Cranswick PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cranswick Bundle

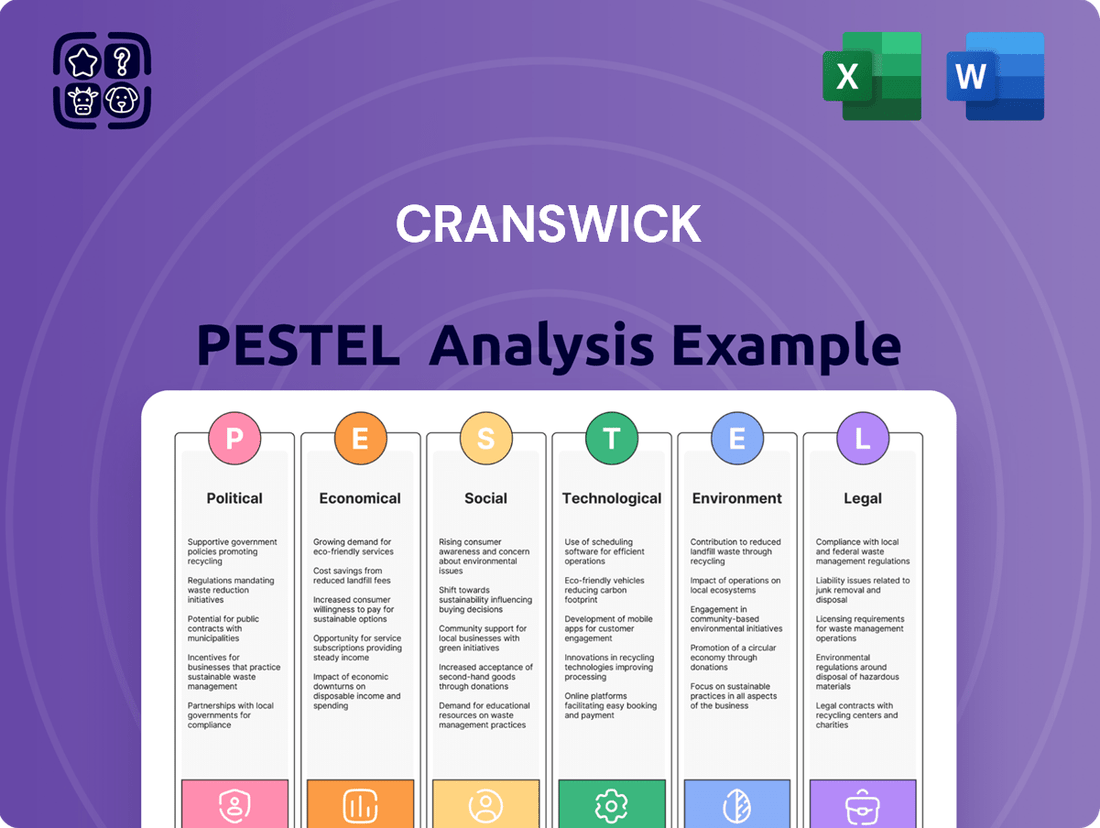

Unlock the critical external factors shaping Cranswick's trajectory with our comprehensive PESTEL analysis. From evolving political landscapes to emerging technological advancements, understand the forces that will define their future success. Equip yourself with actionable intelligence to refine your own market strategies and gain a competitive edge. Download the full version now for immediate access to these vital insights.

Political factors

The UK government is set to introduce a new food strategy in 2025, focusing on enhancing food security, public health, and economic development within the food industry. Cranswick, a significant player in food production, will be directly affected by these upcoming policies, which may include updated food labeling requirements, restrictions on advertising for less healthy food options, and programs promoting healthier dietary choices.

Concerns have been voiced by the meat and dairy sectors regarding their limited involvement in early policy discussions, potentially impacting how their interests are considered in the developing strategy.

Brexit continues to influence the UK's trade dynamics, especially with the European Union, its primary food and drink trading partner. Despite an initial dip in UK agri-food exports to the EU following Brexit, a projected recovery is anticipated by 2025, bolstered by a new agreement designed to streamline food export procedures.

Cranswick has demonstrated robust export revenue growth, exemplified by the December 2024 renewal of its Norfolk fresh pork site's export license to China. This highlights the critical role of international trade agreements in supporting the company's global market access and sales performance.

Government support for farming, including changes to agricultural subsidies and environmental land management schemes (ELMS), directly influences Cranswick's raw material sourcing and farming operations. The UK government has committed £5.2 billion to the farming sector through its new Environmental Land Management schemes (ELMS) in England, aiming to support farmers during a transition period.

While these schemes offer potential benefits, concerns persist regarding the rapid reduction in delinked payments, which could impact the financial stability of some domestic food producers. For instance, the phasing out of direct payments under the Basic Payment Scheme (BPS) means farmers are increasingly reliant on new environmental and productivity grants, creating uncertainty in the supply chain for businesses like Cranswick.

Animal Welfare Regulations

Political and public attention on animal welfare in the food industry is intensifying, suggesting a future with more stringent regulations and stricter oversight. Cranswick acknowledges this trend, actively working to enhance its animal welfare compliance through robust practices and checks. This includes an ongoing review led by an independent expert veterinarian, underscoring the company's dedication to meeting evolving societal and legal standards.

The company's proactive approach is crucial, as non-compliance could lead to reputational damage and financial penalties. For instance, in the UK, the Animal Welfare (Sentience) Act 2022 formally recognizes animals as sentient beings, setting a precedent for future legislative actions. Cranswick's investment in animal welfare aligns with the broader agricultural sector's need to adapt to these growing expectations.

- Increased Scrutiny: Growing public and political focus on animal welfare standards.

- Regulatory Evolution: Potential for new regulations or stricter enforcement of existing ones.

- Cranswick's Commitment: Investment in strengthening animal welfare compliance and checks.

- Expert Review: An independent veterinarian-led review is underway to ensure best practices.

Food Security Initiatives

The UK government's emphasis on bolstering food security, particularly in light of climate volatility and international geopolitical shifts, creates a dynamic environment for Cranswick. This focus offers opportunities for companies like Cranswick, which possess a robust, vertically integrated supply chain, to play a key role in enhancing domestic food resilience.

Cranswick's operations, spanning from agricultural sourcing to food processing, are well-suited to contribute to national food security goals. However, this also underscores the necessity for collaborative strategies to safeguard supply chains and encourage further investment within the agricultural and food production sectors.

- Government Support: The UK's National Food Strategy, launched in 2021, aims to ensure a secure, affordable, and healthy food supply, with ongoing reviews and potential funding initiatives expected through 2024 and 2025.

- Supply Chain Resilience: Cranswick's integrated model, which includes its own farms and processing facilities, directly addresses government objectives for more resilient domestic food production, reducing reliance on imports susceptible to disruption.

- Investment Needs: While Cranswick is positioned to benefit, the broader sector requires significant investment in technology, infrastructure, and skilled labor to meet enhanced food security targets, a point likely to be addressed in future government policy updates.

The UK's evolving food strategy, with a focus on security and health from 2025, will shape Cranswick's operational landscape, potentially introducing new labeling and advertising rules. Brexit's ongoing impact on trade, particularly with the EU, is a key political factor, though a projected recovery in UK agri-food exports by 2025, aided by new agreements, offers a more positive outlook.

What is included in the product

This PESTLE analysis meticulously examines the external macro-environmental factors impacting Cranswick across Political, Economic, Social, Technological, Environmental, and Legal dimensions, offering a comprehensive understanding of its operating landscape.

The Cranswick PESTLE Analysis provides a clear, summarized version of the full analysis for easy referencing during meetings or presentations, alleviating the pain of sifting through extensive data.

Economic factors

Consumer spending patterns and inflationary pressures are key drivers for Cranswick. Strong revenue growth, as seen in their recent reports, has been bolstered by volume and the success of premium product lines. However, persistent inflation in 2024 and into 2025 could potentially erode consumer purchasing power, leading to a shift towards more value-oriented choices in the food market.

Fluctuations in the cost of feed, energy, and other agricultural inputs significantly impact Cranswick's production expenses and overall profitability. For instance, the price of key feed ingredients like wheat and corn can be volatile, directly affecting the cost of raising livestock.

Cranswick's emphasis on agricultural operations and stringent cost management, a recurring theme in their financial reporting, is vital for navigating these economic shifts. Maintaining tight control over these input costs is essential for preserving operating margins, especially when facing inflationary pressures on agricultural commodities.

In 2024, global agricultural commodity prices have shown mixed trends. While some feed grains have seen stabilization, energy costs, a significant component of transportation and processing, remain a key consideration for companies like Cranswick. This economic backdrop underscores the importance of their cost-control strategies.

Cranswick's significant export revenue, which grew by 17% in the first half of fiscal year 2024, directly reflects its exposure to exchange rate volatility. While the report from February 2024 indicated that stronger pricing and favorable exchange rates contributed to this growth, ongoing fluctuations present a dynamic challenge.

The company's ability to maintain competitive pricing in international markets is directly tied to the strength of the Australian dollar relative to its trading partners' currencies. A stronger AUD can make Cranswick's products more expensive abroad, potentially dampening demand.

Conversely, a weaker AUD can boost export competitiveness and increase the AUD value of overseas earnings, as seen in the recent fiscal performance. This highlights the dual nature of exchange rate movements for an export-oriented business like Cranswick.

Investment and Capital Expenditure

Cranswick is significantly boosting its investment in capital expenditure, aiming to expand production capacity and improve operational efficiency. This strategy is evident in their recent acquisitions, such as Blakemans and JSR Genetics, which are designed to bolster long-term growth and market presence.

The company's commitment to capital investment underscores a proactive approach to seizing market opportunities and strengthening its competitive position. This focus on enhancing capabilities and driving efficiencies is crucial for sustained success in the dynamic food industry.

- Accelerated Capital Expenditure: Cranswick is prioritizing investments to upgrade and expand its production facilities and farming operations.

- Strategic Acquisitions: Recent purchases, including Blakemans and JSR Genetics, are integral to this investment strategy, aiming to enhance capabilities and market reach.

- Focus on Efficiency and Capacity: The capital expenditure is geared towards improving operating efficiencies and increasing production capacity to meet growing demand.

- Long-Term Growth and Market Share: These investments signal a clear strategy to achieve sustained growth and capture a larger share of the market.

Market Competition and Consolidation

The UK food production sector is characterized by intense competition, driving a trend towards consolidation and strategic alliances. This environment necessitates agile business strategies to maintain market share and foster growth.

Cranswick has navigated this competitive landscape effectively. Their ability to secure and extend long-term supply contracts with key retailers, such as Sainsbury's, highlights their strong relationships and reliable operations. For instance, Cranswick's partnership with Sainsbury's is a significant contributor to their revenue, reflecting the importance of such agreements.

Furthermore, Cranswick's strategic acquisitions, like the purchase of Blakemans, demonstrate a proactive approach to expanding their capabilities and market reach. This consolidation strategy allows them to leverage economies of scale and enhance their competitive positioning within the industry.

- Competitive Landscape: The UK food sector sees significant competition from both large established players and emerging businesses.

- Consolidation Trend: Businesses are merging or forming partnerships to gain scale and efficiency, as seen with Cranswick's acquisition of Blakemans.

- Retailer Partnerships: Long-term supply agreements with major supermarkets like Sainsbury's are crucial for stable revenue streams.

- Market Share Dynamics: Strategic moves, including acquisitions and strong retail ties, are key to maintaining and growing market share in this dynamic economic factor.

Economic factors continue to shape Cranswick's performance, with consumer spending and inflation remaining central concerns. While Cranswick reported strong revenue growth in the first half of fiscal year 2024, driven by volume and premium products, persistent inflation into 2025 could impact consumer purchasing power, potentially shifting demand towards value options.

Input costs, particularly for feed and energy, are critical economic variables for Cranswick. Fluctuations in agricultural commodity prices, such as wheat and corn, directly affect livestock production expenses. Energy costs, essential for transportation and processing, also remain a significant consideration for the company throughout 2024 and into 2025.

Cranswick's export revenue, which saw a substantial 17% increase in H1 FY24, highlights its exposure to exchange rate volatility. While favorable exchange rates contributed to this growth, ongoing currency fluctuations present a dynamic economic challenge, impacting both export competitiveness and the value of overseas earnings.

| Economic Factor | Impact on Cranswick | Data/Trend (2024/2025 Focus) |

|---|---|---|

| Consumer Spending & Inflation | Affects demand and pricing power. | Inflationary pressures persist; potential shift to value-oriented products anticipated. |

| Input Costs (Feed, Energy) | Impacts production expenses and profitability. | Volatile feed grain prices and elevated energy costs are key considerations. |

| Exchange Rates | Influences export revenue and competitiveness. | H1 FY24 export revenue grew 17%; ongoing AUD fluctuations are a dynamic factor. |

Preview Before You Purchase

Cranswick PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Cranswick PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain immediate access to this detailed report upon completing your purchase.

Sociological factors

Consumer demand for healthier and more sustainable food options continues to reshape the grocery landscape. In 2024, the global plant-based food market was valued at approximately $33.7 billion, with projections indicating significant growth. This trend directly impacts traditional meat producers.

Cranswick, recognizing this shift, is actively innovating. By 2025, the company aims to expand its portfolio to include a wider array of healthier food choices and plant-based alternatives. This strategic pivot is designed to align with evolving consumer tastes and tap into emerging market opportunities.

Public perception of meat production is increasingly shaped by concerns over environmental impact and animal welfare, directly influencing consumer choices and brand loyalty. Cranswick's commitment to sustainability through initiatives like 'Second Nature,' which targets reductions in its carbon footprint and promotes ethical sourcing, is crucial for maintaining a positive brand image and market share.

The increasing consumer appetite for convenience foods directly benefits Cranswick, as its product offerings heavily feature cooked meats and ready-to-eat meals. This trend is a significant driver for the company's strategic focus.

Cranswick's investment in expanding its prepared poultry segment and its consistent success with premium, value-added product lines underscore its alignment with this powerful sociological shift. For instance, in the fiscal year ending March 2024, Cranswick reported strong growth in its value-added categories, directly linked to consumer demand for convenient meal solutions.

Workforce Demographics and Skills

The availability of a skilled workforce and evolving demographic trends significantly influence Cranswick's operational efficiency and future growth. For instance, the UK's aging population, with a growing proportion of older workers, presents both opportunities and challenges in terms of experience and potential labor shortages in specific sectors.

Cranswick's dedication to its workforce and community, as demonstrated through its 'Second Nature' initiative, underscores the critical role of human capital. This commitment is vital for attracting and retaining talent, ensuring the company has the necessary skills to adapt to market demands and maintain its competitive edge.

- Labor Market Shifts: The UK unemployment rate remained low, averaging around 4.2% in the year to March 2024, indicating a tight labor market where skilled workers are in demand.

- Skills Gap Concerns: Reports in early 2024 highlighted ongoing concerns about skills gaps in sectors like food manufacturing, potentially affecting productivity and innovation.

- Employee Investment: Cranswick's focus on employee development and well-being, a core tenet of its sustainability strategy, aims to mitigate these challenges by fostering a loyal and capable workforce.

Ethical Sourcing and Transparency

Consumers are increasingly scrutinizing where their food comes from and how it's produced, pushing companies towards greater ethical sourcing and transparency. This trend directly impacts food producers like Cranswick, who must demonstrate responsible practices to maintain consumer loyalty and market share.

Cranswick's strategic advantage lies in its integrated 'farm to fork' supply chain. This model allows for enhanced control over animal welfare standards, a key concern for ethically-minded shoppers. By prioritizing these practices, Cranswick aims to build robust consumer trust and meet evolving market demands.

- Consumer Demand: Reports indicate a significant rise in consumer willingness to pay more for ethically sourced and transparently produced food products, with studies in 2024 showing over 60% of consumers actively seeking this information.

- Animal Welfare Focus: Cranswick's commitment to high animal welfare standards, including specific protocols for pig farming, aligns with growing societal expectations and regulatory pressures, as evidenced by their public reporting on welfare metrics.

- Supply Chain Integration: The company's vertically integrated model, controlling aspects from farming to processing, enables greater oversight and assurance of ethical practices throughout the production cycle, a critical factor in building brand reputation.

Societal shifts towards healthier eating and plant-based options are profoundly influencing the food industry. Cranswick's proactive expansion into these areas, aiming for a broader healthier food portfolio by 2025, directly addresses these evolving consumer preferences.

Public scrutiny over meat production's environmental and ethical footprint is intensifying, making Cranswick's sustainability initiatives, like carbon footprint reduction under its 'Second Nature' program, vital for brand perception and loyalty.

The demand for convenient, ready-to-eat meals is a significant tailwind for Cranswick, as demonstrated by the strong growth in its value-added product lines in the fiscal year ending March 2024, which caters to busy lifestyles.

Ethical sourcing and supply chain transparency are paramount for today's consumers, with over 60% actively seeking this information in 2024. Cranswick's vertically integrated 'farm to fork' model, emphasizing high animal welfare standards, builds crucial consumer trust.

Technological factors

Advancements in automation and processing technologies are significantly boosting Cranswick's production efficiency. These upgrades help lower labor costs and ensure greater product consistency across their operations. For instance, Cranswick's accelerated capital expenditure program, which focuses on expanding capacity and improving operating efficiencies, is a clear indicator of their commitment to integrating these advanced technologies. This strategic investment is crucial for maintaining competitiveness in the food processing industry.

Cranswick's integrated supply chain stands to gain significantly from further digitization, enhancing operational visibility and reducing waste. By adopting digital technologies for improved traceability, the company can build greater consumer confidence. For instance, advancements in blockchain technology offer immutable records of product journeys, a key factor in food safety and provenance, which is increasingly valued by consumers in the 2024-2025 period.

New technologies in food processing and preservation are crucial for extending shelf life and maintaining quality, which directly benefits companies like Cranswick. For instance, advancements in high-pressure processing (HPP) allow for microbial inactivation without significant heat, preserving nutrients and flavor, a key factor as consumer demand for minimally processed foods grows. Cranswick's focus on product innovation, including healthier options, can capitalize on these techniques to introduce novel offerings.

Data Analytics and AI in Farming

Data analytics and AI are transforming agriculture, including pig and poultry farming. These technologies help optimize feed conversion ratios, which is crucial for cost management. For instance, advanced algorithms can analyze individual animal data to tailor feed formulations, potentially improving conversion by 5-10% in commercial settings. This directly impacts profitability by reducing feed costs, the largest variable expense in livestock production.

Monitoring animal health through AI-powered systems offers early detection of diseases, minimizing losses and the need for widespread antibiotic use. Sensors and cameras can track behavior, temperature, and other vital signs, flagging anomalies before they become serious. Cranswick's strategic investments, such as its significant stake in pig farming operations and the acquisition of JSR Genetics, underscore a clear intent to integrate and benefit from these genetic and operational advancements. This positions them to leverage cutting-edge technology for enhanced efficiency and animal welfare.

- Optimized Feed Conversion: AI-driven analytics can refine feed formulations, potentially boosting feed conversion efficiency by up to 10% in livestock operations.

- Proactive Health Monitoring: AI systems enable early disease detection in animals, reducing mortality rates and the reliance on antibiotics.

- Enhanced Farm Productivity: The integration of data analytics and AI directly contributes to improved overall farm output and operational efficiency.

- Strategic Technology Adoption: Cranswick's investments in pig farming and genetics signal a commitment to leveraging technological progress in its core business.

Packaging Technology Innovations

Cranswick is actively embracing advancements in packaging technology, particularly focusing on sustainability. Their commitment to using 100% recyclable and sustainably sourced packaging by 2025 highlights a strategic move towards eco-friendly solutions. This aligns with growing consumer preference for environmentally responsible products and regulatory pressures pushing for reduced packaging waste.

Innovations in packaging materials are key for Cranswick to meet its environmental targets and appeal to a market increasingly conscious of its ecological footprint. The food industry, in general, is seeing significant investment in biodegradable films and compostable containers, areas Cranswick is likely exploring to enhance its product presentation and environmental credentials.

- Sustainable Materials: Cranswick's 2025 goal for 100% recyclable and sustainably sourced packaging.

- Consumer Demand: Growing consumer preference for eco-friendly packaging solutions in the food sector.

- Regulatory Landscape: Increasing government regulations worldwide mandating reduced plastic use and improved recyclability.

Cranswick's adoption of advanced processing technologies, including automation and AI, is directly enhancing production efficiency and product quality. Their capital expenditure program, focused on operational improvements, reflects a commitment to staying at the forefront of technological integration within the food processing sector. This strategic technological investment is key to maintaining a competitive edge and meeting evolving market demands.

Legal factors

Cranswick operates under strict UK food safety and hygiene legislation, such as the Food Safety Act 1990 and the Food Hygiene Regulations 2006. These laws are critical for maintaining consumer trust and product integrity. The company must ensure all its production processes and products meet these rigorous standards to avoid penalties and reputational damage.

Navigating recent reforms, including those effective April 2025 that aim to simplify risk assessments for food product market authorizations, is a key legal challenge. Cranswick needs to adapt its compliance strategies to align with these updated regulatory frameworks, ensuring efficient market access for its diverse product portfolio while upholding the highest safety benchmarks.

Cranswick operates under a framework of environmental regulations covering waste management, emissions, and resource use. These rules are becoming increasingly stringent, impacting operational costs and supply chain management.

New recycling mandates, specifically those requiring food waste separation from March 2025, will necessitate adjustments in waste handling processes. Furthermore, the EU Deforestation Regulations (EUDR), set to be implemented by late 2025, will directly affect Cranswick's sourcing of commodities like soy and palm oil, requiring enhanced due diligence and traceability.

Cranswick must strictly adhere to the UK's comprehensive labor laws. This includes ensuring compliance with the National Living Wage, which for those aged 21 and over was £11.44 per hour as of April 2024, and adhering to regulations on working hours and rest breaks.

Maintaining robust health and safety standards across its processing plants and farms is paramount. In 2023, the Health and Safety Executive reported over 600,000 working days lost due to work-related ill health in the agriculture, forestry, and fishing sector, highlighting the importance of Cranswick's diligence in this area.

Potential shifts in employment legislation, such as changes to furlough schemes or new regulations on worker benefits, could directly influence Cranswick's labor costs and its approach to workforce management, impacting overall operational expenses and strategic planning.

Competition Law and Acquisitions

Cranswick's strategic acquisitions, like the 2023 purchase of Blakemans for £120 million and the earlier acquisition of JSR Genetics, are closely monitored under competition law. This ensures that such moves do not unfairly stifle market competition or create monopolies within the food processing sector. Regulatory bodies assess whether these transactions enhance Cranswick's market dominance to an extent that could harm consumers or other businesses.

These acquisitions are pivotal for Cranswick’s expansion, allowing it to broaden its product portfolio and strengthen its supply chain. For instance, the Blakemans deal significantly boosted its value-added pork products segment. The competition authorities' approval is thus a critical step, confirming that the integration is unlikely to lead to adverse competitive effects.

- Market Share Assessment: Competition authorities examine the combined market share of Cranswick post-acquisition to identify potential dominance.

- Consumer Impact: The primary focus is on whether acquisitions lead to higher prices, reduced choice, or lower quality for consumers.

- Regulatory Approval: Transactions exceeding certain thresholds require notification and approval from relevant competition watchdogs, such as the Competition and Markets Authority (CMA) in the UK.

- Past Precedents: Cranswick, like other major players, operates within a framework shaped by past merger reviews and competition rulings in the food industry.

Product Labeling and Advertising Standards

The UK's regulatory landscape for product labeling and advertising, especially concerning 'less healthy foods,' is undergoing significant changes. New restrictions are set to take effect in October 2025, impacting how companies like Cranswick present their products to consumers. Cranswick must proactively adapt its product information and marketing strategies to align with these evolving standards, ensuring full compliance to avoid penalties and maintain consumer trust.

These evolving legal factors necessitate a thorough review of Cranswick's current practices. The upcoming regulations are designed to provide consumers with clearer information about food products, potentially influencing purchasing decisions. For instance, the government has indicated a focus on calorie information and potentially restricting promotions for certain food categories.

- UK Government's Health and Social Care Select Committee report in early 2024 highlighted concerns over the effectiveness of current advertising regulations for food.

- The upcoming October 2025 deadline for new restrictions on 'less healthy foods' advertising is a critical compliance point for Cranswick.

- Potential new rules could include restrictions on prominent placement of high-fat, high-sugar, or high-salt products in stores and online.

- Cranswick's marketing teams will need to be vigilant about compliance with the Advertising Standards Authority (ASA) guidelines, which are likely to be updated to reflect the new legislation.

Cranswick must navigate evolving food safety and labeling laws, with new restrictions on 'less healthy foods' advertising due in October 2025. Compliance with UK labor laws, including the National Living Wage of £11.44 per hour (April 2024 for those 21+), is also critical, alongside stringent health and safety regulations in its operations. Furthermore, competition law scrutinizes acquisitions, such as the £120 million Blakemans purchase in 2023, to prevent market dominance. New environmental mandates, like food waste separation from March 2025 and the EU Deforestation Regulations by late 2025, also impact sourcing and waste management.

| Legal Area | Key Legislation/Regulation | Effective Date/Period | Impact on Cranswick |

|---|---|---|---|

| Food Safety | Food Safety Act 1990, Food Hygiene Regulations 2006 | Ongoing | Ensures product integrity and consumer trust; requires adherence to rigorous standards. |

| Product Market Access | Recent reforms simplifying risk assessments | From April 2025 | Requires adaptation of compliance strategies for efficient market access. |

| Environmental | Waste management, emissions, resource use regulations; Food waste separation mandates | From March 2025 | Impacts operational costs and supply chain; necessitates adjustments in waste handling. |

| Supply Chain Due Diligence | EU Deforestation Regulations (EUDR) | By late 2025 | Requires enhanced due diligence and traceability for commodities like soy and palm oil. |

| Labor Law | National Living Wage, Working Hours Regulations | Ongoing (e.g., £11.44/hr from April 2024 for 21+) | Influences labor costs and workforce management strategies. |

| Health & Safety | Health and Safety at Work etc. Act 1974 | Ongoing | Paramount for processing plants and farms; aims to reduce work-related ill health. |

| Competition Law | Merger control regulations (e.g., CMA in UK) | Ongoing (e.g., Blakemans acquisition 2023) | Monitors acquisitions to prevent unfair market dominance and ensure fair competition. |

| Product Labeling & Advertising | Restrictions on 'less healthy foods' | From October 2025 | Requires adaptation of product information and marketing strategies to align with new standards. |

Environmental factors

Cranswick is actively addressing climate change by targeting net-zero carbon emissions by 2040, with an interim goal of a 25% reduction by 2030. This commitment is backed by significant investments in energy-efficient technologies and the adoption of renewable energy sources throughout its business. For instance, in the fiscal year ending March 2024, the company reported a reduction in its Scope 1 and 2 emissions intensity.

Cranswick is actively addressing plastic waste, setting a bold goal to eliminate all avoidable plastic by 2025. This commitment includes a 50% reduction in the weight of plastic packaging used and ensuring that 100% of their packaging is recyclable and sourced sustainably.

To achieve this, Cranswick is collaborating with industry partners to establish a circular economy for packaging materials. This cooperative effort is crucial for creating effective closed-loop systems that minimize environmental impact.

Cranswick's commitment to sustainability necessitates robust water stewardship across its extensive farming and food processing activities. While specific 2024 or 2025 water usage figures for Cranswick are not publicly detailed, the company's environmental policy, aligned with industry best practices, likely emphasizes efficient water use and responsible management to minimize its ecological footprint.

The agricultural sector, a core component of Cranswick's supply chain, is particularly sensitive to water availability and quality. In the UK, for instance, average rainfall patterns can fluctuate, impacting crop yields and the need for irrigation. Cranswick's proactive approach would involve implementing water-saving technologies and practices on its farms and in its processing plants to ensure resilience against potential water scarcity and to comply with evolving environmental regulations.

Biodiversity and Land Use

Cranswick is actively addressing biodiversity and land use by focusing on habitat improvement. The company has committed to setting a Science Based Target for Nature by 2025, a significant step in aligning its operations with ecological preservation goals.

Furthermore, Cranswick plans to report on Biodiversity Net Gains (BNG) at all its owned sites. This initiative demonstrates a tangible commitment to enhancing the natural environment where it operates, ensuring that development projects contribute positively to local ecosystems.

- Science Based Target for Nature: Aiming for establishment by 2025.

- Biodiversity Net Gains (BNG): Reporting planned for owned sites.

- Habitat Improvement: Integration of wildlife habitat enhancements in land use strategies.

Food Waste Reduction

Cranswick is actively pursuing a goal to achieve zero food waste by 2030, a target that aligns with widespread industry efforts to minimize food loss throughout the entire supply chain. This ambitious commitment is a cornerstone of their 'Second Nature' sustainability initiative, demonstrating a dedication to establishing new benchmarks for eco-conscious manufacturing practices.

The company's focus on food waste reduction is not just an environmental aspiration; it's also a strategic business imperative. By tackling waste, Cranswick can improve operational efficiency and potentially lower costs associated with disposal and resource utilization. For instance, in the UK, food waste from the manufacturing and retail sectors alone was estimated to be around 1.1 million tonnes in 2021, costing the economy billions annually, highlighting the significant financial benefits of waste reduction.

- Zero Food Waste Target: Cranswick aims for zero food waste by 2030.

- Sustainability Initiative: This goal is part of the 'Second Nature' program.

- Industry Alignment: The target supports broader efforts to reduce food loss across supply chains.

- Economic Impact: Reducing food waste can lead to significant cost savings and improved resource management.

Cranswick's environmental strategy prioritizes significant emissions reductions, targeting net-zero by 2040 with an interim goal of a 25% cut by 2030, supported by investments in energy efficiency and renewables. The company is also committed to eliminating avoidable plastic by 2025, aiming for 100% recyclable packaging. Furthermore, Cranswick is focusing on biodiversity by setting a Science Based Target for Nature by 2025 and planning to report Biodiversity Net Gains at all owned sites. Their ambition extends to achieving zero food waste by 2030, a key part of their 'Second Nature' sustainability initiative.

| Environmental Focus | Target/Goal | Progress/Status |

|---|---|---|

| Carbon Emissions | Net-zero by 2040; 25% reduction by 2030 | Reduced Scope 1 & 2 emissions intensity in FY24 |

| Plastic Packaging | Eliminate avoidable plastic by 2025; 100% recyclable | Ongoing initiatives to reduce plastic weight |

| Biodiversity | Science Based Target for Nature by 2025; BNG reporting | Commitment to habitat improvement |

| Food Waste | Zero food waste by 2030 | Part of 'Second Nature' sustainability program |

PESTLE Analysis Data Sources

Our Cranswick PESTLE Analysis draws from a comprehensive blend of official government publications, reputable market research firms, and international economic bodies. We ensure each factor, from political stability to technological advancements, is supported by current and verifiable data.