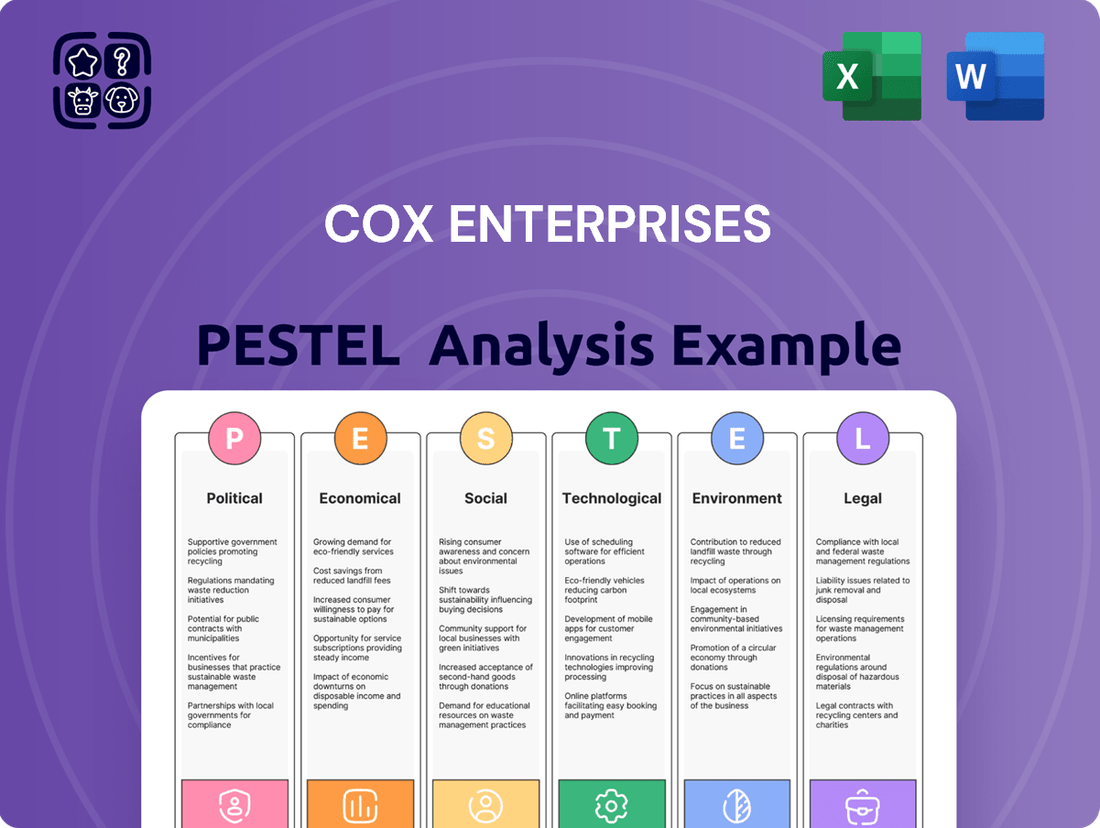

Cox Enterprises PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cox Enterprises Bundle

Navigate the complex external forces shaping Cox Enterprises's future with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements are impacting their operations and strategic direction. Gain a competitive edge by leveraging these crucial insights to refine your own market strategy. Download the full PESTLE analysis now for actionable intelligence that empowers smarter decision-making.

Political factors

Cox Communications, a key part of Cox Enterprises, navigates a telecommunications sector shaped by significant government oversight. The Federal Communications Commission (FCC) imposes stringent rules that directly affect how Cox operates, with compliance expenses projected to reach $200 million in 2024.

These regulations, covering critical areas such as net neutrality principles, the expansion of broadband infrastructure, and the safeguarding of customer data privacy, exert a considerable influence on Cox's strategic decisions regarding service development and capital allocation.

Cox Automotive's operations are significantly influenced by evolving automotive emissions and safety regulations. Governments worldwide, including the U.S., are intensifying these standards. For instance, the Environmental Protection Agency (EPA) introduced new greenhouse gas emissions standards for model years 2027 and beyond, targeting reductions in CO2 and other pollutants.

Cox Automotive, by providing services to dealerships and manufacturers, must adapt to these regulatory shifts. This adaptation may necessitate increased investment in emissions control technologies and support for the development and adoption of cleaner vehicle alternatives. Staying ahead of these regulatory changes is crucial for Cox Automotive's continued success and market relevance.

Uncertainty surrounding trade policies and potential tariffs, especially concerning imported vehicles and auto parts, is a significant political factor impacting the automotive sector. These tariffs could directly increase production expenses for companies like Cox Enterprises, leading to higher vehicle prices for consumers and potentially altering purchasing patterns.

For instance, a hypothetical 25% tariff on imported auto parts, as has been discussed in the past, could add hundreds or even thousands of dollars to the cost of a new vehicle. This cost increase might initially spur a short-term rush to buy before prices fully adjust, but it could lead to a sustained slowdown in sales as affordability decreases over the longer term.

Cox Automotive, a key subsidiary of Cox Enterprises, must closely track these evolving trade dynamics. Shifts in tariff structures can fundamentally reshape supply chain strategies, influence vehicle inventory levels, and ultimately impact consumer demand for automotive products and services.

Government Support for Broadband and Cleantech

Government initiatives and funding for broadband expansion, particularly in underserved rural areas, create significant opportunities for Cox Communications to broaden its service footprint. For instance, the US government's commitment to bridging the digital divide, with programs like the Broadband Equity, Access, and Deployment (BEAD) program allocating billions, directly supports such growth.

Political backing and incentives for cleantech and sustainable solutions offer substantial advantages for Cox Enterprises' ventures in this domain. Governments worldwide are increasingly prioritizing industrial policies that shape the energy transition, focusing on job creation, domestic manufacturing, energy security, and cost-effectiveness in their clean energy strategies.

- Broadband Expansion Funding: The U.S. government has committed over $42 billion through the BEAD program to expand broadband access, a direct opportunity for Cox Communications.

- Cleantech Incentives: Policies like the Inflation Reduction Act in the U.S. provide tax credits and incentives for renewable energy and sustainable technologies, benefiting Cox Enterprises' cleantech investments.

- Energy Transition Focus: Governments are actively promoting domestic manufacturing of clean energy components, aligning with Cox Enterprises' strategic interests in sustainable infrastructure.

Political Stability and Lobbying Efforts

The political stability within the United States is a cornerstone for Cox Enterprises' expansion across its diverse sectors, including telecommunications, media, and automotive. Any significant political instability can dampen consumer confidence and subsequently impact discretionary spending, directly affecting Cox's revenue streams.

Cox Enterprises demonstrates a proactive approach to policy engagement through its lobbying activities. The company employs a considerable number of lobbyists who possess prior government experience. This strategic deployment of experienced personnel highlights Cox's commitment to influencing legislative and regulatory outcomes, ensuring a more favorable operating environment.

- Lobbying Expenditure: In 2023, Cox Enterprises reported spending $5.2 million on federal lobbying efforts, reflecting a substantial investment in shaping policy.

- Key Areas of Focus: Lobbying efforts often concentrate on issues related to broadband deployment, media ownership rules, and automotive industry regulations.

- Impact of Elections: Upcoming elections in 2024 and beyond could introduce policy shifts, particularly concerning net neutrality and digital infrastructure funding, which are critical for Cox's telecom division.

Government policies directly influence Cox Enterprises' telecommunications and automotive sectors, with significant regulatory frameworks like those from the FCC impacting broadband operations. The push for broadband expansion, supported by substantial government funding like the $42 billion BEAD program, presents a key growth avenue for Cox Communications.

Evolving environmental and emissions standards, such as the EPA's new rules for 2027 model years, necessitate adaptation within Cox Automotive, potentially requiring increased investment in cleaner vehicle technologies.

Trade policies and potential tariffs on vehicle parts pose a risk, as a hypothetical 25% tariff could add significantly to vehicle costs, impacting consumer purchasing patterns and Cox Automotive's supply chain strategies.

Cox Enterprises actively engages in policy shaping through lobbying, investing $5.2 million in federal lobbying efforts in 2023 to influence regulations critical to its diverse business segments.

| Factor | Impact on Cox Enterprises | Data Point/Example |

| Broadband Regulation | FCC rules affect net neutrality, data privacy, and infrastructure deployment. | Compliance costs estimated at $200 million for 2024. |

| Environmental Standards | Stricter emissions standards impact automotive sector operations. | EPA's new standards for model years 2027 and beyond. |

| Trade Policy | Tariffs on auto parts can increase costs and alter consumer behavior. | Hypothetical 25% tariff could add thousands to vehicle costs. |

| Government Funding | Initiatives for broadband expansion create growth opportunities. | US BEAD program allocating over $42 billion. |

| Lobbying Efforts | Proactive engagement to influence legislative and regulatory outcomes. | Cox spent $5.2 million on federal lobbying in 2023. |

What is included in the product

This PESTLE analysis examines the political, economic, social, technological, environmental, and legal forces impacting Cox Enterprises, offering a strategic overview for informed decision-making.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of the external factors impacting Cox Enterprises.

Helps support discussions on external risk and market positioning during planning sessions by highlighting key political, economic, social, technological, environmental, and legal influences on Cox Enterprises.

Economic factors

The U.S. automotive market is anticipating robust growth in 2025, underpinned by a stable economy and rising consumer confidence. Cox Automotive projects new vehicle sales to hit 16.3 million units next year, a 3% uptick from 2024, indicating a favorable economic environment for their automotive services.

The overall health of the U.S. economy, including its Gross Domestic Product (GDP) expansion, directly impacts consumer spending across all of Cox Enterprises' diverse business segments, from automotive and media to communications.

Elevated interest rates on auto loans have persistently challenged consumer vehicle affordability. For instance, the average interest rate for a new car loan hovered around 7.5% in late 2023, a significant increase from previous years, directly impacting monthly payments and overall purchasing power.

However, a more optimistic outlook is emerging for 2025, with projections indicating an improvement in vehicle affordability. This is largely attributed to anticipated expansions in credit availability and a projected decline in auto loan rates, potentially falling closer to 6% by mid-2025.

This shift represents a positive development for Cox Automotive, as lower borrowing costs and easier access to credit are expected to invigorate demand, thereby stimulating both new and used vehicle sales volumes throughout the year.

While new vehicle production and inventories have shown improvement in 2024, the lingering effects of inflation and past supply chain disruptions continue to drive up material costs. This trend has directly contributed to higher vehicle prices across the market, impacting affordability for consumers and potentially affecting sales volumes for companies like Cox Enterprises.

Cox Automotive must remain agile in navigating these persistent cost pressures and evolving supply chain landscapes. The introduction of new tariffs on imported products, for instance, could further complicate sourcing and add to operational expenses, necessitating strategic adjustments to procurement and pricing models throughout 2024 and into 2025.

Cleantech Investment Trends

Cleantech investment is on a steep upward trajectory, with projections indicating that spending on clean energy solutions will outpace fossil fuel investments for the first time in 2025. This shift is largely fueled by remarkable cost reductions in key technologies such as solar power and battery storage, creating fertile ground for companies like Cox Enterprises with interests in cleantech and venture capital.

The cleantech sector is experiencing a significant boost in research and development (R&D) and innovation. For instance, global investment in energy transition technologies reached $1.7 trillion in 2023, a 17% increase from 2022, according to BloombergNEF. This growth signifies a robust market eager for new solutions and advancements.

- Accelerating Investment: Cleantech investments are set to surpass fossil fuel spending in 2025.

- Cost Reduction Drivers: Rapid decreases in solar and battery technology costs are fueling this growth.

- Opportunity for Cox Enterprises: Significant potential exists for Cox's cleantech and venture capital arms.

- Innovation Surge: The sector is witnessing increased R&D and groundbreaking innovations.

Market Forecasts for Automotive Sales

Automotive sales are showing a robust recovery. Cox Automotive forecasts new vehicle sales to hit 16.3 million units in 2025. This represents the third year in a row for sales increases, and the best performance seen since 2019.

The used vehicle market is also poised for expansion. Projections suggest the retail used-vehicle market could reach 20.1 million units. These figures paint a favorable picture for Cox Automotive's primary business operations.

- New Vehicle Sales Projection (2025): 16.3 million units

- Used Vehicle Market Projection: 20.1 million units

- Sales Trend: Third consecutive year of growth

- Performance Benchmark: Strongest since 2019

The U.S. economy's trajectory significantly influences Cox Enterprises' diverse operations. Projections for 2025 indicate new vehicle sales are expected to reach 16.3 million units, a 3% increase from 2024, signaling a healthy consumer demand environment. While elevated interest rates in late 2023 impacted vehicle affordability, anticipated lower rates and improved credit availability in mid-2025 are poised to boost purchasing power.

Persistent inflation continues to affect material costs, leading to higher vehicle prices. However, the cleantech sector is experiencing a surge in investment, with global spending projected to outpace fossil fuels in 2025, driven by cost reductions in solar and battery technology. This presents a substantial opportunity for Cox's ventures in this growing market.

| Economic Factor | 2024 Projection/Trend | 2025 Projection/Trend | Impact on Cox Enterprises |

|---|---|---|---|

| U.S. GDP Growth | Stable Expansion | Continued Growth | Supports consumer spending across all segments |

| New Vehicle Sales | Projected 15.8 million units | Projected 16.3 million units (3% increase) | Favorable for Cox Automotive services |

| Auto Loan Interest Rates | Around 7.5% (late 2023) | Projected to decline towards 6% (mid-2025) | Improved affordability, increased demand |

| Cleantech Investment | Strong R&D and innovation | Expected to surpass fossil fuel investment | Growth opportunities for cleantech and venture capital arms |

Preview Before You Purchase

Cox Enterprises PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Cox Enterprises delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

You'll gain valuable insights into market trends, competitive landscapes, and potential challenges and opportunities. This detailed report is designed to equip you with the knowledge needed to understand Cox Enterprises' business environment thoroughly.

Sociological factors

U.S. consumers are spending more time with digital media, with projections indicating nearly eight hours daily by 2025, eclipsing traditional television. This fundamental shift directly influences Cox Communications' media division, shaping how it connects with audiences and crafts its content. Digital video, in particular, is a major catalyst for this change.

Younger demographics, especially Gen Z, are deeply immersed in short-form video platforms and social media. This preference necessitates a strategic pivot for Cox's media assets, demanding adaptable content creation and distribution models to capture and retain these valuable viewer segments.

The way people buy cars has changed a lot, with many now happy with the blended online and in-person approach, known as omnichannel retailing. This shift means dealerships need to be flexible, offering digital tools alongside traditional showroom experiences.

Interestingly, while electric vehicles (EVs) are a big topic, some markets are seeing less enthusiasm for all-battery EVs, with a noticeable uptick in interest for traditional gasoline cars and hybrids. This suggests a more nuanced consumer demand than a simple move to electric.

Furthermore, younger generations are increasingly open to mobility-as-a-service options, like ride-sharing or subscription models, rather than the traditional idea of owning a car outright, signaling a potential long-term shift in vehicle acquisition.

The increasing adoption of remote work, coupled with the popularity of streaming services and cloud computing, significantly boosts the demand for robust, high-speed internet. This societal shift underscores the growing need for reliable connectivity in households.

Cox Communications is well-positioned to capitalize on this trend through its ongoing investment in Fiber-to-the-Home (FTTH) technology. By expanding its fiber network, Cox aims to meet and exceed consumer expectations for faster and more dependable internet access, a critical factor in today's digital economy.

Consumer Interest in Sustainability

Consumers increasingly favor sustainable options, impacting purchasing decisions across industries. This heightened awareness of environmental impact is evident in the automotive sector, extending to interest in the full lifecycle of vehicles, including recycling. In 2024, a significant majority of consumers, around 60%, indicated they would pay more for products from environmentally responsible companies.

This shift in consumer values is a powerful driver for businesses. Cox Enterprises' strategic investments in cleantech initiatives, such as its involvement in electric vehicle charging infrastructure and sustainable waste management solutions, directly address this growing demand. For instance, by 2025, the global market for green vehicles is projected to reach over $800 billion, reflecting this strong consumer pull.

The growing interest in sustainability isn't limited to new purchases; it's also reshaping perceptions of older products. Consumers are showing greater interest in the environmental footprint of vehicle disposal and recycling processes. This broader view of sustainability means companies need to consider their entire value chain to meet evolving consumer expectations.

- Growing Demand: Over 60% of consumers in 2024 expressed willingness to pay a premium for sustainable products.

- Automotive Impact: Consumer interest spans EVs and the environmental aspects of vehicle recycling.

- Cleantech Alignment: Cox Enterprises' ventures in cleantech directly tap into this increasing societal value.

- Market Growth: The green vehicle market is anticipated to exceed $800 billion by 2025, underscoring consumer preference.

Demographic Shifts and Service Adaptation

Demographic shifts are significantly influencing how companies like Cox Enterprises need to adapt their services. For instance, the media consumption habits of Generation Z, who are now entering their prime spending years, heavily favor short-form video content and interactive media experiences. This means Cox's media and telecommunications divisions must evolve their content strategies and delivery platforms to resonate with this digitally native audience. By 2025, Gen Z is projected to represent a substantial portion of the consumer market, making their preferences a critical factor in service design and marketing.

Understanding these generational changes is paramount for tailoring services and marketing efforts to a diverse consumer base. As of 2024, there's a noticeable trend of younger demographics seeking personalized and on-demand content, pushing traditional media models to innovate. Cox's ability to integrate new technologies and content formats will be key to capturing and retaining these evolving customer segments.

- Gen Z Media Habits: Prioritize short-form video and interactive content, impacting Cox's content strategy.

- Generational Marketing: Tailoring services and marketing to diverse age groups is crucial for market penetration.

- Digital Natives: Younger consumers expect personalized, on-demand experiences, driving innovation in service delivery.

- Market Evolution: Adapting to changing consumer preferences is essential for Cox to remain competitive in 2024-2025.

Societal values are shifting, with a growing emphasis on sustainability influencing consumer choices. By 2025, the global green vehicle market is expected to surpass $800 billion, highlighting this trend. Cox Enterprises' investments in cleantech, such as EV charging infrastructure, align with this demand.

Generational differences significantly shape media consumption, with Gen Z favoring short-form video and interactive content. This necessitates adaptable strategies for Cox's media divisions to engage younger demographics, who are projected to form a substantial market segment by 2025.

Consumer preferences are increasingly digital, with nearly eight hours of daily digital media consumption anticipated by 2025. This trend impacts Cox Communications, requiring a focus on digital video and adaptable content models to reach audiences, especially younger ones.

| Sociological Factor | Impact on Cox Enterprises | Data/Projection |

|---|---|---|

| Sustainability Focus | Drives demand for eco-friendly products and services. | 60% of consumers in 2024 willing to pay more for sustainable products. |

| Generational Media Habits | Requires adaptation to short-form video and interactive content. | Gen Z's preferences critical for market engagement by 2025. |

| Digital Media Consumption | Increases need for robust digital infrastructure and content. | Projected 8 hours of daily digital media use by 2025. |

Technological factors

The rapid expansion of 5G networks, heavily reliant on robust fiber optic infrastructure, is a significant technological factor. Cox Communications is well-positioned to capitalize on this trend by extending its fiber-to-the-home (FTTH) services and offering fiber solutions for burgeoning smart city initiatives. By 2024, over 50% of U.S. households were projected to have access to 5G, underscoring the demand for the underlying fiber backbone.

Artificial Intelligence is fundamentally reshaping the automotive landscape. By 2024, the global AI in automotive market was projected to reach over $12 billion, with significant growth expected through 2025, driven by advancements in autonomous driving and enhanced vehicle safety features.

AI is optimizing everything from the factory floor to the driver's seat. For instance, AI algorithms are crucial for predictive maintenance, potentially reducing vehicle downtime by up to 20% for fleet operators. This technology also powers sophisticated driver-assistance systems and the complex data processing required for Level 4 and Level 5 autonomous vehicles.

Cox Automotive can harness these AI capabilities to streamline operations and deliver cutting-edge services. By integrating AI into its dealer management systems and consumer-facing platforms, the company can offer more personalized experiences, predictive analytics for inventory management, and improved efficiency in its remarketing and logistics services.

Consumers are dedicating more time to digital platforms, with digital video and social media usage surging. In 2024, it's estimated that the average person will spend over 3 hours daily on social media, a significant portion of which involves video content. This shift presents a dual-edged sword for Cox Enterprises' media operations, offering avenues for engagement but also demanding adaptation to evolving viewing habits.

The rise of streaming services and short-form social videos means Cox's media division must navigate a fragmented audience. While this fragmentation offers opportunities for targeted advertising, the trend of subscription cycling, where consumers dip in and out of services, necessitates innovative approaches to ad placement and retention strategies beyond traditional television models. Ensuring ads are seen and effective in this dynamic environment is key.

Artificial intelligence is increasingly integrated into consumer experiences, notably enhancing infotainment systems in vehicles. This technological advancement allows for personalized content delivery and improved user interfaces. Furthermore, AI facilitates over-the-air updates for vehicles, enabling continuous improvement and feature additions without physical dealership visits, a trend that Cox Automotive can leverage for its automotive clients.

Innovation in Cleantech and Energy Storage

The cleantech sector is experiencing a surge of innovation, particularly in energy storage. The cost of lithium-ion batteries, a key component for many clean energy solutions, has seen a remarkable decline. For instance, by late 2023, the average cost of lithium-ion battery packs had fallen to approximately $156 per kilowatt-hour, a significant drop from previous years.

Cox Enterprises can leverage these advancements by investing in areas like solar photovoltaic (PV) technology and wind power. Furthermore, the integration of artificial intelligence (AI) is proving crucial for optimizing energy consumption and grid management. Reports from 2024 indicate that AI-driven energy optimization solutions can lead to efficiency gains of up to 15% in commercial buildings.

- Falling Battery Costs: Lithium-ion battery pack prices are projected to reach below $100 per kWh by 2025, making electric vehicles and grid-scale storage more accessible.

- Solar PV Efficiency Gains: The efficiency of solar panels continues to improve, with new perovskite-silicon tandem cells achieving efficiencies exceeding 30% in laboratory settings as of early 2024.

- AI in Energy Management: AI is being deployed to predict energy demand, manage renewable energy intermittency, and optimize smart grid operations, contributing to a more stable and efficient energy system.

Cybersecurity and Data Security

Cox Enterprises' reliance on digital platforms across its telecommunications, automotive, and media sectors makes cybersecurity a paramount technological concern. In 2024, the global cybersecurity market was valued at over $200 billion, underscoring the significant investment and attention required in this area. Protecting sensitive customer data and ensuring the robustness of its network infrastructure are crucial for maintaining operational continuity and customer trust in an increasingly digital landscape.

The company faces evolving threats, including ransomware and data breaches, which can have severe financial and reputational consequences. For instance, the average cost of a data breach in 2024 reached an all-time high, exceeding $4.5 million globally. Cox Enterprises must continuously invest in advanced security measures and employee training to mitigate these risks effectively.

Key technological considerations for Cox Enterprises include:

- Investment in advanced threat detection and response systems.

- Implementation of robust data encryption and access control protocols.

- Regular security audits and vulnerability assessments of all digital assets.

- Ongoing training for employees on cybersecurity best practices to prevent human error.

The rapid expansion of 5G networks, heavily reliant on robust fiber optic infrastructure, is a significant technological factor. Cox Communications is well-positioned to capitalize on this trend by extending its fiber-to-the-home (FTTH) services and offering fiber solutions for burgeoning smart city initiatives. By 2024, over 50% of U.S. households were projected to have access to 5G, underscoring the demand for the underlying fiber backbone.

Artificial intelligence is fundamentally reshaping the automotive landscape, with the global AI in automotive market projected to exceed $12 billion in 2024 and continue its strong growth through 2025. AI optimizes vehicle operations, from predictive maintenance that can reduce fleet downtime by up to 20%, to powering advanced driver-assistance systems and autonomous driving capabilities. Cox Automotive can leverage these AI advancements to enhance its dealer management systems, inventory analytics, and remarketing services, offering more personalized and efficient solutions.

Consumers are dedicating more time to digital platforms, with social media usage expected to surpass 3 hours daily per person in 2024, much of it involving video content. This trend requires Cox's media division to adapt to fragmented audiences and evolving viewing habits. While this fragmentation offers opportunities for targeted advertising, the rise of subscription cycling necessitates innovative ad placement and retention strategies beyond traditional television models to ensure ad effectiveness.

The cleantech sector is experiencing significant innovation, particularly in energy storage, with lithium-ion battery costs falling to approximately $156 per kilowatt-hour by late 2023. Cox Enterprises can benefit from these advancements by investing in solar and wind power, further enhanced by AI-driven energy optimization solutions that can achieve up to 15% efficiency gains in commercial buildings as reported in 2024. Falling battery costs are projected to bring electric vehicles and grid-scale storage below $100 per kWh by 2025, while solar panel efficiencies are also improving.

Cybersecurity remains a paramount concern for Cox Enterprises, given its reliance on digital platforms across its diverse sectors. The global cybersecurity market was valued at over $200 billion in 2024, reflecting the critical need for robust protection. The average cost of a data breach reached an all-time high exceeding $4.5 million globally in 2024, highlighting the financial and reputational risks Cox must mitigate through continuous investment in advanced security measures, encryption, and employee training.

Legal factors

Cox Communications operates under the close watch of the Federal Communications Commission (FCC), a reality that translates into significant expenses for regulatory compliance. These costs are directly tied to adhering to a complex web of rules governing everything from broadband service standards to fostering fair competition and safeguarding consumer rights.

Failure to meet these FCC mandates can result in severe penalties. For instance, in 2023, the FCC continued to enforce rules that could lead to substantial fines, impacting Cox's financial performance and potentially limiting its ability to expand services or introduce new technologies.

Cox Enterprises, with its vast customer data holdings in telecommunications and automotive sectors, faces a dynamic legal environment concerning data privacy and consumer protection. Regulations like the California Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), which went into full effect in 2023, set stringent standards for data collection, usage, and consumer consent. Failure to comply can result in significant fines; for instance, CCPA violations can lead to penalties of $2,500 per unintentional violation and $7,500 per intentional violation.

Cox Enterprises, as a major player in sectors like telecommunications and automotive services, faces significant antitrust and competition law oversight. For instance, the Federal Trade Commission (FTC) and the Department of Justice (DOJ) actively monitor mergers and acquisitions within these industries to prevent undue market concentration. In 2024, the FTC continued its focus on broadband competition, a key area for Cox Communications, scrutinizing practices that could stifle innovation or consumer choice.

Compliance with these regulations is crucial to avoid penalties and maintain operational freedom. Any proposed mergers or acquisitions by Cox Enterprises in 2024 or 2025 would undergo rigorous review to ensure they do not create monopolistic advantages or harm fair market competition, as mandated by laws like the Sherman Act and Clayton Act.

Vehicle Emissions and Safety Standards

Cox Automotive, a significant player in the automotive industry, is directly influenced by a complex web of federal and state regulations governing vehicle emissions and safety. These legal frameworks necessitate continuous adaptation for automakers and service providers alike. For instance, the Environmental Protection Agency's (EPA) updated multi-pollutant emission standards, set to be implemented progressively from 2027, will demand substantial adjustments in vehicle design and manufacturing processes to meet more stringent requirements.

The evolving legal landscape also presents challenges. The introduction of new standards often triggers legal scrutiny and potential challenges from industry stakeholders, creating a dynamic and sometimes unpredictable operating environment. This means Cox Automotive must remain agile, monitoring legislative developments and potential litigation that could impact vehicle production, sales, and aftermarket services. For example, ongoing debates and legal actions surrounding emissions targets can influence the pace of adoption for new technologies and the overall market for vehicles adhering to different standards.

- EPA Emissions Standards: The EPA's stringent new emission standards, phasing in from 2027, will require significant investment in cleaner technologies by automakers, impacting the supply chain and the types of vehicles available.

- Safety Regulations: Federal Motor Vehicle Safety Standards (FMVSS) are continuously updated, requiring manufacturers to incorporate advanced safety features, which can increase vehicle costs and complexity for service providers.

- State-Level Variations: Individual states may enact their own emissions and safety regulations, creating a patchwork of compliance requirements that Cox Automotive must navigate.

- Legal Challenges: The automotive industry frequently faces legal challenges to new regulations, creating uncertainty and potentially delaying or altering implementation timelines.

Intellectual Property Rights

Intellectual property rights are crucial for Cox Enterprises, particularly in its cleantech and technology sectors. This involves securing patents for innovative technologies, protecting media content through copyrights, and safeguarding brand identity with trademarks. For instance, in 2024, companies in the technology sector saw significant investment in R&D, highlighting the ongoing need to protect these innovations.

Cox Enterprises' commitment to innovation necessitates robust IP protection strategies. This legal framework is essential for maintaining a competitive edge and encouraging further development in areas like advanced media solutions and sustainable technologies. The company's focus on these growth areas means IP is a core asset.

- Patents: Protecting novel technologies developed in cleantech and digital innovation.

- Copyrights: Safeguarding original content across Cox's media platforms.

- Trademarks: Ensuring brand recognition and preventing infringement on Cox's established names.

Cox Communications operates under strict FCC regulations, demanding significant compliance investment for broadband standards and consumer protection, with potential fines for non-adherence. Data privacy laws like CCPA/CPRA, effective in 2023, impose stringent rules on data handling, carrying penalties of up to $7,500 per intentional violation. Antitrust oversight by the FTC and DOJ scrutinizes mergers, particularly in broadband, to ensure fair competition, with continued focus in 2024.

Environmental factors

The automotive sector is under significant pressure to meet increasingly stringent environmental regulations, particularly concerning greenhouse gas emissions. For instance, by 2025, the U.S. is aiming for fleet-wide average emissions to be 43 miles per gallon, a target that necessitates substantial technological advancements.

This regulatory landscape directly fuels the demand for green automotive technologies, impacting everything from vehicle manufacturing to the aftermarket services offered by companies like Cox Automotive. The shift towards electric vehicles (EVs) and improved fuel efficiency is a prime example of this trend.

Cox Enterprises, as a parent company, actively embraces sustainability. Its commitment is underscored by its recognition as one of America's Greenest Companies for 2025, reflecting a strategic alignment with environmental stewardship that resonates throughout its diverse business units, including its automotive segment.

Cox Enterprises' strategic investments in cleantech and renewable energy align perfectly with a rapidly expanding global market. The clean energy sector is experiencing unprecedented growth, with projections indicating that cleantech investments will outpace fossil fuels as early as 2025. This trend is largely driven by advancements in solar photovoltaic (PV) technology and significant improvements in battery storage capabilities.

This focus positions Cox Enterprises to capitalize on the increasing demand for sustainable solutions. By investing in areas like solar and battery storage, Cox is not only preparing for future energy landscapes but also actively contributing to the transition away from traditional energy sources, a shift that is gaining significant momentum worldwide.

Cox Enterprises is under growing pressure to address its environmental impact, especially concerning electronic waste from returns and the packaging used throughout its operations. The company is actively working to quantify and lessen these effects, with a strong focus on sustainability across its entire business.

In 2023, the electronics industry generated an estimated 24.9 million metric tons of e-waste globally, highlighting the scale of the challenge Cox faces. The company's commitment includes initiatives aimed at reducing waste generation and fostering responsible management of resources, such as exploring more sustainable packaging alternatives and improving recycling processes for returned electronics.

Water Conservation Efforts

Cox Enterprises, like many large corporations, is increasingly focused on water conservation as a key environmental responsibility. While specific, publicly detailed 2024 or 2025 water neutrality targets for Cox are not readily available, their ongoing commitment to efficient natural resource management is evident across their diverse business segments, which include telecommunications, automotive services, and media. This focus aligns with a growing industry trend and regulatory pressure to minimize water usage and impact.

The company's approach to water conservation is likely multifaceted, encompassing:

- Operational Efficiency: Implementing water-saving technologies and practices within facilities, data centers, and vehicle maintenance operations.

- Supply Chain Engagement: Encouraging water stewardship among suppliers and partners to extend conservation efforts beyond direct operations.

- Community Involvement: Supporting local water conservation initiatives and raising awareness about water scarcity issues.

- Reporting and Transparency: While specific targets may not be public, companies like Cox are increasingly expected to report on their environmental performance, including water usage and reduction efforts, often through sustainability reports.

Climate Change Adaptation and Resilience

Climate change presents significant challenges for companies like Cox Enterprises, particularly concerning extreme weather events and resource scarcity. These factors can directly affect Cox's extensive telecom infrastructure, potentially disrupting services and requiring costly repairs. Furthermore, its automotive sector operations and supply chains are vulnerable to disruptions caused by changing weather patterns and the availability of critical resources.

To navigate these risks, Cox Enterprises' focus on climate change adaptation and resilience is paramount. Investing in robust, weather-resistant infrastructure for its networks is essential for maintaining operational continuity. For instance, in 2024, the telecommunications industry globally saw increased investment in hardening infrastructure against extreme weather, with estimates suggesting billions spent on upgrades to withstand events like hurricanes and severe storms.

Cox's commitment to sustainable practices across its diverse business segments, including its automotive division, helps mitigate long-term environmental risks. This proactive approach not only bolsters operational stability but also positions the company favorably in an increasingly environmentally conscious market. The automotive sector, in particular, is seeing a push towards more sustainable supply chains, with many major players aiming for significant reductions in their carbon footprint by 2030.

- Infrastructure Vulnerability: Extreme weather events, such as floods and high winds, pose a direct threat to Cox's extensive fiber optic and wireless network infrastructure, potentially leading to service outages and significant repair costs.

- Supply Chain Disruptions: Resource scarcity, driven by climate change, can impact the availability and cost of components for Cox's automotive businesses and its technology infrastructure.

- Resilience Investment: By investing in resilient infrastructure and sustainable operational practices, Cox aims to ensure long-term stability and minimize the financial impact of environmental risks.

- Industry Trend: The broader telecommunications and automotive industries are increasingly prioritizing climate adaptation, with substantial capital allocated to infrastructure hardening and sustainable sourcing in 2024 and projected for 2025.

Cox Enterprises faces increasing pressure to manage its environmental footprint, particularly concerning electronic waste and packaging materials. The global electronics industry generated approximately 24.9 million metric tons of e-waste in 2023, underscoring the scale of this challenge for companies like Cox. The company is actively implementing initiatives to reduce waste generation and promote responsible resource management, including exploring sustainable packaging and enhancing recycling processes for returned electronics.

Water conservation is another key environmental focus for Cox Enterprises, aligning with broader industry trends and regulatory demands for reduced water usage. While specific 2024 or 2025 water neutrality targets are not publicly detailed, the company's commitment to efficient natural resource management is evident across its telecommunications, automotive, and media segments. This likely involves operational efficiencies, supply chain engagement, and community involvement in water stewardship.

Climate change poses risks to Cox's infrastructure and supply chains, necessitating a focus on adaptation and resilience. The telecommunications sector, for instance, saw significant investment in 2024 to harden infrastructure against extreme weather events, with projections indicating billions spent globally on such upgrades. Cox's sustainable practices across its businesses, including its automotive division, help mitigate these long-term environmental risks and position it favorably in an environmentally conscious market.

| Environmental Factor | Impact on Cox Enterprises | Key Data/Trends (2024-2025) |

| Emissions Regulations | Drives demand for green automotive tech, impacting Cox Automotive. | US fleet-wide average emissions target: 43 MPG by 2025. |

| Electronic Waste | Pressure to manage e-waste from returns and packaging. | Global e-waste: 24.9 million metric tons in 2023. |

| Water Conservation | Increasing focus on responsible water usage across operations. | Growing industry trend and regulatory pressure for water stewardship. |

| Climate Change | Risk to infrastructure and supply chains from extreme weather. | Telecom infrastructure hardening investments in 2024 estimated in billions globally. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Cox Enterprises is built upon a robust foundation of publicly available data, encompassing government reports, economic indicators from reputable institutions, and industry-specific market research. We meticulously gather information on regulatory changes, technological advancements, environmental policies, and socio-economic trends to ensure comprehensive insights.