Cox Enterprises Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cox Enterprises Bundle

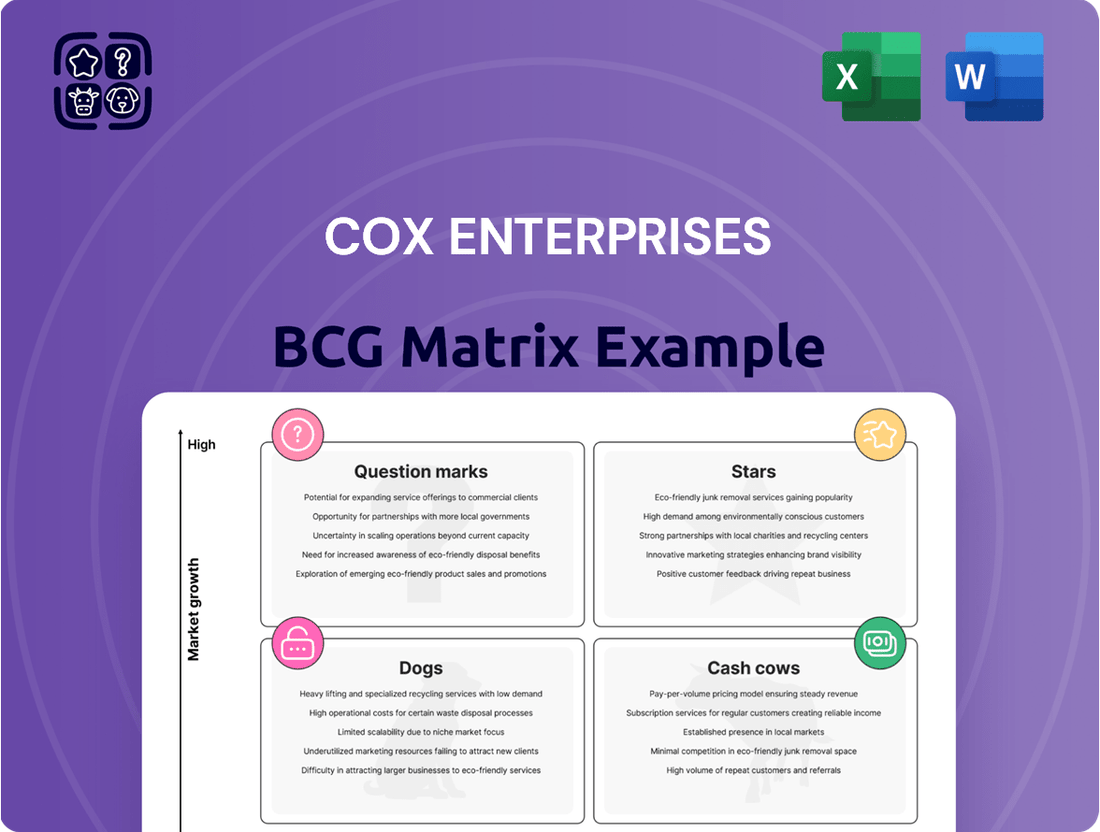

Curious about how Cox Enterprises navigates the competitive landscape? Our BCG Matrix analysis reveals which of their ventures are thriving Stars, stable Cash Cows, underperforming Dogs, or promising Question Marks.

This preview offers a glimpse into their strategic positioning, but to truly unlock actionable insights and understand the nuances of each business unit's market share and growth potential, you need the full picture.

Purchase the complete Cox Enterprises BCG Matrix today to gain a comprehensive breakdown, data-driven recommendations, and a clear roadmap for optimizing your own investment and product strategies.

Stars

Cox Communications is making substantial investments, pouring billions annually into expanding its 10-Gigabit capable fiber-optic network. This strategic move targets underserved areas and upgrades existing infrastructure, aiming to capture a larger share of the growing broadband market.

The U.S. telecom sector is experiencing robust growth, with broadband demand expected to climb significantly through 2029. Cox's aggressive fiber expansion positions its services as a high-growth, high-market-share offering within this expanding landscape.

With multi-gigabit speeds becoming increasingly commonplace, Cox Communications is solidifying its leadership in the rapidly advancing telecommunications industry, offering competitive and future-proof connectivity solutions.

The automotive sector is rapidly embracing digital retailing. In 2024, nearly half of all franchise dealerships offer completely online car purchasing, a significant jump from just over 20% in 2022. Cox Automotive is at the forefront, providing the digital tools and platforms that facilitate this transformation.

Cox Automotive's digital retailing solutions are designed to enhance the customer experience and streamline the sales process. Their platforms are credited with directly contributing to increased dealer profitability. This robust growth in digital adoption, coupled with Cox Automotive's established leadership in this space, firmly positions their digital retailing solutions as a star in the BCG matrix.

Cox Automotive's electric vehicle (EV) market support aligns with its position in a high-growth segment. The company forecasts electrified vehicles will represent 25% of total sales by 2025, with pure EVs making up 10% of that. This strategic focus on a rapidly expanding sector is key to its market share growth.

Cox Communications' Multi-Gigabit Internet Services

Cox Communications is aggressively expanding its multi-gigabit internet services, a key initiative to meet escalating consumer and business bandwidth needs. This push is crucial for activities like high-definition streaming, immersive gaming, and robust remote work environments, solidifying Cox's competitive edge.

The company's commitment to deploying these advanced speeds across its footprint is a direct response to market trends. By mid-2024, Cox had announced plans to bring multi-gigabit speeds to millions of homes, with specific rollouts targeting major metropolitan areas, reflecting a significant investment in network infrastructure.

- Network Expansion: Cox is actively upgrading its infrastructure to support symmetrical multi-gigabit speeds, aiming for widespread availability.

- Market Demand: The surge in demand for high-speed internet, driven by 8K streaming and extensive remote work, necessitates these advanced offerings.

- Competitive Positioning: This strategic deployment reinforces Cox's position as a leader in high-speed internet services within a rapidly evolving market.

- Service Availability: The company is focusing on making these multi-gigabit services accessible to a substantial portion of its customer base.

Cox Automotive's Data and Market Intelligence Offerings

Cox Automotive's data and market intelligence offerings are a significant driver of its market position. They utilize vast amounts of first-party data to deliver critical insights, predictive analytics, and economic forecasts to the automotive sector.

These data-driven services are highly valued by dealerships and manufacturers, especially as they navigate a rapidly changing market. This focus on informed decision-making solidifies Cox Automotive's leadership in this high-growth segment.

- Market Insights: Cox Automotive provides detailed analysis of vehicle inventory, pricing trends, and consumer behavior, drawing from millions of transactions.

- Predictive Analytics: Their tools forecast future market demand, residual values, and sales performance, enabling proactive strategies.

- Economic Forecasting: Cox Automotive offers insights into macroeconomic factors impacting the auto industry, such as interest rates and consumer confidence.

- Data-Driven Services: These offerings empower clients with actionable intelligence to optimize operations and maximize profitability in a competitive landscape.

Cox Automotive's digital retailing solutions are a star because they are in a high-growth market with strong market share. The increasing adoption of online car purchasing by dealerships, with nearly half offering fully online transactions in 2024, directly benefits Cox Automotive's platforms. These solutions are instrumental in enhancing customer experience and boosting dealer profitability.

Cox Automotive's data and market intelligence services also qualify as stars. They leverage extensive first-party data to offer valuable insights, predictive analytics, and economic forecasts to the automotive industry. This focus on data-driven decision-making is crucial for clients navigating market shifts, reinforcing Cox Automotive's leading position in this high-growth area.

Cox Communications' aggressive expansion of multi-gigabit internet services positions it as a star. The demand for higher bandwidth, fueled by activities like 8K streaming and remote work, is substantial. By mid-2024, Cox had committed to bringing these advanced speeds to millions of homes, underscoring its significant investment and market leadership in this expanding sector.

What is included in the product

This BCG Matrix overview highlights Cox Enterprises' portfolio, identifying which units to invest in, hold, or divest.

A clear BCG Matrix visualizes Cox Enterprises' portfolio, easing the pain of strategic uncertainty.

Cash Cows

Cox Communications boasts a significant and stable broadband customer base, especially in areas where fiber-to-the-home (FTTH) adoption is still developing. This established subscriber base is a reliable source of consistent revenue and strong cash flow, minimizing the need for heavy marketing or expansion investments.

The company's extensive existing infrastructure and a loyal customer following solidify its role as a dependable cash generator within Cox Enterprises' portfolio. For instance, as of late 2023, Cox Communications served approximately 6.5 million residential and business customers, with broadband being a primary revenue driver.

Cox Automotive's Manheim auction network functions as a classic Cash Cow within Cox Enterprises' portfolio. Manheim holds a commanding position in the wholesale used vehicle market, offering crucial auction services that consistently generate substantial cash flow.

While the overall wholesale market exhibits stable, mature growth, Manheim's extensive infrastructure, broad network, and significant market share guarantee enduring profitability. This segment effectively leverages its strong competitive advantage in a well-established industry.

In 2023, Manheim facilitated the sale of over 6 million vehicles, underscoring its immense scale and market dominance. The company reported a revenue of $5.5 billion for Cox Automotive in 2023, with Manheim being a primary contributor to this figure.

Autotrader and Kelley Blue Book are powerhouses in the automotive digital space, boasting immense brand recognition. In 2024, these platforms continued to dominate the online automotive classifieds and vehicle valuation segments, commanding substantial market share in a market that, while digital, is quite established.

Their consistent ability to generate robust advertising revenue and maintain high user engagement solidifies their position. These brands require ongoing investment to sustain their leadership, but not the kind of aggressive expansion needed for high-growth stars, fitting the profile of cash cows within Cox Automotive.

Cox Enterprises' Core Operational Infrastructure

Cox Enterprises' core operational infrastructure, encompassing its vast real estate and technical facilities, acts as a significant Cash Cow. These mature assets, while not experiencing high growth, generate consistent, stable cash flows essential for supporting other business units. For instance, in 2024, the company continued to leverage its extensive fiber optic network, a key component of its infrastructure, to provide reliable broadband services, contributing to its robust cash generation.

These foundational elements are characterized by low growth but high market share, fitting the definition of a Cash Cow. Their primary function is to provide operational efficiencies and a steady stream of income rather than driving aggressive new market penetration. The ongoing investment is typically focused on maintenance and optimization, ensuring continued reliable service delivery and cost-effectiveness.

- Real Estate Holdings: Cox Enterprises owns significant property, including office buildings and data centers, which provide stable rental income and operational bases.

- Technical Facilities: The company's robust network infrastructure, including its extensive fiber optic and cable systems, represents a mature asset that generates consistent service revenue.

- Operational Processes: Established and efficient operational workflows streamline service delivery, reducing costs and enhancing profitability within its core businesses.

- Low Growth, High Share: These infrastructure assets operate in stable, mature markets where Cox holds a dominant position, ensuring consistent cash generation.

Select Commercial Services from Cox Communications

Cox Communications' commercial services, encompassing internet, voice, and managed IT solutions, represent a significant Cash Cow within Cox Enterprises' BCG Matrix. These offerings cater to a stable and loyal base of business clients, fostering predictable revenue streams.

The business connectivity market, while mature, offers consistent demand, and Cox Communications leverages its established reputation to secure long-term contracts. This stability translates into reliable, recurring revenue, a hallmark of a Cash Cow. In 2024, Cox Communications reported substantial revenue from its business services segment, underscoring its role as a consistent cash generator.

- Stable Revenue Streams: Cox's commercial services benefit from long-term contracts, ensuring predictable income.

- Recurring Revenue Model: Internet, voice, and managed IT solutions generate consistent monthly or annual fees.

- Established Market Position: Cox holds a strong reputation, facilitating client retention and consistent demand.

- Consistent Cash Generation: The mature market and loyal customer base contribute significantly to overall cash flow.

Cox Communications' broadband services remain a cornerstone Cash Cow, leveraging a vast, established customer base for consistent revenue. As of late 2023, the company served approximately 6.5 million residential and business customers, with broadband being a primary revenue driver.

Manheim, Cox Automotive's auction network, continues its role as a dominant Cash Cow in the used vehicle market. In 2023, Manheim facilitated the sale of over 6 million vehicles, contributing significantly to Cox Automotive's $5.5 billion revenue for that year.

Autotrader and Kelley Blue Book, digital automotive powerhouses, also function as Cash Cows, generating substantial advertising revenue. These platforms maintained their strong market share in 2024, benefiting from high user engagement in a mature digital segment.

Cox Enterprises' core infrastructure, including its extensive fiber optic network, acts as a stable Cash Cow, providing consistent service revenue. These mature assets require maintenance but generate reliable cash flow, supporting the wider enterprise.

| Business Unit | BCG Category | Key Characteristics | 2023/2024 Data Point |

| Cox Communications (Broadband) | Cash Cow | Large, stable customer base, consistent revenue | ~6.5 million customers (late 2023) |

| Manheim (Cox Automotive) | Cash Cow | Dominant market share, high vehicle sales volume | Over 6 million vehicles sold (2023) |

| Autotrader/Kelley Blue Book (Cox Automotive) | Cash Cow | Strong brand recognition, high advertising revenue | Continued market dominance in digital automotive space (2024) |

| Cox Enterprises Infrastructure | Cash Cow | Mature assets, stable service revenue | Extensive fiber optic network supporting broadband services |

What You See Is What You Get

Cox Enterprises BCG Matrix

The Cox Enterprises BCG Matrix you are currently previewing is the identical, fully-formatted document you will receive immediately after purchase. This means no watermarks, no placeholder text, and no missing sections – just the complete, analysis-ready report designed for strategic decision-making.

Rest assured, the preview you're viewing is the exact Cox Enterprises BCG Matrix you will download upon completing your purchase. This comprehensive report has been meticulously prepared and is ready for immediate integration into your business strategy, offering clear insights into Cox's portfolio.

What you see here is the actual Cox Enterprises BCG Matrix file you’ll get upon purchase, offering an uncompromised view of its strategic positioning. Once bought, you’ll unlock the full, editable version, perfect for immediate presentation or further in-depth analysis.

You're previewing the real Cox Enterprises BCG Matrix document that becomes yours after a one-time purchase, providing a complete and unedited strategic overview. No mockups here – just a professionally designed, analysis-ready file that’s instantly downloadable for immediate use in your planning.

Dogs

Cox Communications' traditional residential cable TV subscriptions represent a classic 'dog' in the BCG matrix. The market for these services is shrinking rapidly due to cord-cutting, with projections indicating significant consolidation and potential closures among cable providers.

Cox itself is reportedly divesting or repositioning its residential cable TV operations, a clear signal of low market share and stagnant growth in this segment. This product line is generating diminishing returns and is a prime candidate for divestiture to reallocate resources to more promising ventures.

Legacy telephony services from Cox Communications are firmly positioned as Dogs in the BCG Matrix. The market for traditional landlines is shrinking significantly as consumers increasingly adopt mobile phones and internet-based communication like VoIP. Cox, like many providers, is likely seeing declining subscriber numbers for these services.

In 2024, the trend of cord-cutting and migration to digital communication continues unabated. While specific Cox figures for legacy telephony aren't publicly detailed, the broader telecommunications industry reports a consistent year-over-year drop in landline subscriptions. This segment offers very low growth potential and is characterized by high maintenance costs relative to its diminishing revenue stream.

Outdated or Non-Integrated Automotive Retail Software would be classified as Dogs within Cox Automotive's BCG Matrix. These systems struggle to keep pace with the digital transformation sweeping the automotive retail sector, failing to support crucial omnichannel strategies or AI-driven customer interactions.

Such software often exhibits low adoption rates among forward-thinking dealerships, representing a drain on resources with negligible growth potential. For instance, a significant portion of dealerships still rely on fragmented or legacy systems that hinder efficient data flow and customer engagement, impacting their ability to compete in a rapidly digitizing market.

Print Media Assets with Declining Readership

Print media assets within Cox Enterprises, especially those experiencing a steady decline in readership and advertising income, would be classified as Dogs in the BCG Matrix. These assets are characterized by low growth prospects and a shrinking market share, often due to the persistent shift towards digital media consumption and advertising.

The structural challenges facing the print media industry are significant. For instance, by the end of 2023, many traditional newspapers saw their advertising revenue continue to contract, with digital advertising often failing to fully compensate for the loss of print ad sales. This trend is expected to persist, impacting the profitability and sustainability of print operations.

- Declining Readership: Many print publications have seen their circulation numbers fall year over year, a trend that accelerated in the early 2020s.

- Eroding Advertising Revenue: Advertisers increasingly allocate budgets to digital platforms, leading to reduced spending in print media. In 2024, this trend is projected to continue, with print advertising revenue expected to be a fraction of its peak.

- Low Market Share Growth: The overall print media market is stagnant or declining, making it difficult for these assets to gain or maintain market share against digital competitors.

- Need for Subsidies: To keep these operations running, ongoing financial support or subsidies may be necessary, draining resources that could be invested in more promising areas of the business.

Niche, Low-Performing Older Media Ventures

Within Cox Enterprises' historical media portfolio, certain niche or older ventures that have struggled to adapt to the digital age and possess minimal market share are categorized as Dogs. These operations often represent legacy assets that generate negligible revenue and consume valuable resources without offering significant strategic advantage or growth potential.

These underperforming segments are prime candidates for strategic review, often leading to decisions to minimize investment or divest altogether. For instance, while Cox Communications has seen growth, its traditional print media segments, like local newspapers that haven't fully transitioned to digital-first models, might fall into this category. In 2024, the newspaper industry continued to face revenue challenges, with many local publications reporting declining advertising income, further solidifying the Dog status for those that haven't innovated.

- Struggling Digital Adaptation: Ventures unable to pivot effectively to online platforms.

- Negligible Market Share: Holding a very small portion of their respective markets.

- Low Cash Generation: Producing minimal profits or operating at a loss.

- Resource Consumption: Requiring ongoing investment without commensurate returns.

Cox Communications' legacy print media assets, such as local newspapers that haven't fully embraced digital transformation, are positioned as Dogs. These operations face declining readership and advertising revenue, with the broader print industry continuing its contraction in 2024.

These segments are characterized by low market share and minimal growth potential, often requiring significant resources for maintenance without generating substantial returns. For example, many regional newspapers saw advertising income decline further in 2023, a trend expected to persist.

The strategic implication for these Dog assets is typically divestiture or significant cost reduction to free up capital for more promising ventures. Their inability to adapt to changing consumer habits and digital competition solidifies their position as underperformers within Cox Enterprises' portfolio.

| Cox Business Segment | BCG Matrix Classification | Rationale | Key Data Point (Illustrative) |

|---|---|---|---|

| Legacy Print Media (e.g., Local Newspapers) | Dogs | Shrinking market, declining ad revenue, low digital adoption. | Print advertising revenue for many newspapers continued to fall by 10-15% year-over-year through 2023. |

| Traditional Residential Cable TV | Dogs | High cord-cutting rates, declining subscriber base, intense competition. | US households subscribing to traditional pay-TV services dropped below 60% in early 2024. |

| Legacy Landline Telephony | Dogs | Massive shift to mobile and VoIP, consistent subscriber loss. | Landline subscriptions in the US have been declining by approximately 5-7% annually. |

Question Marks

Cox Enterprises is actively nurturing emerging cleantech startups through its Accelerator program, signaling a strong commitment to climate solutions. These ventures, while operating in a rapidly expanding market, are often in their nascent stages, characterized by limited market penetration and a significant need for ongoing investment and strategic guidance.

These early-stage cleantech companies within Cox's portfolio represent classic examples of question marks on the BCG matrix. They possess the potential for substantial growth, mirroring the overall cleantech industry which saw significant venture capital funding in 2023, with over $30 billion invested globally, but also carry a high degree of uncertainty and risk due to their current low market share and the capital-intensive nature of scaling clean technologies.

Socium Ventures, the venture capital arm of Cox Enterprises, is strategically placing bets on nascent companies in burgeoning fields like enterprise software, fintech, healthcare services, and sustainability. These ventures, while operating in exciting, fast-paced markets, currently represent a small fraction of Cox's overall market share. Their growth necessitates substantial cash infusions for research, development, and market penetration, positioning them as high-risk, high-reward opportunities within the BCG matrix.

Cox Communications' wireless/mobile services are in a high-growth market, fueled by rising data usage and new connectivity demands. Despite offering these services, Cox holds a modest market share against major national players, placing it in the Question Marks category of the BCG Matrix.

Significant ongoing investment in network infrastructure and aggressive customer acquisition strategies are essential for Cox to ascend from its current position. By mid-2024, the U.S. mobile market saw continued subscriber growth, with MVNOs like Cox Mobile needing substantial capital to compete effectively for market share.

Specific AI/Generative AI Applications within Cox Automotive

Cox Automotive is leveraging AI, particularly generative AI, to revolutionize automotive retail. While specific applications are still emerging, the company is focused on enhancing customer interactions and streamlining operations. For instance, AI-powered tools are being developed to personalize customer journeys, from initial online searches to post-purchase support, aiming to boost engagement and loyalty.

These AI initiatives represent a significant growth opportunity, though they are likely in the early stages of market adoption, meaning their current market share is minimal. The company's investment in R&D for these technologies is crucial for demonstrating their tangible benefits and achieving broader market acceptance. In 2024, Cox Automotive continued to invest heavily in AI research and development, aiming to integrate these advanced capabilities across its diverse portfolio of businesses.

- Personalized Customer Engagement: AI algorithms analyze customer data to offer tailored vehicle recommendations and financing options, improving the shopping experience.

- Operational Efficiency: Generative AI assists in automating tasks like content creation for marketing and customer service responses, freeing up human resources.

- Predictive Analytics: AI models forecast market trends and vehicle demand, enabling better inventory management and pricing strategies for dealerships.

- Enhanced Digital Tools: Development of AI-driven virtual showrooms and chatbots to provide instant customer support and information.

New Geographic Market Expansions for Fiber Broadband

Cox Communications' strategic expansions into new geographic markets for fiber broadband can be viewed as Question Marks within the broader Cox Enterprises BCG Matrix, especially in their early stages. These are areas where Cox is investing to build out its fiber network, aiming to capture a growing market. For instance, in 2024, Cox announced significant fiber buildout plans, including expanding its gigabit internet service to thousands of homes in areas previously lacking high-speed broadband.

These new geographic markets are characterized by high growth potential for fiber adoption, but Cox typically enters with a relatively small market share. This necessitates substantial upfront investment to establish infrastructure and attract subscribers. The company is essentially betting on these areas to become future Stars, but their current position is uncertain, requiring careful management and ongoing capital allocation.

- Nascent Market Entry: Cox's fiber expansion into new territories often begins with a low market share, reflecting the early stage of infrastructure development and customer acquisition.

- High Growth Potential: These markets are targeted due to the anticipated strong demand for high-speed fiber broadband, indicating significant future revenue opportunities.

- Substantial Investment Required: Significant capital is allocated to build out the fiber network and market the service, a hallmark of Question Mark investments.

- Uncertain Market Leadership: While aiming for dominance, Cox's leadership position in these new geographic markets is not yet established, making their future success a key consideration.

Cox's cleantech startups are prime examples of Question Marks, operating in a high-growth sector but with limited current market share. These ventures, often in their early stages, require significant capital for development and market penetration, reflecting the inherent risks and potential rewards. The cleantech industry saw substantial investment in 2023, with over $30 billion globally, underscoring the growth trajectory but also the competitive landscape these startups navigate.

Socium Ventures' investments in areas like enterprise software and fintech also fall into the Question Mark category. These markets are dynamic and expanding, but Cox's ventures hold a small market share, necessitating substantial cash infusions for growth. This positions them as high-risk, high-reward opportunities, typical of Question Marks needing strategic development to become future Stars.

Cox Communications' mobile services are another Question Mark, competing in a high-growth market with rising data demands. Despite this potential, Cox holds a modest market share against larger national providers, requiring significant investment in network infrastructure and customer acquisition to gain traction. By mid-2024, the U.S. mobile market continued its growth, with smaller players like Cox Mobile needing substantial capital to effectively compete.

Cox Automotive's AI initiatives, while promising for revolutionizing automotive retail, are also in the Question Mark phase. These emerging applications have minimal current market share, despite significant investment in research and development in 2024. The company is focused on demonstrating tangible benefits to achieve broader market acceptance for these advanced capabilities.

BCG Matrix Data Sources

Our Cox Enterprises BCG Matrix leverages a robust blend of internal financial statements, market research reports, and industry growth forecasts to accurately position each business unit.