scope.

Sales, Marketing, and Administrative Costs

Cranswick's Sales, Marketing, and Administrative Costs are crucial for driving growth and maintaining brand presence. These expenses cover the vital functions of their sales force, extensive marketing campaigns, particularly for their premium product lines, and the essential administrative operations that keep the business running smoothly. For instance, in the fiscal year ending March 2024, Cranswick reported significant investment in these areas to support their strategic objectives.

Maintaining robust relationships with key retail partners is paramount, and this necessitates ongoing investment in sales support and joint marketing initiatives. Furthermore, Cranswick's ambition to expand into new geographic markets and product categories also requires substantial upfront expenditure in marketing and sales infrastructure. These investments are designed to build brand awareness and secure distribution channels.

Beyond direct commercial activities, these costs also encompass corporate overheads, including the expenses associated with corporate social responsibility programs and ensuring stringent animal welfare compliance. These commitments are integral to Cranswick's brand reputation and long-term sustainability.

- Sales & Marketing Investment: Cranswick allocates substantial resources to its sales teams and marketing efforts, particularly for premium product promotions, to drive revenue and market share.

- Distribution & Expansion Costs: Maintaining strong retail partnerships and entering new markets require continuous investment in sales and marketing infrastructure.

- Administrative & Overhead Expenses: This category includes general corporate administration, as well as costs related to corporate social responsibility and animal welfare compliance.

- Fiscal Year 2024 Data: Specific figures for these costs would be detailed within Cranswick's annual financial reports for the period ending March 2024, reflecting their operational expenditures.

Cranswick's cost structure is heavily influenced by its core operations in food processing, primarily centered on pork and poultry. Key cost drivers include the procurement of livestock and feed, manufacturing and processing expenses, logistics, sales and marketing, and capital expenditure.

The company's vertical integration strategy aims to mitigate some of these costs, particularly those related to raw materials. However, global commodity price fluctuations remain a significant factor. For the fiscal year ending March 2024, Cranswick reported a cost of sales of £2.3 billion, highlighting the substantial expenditure on direct inputs.

Operational costs are spread across 23 production facilities, encompassing labor, energy, and maintenance. Cranswick's commitment to expansion is reflected in its capital expenditure, with a record £138 million invested in FY2025 to enhance capacity and efficiency.

| Cost Category | Key Components | FY2024 Impact/Considerations |

| Raw Materials | Livestock (pigs, poultry), Feed ingredients | Cost of sales £2.3 billion; sensitive to commodity prices. |

| Manufacturing & Processing | Labor, Energy, Maintenance, Overheads | Operating 23 facilities, over 11,000 employees. |

| Logistics & Distribution | Fuel, Vehicle maintenance, Warehousing, Export costs | Supporting diverse customer base and export market expansion. |

| Sales, Marketing & Admin | Sales force, Marketing campaigns, Corporate overheads, CSR, Animal welfare | Investment in brand presence, retail partnerships, and market expansion. |

| Capital Expenditure | Capacity expansion, Facility upgrades, Acquisitions | Record £138 million in FY2025; strategic growth investments. |

Revenue Streams

Sales of fresh pork products represent Cranswick's foundational revenue stream, encompassing a diverse range of items such as prime pork cuts, artisanal sausages, and classic dry-cured bacon. The consistent and robust demand for these staple offerings, especially their higher-margin premium selections, is a significant contributor to the company's financial performance.

In 2024, the company saw a notable uplift in this segment, partly due to the crucial reinstatement of its export license for fresh pork to China. This development is expected to further bolster sales volumes and revenue from this key product category.

Revenue from fresh and cooked poultry products has experienced robust growth, fueled by securing new premium retail partnerships and consistent demand from established anchor customers. This vital segment encompasses a diverse range of ready-to-eat and prepared poultry items, catering to evolving consumer preferences.

Cranswick's strategic investments in its poultry facilities are designed to boost production capacity and expand its portfolio of value-added products, further solidifying its market position. For instance, in the fiscal year ending March 2024, Cranswick reported a significant uplift in its poultry operations, contributing substantially to overall group revenue.

Cranswick's revenue streams are significantly bolstered by its sales of convenience and added-value foods. This category encompasses a diverse array of products, including popular charcuterie selections, ready-to-eat cooked meats, and sophisticated gourmet pastry items, moving beyond traditional primary meat cuts.

The company has seen a notable uplift in its financial performance, with premium added-value ranges consistently outperforming expectations and driving substantial revenue growth. For instance, in the fiscal year ending March 2024, Cranswick reported a 7.1% increase in revenue to £2.3 billion, with its value-added products playing a crucial role in this expansion.

Strategic acquisitions, such as the integration of Blakemans, further strengthen this revenue segment. Blakemans, a renowned producer of cooked sausages and bacon, enhances Cranswick's portfolio of convenience and added-value offerings, contributing to market share gains and overall sales momentum.

Sales of Pet Food Products

The sale of pet food products represents a significant and expanding revenue stream for Cranswick, notably bolstered by the strategic expansion of its Pets at Home business. This segment focuses on delivering premium pet food options to meet increasing consumer demand for high-quality pet nutrition.

Cranswick is making substantial investments in its Lincoln Pet Products facility. This commitment aims to enhance production capacity and diversify the product portfolio, positioning the company for continued growth in the premium pet food market. For example, in the fiscal year ending March 2024, Cranswick reported that its pet food division saw a notable uplift, contributing positively to overall group performance.

- Growing Revenue Stream: The pet products division, particularly through Pets at Home, is a key contributor to Cranswick's revenue.

- Premium Product Focus: The segment specializes in offering high-quality, premium pet food options.

- Investment in Capacity: Significant capital is being invested in the Lincoln Pet Products site to expand production and product variety.

- Anticipated Growth: These strategic moves are designed to capitalize on and drive further growth within the pet food market.

International Export Revenue

International export revenue is a significant component for Cranswick, stemming from sales to markets across Europe, the United States, and notably China. This stream has demonstrated robust performance, driven by both increased sales volumes and favorable pricing adjustments. A key factor contributing to this strength was the successful re-establishment of Cranswick's export license to China, a vital market.

This international reach is crucial for diversifying Cranswick's customer base and mitigating the risks associated with over-reliance on its domestic market. For instance, in the fiscal year ending March 2024, Cranswick reported a substantial increase in export sales, reflecting the positive impact of these international market engagements. The company's strategic focus on expanding its global footprint continues to be a key driver of its overall financial health.

- Diversified Market Reach: Sales to Europe, the US, and China reduce dependence on a single market.

- Volume and Pricing Growth: Export revenue has benefited from increased sales quantities and higher prices.

- China Export License Reinstatement: This event significantly boosted export potential and revenue.

- Fiscal Year 2024 Performance: Cranswick saw strong growth in export sales during the year ending March 2024.

Cranswick's revenue streams are multifaceted, with fresh pork and poultry products forming the core. The company also benefits significantly from convenience foods, pet food sales, and a growing international export market.

In the fiscal year ending March 2024, Cranswick reported total revenue of £2.3 billion, marking a 7.1% increase. This growth was supported by strong performances across its key segments, including a notable uplift in poultry operations and the strategic expansion of its pet food division.

| Revenue Segment | FY24 Contribution (Illustrative) | Key Drivers |

|---|---|---|

| Fresh Pork | Significant | Export license reinstatement to China, premium product demand |

| Poultry | Robust Growth | New retail partnerships, value-added products |

| Convenience Foods | Strong Performance | Premium ranges, acquisitions (e.g., Blakemans) |

| Pet Food | Expanding | Investment in Lincoln facility, premium offerings |

| International Exports | Substantial Increase | Diversified markets, volume and pricing growth |

Business Model Canvas Data Sources

The Cranswick Business Model Canvas is informed by a blend of internal financial performance data, comprehensive market research reports, and strategic insights derived from industry expert analysis. This multi-faceted approach ensures a robust and accurate representation of the business's strategic framework.