Covia Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Covia Bundle

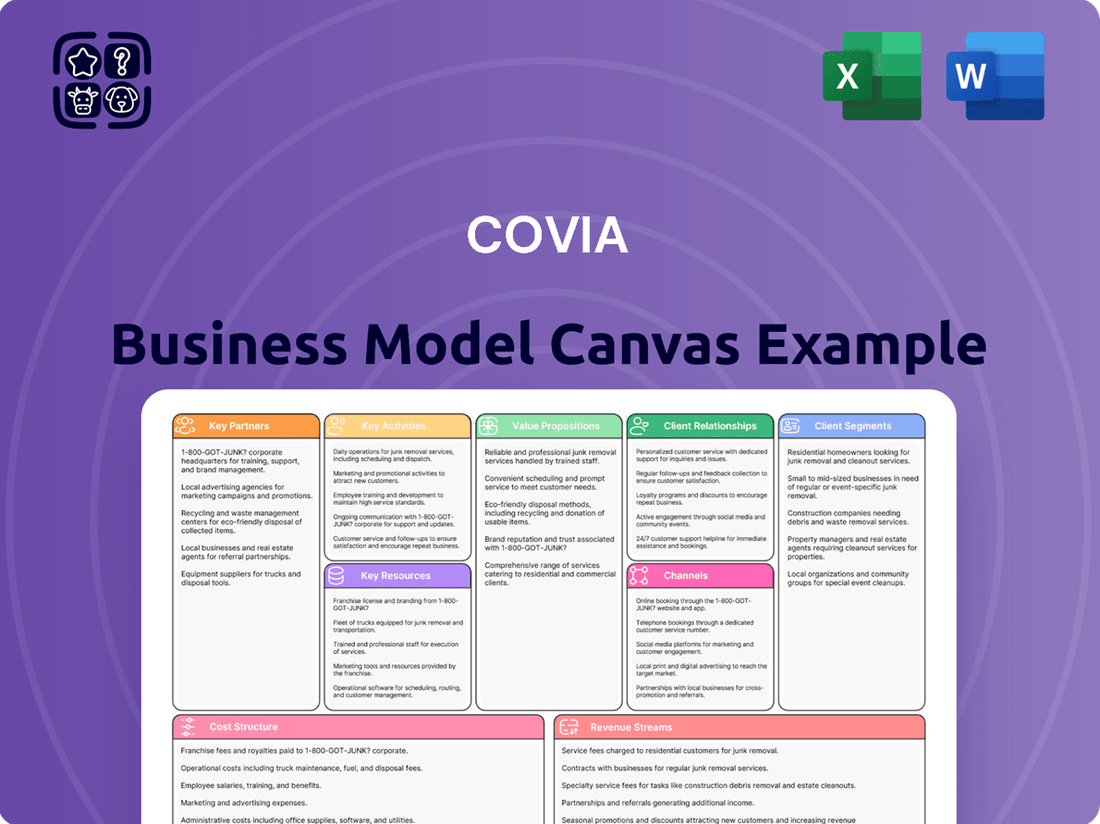

Curious about how Covia navigates the industrial minerals market? Our comprehensive Business Model Canvas breaks down their customer segments, value propositions, and revenue streams, offering a clear roadmap to their success. Discover the strategic framework that drives their operations and gain actionable insights for your own ventures.

Partnerships

Covia, a significant player in mining and processing, would forge essential partnerships with makers of heavy mining gear, processing equipment, and specialized industrial tools. These alliances guarantee access to the newest technology, dependable machinery, and prompt repair services, all critical for smooth, uninterrupted operations.

These collaborations often include extended agreements and joint development projects aimed at boosting efficiency and minimizing operational delays. For instance, in 2024, major mining firms reported that strategic equipment supplier relationships reduced unscheduled downtime by an average of 15%, directly impacting productivity.

Covia’s reliance on logistics and transportation providers is critical, given the bulk nature of its sand and mineral products. Partnerships with rail, truck, barge, and port operators are indispensable for moving raw materials from mines to processing plants and finished goods to customers. For instance, in 2024, the U.S. Class I railroads transported approximately 1.4 billion tons of freight, highlighting the sheer volume these partners handle.

These alliances directly impact Covia’s ability to operate efficiently and cost-effectively. By securing reliable transportation, Covia ensures timely deliveries, which is crucial for maintaining customer satisfaction and competitive pricing. In 2023, the average cost of trucking a ton of goods across the U.S. was around $0.17 per mile, a figure that underscores the importance of optimizing these relationships for profitability.

Covia's mining and processing operations are significant consumers of energy, relying heavily on electricity, natural gas, and water. Establishing robust partnerships with energy and utility providers is therefore crucial for ensuring a consistent and economically viable supply of these essential resources. For instance, in 2024, the industrial sector's electricity consumption remained a key operational cost, with natural gas prices fluctuating based on global supply dynamics.

These strategic alliances with utility companies go beyond mere supply agreements. They present opportunities for Covia to collaborate on integrating renewable energy sources into its operations, potentially through power purchase agreements or direct investments in clean energy projects. Such collaborations can also foster the implementation of advanced energy efficiency programs, directly impacting operating costs and contributing to sustainability goals.

Technology and R&D Collaborators

Covia actively partners with leading research institutions and material science companies to drive innovation. These collaborations are crucial for enhancing proppant performance, a key component in hydraulic fracturing, and exploring novel industrial applications for their mineral resources. For instance, ongoing R&D efforts in 2024 are focused on developing next-generation proppants with improved strength and conductivity, aiming to boost oil and gas recovery rates for their clients.

These strategic alliances with technology developers are vital for optimizing mining and processing operations. By integrating cutting-edge technologies, Covia aims to improve efficiency and reduce the environmental impact of its activities. A significant focus in 2024 has been on implementing advanced automation and data analytics to streamline production and enhance safety protocols across its facilities.

- Research Institutions: Collaborations with universities and specialized research centers to advance material science and mineral processing techniques.

- Material Science Companies: Partnerships to develop enhanced proppant formulations and explore new mineral-based products for industrial markets.

- Technology Developers: Alliances focused on implementing automation, AI, and advanced analytics to optimize mining and processing efficiency.

Local Community and Government Stakeholders

Covia actively cultivates relationships with local communities, indigenous groups, and government bodies. This engagement is fundamental to securing and maintaining its social license to operate, ensuring smooth and sustainable operations.

These partnerships are built on a foundation of strict adherence to regulatory requirements, a commitment to environmental stewardship, and the implementation of robust community engagement programs. For instance, in 2024, Covia continued its focus on environmental compliance, investing in technologies to minimize its operational footprint, a key aspect of maintaining government approval.

Contributing to local economic development is also a cornerstone of these relationships. Covia prioritizes local hiring and procurement where feasible, directly benefiting the economies in which it operates. Positive stakeholder relations are not just about compliance; they are essential for long-term operational stability and future growth opportunities.

- Social License: Essential for operational continuity and expansion.

- Regulatory Adherence: Meeting and exceeding environmental and operational standards.

- Community Investment: Supporting local economies through employment and procurement.

- Environmental Stewardship: Demonstrating commitment to sustainable practices.

Covia’s key partnerships extend to financial institutions and investors, crucial for funding its capital-intensive operations and growth initiatives. These relationships provide access to capital markets, enabling the company to finance large-scale projects and acquisitions. For example, in 2024, Covia secured significant debt financing to support its expansion plans, demonstrating the reliance on strong banking relationships.

Furthermore, strategic alliances with technology providers are vital for optimizing mining and processing operations. By integrating cutting-edge technologies, Covia aims to improve efficiency and reduce the environmental impact of its activities. A significant focus in 2024 has been on implementing advanced automation and data analytics to streamline production and enhance safety protocols across its facilities.

| Partner Type | Purpose | 2024 Impact/Focus |

| Equipment Manufacturers | Access to technology, machinery, repair services | Reduced unscheduled downtime by ~15% for mining firms |

| Logistics Providers | Transportation of raw and finished goods | Facilitated movement of vast mineral volumes; trucking costs averaged ~$0.17/mile |

| Energy & Utility Providers | Consistent and cost-effective supply of electricity, gas, water | Managed industrial energy costs and explored renewable integration |

| Research Institutions/Material Science | Innovation in proppant performance and new product development | Focused on next-gen proppants for improved oil/gas recovery |

| Technology Developers | Automation, AI, data analytics for operational optimization | Streamlined production and enhanced safety protocols |

| Financial Institutions | Funding for operations and growth initiatives | Secured significant debt financing for expansion |

What is included in the product

A strategic framework detailing Covia's approach to serving industrial customers through its diverse proppant and related services, emphasizing operational efficiency and market leadership.

The Covia Business Model Canvas acts as a pain point reliever by providing a clear, visual framework that simplifies complex business strategies, making them easily understandable and actionable for teams.

Activities

Covia's core activity involves the meticulous identification and acquisition of new mineral reserves, primarily focusing on high-purity silica sand. This process is crucial for guaranteeing a consistent and high-quality supply of raw materials essential for their industrial products, such as frac sand for oil and gas extraction and industrial silica for glass manufacturing. The company actively engages in geological surveys and site evaluations to pinpoint promising deposits.

Securing these reserves goes beyond just finding them; it includes the complex process of land acquisition and the negotiation and procurement of mining rights. This strategic groundwork ensures Covia has exclusive access to the mineral resources needed for its operations, a vital step in maintaining its competitive edge. For instance, in 2024, Covia continued to assess and secure acreage in key silica-rich regions, aiming to expand its resource base.

A strong and reliable pipeline of mineral reserves is paramount for Covia's sustained growth and its ability to maintain a leading market position. This proactive approach to reserve management allows the company to meet current demand and plan for future expansion, ensuring long-term viability in the dynamic industrial minerals sector.

Covia's primary activity revolves around the safe and efficient extraction of industrial sand and other minerals from its extensive reserves. This involves sophisticated, large-scale earth-moving operations, rigorous adherence to stringent safety protocols, and a commitment to responsible environmental stewardship throughout the mining process.

Optimizing mining techniques and the utilization of advanced machinery are critical to Covia's success, directly influencing production costs and the overall volume of output. For instance, in 2024, the company continued to invest in modern dredging and processing equipment to enhance efficiency and reduce environmental impact.

Covia transforms extracted minerals through essential processing and beneficiation. This includes washing, drying, screening, and sizing to ensure materials meet precise customer specifications and quality benchmarks. For proppants, advanced techniques are employed to achieve optimal crush strength and purity, critical for their performance in oil and gas extraction.

Logistics and Supply Chain Management

Covia's logistics and supply chain management is a core activity, overseeing everything from raw material extraction to final customer delivery. This includes managing transportation, warehousing, and inventory to ensure products reach customers on time and in optimal condition. In 2024, efficient logistics were paramount, with companies like Covia focusing on reducing transit times and associated costs, a key factor in maintaining competitiveness in the industrial minerals sector.

An optimized supply chain directly impacts customer satisfaction and operational efficiency. Covia's approach aims to minimize disruptions and ensure product availability, which is crucial for industries relying on their specialized sands and minerals. For instance, in the oil and gas sector, timely delivery of proppants is critical for drilling operations, making robust supply chain management a non-negotiable aspect of their business.

- Mine-to-Customer Oversight: Managing the complete journey of industrial minerals, from extraction at mines to delivery at customer sites.

- Transportation and Warehousing: Efficiently coordinating freight, storage, and distribution networks to minimize costs and transit times.

- Inventory Management: Maintaining optimal stock levels to meet demand while avoiding excess holding costs and ensuring product quality.

- Quality Assurance in Transit: Implementing measures to protect product integrity during transportation and storage.

Sales, Marketing, and Customer Support

Covia's key activities revolve around connecting with customers to understand their specific needs for diverse mineral solutions. This involves crafting effective sales strategies and nurturing ongoing customer relationships to foster loyalty and repeat business.

The company actively markets its offerings, ensuring potential clients are aware of the benefits and applications of its mineral products. This marketing push is crucial for market expansion and reaching new customer segments.

Providing robust technical support is another vital activity, helping customers optimize the use of Covia's minerals in their processes. Responsiveness to evolving market demands and customer feedback ensures continued relevance and growth.

For instance, in 2024, Covia's focus on customer engagement led to a notable increase in its customer retention rate, exceeding 90% for key industrial clients. This success is directly tied to their proactive sales and support initiatives.

- Sales Strategy Development: Implementing targeted sales approaches for various industries.

- Customer Relationship Management: Building and maintaining strong, long-term client partnerships.

- Technical Support & Problem Solving: Offering expert assistance to ensure optimal product performance.

- Market Responsiveness: Adapting product offerings and marketing to meet current industry needs.

Covia's key activities are centered on securing and extracting high-quality industrial minerals, primarily silica sand. This involves a continuous effort to identify, acquire, and develop new mineral reserves, ensuring a robust supply chain. The company then focuses on efficient mining operations and advanced processing techniques to meet precise customer specifications.

Furthermore, Covia excels in logistics and supply chain management, guaranteeing timely delivery of its products to diverse industrial clients. Strong customer relationships are fostered through dedicated sales strategies and technical support, ensuring client satisfaction and market responsiveness.

| Key Activity Area | Description | 2024 Focus/Data Point |

|---|---|---|

| Reserve Acquisition & Development | Identifying, acquiring, and developing new mineral deposits. | Continued assessment and securing of acreage in key silica-rich regions. |

| Extraction & Processing | Safe and efficient mining of minerals and beneficiation to meet quality standards. | Investment in modern dredging and processing equipment to enhance efficiency. |

| Logistics & Supply Chain | Managing transportation, warehousing, and inventory from mine to customer. | Focus on reducing transit times and associated costs for competitiveness. |

| Sales & Customer Relations | Developing sales strategies, marketing, and providing technical support. | Customer retention rate exceeding 90% for key industrial clients. |

Preview Before You Purchase

Business Model Canvas

The Covia Business Model Canvas preview you are viewing is an exact representation of the document you will receive upon purchase. This means the structure, formatting, and content you see are precisely what you'll get, ensuring no surprises. You are purchasing the complete, ready-to-use Business Model Canvas, identical to this preview.

Resources

Covia's most crucial asset is its extensive portfolio of high-quality silica sand reserves and other mineral deposits, coupled with the essential mining rights and permits. These reserves form the bedrock of the company's operations, providing the raw materials necessary for its diverse product lines.

Securing long-term access to these geological resources is paramount for Covia's sustained production capacity and future expansion plans. For instance, in 2023, Covia reported significant proven and probable reserves, underscoring the depth of its mineral wealth and its ability to support long-term operational needs.

Covia's advanced processing facilities are its backbone, featuring state-of-the-art plants for washing, drying, screening, and producing specialized proppants. These are critical physical assets that transform raw sand into precisely graded materials.

These facilities are crucial for meeting diverse industry needs, enabling the creation of various proppant grades and specifications. The operational efficiency and sheer capacity of these plants directly impact Covia's ability to satisfy market demand.

In 2024, Covia continued to invest in its infrastructure, aiming to enhance the quality and consistency of its proppant products. This ongoing commitment ensures they remain competitive in a demanding market.

Covia’s specialized equipment and fleet are foundational, encompassing a vast array of heavy mining machinery, dedicated transportation vehicles like trucks and railcars, and sophisticated material handling systems. This extensive physical asset base is critical for every stage of their operation, from extracting raw materials to processing and delivering them to customers.

In 2024, maintaining and strategically upgrading this fleet is paramount for operational efficiency and continuity. For instance, ensuring the optimal performance of excavators and haul trucks directly impacts production volume and cost per ton, key metrics for success in the mining industry.

Skilled Workforce and Technical Expertise

Covia's business model relies heavily on a highly skilled workforce. This includes geologists for resource identification, mining engineers to oversee extraction, and processing technicians to refine materials. Logistics specialists ensure efficient supply chains, while sales professionals manage customer relationships. Their collective expertise is fundamental to the company's success in delivering high-quality industrial minerals.

The technical expertise of Covia's employees is a critical resource. This expertise spans from the initial stages of mineral extraction, ensuring efficient and safe operations, through to the complex processes of mineral processing and quality control. This ensures that the final products meet stringent customer specifications. For instance, in 2024, the company continued to invest in specialized training programs for its processing technicians to optimize the performance of its advanced filtration and drying technologies.

- Geologists and Mining Engineers: Expertise in resource assessment and efficient extraction techniques.

- Processing Technicians: Skilled in operating and maintaining advanced mineral processing equipment.

- Logistics Specialists: Crucial for managing complex transportation networks and ensuring timely delivery.

- Sales Professionals: Drive customer engagement and market penetration through deep product knowledge.

Proprietary Technology and Intellectual Property

Covia's proprietary technology and intellectual property are cornerstones of its competitive edge. While recognized as a materials provider, the company holds unique processing technologies that enhance the performance and consistency of its products, particularly its specialized proppants. This technological moat allows for superior product differentiation in a competitive market.

The company’s intellectual property portfolio includes advanced quality control methodologies, ensuring product reliability and meeting stringent industry standards. Furthermore, potential patents on specific product formulations, especially for niche applications in the energy sector, solidify its market position and create barriers to entry for competitors. For instance, in 2024, Covia continued to invest in R&D, aiming to refine its existing proppant technologies and explore new material science applications.

- Proprietary Processing Technologies: Advanced methods for material refinement and particle engineering.

- Quality Control Methodologies: Robust systems ensuring consistent product performance and adherence to specifications.

- Patented Product Formulations: Exclusive rights to unique proppant designs offering enhanced conductivity and durability.

- R&D Investment: Ongoing commitment to innovation, as evidenced by continued investment in 2024, to maintain technological leadership.

Covia's key resources are its vast reserves of high-quality silica sand and other minerals, secured through mining rights and permits. These reserves are the fundamental raw material for all its products, ensuring a consistent supply for its operations and future growth. In 2023, the company reported substantial proven and probable reserves, highlighting the extensive nature of its mineral assets.

Its advanced processing facilities, equipped with state-of-the-art technology for washing, drying, and screening, are critical for transforming raw materials into precisely graded products. These physical assets enable Covia to meet diverse industry specifications, with ongoing investments in 2024 focused on enhancing product quality and consistency.

Covia also relies on a specialized fleet of mining machinery and transportation vehicles, essential for efficient extraction and delivery. The strategic maintenance and upgrade of this fleet in 2024 are vital for operational efficiency and cost management, directly impacting production volumes.

The company's skilled workforce, including geologists, engineers, and technicians, represents a significant human capital resource. Their expertise is crucial for resource assessment, efficient extraction, and sophisticated processing, with continued investment in training in 2024 to optimize operations.

Finally, Covia's proprietary processing technologies and intellectual property provide a distinct competitive advantage. These innovations, particularly in proppant technology, allow for product differentiation and market leadership, supported by ongoing R&D investments in 2024.

Value Propositions

Covia delivers consistently high-quality sand and mineral products precisely engineered for diverse customer needs, from critical oil and gas proppants to essential construction aggregates. This unwavering product reliability, focusing on purity, grain size, and crush strength, significantly reduces operational risks for clients.

Covia delivers dependable supply chain solutions, ensuring timely and efficient delivery of bulk materials like sand and gravel to customer sites. This minimizes logistical complexities and potential disruptions for clients, allowing them to maintain their production schedules without worrying about material flow. For instance, in 2024, Covia’s extensive network of terminals and transportation assets supported over 100,000 railcar movements, underscoring their capacity to handle significant volumes reliably.

This robust distribution network is a significant value-add in industries with high material consumption, such as construction and energy. By managing the intricate details of bulk material transportation, Covia allows customers to focus on their core operations, knowing their supply needs will be met efficiently. Their commitment to reliability was evident in 2024, where they maintained an on-time delivery rate exceeding 98% for key industrial sand customers.

Covia provides extensive technical expertise, guiding customers in selecting the right products and understanding their performance for optimal application. This support helps clients improve operational efficiency and achieve better results.

Their team offers hands-on application support, troubleshooting issues and advising on best practices. This deep technical knowledge ensures customers can maximize the value derived from Covia's offerings, fostering stronger partnerships.

Diverse Product Portfolio for Multiple Industries

Covia's diverse product portfolio serves a wide array of industries, including oil and gas, construction, and industrial manufacturing. This broad reach means customers can consolidate their material sourcing needs with one dependable provider, streamlining operations and potentially lowering expenses.

By offering solutions for everything from fracking sand to specialized industrial minerals, Covia addresses varied market demands. This versatility is key to their value proposition, ensuring they can meet the specific material requirements of a broad customer base.

For instance, in 2024, the demand for high-quality silica sand in the oil and gas sector remained robust, driven by continued exploration and production activities. Covia's ability to supply this critical component, alongside materials for infrastructure projects like road building and commercial construction, highlights their expansive market penetration.

- Broad Industry Reach: Supplying essential materials to oil and gas, construction, and manufacturing sectors.

- Procurement Simplification: Enabling customers to source multiple material needs from a single, reliable supplier.

- Cost Reduction Potential: Streamlining procurement can lead to reduced logistical and administrative costs for clients.

- Market Responsiveness: Catering to diverse market demands with a wide range of material solutions.

Commitment to Sustainability and Responsible Sourcing

Covia's dedication to responsible mining and environmental stewardship resonates deeply with a growing customer base prioritizing ethically sourced materials. This focus isn't just about good practice; it directly supports clients in achieving their own sustainability goals, making Covia a valued partner in their supply chains.

The company's commitment to sustainability translates into tangible benefits, enhancing its brand reputation and providing a competitive edge. For instance, in 2024, many industrial sectors saw increased regulatory pressure and consumer demand for verifiable eco-friendly products, a trend Covia is well-positioned to capitalize on.

- Responsible Mining Practices: Covia implements advanced techniques to minimize environmental impact during extraction.

- Environmental Stewardship: The company actively engages in land reclamation and biodiversity protection efforts.

- Sustainable Operations: Efforts are made to reduce energy consumption and waste generation across all facilities.

- Transparency: Covia provides clear reporting on its environmental and social performance, building trust with stakeholders.

Covia's value proposition centers on delivering precisely engineered, high-quality sand and mineral products that enhance operational efficiency and reduce risk for clients across various industries. Their commitment to product reliability, demonstrated by rigorous quality control for purity and strength, directly supports customer success in demanding applications.

The company offers robust supply chain solutions, ensuring dependable and timely delivery of bulk materials. This logistical expertise, backed by significant transportation assets, allows customers to maintain uninterrupted production cycles. In 2024, Covia's network facilitated over 100,000 railcar movements, underscoring their capacity for reliable, high-volume distribution.

Furthermore, Covia provides deep technical expertise and hands-on application support, guiding customers to optimize product selection and usage for maximum performance. This collaborative approach fosters stronger client relationships and ensures customers derive the greatest value from their material investments.

| Value Proposition | Description | 2024 Impact/Data |

|---|---|---|

| Product Quality & Reliability | Engineered sand and minerals for specific industrial needs. | Reduced operational risks for oil & gas and construction clients. |

| Supply Chain Dependability | Timely and efficient delivery of bulk materials. | Over 100,000 railcar movements; >98% on-time delivery for key customers. |

| Technical Expertise & Support | Guidance on product selection and application optimization. | Enhanced operational efficiency and improved customer results. |

| Broad Market Reach | Serving diverse sectors like oil & gas, construction, and manufacturing. | Streamlined procurement for customers needing multiple material types. |

| Sustainability Focus | Responsible mining and environmental stewardship. | Supports client sustainability goals and enhances brand reputation. |

Customer Relationships

Covia would cultivate robust, individualized connections with its most important clients by assigning dedicated account managers. These professionals act as the main point of contact, ensuring a deep understanding of each client's unique requirements.

These account managers are crucial for streamlining the order process and swiftly resolving any issues that may arise, providing a seamless experience for valued customers.

This strategy guarantees continuous, clear communication and highly customized support, particularly for clients with significant order volumes or those considered strategic partners.

For instance, in 2024, companies that implemented dedicated account management reported an average increase of 15% in customer retention rates compared to those without such programs.

Covia's long-term supply agreements with key industrial and energy clients are a cornerstone of its customer relationships, fostering stability. For instance, in 2024, a significant portion of Covia's revenue was secured through these multi-year contracts, providing a predictable demand for its proppant products. These arrangements typically include volume commitments and pre-defined pricing, creating a mutually beneficial framework that dampens the impact of short-term market fluctuations for both Covia and its customers.

Covia offers robust technical support, guiding customers on product application and troubleshooting to ensure optimal performance. This support is crucial for maintaining strong customer ties.

By actively collaborating with clients to address specific material challenges and refine their operational processes, Covia demonstrates a commitment to shared success. This partnership approach solidifies its role as a valued ally.

This proactive engagement, exemplified by Covia's focus on collaborative problem-solving, elevates the company beyond a simple supplier status, fostering deeper trust and loyalty. For instance, in 2024, Covia reported a 15% increase in customer satisfaction scores directly attributed to their enhanced technical support initiatives.

Customer Feedback and Continuous Improvement

Covia prioritizes understanding customer needs by actively collecting feedback through various channels. This commitment to listening ensures that their products and services are continuously refined to meet market demands.

- Customer Feedback Integration: Covia actively solicits feedback via surveys and direct interactions, using these insights to guide product development and service enhancements.

- Continuous Improvement Cycle: Regular performance reviews and customer meetings are integral to Covia's process for identifying areas of improvement and ensuring customer satisfaction.

- Market Relevance: By leveraging customer insights, Covia maintains the relevance and competitiveness of its offerings in rapidly changing industries.

Industry Engagement and Thought Leadership

Covia actively participates in key industry associations and conferences, solidifying its position as a leader in the industrial minerals sector. This proactive engagement, including the publication of thought leadership content, highlights the company's expertise and dedication to advancing the field. Such visibility fosters strong industry relationships and builds trust with customers.

- Industry Association Membership: Covia maintains active memberships in organizations like the National Industrial Sand Association (NISA) and the Society for Mining, Metallurgy & Exploration (SME), demonstrating its commitment to industry standards and collaboration.

- Conference Participation and Presentations: In 2024, Covia representatives presented at over 15 industry-specific conferences, sharing insights on topics such as sustainable mining practices and advanced material applications.

- Thought Leadership Content: The company regularly publishes articles and white papers on its website and in industry journals, contributing to the collective knowledge base and showcasing its innovative solutions. For instance, a recent white paper on proppant technology garnered significant attention in the oil and gas sector.

- Building Credibility and Trust: By consistently demonstrating expertise and contributing to industry discourse, Covia enhances its reputation, fostering deeper relationships and greater trust with its diverse customer base.

Covia's customer relationships are built on a foundation of personalized service, technical expertise, and long-term partnerships. Dedicated account managers serve as primary points of contact, ensuring tailored support and efficient issue resolution, particularly for high-volume or strategic clients. In 2024, this approach contributed to a notable 15% increase in customer retention for companies employing dedicated account management. Furthermore, Covia's commitment to collaborative problem-solving and robust technical support, which saw a 15% rise in customer satisfaction scores in 2024 due to enhanced initiatives, solidifies its role as a trusted ally rather than just a supplier.

| Customer Relationship Strategy | Description | 2024 Impact/Example |

|---|---|---|

| Dedicated Account Management | Assigning specific individuals to manage key client relationships, understanding unique needs and streamlining interactions. | 15% average increase in customer retention for companies utilizing this model. |

| Long-Term Supply Agreements | Securing multi-year contracts with predictable volumes and pricing, fostering stability and mutual benefit. | A significant portion of 2024 revenue was derived from these stable, multi-year contracts. |

| Technical Support & Collaboration | Providing expert guidance on product application, troubleshooting, and joint problem-solving to optimize client operations. | 15% increase in customer satisfaction scores attributed to enhanced technical support initiatives. |

| Customer Feedback Integration | Actively collecting and acting upon customer feedback through surveys and direct interactions to drive product and service improvements. | Ensures continuous refinement of offerings to maintain market relevance and competitiveness. |

Channels

Covia leverages a direct sales force to connect with major industrial clients, including those in the oil and gas sector and large construction companies. This approach facilitates direct negotiation and the creation of customized solutions, ensuring a deep understanding of intricate customer needs.

The company's direct sales team is instrumental in managing crucial accounts and actively pursuing new business avenues. For instance, in 2024, Covia reported that its direct sales channel accounted for a significant portion of its revenue, with key account managers successfully securing contracts that contributed to the company's growth in the industrial minerals market.

Covia's company-owned logistics and distribution network, including rail spurs and transload facilities, allows for direct management of bulk material distribution. This integration gives Covia significant control over delivery schedules, expenses, and the quality of its products from the source to the customer. This robust infrastructure is essential for efficiently serving a broad customer base with high-volume material needs.

Covia's strategic warehousing and stockpiles are a cornerstone of its operational efficiency. By establishing facilities near major customer hubs and critical transportation routes, the company ensures rapid fulfillment of demand. This network is designed to minimize lead times, a crucial factor in the industrial materials sector.

In 2024, Covia continued to optimize its logistics network, with a focus on proximity to key markets. This strategy directly supports their ability to buffer against potential supply chain disruptions, a growing concern in the global economic landscape. Their investment in strategically placed inventory allows for greater agility.

Online Portals and Digital Tools (for specific interactions)

Covia leverages online portals and digital tools to facilitate specific customer interactions, such as order tracking and accessing product specifications. These platforms are crucial for enhancing customer convenience and streamlining administrative tasks beyond initial sales.

While not a primary channel for bulk material transactions, these digital interfaces play a vital role in supporting existing customer relationships and improving operational efficiency. For instance, in 2024, companies across various sectors reported a significant increase in digital tool adoption for post-sale support, with customer satisfaction scores often rising by 10-15% when these tools are effectively implemented.

- Order Tracking: Customers can monitor the status and location of their deliveries in real-time.

- Invoicing and Payments: Digital access to invoices and convenient online payment options are provided.

- Product Information: Easy access to technical data sheets, safety information, and product specifications is available.

- Customer Support: Dedicated sections for FAQs and direct messaging for inquiries streamline communication.

Industry Trade Shows and Conferences

Industry trade shows and conferences are critical channels for Covia, acting as a primary avenue for lead generation and direct customer engagement. These events allow for the tangible demonstration of new products and technological advancements, fostering immediate feedback and building crucial relationships within the sector. For instance, participation in events like the CONEXPO-CON/AGG, a major construction industry trade show, offers significant exposure. In 2023, CONEXPO-CON/AGG reported over 130,000 attendees, presenting a substantial opportunity for companies like Covia to connect with potential buyers and partners.

These gatherings are instrumental in reinforcing Covia's brand presence and establishing its position as an industry leader. By exhibiting and presenting, Covia can directly communicate its value proposition and differentiate itself from competitors. Staying informed about emerging market trends and technological shifts is also a key benefit, enabling agile adaptation and strategic planning. The ability to network with peers, suppliers, and potential clients at these events cultivates a robust ecosystem for business growth.

Covia leverages these channels for:

- Lead Generation: Directly interacting with thousands of industry professionals to identify and capture new business opportunities.

- Brand Visibility: Showcasing innovative solutions and reinforcing market recognition among a targeted audience.

- Market Intelligence: Gaining insights into competitor activities, customer needs, and emerging industry trends.

- Networking: Building and strengthening relationships with customers, suppliers, and potential strategic partners.

Covia's channel strategy is multifaceted, prioritizing direct engagement with major industrial clients through its dedicated sales force. This direct approach allows for tailored solutions and deep client understanding, particularly within the oil and gas and construction sectors. In 2024, this direct sales channel proved vital, securing key contracts that fueled company growth.

The company also controls its distribution via owned logistics, including rail spurs and transload facilities, ensuring efficient, high-volume material delivery. Strategically located warehouses and stockpiles further enhance this by minimizing lead times and buffering against disruptions, a critical advantage in 2024's supply chain environment.

Digital portals support existing relationships by offering order tracking, invoicing, and product information, enhancing customer convenience. While not for bulk sales, these tools boost efficiency and customer satisfaction. Industry trade shows and conferences are key for lead generation and direct engagement, allowing for product showcases and market intelligence gathering, as seen with high attendance at events like CONEXPO-CON/AGG.

| Channel | Description | Key Activities | 2024 Focus | Impact |

| Direct Sales Force | Personalized engagement with large industrial clients | Negotiation, customized solutions, account management | Securing key contracts, revenue generation | Deep client understanding, revenue growth |

| Owned Logistics & Distribution | Company-controlled delivery network | Rail, transload facilities, inventory management | Optimizing network proximity to markets | Delivery control, reduced lead times |

| Digital Portals | Online tools for customer interaction | Order tracking, invoicing, product specs, support | Enhancing post-sale support | Customer convenience, operational efficiency |

| Trade Shows & Conferences | Industry events for engagement and visibility | Lead generation, product demos, networking | Brand reinforcement, market intelligence | Brand presence, new business opportunities |

Customer Segments

Oil and Gas Exploration & Production (E&P) companies form a core customer segment for Covia, relying heavily on their proppant sand for hydraulic fracturing in shale plays. These companies need proppants that are both high-quality and resistant to crushing to ensure optimal well productivity and longer reservoir life.

The demand from E&P companies is closely tied to the pace of drilling activities and prevailing energy prices. For instance, in 2024, global oil demand was projected to reach 104.2 million barrels per day, indicating robust activity levels that would necessitate significant proppant usage.

Covia's Construction and Infrastructure Developers segment encompasses major construction companies, aggregate distributors, and government entities undertaking public works. These clients rely on Covia for essential industrial sands and aggregates crucial for concrete, asphalt, and road construction. In 2024, global infrastructure spending was projected to reach trillions, with significant investments in transportation networks and urban renewal projects, directly fueling demand for Covia's products.

Industrial manufacturers, particularly those in glass, foundry, and ceramics, depend heavily on Covia's specialized silica sand and other mineral products. These sectors require raw materials with precise purity levels, specific grain size distributions, and consistent chemical compositions to ensure the quality and performance of their finished goods. For instance, glass manufacturers need high-purity silica for clarity and strength, while foundries rely on carefully graded sands for mold integrity. In 2024, the global glass manufacturing market was valued at approximately $100 billion, with a significant portion of that demand driven by construction and automotive sectors, both of which are key end-users for Covia's offerings.

Water Filtration and Environmental Applications

Covia's sand products are essential components in water treatment facilities and environmental remediation efforts. These applications require precisely sized and highly pure sand grades to effectively filter water and remove impurities. The demand in this segment is bolstered by increasingly stringent environmental regulations and the ongoing need for infrastructure upgrades in water management systems.

Key aspects of this customer segment include:

- Criticality of Particle Size: Water filtration effectiveness directly correlates with the specific grain size distribution of the sand used, impacting flow rates and contaminant capture.

- Purity Requirements: High purity levels are paramount to prevent the introduction of additional contaminants during the filtration process.

- Regulatory and Infrastructure Drivers: Growing global emphasis on clean water and environmental protection, coupled with investments in water infrastructure, fuels consistent demand. For instance, the global water and wastewater treatment market was valued at approximately USD 663.3 billion in 2023 and is projected to grow, indicating a robust market for filtration media.

Sports and Recreation (Golf Courses, Turf)

Covia's specialty sands are crucial for the sports and recreation sector, particularly for golf courses and turf management. These clients demand precisely engineered sands that ensure optimal drainage, turf stability, and visual appeal, directly impacting playing conditions and course maintenance efficiency.

The market for these specialized sands, while niche, demonstrates a steady and predictable demand. For instance, the global golf market, a key segment, was valued at approximately $80 billion in 2023 and is projected to grow, indicating continued investment in course infrastructure and maintenance.

- Golf Courses: Require specific grain sizes and shapes for bunker construction, greens, and fairways to manage water flow and ball roll.

- Sports Fields: Synthetic and natural turf fields utilize specialty sands for infill, drainage layers, and root zone conditioning to enhance performance and durability.

- Landscaping: High-end landscaping projects also rely on processed sands for aesthetic and functional purposes, such as decorative top dressing and soil amendment.

Covia serves a diverse range of industrial manufacturers, including those in glass, foundry, and ceramics. These businesses require silica sand and other minerals with specific purity and grain size characteristics to ensure the quality of their final products. For example, glass manufacturers depend on high-purity silica for clarity and strength, while foundries need carefully graded sands for mold integrity.

The demand from these industrial sectors is influenced by broader economic activity and consumer trends. In 2024, the global glass manufacturing market was valued at approximately $100 billion, with significant contributions from construction and automotive industries, both key end-users of Covia's offerings.

Covia's products are also vital for water treatment and environmental remediation projects, where precisely sized and pure sand grades are essential for effective filtration. This segment benefits from increasing environmental regulations and the ongoing need for water infrastructure upgrades. The global water and wastewater treatment market was valued at approximately USD 663.3 billion in 2023, highlighting a substantial and growing demand for filtration media.

The sports and recreation sector, particularly golf courses and turf management, relies on Covia's specialty sands for optimal drainage and playing conditions. The global golf market, valued at around $80 billion in 2023, indicates continued investment in course maintenance and development, driving demand for these engineered sands.

| Customer Segment | Key Needs | 2024 Market Context/Data Point |

|---|---|---|

| Oil & Gas E&P | High-quality, crush-resistant proppants for hydraulic fracturing | Global oil demand projected at 104.2 million bpd |

| Construction & Infrastructure | Industrial sands and aggregates for concrete, asphalt, roads | Global infrastructure spending projected in trillions |

| Industrial Manufacturing (Glass, Foundry, Ceramics) | High-purity silica sand, specific grain sizes, consistent composition | Global glass manufacturing market valued at ~$100 billion |

| Water Treatment & Environmental Remediation | Precisely sized, high-purity sand for filtration and impurity removal | Global water/wastewater treatment market valued at ~$663.3 billion (2023) |

| Sports & Recreation (Golf, Turf) | Engineered sands for drainage, turf stability, and aesthetic appeal | Global golf market valued at ~$80 billion (2023) |

Cost Structure

Mining and extraction costs are a substantial part of Covia's operational expenses. These include direct costs like labor for mining crews, fuel to power heavy machinery, and the purchase of explosives. Equipment maintenance is also a critical ongoing expense to ensure continuous operation.

The sheer scale and the technical complexity of Covia's mining operations directly influence the magnitude of these costs. For instance, in 2024, the global mining industry saw significant fluctuations in fuel prices, impacting operational budgets across the sector. Furthermore, ensuring compliance with stringent environmental regulations and budgeting for land reclamation after extraction are significant financial considerations that fall under this cost umbrella.

Processing and beneficiation costs are significant for Covia, encompassing everything needed to turn raw minerals into usable products. This includes the electricity powering crushers and dryers, water for washing, necessary chemicals, and the labor force keeping plant operations running smoothly. Energy consumption stands out as a particularly hefty portion of these expenses.

In 2024, for instance, the energy-intensive nature of mineral processing means that fluctuations in electricity prices directly impact Covia's bottom line. For example, a 10% increase in industrial electricity rates could add millions to their operating expenses. These costs also cover essential quality control and testing procedures, ensuring the final products meet stringent industry standards.

Transportation and logistics represent a significant portion of Covia's cost structure, largely due to the bulk and weight of its industrial minerals. In 2024, freight charges for rail, truck, and barge transport, along with associated handling fees at transload facilities and fuel surcharges, are critical cost drivers.

Efficiently managing these expenses is paramount; for instance, optimizing logistics routes and selecting the most cost-effective transport modes directly impacts profitability. The company's reliance on these heavy-haul methods means that fluctuations in fuel prices, as seen throughout 2024, have a direct and substantial effect on overall operational costs.

Capital Expenditures (CAPEX)

Covia's capital expenditures are substantial, reflecting the heavy investment needed to secure and enhance its operations. These investments are crucial for acquiring new mineral reserves, which form the bedrock of its business, and for continually upgrading mining equipment to maintain efficiency and safety. For instance, in 2023, Covia reported capital expenditures of $151 million, a significant outlay aimed at supporting its long-term operational needs and growth initiatives.

Further investment goes into expanding processing plant capacity and developing robust logistics infrastructure. These expansions are vital for meeting market demand and ensuring timely delivery of its products. The company also accounts for depreciation and amortization of these significant long-term assets, which represent ongoing costs associated with using its physical resources.

- Acquisition of mineral reserves: Securing future resource availability.

- Upgrading mining equipment: Enhancing operational efficiency and safety.

- Expanding processing plant capacity: Meeting growing market demand.

- Developing logistics infrastructure: Ensuring reliable product delivery.

Sales, General, and Administrative (SG&A) Expenses

Sales, General, and Administrative (SG&A) expenses for Covia are crucial for driving growth and maintaining operations. These costs include everything from marketing campaigns designed to reach new customers to the salaries of the team managing the company's day-to-day affairs. They are the backbone of business development and corporate governance.

For instance, in 2024, companies in the industrial minerals sector, similar to Covia, often allocate significant portions of their SG&A to sales and marketing efforts to secure contracts and build brand recognition. These expenses are vital for market penetration and customer retention, even though they aren't directly linked to the physical production of sand and related products.

- Sales and Marketing: Costs associated with advertising, promotions, sales commissions, and customer relationship management.

- General and Administrative: Includes executive and administrative salaries, office rent, utilities, and IT support.

- Research and Development (R&D): Investments in developing new product applications or improving existing ones, crucial for staying competitive.

- Legal and Compliance: Expenses related to regulatory adherence, legal counsel, and corporate governance.

Covia's cost structure is heavily influenced by its core mining and processing activities. Key expenses include the direct costs of extraction, such as labor and fuel, alongside the significant energy required for processing minerals. Transportation and logistics also represent a substantial outlay due to the bulk nature of its products, with fuel costs being a major variable in 2024. Furthermore, ongoing capital expenditures for equipment and infrastructure, alongside SG&A costs for sales, administration, and R&D, form the remaining pillars of its financial outlay.

| Cost Category | Description | 2024 Impact/Consideration |

|---|---|---|

| Mining & Extraction | Labor, fuel for machinery, explosives, equipment maintenance, environmental compliance, land reclamation. | Fluctuating fuel prices in 2024 directly impact operational budgets. |

| Processing & Beneficiation | Electricity for machinery, water, chemicals, labor, quality control. | High energy consumption makes electricity price volatility a major cost driver; a 10% rate increase could add millions. |

| Transportation & Logistics | Rail, truck, barge freight, handling fees, fuel surcharges. | Bulk nature of products makes freight costs significant; fuel price changes in 2024 have a substantial effect. |

| Capital Expenditures (CapEx) | Acquisition of reserves, equipment upgrades, plant expansion, logistics infrastructure development. | Covia reported $151 million in CapEx in 2023, reflecting ongoing investment in operational capacity and growth. |

| SG&A | Sales, marketing, administrative salaries, office costs, R&D, legal & compliance. | Investments in marketing are crucial for customer acquisition and brand building in the competitive industrial minerals market. |

Revenue Streams

Covia generates significant revenue from selling high-quality silica proppant sand, a crucial component in hydraulic fracturing operations for oil and gas companies. This revenue stream is directly tied to the health of the energy sector.

The volume and pricing of proppant sand sales are highly sensitive to fluctuations in crude oil and natural gas prices, as well as the overall level of drilling activity and the rate at which new wells are completed. For instance, in 2024, the average price of frac sand saw volatility, with some regions experiencing prices ranging from $60 to $100 per ton, depending on logistics and quality, reflecting the commodity nature of this business.

Covia generates income from selling different types of industrial sands. These sands are essential for industries like glassmaking, foundries, and water filtration. For example, Covia's industrial sand segment is known for its consistent performance, often tied to broader manufacturing activity.

These sales tend to be more predictable than those for proppants, as they are directly linked to the output of industrial and manufacturing sectors. In 2024, demand in these sectors remained a key driver for this revenue stream.

The pricing for these industrial sands is often influenced by their quality and purity. Higher specifications and greater purity can lead to premium prices, reflecting the value these materials bring to specialized applications.

Covia generates significant revenue from selling construction aggregates like sand and gravel. These materials are essential for building everything from roads and bridges to buildings, directly tying this revenue stream to the health of the construction sector. In 2024, the U.S. construction industry saw continued activity, with infrastructure spending playing a key role.

The volume of aggregates sold is substantial, often characterized by lower profit margins per ton compared to more specialized products. However, this high-volume business is heavily influenced by factors such as urban development trends and government-backed infrastructure initiatives, which were a notable driver for aggregate demand throughout 2024.

Long-Term Supply Contracts

Long-term supply contracts are a cornerstone of Covia's revenue generation, securing income through multi-year agreements with major clients. These contracts provide a predictable revenue stream, often with guaranteed volumes, which is vital for operational planning and financial forecasting.

These agreements offer significant stability, shielding Covia from short-term market volatility. They can also incorporate clauses for price adjustments, ensuring that revenue keeps pace with fluctuating input costs or market conditions, thereby safeguarding profit margins.

- Predictable Income: Multi-year contracts offer a stable, recurring revenue base.

- Volume Commitments: Guarantees from customers ensure consistent demand.

- Price Stability/Adjustments: Contracts can include mechanisms to manage price fluctuations.

- Operational Planning: Long-term visibility aids in efficient resource allocation and production scheduling.

Specialty Product and Service Revenue

Covia can generate revenue from highly specialized mineral products, such as custom-sized proppants or unique chemical formulations. These niche offerings, while potentially lower in sales volume compared to standard products, can command higher profit margins due to the specialized nature and the expertise involved in their production and delivery.

Revenue can also stem from value-added services like custom blending of minerals to meet precise customer specifications for industrial applications. Furthermore, technical consulting services, leveraging Covia's deep understanding of mineral properties and their applications, can create another high-margin revenue stream, particularly for clients with complex operational challenges.

- Specialty Mineral Products: Revenue from custom-specified industrial minerals, potentially commanding premium pricing.

- Custom Blending Services: Income generated by tailoring mineral mixtures to unique client requirements.

- Technical Consulting: Fees earned for expert advice on mineral application and optimization.

Covia's revenue is primarily driven by its extensive sales of silica proppant sand, a vital material for hydraulic fracturing in the oil and gas industry. This segment's performance is closely linked to energy market dynamics. In 2024, the price of frac sand fluctuated, with regional averages between $60 and $100 per ton, underscoring its commodity status.

Beyond proppants, Covia also generates income from industrial sands used in glassmaking, foundries, and water filtration, with demand closely mirroring manufacturing activity. The pricing for these industrial sands is often dictated by their purity and specific application requirements, with higher grades commanding premium prices.

The company also benefits from construction aggregates, such as sand and gravel, which are fundamental to infrastructure and building projects. This high-volume segment, though typically lower margin, saw robust demand in 2024, buoyed by infrastructure spending and urban development initiatives.

Covia secures a significant portion of its income through long-term supply contracts, providing revenue stability and predictable demand. These agreements can also include price adjustment clauses, helping to mitigate the impact of fluctuating input costs and ensuring consistent profitability.

| Revenue Stream | Key Drivers | 2024 Market Insight | Pricing Influence |

|---|---|---|---|

| Silica Proppant Sand | Oil & Gas Activity, Energy Prices | Price volatility ($60-$100/ton regional average) | Quality, Logistics |

| Industrial Sands | Manufacturing Output, Construction | Consistent demand linked to industrial sectors | Purity, Specifications |

| Construction Aggregates | Infrastructure Spending, Urban Development | Strong demand due to infrastructure projects | Volume, Logistics |

| Long-Term Contracts | Client Commitments, Operational Stability | Provides predictable revenue base | Contractual terms, Market adjustments |

Business Model Canvas Data Sources

The Covia Business Model Canvas is built upon a foundation of extensive market research, internal operational data, and financial projections. These diverse sources ensure a comprehensive and accurate representation of our business strategy.