Cox Enterprises Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cox Enterprises Bundle

Cox Enterprises leverages a powerful marketing mix, but understanding the nuances of their product innovation, pricing strategies, diverse distribution channels, and targeted promotional campaigns is key to unlocking their success. This analysis goes beyond the surface, revealing how each element synergizes to create a formidable market presence.

Dive deeper into the strategic brilliance behind Cox Enterprises' marketing efforts. Our comprehensive 4Ps analysis provides an in-depth look at their product portfolio, pricing architecture, place in the market, and promotional tactics, offering actionable insights for your own business strategies.

Ready to gain a competitive edge? Access the complete Cox Enterprises 4Ps Marketing Mix Analysis and discover the detailed strategies that drive their market leadership. This professionally written, editable report is your blueprint for understanding and replicating success.

Product

Cox Communications, a key part of Cox Enterprises, offers a robust product portfolio in broadband and telecommunication services. Their internet plans range from 300 Mbps to a high-speed 2 Gbps, designed to meet diverse consumer and business demands, from everyday browsing to intensive data usage like 4K streaming and online gaming. This wide selection ensures customers can find a speed that fits their specific needs and budget.

Beyond just internet, Cox provides integrated cable television and telephone services, creating a bundled offering that simplifies connectivity for households and businesses. This comprehensive approach positions Cox as a one-stop shop for communication needs, enhancing customer convenience and loyalty. For instance, in 2023, Cox Communications reported over 6 million residential internet customers, underscoring the significant market penetration of their product offerings.

Cox Automotive, a segment of Cox Enterprises, offers a comprehensive suite of automotive solutions designed to serve both dealerships and manufacturers. Their product strategy focuses on providing value across the entire vehicle lifecycle, from initial consumer engagement to wholesale transactions.

The Place component of Cox Automotive's marketing mix is evident in its extensive digital and physical footprint. Platforms like Autotrader and Kelley Blue Book provide broad consumer reach, while Manheim's auction facilities offer a critical physical marketplace for wholesale vehicle distribution. This multi-channel approach ensures accessibility for a diverse range of industry participants.

In terms of Promotion, Cox Automotive leverages its well-established brands and digital marketing expertise to connect with its target audience. Their promotional efforts highlight the integrated nature of their offerings, showcasing how platforms like vAuto and Dealertrack streamline dealership operations and enhance customer experiences. This integrated approach aims to drive adoption and loyalty among dealers and manufacturers.

The company's pricing strategy is multifaceted, reflecting the diverse value propositions of its various products and services. For instance, digital advertising on Autotrader is typically subscription-based, while wholesale services at Manheim involve transaction fees. This tiered pricing model caters to different customer needs and budgets, ensuring competitive positioning in the market.

Cox Automotive's product strategy for consumers centers on simplifying and enhancing the entire automotive lifecycle. They offer a comprehensive suite of digital tools and resources designed to empower individuals throughout the car buying, selling, and ownership processes. This includes access to vast vehicle inventories, transparent pricing data, and innovative digital solutions like online credit applications and digital deal jackets, all aimed at creating a more efficient and satisfying customer experience.

In 2024, the automotive retail landscape continues to be shaped by digital transformation, with consumers increasingly expecting seamless online interactions. Cox Automotive's offerings, such as Kelley Blue Book for pricing and Autotrader for inventory search, directly address this trend. For instance, Autotrader reported over 1.6 billion sessions in 2023, demonstrating the significant consumer reliance on these platforms for their automotive needs, with a growing percentage of these interactions involving digital financing and purchase steps.

Cleantech Investments and Sustainable Technologies

Cox Enterprises demonstrates a strong commitment to cleantech through its investment strategy, focusing on companies that drive environmental solutions. This aligns with the Product aspect of their marketing mix by offering services and technologies that appeal to a growing market segment prioritizing sustainability. For instance, Cox’s involvement in renewable energy and waste reduction initiatives positions them as a forward-thinking entity in the environmental sector.

The Cox Cleantech Accelerator is a prime example of their proactive approach, directly supporting innovation in climate change solutions. This accelerator provides crucial early-stage funding and mentorship, fostering the growth of startups. In 2024, the cleantech sector saw significant global investment, with projections indicating continued robust growth through 2025, making Cox's strategic focus highly relevant.

Cox Enterprises' cleantech investments contribute to their overall product portfolio by integrating sustainable practices and offerings. This strategic direction is not only about financial returns but also about building brand reputation and meeting evolving consumer and business demands for environmentally responsible solutions. Their support for companies tackling climate change directly enhances the perceived value and impact of their broader business operations.

Key areas of Cox's cleantech focus include:

- Renewable Energy Solutions Supporting companies developing solar, wind, and other clean energy generation and storage technologies.

- Waste Reduction and Circular Economy Investing in businesses that promote recycling, upcycling, and innovative waste management practices.

- Sustainable Transportation Backing advancements in electric vehicles, charging infrastructure, and efficient logistics.

- Climate Tech Innovation Funding startups developing novel technologies to mitigate and adapt to climate change impacts.

Venture Capital and Emerging Technologies

Cox Enterprises, through its venture capital arm Socium Ventures, actively invests in emerging technologies to shape its future portfolio. This strategic move targets companies in sectors like public sector software, enterprise solutions, healthcare tech, fintech, and sustainability. For instance, in 2024, Socium Ventures continued its focus on identifying and funding disruptive technologies that align with Cox's long-term growth objectives.

This approach to Product, specifically in the realm of venture capital, allows Cox to:

- Diversify its business interests by gaining exposure to high-growth technology sectors.

- Foster innovation by supporting companies developing cutting-edge solutions.

- Identify potential acquisition targets or strategic partnerships for its existing businesses.

- Stay ahead of market trends by investing in technologies that will define future industries.

Cox Communications' product strategy centers on delivering high-speed internet, integrated cable TV, and phone services, catering to both residential and business needs. Their broadband offerings, ranging from 300 Mbps to 2 Gbps, address demands for streaming, gaming, and remote work. In 2023, Cox reported over 6 million residential internet customers, highlighting the broad adoption of their connectivity solutions.

Cox Automotive provides a comprehensive suite of digital and physical solutions for the automotive industry, covering the entire vehicle lifecycle. Platforms like Autotrader and Kelley Blue Book offer extensive consumer reach and transparent pricing information, while Manheim facilitates wholesale transactions. Autotrader saw over 1.6 billion sessions in 2023, underscoring its role in consumer vehicle discovery.

Cox Enterprises actively invests in cleantech through its venture capital arm, Socium Ventures, focusing on renewable energy, waste reduction, and sustainable transportation. This aligns with market demand for environmentally conscious solutions, with the cleantech sector projected for robust growth through 2025. Cox's cleantech accelerator actively supports climate tech innovation.

| Cox Segment | Key Products/Services | Target Market | 2023/2024 Data Points |

|---|---|---|---|

| Cox Communications | Broadband Internet (300 Mbps - 2 Gbps), Cable TV, Phone Services | Residential & Business Customers | Over 6 million residential internet customers (2023) |

| Cox Automotive | Digital Platforms (Autotrader, Kelley Blue Book), Wholesale Auctions (Manheim), Dealership Software (vAuto, Dealertrack) | Consumers, Dealerships, Manufacturers | Over 1.6 billion Autotrader sessions (2023) |

| Cox Cleantech Investments | Renewable Energy, Waste Reduction, Sustainable Transportation, Climate Tech | Environmentally Focused Investors & Businesses | Continued focus on cleantech innovation and investment in 2024, anticipating sector growth through 2025 |

What is included in the product

This analysis offers a comprehensive examination of Cox Enterprises' marketing strategies, detailing their approach to Product, Price, Place, and Promotion with real-world examples and strategic implications.

It's designed for professionals seeking a deep understanding of Cox Enterprises' marketing positioning, providing a benchmark for competitive analysis and strategic planning.

Simplifies complex marketing strategies by clearly outlining Cox Enterprises' Product, Price, Place, and Promotion, making it easier to identify and address potential market challenges.

Place

Cox Communications, a subsidiary of Cox Enterprises, utilizes a direct-to-consumer (DTC) distribution strategy for its telecommunications offerings. This means they deliver broadband internet, cable television, and telephone services straight to households and businesses without intermediaries. Their extensive fiber optic and coaxial cable network forms the backbone of this direct delivery, reaching millions of customers. In 2023, Cox Communications reported approximately 4.5 million broadband customers, underscoring the scale of their DTC operations.

Cox Automotive's digital platforms are central to its marketing mix, offering extensive online marketplaces that link various automotive stakeholders. Autotrader and Kelley Blue Book are prominent consumer-facing sites, facilitating vehicle discovery and valuation.

These digital assets empower consumers, with Autotrader reporting over 18 million unique monthly visitors in early 2024, showcasing their significant reach. Manheim's online auctions and Dealertrack's dealer management solutions further underscore Cox's commitment to digital innovation, streamlining operations for businesses within the automotive ecosystem.

Manheim, a prominent Cox Automotive brand, strategically operates a vast network of physical auction locations across the United States. These sites are essential for the wholesale automotive market, facilitating the buying and selling of used vehicles by dealerships. In 2023, Manheim’s physical auctions processed millions of vehicles, underscoring their continued importance in the industry.

Strategic Partnerships and Accelerators for Cleantech

Cox Enterprises actively fosters innovation in cleantech through strategic partnerships and dedicated accelerator programs. A prime example is the Cox Cleantech Accelerator, designed to scout, fund, and nurture promising startups in the sustainability sector. This initiative provides crucial capital, expert guidance, and mentorship, accelerating the development and market adoption of environmentally friendly technologies.

By engaging with these early-stage companies, Cox Enterprises gains access to cutting-edge solutions and positions itself at the forefront of the cleantech revolution. This strategic focus not only drives internal innovation but also contributes to the broader ecosystem of sustainable development. For instance, accelerator programs often see significant investment rounds in their participating companies, with many startups achieving substantial growth and market traction within a few years of their inception, demonstrating the efficacy of this approach.

Key aspects of this strategy include:

- Investment in Innovation: Direct capital infusion into promising cleantech startups, fostering their growth and market entry.

- Mentorship and Expertise: Providing access to industry leaders and technical guidance to help startups refine their products and strategies.

- Market Access: Facilitating connections and potential pilot programs within Cox Enterprises' vast network, offering real-world testing grounds for new technologies.

- Ecosystem Development: Contributing to the growth of the cleantech sector by supporting emerging companies and driving sustainable solutions.

Venture Capital Investment Channels

Socium Ventures, Cox Enterprises' venture capital arm, serves as a key financial channel, actively investing in promising technology companies. This strategic approach allows Cox to explore and capitalize on emerging market trends and innovations.

Socium Ventures focuses on direct investments, typically in Series A and later funding rounds for startups. This method provides Cox with a stake in companies poised for growth, thereby diversifying its overall investment portfolio and opening doors to new revenue streams and market insights. For instance, in 2024, Socium Ventures continued its active investment strategy, with reported investments in several early-stage technology firms across sectors like AI and sustainable energy, although specific deal sizes and total capital deployed are often proprietary.

- Socium Ventures: The dedicated venture capital arm of Cox Enterprises.

- Investment Focus: Direct investments in emerging technology companies, primarily Series A and later stages.

- Strategic Goal: Portfolio diversification and gaining exposure to new, high-growth markets.

- 2024 Activity: Continued investment in early-stage tech, with a focus on AI and sustainability, reflecting ongoing strategic alignment.

Cox Enterprises' Place strategy is multifaceted, leveraging both direct and indirect distribution channels across its diverse business units. For Cox Communications, this means a robust direct-to-consumer model, utilizing its extensive infrastructure to deliver services directly to homes and businesses. In contrast, Cox Automotive relies heavily on digital platforms and a network of physical locations, like Manheim's auction sites, to serve its automotive industry clients.

What You See Is What You Get

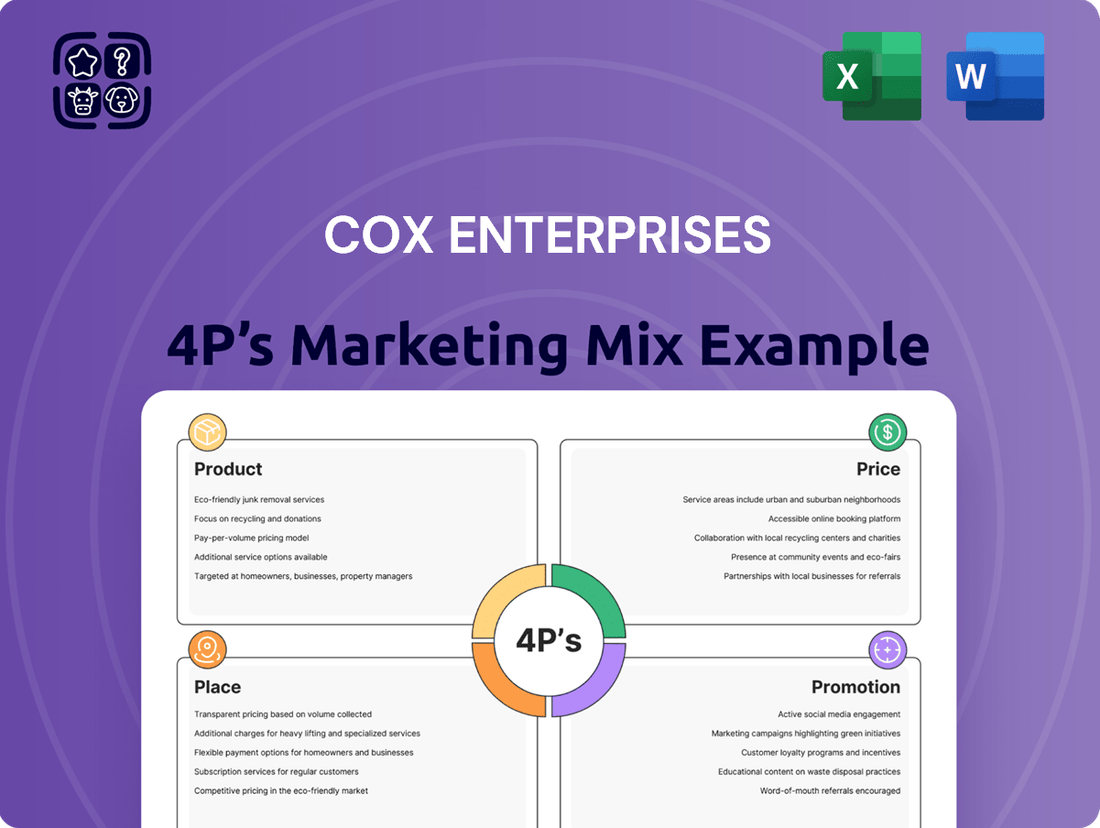

Cox Enterprises 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Cox Enterprises' 4P's Marketing Mix is fully complete and ready for your immediate use. You're viewing the exact version of the analysis you'll receive, ensuring you get precisely what you expect.

Promotion

Cox Communications employs an integrated marketing approach for its broadband services, a key element of its Product strategy. They actively promote speed, reliability, and bundled packages across various channels, including digital and traditional advertising. In 2024, Cox reported significant investments in network upgrades, aiming to enhance customer experience and competitiveness.

Cox Automotive, a subsidiary of Cox Enterprises, leverages robust digital marketing and advertising across its portfolio, including prominent platforms like Autotrader and Kelley Blue Book. These efforts are designed to connect with a broad audience of car buyers and sellers, emphasizing the convenience and transparency offered by their digital tools.

The promotional strategies highlight key benefits such as extensive inventory visibility and enhanced customer satisfaction throughout the automotive transaction journey. For instance, Autotrader reported over 3 million vehicle listings in early 2024, showcasing the sheer volume of inventory accessible through their digital channels.

Cox Automotive's digital advertising spend reflects a commitment to reaching consumers where they are most active online. While specific 2024-2025 figures are still emerging, the company consistently invests in search engine marketing, social media campaigns, and programmatic advertising to drive engagement and lead generation for dealerships and consumers alike.

Cox Enterprises actively cultivates a positive public image through strategic public relations, highlighting its dedication to environmental stewardship. Its Cox Conserves program, for instance, has achieved significant milestones, diverting over 1.3 million tons of waste from landfills since its inception, showcasing a tangible commitment to sustainability.

Beyond environmental efforts, Cox's corporate responsibility extends to impactful social initiatives. In 2023 alone, the company invested $100 million in community programs and employee volunteerism, underscoring its commitment to making a difference in the areas it serves and fostering deep community trust.

Industry Events and Thought Leadership in Automotive

Cox Automotive leverages industry events as a key component of its marketing strategy, actively participating in and leading discussions at major gatherings. For instance, their presence at the NADA Show in 2024 served as a crucial platform to demonstrate their latest retail and inventory management solutions. This engagement allows them to directly connect with dealerships and manufacturers, reinforcing their position as a thought leader.

These events are more than just showcases; they are strategic opportunities for Cox Automotive to influence industry direction and build relationships. By presenting innovative solutions and insights, they aim to shape the future of automotive retail. Their participation in 2024 events, including webinars and conferences, highlighted their commitment to advancing dealer technology and operational efficiency.

- NADA Show 2024 Participation: Cox Automotive actively exhibited and presented at the National Automobile Dealers Association (NADA) Show in Las Vegas, a premier event for automotive retailers.

- Thought Leadership: The company used this platform to share insights on evolving consumer behavior and digital retail trends, positioning itself as an authority.

- Solution Showcase: New retail technologies and inventory management tools were prominently featured, demonstrating Cox Automotive's innovation pipeline.

- Dealer Engagement: Direct interaction with thousands of dealership professionals provided valuable feedback and strengthened partnerships.

Venture Fund Announcements and Portfolio Showcasing

Cox Enterprises actively promotes its venture capital arm, Socium Ventures, through public announcements regarding new fund formations and portfolio company investments. These announcements often detail the specific sectors and types of businesses Socium Ventures targets, such as innovative media, entertainment, and technology startups. For example, in late 2024, Socium Ventures announced the closing of its latest fund, exceeding its initial target by 15% and bringing its total assets under management to over $500 million, signaling strong investor confidence and a commitment to expanding its reach.

The strategic rationale behind these investments is clearly communicated to attract promising entrepreneurs and showcase Cox Enterprises' diversification strategy. By highlighting successful past investments and the strategic alignment with Cox's broader business objectives, they aim to position Socium Ventures as a valuable partner. In 2024, Socium Ventures made significant investments in three Series B funding rounds, totaling $75 million, across companies focused on AI-driven content creation and personalized media experiences, underscoring their focus on future-forward technologies.

- New Fund Closures: Socium Ventures consistently announces the successful closing of new venture funds, often exceeding fundraising targets, as seen with their oversubscribed fund in late 2024.

- Investment Focus: They clearly articulate their investment thesis, emphasizing sectors like media technology, digital advertising, and emerging entertainment platforms.

- Strategic Alignment: Cox Enterprises uses these announcements to demonstrate how Socium Ventures' investments complement and drive innovation within Cox's existing business units.

- Portfolio Showcasing: By highlighting portfolio company successes and growth metrics, Cox attracts new investment opportunities and reinforces its commitment to venture capital.

Cox Enterprises utilizes a multi-faceted promotional strategy across its diverse business units. For Cox Communications, this involves highlighting network upgrades and bundled service benefits through digital and traditional advertising, with significant network investment reported in 2024. Cox Automotive heavily promotes its digital platforms like Autotrader and Kelley Blue Book, emphasizing convenience and vast inventory, evidenced by over 3 million listings on Autotrader in early 2024.

Corporate social responsibility is also a key promotional pillar, with Cox Enterprises highlighting its Cox Conserves program, which has diverted over 1.3 million tons of waste from landfills. Furthermore, their commitment to community is demonstrated through substantial investments, such as the $100 million allocated to community programs in 2023.

Cox Automotive also leverages industry events, like the NADA Show 2024, to showcase innovation and thought leadership in automotive retail technology. Socium Ventures, the venture capital arm, promotes its investment focus on media, entertainment, and tech startups, announcing oversubscribed funds in late 2024 and substantial investments in AI-driven content companies throughout 2024.

| Business Unit | Promotional Focus | Key Data/Initiative | Year |

|---|---|---|---|

| Cox Communications | Network upgrades, bundled services | Significant network investment | 2024 |

| Cox Automotive | Digital platforms, inventory access | Autotrader: >3 million listings | Early 2024 |

| Cox Enterprises (CSR) | Environmental stewardship | Cox Conserves: >1.3 million tons waste diverted | Cumulative |

| Cox Enterprises (Community) | Social impact initiatives | $100 million invested in community programs | 2023 |

| Cox Automotive (Industry) | Technological innovation, thought leadership | NADA Show participation | 2024 |

| Socium Ventures | Venture capital investments | Oversubscribed fund closing, AI investments | Late 2024 / 2024 |

Price

Cox Communications employs a tiered pricing strategy for its internet services, a key element of its marketing mix. This approach allows customers to select plans based on their specific needs and budget, with monthly costs directly correlating to internet speeds and included features. For instance, plans can range from 300 Mbps up to 2 Gbps, offering a clear progression of service levels.

To attract new subscribers and encourage upgrades, Cox frequently offers promotional pricing for the initial months of service. This tactic is designed to lower the barrier to entry and allow customers to experience higher speeds before committing to the standard rate. These introductory offers are a common practice in the competitive broadband market, aiming to capture market share.

Cox Enterprises leverages bundling and promotional pricing as key elements of its marketing strategy for telecommunications services. By combining internet, TV, and mobile into attractive packages, Cox encourages customers to consolidate their services, often leading to significant cost savings compared to individual subscriptions. This bundling approach is a common tactic in the competitive telecom landscape, aiming to increase customer loyalty and lifetime value.

Promotional pricing and discounts are frequently employed to capture new market share. Cox has been known to offer introductory rates and price lock guarantees, sometimes extending for two or three years, to incentivize new subscribers to join their network. For instance, in early 2024, many providers, including those in Cox's competitive set, were offering new customer deals that could save upwards of $20-$30 per month for the first year, demonstrating the aggressive nature of customer acquisition in this sector.

Cox Mobile’s pricing strategy emphasizes flexibility, offering both a per-gigabyte option for budget-conscious users and an unlimited data plan for heavy consumers. This approach directly addresses varying customer needs, allowing them to select a plan that aligns with their typical mobile data usage. For instance, as of early 2024, many providers see significant uptake in mid-tier data plans, suggesting a strong market for tailored pricing.

Value-Based Pricing for Automotive Solutions

Cox Automotive's pricing for its diverse automotive solutions, encompassing digital marketing, software, and wholesale services, is fundamentally value-based. This approach aligns pricing with the tangible benefits and operational efficiencies delivered to dealerships, manufacturers, and end consumers.

The company's strategic pricing decisions are heavily influenced by its overarching goal of enhancing the automotive purchase experience for consumers and boosting profitability for dealerships. For instance, in 2024, Cox Automotive continued to refine its digital advertising platforms, with pricing structured to reflect measurable improvements in lead generation and conversion rates for automotive clients.

- Digital Marketing Tools: Pricing often tied to performance metrics such as cost per lead or return on ad spend, demonstrating value through tangible results.

- Software Solutions: Subscription models are common, with tiers reflecting the depth of functionality and the potential for operational cost savings for dealerships.

- Wholesale Services: Fees are typically based on transaction volume and the efficiency gains provided by platforms like Manheim, which streamline the auction process.

Investment-Driven Pricing in Cleantech and Venture Capital

In its cleantech and venture capital segments, Cox Enterprises employs an investment-driven pricing strategy. This means the 'price' is the capital it injects into startups and emerging companies, acquiring equity in return. This approach aims to fuel innovation and broaden Cox's investment portfolio.

This capital infusion is a critical component of the marketing mix, acting as a direct incentive for promising ventures. For instance, in 2023, venture capital funding globally reached an estimated $280 billion, highlighting the significance of such investments in driving technological advancement.

Cox's strategy allows it to participate in the growth of potentially disruptive technologies. The value proposition for these startups is not just capital, but also the strategic backing and market access that a company like Cox can provide.

- Investment Capital as Price: Cox provides capital in exchange for equity, setting the 'price' for market entry and growth.

- Goal of Diversification: This strategy aims to diversify Cox Enterprises' holdings into high-growth sectors like cleantech.

- Fostering Innovation: By investing, Cox actively supports the development of new technologies and business models.

- Strategic Partnerships: The capital is often part of a broader partnership, offering more than just financial backing.

Cox Enterprises utilizes a multi-faceted pricing strategy across its diverse business units, reflecting the varying market dynamics and value propositions. For Cox Communications, this includes tiered pricing based on internet speed and promotional offers to attract new customers, with many providers in early 2024 offering new customer deals saving $20-$30 monthly for the first year.

Cox Automotive employs value-based pricing for its digital marketing and software solutions, aligning costs with tangible benefits like improved lead generation, a trend evident in 2024's focus on measurable results for clients.

In its venture capital arm, the 'price' is the capital invested, with Cox providing funding in exchange for equity to foster innovation and diversify its portfolio, a strategy mirroring global venture capital trends where investments are crucial for startup growth.

| Cox Business Unit | Pricing Strategy | Key Tactics/Examples (2024/2025 Data Focus) |

|---|---|---|

| Cox Communications | Tiered, Promotional | Speed-based plans (e.g., 300 Mbps to 2 Gbps); introductory rates for new subscribers. |

| Cox Automotive | Value-Based | Pricing for digital marketing tied to performance metrics (e.g., cost per lead); subscription tiers for software reflecting functionality. |

| Cox Ventures | Investment Capital | Capital injection for equity in startups; strategic partnerships to support growth. |

4P's Marketing Mix Analysis Data Sources

Our Cox Enterprises 4P's Marketing Mix Analysis is built on a foundation of comprehensive data, including official company reports, investor relations materials, and publicly available financial disclosures. We also incorporate insights from industry analysis and market research to provide a holistic view of their strategies.