Covia SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Covia Bundle

Covia's SWOT analysis reveals a company with significant market presence and a strong product portfolio, but also highlights potential challenges in a dynamic industry. Understanding these internal capabilities and external pressures is crucial for anyone looking to invest or strategize within this sector.

Want the full story behind Covia's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Covia, now integrated into SCR-Sibelco NV, has showcased a remarkable financial recovery and consistent growth following its bankruptcy. Sibelco's 2024 financial results underscore this strength, with a 5.7% revenue increase to €2,225 million and a significant 13.8% jump in EBITDA to €471 million.

This upward trajectory translates to an impressive compound annual growth rate exceeding 23% in EBITDA between 2020 and 2024. Such performance is a clear indicator of successful post-restructuring strategies and enhanced operational efficiency.

Sibelco boasts a diversified product portfolio encompassing essential industrial minerals like silica, clays, and feldspars. This breadth allows them to serve a wide spectrum of industrial and energy markets, from glass and ceramics to foundry and construction. For instance, in 2024, Sibelco reported significant contributions from its silica segment, which saw robust demand in the electronics and solar industries, underpinning its market resilience.

Covia's global reach is substantial, with operations at around 230 sites across more than 40 countries, demonstrating a broad international footprint.

The acquisition of Strategic Materials Inc. (SMI) in June 2024 was a pivotal move, integrating North America's leading glass recycler into Covia's portfolio.

This acquisition not only bolstered Covia's presence in the North American glass recycling market but also reinforced its already robust mineral platform, enhancing its competitive position.

Commitment to Sustainability & ESG Initiatives

Covia, through its parent company Sibelco, demonstrates a strong commitment to sustainability and ESG initiatives. Sibelco has set clear 2025 sustainability priorities aligned with the UN's Sustainable Development Goals, focusing on reducing CO2 emissions, optimizing water usage, and strengthening community relationships.

This proactive stance on environmental and social governance is a significant strength. It not only bolsters Covia's brand image among increasingly eco-conscious consumers and investors but also positions the company favorably to attract business from clients who prioritize sustainability in their supply chains. For instance, Sibelco aims for a 25% reduction in Scope 1 and 2 CO2 emissions by 2030 compared to a 2019 baseline, a target that demonstrates tangible progress in their environmental stewardship.

- Alignment with UN SDGs: Sibelco's sustainability framework directly addresses global environmental and social challenges.

- Tangible Emission Reduction Targets: The company has set specific goals for CO2 reduction, such as the 25% reduction by 2030.

- Enhanced Brand Reputation: Proactive ESG practices improve public perception and stakeholder trust.

- Attraction of ESG-Conscious Clients: A strong sustainability record appeals to businesses with similar values, potentially leading to new partnerships and market opportunities.

Focus on Innovation and Material Solutions

Covia's strategic pivot towards innovation is a significant strength, aiming to transform from a basic industrial mineral supplier into a developer of advanced material solutions. This forward-thinking approach is underscored by a commitment to commercialize at least one new product each year from its robust innovation pipeline between 2020 and 2025.

This dedication to technology and innovation directly enhances customer satisfaction by providing customized solutions. It also strategically positions Covia to lead in markets that are rapidly evolving and demanding more sophisticated material offerings.

- Innovation Pipeline: Covia targets annual commercialization of new products from its innovation pipeline through 2025.

- Business Model Transformation: Shifting from industrial minerals to advanced material solutions.

- Customer-Centric Solutions: Tailoring offerings to meet specific client needs through technological advancement.

- Market Leadership: Positioning the company at the forefront of evolving market demands through R&D.

Covia's integration into Sibelco has resulted in a strong financial recovery, evidenced by Sibelco's 2024 revenue of €2,225 million, a 5.7% increase year-over-year, and an EBITDA of €471 million, up 13.8%. This performance reflects a successful post-bankruptcy strategy and enhanced operational efficiency, with EBITDA growing over 23% annually from 2020 to 2024.

The company benefits from a diversified product portfolio, including silica, clays, and feldspars, serving numerous industrial and energy sectors. The strategic acquisition of Strategic Materials Inc. in June 2024 further solidified its market position, particularly in North American glass recycling.

Covia, through Sibelco, demonstrates a robust commitment to sustainability, aiming for a 25% reduction in Scope 1 and 2 CO2 emissions by 2030 against a 2019 baseline, aligning with UN SDGs.

Furthermore, Covia's focus on innovation, with a goal to commercialize at least one new product annually through 2025, positions it as a developer of advanced material solutions, enhancing customer satisfaction and market leadership.

What is included in the product

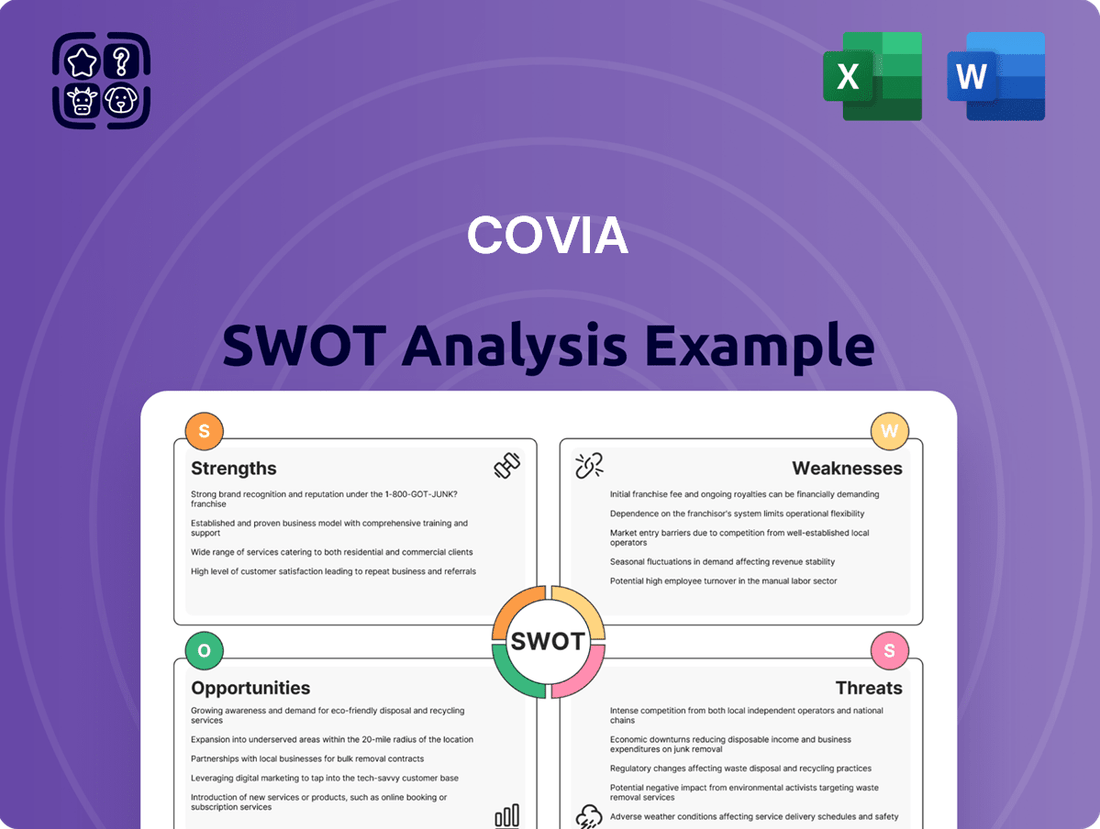

Analyzes Covia’s competitive position through key internal and external factors, identifying strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic challenges, transforming potential weaknesses into opportunities.

Weaknesses

Covia's reliance on cyclical industries like construction and energy presents a significant weakness. These sectors are prone to economic downturns, directly impacting demand for Covia's products. For instance, Sibelco, a related entity, noted weak construction markets in Europe during 2024 and a sharp decline in its US high purity quartz business, which is tied to the photovoltaic sector.

Covia's historical reliance on proppants for the oil and gas sector creates a significant vulnerability to energy market swings. For instance, during periods of low crude oil prices, such as the downturns seen in 2020, exploration and production activities often decrease, directly impacting the demand for proppants and consequently Covia's revenue streams. This inherent link to the volatile energy sector means the company's financial performance is closely tied to the unpredictable global energy landscape.

Covia's operations, particularly those situated in areas susceptible to extreme weather, face significant risks from natural disasters. This vulnerability was highlighted by Hurricane Helene in the fourth quarter of 2024, which caused substantial disruptions to Sibelco's high purity quartz facilities in the United States.

These natural events can trigger immediate production stoppages, create extensive supply chain interruptions, and ultimately drive up operational expenses for the company. The financial implications of such disruptions can be considerable, impacting revenue and profitability.

Increasing Regulatory Scrutiny on Mining

Covia, like others in the industrial minerals sector, faces growing global regulatory pressure. This includes stricter rules on environmental impact assessments, emissions, and water usage, directly affecting operations. For instance, in 2024, several jurisdictions announced enhanced compliance requirements for mining operations, potentially increasing capital expenditure needs for Covia to meet these standards.

These evolving environmental regulations can translate into higher operational costs for Covia. Adapting to new technologies and stricter management practices for aspects like water stewardship and emission controls requires significant investment. This increased cost burden can impact profitability and competitiveness within the industrial minerals market.

- Heightened compliance costs: Evolving environmental standards can necessitate substantial capital outlays for Covia to upgrade facilities and technologies.

- Potential production limitations: Stricter regulations, particularly concerning water management and emissions in silica sand extraction, could lead to constraints on production volumes.

- Increased operational complexity: Navigating a patchwork of global environmental regulations adds layers of complexity to Covia's operational planning and execution.

Dependence on Raw Material Availability and Quality

Covia's operations are significantly tied to the availability and quality of its mineral reserves, especially for niche markets requiring specific purity levels. The company faces a hurdle as high-purity silica sand deposits, crucial for certain applications, are becoming scarcer in some operational areas. This scarcity could drive up procurement expenses or necessitate investment in more challenging extraction sites.

Maintaining a steady supply of raw materials that meet stringent quality standards is paramount for Covia's production efficiency and its standing in the market. For instance, in 2023, the company's reliance on specific silica sand grades meant that regional supply disruptions could directly impact its ability to fulfill customer orders, particularly in the glass and foundry sectors.

- Resource Depletion: High-purity silica sand reserves are finite, and their depletion in key sourcing regions presents a long-term challenge.

- Quality Consistency: Ensuring uniform quality across different mining sites is vital for meeting diverse customer specifications.

- Sourcing Costs: As easily accessible, high-quality reserves diminish, the cost of acquiring suitable raw materials is likely to increase.

Covia's dependence on construction and energy markets makes it susceptible to economic downturns. For example, Sibelco, a related entity, reported weak construction markets in Europe during 2024 and a decline in its US high purity quartz business, impacting demand for Covia's products.

The company's historical reliance on proppants for oil and gas exposes it to energy market volatility. A significant drop in crude oil prices, like those seen in 2020, directly reduces exploration and production activities, thus lowering demand for proppants and Covia's revenue.

Operations in weather-prone areas face disruption from natural disasters. Hurricane Helene in Q4 2024 disrupted Sibelco's US high purity quartz facilities, leading to production stoppages and increased operational costs.

Increasing global regulatory pressure, especially concerning environmental impact, adds to operational costs. In 2024, new compliance requirements in various jurisdictions could necessitate capital expenditures for Covia to meet standards.

The scarcity of high-purity silica sand reserves is a growing concern. In 2023, regional supply disruptions for specific silica sand grades impacted Covia's ability to fulfill orders, particularly for the glass and foundry sectors.

Same Document Delivered

Covia SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use.

The content below is pulled directly from the final Covia SWOT analysis. Unlock the full report when you purchase.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

The global fracking proppants market is set for robust growth, anticipated to reach USD 121,574 million by 2025. This expansion, driven by a projected compound annual growth rate of 10.97% through 2033, presents a significant opportunity for Covia.

This market surge is fueled by the increasing need for unconventional oil and gas extraction methods, directly benefiting companies like Covia that supply essential proppant materials. The sustained global demand for energy ensures a consistent market for these products.

The global construction aggregates market is a significant growth area, expected to expand from USD 444.7 billion in 2024 to USD 796.3 billion by 2034, reflecting a compound annual growth rate of 6.1%. This robust expansion is fueled by increasing urbanization and substantial government investment in infrastructure development across the globe. The consistent demand for essential materials like sand, gravel, and crushed stone positions this sector as a stable and attractive opportunity.

The booming renewable energy sector, especially the manufacturing of photovoltaic solar panels, is a significant new demand driver for high-purity silica sand. In 2024, global solar capacity additions were projected to reach over 400 GW, a substantial increase from previous years, directly benefiting suppliers of essential raw materials like silica.

Beyond solar, the growth in specialty glass production for electronics and advanced materials also presents promising avenues for diversification. This expansion into green technologies and niche markets is well-aligned with the increasing global emphasis on sustainability and environmental responsibility, opening up fresh revenue streams.

Leveraging Digital Transformation and AI in Mining

The mining sector is embracing digital transformation, with AI in Mining and Natural Resources Market projected to hit USD 20.3 billion by 2031. Covia can capitalize on this by integrating AI, automation, and real-time monitoring to boost efficiency and safety.

These advanced technologies offer a clear path to optimizing resource extraction and achieving significant cost reductions. For instance, predictive maintenance alone can prevent costly equipment failures, directly impacting the bottom line.

- Enhanced Operational Efficiency: Implementing AI for process optimization and automation can streamline mining operations.

- Improved Safety Standards: Automation and real-time monitoring reduce human exposure to hazardous environments.

- Optimized Resource Extraction: AI-driven analytics can identify richer deposits and improve yield.

- Cost Reduction: Predictive maintenance and optimized energy usage contribute to lower operating expenses.

Growth in Circular Economy and Recycled Materials

Covia can leverage the expanding circular economy, particularly in North America. The increasing demand for recycled glass, driven by sustainability initiatives, presents a significant opportunity. For instance, the U.S. Environmental Protection Agency (EPA) reported in 2024 that glass recycling rates continue to climb, with manufacturers actively seeking recycled content to meet environmental, social, and governance (ESG) goals.

This trend directly benefits Covia by creating new markets for its processed materials. The strategic acquisition of Strategic Materials Inc. by Sibelco, a major player in the materials sector, highlights this market potential. This move positions Sibelco, and by extension Covia's competitive landscape, to benefit from the growing preference for recycled inputs across various industries, including construction and manufacturing.

- Expanding Market Demand: Growing consumer and industrial preference for products made with recycled content.

- Regulatory Support: Increased government policies and incentives promoting circular economy practices and waste reduction.

- Cost Advantages: Recycled materials can often be more cost-effective than virgin resources, improving margins.

- Enhanced Brand Image: Demonstrating commitment to sustainability through the use of recycled materials can boost brand reputation.

Covia is well-positioned to benefit from the expanding global fracking proppants market, which is projected to reach USD 121,574 million by 2025, with a strong CAGR of 10.97% through 2033. The construction aggregates market also presents a substantial opportunity, expected to grow from USD 444.7 billion in 2024 to USD 796.3 billion by 2034, driven by global infrastructure development. Furthermore, the burgeoning renewable energy sector, particularly solar panel manufacturing, creates new demand for high-purity silica sand, with global solar capacity additions exceeding 400 GW in 2024.

The company can also capitalize on the growing circular economy, especially in North America, where recycled glass demand is rising due to sustainability initiatives. Covia can leverage digital transformation in mining, with the AI in Mining market projected to reach USD 20.3 billion by 2031, to enhance operational efficiency and safety.

| Market Segment | 2024 Data/Projection | Growth Driver |

|---|---|---|

| Fracking Proppants | Market to reach USD 121,574 million by 2025; 10.97% CAGR through 2033 | Increased unconventional oil and gas extraction |

| Construction Aggregates | USD 444.7 billion in 2024; projected to reach USD 796.3 billion by 2034 (6.1% CAGR) | Urbanization and infrastructure investment |

| Solar Panel Manufacturing (Silica Sand) | Global solar capacity additions > 400 GW in 2024 | Renewable energy expansion |

| AI in Mining | Market projected to reach USD 20.3 billion by 2031 | Digital transformation for efficiency and safety |

| Circular Economy (Recycled Glass) | Increasing demand driven by ESG goals | Sustainability initiatives and corporate responsibility |

Threats

Fluctuations in global oil and natural gas prices present a substantial threat to Covia. For instance, in early 2024, Brent crude oil prices experienced volatility, trading in a range that impacted upstream investment decisions. These price swings directly influence exploration and production spending, which in turn affects the demand for proppants, a key component of Covia's business.

Unpredictable price movements in the energy sector can cause sudden shifts in market demand for proppant solutions. This unpredictability can lead to revenue instability for Covia, as companies in the exploration and production sector may scale back or accelerate their activities based on perceived future energy prices. For example, a sharp decline in oil prices during 2023 led to reduced drilling activity in some regions, directly impacting proppant suppliers.

Covia, like many in the mining and industrial minerals sector, faces a growing wave of tougher environmental rules worldwide. This means more detailed checks on how operations affect the environment, tighter limits on what can be released into the air and water, and better ways to handle waste. For instance, in 2024, many regions saw updated regulations on dust control and water discharge quality, impacting mining sites directly.

Meeting these evolving legal standards is not cheap. It often requires substantial investments in new technology and equipment to ensure compliance, which can significantly raise operating expenses. Covia's capital expenditure plans in 2024 included an estimated $15 million allocated specifically to environmental upgrades across its key facilities to meet new emissions standards.

Furthermore, these stricter regulations can put a damper on growth. They might limit where new mines can be opened or even force changes to how existing operations are run, potentially affecting output and profitability. The challenge lies in balancing necessary environmental stewardship with the need for operational efficiency and future development.

Covia, now integrated with Sibelco, faces formidable competition in the industrial minerals sector from giants like Imerys and U.S. Silica. These established players, along with emerging Asian competitors, create a dynamic and challenging market environment.

This intense rivalry can result in significant pricing pressures, potentially impacting Covia's profitability and market share. For instance, the global industrial minerals market, valued at approximately $250 billion in 2023, is characterized by intense competition across various segments.

To counter this, Covia must consistently invest in innovation and operational efficiency to maintain its competitive standing. The need for differentiation and cost leadership is paramount in securing and expanding its market position against well-resourced rivals.

Supply Chain Disruptions and Rising Logistics Costs

The transportation of bulk materials like industrial sand and aggregates, crucial for Covia's operations, faces significant headwinds from escalating fuel prices and ongoing logistical complexities. These factors directly translate into higher operating expenses and can lead to extended delivery schedules.

For instance, the U.S. average on-highway diesel fuel price hovered around $4.00 per gallon in early 2024, a notable increase from previous years, directly impacting freight costs. Such elevated transportation expenses can erode profit margins and diminish overall operational efficiency, especially for a company with a broad, international reach.

- Rising Fuel Prices: Global oil market volatility directly increases transportation costs for bulk materials.

- Logistical Bottlenecks: Port congestion and labor shortages continue to create delays and add expenses.

- Impact on Profitability: Higher freight expenses can reduce net income and competitive pricing power.

Geopolitical Risks and Trade Policies

Global geopolitical instability remains a significant threat to Covia, as evidenced by ongoing conflicts and shifting alliances that can disrupt international trade. For instance, the ongoing trade tensions between major economic blocs could lead to new tariffs or export restrictions on critical minerals, directly impacting Covia's ability to source materials and sell its products globally.

Changes in international trade policies, such as increased royalties or import duties imposed by governments on extracted resources, present a direct financial risk. These policy shifts can alter the economic viability of mining operations and international sales channels, potentially reducing profitability and market access for Covia's diverse product offerings.

- Supply Chain Disruptions: Geopolitical events can sever critical links in the supply chain, delaying or preventing the delivery of essential raw materials and finished goods.

- Market Access Limitations: New trade barriers or sanctions can restrict Covia's access to key international markets, impacting sales volume and revenue.

- Increased Operational Costs: Tariffs, export restrictions, and higher royalties directly increase the cost of doing business, squeezing profit margins.

- Uncertainty in Long-Term Planning: The unpredictable nature of geopolitical shifts makes it challenging for Covia to forecast demand and plan long-term investments effectively.

Intensifying competition from both established players and emerging international firms poses a significant threat, potentially leading to price wars and market share erosion. Covia must navigate a landscape where rivals like Imerys and U.S. Silica are also investing in innovation and efficiency to maintain their edge.

The company's reliance on transportation for its bulk materials exposes it to the volatility of fuel prices and logistical challenges. For instance, average diesel prices in early 2024 remained elevated, directly impacting freight costs and potentially reducing profit margins.

Stricter environmental regulations globally necessitate ongoing investment in compliance technologies, increasing operational costs. Covia's 2024 capital expenditure included an estimated $15 million for environmental upgrades, highlighting the financial burden of meeting evolving standards.

Geopolitical instability can disrupt supply chains and market access, leading to increased operational costs through tariffs or export restrictions. The unpredictable nature of global events makes long-term planning and demand forecasting particularly challenging for Covia.

SWOT Analysis Data Sources

This Covia SWOT analysis is built upon a foundation of robust data, including publicly available financial reports, comprehensive market intelligence, and insights from industry experts and analysts to ensure a well-rounded and accurate assessment.