CP All Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CP All Bundle

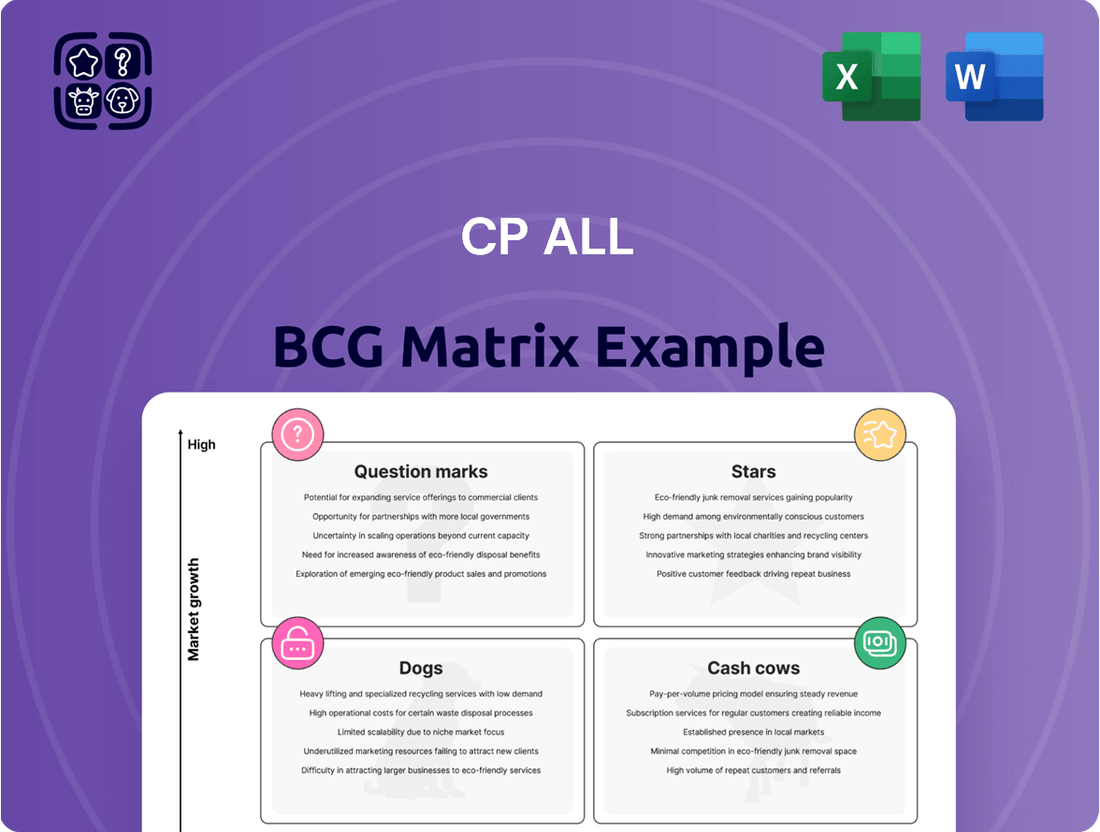

Unlock the strategic secrets behind CP All's product portfolio with a glimpse into its BCG Matrix. See which offerings are driving growth and which might need a closer look. Ready to transform this insight into decisive action?

Dive deeper into CP All's BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

The 7-Eleven convenience store network in Thailand, operated by CP All, is a definitive Star within the company's BCG portfolio. With an impressive network exceeding 15,000 outlets, 7-Eleven commands a substantial market share of approximately 72% in Thailand's convenience store sector, a testament to its widespread reach and consumer trust.

This dominance in a rapidly expanding retail landscape, fueled by consistent store growth and robust brand equity, translates into substantial revenue generation for CP All. The company's strategic commitment to opening around 700 new stores annually in Thailand underscores its intent to further cement its leadership position.

CP All's strategic push to expand its ready-to-eat (RTE) food selection at 7-Eleven is a clear indicator of a Star in its BCG matrix. These convenient, high-margin items are resonating with consumers seeking quick and quality meal solutions, a trend amplified by rising tourism and economic vibrancy.

The company's deliberate strategy to increase the share of profitable products, such as RTE meals and premium beverages like All Café and All Select, directly fuels gross profit expansion. This focus highlights RTE as a rapidly growing segment within CP All's core convenience store operations, demonstrating strong market appeal and growth potential.

Makro, CP All's cash and carry wholesale arm, shines as a Star in the BCG Matrix. Its robust market standing and impressive growth within the B2B e-commerce grocery space are key drivers.

Makro PRO, its digital storefront, secured a commanding 39.5% of Thailand's grocery e-commerce market in 2024. This substantial share underscores its rapid expansion and leadership in a burgeoning sector.

Further solidifying its Star status, Makro was recognized as a premier company across Asia-Pacific in 2025, specifically within the retail, wholesale, and consumer goods industries. This accolade points to its exceptional performance and promising future growth trajectory.

O2O (Online-to-Offline) Strategy and Digital Platforms

CP All's O2O strategy, powered by platforms like 7Delivery and All Online, is a key growth driver, aligning with the increasing consumer preference for digital engagement and seamless omnichannel experiences.

This strategic focus is proving highly effective, with O2O sales representing a significant 11% of 7-Eleven's total sales in 2023, demonstrating strong customer adoption and revenue contribution.

The company's ongoing commitment to digital advancements, including the integration of AI and Big Data for enhanced logistics and demand forecasting, underpins its potential for sustained high growth and increased market dominance in the evolving retail landscape.

- O2O Platforms: 7Delivery and All Online are central to CP All's digital strategy.

- Market Trend Alignment: Addresses the growing demand for omnichannel retail and digital consumption.

- Revenue Impact: O2O sales reached 11% of 7-Eleven's total sales in 2023.

- Future Growth Drivers: Investments in AI and Big Data for optimization and prediction.

Expansion into Cambodia and Laos

CP All's strategic move into Cambodia and Laos positions these ventures as Stars within its BCG Matrix. These emerging markets present significant opportunities for growth in the convenience store sector, mirroring Thailand's established success.

The company's commitment to expanding its 7-Eleven footprint in these nations, with plans for new store openings in 2025, underscores an aggressive strategy to capture market share. This expansion aims to leverage the proven 7-Eleven model in environments ripe for development.

- Market Potential: Cambodia and Laos represent untapped potential for modern retail convenience formats.

- Growth Strategy: CP All is actively investing in new store development to establish a strong presence.

- Replication of Success: The company aims to replicate its successful operational and marketing strategies from Thailand.

CP All's 7-Eleven network in Thailand is a prime example of a Star, dominating the convenience store market with over 15,000 outlets and an estimated 72% market share. The company's aggressive expansion, with plans for around 700 new stores annually, further solidifies its high-growth, high-market-share position. This segment is a significant revenue driver, bolstered by strategic product enhancements like ready-to-eat meals and premium beverages.

Makro, CP All's wholesale business, also stands out as a Star, particularly in the B2B e-commerce grocery sector. Its digital platform, Makro PRO, captured a notable 39.5% of Thailand's grocery e-commerce market in 2024, showcasing rapid growth and market penetration. Recognition as a leading retail and wholesale entity in Asia-Pacific in 2025 further validates its Star status and future potential.

The company's O2O (Online-to-Offline) strategy, encompassing platforms like 7Delivery and All Online, is a critical component of its Star classification. This digital integration is highly effective, with O2O sales contributing 11% to 7-Eleven's total revenue in 2023. Ongoing investments in AI and Big Data are expected to further enhance operational efficiency and market dominance.

CP All's ventures into Cambodia and Laos are also positioned as Stars, representing significant growth opportunities in emerging markets. The company's strategic expansion plans for new 7-Eleven outlets in these countries during 2025 aim to replicate its successful Thai model. These markets offer substantial untapped potential for modern convenience retail formats.

| Business Unit | BCG Category | Key Growth Indicators | Market Share/Position | Future Outlook |

| 7-Eleven (Thailand) | Star | ~700 new stores annually, expanding RTE offerings | ~72% convenience store market share | Continued dominance and revenue growth |

| Makro (Wholesale) | Star | Strong B2B e-commerce growth, digital platform expansion | 39.5% of Thailand's grocery e-commerce market (Makro PRO, 2024) | Sustained leadership and market expansion |

| O2O Platforms (7Delivery, All Online) | Star | 11% of 7-Eleven sales in 2023, AI/Big Data integration | Growing digital engagement and sales contribution | Enhanced operational efficiency and customer reach |

| International Expansion (Cambodia, Laos) | Star | New store openings planned for 2025 | Untapped market potential, replicating Thai success | Significant growth opportunities in emerging markets |

What is included in the product

Highlights which CP All business units to invest in, hold, or divest based on market share and growth.

CP All's BCG Matrix offers a clear, visual pain point reliever by instantly categorizing business units, simplifying strategic decision-making.

Cash Cows

CP All's extensive network of over 15,000 7-Eleven physical stores in Thailand is the bedrock of its Cash Cow strategy. This dominant market presence ensures consistent, high-margin cash flow, even in a mature retail landscape. The brand's strong loyalty and operational efficiency minimize the need for aggressive promotional spending, freeing up capital.

The core product categories found in CP All's 7-Eleven stores, encompassing beverages, snacks, and everyday necessities, firmly establish themselves as Cash Cows within the BCG matrix. These are the reliable staples that consumers consistently purchase, operating within a well-established and mature market. This consistent demand translates into predictable revenue streams and healthy profit margins for the company.

CP All's significant bargaining power with its suppliers for these high-volume, everyday products is a key driver of their profitability. This leverage allows them to secure favorable pricing, thereby boosting the profit margins on these essential convenience items. For instance, in 2024, CP All reported substantial revenue from its retail segment, largely driven by these consistent sellers.

CP All's robust logistics and distribution infrastructure, a backbone for both its 7-Eleven convenience stores and Makro wholesale operations, functions as a significant Cash Cow. This well-oiled network offers a substantial competitive edge, translating into reduced distribution costs per outlet and highly efficient supply chain operations.

The maturity of this infrastructure means that current capital expenditures are largely directed towards enhancing efficiency rather than undertaking large-scale expansion. For instance, in 2023, CP All continued to invest in optimizing its distribution centers and fleet management systems, which directly contributes to maximizing cash flow generation from this segment.

Loyalty Programs and Payment Systems

CP All's established loyalty programs, such as Makro PRO Point, and payment systems like the Thai Smart Card and Smart Purse Payment Card, are key components of its Cash Cows. These initiatives focus on solidifying relationships with existing customers, driving repeat business and consistent revenue. For instance, in 2023, CP All continued to see strong engagement with its loyalty programs, contributing to increased customer lifetime value.

These programs, while not experiencing explosive growth, are crucial for customer retention and boosting transaction frequency. They generate steady income and collect valuable customer data, which can be leveraged for targeted marketing and service improvements. The maturity of these systems means that marketing investments are more about maintenance and optimization rather than aggressive customer acquisition.

- Customer Retention: Loyalty programs are designed to keep customers coming back, fostering a stable revenue base.

- Transaction Frequency: Payment systems and loyalty rewards encourage more frequent purchases.

- Data Generation: These initiatives provide rich data for understanding customer behavior and preferences.

- Mature Phase: Investment is focused on sustaining and optimizing rather than rapid expansion.

CPRAM Food Manufacturing and Distribution

CPRAM, CP All's food manufacturing and distribution entity, operates as a cornerstone Cash Cow. It guarantees a consistent flow of sought-after products, especially those profitable ready-to-eat items, to the extensive 7-Eleven network and other CP All ventures.

With its robust and well-established production and distribution infrastructure within Thailand's mature food sector, CPRAM generates reliable profits. This consistent performance is a major contributor to CP All's overall financial strength and cash generation.

- Stable Revenue Streams: CPRAM benefits from the high volume and consistent demand for its products through CP All's retail channels.

- High Profit Margins: Ready-to-eat meals and other convenience food items typically offer attractive profit margins, bolstering CPRAM's cash-generating ability.

- Operational Efficiency: Years of experience have honed CPRAM's manufacturing and logistics, leading to cost efficiencies that enhance profitability.

- Market Dominance: CPRAM's integration with the dominant 7-Eleven convenience store chain in Thailand provides a significant competitive advantage and predictable sales volume.

CP All's vast network of 7-Eleven stores in Thailand, exceeding 15,000 locations by early 2024, forms the backbone of its Cash Cow strategy. These mature, high-traffic locations consistently generate substantial revenue from everyday convenience items, ensuring predictable cash flow. The company's operational efficiency and strong brand loyalty minimize the need for heavy marketing spend, allowing for robust profit generation.

Core product categories like beverages, snacks, and essential daily goods are significant Cash Cows, benefiting from consistent consumer demand in a saturated market. CP All's considerable bargaining power with suppliers for these high-volume items further enhances profit margins. For instance, the retail segment, driven by these staples, reported strong revenue growth in 2024, underscoring their cash-generating power.

CP All's integrated food manufacturing arm, CPRAM, also operates as a key Cash Cow. It reliably supplies high-demand products, particularly ready-to-eat meals, to the extensive 7-Eleven network. This integration, coupled with efficient production and distribution, ensures consistent profitability and significant cash flow for the company.

| Business Segment | BCG Category | Key Drivers | 2023/2024 Data Highlight |

|---|---|---|---|

| 7-Eleven Thailand Stores | Cash Cow | Extensive network, brand loyalty, operational efficiency | Over 15,000 stores operational by early 2024; consistent high-margin sales. |

| Core Retail Products (Beverages, Snacks, Essentials) | Cash Cow | Consistent consumer demand, supplier bargaining power | Major contributor to retail segment revenue growth in 2024. |

| CPRAM (Food Manufacturing) | Cash Cow | Integration with 7-Eleven, efficient production, ready-to-eat demand | Reliable profitability from supplying high-demand convenience foods. |

Preview = Final Product

CP All BCG Matrix

The CP All BCG Matrix document you are previewing is the identical, fully formatted report you will receive immediately after your purchase. This means you'll get the complete strategic analysis without any watermarks or placeholder content, ready for immediate application in your business planning.

Rest assured, the BCG Matrix analysis for CP All that you see here is precisely the file you will download once your purchase is complete. This preview showcases the final, professionally structured report, ensuring you receive exactly what you need for informed strategic decision-making.

Dogs

Underperforming or obsolete store formats and locations represent the 'Dogs' within CP All's BCG matrix. For instance, individual 7-Eleven or Makro stores consistently showing low sales and profitability, especially in saturated or declining markets, fall into this category. These outlets struggle to generate meaningful returns despite incurring operational expenses, signaling a weak market share in a low-growth segment.

CP All must carefully assess these underperforming locations for potential divestiture or significant restructuring. The company reported in its 2023 annual report that while its overall store network expanded, a small percentage of older or less strategically located stores did not meet performance benchmarks, necessitating strategic review. Expensive turnaround plans for such outlets are often economically unviable, making closure or sale a more prudent course of action.

Certain commodity-like products or very low-margin items sold across CP All's retail formats, particularly those easily available elsewhere with intense price competition, fall into this category. These products offer little differentiation, resulting in low market share and minimal profitability.

For instance, in 2024, the sale of basic bottled water or generic snacks, which are ubiquitous and subject to aggressive price wars, exemplifies this. CP All's gross profit margin on such items is typically razor-thin, often in the single digits, making significant revenue generation challenging without substantial volume.

Continued investment in promoting these items would likely yield low returns, as their appeal is primarily price-driven. CP All's strategy here would focus on efficient inventory management and minimal marketing spend to avoid diluting overall profitability.

Legacy technologies within CP ALL, such as older point-of-sale (POS) systems or inventory management platforms, can be categorized as Dogs. These systems, while functional, often incur high maintenance costs and offer limited scalability in the fast-paced retail environment. For instance, many legacy POS systems struggle to integrate with modern e-commerce or mobile payment solutions, hindering CP ALL's omnichannel strategy.

These outdated systems typically possess a low market share in the context of advanced retail technologies, which are increasingly dominated by cloud-based, AI-driven solutions. CP ALL's investment in maintaining these legacy platforms without substantial upgrades or replacements yields minimal competitive advantage and low growth prospects for efficiency improvements. Their continued operation without modernization represents a significant cash trap, diverting resources that could be allocated to more innovative and profitable ventures.

Non-Core, Minor Investments with Limited Synergy

Non-Core, Minor Investments with Limited Synergy represent ventures that fall outside CP All's primary focus on retail and wholesale. These might include smaller, peripheral businesses that haven't demonstrated substantial growth or market penetration. For example, a small investment in a niche food processing unit with no direct link to 7-Eleven's supply chain would fit this category. Such investments often operate in low-growth sectors and contribute minimally to the company's overall financial performance.

These types of investments are characterized by their lack of strategic alignment and limited potential to create value through synergies with CP All's core operations. They may represent a small portion of the company's total assets, perhaps in the low single digits of percentage of total revenue. Given their limited impact and potential for future growth, these investments are often considered for divestment to reallocate capital towards more promising strategic initiatives.

- Low Growth Potential: These ventures typically operate in market segments that are not experiencing significant expansion, limiting their ability to generate substantial returns.

- Minimal Synergy: They lack meaningful connections or collaborative opportunities with CP All's core retail and wholesale businesses, hindering the creation of added value.

- Negligible Contribution: Their impact on overall revenue and profitability is often marginal, making them less critical to the company's financial success.

- Divestiture Candidates: Due to their limited strategic importance and growth prospects, these investments are prime candidates for sale to optimize resource allocation.

Ineffective or Stagnant International Ventures (if any)

If any of CP All's international ventures beyond Cambodia and Laos struggle to gain meaningful traction or generate profits, they would be categorized as dogs. These ventures would exhibit a low market share within potentially slow-growing international segments, consuming valuable resources without a clear trajectory to becoming stars.

For instance, if a venture in a market like Vietnam, where CP All has previously explored opportunities, failed to capture significant market share by 2024, it could be classified as a dog. This would be particularly true if the overall convenience store market in that specific region showed limited growth potential or intense competition from established local players.

- Stagnant Market Share: Ventures failing to achieve more than a minimal percentage of the local market by 2024.

- Low Profitability: Operations consistently reporting losses or negligible profits, indicating an inability to cover costs.

- Resource Drain: Continued investment in these ventures without a clear return on investment or a viable strategy for future growth.

- Limited Growth Prospects: Operating in markets with identified low growth potential, making a turnaround unlikely.

Underperforming store formats, obsolete technologies, and non-core investments with low synergy represent CP All's 'Dogs'. These segments, often characterized by low growth potential and minimal contribution to overall profitability, require careful strategic review. For example, legacy POS systems, while functional, incur high maintenance costs and hinder omnichannel integration, impacting efficiency. Similarly, certain commodity products with razor-thin margins, like basic bottled water, offer little differentiation and face intense price competition, yielding negligible returns for CP All.

| Category | Description | Example | Market Share | Growth Potential | Profitability |

| Underperforming Stores | Outlets with consistently low sales and profitability. | Older 7-Eleven or Makro stores in saturated markets. | Low | Low | Low |

| Obsolete Technologies | Legacy systems that are costly to maintain and lack modern integration. | Older POS systems unable to support advanced e-commerce. | Low (vs. advanced tech) | Low | Low |

| Low-Margin Products | Commodity items with intense price competition. | Basic bottled water, generic snacks. | Low | Low | Very Low |

| Non-Core Investments | Minor ventures outside primary retail/wholesale focus with limited synergy. | Small niche food processing unit unrelated to core supply chain. | Negligible | Low | Marginal |

Question Marks

CP All is exploring new convenience store concepts like Convenience Allife, which emphasizes health and beauty, and a focus on ready-to-eat (RTE) food items. These initiatives target potentially lucrative segments within the broader convenience retail landscape.

As these are relatively new ventures, they currently hold a small market share, reflecting their early stage of development and expansion. Significant investment is anticipated to drive consumer adoption and build a stronger market presence for these specialized formats.

The success of these new concepts could see them transition into Stars within the BCG matrix, provided they can capture significant market share in their chosen high-growth niches. For instance, the health and wellness sector continues to see robust growth, with global sales reaching trillions of dollars annually, indicating a substantial opportunity for well-executed retail strategies.

CP All's deeper integration of advanced AI and predictive analytics, moving beyond current optimization efforts, positions these initiatives as a Question Mark. While the retail sector sees high growth in these areas, the tangible, widespread benefits of their full potential are still materializing. For instance, in 2024, global retail AI spending was projected to reach over $20 billion, highlighting the investment potential.

Significant investment in research and development, alongside implementation, is crucial for CP All to harness these technologies. The goal is to achieve hyper-personalization for customers and enhance demand prediction accuracy, with the aim of transforming these into substantial competitive advantages. By 2025, it's estimated that AI in retail could drive over $100 billion in value, underscoring the strategic importance.

Aggressively expanding CP All's O2O delivery services into new product categories or aiming for faster delivery times across the board could position it as a Question Mark on the BCG matrix. This venture targets the rapidly growing e-commerce delivery sector, where CP All may currently hold a smaller market share compared to established, specialized players.

Such an expansion necessitates significant capital outlay for logistics infrastructure and advanced technology to ensure efficient scaling and robust competition. For instance, in 2024, the Thai e-commerce market was projected to reach over $30 billion, with delivery services being a critical component of its growth, indicating a substantial opportunity but also intense competition.

New Digital Payment Solutions or Fintech Integrations

New digital payment solutions or deeper integrations with fintech services, beyond CP All's existing loyalty and payment card systems, would fall into the Question Mark category of the BCG Matrix. The digital finance sector is experiencing rapid growth, but CP All's initial market share in these nascent areas would likely be minimal.

Significant investment is required to develop and promote these innovative solutions. This capital injection is crucial for achieving widespread customer adoption and securing a strong market position. For instance, as of early 2024, the global digital payments market was projected to reach over $1.5 trillion, highlighting the immense potential and competitive nature of this space.

- High Growth Potential: The digital payment landscape is expanding rapidly, offering opportunities for new revenue streams.

- Low Initial Market Share: CP All would be entering these new fintech areas with a limited existing customer base or established presence.

- Investment Requirement: Developing and marketing novel digital payment solutions necessitates substantial financial commitment.

- Strategic Importance: Early adoption and integration of emerging fintech can provide a competitive advantage in the evolving retail market.

Sustainability-Focused Product Lines and Services

CP All's development of sustainability-focused product lines and services, such as eco-friendly packaging or waste reduction programs, currently falls into the Question Mark category of the BCG Matrix. While consumer demand for sustainable options is on the rise, CP All's market penetration in these emerging areas is likely still developing. For instance, a 2024 survey indicated that over 60% of Thai consumers consider environmental impact when making purchasing decisions, yet CP All's specific market share in eco-conscious product categories remains to be fully established.

These initiatives require substantial investment in research and development, innovative marketing campaigns, and consumer education to build brand loyalty and market share. CP All might need to allocate significant capital to ensure these new offerings resonate with their target audience.

- Eco-friendly Packaging: CP All is exploring biodegradable and recyclable materials for its private label products, aiming to reduce plastic waste.

- Low-Carbon Products: The company is investigating sourcing strategies for products with a lower carbon footprint throughout their lifecycle.

- Waste Reduction Initiatives: CP All is piloting programs in select stores to minimize food waste and improve recycling rates, with a target of a 15% reduction in operational waste by 2025.

- Consumer Education Campaigns: Marketing efforts are being developed to inform customers about the benefits and availability of these sustainable choices.

CP All's ventures into advanced AI for hyper-personalization and predictive analytics represent a significant strategic push. While the retail sector is rapidly adopting AI, with global spending projected to exceed $20 billion in 2024, CP All's specific market share and the full realization of these technologies' benefits are still developing.

These initiatives require substantial investment in R&D and implementation to achieve their full potential, aiming to drive over $100 billion in value by 2025 through enhanced customer experiences and improved demand forecasting.

The expansion of O2O delivery services into new categories or with faster delivery targets also falls into the Question Mark category. The Thai e-commerce market, valued at over $30 billion in 2024, offers growth but intense competition from specialized players means CP All's current share in these expanded services is likely small.

Similarly, new digital payment solutions beyond existing loyalty programs are Question Marks. The global digital payments market, projected to surpass $1.5 trillion by early 2024, presents a vast opportunity, but CP All's initial footprint in these innovative fintech areas would be minimal, demanding significant capital for development and adoption.

BCG Matrix Data Sources

Our CP All BCG Matrix is built on comprehensive financial disclosures, market growth statistics, and internal sales data to provide an accurate strategic overview.