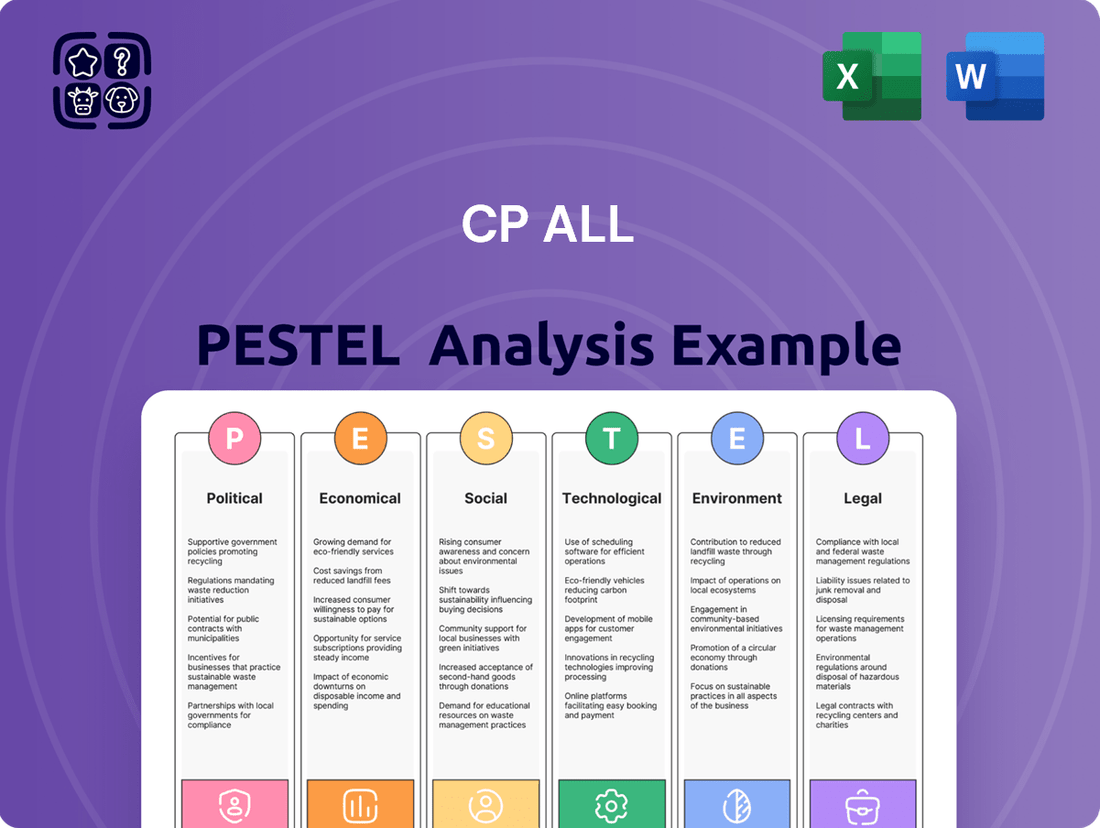

CP All PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CP All Bundle

Unlock the strategic advantages CP All holds by understanding the intricate web of political, economic, social, technological, legal, and environmental factors affecting its operations. Our comprehensive PESTLE analysis provides actionable intelligence to navigate this complex landscape. Download the full version now and gain the foresight needed to outmaneuver competitors and capitalize on emerging opportunities.

Political factors

The Thai government's commitment to economic stimulation, evident in programs like the 10,000 baht digital wallet scheme and the 'Easy E-Receipt' tax rebate, directly aims to bolster consumer demand. These initiatives are particularly impactful for retailers like CP All, as they enhance disposable income and encourage spending on goods and services.

The modern trade sector, encompassing convenience stores and wholesale operations, stands to gain considerably. For instance, the 'Easy E-Receipt' program, allowing tax deductions for purchases up to 50,000 baht in 2024, incentivizes spending on a wide array of products, from everyday necessities to consumer electronics, which CP All offers.

Political stability in Thailand is a cornerstone for business confidence, directly influencing investment decisions. CP All, a dominant force in the Thai retail landscape, benefits significantly from a predictable political climate that fosters long-term strategic planning and operational expansion. For instance, Thailand's general election in May 2023, while bringing a new coalition government, initially led to a period of policy uncertainty, which can temper consumer sentiment and economic growth, impacting CP All's performance.

The consistency of government policies, particularly those affecting the retail sector and consumer spending, is paramount for CP All's continued success. Fluctuations in policy, whether related to taxation, import/export regulations, or labor laws, can introduce operational complexities and affect profitability. A stable policy framework allows CP All to confidently invest in new store openings and technological advancements, crucial for maintaining its market leadership in the competitive convenience store segment.

Government initiatives aimed at reviving the tourism sector are a significant boost, directly contributing to increased economic activity and consumer spending, particularly in urban and tourist-heavy areas. For instance, Thailand's Ministry of Tourism and Sports projected a substantial increase in international tourist arrivals for 2024, aiming for 35 million visitors, a notable rebound from the 28 million in 2023.

The resurgence of international tourist arrivals positively impacts retail sales, benefiting CP All's extensive network of convenience stores and wholesale operations. As these visitors spend on food, beverages, and daily necessities, CP All is well-positioned to capture this increased demand. This focus on tourism recovery aligns with broader economic recovery efforts, creating a more favorable operating environment.

Trade Competition Regulations

Thailand's Trade Competition Commission (TCCT) plays a significant role in shaping the business landscape, actively monitoring mergers and market dominance to foster a competitive environment. This oversight directly impacts CP All, particularly concerning its market position.

A prime example is the TCCT's conditional approval of CP All's acquisition of Tesco Lotus's retail operations in Thailand in 2021. The commission imposed stipulations aimed at preventing monopolistic practices and supporting the growth of small and medium-sized enterprises (SMEs), underscoring the ongoing political scrutiny of large-scale business integrations.

- TCCT's Role: The TCCT actively regulates business integrations and market dominance to ensure fair competition in Thailand.

- CP All Acquisition: CP All's 2021 acquisition of Tesco's Thai retail stores was approved with conditions to prevent monopolies.

- SME Support: Conditions attached to the acquisition aimed to promote the growth and competitiveness of small and medium-sized enterprises.

- Ongoing Scrutiny: CP All faces continuous political consideration due to the TCCT's ongoing examination of trade practices and business combinations.

Digital Economy Promotion

The Thai government's Thailand 4.0 initiative, a national ICT strategy, is actively promoting the digital economy with the goal of establishing Thailand as an ASEAN digital hub. This policy directly encourages the integration of digital technologies across various industries, including retail, manufacturing, and logistics. CP All can capitalize on this governmental push to enhance its e-commerce platforms, expand its digital payment infrastructure, and improve operational effectiveness through technology.

This digital transformation strategy is projected to significantly boost Thailand's digital economy. For instance, the e-commerce market in Thailand was estimated to reach approximately $20 billion in 2023 and is expected to continue its upward trajectory. CP All, with its extensive retail network, is well-positioned to benefit from this growth, particularly in areas like online sales and digital customer engagement.

- Government Support for Digitalization: Thailand 4.0 aims to create a digitally driven economy, fostering innovation and adoption of new technologies.

- Sectoral Impact: The strategy encourages digital solutions in retail, manufacturing, and logistics, directly benefiting companies like CP All.

- E-commerce Growth: Thailand's e-commerce market is expanding rapidly, presenting significant opportunities for CP All's online ventures.

- Digital Payments Adoption: Increased government focus on digital payments facilitates CP All's efforts to enhance its payment systems and customer convenience.

Government economic stimulus measures, such as the 10,000 baht digital wallet scheme and the 'Easy E-Receipt' tax rebate, are designed to boost consumer spending, directly benefiting retailers like CP All. The 'Easy E-Receipt' program, allowing tax deductions up to 50,000 baht in 2024, incentivizes purchases across a broad range of products offered by CP All.

Political stability is crucial for business confidence and long-term planning, which CP All relies on for its extensive operations. While Thailand's May 2023 election introduced a new government, initial policy uncertainty can affect consumer sentiment and economic growth, indirectly impacting CP All's performance.

Government initiatives to revive tourism are a significant economic driver, with Thailand aiming for 35 million international tourist arrivals in 2024, up from 28 million in 2023. This influx of visitors directly boosts retail sales, particularly for convenience stores like CP All's 7-Eleven chain, which cater to daily needs and impulse purchases.

The Trade Competition Commission (TCCT) actively monitors market dominance, influencing large-scale business integrations like CP All's 2021 acquisition of Tesco Lotus's Thai operations. The TCCT's conditional approval, aimed at preventing monopolies and supporting SMEs, highlights ongoing political oversight of CP All's market position.

What is included in the product

This CP All PESTLE analysis dissects the influence of political, economic, social, technological, environmental, and legal forces on the company's operations and strategy.

A clear, actionable breakdown of CP All's external environment, enabling proactive strategy development and mitigating potential risks before they impact operations.

Economic factors

Thailand's retail market is on a strong upward trajectory, demonstrating significant expansion. In 2024, the market grew by an impressive 6.02%, reaching a total value of 4.51 trillion Baht.

Looking ahead, this growth is expected to continue, with forecasts predicting an increase of USD 49.69 billion between 2024 and 2029. This translates to a compound annual growth rate (CAGR) of 6.9% over the same period.

This expansion is fueled by robust consumer demand across diverse product segments, notably groceries and beauty and personal care items. These trends create substantial opportunities for companies like CP All within the evolving retail landscape.

Consumer confidence saw a notable rebound in the latter half of 2024, with Q4 data indicating increased optimism among households. This renewed sentiment is crucial for businesses like CP All, which rely on consistent consumer spending.

Despite the positive trend in confidence, elevated living costs and persistent household debt continue to constrain overall purchasing power. For instance, inflation in Thailand remained a concern through much of 2024, impacting discretionary spending.

CP All's strategic positioning with its 7-Eleven convenience stores, offering a wide range of daily necessities and affordable food and beverage options, provides a degree of insulation. This focus on essential goods means a substantial portion of its revenue is derived from products consumers need regardless of economic headwinds.

Inflationary pressures and fluctuating raw material costs present a significant economic challenge for CP All. For instance, Thailand's headline inflation rate averaged 1.5% in the first half of 2024, a moderate increase from the previous year, impacting the cost of goods sold. This volatility directly affects CP All's operational expenses and its ability to maintain healthy profit margins.

CP All actively manages these economic headwinds by strategically adjusting its product assortment, leaning into higher-margin items and optimizing supply chain efficiencies. This approach helps to buffer the impact of rising input costs and maintain profitability in a dynamic retail environment.

Tourism Sector Contribution

The rebound of Thailand's tourism industry is a crucial economic catalyst for the retail sector. As international arrivals climb, so does consumer spending, directly benefiting retailers like CP All that serve a diverse customer base in key tourist destinations. This trend underpins a positive outlook for retail sales throughout 2024 and into 2025.

Thailand's tourism sector is showing robust recovery, with international tourist arrivals reaching approximately 28 million in 2023, a significant increase from previous years. Projections for 2024 anticipate this figure to exceed 35 million. This surge directly translates into increased demand for goods and services, boosting retail revenue streams.

- 2023 International Arrivals: ~28 million

- 2024 Projected Arrivals: >35 million

- Impact on Retail: Increased tourist spending drives higher sales volumes.

- Economic Outlook: Tourism recovery is a key driver for projected GDP growth in 2024-2025.

CP All's Strong Financial Performance

CP All has showcased impressive financial strength, with its early 2025 reports indicating a rise in both revenue and net income. The company anticipates sustained earnings growth through 2024 and 2025, bolstered by healthy same-store-sales increases across its various store formats and the impact of new store establishments.

This financial resilience is a significant advantage for CP All, enabling strategic expansion and investment opportunities. For instance, the company reported a net profit of THB 13.6 billion for the first nine months of 2024, a notable increase from the previous year.

- Revenue Growth: CP All's revenue for the first nine months of 2024 reached THB 158.5 billion, up from THB 140.2 billion in the same period of 2023.

- Profitability: Net income for the first nine months of 2024 was THB 13.6 billion, compared to THB 11.1 billion in the prior year.

- Same-Store Sales: Positive same-store sales growth was observed across all formats, contributing to the overall financial upturn.

- Outlook: The company projects continued strong earnings growth for the remainder of 2024 and into 2025.

Thailand's economy continues to show resilience, with retail market growth projected at 6.9% CAGR from 2024-2029, reaching USD 49.69 billion. This expansion is supported by a recovering tourism sector, with over 35 million international arrivals anticipated in 2024, up from 28 million in 2023. Despite inflation averaging 1.5% in early 2024, consumer confidence has improved, benefiting companies like CP All.

| Economic Indicator | 2023 Data | 2024 Projection/Data | 2025 Projection |

|---|---|---|---|

| Retail Market Growth (CAGR) | N/A | 6.9% (2024-2029) | Projected continued growth |

| International Tourist Arrivals | ~28 million | >35 million | Continued increase expected |

| Headline Inflation Rate | N/A | ~1.5% (H1 2024) | Monitoring for stability |

Preview the Actual Deliverable

CP All PESTLE Analysis

The content and structure shown in the preview is the same document you’ll download after payment. This CP All PESTLE Analysis provides a comprehensive overview of the external factors impacting the company, covering Political, Economic, Social, Technological, Legal, and Environmental aspects. You'll receive the full, detailed analysis as presented here, ready for your immediate use.

Sociological factors

Thai consumers are rapidly shifting towards digital channels for their shopping needs, with a notable increase in online purchases and mobile-centric interactions. This digital embrace is reshaping daily life, fostering a demand for integrated online and offline experiences.

CP All is actively responding to this evolution by enhancing its digital offerings, such as the 7Delivery service and its All Online platform, to cater to these changing consumer habits and preferences.

Thailand's increasing urbanization fuels a strong consumer desire for convenience, making easily accessible retail points like supermarkets and smaller neighborhood stores highly sought after, especially near business districts.

CP All's vast network of 7-Eleven stores perfectly aligns with this trend, offering quick and convenient shopping solutions that cater to the busy lifestyles of urban dwellers.

In 2024, CP All continued its aggressive expansion, aiming to open approximately 700 new 7-Eleven stores, further solidifying its presence and accessibility across Thailand to meet this growing demand.

Generational differences significantly shape consumer behavior, with Gen Z often showing a preference for novel and experimental products, while Millennials increasingly prioritize health and wellness in their purchases. CP All must adapt its product assortment and marketing to resonate with these evolving preferences.

The growing popularity of impulse buy items and ready-to-drink beverages directly reflects these generational shifts in consumption habits. For instance, convenience store sales in Thailand, CP All's primary market, saw a notable increase in the ready-to-drink coffee segment in 2024, driven by younger demographics seeking quick and convenient options.

Growing Health and Wellness Consciousness

Thai consumers are increasingly prioritizing health and wellness, with a growing demand for sustainable living and health-conscious products. This societal shift presents a significant opportunity for CP All to expand its offerings in healthy food options and eco-friendly merchandise. Given that food products represent a substantial portion of CP All's revenue, this trend directly supports the company's core business strategy.

This growing consciousness is reflected in market data. For instance, the Thai health and wellness market was valued at approximately USD 12.7 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of around 7.5% through 2028. CP All's commitment to offering a diverse range of fresh and prepared foods, including those catering to specific dietary needs, positions it well to capture this expanding market segment.

- Growing Demand for Healthy Options: Consumers are actively seeking out healthier alternatives, influencing purchasing decisions in convenience stores and supermarkets.

- Sustainability as a Key Driver: Environmental concerns are becoming more prominent, leading consumers to favor brands and products with sustainable practices.

- CP All's Food Focus: The company's strong presence in the food sector, a significant contributor to its overall sales, allows it to directly address these evolving consumer priorities.

- Market Growth Potential: The expanding health and wellness sector in Thailand offers substantial opportunities for CP All to innovate and diversify its product portfolio to meet consumer needs.

Community Engagement and Social Responsibility

CP All actively pursues its mission to be a 'Partner to Communities, Building a Sustainable Society,' deeply embedding Environmental, Social, and Governance (ESG) principles across its business. This commitment is evident in programs like the '7 Go Green' and '7 Go Together' policies, which are designed to cultivate skilled individuals, create employment opportunities, foster career growth, and build robust community foundations.

These social development efforts significantly bolster CP All's public image and cultivate stronger, more positive relationships with stakeholders. For instance, in 2023, CP All reported a significant increase in its community investment, with over 1.2 billion Thai Baht allocated to social and environmental projects, demonstrating a tangible commitment to societal well-being.

- Community Investment: CP All allocated over 1.2 billion Thai Baht to social and environmental initiatives in 2023.

- Job Creation: The company's focus on 'jobs and careers' contributes to local economic development by providing employment opportunities.

- Sustainable Society: Initiatives like '7 Go Green' and '7 Go Together' directly support the building of a more sustainable and resilient society.

- Reputation Enhancement: Strong community engagement positively impacts brand perception and public trust.

Thai consumers are increasingly prioritizing health and wellness, driving demand for healthier food options and sustainable products. CP All's focus on its food business, a substantial revenue driver, positions it well to capitalize on this trend. The Thai health and wellness market was valued at approximately USD 12.7 billion in 2023 and is projected for robust growth.

Technological factors

Thailand's retail landscape is rapidly shifting towards digital, with e-commerce expected to hit an impressive USD 32 billion by 2025. This surge is directly linked to higher internet and smartphone adoption rates across the nation.

CP All is strategically leveraging this trend by implementing a robust online-to-offline (O2O) approach. This integration connects its extensive network of physical stores with digital platforms, positioning the company to effectively capitalize on the booming e-commerce market.

CP All is increasingly leveraging AI, particularly generative AI, to create highly personalized customer experiences and boost operational efficiency across its vast retail network. This technology allows for tailored product recommendations and dynamic e-commerce platforms. For instance, in 2024, many leading retailers reported significant increases in conversion rates, sometimes as high as 15-20%, directly attributed to AI-driven personalization engines.

The application of AI extends to optimizing inventory management and automating tasks like content creation for marketing campaigns. CP All can utilize these advancements to refine its supply chain, reduce waste, and free up staff time for more customer-facing activities. By mid-2025, it's projected that AI will be instrumental in managing over 30% of routine operational tasks in the retail sector, a substantial jump from previous years.

The demand for seamless integration between online and offline shopping is a significant technological driver in Thailand's retail sector. Businesses are increasingly adopting hybrid strategies, blending e-commerce platforms with physical touchpoints like in-store pickup. This trend is reshaping customer expectations for convenience and accessibility.

CP All is actively responding to this by enhancing its omnichannel capabilities. Services like 'All Online' and '7Delivery' exemplify this, aiming to create a unified customer journey. These initiatives allow customers to engage with CP All's brands through various channels, from mobile apps to physical stores, ensuring a smooth and consistent experience.

In 2023, Thailand's e-commerce market continued its robust growth, with online retail sales projected to reach over 15% of total retail sales. CP All's investment in its digital infrastructure, including its 'All Online' platform which saw significant user engagement in 2024, positions it to capitalize on this shift towards integrated shopping experiences.

Advancements in Digital Payments and Mobile Wallets

The rapid expansion of digital payments and mobile wallets is a key technological force shaping the Thai retail landscape. With mobile devices now driving more than 80% of online sales, this trend is undeniable. CP All is capitalizing on this by integrating these convenient payment methods, which are expected to see their adoption rate climb to 63% by 2025, directly meeting evolving customer expectations.

This technological shift offers significant advantages for CP All:

- Increased Customer Convenience: Mobile payment options streamline the purchasing process, reducing friction at checkout.

- Alignment with Market Trends: Embracing digital payments positions CP All favorably with a growing segment of tech-savvy consumers.

- Enhanced Data Collection: Digital transactions can provide valuable insights into customer behavior and preferences.

- Operational Efficiency: Reduced reliance on cash can lead to lower handling costs and improved security.

Technological Enhancements in Supply Chain and Logistics

Technological advancements are pivotal for CP All's extensive supply chain, supporting its vast network of 7-Eleven convenience stores and Makro wholesale centers. Innovations in automated warehousing and route optimization software are key to managing the sheer volume of goods. For instance, CP All has been investing in smart logistics solutions to enhance delivery efficiency, aiming to reduce transit times and fuel consumption across its operations.

Data analytics and artificial intelligence are increasingly utilized to forecast demand more accurately, minimizing stockouts and overstocking. This allows for better inventory management, ensuring products reach shelves when and where they are needed most. CP All's commitment to digital transformation includes leveraging these technologies to gain a competitive edge in the dynamic retail landscape.

- AI-powered demand forecasting is being implemented to improve inventory accuracy across CP All's diverse store formats.

- Investments in automated sorting and delivery systems aim to streamline the movement of goods from distribution centers to retail outlets.

- The adoption of advanced analytics helps in identifying inefficiencies within the logistics network, leading to cost reductions.

- Exploring blockchain technology for enhanced transparency and traceability in the food supply chain is a potential area for future development.

CP All is significantly enhancing its customer engagement through AI, particularly generative AI, to personalize shopping experiences and streamline operations. This focus on AI is projected to boost conversion rates by 15-20% in 2024 for leading retailers, a trend CP All is keen to replicate. The company is also investing in advanced analytics and AI for more accurate demand forecasting, aiming to optimize inventory across its vast network. By mid-2025, AI is expected to manage over 30% of routine retail tasks, improving efficiency and reducing waste.

The company is also capitalizing on the surge in digital payments and mobile wallets, which are expected to be used in 63% of transactions by 2025, as mobile devices now drive over 80% of online sales. This integration enhances customer convenience and provides valuable data insights. CP All’s commitment to technology also extends to its supply chain, with investments in automated warehousing and route optimization software to improve delivery efficiency and reduce transit times.

| Technology Area | CP All's Strategic Focus | Projected Impact/Adoption (2024-2025) |

|---|---|---|

| Artificial Intelligence (AI) | Personalization, Demand Forecasting, Operational Automation | 15-20% conversion rate increase (retail benchmark), 30%+ routine tasks automated by mid-2025 |

| E-commerce & Omnichannel | Online-to-Offline (O2O) integration, Digital Platforms (All Online, 7Delivery) | E-commerce to reach USD 32 billion by 2025; 15%+ of total retail sales online |

| Digital Payments | Mobile wallets, Seamless checkout integration | 63% adoption rate by 2025; 80%+ of online sales driven by mobile devices |

| Supply Chain Technology | Automated Warehousing, Route Optimization, Data Analytics | Reduced transit times, improved delivery efficiency, minimized stockouts |

Legal factors

Thailand's Ministry of Public Health and the Thai FDA are continuously updating food labeling and safety regulations. For instance, recent notifications in 2024-2025 have clarified definitions for 'best before' dates and introduced new guidelines for warning displays and claims about food ingredients.

CP All, a major player in Thailand's food sector, must navigate these evolving legal landscapes. Strict adherence to these updated standards, which impact everything from product formulation to marketing, is crucial for maintaining consumer confidence and avoiding potential penalties. In 2023, the Thai FDA reported a significant increase in food safety inspections, highlighting the government's focus on enforcement.

Thailand's Trade Competition Act B.E. 2560 (2017) is crucial for CP All, as it governs anticompetitive practices. The Trade Competition Commission of Thailand (TCCT) actively monitors agreements that restrict competition, the misuse of dominant market positions, and mergers.

CP All, holding a significant share in convenience retail and wholesale, faces direct oversight to prevent monopolistic behavior. The conditions attached to its previous mergers underscore the necessity of strict compliance with these antitrust regulations.

Consumer protection laws in Thailand are robust, designed to shield customers from unfair trade practices, ensuring fair pricing, accurate product labeling, and providing avenues for complaint resolution. CP All, as a major retailer, must adhere strictly to these regulations, which cover everything from advertising standards to product safety across its extensive network of 7-Eleven stores and other ventures.

For instance, the Consumer Protection Act B.E. 2522 (1979) and its subsequent amendments mandate clear information disclosure and prohibit misleading advertisements. CP All's commitment to transparency in its pricing and promotions, especially in the highly competitive convenience store sector where it holds a significant market share, is crucial for maintaining consumer confidence and avoiding potential penalties. In 2023, the Office of the Consumer Protection Board (OCPB) reported a notable increase in consumer complaints related to online sales, highlighting the evolving landscape and the importance of digital compliance for retailers like CP All.

Packaging and Waste Management Legislation

Thailand is actively developing new legislation concerning packaging and waste management, with the Draft Sustainable Packaging Management Act being a key example. This upcoming act is designed to foster more sustainable business practices across the board, emphasizing reductions in plastic consumption and significant boosts in recycling rates. For instance, by 2027, Thailand aims to increase the recycling rate of plastic packaging to 90%.

CP All's existing '7 Go Green' policy, which prioritizes reducing plastic use and improving resource efficiency, is well-positioned to adapt to these evolving legal requirements. This proactive approach means CP All is already aligning its operations with the spirit and anticipated mandates of these new regulations, potentially giving it a competitive advantage as they are implemented. The company has reported a 15% reduction in single-use plastic bags in its 7-Eleven stores nationwide since the policy's inception in 2022.

- Regulatory Development: Thailand is introducing new laws like the Draft Sustainable Packaging Management Act to govern packaging and waste.

- Sustainability Focus: The legislation targets plastic reduction and enhanced recycling efforts, with a national goal to recycle 90% of plastic packaging by 2027.

- CP All's Alignment: The company's '7 Go Green' policy proactively supports these sustainability goals, having already achieved a 15% decrease in single-use plastic bags since 2022.

- Proactive Strategy: CP All's existing initiatives position it favorably to comply with and potentially exceed future packaging and waste management requirements.

Labor Laws and Employment Standards

CP All, as a major employer in Thailand, navigates a complex landscape of labor laws and employment standards. These regulations dictate minimum wages, working hours, safety protocols, and employee benefits, all of which CP All must meticulously follow to ensure legal compliance and operational stability. Failure to adhere can result in significant penalties and damage to the company's reputation.

The company's commitment to its '7 Go Together' policy, which emphasizes job creation and career development, directly addresses the legal and social imperative to provide fair employment opportunities. This policy aims to foster a positive work environment, which is essential for retaining talent and minimizing labor disputes. For instance, as of early 2024, Thailand's minimum wage varies by province, with rates around 350-370 THB per day, a benchmark CP All must meet or exceed across its operations.

- Compliance with Thailand's Labor Protection Act: This covers aspects like overtime pay, annual leave, and sick leave, ensuring fair treatment of all employees.

- Minimum Wage Adherence: CP All must ensure all employees receive at least the legally mandated minimum wage, which is subject to provincial adjustments.

- Workplace Safety and Health Regulations: The company is obligated to provide a safe working environment, adhering to standards set by the Ministry of Labour.

- Employee Benefits and Social Security Contributions: CP All is required to contribute to the Social Security Fund for its employees, providing them with access to healthcare and other benefits.

CP All operates under Thailand's strict legal framework, which includes food safety, consumer protection, competition, and labor laws. The Thai FDA's ongoing updates to food labeling and safety regulations, as seen in 2024-2025 clarifications on 'best before' dates, require constant vigilance. Furthermore, adherence to the Trade Competition Act B.E. 2560 (2017) is critical to prevent monopolistic practices, as the Trade Competition Commission of Thailand actively monitors market conduct.

The company must also comply with robust consumer protection laws, such as the Consumer Protection Act B.E. 2522 (1979), ensuring fair pricing and accurate product information, especially in its dominant convenience store sector. New legislation, like the Draft Sustainable Packaging Management Act, is also emerging, aiming for a 90% plastic packaging recycling rate by 2027, a goal CP All's '7 Go Green' policy already supports, having reduced single-use plastic bags by 15% since 2022.

Labor laws are equally significant, dictating minimum wages, working hours, and safety standards. CP All's '7 Go Together' policy aligns with these, ensuring compliance with provincial minimum wages, which stood around 350-370 THB per day in early 2024, and providing essential employee benefits and social security contributions.

| Legal Area | Key Regulations/Acts | CP All's Compliance Focus | Recent/Relevant Data |

| Food Safety & Labeling | Thai FDA Notifications (2024-2025) | Product formulation, marketing claims, warning displays | Clarified 'best before' dates, increased FDA inspections in 2023 |

| Competition Law | Trade Competition Act B.E. 2560 (2017) | Preventing monopolistic behavior, merger compliance | TCCT monitors market dominance and anticompetitive agreements |

| Consumer Protection | Consumer Protection Act B.E. 2522 (1979) | Accurate labeling, fair pricing, transparent advertising | OCPB noted increased online sales complaints in 2023 |

| Packaging & Waste Management | Draft Sustainable Packaging Management Act | Plastic reduction, increased recycling rates | National goal: 90% plastic packaging recycling by 2027; CP All reduced plastic bags by 15% (2022-2024) |

| Labor Law | Thailand's Labor Protection Act | Minimum wage, working hours, safety, benefits | Provincial minimum wage ~350-370 THB/day (early 2024); Social Security Fund contributions |

Environmental factors

CP All is actively pursuing carbon neutrality by 2030 and net-zero emissions by 2050, a key component of its 2024-2025 Sustainability Framework. This ambitious environmental agenda, part of its '7 Go Green' policy, underscores a deep commitment to reducing its ecological footprint and aligns with growing global demands for corporate sustainability.

CP All is actively working to cut down on plastic, particularly virgin and single-use plastics, by promoting the use of recycled packaging materials. This commitment is a core part of their '7 Go Green' policy, specifically under the '2 Reductions' strategy, aiming for a more sustainable operational footprint.

These initiatives are crucial as regulatory bodies and consumers increasingly demand eco-friendly packaging. For instance, Thailand's Ministry of Industry has been pushing for greater use of recycled materials and reduction of plastic waste, with targets for increased recycling rates by 2027. CP All's proactive approach positions them favorably to meet these evolving environmental standards and consumer preferences.

CP All is actively pursuing energy efficiency and renewable energy adoption. In 2023, the company reported a 10% reduction in energy consumption per store compared to the previous year, driven by initiatives like LED lighting upgrades and improved HVAC systems across its 7-Eleven outlets.

Further demonstrating its commitment, CP All aims to install solar rooftops on 500 stores by the end of 2024, with an initial phase covering 150 locations by mid-2024, projected to offset approximately 8% of their total electricity usage.

Beyond solar, CP All is investigating the feasibility of solar thermal and geothermal heat solutions for its distribution centers, signaling a broader strategy to diversify its renewable energy portfolio and minimize its environmental impact, aligning with Thailand's national renewable energy targets.

Waste Management and Food Waste Reduction

CP All places significant emphasis on waste management, particularly focusing on food waste reduction and the segregation of plastic waste by consumers. These efforts are central to their environmental strategy, aiming to use resources more efficiently and lessen their ecological footprint.

The company actively promotes consumer participation in sustainable consumption, encouraging habits that lead to a decrease in overall waste. For instance, in 2023, CP All reported a 5% reduction in food waste across its 7-Eleven stores through improved inventory management and donation programs.

- Food Waste Reduction: Initiatives like optimized stock rotation and partnerships with food banks aim to minimize surplus food disposal.

- Plastic Waste Segregation: Campaigns are in place to educate customers on proper plastic recycling and encourage the use of reusable containers.

- Resource Optimization: By managing waste effectively, CP All seeks to conserve raw materials and reduce energy consumption in its operations.

- Consumer Collaboration: The company leverages its extensive retail network to drive behavioral change among millions of customers towards more sustainable practices.

Compliance with Environmental Regulations and Standards

Thailand is progressively enhancing its environmental regulations, with a notable focus on more rigorous Environmental Impact Assessments (EIAs) and stricter pollution control measures. The proposed Clean Air Management Act exemplifies this trend, aiming to set clearer standards for air quality and emissions.

CP All, as a major retail operator, must diligently ensure its operations comply with these evolving environmental laws. This includes adhering to mandated environmental standards and implementing robust waste management practices to avoid penalties and maintain its social license to operate.

By integrating sustainability into its core business strategy, CP All can not only meet these regulatory demands but also potentially gain a competitive edge by appealing to environmentally conscious consumers and investors. For instance, Thailand's Ministry of Natural Resources and Environment reported a 15% increase in EIA applications reviewed in 2024 compared to the previous year, highlighting the growing regulatory scrutiny.

- Stricter EIAs: Increased compliance burden and potential project delays if assessments are not thorough.

- Pollution Control: Investments required in technology and processes to meet air and waste discharge standards.

- Clean Air Act: Potential impact on energy sourcing and operational emissions for convenience stores and distribution centers.

- Sustainability Advantage: Opportunities to enhance brand reputation and attract customers through eco-friendly initiatives.

CP All's environmental strategy centers on achieving carbon neutrality by 2030 and net-zero emissions by 2050, a significant undertaking within its 2024-2025 Sustainability Framework. This commitment is further reinforced by its '7 Go Green' policy, which prioritizes reducing plastic waste, particularly single-use items, by increasing the use of recycled packaging materials.

The company is making strides in energy efficiency, having reduced energy consumption per store by 10% in 2023. Furthermore, CP All plans to install solar rooftops on 500 stores by the end of 2024, with an initial 150 locations targeted for mid-2024, aiming to offset approximately 8% of its total electricity usage.

Waste management is another key focus, with initiatives to reduce food waste, reporting a 5% decrease in 2023 through improved inventory and donation programs. CP All also actively encourages consumer participation in sustainable practices, such as proper plastic segregation and the use of reusable containers.

These efforts are crucial given Thailand's evolving environmental regulations, including stricter Environmental Impact Assessments and the proposed Clean Air Management Act. CP All's proactive approach to sustainability not only ensures compliance but also offers a competitive advantage by appealing to environmentally conscious consumers and investors.

| Environmental Initiative | Target/Status | Impact/Metric |

|---|---|---|

| Carbon Neutrality | By 2030 | Net-zero emissions by 2050 |

| Plastic Reduction | Promoting recycled packaging | Core of '2 Reductions' strategy |

| Energy Efficiency | 10% reduction in energy consumption per store (2023) | LED lighting, improved HVAC |

| Renewable Energy | 500 solar rooftops by end of 2024 | Offset ~8% of total electricity usage |

| Food Waste Reduction | 5% reduction in food waste (2023) | Optimized inventory, donation programs |

PESTLE Analysis Data Sources

Our CP All PESTLE Analysis is meticulously crafted using a blend of official government reports, economic indicators from reputable international organizations like the IMF and World Bank, and industry-specific market research. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting CP All's operations.