CP All Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CP All Bundle

CP All faces significant bargaining power from its suppliers, particularly for key consumer goods and fresh produce, impacting its cost structure. The intense rivalry within Thailand's convenience store sector, driven by numerous local and international players, also exerts considerable pressure on pricing and innovation.

The threat of new entrants, while somewhat mitigated by established brand loyalty and extensive distribution networks, remains a factor to monitor as the market continues to grow. Understanding these dynamics is crucial for navigating CP All's competitive landscape.

Ready to move beyond the basics? Get a full strategic breakdown of CP All’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

CP All’s diverse supplier base significantly dilutes individual supplier bargaining power. With operations spanning 7-Eleven, Makro, and food manufacturing, CP All sources from a wide spectrum of vendors for everything from everyday consumables to specialized equipment. This broad network means no single supplier holds a dominant position.

The sheer number of available suppliers for many product categories, especially for standard fast-moving consumer goods, provides CP All with ample alternatives. For instance, in 2024, CP All's procurement for its extensive 7-Eleven network likely involved thousands of SKUs sourced from numerous domestic and international manufacturers and distributors, making it difficult for any one to dictate terms.

CP All, as Thailand's leading retail and wholesale operator, leverages its massive purchasing volume, a key factor in its bargaining power with suppliers. For instance, in 2023, CP All's revenue reached approximately THB 234.8 billion, indicating the sheer scale of its procurement activities.

This substantial buying power means many suppliers depend heavily on CP All for a significant portion of their revenue. This reliance enables CP All to negotiate highly favorable terms, including competitive pricing and advantageous payment schedules, strengthening its position in the supply chain.

CP All's engagement in manufacturing and distributing food products and equipment signifies its backward integration capabilities. This allows CP All to produce certain items internally or manage their sourcing through its own channels, lessening reliance on external suppliers.

This potential for in-house production grants CP All greater control over its supply chain for specific goods. For instance, in 2023, CP All's food manufacturing segment, which includes its 7-Fresh ready-to-eat meals and bakery items, continued to be a significant contributor to its revenue, demonstrating its operational capacity in these areas.

By having the option to produce internally, CP All can reduce its vulnerability to price hikes or supply disruptions from external vendors. This self-sufficiency enhances its bargaining power, as suppliers know CP All has alternatives to their offerings.

Importance of Distribution Channels

The bargaining power of suppliers is significantly influenced by the importance of distribution channels, especially for CP All in Thailand. For many suppliers, particularly smaller local producers or international brands looking to enter the Thai market, gaining access to CP All’s extensive 7-Eleven and Makro networks is crucial. This reliance on CP All for market reach and consumer access grants the company considerable leverage.

Suppliers often find themselves offering more favorable terms, such as lower prices or extended payment periods, to secure shelf space and distribution through CP All’s vast retail footprint. In 2023, CP All operated over 14,000 7-Eleven stores across Thailand, and its Makro wholesale business further solidifies its distribution dominance. This widespread presence means suppliers often have limited alternative channels to reach a comparable volume of consumers efficiently.

- Access to 7-Eleven and Makro: Crucial for suppliers, especially smaller local producers and international brands entering the Thai market.

- Market Reach: CP All's extensive network provides unparalleled consumer access, giving suppliers a strong incentive to comply with CP All's terms.

- Supplier Reliance: Suppliers are often dependent on CP All for significant sales volume, reducing their bargaining power.

- Favorable Terms: Suppliers may offer better pricing or terms to secure placement within CP All's highly sought-after distribution channels.

Supplier Switching Costs

Supplier switching costs for CP All are generally low across its vast product range. This is largely due to a competitive supplier landscape for many of its everyday items, meaning it's relatively easy to find alternative sources if needed. For instance, a significant portion of CP All's procurement involves fast-moving consumer goods where numerous manufacturers and distributors can supply products.

However, there are instances where switching costs can be higher. This typically applies to specialized products or proprietary systems that require specific integration or have unique contractual obligations. These might include certain private label manufacturing agreements or technology solutions that are deeply embedded within CP All's operational infrastructure.

Despite these exceptions, the overall impact of supplier switching costs on CP All's bargaining power is limited. The sheer volume of suppliers and CP All's robust internal procurement and logistics capabilities allow it to effectively manage relationships and negotiate favorable terms. This inherent flexibility in sourcing strengthens its position against suppliers.

- Low Switching Costs for Commodities: CP All benefits from a wide availability of suppliers for many of its core product categories, reducing the cost and effort to switch.

- Higher Costs for Specialized Items: Proprietary goods or integrated systems may present higher switching costs, requiring more effort and investment to change suppliers.

- Mitigation through Scale and Capability: CP All's large operational scale and strong internal procurement expertise help to minimize the risks and costs associated with supplier changes, thereby enhancing its bargaining power.

CP All's immense purchasing volume, evidenced by its THB 234.8 billion revenue in 2023, grants it substantial bargaining power over suppliers. This scale means many vendors depend heavily on CP All for sales, enabling the company to negotiate favorable pricing and payment terms.

The company's ability to potentially produce certain goods internally, as seen in its food manufacturing segment, further reduces supplier reliance and strengthens its negotiation position. This self-sufficiency is a key factor in maintaining its leverage.

Suppliers often find their bargaining power diminished because CP All's extensive 7-Eleven and Makro networks offer crucial market access. For many, securing shelf space within CP All's over 14,000 7-Eleven stores in Thailand in 2023 is vital, leading them to offer more competitive terms.

Supplier switching costs for CP All are generally low for commodity items due to a wide array of available vendors, though specialized products may present higher costs. However, CP All's operational scale and procurement expertise effectively manage these costs, enhancing its overall bargaining power.

| Factor | CP All's Position | Impact on Supplier Bargaining Power |

| Purchasing Volume (2023 Revenue: THB 234.8 Billion) | Very High | Lowers supplier power significantly |

| Supplier Dependence | High for many suppliers | Lowers supplier power |

| Market Access (Over 14,000 7-Eleven stores in 2023) | Dominant | Lowers supplier power |

| Backward Integration Capability | Present (e.g., food manufacturing) | Lowers supplier power |

| Switching Costs | Generally Low (for commodities) | Lowers supplier power |

What is included in the product

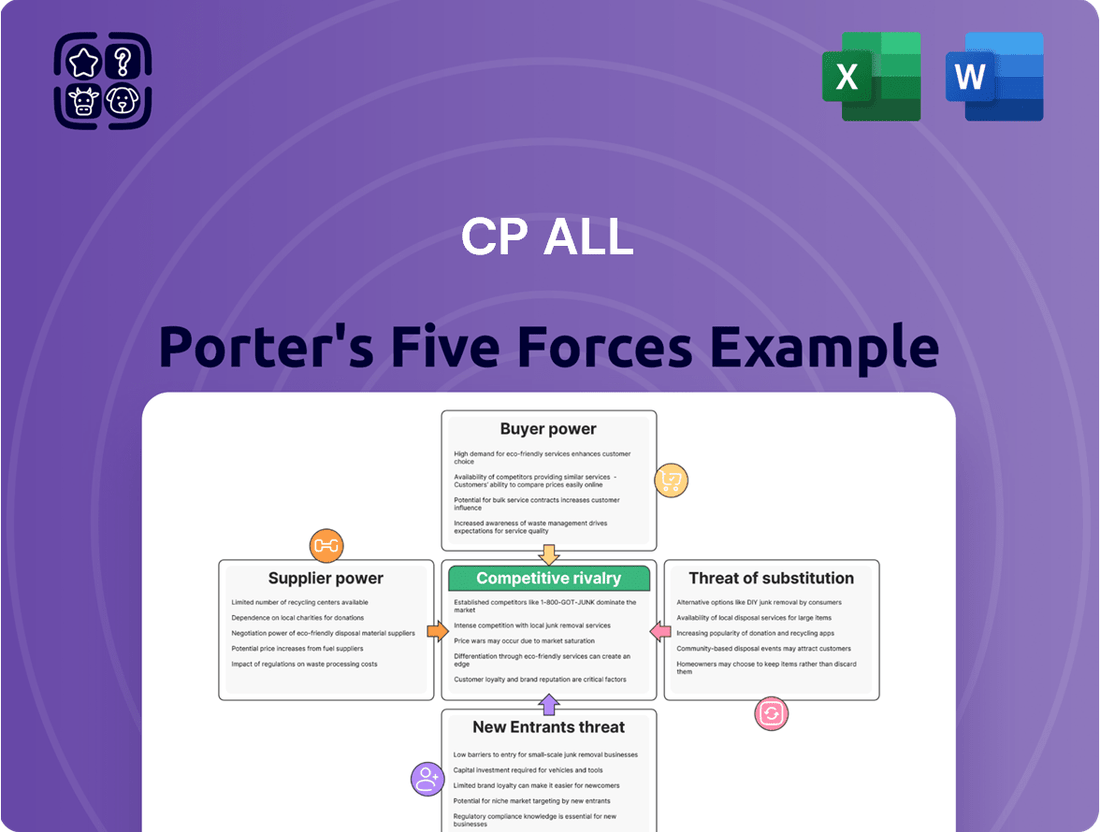

This analysis delves into the competitive forces impacting CP All, examining industry rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes to understand CP All's strategic positioning.

CP All's Porter's Five Forces Analysis provides a streamlined, visual dashboard to instantly identify and prioritize competitive threats, alleviating the pain of complex market assessments.

Customers Bargaining Power

CP All's customer base, primarily individual consumers frequenting its 7-Eleven stores, is incredibly vast and dispersed. With millions of transactions daily, no single customer or small group holds significant sway over pricing or product offerings. This fragmentation means individual purchasing power is negligible, as decisions are driven by convenience and immediate need, not collective bargaining.

While 7-Eleven's core appeal is convenience, customers across the general retail landscape, including convenience stores, do show price sensitivity, particularly for staple items. CP All needs to carefully manage its pricing, ensuring it remains competitive against a wide array of other retail options to keep shoppers coming back.

This price sensitivity is evident in consumer behavior; for instance, a 2024 survey indicated that over 60% of Thai consumers consider price a primary factor when choosing between similar convenience store brands for everyday purchases. CP All frequently employs promotional campaigns and loyalty programs to directly address this, aiming to offer value beyond just immediate accessibility.

Makro's diverse business clientele, encompassing restaurants, small retailers, and institutions, frequently engages in bulk purchases. This characteristic grants these business customers a degree of enhanced bargaining power, stemming from their substantial order volumes and a more informed approach to procurement compared to individual consumers.

To effectively manage this, Makro strategically employs bulk discounts and offers tailored services, directly addressing the purchasing needs and leverage of its business-oriented customer base. For instance, in 2024, Makro continued to refine its loyalty programs for business clients, offering tiered discounts that increase with purchase volume, a direct response to the bargaining power of its larger corporate customers.

Low Customer Switching Costs

For CP All, the bargaining power of customers is significantly influenced by low switching costs across its diverse customer base. Both individual consumers patronizing 7-Eleven and business clients utilizing Makro face minimal hurdles when shifting to competitors. This means customers can readily opt for another convenience store, a different supermarket, or an alternative online grocery platform without incurring substantial expenses or effort. Similarly, businesses have a wide array of wholesale suppliers to choose from, making it easy to change their procurement sources.

This low switching cost environment places a premium on CP All’s ability to retain customers through superior value, unparalleled convenience, and consistent service quality. For instance, in 2024, the Thai retail market saw intense competition, with players like Lotus's and Big C actively vying for market share, often through aggressive pricing and loyalty programs. CP All’s strategy must therefore continuously adapt to meet these customer expectations, as a dissatisfied customer can easily explore other options.

- Low Switching Costs for 7-Eleven Customers: Consumers can easily switch between convenience stores like 7-Eleven, FamilyMart, and local minimarts based on promotions, location, or product availability.

- Low Switching Costs for Makro Customers: Business clients, such as small retailers and restaurants, can switch between wholesale suppliers like Makro, Siam Makro Public Company Limited, and other cash-and-carry or traditional distributors with relative ease.

- Impact on CP All: The ease of switching necessitates a constant focus on competitive pricing, product assortment, store accessibility, and customer service to maintain loyalty and market share.

- Competitive Landscape (2024): The Thai retail sector in 2024 remained highly competitive, with significant promotional activities and expansion efforts by key players, underscoring the importance of customer retention strategies for CP All.

Ubiquitous Convenience and Location Advantage

CP All's 7-Eleven stores leverage their ubiquitous presence and prime locations across Thailand, making them incredibly convenient for a vast customer base. This widespread accessibility, coupled with 24/7 operations, significantly reduces the need for customers to explore alternative purchasing options for immediate needs. In 2023, CP All operated over 14,000 7-Eleven stores in Thailand, a testament to their strategic location advantage.

The sheer density of 7-Eleven outlets means that for many consumers, a store is never far away, diminishing the perceived value of seeking out competitors for small, impulse buys. This convenience factor acts as a powerful deterrent against customers actively searching for alternatives, thereby lessening their bargaining power for everyday convenience items.

- Ubiquitous Network: Over 14,000 7-Eleven stores in Thailand as of 2023.

- 24/7 Accessibility: Constant availability reduces the need for customers to shop elsewhere.

- Location Advantage: Stores are strategically placed in high-traffic, easily accessible areas.

- Reduced Search Costs: Customers face minimal effort to find a 7-Eleven for immediate purchases.

CP All faces moderate bargaining power from its customers, primarily due to low switching costs across both its 7-Eleven convenience store and Makro wholesale segments. While individual 7-Eleven shoppers have minimal power due to the sheer volume of transactions, their price sensitivity, especially for staples, necessitates competitive pricing strategies. Makro's business clients, however, wield more influence due to bulk purchasing and a more informed procurement process.

The convenience factor of 7-Eleven, supported by over 14,000 stores across Thailand as of 2023, significantly reduces customer search costs and thus their bargaining leverage for immediate needs. However, the competitive retail landscape in 2024, with rivals like Lotus's and Big C employing aggressive promotions, means CP All must continuously offer superior value to retain its customer base.

| Customer Segment | Bargaining Power Drivers | CP All's Mitigation Strategies | 2024 Market Context |

|---|---|---|---|

| Individual Consumers (7-Eleven) | Price sensitivity for staples, Low switching costs | Promotional campaigns, Loyalty programs, Ubiquitous presence, 24/7 access | Intense competition from Lotus's, Big C; focus on value and convenience |

| Business Clients (Makro) | Bulk purchasing, Informed procurement, Low switching costs | Bulk discounts, Tiered loyalty programs, Tailored services | Refined loyalty programs for business clients, increasing discounts with volume |

Preview Before You Purchase

CP All Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Porter's Five Forces analysis of CP All provides an in-depth examination of industry rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products, offering actionable insights for strategic decision-making.

Rivalry Among Competitors

The Thai retail landscape, from convenience stores to hypermarkets, is a fiercely contested arena. CP All, a major player, contends with a multitude of domestic and international brands, each vying for consumer loyalty and market dominance. This intense rivalry necessitates constant innovation and strategic adjustments to stay ahead.

In 2024, the Thai retail sector saw continued aggressive expansion and promotional activities. For instance, CP All's primary competitor, Big C, owned by BJC, has been actively investing in store upgrades and digital initiatives to enhance customer experience. Similarly, international players like Lotus's (formerly Tesco Lotus) are also enhancing their omnichannel strategies, putting pressure on CP All to maintain its competitive edge.

CP All faces intense competition from major players like Central Group, which operates FamilyMart and Tops Market, alongside Big C and Lotus’s. This diverse competitive landscape means CP All must constantly innovate and adapt to market demands.

These rivals actively compete through aggressive pricing strategies, frequent promotional offers, and strategic expansion plans, aiming to capture a larger market share. For instance, in 2024, the Thai retail sector saw significant investment in store modernization and digital integration by these key players, directly impacting CP All's market dynamics.

The presence of numerous smaller, independent retailers and specialized chains further fragments the market, intensifying rivalry across various product categories and geographic locations. This broad spectrum of competitors requires CP All to maintain a sharp focus on operational efficiency and customer loyalty.

CP All's 7-Eleven commands a substantial market share in Thailand's convenience retail sector, a testament to its extensive store network and deeply ingrained brand loyalty. This dominance, however, positions CP All as the benchmark, attracting intense scrutiny and strategic challenges from rivals aiming to capture a piece of its market leadership.

While CP All's market leadership in Thai convenience stores is undeniable, with 7-Eleven operating over 13,000 outlets as of early 2024, this very strength fuels fierce competition. Competitors are actively pursuing strategies to chip away at this dominance, often through localized offerings and aggressive expansion, intensifying the rivalry.

Aggressive Expansion and Format Diversification

CP All faces intense rivalry as competitors aggressively expand their store networks, a trend exemplified by the rapid growth of convenience store chains across Southeast Asia. For instance, in Thailand, CP All's 7-Eleven stores are in constant competition with other local and international players who are also scaling up their physical presence.

This expansion isn't just about more stores; it includes experimenting with diverse retail formats. Competitors are also heavily investing in digital channels, such as online grocery delivery services, to reach a wider customer base and offer greater convenience. This dual focus on physical and digital expansion intensifies pressure on all market participants.

- Store Network Growth: Competitors are actively increasing their number of outlets, mirroring CP All's own expansion strategies.

- Format Innovation: New retail formats are being explored to cater to evolving consumer preferences and capture different market segments.

- Digital Investment: Significant resources are being allocated to online platforms and delivery services to compete in the e-commerce space.

- Intensified Competition: This aggressive growth and diversification strategy forces all players to continuously innovate and optimize operations to maintain market share.

Price and Promotional Wars

CP All, operating in the highly competitive Thai retail market, frequently encounters intense price and promotional wars, particularly within the fast-moving consumer goods (FMCG) segment. Retailers often resort to aggressive pricing strategies and frequent sales events to draw in customers and stimulate sales volume. This constant promotional activity can significantly compress profit margins for all players in the industry.

For instance, in 2024, the Thai retail sector saw a notable increase in promotional intensity as companies vied for market share. This often translates to discounts and special offers that, while driving traffic, challenge profitability. Companies like CP All must therefore focus on operational excellence and efficient supply chains to mitigate the impact of these price battles.

- Price Sensitivity: Consumers in Thailand are often price-sensitive, making them responsive to discounts and promotions, which fuels the competitive rivalry.

- Promotional Cycles: The retail landscape is characterized by frequent promotional cycles, with major events and seasonal sales intensifying competition throughout the year.

- Margin Squeeze: Aggressive pricing and promotional activities can lead to a squeeze on profit margins, requiring retailers to seek cost efficiencies and value-added services.

- Operational Efficiency: Strong supply chain management and operational efficiency are critical differentiators, enabling companies to absorb promotional costs and maintain competitiveness.

CP All faces formidable competitive rivalry in Thailand's retail sector, with major players like Big C, Lotus's, and Central Group actively expanding and innovating. This intense competition is characterized by aggressive pricing, frequent promotions, and significant investments in both physical store enhancements and digital capabilities, such as online delivery services. In 2024, this rivalry intensified as competitors focused on omnichannel strategies and store modernization to capture market share.

| Competitor | Key Strategies in 2024 | Impact on CP All |

|---|---|---|

| Big C (BJC) | Store upgrades, digital initiatives | Increased pressure on customer experience and loyalty |

| Lotus's | Omnichannel strategy enhancement | Need for CP All to strengthen its online and offline integration |

| Central Group (FamilyMart, Tops Market) | Aggressive expansion, diverse retail formats | Broadened competitive front across different retail segments |

SSubstitutes Threaten

Despite the rise of modern retail, traditional wet markets, street food stalls, and small independent shops continue to serve as significant substitutes for convenience stores like CP All in Thailand. These outlets often provide a unique shopping experience, emphasizing fresh produce or local delicacies, and can sometimes offer more competitive pricing on certain goods. For instance, in 2024, it's estimated that these traditional channels still capture a substantial portion of consumer spending, particularly for daily necessities and fresh food items, reflecting diverse consumer habits and preferences.

The expanding reach of online grocery and e-commerce platforms poses a significant threat of substitution for traditional brick-and-mortar retailers like CP All. These digital channels offer unparalleled convenience, allowing consumers to purchase a vast array of goods, including groceries, directly from their homes. For instance, in 2024, the global online grocery market is projected to continue its upward trajectory, with many consumers prioritizing the ease of delivery for both everyday needs and larger purchases.

While CP All has invested in its own digital capabilities, the dedicated focus and often broader product selection of pure-play online retailers can attract customers seeking a seamless e-commerce experience. This shift in consumer behavior, driven by the convenience and accessibility of online alternatives, means that CP All must continually innovate and enhance its digital offerings to remain competitive against these evolving substitute channels.

Hypermarkets and larger supermarkets present a significant threat of substitution for convenience stores, especially for customers undertaking weekly grocery shops or seeking a wider array of products beyond immediate necessities. These formats often provide a more compelling value proposition through lower unit prices and a more extensive product selection, drawing consumers who prioritize comprehensive shopping trips over quick, convenience-driven purchases.

For example, in 2024, the average basket size at hypermarkets in Thailand, a key market for CP All, can be significantly larger than at a 7-Eleven convenience store, reflecting their appeal for bulk buying and a broader range of goods. This difference in shopping behavior directly challenges convenience stores’ ability to capture larger share-of-wallet transactions.

Food Service Establishments and Vending Machines

The threat of substitutes for convenience stores like CP All's 7-Eleven is significant, primarily from other food service establishments and the growing prevalence of vending machines. Cafes, restaurants, and fast-food outlets offer consumers alternatives for immediate food and beverage needs.

Consumers may opt for these substitutes for a more specialized dining experience or freshly prepared meals, which can divert sales from convenience stores. For instance, the quick-service restaurant (QSR) market in Thailand, a key market for CP All, saw substantial growth. In 2023, the QSR market was valued at approximately $14.5 billion USD and is projected to grow at a CAGR of 6.2% through 2028, indicating a strong competitive landscape for immediate food consumption.

- Alternative Dining: Cafes and restaurants provide a different ambiance and often a wider selection of freshly prepared items.

- Fast Food Convenience: Fast-food chains offer quick service for meals, directly competing for snack and light meal occasions.

- Vending Machine Growth: An increasing number of automated vending machines offer convenience and specific product availability, acting as a direct substitute for grab-and-go items.

- Consumer Preference Shifts: Consumers may choose substitutes based on perceived value, taste preferences, or the desire for a more complete meal experience.

Direct-to-Consumer (DTC) Sales Channels

The rise of direct-to-consumer (DTC) sales channels presents an emerging threat to CP All. Brands are increasingly bypassing traditional retail, allowing consumers to purchase directly from manufacturers. This trend, while still nascent for many packaged goods, could evolve into a more significant substitute, potentially diverting sales from CP All's extensive network of convenience stores.

For instance, in 2024, the global DTC e-commerce market continued its expansion, with many consumer packaged goods (CPG) companies investing heavily in their own online platforms. This allows them to control the customer experience and potentially offer competitive pricing, directly challenging the convenience model offered by CP All.

- Growing DTC Adoption: Brands are investing in their own online sales infrastructure.

- Consumer Preference Shift: A segment of consumers may opt for direct purchasing for convenience or perceived value.

- Potential Sales Diversion: This directly competes with CP All's core business model for certain product categories.

- Competitive Pricing: DTC models can sometimes offer more attractive pricing by cutting out intermediaries.

The threat of substitutes for CP All's convenience store model is multifaceted, encompassing traditional retail, online platforms, and alternative food service providers. Traditional wet markets and small independent shops remain relevant, especially for fresh produce, while e-commerce offers unparalleled convenience and a vast product selection. Furthermore, the robust growth in the quick-service restaurant sector directly competes for immediate food and beverage consumption occasions.

In 2024, the ongoing expansion of online grocery and e-commerce platforms continues to present a significant substitute, with consumers increasingly valuing home delivery. Hypermarkets and larger supermarkets also draw customers seeking bulk purchases and wider selections, often at lower unit prices, as evidenced by larger average basket sizes in 2024 compared to convenience stores. Additionally, the quick-service restaurant market in Thailand, valued at approximately $14.5 billion USD in 2023, demonstrates a strong competitive landscape for immediate food needs.

Entrants Threaten

The Thai retail and wholesale sector, especially for a player aiming for CP All's scale, requires immense upfront capital. Think about acquiring prime real estate, building modern stores, stocking shelves, and setting up efficient supply chains. These aren't small expenses; they represent a significant hurdle.

For instance, establishing a new convenience store chain comparable to CP All's 7-Eleven network would necessitate billions of Thai Baht for store development and inventory alone. This high barrier to entry deters many potential competitors from even attempting to challenge CP All's established market position.

CP All enjoys substantial economies of scale across its operations, from sourcing products to delivering them to over 13,000 7-Eleven stores and Makro wholesale centers in Thailand. This vast network allows for significant cost advantages in purchasing power and logistical efficiency. For instance, in 2023, CP All reported total revenue of THB 292,528 million, underscoring the sheer volume of its business.

Newcomers face a formidable barrier in replicating CP All's scale, which translates directly into lower per-unit costs and enhanced marketing reach. Achieving comparable procurement discounts or establishing a distribution network of similar density would require massive upfront investment, making it exceptionally difficult for new entrants to compete on price or accessibility.

Furthermore, CP All benefits from powerful network effects. The more 7-Eleven stores there are, the more convenient it is for consumers, which in turn attracts more customers and strengthens the brand's appeal. This self-reinforcing cycle makes it challenging for new convenience store chains to gain traction and build a comparable customer base quickly.

Established brand loyalty and ingrained customer habits present a significant barrier to new entrants for CP All, the operator of 7-Eleven in Thailand. For decades, 7-Eleven has become a daily staple for millions of Thai consumers, fostering deep trust and convenience. This makes it incredibly difficult for newcomers to replicate the same level of ingrained routine and customer preference.

Regulatory and Licensing Complexities

The regulatory and licensing complexities in Thailand present a significant barrier to entry for new retail players. Securing the necessary retail and wholesale licenses, along with prime store locations, is a time-consuming and intricate process. For instance, obtaining a business operating license in Thailand can involve multiple government agencies and varying requirements depending on the business type and scale.

Existing established companies like CP All have cultivated deep expertise and strong relationships with regulatory bodies, streamlining their operations and compliance. This established network and understanding of the Thai legal framework provide a distinct advantage, making it challenging for newcomers to replicate their speed and efficiency in market penetration.

- Regulatory Hurdles: New entrants must navigate a complex web of Thai regulations governing retail operations, including zoning laws, food safety standards, and advertising guidelines.

- Licensing Requirements: Obtaining specific retail and wholesale licenses can be a lengthy procedure, often requiring detailed documentation and adherence to strict criteria.

- Location Acquisition: Securing desirable retail locations is highly competitive, with established players often having pre-existing agreements and a better understanding of optimal site selection.

- Compliance Expertise: CP All's long-standing presence translates to a robust understanding of compliance, reducing the risk of penalties and operational disruptions that new entrants might face.

Potential for Incumbent Retaliation

CP All, as the dominant force in Thailand's convenience store sector, is poised to react strongly to any new entrants. Imagine a new competitor trying to open shop; CP All has the resources and market power to make that very difficult.

This aggressive stance can take many forms. They might slash prices to make it unprofitable for newcomers, or significantly boost their advertising to drown out any new brand messaging. Another tactic could be to quickly open more stores in areas where a new player tries to establish themselves, effectively boxing them in. CP All also has deep-rooted relationships with suppliers, which could be leveraged to limit access or favorable terms for new businesses.

For instance, in 2023, CP All operated over 13,000 7-Eleven stores across Thailand. This extensive network provides significant economies of scale and brand recognition, making it a formidable barrier. Any new entrant would face immense pressure to match this scale and customer loyalty, which is a substantial hurdle.

- Aggressive Pricing: CP All can absorb temporary losses through competitive pricing to deter new market entrants.

- Marketing Dominance: With a substantial marketing budget, CP All can outspend and overshadow new competitors' promotional efforts.

- Network Expansion: Rapidly opening new outlets in contested territories can saturate the market and limit growth opportunities for rivals.

- Supplier Leverage: Existing strong supplier relationships can be used to create preferential terms, making it harder for new entrants to secure necessary inventory and supplies.

The threat of new entrants for CP All is significantly low due to substantial capital requirements for establishing a retail network of comparable scale. The sheer investment needed for real estate, inventory, and supply chain infrastructure acts as a major deterrent, making it financially prohibitive for most new players to challenge CP All's market dominance.

CP All's vast economies of scale, evidenced by its THB 292,528 million revenue in 2023, translate into significant cost advantages. Newcomers would struggle to match CP All's purchasing power and logistical efficiency, making it difficult to compete on price or accessibility.

Furthermore, established brand loyalty and network effects, with over 13,000 7-Eleven stores in Thailand, create a powerful barrier. These factors, combined with regulatory complexities and CP All's potential for aggressive competitive responses, further minimize the threat of new entrants.

Porter's Five Forces Analysis Data Sources

Our CP All Porter's Five Forces analysis is built upon a foundation of robust data, including CP All's annual reports, investor presentations, and publicly available financial statements. We supplement this with industry-specific market research reports and data from reputable business intelligence platforms.