CP All Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CP All Bundle

Unlock the strategic brilliance behind CP All's dominant market position with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer segments, value propositions, and revenue streams, offering a clear roadmap to their success. Discover how CP All effectively leverages key resources and activities to maintain its competitive edge.

Ready to gain a deeper understanding of CP All's operational genius? Our full Business Model Canvas provides an in-depth, section-by-section exploration of their entire business framework, from cost structure to key partnerships. Download it now to gain actionable insights for your own strategic planning.

Partnerships

CP All's relationship with 7-Eleven, Inc. is the cornerstone of its business. As the exclusive master franchisee for Thailand, CP All gains the invaluable right to operate and expand the 7-Eleven convenience store network across the country. This partnership isn't just about using a brand; it's about adopting a proven, globally successful operating model.

This strategic alliance allows CP All to tap into 7-Eleven's immense brand recognition and established operational expertise. By the end of 2023, CP All operated over 14,000 7-Eleven stores in Thailand, demonstrating the scale and success of this master franchise agreement.

CP All leverages its position within the Charoen Pokphand Group (CPG) for significant operational advantages. This includes close collaboration with CP Axtra, which operates Makro and Lotus's, facilitating shared resources and supply chain optimizations across a vast retail network.

In 2024, the synergy is evident in CP All's ability to tap into CPG's extensive distribution channels and procurement power, enhancing cost efficiencies. For instance, CP Axtra's wholesale model complements CP All's convenience store format, allowing for bulk purchasing and streamlined logistics that benefit both entities.

CP All actively cultivates a robust network of local suppliers, encompassing small and medium-sized enterprises (SMEs), farmers, and food producers. This strategic collaboration is fundamental to sourcing a wide array of food products, fresh produce, and diverse merchandise for their extensive retail operations.

This partnership model directly fuels local economies by providing consistent demand and market access for these smaller businesses. For instance, in 2023, CP All's commitment to local sourcing contributed significantly to the livelihoods of numerous agricultural communities across Thailand, fostering economic resilience.

Furthermore, this deep integration with local suppliers ensures a dynamic and varied product assortment for consumers, reflecting regional tastes and seasonal availability. It also underpins CP All's sustainability ethos, aligning with their 'Growing Together' initiative by promoting responsible sourcing and community development.

Technology and IT System Providers

CP All partners with technology and IT system providers to streamline operations and expand its reach. In 2024, this focus on digital transformation is evident in their continued investment in AI for data analytics, aiming to personalize customer experiences and optimize inventory management across their vast network. This also fuels the development of their online-to-offline (O2O) strategies, integrating physical stores with digital platforms for enhanced delivery and e-commerce capabilities.

These collaborations are crucial for CP All’s competitive edge. For instance, their investment in advanced analytics helps them understand consumer behavior more deeply, leading to more effective promotions and product placement. The ongoing development of their O2O ecosystem, which saw significant growth in 2023 and is projected to continue its upward trend in 2024, relies heavily on robust IT infrastructure and innovative solutions from these tech partners.

- AI-driven data analytics: Enhancing customer insights and operational efficiency.

- O2O platform development: Integrating online and offline channels for seamless delivery and e-commerce.

- Cloud infrastructure: Supporting scalability and accessibility of digital services.

- Cybersecurity solutions: Protecting customer data and business operations.

Financial Institutions and Investors

CP All actively collaborates with financial institutions to secure necessary funding, notably through the issuance of debentures. For instance, in 2023, CP All successfully issued debentures totaling THB 30 billion, demonstrating its reliance on debt markets to manage its financial obligations and operational growth. These partnerships are vital for optimizing financial costs and ensuring access to capital for ongoing business development.

Furthermore, CP All cultivates strong relationships with a diverse range of investors, including institutional and retail participants. These relationships are fundamental for raising capital to fuel strategic expansion initiatives and maintain a robust market presence. In 2024, investor confidence remains a key driver, supporting CP All's ability to undertake significant projects and sustain its market leadership.

- Debenture Issuance: CP All leverages financial institutions for debt financing, exemplified by its THB 30 billion debenture issuance in 2023.

- Investor Relations: Maintaining strong ties with investors is critical for capital raising and supporting expansion.

- Market Confidence: Positive investor sentiment underpins CP All's ability to access capital and pursue growth strategies.

CP All’s key partnerships are crucial for its operational success and market dominance. The exclusive master franchise agreement with 7-Eleven, Inc. provides access to a globally recognized brand and proven business model, which CP All has scaled to over 14,000 stores in Thailand by the end of 2023.

Synergies within the Charoen Pokphand Group, especially with CP Axtra, enhance supply chain efficiencies and procurement power, as seen in 2024 through shared logistics and bulk purchasing advantages.

A strong network of local suppliers, including SMEs and agricultural producers, ensures a diverse product offering and supports local economies, a commitment evident in CP All's 2023 sourcing practices.

Collaborations with technology providers are vital for digital transformation, focusing on AI for analytics and O2O platform development to enhance customer experience and operational efficiency in 2024.

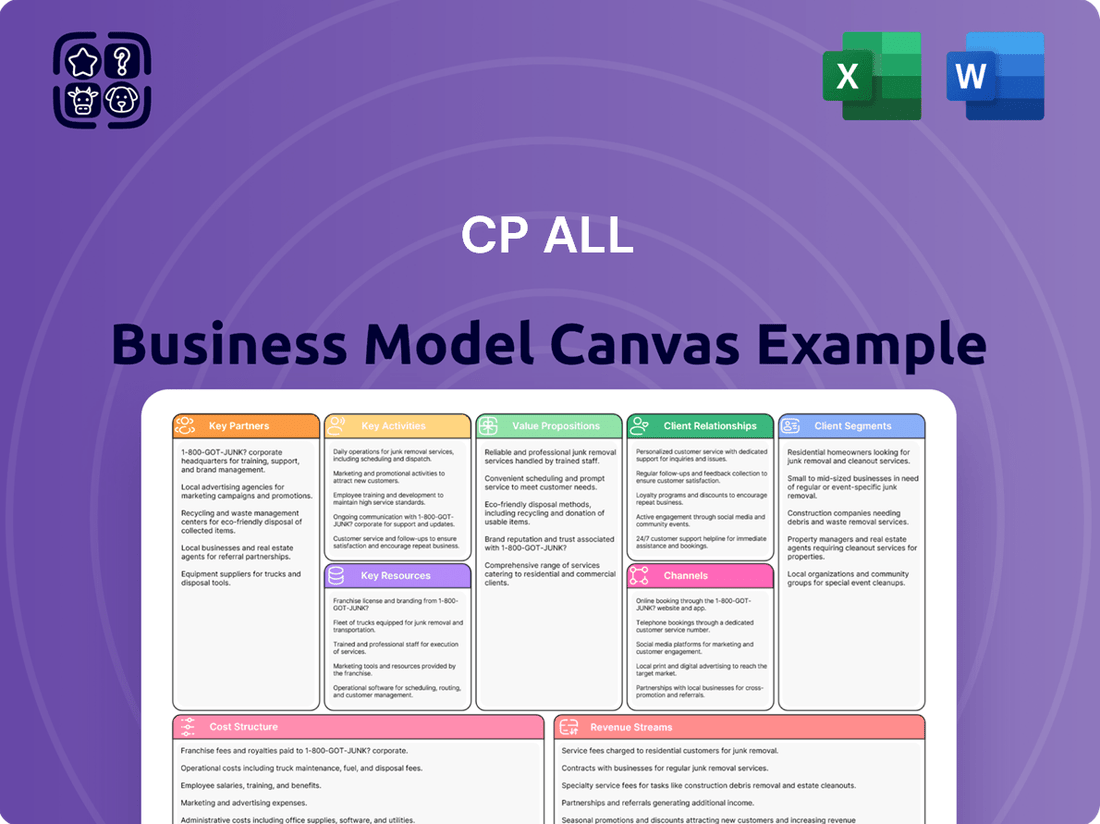

What is included in the product

A detailed breakdown of CP All's operations, outlining its diverse customer segments, extensive distribution channels, and compelling value propositions. This model highlights the company's strategic partnerships and cost structure, crucial for understanding its success in the convenience retail sector.

CP All's Business Model Canvas offers a structured approach to quickly identify and address operational inefficiencies, streamlining their vast retail network.

By visualizing key activities and resources, it helps CP All proactively solve logistical challenges and optimize customer service delivery.

Activities

The primary activity for CP All is the efficient operation and strategic franchising of its extensive 7-Eleven convenience store network. This encompasses meticulous daily management of individual stores, focusing on product assortment and presentation, and maintaining high standards of customer service to drive foot traffic and sales.

In 2023, CP All operated over 14,000 7-Eleven stores in Thailand, a testament to the scale of their core operations. The company's expansion efforts are also a key activity, with recent moves into markets like Cambodia and Laos, aiming to replicate their domestic success in new territories.

CP All operates Makro, a cash and carry wholesale business catering to a broad customer base including businesses, restaurants, and bulk purchasers. This segment is crucial for supplying essential goods to a wide array of commercial entities.

Key activities include the meticulous management of extensive inventory across numerous product categories, ensuring availability for its wholesale clientele. Makro’s operations also focus on efficient distribution logistics to serve its diverse business customers effectively.

Maintaining competitive pricing is paramount in the wholesale sector, and Makro strives to offer favorable terms to its business clients. In 2023, Makro’s revenue reached THB 248,878 million, demonstrating its significant scale and market presence.

CP All actively engages in manufacturing and distributing a wide array of food products, notably ready-to-eat meals and freshly baked goods. This vertical integration is a cornerstone of their strategy, directly fueling their extensive retail network.

These in-house produced items are crucial for CP All's retail arm, offering higher profit margins compared to third-party products. Furthermore, this capability allows them to swiftly adapt to and capitalize on changing consumer tastes and demands for convenient, quality food options.

In 2024, CP All's food business segment continued to demonstrate robust performance, contributing significantly to the company's overall revenue. For instance, their bakery segment alone has shown consistent year-on-year growth, reflecting strong consumer trust and demand for their freshly prepared offerings.

Supply Chain and Logistics Management

CP ALL's success hinges on its robust supply chain and logistics. This involves meticulously managing the flow of products from suppliers to its extensive network of 7-Eleven stores across Thailand. The company consistently invests in optimizing its distribution network to ensure product availability and freshness.

Key activities include:

- Distribution Network Optimization: CP ALL actively upgrades its distribution centers and fleet to enhance efficiency and reduce delivery times. In 2024, the company continued its focus on modernizing its logistics infrastructure to support its ongoing store expansion plans.

- Inventory Management: Sophisticated inventory systems are employed to minimize stockouts and reduce waste, ensuring popular items are always on shelves. This data-driven approach allows for precise forecasting and replenishment.

- Supplier Relationships: Maintaining strong partnerships with a diverse range of suppliers is vital for securing a consistent and high-quality supply of goods. CP ALL works closely with its suppliers to ensure product standards are met.

- Technology Integration: The company leverages technology, including advanced tracking and management systems, to gain real-time visibility across its entire supply chain, from procurement to store delivery. This technological backbone is critical for operational excellence.

Digital Platform Development and O2O Strategy

CP All is heavily invested in building and maintaining its digital ecosystem, notably the 7App, which powers its '7Delivery' service, and the 'All Online' platform. This dual focus on online presence and physical retail integration is central to their strategy.

The core of this activity is to create a seamless customer journey by bridging the gap between digital interactions and in-store experiences. This omnichannel approach aims to boost convenience and ultimately drive sales across all channels.

By 2024, CP All's digital initiatives have shown significant traction:

- Digital Sales Growth: The company reported a substantial increase in sales originating from its digital platforms, contributing to overall revenue growth.

- App User Engagement: 7App has seen a marked rise in active users, indicating successful adoption of their delivery and loyalty programs.

- O2O Integration Success: Customer feedback highlights improved convenience through services like click-and-collect, directly linking online browsing to physical store purchases.

- Expansion of Online Offerings: 'All Online' has broadened its product selection beyond convenience store staples, catering to a wider range of consumer needs.

CP All's key activities revolve around managing its vast 7-Eleven retail network, operating Makro wholesale, and integrating its digital platforms. The company also focuses on in-house food production and optimizing its extensive supply chain and logistics to ensure product availability and freshness across all its channels.

The company’s commitment to optimizing its distribution network and inventory management, supported by strong supplier relationships and technology integration, underpins its operational efficiency. These efforts ensure that products reach consumers reliably and efficiently.

CP All’s digital ecosystem, including 7App and All Online, is a critical activity aimed at enhancing customer engagement and driving sales through an omnichannel approach. This digital expansion is key to their future growth strategy.

| Key Activity Area | Description | 2023/2024 Data Point |

|---|---|---|

| 7-Eleven Operations | Efficient operation and franchising of convenience stores. | Over 14,000 stores in Thailand (2023). |

| Makro Wholesale | Supplying businesses and bulk purchasers with essential goods. | Revenue of THB 248,878 million (2023). |

| Food Production | Manufacturing ready-to-eat meals and baked goods for retail. | Consistent year-on-year growth in bakery segment (2024). |

| Supply Chain & Logistics | Optimizing distribution and inventory management. | Continued modernization of logistics infrastructure (2024). |

| Digital Ecosystem | Developing and integrating 7App and All Online. | Substantial increase in digital sales (2024). |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas you are previewing is the actual, complete document you will receive upon purchase. This means the structure, content, and formatting are exactly as you see them now, ensuring no surprises and immediate usability. You're getting a direct look at the professional, ready-to-use deliverable that will be yours to download and work with.

Resources

CP All's most critical physical asset is its extensive and growing network of 7-Eleven convenience stores. By the close of 2024, this network surpassed 15,245 locations across Thailand, augmented by the presence of Makro and Lotus's stores.

These strategically positioned stores are the backbone of CP All's accessibility, ensuring deep market penetration. This widespread physical presence is fundamental to their customer reach and operational efficiency.

CP All leverages the globally recognized 7-Eleven brand and the established Makro brand, giving it a substantial competitive edge. This strong brand equity cultivates customer trust and loyalty. In 2023, 7-Eleven Thailand reported revenue of approximately 470 billion Thai Baht, underscoring the power of its brand recognition.

CP All's human capital is immense, encompassing over 270,000 employees as of 2023, a significant portion of whom are frontline store staff. This vast workforce is augmented by a crucial network of Store Business Partners (SBPs) and sub-area franchisees, who act as vital operational hubs and local market experts.

The operational expertise of these individuals, from store associates to the broader franchisee network, is fundamental to CP All's success in managing its extensive retail operations and driving expansion. Their deep understanding of local consumer preferences and market dynamics is a key differentiator.

Robust Supply Chain and Distribution Infrastructure

CP All’s robust supply chain and distribution infrastructure is a cornerstone of its business model, ensuring a vast array of products consistently reach its extensive network of stores. This includes a sophisticated network of distribution centers and advanced logistics operations.

This infrastructure is critical for efficiently managing procurement, warehousing, and the timely delivery of goods, supporting CP All's extensive retail and wholesale operations across Thailand. The company's commitment to optimizing these processes directly impacts product availability and customer satisfaction.

- Extensive Distribution Network: CP All operates a significant number of distribution centers strategically located to serve its vast store base efficiently.

- Logistics Capabilities: The company leverages advanced logistics and transportation management systems to ensure product freshness and availability.

- Product Range Management: This infrastructure supports the handling and distribution of a diverse product mix, from fresh food to general merchandise.

- Efficiency and Timeliness: CP All’s supply chain is designed for speed and reliability, minimizing stockouts and ensuring products are on shelves when customers need them.

Technology and Digital Assets

CP All heavily invests in technology, viewing it as a cornerstone of its operations. This includes robust IT systems, advanced point-of-sale (POS) solutions, and the development of user-friendly mobile applications like 7App. These digital assets are crucial for streamlining business processes and enhancing customer engagement.

The company's commitment to data analytics is another vital technological resource. By leveraging data, CP All can better understand customer behavior, optimize inventory management, and personalize marketing efforts. This data-driven approach allows for more informed strategic decisions and improved operational efficiency.

In 2023, CP All continued to expand its digital footprint. For instance, the 7App platform saw significant user growth, facilitating online orders and loyalty programs. The company also focused on upgrading its in-store technology to improve checkout speed and customer experience. These investments are designed to maintain a competitive edge in the rapidly evolving retail landscape.

- IT Infrastructure: Comprehensive systems supporting all business functions.

- POS Systems: Modernized terminals for efficient transactions and data capture.

- Mobile Applications: Platforms like 7App for customer interaction and sales.

- Data Analytics: Tools and expertise for deriving insights from customer and operational data.

CP All's key resources are its vast retail network, strong brand equity, extensive human capital, robust supply chain, and significant technology investments. These elements collectively enable the company to maintain its market leadership and drive continuous growth.

The company's physical stores, particularly the 7-Eleven chain, are its most critical physical asset, with over 15,245 locations across Thailand by the end of 2024. This network is complemented by Makro and Lotus's stores, ensuring deep market penetration and accessibility. Brand recognition, notably the 7-Eleven brand, is a significant intangible asset, fostering customer trust and loyalty. In 2023, 7-Eleven Thailand generated approximately 470 billion Thai Baht in revenue, highlighting the power of its brand equity.

CP All's human capital, numbering over 270,000 employees as of 2023, is a vital resource, supported by a network of Store Business Partners and sub-area franchisees. These individuals bring crucial operational expertise and local market knowledge. The company's advanced supply chain and distribution infrastructure, featuring numerous distribution centers and sophisticated logistics, ensures efficient product management and timely delivery across its extensive network. Furthermore, significant investments in technology, including IT systems, POS solutions, and mobile applications like 7App, enhance operational efficiency and customer engagement, with 7App seeing substantial user growth in 2023.

| Key Resource | Description | 2023/2024 Data Point |

|---|---|---|

| Physical Stores | Extensive network of convenience stores and wholesale outlets. | Over 15,245 7-Eleven stores by end of 2024. |

| Brand Equity | Globally recognized and trusted brands. | 7-Eleven Thailand revenue: ~470 billion Thai Baht (2023). |

| Human Capital | Large workforce including employees and franchisees. | Over 270,000 employees (2023). |

| Supply Chain & Logistics | Sophisticated infrastructure for product distribution. | Supports diverse product range and efficient delivery. |

| Technology | IT systems, POS, and mobile applications. | Continued expansion of 7App; in-store technology upgrades. |

Value Propositions

CP All's 7-Eleven stores are strategically located across Thailand, offering unmatched convenience. As of the first quarter of 2024, CP All operated over 14,000 7-Eleven stores nationwide, ensuring customers can easily access essential goods and services around the clock.

This extensive network means a 7-Eleven is rarely far away, catering to immediate needs and simplifying daily routines for millions of consumers. The 24/7 operating model further enhances accessibility, making it a go-to destination for everything from quick snacks to bill payments.

CP All's diverse product offering is a cornerstone of its value proposition, encompassing everything from everyday groceries and beverages to convenient ready-to-eat meals and a significant focus on fresh food. This broad selection ensures they cater to a wide array of customer needs and preferences, making them a one-stop shop for many.

The strategic emphasis on high-margin items significantly boosts profitability. Products like freshly brewed coffee, a consistent draw for convenience store patrons, and specialized food items such as Japanese and Korean ready-to-eat meals, alongside growing demand for healthy meal options, are key drivers of this strategy. For instance, CP All has been actively expanding its private label fresh food offerings, aiming to capture a larger share of the convenience food market.

Makro's cash and carry wholesale model is a cornerstone of its value proposition for businesses and bulk purchasers. It provides highly competitive pricing, a significant draw for entrepreneurs and retailers looking to optimize their cost of goods. This model is particularly effective for those needing to acquire inventory in substantial volumes to meet customer demand.

The extensive product range available at Makro further enhances its appeal to business buyers. Offering a wide variety of goods, from groceries and household items to professional supplies, allows businesses to consolidate their purchasing, saving time and logistical effort. This breadth of selection ensures that most operational needs can be met under one roof.

For the fiscal year 2023, CP All, the parent company of Makro, reported significant revenue growth, with Makro contributing substantially to this performance. In the first nine months of 2023, Makro's sales revenue reached THB 179,166 million, demonstrating the strong demand for its wholesale offerings. This financial data underscores Makro's effectiveness in serving its target business clientele.

Integrated Online-to-Offline (O2O) Experience

CP All masterfully bridges the digital and physical worlds with its integrated Online-to-Offline (O2O) strategy. Services like 7Delivery and All Online allow customers to conveniently order goods online for either home delivery or in-store pickup, reflecting evolving consumer preferences for flexibility and accessibility.

This O2O approach significantly broadens CP All's reach and enhances customer convenience. For instance, in 2023, CP All reported a substantial increase in sales driven by its e-commerce initiatives, with digital channels contributing a growing percentage to overall revenue. This strategy directly addresses the demand for seamless shopping experiences, blending the ease of online browsing with the immediacy of physical retail.

- Seamless Integration: 7Delivery and All Online offer a unified platform for customer orders.

- Customer Convenience: Options for home delivery or in-store pickup cater to diverse needs.

- Market Responsiveness: Aligns with modern consumer habits valuing flexibility and speed.

- Growth Driver: Digital channels are increasingly contributing to CP All's overall sales performance.

Community Partnership and Sustainability Focus

CP All actively cultivates community partnerships, positioning itself as a key contributor to a sustainable society. This commitment is deeply embedded in its operations, aligning with Environmental, Social, and Governance (ESG) principles.

The company champions initiatives such as '7 Go Green' and '7 Go Together,' which directly address environmental concerns and social well-being. These programs focus on tangible actions like reducing plastic and energy consumption, demonstrating a clear dedication to eco-friendly practices.

Furthermore, CP All's support for Small and Medium-sized Enterprises (SMEs) and the promotion of local products strengthens community economies. This approach resonates strongly with a growing segment of consumers who prioritize businesses with a positive social and environmental impact.

For instance, in 2023, CP All reported a significant reduction in plastic bag usage across its 7-Eleven stores in Thailand, with over 10 billion plastic bags being avoided through customer participation in reusable bag campaigns. This reflects their tangible commitment to sustainability and community engagement.

- Community Integration: CP All fosters strong ties with local communities, acting as a partner rather than just a retailer.

- ESG Focus: Initiatives like '7 Go Green' and '7 Go Together' underscore a strategic commitment to environmental stewardship and social responsibility.

- SME Empowerment: The company actively supports local businesses and entrepreneurs, contributing to economic development within communities.

- Consumer Appeal: This sustainability-driven approach attracts and retains socially conscious consumers, enhancing brand loyalty and market position.

CP All's extensive network of over 14,000 7-Eleven stores across Thailand, as of Q1 2024, provides unparalleled convenience. This dense presence ensures immediate access to essential goods and services, operating 24/7 to simplify daily life for millions.

The company offers a vast product selection, from daily groceries and beverages to ready-to-eat meals and fresh food, positioning itself as a comprehensive one-stop shop. High-margin items, including coffee and specialized meal options, are key to their profitability strategy.

Makro's wholesale model offers competitive pricing and a wide product range for businesses, facilitating bulk purchasing and operational efficiency. In the first nine months of 2023, Makro's sales revenue reached THB 179,166 million, highlighting its strong performance in the business segment.

CP All's integrated Online-to-Offline (O2O) strategy, featuring 7Delivery and All Online, enhances customer convenience through flexible delivery and pickup options. Digital channels significantly contributed to sales growth in 2023, reflecting evolving consumer preferences.

The company's commitment to sustainability and community is evident through initiatives like '7 Go Green' and '7 Go Together,' focusing on environmental impact and social well-being. In 2023, CP All avoided over 10 billion plastic bags through customer participation in reusable bag campaigns, showcasing tangible environmental action.

Customer Relationships

CP All, the operator of 7-Eleven in Thailand, prioritizes everyday transactional convenience as a core customer relationship. This means the focus is on making quick, easy purchases for daily needs.

The extensive network of 7-Eleven stores, with over 13,000 locations across Thailand as of early 2024, ensures widespread accessibility. This convenience fosters frequent, low-engagement interactions, where speed and efficiency are paramount for customers grabbing a coffee, snack, or essential item.

CP All actively cultivates customer loyalty through its 7App, a digital platform offering exclusive promotions, discounts, and tailored product suggestions. This strategy is designed to encourage repeat business and gather valuable customer data. In 2023, CP All reported a significant increase in digital transactions, with the 7App playing a crucial role in driving customer engagement and sales.

CP All actively fosters community ties through robust social responsibility programs. In 2024, their commitment to empowering local economies was evident in their continued support for small and medium-sized enterprises (SMEs), a cornerstone of their community engagement strategy.

By championing local products and businesses, CP All not only strengthens its brand reputation but also cultivates significant goodwill within the communities it serves. This approach directly contributes to their customer relationships by demonstrating a genuine investment in local prosperity.

Wholesale Business Partnerships (Makro)

Makro's customer relationships are primarily business-to-business, focusing on building strong, long-term partnerships with entrepreneurs and small to medium-sized enterprises (SMEs). This involves direct sales teams who understand the needs of these business customers, offering them bulk purchasing options that drive down per-unit costs.

These relationships are further strengthened by tailored services designed to support business growth. This can include credit facilities, delivery services, and even specialized product assortments catering to specific industries. The emphasis is on providing value beyond just the product itself, fostering loyalty and repeat business.

- B2B Focus: Direct engagement with business clients, not individual consumers.

- Bulk Purchasing: Offering significant discounts for larger order volumes.

- Tailored Services: Providing solutions like credit, delivery, and customized assortments to meet business needs.

- Long-Term Partnerships: Cultivating relationships built on reliability and competitive pricing, crucial for business operational costs. For instance, in 2024, Makro continued to emphasize its value proposition for businesses, aiming to secure a larger share of the SME market through these relationship-building initiatives.

Customer Feedback and Service Improvement

CP All actively seeks customer feedback to enhance satisfaction, utilizing numerous channels to gather insights. This commitment to listening allows them to adapt their offerings and service, ensuring they meet evolving customer demands.

In 2024, CP All continued to emphasize customer experience, with initiatives focused on digital feedback collection and in-store service quality. For instance, their 7-Eleven stores in Thailand regularly conduct customer satisfaction surveys, with a significant portion of customers reporting positive experiences with staff helpfulness.

- Customer Feedback Channels: CP All leverages in-store feedback boxes, mobile app surveys, and social media monitoring to capture customer sentiment.

- Service Improvement Initiatives: Based on feedback, they implement targeted training programs for staff and refine store layouts and product assortments.

- Customer Satisfaction Metrics: The company tracks key performance indicators such as Net Promoter Score (NPS) and customer retention rates, aiming for continuous year-on-year improvement.

CP All's customer relationships are built on convenience and digital engagement, with the 7App acting as a key loyalty driver. This platform offers exclusive deals and personalized recommendations, encouraging repeat visits and purchases. By early 2024, CP All operated over 13,000 7-Eleven stores, ensuring widespread accessibility for everyday transactions.

Beyond transactional convenience, CP All fosters community ties through social responsibility, supporting local SMEs. This approach builds goodwill and strengthens brand reputation. Makro's relationships are B2B, focusing on bulk purchasing and tailored services like credit and delivery for business clients, aiming for long-term partnerships. In 2024, Makro continued to focus on its value proposition for businesses, seeking to increase its market share among SMEs.

CP All actively gathers customer feedback through various channels, including in-store surveys and mobile app prompts, to enhance satisfaction. In 2024, the company focused on digital feedback collection and improving in-store service quality, with many customers reporting positive experiences with staff helpfulness.

| Customer Relationship Aspect | Description | Key Initiatives/Data (as of early 2024) |

|---|---|---|

| Convenience & Accessibility | Everyday transactional ease through extensive store network. | Over 13,000 7-Eleven stores across Thailand. |

| Digital Engagement & Loyalty | Cultivating repeat business via the 7App. | 7App offers exclusive promotions and personalized suggestions. |

| Community & Social Responsibility | Building goodwill by supporting local economies and SMEs. | Continued support for SMEs in 2024. |

| B2B Partnerships (Makro) | Long-term relationships with businesses through bulk buying and tailored services. | Focus on credit facilities, delivery, and industry-specific assortments. |

| Customer Feedback & Service Improvement | Actively seeking and acting on customer input. | In-store feedback boxes, app surveys, social media monitoring; focus on staff training and store enhancements. |

Channels

The extensive 7-Eleven convenience store network is CP All's primary and most visible channel. As of the first quarter of 2024, Thailand boasted over 14,000 7-Eleven stores, a testament to their ubiquitous presence. This vast physical footprint serves as the core point of sale for a diverse product offering, with ongoing domestic expansion and strategic international growth plans.

Makro Cash & Carry Wholesale Stores are a cornerstone for CP All's distribution strategy, acting as a primary channel for bulk and wholesale transactions. These large-format stores are specifically designed to meet the needs of business customers, including hotels, restaurants, catering services, and other retailers, offering them a curated selection of products in larger quantities.

The shopping experience at Makro is distinct, emphasizing volume purchasing and cost-effectiveness. This focus allows businesses to procure essential supplies efficiently, directly impacting their operational costs and profitability. For instance, in 2024, Makro continued to expand its reach, with CP All reporting significant revenue contributions from this segment, underscoring its vital role in serving the B2B market.

CP All effectively utilizes its 7App to power '7Delivery' and 'All Online,' bridging the gap between digital convenience and its vast physical store network. This strategy allows customers to order products online for home delivery or convenient in-store pickup, seamlessly merging online and offline retail experiences.

In 2024, CP All continued to expand its digital footprint, with the 7App serving as a crucial touchpoint for millions of customers. The platform facilitates a growing volume of transactions, demonstrating the increasing consumer preference for integrated shopping solutions that offer flexibility and accessibility.

Food Production and Distribution Facilities

CP All's integrated food production and distribution facilities are crucial internal channels, ensuring a steady flow of fresh and ready-to-eat items to its extensive network of 7-Eleven stores and other retail formats. This direct control over manufacturing and logistics allows for rigorous quality assurance and a reliable supply chain for high-demand food categories.

These facilities are instrumental in maintaining the freshness and quality of products, from the sourcing of ingredients to the final delivery. For instance, CP All operates numerous food processing plants, including those for ready-to-eat meals, bakery items, and beverages, which are then distributed through its own logistics network. This vertical integration is a cornerstone of their operational efficiency and product consistency.

- Internal Supply Chain: Owns and operates food manufacturing and distribution centers.

- Quality Control: Ensures product quality and safety from production to retail.

- Product Availability: Guarantees consistent supply of fresh and ready-to-eat items to over 13,000 7-Eleven stores in Thailand as of early 2024.

- Cost Efficiency: Reduces reliance on external suppliers, potentially lowering costs and improving margins.

Strategic Partnerships and Alliances

CP All leverages strategic partnerships to significantly broaden its market reach. A prime example is its collaboration with PTT, integrating 7-Eleven convenience stores within PTT's extensive network of gas stations. This symbiotic relationship allows CP All to tap into a captive audience already frequenting these locations, enhancing convenience for PTT customers and driving foot traffic for 7-Eleven.

These alliances are crucial for expanding CP All's physical presence without the sole burden of traditional store development. By co-locating with established entities like PTT, CP All can access high-traffic areas and diverse customer demographics more efficiently. For instance, by the end of 2023, PTT operated over 2,000 service stations across Thailand, providing a substantial platform for 7-Eleven's accessibility.

- Strategic Co-location: Partnerships, like the one with PTT, enable 7-Eleven to operate within high-traffic service stations, increasing visibility and customer access.

- Expanded Footprint: This strategy allows CP All to quickly scale its store network, reaching more consumers in diverse geographical locations.

- Synergistic Growth: The collaboration benefits both partners, with 7-Eleven offering convenience to PTT customers and PTT providing prime retail real estate.

- Customer Diversification: By being present at PTT stations, 7-Eleven can cater to a wider range of customers, including travelers and commuters.

CP All's channels are designed for maximum customer reach and convenience, blending extensive physical networks with robust digital offerings. The core of this strategy is the vast 7-Eleven convenience store chain, complemented by the wholesale operations of Makro. Digital platforms like the 7App further enhance accessibility, enabling services such as 7Delivery and All Online, which integrate seamlessly with the physical stores.

The company also leverages its internal supply chain, including food production and distribution centers, to ensure product quality and availability across its retail outlets. Strategic partnerships, notably with PTT, expand its physical footprint by co-locating 7-Eleven stores within high-traffic service stations, thereby capturing a wider customer base and enhancing overall market penetration.

| Channel Type | Description | Key Features/Reach (Early 2024) | Strategic Importance |

|---|---|---|---|

| 7-Eleven Stores | Convenience retail | Over 14,000 stores in Thailand; ongoing domestic and international expansion. | Primary point of sale, brand visibility, customer engagement. |

| Makro Cash & Carry | Wholesale and bulk sales | Caters to businesses (hotels, restaurants, retailers); significant revenue contributor. | B2B market penetration, volume sales, cost-efficiency for businesses. |

| 7App (7Delivery & All Online) | Digital platform | Facilitates online orders for delivery or in-store pickup; growing transaction volume. | Omnichannel integration, digital convenience, customer loyalty. |

| Internal Supply Chain | Food production & distribution | Operates food processing plants for ready-to-eat items, bakery, beverages. | Quality control, product freshness, supply chain efficiency, cost management. |

| Strategic Partnerships (e.g., PTT) | Co-location and alliances | 7-Eleven stores within PTT service stations (over 2,000 PTT stations in Thailand). | Expanded physical reach, access to high-traffic locations, synergistic growth. |

Customer Segments

Everyday Consumers, also known as the mass market, represent a significant customer segment for businesses like CP All. This group comprises individuals and families who prioritize convenience and readily available access to essential goods. They are looking for quick solutions for their daily needs, from snacks and drinks to ready-to-eat meals, making them a core focus for retail operations.

In 2024, the sheer volume of transactions within this segment is substantial. For instance, CP All's 7-Eleven stores, a prime example of serving this segment, reported a significant number of daily customers across Thailand, highlighting the immense purchasing power and frequency of this consumer group. Their purchasing decisions are often impulse-driven, prioritizing immediate gratification and ease of access.

CP All's business customers and entrepreneurs are primarily small to medium-sized enterprises, including restaurants, hotels, and various retailers. These businesses rely on CP All for bulk purchases of goods essential to their daily operations. In 2024, the demand for efficient and cost-effective supply chains for these businesses remained a key driver.

These customers prioritize competitive pricing and a wide assortment of products to meet their diverse operational needs. They value the convenience of sourcing multiple items from a single, reliable supplier. In Thailand's dynamic retail landscape, CP All's ability to provide consistent inventory and bulk discounts directly addresses these core requirements for entrepreneurs and businesses.

Health-conscious consumers represent a rapidly expanding market segment for CP All. This group actively seeks out healthier food and beverage choices, prioritizing items like clean food, low-calorie options, and high-protein products. In 2024, the global market for healthy foods was valued at over $1 trillion, demonstrating the significant opportunity for businesses that can effectively cater to these preferences.

CP All is strategically responding to this trend by broadening its product portfolio to include more nutritious selections. This includes introducing new lines of ready-to-eat meals with clear nutritional labeling and expanding the availability of fresh produce and healthier snack alternatives within its 7-Eleven stores. This focus aims to capture a larger share of this growing consumer base.

Digital-Savvy Consumers

Digital-savvy consumers are a key segment for CP All, prioritizing convenience through online channels. They actively use CP All's digital ecosystem, including the 7App and All Online, for seamless shopping experiences. This preference for digital interaction highlights a growing trend in retail, where accessibility and integrated services are paramount.

In 2024, CP All reported significant growth in its digital segment. The 7App, for instance, saw a substantial increase in active users, reflecting the segment's engagement with CP All's digital offerings. This digital adoption is driven by a desire for:

- Convenience: Accessing products and services anytime, anywhere.

- Expanded Choice: Utilizing online platforms for a wider product selection than available in-store.

- Integrated Experience: Leveraging online-to-offline solutions, such as click-and-collect services.

Tourists and Travelers

Tourists and travelers are a crucial customer segment for CP All, especially given Thailand's robust tourism industry. In 2024, Thailand welcomed an estimated 30 million international visitors, a significant rebound indicating strong demand for travel services and related retail convenience.

For these visitors, 7-Eleven stores, strategically positioned in popular tourist areas and transit points like airports and train stations, offer essential goods. They provide quick access to ready-to-eat meals, beverages, toiletries, and travel-sized necessities, catering to immediate needs and on-the-go consumption.

- Convenience: Tourists often have limited time and need quick access to food, drinks, and travel essentials.

- Location: Stores in tourist hotspots and transportation hubs are particularly vital for this segment.

- Product Variety: Offerings range from snacks and beverages to personal care items and souvenirs, meeting diverse traveler needs.

CP All serves a broad customer base, from everyday consumers seeking convenience to health-conscious individuals and digital-savvy shoppers. Businesses and entrepreneurs also form a key segment, relying on CP All for their supply chain needs. Tourists and travelers further contribute to this diverse customer portfolio, valuing the accessibility and essential offerings provided by CP All's extensive network.

Cost Structure

The Cost of Goods Sold (COGS) is a significant part of CP All's cost structure. It directly covers the expenses incurred in acquiring the products sold in its 7-Eleven convenience stores and Makro wholesale stores. This also includes the cost of raw materials used to produce food items.

For CP All, COGS represents the cost of inventory and payments made to suppliers for the vast array of merchandise. In 2023, CP All reported a COGS of approximately THB 237.8 billion, reflecting the substantial investment in maintaining its extensive product offerings.

CP All's operating expenses are substantial, driven by its extensive retail footprint. Personnel costs, encompassing salaries and wages for a large workforce, represent a significant portion. Additionally, utility expenses, particularly electricity for refrigeration and lighting across thousands of stores, are a major outlay. Rental fees for prime store locations also contribute heavily to this cost category.

In 2024, CP All continued its strategic focus on optimizing electricity consumption. This initiative is crucial for managing operating costs, as electricity is a primary driver of utility expenses. By implementing energy-efficient technologies and practices, the company aims to mitigate the impact of rising energy prices and improve overall profitability.

CP All's distribution and logistics costs are substantial, encompassing the movement of goods from their extensive network of distribution centers to thousands of 7-Eleven stores across Thailand. These expenses include fuel for delivery fleets, regular vehicle maintenance, and the operational costs of warehousing and inventory management.

Significant capital is continually invested in developing and upgrading their distribution centers to enhance efficiency and speed. For instance, in 2023, CP All reported substantial investments in logistics infrastructure, aiming to optimize delivery routes and reduce transit times, which directly impacts these cost categories.

Marketing and Sales Expenses

CP All’s marketing and sales expenses are crucial for driving customer acquisition and retention across its diverse business segments, including its extensive convenience store network. These costs encompass advertising, promotional activities, and the operation of loyalty programs designed to build brand preference and encourage repeat purchases. For instance, in 2024, CP All continued its robust marketing efforts, with a significant portion of its budget allocated to digital advertising and in-store promotions to maintain its market leadership.

The company invests heavily in campaigns that highlight product variety and value, aiming to attract a broad customer base. Loyalty programs, such as those linked to its convenience stores, are a key component of this strategy, fostering customer engagement and providing valuable data for targeted marketing. These expenditures are essential for competing effectively in the fast-moving consumer goods sector.

- Advertising and Promotions: CP All regularly runs national advertising campaigns across various media channels, including television, digital platforms, and out-of-home advertising, to promote new products and seasonal offers.

- Loyalty Programs: The company manages extensive loyalty programs, such as the All Member program, which offers points, discounts, and exclusive benefits to members, driving repeat business and customer lifetime value.

- Sales Force and Distribution: Costs associated with maintaining a sales force and managing the distribution network are also included, ensuring products are readily available to consumers.

- Market Research: CP All invests in market research to understand consumer trends and preferences, informing its marketing strategies and product development.

Capital Expenditures (Store Expansion, IT, Fixed Assets)

CP All makes substantial investments in its physical and technological infrastructure. This includes opening new stores and renovating existing ones to enhance customer experience and operational efficiency. For instance, in 2023, CP All continued its aggressive store expansion, aiming to reach over 15,000 stores by the end of the year.

Upgrades to IT systems are crucial for managing inventory, sales, and customer data effectively. The company also invests in acquiring essential fixed assets, such as delivery vehicles and warehouse equipment, to support its extensive distribution network. These capital expenditures are vital for maintaining competitiveness and facilitating growth.

Looking ahead, CP All has outlined significant capital expenditure plans for 2024 and 2025, primarily focused on continued store network expansion. This strategic investment underscores the company's commitment to increasing its market presence and operational capabilities.

Key capital expenditure areas include:

- Store Expansion: Opening new 7-Eleven convenience stores across Thailand.

- Store Renovations: Upgrading the look and functionality of existing outlets.

- IT System Upgrades: Enhancing point-of-sale, inventory management, and data analytics capabilities.

- Fixed Assets: Acquiring new equipment for stores, distribution centers, and logistics.

CP All's cost structure is dominated by its Cost of Goods Sold (COGS), which represents the direct costs of products sold. This is followed by substantial operating expenses driven by its vast retail network, including personnel, utilities, and rent. Distribution and logistics costs are also significant due to the extensive supply chain operations required to serve thousands of stores.

The company's marketing and sales efforts are critical for maintaining market share, involving advertising, promotions, and loyalty programs. Furthermore, significant capital expenditures are allocated towards store expansion, renovations, and IT infrastructure upgrades to support growth and operational efficiency.

| Cost Category | 2023 (THB Billion) | Key Drivers |

|---|---|---|

| Cost of Goods Sold (COGS) | 237.8 | Inventory acquisition, supplier payments, raw materials |

| Operating Expenses | N/A | Personnel costs, utilities (electricity), rent |

| Distribution & Logistics | N/A | Fuel, vehicle maintenance, warehousing, inventory management |

| Marketing & Sales | N/A | Advertising, promotions, loyalty programs, market research |

| Capital Expenditures | N/A | Store expansion, renovations, IT upgrades, fixed assets |

Revenue Streams

CP All's main income comes from selling a wide variety of items at its 7-Eleven stores. Think of everyday essentials, tasty snacks, refreshing drinks, and quick meal options. This category is a huge contributor to their overall earnings, forming the backbone of their business model.

In 2023, CP All reported a substantial revenue of THB 280.5 billion, with the retail segment, primarily driven by 7-Eleven, being the largest contributor. This highlights the immense volume and consistent demand for the diverse product assortment offered.

CP All generates significant revenue from the wholesale sales of goods via its Makro cash-and-carry operations. These sales are primarily directed towards businesses and other bulk purchasers, acting as a crucial distribution channel.

The expansion of both Makro and Lotus's businesses in 2024 has further bolstered this revenue stream. For instance, Makro Thailand reported a revenue of THB 246 billion in 2023, with wholesale contributing a substantial portion, indicating continued growth potential.

CP All, as the master franchisee for 7-Eleven in Thailand, generates significant revenue through initial franchise fees and recurring royalty payments from its extensive network of franchised stores. This dual approach ensures a consistent and expandable income base, directly tied to the growth and success of its retail partners.

In 2024, CP All's robust franchise model continued to be a cornerstone of its financial performance. The company reported that its 7-Eleven operations, heavily reliant on these franchise fees and royalties, contributed substantially to its overall earnings, demonstrating the scalability and stability of this revenue stream as more entrepreneurs join the 7-Eleven system.

Service Income (Bill Payments, Other Services)

CP All, through its extensive 7-Eleven network, generates significant revenue from service income, particularly from bill payment and top-up services. These offerings act as a powerful draw for customers, driving foot traffic into stores and creating opportunities for impulse purchases of other goods.

These convenience services not only provide a direct revenue stream but also bolster customer loyalty and store utility. In 2024, CP All continued to leverage its vast retail footprint to facilitate a wide array of transactions for its customers.

- Bill Payments: Facilitating utility bill payments, credit card payments, and other financial transactions for a fee.

- Top-Up Services: Offering mobile phone credit top-ups and digital wallet reloads.

- Other Convenience Services: Including parcel delivery drop-off/pick-up, ticket sales, and ATM services.

Rental Income and Other Income

CP All generates revenue not only from its core retail operations but also through rental income. This is particularly relevant for its Makro and Lotus's hypermarket and supermarket properties, where it leases out retail space to other businesses.

Beyond direct property rentals, CP All captures other miscellaneous income streams that contribute to its overall financial performance. These can include fees from services offered within its retail environments or other operational byproducts.

For instance, in 2024, CP All continued to optimize its extensive store network, which includes thousands of locations. While specific figures for rental income are not always broken out separately, the strategic utilization of prime retail space within its larger formats like Makro and Lotus's is a recognized revenue diversification strategy.

- Rental Income: Monetizing retail space within Makro and Lotus's stores.

- Other Income Streams: Capturing revenue from miscellaneous operational activities.

- Strategic Space Utilization: Leveraging prime locations for additional revenue generation.

CP All's revenue streams are diverse, anchored by its massive 7-Eleven convenience store network. This segment thrives on high-volume sales of everyday goods, snacks, and meals, contributing significantly to the company's bottom line. In 2023, CP All's retail segment, powered by 7-Eleven, was the largest revenue generator, underscoring the consistent demand for its product assortment.

The company also benefits from wholesale operations through Makro, catering to businesses and bulk purchasers. This segment, alongside the expanding Lotus's business, represents another critical income source. Makro Thailand alone reported THB 246 billion in revenue in 2023, with wholesale sales forming a substantial part of this figure.

Furthermore, CP All leverages its 7-Eleven franchise model, earning fees and royalties from its vast network of franchised stores. This model ensures a stable and scalable income base, directly linked to the growth of its retail partners. In 2024, this franchise revenue continued to be a key contributor to overall earnings.

Convenience services like bill payments and top-ups at 7-Eleven stores also generate income and drive foot traffic, creating additional sales opportunities. Rental income from retail space within Makro and Lotus's properties, along with other miscellaneous operational revenues, further diversifies CP All's financial performance.

| Revenue Stream | Primary Source | 2023 Contribution (Approximate) |

|---|---|---|

| Retail Sales (7-Eleven) | Everyday goods, snacks, meals | Largest contributor to THB 280.5 billion total revenue |

| Wholesale Sales (Makro) | Bulk goods to businesses | Substantial portion of Makro Thailand's THB 246 billion revenue |

| Franchise Fees & Royalties (7-Eleven) | Fees from franchised stores | Key contributor to 7-Eleven's earnings |

| Convenience Services | Bill payments, top-ups | Drives foot traffic and impulse purchases |

| Rental Income & Other | Leasing retail space, miscellaneous operations | Diversifies overall financial performance |

Business Model Canvas Data Sources

The CP All Business Model Canvas is built using a combination of internal financial reports, extensive market research on the convenience store sector, and operational data from existing stores. These sources provide a comprehensive view of CP All's current business and potential growth areas.