CP All Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CP All Bundle

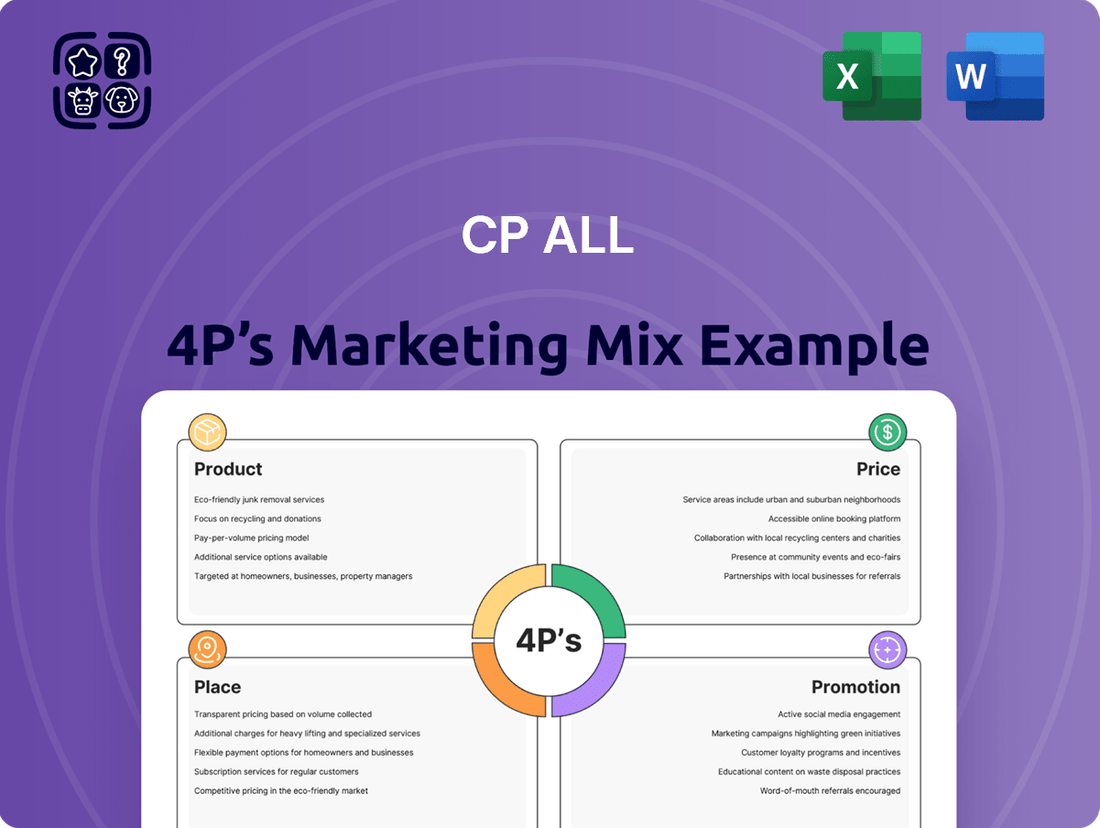

CP All masterfully orchestrates its Product, Price, Place, and Promotion strategies to dominate the convenience store market. This analysis delves into how their diverse product range, competitive pricing, extensive store network, and impactful promotions create a winning formula.

Unlock the complete, in-depth 4Ps Marketing Mix Analysis for CP All, providing actionable insights into their product innovation, pricing strategies, distribution reach, and promotional campaigns. This ready-to-use report is ideal for business professionals and students seeking to understand and replicate their success.

Product

CP All, primarily through its 7-Eleven convenience stores, excels in its product offering by providing diverse convenience. Food and beverages are a cornerstone, driving a substantial 76.0% of sales in 2024, a clear indicator of their alignment with consumer demand.

The company actively engages customers by consistently introducing new products and running promotions, particularly within the food and beverage segments. This strategy ensures a dynamic and appealing selection for shoppers.

CP All's product range prominently features ready-to-eat meals, various snacks, and fresh food items. This variety is specifically curated to meet the needs of busy Thai consumers who seek convenient, on-the-go solutions.

The 'All Convenience' concept is central to 7-Eleven's strategy, aiming to be more than just a convenience store. By offering a wide array of services, from bill payments to food delivery through their app, they are transforming into a daily life hub. This approach directly addresses diverse customer needs, making 7-Eleven an integral part of many people's routines.

In 2024, CP All, the operator of 7-Eleven in Thailand, continued to expand its digital offerings. The company reported a significant increase in transactions through its mobile application, reflecting customer adoption of these convenient services. This digital push is key to solidifying 7-Eleven's position as a one-stop shop for both products and essential services, enhancing its 'All Convenience' promise.

CP All's 7-Eleven stores are increasingly catering to evolving consumer lifestyles by stocking a wider array of health, beauty, and personal care products. This includes dedicated sections for detox drinks, beauty serums, and other healthy lifestyle items, reflecting a growing market demand.

The company is strategically expanding its beauty offerings with conveniently packaged cosmetics and a broad range of personal care essentials. This move aims to position 7-Eleven as a comprehensive destination for everyday needs, simplifying the shopping experience for customers.

In 2024, the health and beauty market in Thailand continued its upward trajectory, with projections indicating robust growth driven by increased consumer spending on wellness and personal grooming. CP All's investment in this segment aligns with these positive market trends, aiming to capture a significant share of this expanding sector.

Wholesale and Food Manufacturing

CP All's wholesale and food manufacturing segment, primarily through Makro, is a significant driver of its business-to-business (B2B) strategy. Makro operates a cash & carry model, catering to professional customers like small business owners and retailers.

The Makro PRO platform enhances this by offering a vast selection of food products, equipment, and supplies online. In 2024, Makro continued to expand its reach, with reports indicating a steady increase in its customer base and transaction volumes, reflecting strong demand from its target segments.

This expansion is crucial for CP All as it diversifies revenue streams beyond convenience retail. Key aspects include:

- Wholesale Reach: Makro serves over 2.7 million members as of early 2024, providing essential goods to a wide array of businesses.

- E-commerce Growth: Makro PRO's digital presence is strengthening, facilitating easier access to products for businesses nationwide.

- Product Diversity: The segment offers a broad range of private label and branded food products, alongside operational equipment, supporting various business needs.

- Distribution Network: CP All leverages its robust logistics to ensure efficient supply chain management for its wholesale operations.

Innovation and High-Margin Focus

CP All is strategically focusing on enhancing its profit margins by increasing the sales mix of high-margin products across its diverse business segments. This proactive approach is designed to bolster overall profitability and create a more resilient financial structure.

Innovation is a cornerstone of CP All's strategy, fostering the development of new and improved offerings. The company's commitment is highlighted by initiatives like the '7 Innovation Awards 2024,' which actively supports small and medium-sized enterprises (SMEs) and startups. This program specifically targets innovations in crucial areas such as health and environmental sustainability, aiming to drive both commercial success and positive societal impact.

The emphasis on high-margin products and innovation directly contributes to CP All's competitive advantage. By offering differentiated value, the company aims to attract and retain customers while simultaneously improving its bottom line.

- Margin Enhancement: CP All prioritizes increasing the proportion of high-margin products in its sales mix.

- Innovation Drive: The '7 Innovation Awards 2024' showcases a commitment to fostering new product development, especially in health and environmental sectors.

- SME & Startup Support: The awards program actively encourages and supports SMEs and startups in their innovation efforts.

- Differentiated Value: This strategy aims to boost profitability and deliver unique value propositions to consumers.

CP All's product strategy centers on convenience and variety, with food and beverages forming the core, accounting for 76.0% of sales in 2024. They continuously refresh their offerings, especially in ready-to-eat meals and snacks, to meet the fast-paced lifestyles of Thai consumers.

Beyond consumables, CP All is expanding its health, beauty, and personal care lines, recognizing the growing market demand for wellness products. This diversification aims to solidify 7-Eleven as a comprehensive daily needs destination.

The company's wholesale arm, Makro, serves over 2.7 million members as of early 2024, providing a broad selection of goods to businesses and strengthening CP All's B2B presence.

CP All actively drives innovation, exemplified by the '7 Innovation Awards 2024,' supporting SMEs and startups in health and sustainability to enhance its product portfolio and competitive edge.

| Product Category | 2024 Sales Contribution | Key Strategy | Target Consumer |

|---|---|---|---|

| Food & Beverages | 76.0% | New product introductions, promotions, ready-to-eat options | Busy consumers seeking convenience |

| Health & Beauty | Growing segment | Expanded product range, focus on wellness | Health-conscious individuals |

| Wholesale (Makro) | Significant B2B revenue | Extensive product selection, e-commerce platform (Makro PRO) | Small business owners, retailers |

| Services | Integral to 'All Convenience' | Bill payments, food delivery, digital services | All customers needing daily life solutions |

What is included in the product

This analysis provides a comprehensive breakdown of CP All's marketing mix, examining their Product, Price, Place, and Promotion strategies with real-world examples and strategic implications.

It offers a deep dive into CP All's marketing positioning, ideal for managers and marketers seeking to understand and benchmark against their practices.

Simplifies complex marketing strategies into actionable insights, alleviating the burden of deciphering intricate plans.

Place

CP All boasts an extensive store network, a cornerstone of its marketing strategy. By the close of 2024, the company operated an impressive 15,245 7-Eleven convenience stores throughout Thailand. This vast physical footprint is a key differentiator, ensuring unparalleled customer accessibility across the nation.

The company's commitment to expansion is evident in its plans to open around 700 new stores in 2025. This strategic growth is meticulously planned, with new locations chosen based on factors like community development, existing infrastructure, and proximity to tourist attractions to maximize market penetration and customer convenience.

CP All is aggressively pursuing an omnichannel distribution strategy, blending online and offline touchpoints. This O2O (online-to-offline) approach is central to their marketing mix, ensuring customers can engage with their brands seamlessly. For instance, the 7App serves as a crucial hub, connecting the vast network of 7-Eleven stores with digital services like 7Delivery and All Online, reflecting a commitment to meeting modern consumer demands.

CP All is strategically extending its 7-Eleven brand beyond Thailand, a key component of its international expansion efforts. By the close of 2024, the company is projected to operate 112 stores in Cambodia and has already established 10 stores in Lao PDR, showcasing a deliberate push into new regional markets.

Makro's Wholesale and E-commerce Dominance

Makro, CP All's wholesale powerhouse, solidifies its market position through an extensive physical and digital network. As of 2024, it operates over 152 branches across 66 provinces, supported by more than 100 distribution centers, ensuring widespread accessibility for its business clientele.

The company's digital transformation is evident in its B2B e-commerce platform, Makro PRO. This platform achieved a significant milestone in 2024, becoming Thailand's leading grocery e-commerce platform with an impressive 39.5% market share. This dual approach of a strong physical footprint and a dominant online presence underscores Makro's commitment to serving the business sector efficiently.

- Physical Reach: Over 152 branches in 66 provinces and 100+ distribution centers.

- E-commerce Leadership: Makro PRO is Thailand's No. 1 grocery e-commerce platform in 2024.

- Market Dominance: Makro PRO captured a 39.5% market share in 2024.

- Integrated Strategy: Combines robust online and offline infrastructure for business efficiency.

Logistics and Technology Investment

CP All's commitment to logistics and technology is evident in its substantial investments aimed at boosting distribution efficiency. This includes the strategic development of new warehouses and advanced IT systems to streamline operations across its vast network.

Makro PRO, a key part of CP All's strategy, actively utilizes artificial intelligence and big data analytics. These technologies are instrumental in optimizing logistics, accurately predicting customer demand, and ensuring the efficient flow of products to meet market needs.

These technological integrations are vital for maintaining smooth and effective operations, supporting both CP All's extensive physical store presence and its growing digital channels. For instance, in 2024, CP All announced plans to invest approximately THB 20 billion (USD 550 million) in technology and logistics infrastructure to support its omnichannel growth strategy.

- Distribution Network Expansion: CP All continues to invest in modernizing and expanding its warehouse facilities to handle increased volumes and improve delivery times.

- AI-Powered Demand Forecasting: Makro PRO employs AI to analyze sales data, market trends, and external factors to predict demand with greater accuracy, minimizing stockouts and overstocking.

- Supply Chain Optimization: Big data analytics helps identify inefficiencies in the supply chain, leading to cost reductions and improved resource allocation.

- Omnichannel Integration: Technology investments are crucial for seamlessly connecting online and offline sales channels, ensuring a consistent customer experience.

CP All's 'Place' strategy centers on an expansive and accessible retail footprint, complemented by a robust digital presence. The company's 7-Eleven stores are strategically located across Thailand, ensuring widespread convenience. This physical network is further enhanced by an integrated online-to-offline (O2O) approach, exemplified by the 7App, which connects customers to delivery and e-commerce services.

Makro, CP All's wholesale arm, reinforces its market position through a significant physical presence, operating over 152 branches nationwide as of 2024. This is augmented by its leading B2B e-commerce platform, Makro PRO, which captured a substantial 39.5% market share in Thailand's grocery e-commerce sector in 2024, demonstrating a successful blend of brick-and-mortar and digital accessibility.

CP All is actively expanding its reach internationally, with a growing number of 7-Eleven stores in markets like Cambodia and Lao PDR. This global expansion, alongside domestic growth, highlights a commitment to making its brands and services readily available to a diverse customer base across various geographies.

| Channel | 2024 Data/Projections | Key Features |

|---|---|---|

| 7-Eleven (Thailand) | 15,245 stores (end of 2024) | Extensive physical network, community accessibility |

| 7-Eleven (International) | 112 stores in Cambodia, 10 in Lao PDR (end of 2024) | Strategic regional expansion |

| Makro (Physical) | 152+ branches, 100+ distribution centers | Widespread accessibility for business clients |

| Makro PRO (E-commerce) | Thailand's No. 1 grocery e-commerce platform (2024) | 39.5% market share (2024), B2B focus |

What You See Is What You Get

CP All 4P's Marketing Mix Analysis

The preview you see here is the actual, complete CP All 4P's Marketing Mix Analysis document you’ll receive instantly after purchase. You can confidently review the full content, knowing there will be no surprises or missing sections. This ensures you get exactly what you need to understand CP All's marketing strategy.

Promotion

CP All excels in loyalty programs and digital engagement, a key part of its marketing strategy. The company's commitment to fostering customer loyalty is evident in its highly successful 7-Eleven stamp collection campaigns. These initiatives not only drive repeat business but also garnered significant recognition, including Gold Awards for Excellence in Loyalty Marketing and Mobile Marketing at the 2024 Marketing Excellence Awards.

Furthermore, CP All leverages mobile marketing to create a direct and interactive channel with its customer base. This digital focus enhances customer experience and provides valuable data for future marketing efforts, reinforcing customer relationships in the competitive retail landscape.

CP All masterfully employs integrated online and offline campaigns to drive its 'All Convenience' slogan for 7-Eleven. This dual-channel approach ensures broad customer reach and reinforces the value proposition. For instance, in 2024, CP All continued to launch innovative products, such as their expanded ready-to-eat meal selections, supported by targeted digital advertising and in-store promotions, aiming to capture both local and tourist spending.

The company's commitment to an O2O (Online-to-Offline) strategy is evident in how promotional activities bridge physical stores and digital platforms. This integration allows for seamless customer journeys, from discovering new offers on social media or the 7-App to making purchases in-store. In Q1 2025, 7-Eleven Thailand reported a 7.5% year-on-year increase in sales, partly attributed to these well-executed integrated campaigns that consistently highlight convenience and product variety.

CP All effectively employs content marketing to foster deeper brand connections, evidenced by their Silver Award for Excellence in Content Marketing at the 2024 Marketing Excellence Awards for their advertisement 'Cherd Choo Jid Winyan Kwam Pen Kru'. This recognition underscores their dedication to crafting resonant, value-driven narratives that go beyond mere product promotion.

Through strategic storytelling, CP All communicates its core brand values and purpose, creating emotional resonance with consumers. This approach allows them to build a loyal community by sharing authentic stories that reflect their commitment to societal well-being and customer empowerment, thereby differentiating themselves in a competitive market.

Affiliate Marketing and Influencer Engagement

CP All, through its 7-Eleven Thailand operations, is actively enhancing its online presence via an Affiliate Marketing and Influencer Engagement strategy. This initiative, part of its broader 4Ps marketing mix, aims to drive sales for its ALL ONLINE platform.

The ALL ONLINE Affiliate program incentivizes partners, including influencers, to promote 7-Eleven products. Participants earn commissions on sales generated through their unique referral links, fostering a digital word-of-mouth marketing approach. This expands brand visibility and taps into established online communities.

- Program Launch: 7-Eleven Thailand introduced the ALL ONLINE Affiliate program to bolster its e-commerce efforts.

- Commission Structure: Affiliates can earn commissions ranging from 1% to 5% on qualified sales.

- Objective: To leverage influencer marketing and digital partnerships to increase online sales and brand reach.

- Growth Potential: This strategy aims to capitalize on the growing influencer marketing landscape in Thailand, where the market was projected to reach approximately THB 1.5 billion in 2024.

Retail Media Networks and B2B Advertising

CP All's 4P's analysis highlights the strategic importance of Promotion, particularly through innovative retail media networks. Makro, a key part of CP All, has launched the 'Makro Retail Media Network' in collaboration with GroupM Thailand. This initiative provides advertisers with extensive opportunities across Makro's physical stores and its Makro PRO online platform, creating a powerful omnichannel marketing solution.

This network is designed to connect brands directly with entrepreneurs, a crucial customer segment for Makro. By leveraging data and technology, marketers can deliver highly targeted advertising messages at the point of sale, enhancing campaign effectiveness. This move reflects a broader trend in retail advertising, where physical and digital touchpoints are increasingly integrated to drive engagement and sales.

- Omnichannel Reach: Makro Retail Media Network offers advertising across physical stores and the Makro PRO online platform.

- Targeted Audience: The network focuses on connecting brands with entrepreneurs, a key demographic for Makro.

- Point-of-Sale Advertising: Enables marketers to reach consumers precisely when they are making purchasing decisions.

- Partnership with GroupM: Leverages GroupM's expertise in media planning and buying to optimize campaign performance.

CP All's promotional efforts are deeply integrated, utilizing loyalty programs and digital engagement to foster strong customer relationships. Their success in mobile marketing and integrated online-offline campaigns, like those supporting new ready-to-eat meals in 2024, directly contributes to sales growth, with 7-Eleven Thailand seeing a 7.5% year-on-year sales increase in Q1 2025. The company also excels in content marketing, creating emotional connections through storytelling, as recognized by their 2024 Marketing Excellence Awards.

CP All is actively expanding its digital reach through an Affiliate Marketing and Influencer Engagement strategy for its ALL ONLINE platform. This program incentivizes partners, including influencers, to promote 7-Eleven products, earning commissions on sales and expanding brand visibility within established online communities. The Thai influencer marketing market was projected to reach approximately THB 1.5 billion in 2024, highlighting the significant growth potential of this strategy.

The launch of the Makro Retail Media Network, a collaboration with GroupM Thailand, signifies a strategic move into retail media. This network offers advertisers omnichannel advertising opportunities across Makro's physical stores and its Makro PRO online platform, specifically targeting entrepreneurs and enabling data-driven, point-of-sale advertising to enhance campaign effectiveness.

Price

CP All's pricing strategy is deeply rooted in the perceived value customers place on its offerings, ensuring its products and services remain competitive within the market. This approach is crucial for maintaining its strong market position.

The company actively refines its product mix to boost gross profit margins. In 2024, the convenience store segment achieved a gross profit margin of 29.0%, demonstrating a successful focus on higher-margin items to drive overall profitability.

CP All prioritizes a pricing strategy centered on increasing the sales contribution of high-margin products. This applies across their diverse offerings, from ready-to-eat meals to various non-food convenience items.

By strategically shifting their product mix towards these higher-margin goods, CP All directly enhances its gross profit margins. For instance, in the first quarter of 2024, CP All reported a net profit of THB 4.2 billion, an increase from THB 3.7 billion in the same period of 2023, partly driven by such margin improvements.

This approach ensures that as CP All continues to be a go-to convenience store, it simultaneously optimizes its revenue generation. The focus on higher-margin items allows for greater financial flexibility and supports sustained profitability.

CP All navigates a fiercely competitive retail environment, consistently employing pricing strategies designed to be attractive and affordable for its broad customer base. While exact pricing structures are often proprietary, CP All's commanding presence in Thailand's convenience store market, with over 14,000 7-Eleven stores as of early 2024, underscores its adeptness at aligning prices with market demand and competitor offerings.

Dynamic Pricing and Promotional Adjustments

CP All's revenue growth is a testament to its dynamic pricing and promotional strategies, fueled by new store openings, robust same-store-sales growth, and expanding online sales. This approach allows them to effectively stimulate demand and adapt to market shifts. For instance, in 2024, the average spending per customer at 7-Eleven reached Baht 85, reflecting successful in-store promotions and product mix management.

The company's pricing strategy is clearly adaptable, leveraging promotional adjustments and discounts to drive sales volume and capture market share. This is evident in how they manage their product assortment and pricing to align with consumer purchasing power and competitive pressures.

- New Store Contributions: A key driver of overall revenue, expanding CP All's physical footprint.

- Same-Store-Sales Growth (SSSG): Indicates healthy organic growth and customer loyalty.

- Online Channel Sales: Demonstrates successful e-commerce integration and reach.

- Average Spending per Ticket (2024): Baht 85, showing effective in-store merchandising and promotional impact.

Consideration of Economic Factors

CP All's pricing decisions are deeply intertwined with the broader economic landscape. The company actively monitors inflation rates, which can significantly impact purchasing power and the cost of goods. For instance, Thailand's headline inflation rate averaged 1.5% in 2023 and is projected to remain within the Bank of Thailand's target range in 2024 and 2025, providing a degree of price stability.

Fluctuations in raw material prices and energy costs are also critical considerations. These inputs directly affect CP All's cost of goods sold and operational expenses, necessitating careful price adjustments to maintain margins without alienating consumers. The company aims to balance these pressures to ensure its products remain accessible, supporting continued private consumption growth.

CP All is strategically positioned for sustained growth, with ambitious targets reflecting its market confidence. The company has projected revenues to surpass THB 1 trillion in 2025, a testament to its effective pricing strategies that navigate economic headwinds while prioritizing consumer value and accessibility.

- Inflation Monitoring: CP All closely tracks Thailand's inflation, which averaged 1.5% in 2023, to inform pricing strategies.

- Cost Management: The company navigates rising raw material and energy costs to maintain competitive pricing.

- Consumer Accessibility: Pricing aims to balance profitability with ensuring products remain affordable for a broad customer base.

- Revenue Growth Target: CP All anticipates exceeding THB 1 trillion in revenue by 2025, underscoring its pricing efficacy.

CP All's pricing strategy is designed to balance competitiveness with value, ensuring its extensive network of over 14,000 7-Eleven stores across Thailand remains attractive to a broad customer base. This is supported by a focus on increasing the sales contribution of higher-margin products, which contributed to a net profit of THB 4.2 billion in Q1 2024, up from THB 3.7 billion in Q1 2023.

The company actively manages pricing in response to economic factors like inflation, which averaged 1.5% in 2023, and fluctuating raw material costs, aiming to maintain consumer accessibility. This adaptability is crucial for achieving its ambitious revenue target of surpassing THB 1 trillion by 2025.

Evidence of their effective pricing and promotional strategies includes an average spending per customer at 7-Eleven reaching Baht 85 in 2024, reflecting successful in-store merchandising and product mix management that drives both volume and profitability.

| Metric | 2023 (Actual) | Q1 2024 (Actual) | 2025 (Projected) |

|---|---|---|---|

| Headline Inflation Rate | 1.5% | N/A | Within target range |

| Net Profit | N/A | THB 4.2 billion | N/A |

| Average Spending per Customer | N/A | Baht 85 | N/A |

| Total Revenue | N/A | N/A | > THB 1 trillion |

4P's Marketing Mix Analysis Data Sources

Our CP All 4P's Marketing Mix Analysis leverages a comprehensive suite of data sources, including official company reports, investor relations materials, and publicly available financial disclosures. We also incorporate insights from industry publications, competitive intelligence platforms, and direct observations of CP All's retail operations and promotional activities.