Cox Enterprises SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cox Enterprises Bundle

Cox Enterprises boasts diverse media, automotive, and technology holdings, presenting a robust market presence. However, understanding the nuances of their digital transformation challenges and competitive landscape is crucial for strategic advantage.

Want the full story behind Cox Enterprises' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Cox Enterprises boasts a robustly diversified business portfolio, spanning critical sectors like automotive services, telecommunications, and media. This broad operational base offers significant stability, mitigating risks associated with any single industry's downturn and ensuring a more consistent revenue flow.

Further bolstering this diversification, Cox has made strategic investments in high-growth emerging technologies. Notable areas include cleantech, healthcare solutions, and software tailored for the public sector, which are actively expanding its revenue streams and broadening its market penetration, positioning the company for future growth.

Cox Enterprises' privately-held status grants it significant agility for long-term strategic investments. A prime example is the commitment of $10 billion over five years dedicated to enhancing infrastructure within Cox Communications, underscoring a focus on future growth and service improvement.

Further demonstrating this strategic financial approach, Cox Enterprises completed the acquisition of OpenGov in February 2024 for $1.8 billion. This move highlights a deliberate expansion into new markets or technologies, reinforcing its robust financial position and forward-thinking investment strategy.

The company's financial trajectory appears strong, with consolidated EBITDA anticipated to achieve stability in 2024. Projections indicate a positive growth trend for EBITDA in 2025, suggesting a healthy and improving financial outlook for the organization.

Cox Enterprises demonstrates a significant strength in its unwavering commitment to sustainability and environmental stewardship, primarily through its Cox Conserves program. This initiative has seen substantial investment, exceeding $2 billion in sustainable businesses and technologies since its inception in 2007.

The company has achieved a major milestone by reaching its Zero Waste to Landfill goal by 2024, successfully diverting an impressive 92% of its waste. Looking ahead, Cox Enterprises has set ambitious targets to become carbon and water neutral by 2034, underscoring its dedication to long-term environmental responsibility.

Leadership in Key Markets

Cox Enterprises demonstrates robust leadership across critical sectors. Cox Communications stands as the third-largest cable provider in the United States, serving 6.5 million customers, a testament to its extensive reach and established market presence.

Furthermore, Cox Automotive commands a substantial share of the automotive solutions market. Its portfolio includes highly recognized brands such as Kelley Blue Book and Autotrader, solidifying its influence in automotive information and transactions.

Cox Automotive's strategic outlook remains positive, with projections indicating continued market expansion. For 2025, new vehicle sales are anticipated to reach 16.3 million units, highlighting the sector's ongoing vitality and Cox Automotive's potential to capitalize on this growth.

- Market Dominance: Cox Communications is the third-largest cable provider in the US, serving 6.5 million customers.

- Automotive Strength: Cox Automotive leads in automotive solutions with brands like Kelley Blue Book and Autotrader.

- Growth Outlook: Cox Automotive expects continued market growth, with new vehicle sales projected at 16.3 million units in 2025.

Innovation and Future-Oriented Initiatives

Cox Enterprises demonstrates a strong commitment to innovation through significant investments in future-oriented initiatives. A prime example is the Cox Cleantech Accelerator, which actively supports early-stage startups focused on climate change solutions, reflecting a dedication to sustainable growth.

Furthermore, Cox Automotive is strategically expanding into emerging sectors, notably electric vehicle (EV) battery solutions. This forward-thinking strategy allows Cox to proactively address evolving market demands and leverage technological advancements.

- Investment in Climate Tech: Cox Cleantech Accelerator supports startups addressing climate change.

- EV Battery Solutions: Cox Automotive is actively developing capabilities in the EV battery sector.

- Future Market Positioning: These initiatives position Cox to capitalize on emerging trends and technological shifts.

Cox Enterprises' diversified business model across automotive, telecommunications, and media provides significant resilience against industry-specific downturns. Its strategic investments in emerging technologies like cleantech and public sector software further broaden its revenue base and market reach.

The company's privately held structure enables long-term strategic investments, such as the $10 billion commitment over five years for Cox Communications infrastructure upgrades. This focus on foundational improvements supports sustained growth and service enhancement.

Cox's financial health is robust, with consolidated EBITDA projected for stability in 2024 and positive growth anticipated in 2025, indicating a strengthening financial position. The acquisition of OpenGov in February 2024 for $1.8 billion exemplifies its deliberate market expansion strategy.

Cox Enterprises demonstrates a strong commitment to sustainability, with its Cox Conserves program investing over $2 billion in sustainable businesses since 2007. The company achieved its Zero Waste to Landfill goal by 2024, diverting 92% of waste, and aims for carbon and water neutrality by 2034.

| Strength Area | Key Fact | Impact |

|---|---|---|

| Diversification | Operations in Automotive, Telecommunications, Media | Reduces risk, ensures stable revenue |

| Strategic Investments | $10B over 5 years for Cox Communications infrastructure | Enhances future growth and service capabilities |

| Financial Stability | EBITDA projected for stability in 2024, growth in 2025 | Indicates improving financial health |

| Sustainability Commitment | Cox Conserves program; Zero Waste to Landfill goal met by 2024 | Enhances brand reputation and long-term viability |

What is included in the product

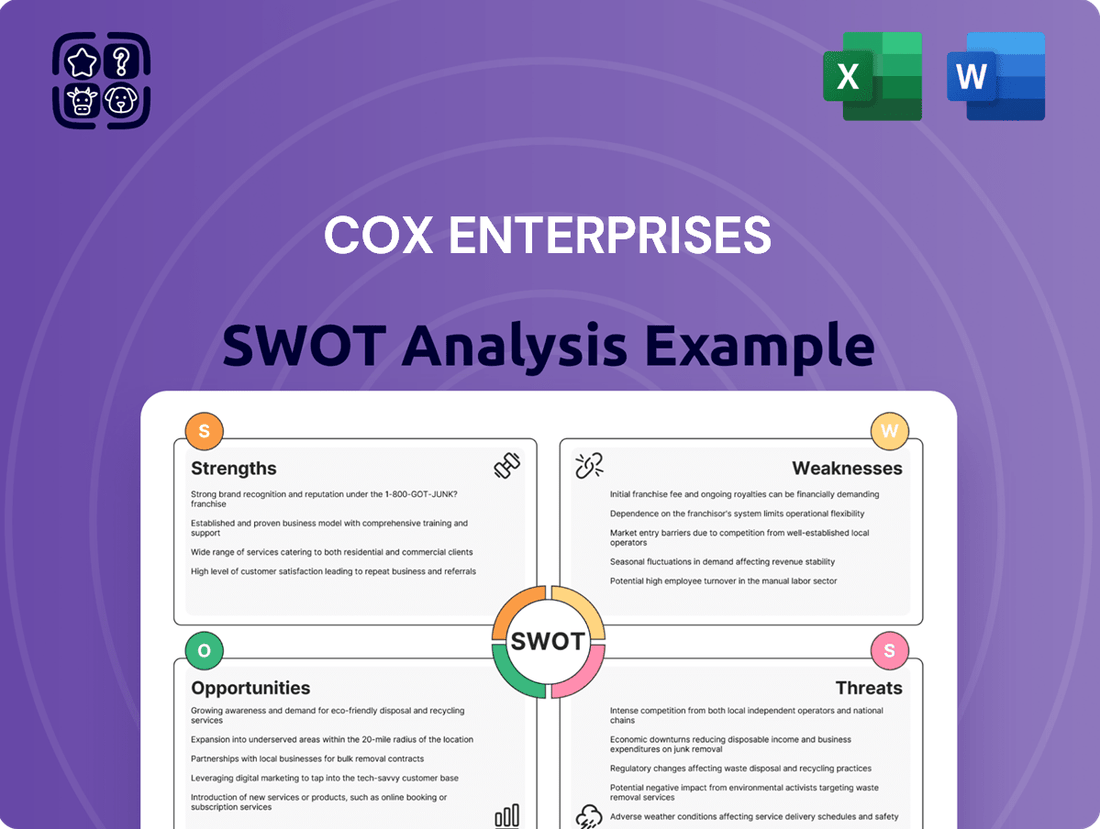

Delivers a strategic overview of Cox Enterprises’s internal and external business factors, highlighting its strengths in diverse media and technology sectors, weaknesses in legacy business reliance, opportunities in digital transformation, and threats from evolving market competition and regulatory changes.

Offers a clear, actionable framework for identifying and addressing Cox Enterprises' strategic challenges and opportunities.

Weaknesses

Cox Enterprises' significant reliance on traditional cable and broadband services presents a notable weakness. While the company has diversified, a substantial portion of its revenue still stems from these legacy offerings, which are increasingly challenged by a competitive landscape that includes wireless, satellite, and over-the-top streaming alternatives. This dependence makes Cox vulnerable to shifts in consumer preference and technological advancements that bypass traditional infrastructure.

The discontinuation of the Affordable Connectivity Program (ACP) in May 2024 poses a direct threat to Cox Communications' subscriber base. This federal program provided subsidies to low-income households for internet service, and its cessation could lead to increased subscriber churn as affordability becomes a greater concern for a segment of Cox's customers. This could impact revenue growth and subscriber numbers in the near term.

Cox's High-Speed Data (HSD) Average Revenue Per User (ARPU) growth faces headwinds as current internet speeds satisfy the majority of consumer demands. This saturation limits the ability to drive ARPU solely through speed upgrades, a traditional growth lever.

The company's ability to command higher prices for incrementally faster tiers diminishes when consumers perceive little practical benefit for their daily usage. For instance, while gigabit speeds are available, many households find 300-500 Mbps perfectly adequate for streaming, remote work, and gaming, capping the potential for significant speed-driven price hikes.

As a privately-held entity, Cox Enterprises faces limitations in accessing public capital markets, which can constrain its capacity for substantial funding of large-scale expansions or acquisitions. This means growth initiatives must be primarily financed through internal cash flow or by taking on debt, potentially impacting financial flexibility.

For instance, while specific 2024 or 2025 funding figures aren't publicly disclosed due to its private status, its 2022 revenue of $23 billion highlights the scale of operations that would typically benefit from public market access for significant capital needs.

Vulnerability to Automotive Market Fluctuations

Cox Automotive's performance is intrinsically linked to the health of the broader automotive market. This sector is known for its cyclical nature, meaning it can experience significant ups and downs based on economic conditions. For instance, during economic downturns, consumers often postpone large purchases like vehicles, directly affecting sales volumes and, consequently, Cox Automotive's revenue streams.

Supply chain issues, a persistent challenge in recent years, also pose a considerable risk. Disruptions in the availability of components, such as semiconductors, can lead to reduced vehicle production. This scarcity impacts not only new car sales but also the used car market, which is a significant area of business for Cox Automotive. The ongoing semiconductor shortage, for example, has continued to affect production lines well into 2024, limiting inventory for dealerships.

Furthermore, the rapid evolution of consumer preferences, particularly the accelerating shift towards electric vehicles (EVs), presents both opportunities and challenges. Cox Automotive needs to adapt its services and platforms to cater to this transition. If the company is slow to support EV sales, charging infrastructure, or related services, it could fall behind competitors and experience diminished market share. The increasing demand for EVs in 2024, with sales projected to rise significantly, underscores the urgency of this adaptation.

- Economic Sensitivity: The automotive sector's susceptibility to economic downturns can lead to reduced consumer spending on vehicles, directly impacting Cox Automotive's revenue.

- Supply Chain Vulnerability: Ongoing issues like the semiconductor shortage continue to limit vehicle production, affecting inventory and sales across the industry.

- EV Transition: The rapid growth of the electric vehicle market requires Cox Automotive to adapt its business models and services to remain competitive.

Cybersecurity Risks Across Divisions

Cox Enterprises, with its broad reach into telecommunications and automotive sectors, faces significant cybersecurity vulnerabilities. The increasing sophistication of threats like ransomware and data breaches poses a constant risk to its operations and customer data. For instance, the global cost of ransomware attacks alone was projected to reach $265 billion annually by 2023, a figure expected to continue rising. This exposure can lead to substantial financial losses and damage to the company's reputation.

The interconnected nature of its diverse business units amplifies these risks. A breach in one division could potentially compromise others, creating a domino effect. In 2024, reports indicated a rise in targeted attacks against critical infrastructure providers, a sector where Cox's telecommunications arm operates. This necessitates robust, unified security protocols across all its subsidiaries to mitigate potential widespread disruption and data compromise.

- Ransomware Exposure: The company is susceptible to ransomware attacks that could halt critical services.

- Data Breach Impact: A data breach could affect millions of customers across its various services.

- Operational Disruption: Cybersecurity incidents can lead to significant downtime and service interruptions.

- Reputational Damage: Trust erosion following a security incident can have long-term financial consequences.

Cox's reliance on traditional cable and broadband faces pressure from newer technologies and evolving consumer habits. The discontinuation of the Affordable Connectivity Program in May 2024 directly impacts a segment of its customer base, potentially increasing churn. Furthermore, the company's ability to significantly increase revenue per user through speed upgrades is limited as current offerings meet most consumer needs.

Cox Automotive's fortunes are tied to the cyclical automotive market, making it vulnerable to economic downturns. Persistent supply chain issues, like the ongoing semiconductor shortage impacting vehicle production into 2024, continue to affect inventory. The accelerating shift towards electric vehicles also requires significant adaptation to maintain market share.

As a privately held company, Cox Enterprises has restricted access to public capital markets, potentially limiting large-scale funding for growth initiatives. This reliance on internal cash flow or debt financing could impact financial flexibility for major expansions or acquisitions. For example, while specific 2024/2025 funding isn't public, its 2022 revenue of $23 billion indicates the scale of capital typically required for significant growth.

Cox faces substantial cybersecurity risks due to the increasing sophistication of threats like ransomware and data breaches, with global ransomware costs projected to exceed $265 billion annually by 2023. The interconnectedness of its businesses means a breach in one area could impact others, and targeted attacks against critical infrastructure providers, a sector Cox operates in, are on the rise in 2024.

Full Version Awaits

Cox Enterprises SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment. You'll receive a comprehensive breakdown of Cox Enterprises' Strengths, Weaknesses, Opportunities, and Threats, ready for your strategic planning.

Opportunities

The ongoing expansion of broadband and fiber infrastructure presents a significant opportunity for Cox Enterprises. Federal initiatives like the Broadband Equity, Access, and Deployment (BEAD) program, with its substantial funding, are designed to close the digital divide, creating fertile ground for increased fiber-to-the-home (FTTH) deployments. This strategic push can bolster Cox Communications' market standing and extend its customer base.

The accelerating global shift towards electric vehicles (EVs) presents a significant growth avenue for Cox Automotive. As more consumers embrace EVs, there's a burgeoning demand for specialized services, from EV certification programs that ensure vehicle quality to innovative solutions for managing EV battery lifecycles and resale value. Cox Automotive is well-positioned to capitalize on this trend by developing and offering these crucial support services.

Industry projections indicate a substantial increase in EV market share. By 2025, electric vehicles are anticipated to represent a considerably larger portion of overall vehicle sales compared to previous years. For instance, some forecasts suggest that EV sales could reach over 20% of the total new vehicle market in major economies by 2025, a figure that was in the single digits just a few years prior, highlighting the rapid expansion and the opportunity for Cox Automotive to scale its EV-related offerings.

Cox Enterprises can bolster its growth by acquiring companies in burgeoning fields like cleantech, healthcare, digital media, and public sector software. This strategic move allows for diversification and the integration of cutting-edge technologies into its existing portfolio.

The company's acquisition of OpenGov in 2023, a leader in cloud financial planning and analysis software for the public sector, exemplifies this forward-thinking approach. This acquisition, valued at over $1.8 billion, signals Cox Enterprises' commitment to expanding its reach into technologically advanced and essential service sectors, aiming to capture market share in these high-potential areas.

Value-Added Services (VAS) in Telecommunications

The telecommunications sector is seeing a significant customer shift towards integrated digital lifestyles, creating a prime opportunity for Cox Communications to deepen its customer relationships through Value-Added Services (VAS). This trend is particularly evident as consumers increasingly seek convenience and enhanced security within their homes and digital lives.

Cox can capitalize on this by expanding its VAS portfolio. Think beyond basic internet and cable; services such as managed data cybersecurity, smart home automation, and video surveillance as a service (VSaaS) directly address these evolving customer needs. For instance, the global smart home market was projected to reach over $150 billion in 2024, with cybersecurity being a major driver.

- Expand cybersecurity offerings: With cyber threats on the rise, managed data security solutions are highly sought after by both residential and business customers.

- Develop integrated smart home solutions: Offering seamless integration of various smart devices, controlled through a single platform, appeals to the convenience-driven consumer.

- Launch video surveillance as a service (VSaaS): This provides a recurring revenue stream and addresses growing concerns about home and business security.

Leveraging Sustainability Initiatives for Business Advantage

Cox Enterprises' robust sustainability efforts, such as achieving zero waste to landfill across its operations and significant investments in cleantech, present a distinct opportunity. This commitment resonates strongly with a growing segment of environmentally conscious consumers and businesses, offering a powerful differentiator in the marketplace. By highlighting these initiatives, Cox can attract and retain customers who prioritize eco-friendly practices, potentially boosting brand loyalty and market share.

Furthermore, Cox's focus on sustainability can unlock new avenues for growth and innovation. Their investments in cleantech, for instance, not only align with environmental goals but also position the company to capitalize on emerging markets and technologies. This strategic alignment could lead to the development of novel business models and revenue streams, further solidifying Cox's competitive edge.

- Attracting Eco-Conscious Consumers: Cox's sustainability achievements appeal to a growing market segment prioritizing environmental responsibility in their purchasing decisions.

- Cleantech Investment Opportunities: Investments in cleantech position Cox to benefit from the expansion of sustainable technologies and related markets.

- Enhanced Brand Reputation: Demonstrating a genuine commitment to sustainability can significantly improve Cox's public image and brand value.

- Potential for New Revenue Streams: Sustainability initiatives can foster innovation, leading to the creation of new products, services, and business models.

The ongoing expansion of broadband and fiber infrastructure, supported by government funding like the BEAD program, offers Cox Communications a significant opportunity to grow its customer base and market share. The increasing adoption of electric vehicles (EVs) creates a substantial growth avenue for Cox Automotive, which can leverage demand for specialized EV services, including certification and battery lifecycle management. Cox Enterprises can also pursue strategic acquisitions in high-growth sectors such as cleantech and digital media, as demonstrated by its 2023 acquisition of OpenGov for over $1.8 billion, to diversify its portfolio and integrate innovative technologies.

Threats

Cox Communications, a subsidiary of Cox Enterprises, operates within a telecommunications sector characterized by fierce rivalry. Traditional cable companies, wireless providers leveraging fixed wireless access (FWA), and satellite internet services all vie for customer subscriptions, creating significant pressure on subscriber retention and pricing strategies. For instance, the FWA market saw substantial growth in 2024, with major wireless carriers expanding their offerings, directly impacting the broadband market share of established players like Cox.

Broader economic uncertainties, such as persistent inflation and the specter of recession, continue to cast a shadow over consumer spending and business investment. For Cox Enterprises, with its diverse portfolio spanning media, automotive, and telecommunications, these conditions can dampen demand for advertising, new vehicle sales, and broadband services. For instance, the U.S. inflation rate remained elevated through much of 2024, impacting disposable income and potentially reducing discretionary spending on services Cox offers.

Geopolitical headwinds, including trade disputes and increased protectionism, also present a threat by potentially disrupting supply chains and increasing operational costs. Rising tariffs, for example, could affect the cost of technology hardware used in Cox Communications' network infrastructure or impact the pricing of vehicles sold through Cox Automotive's platforms. These global tensions create an unpredictable operating environment, making long-term strategic planning more challenging.

The swift evolution of technology, especially artificial intelligence, presents a significant hurdle for Cox Enterprises to keep pace and integrate these innovations seamlessly. Failure to adapt quickly could mean falling behind competitors who are more agile in adopting AI-driven solutions.

There's also a tangible risk that the substantial investments made in AI may not yield the anticipated benefits, potentially leading to inefficient resource allocation. For instance, while many companies are pouring billions into AI research and development, realizing a clear return on investment often proves complex.

Supply Chain Disruptions and Rising Costs

Ongoing supply chain disruptions continue to pose a significant challenge for Cox Automotive. For instance, the semiconductor shortage that heavily impacted vehicle production throughout 2022 and 2023, with some estimates suggesting billions in lost revenue for the auto industry globally, still lingers in certain component areas, affecting the availability of new and used vehicles.

Rising raw material costs, including steel, aluminum, and plastics, directly translate to higher vehicle manufacturing expenses. This inflationary pressure can squeeze profit margins for dealerships and impact the affordability of vehicles for consumers, potentially dampening demand. The average cost of new vehicles in the US hovered around $48,000 in early 2024, reflecting these elevated production costs.

Labor shortages across the automotive sector, from manufacturing plants to dealership service departments, exacerbate these issues. A shortage of skilled technicians, for example, can lead to longer repair times and reduced service revenue. The U.S. Bureau of Labor Statistics projected a need for over 46,000 new automotive technicians annually through 2031, highlighting the persistent gap.

- Supply chain bottlenecks persist, impacting vehicle availability and pricing.

- Increased costs for raw materials like steel and plastics are driving up manufacturing expenses.

- Labor shortages, particularly for skilled technicians, hinder operational efficiency and service delivery.

Regulatory Changes and Compliance Burden

Cox Enterprises faces evolving regulatory landscapes, particularly concerning data privacy and environmental standards. For instance, the increasing stringency of regulations like GDPR and CCPA, which have seen significant enforcement actions and fines in 2024, could necessitate substantial investments in compliance infrastructure and personnel. Furthermore, potential shifts in telecommunications policy, such as net neutrality debates or spectrum allocation rules, could directly impact Cox's core business operations and revenue streams.

The compliance burden associated with these changes can lead to increased operational costs and complexity.

- Increased compliance costs: Adhering to new data privacy laws and environmental regulations can require significant financial outlays for technology upgrades, legal counsel, and staff training.

- Operational complexities: Navigating a patchwork of evolving regulations across different jurisdictions adds layers of complexity to day-to-day operations.

- Potential for fines and penalties: Non-compliance with regulatory mandates can result in substantial financial penalties, impacting profitability.

- Impact on service offerings: Changes in telecommunications policies could affect how Cox delivers its services, potentially limiting innovation or increasing costs for consumers.

Intensifying competition from fixed wireless access (FWA) providers and satellite internet services continues to pressure Cox Communications' subscriber base and pricing power. The ongoing evolution of technology, particularly the rapid integration of AI, presents a significant challenge for Cox Enterprises to adapt quickly and avoid falling behind more agile competitors. Furthermore, Cox must navigate increasingly complex regulatory environments, especially concerning data privacy and environmental standards, which can lead to higher compliance costs and operational complexities.

SWOT Analysis Data Sources

This Cox Enterprises SWOT analysis is built upon a foundation of verified financial filings, comprehensive market intelligence reports, and expert industry evaluations to ensure accurate and actionable insights.