Covia Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Covia Bundle

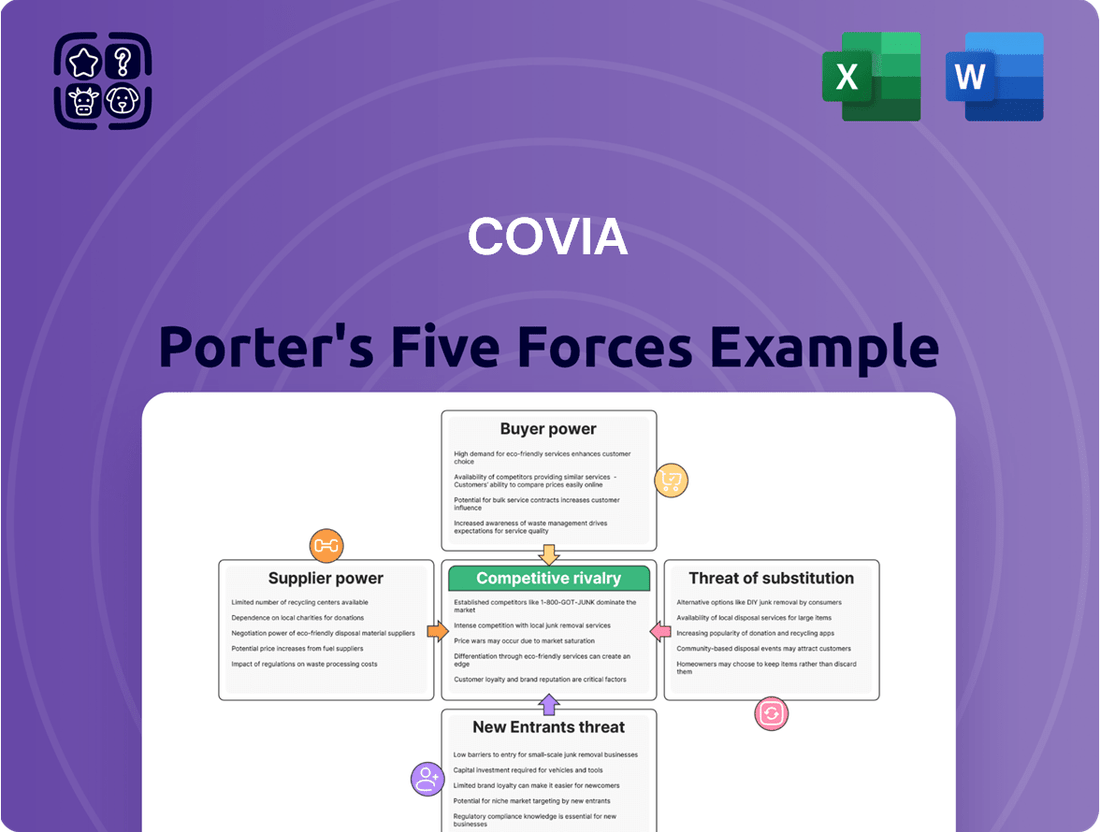

Covia's competitive landscape is shaped by powerful forces, from the bargaining power of its buyers and suppliers to the constant threat of new entrants and substitutes. Understanding these dynamics is crucial for any business operating within or looking to invest in this sector.

The complete report reveals the real forces shaping Covia’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Supplier concentration for specialized industrial minerals, like the silica sands Covia supplies, directly influences their bargaining power. When only a handful of companies can provide a specific grade or type of sand essential for Covia's varied markets, such as oil and gas proppants or advanced manufacturing, these suppliers gain significant leverage on pricing and contract conditions.

The global market for industrial silica sand is on an upward trajectory, with projections indicating continued growth. However, the availability of high-purity quartz reserves is limited and concentrated in specific geographic regions. This scarcity, particularly for niche applications, can amplify the bargaining power of suppliers who control these vital resources.

Covia's bargaining power with its suppliers is significantly impacted by the switching costs associated with its raw materials, such as different grades of sand or other minerals. If Covia faces substantial expenses when changing suppliers, perhaps due to specialized processing needs or complex logistics, then suppliers gain leverage.

For instance, if Covia must re-certify new material sources or invest in new equipment to handle different mineral compositions, these switching costs empower suppliers. In 2023, Covia reported that its cost of goods sold was approximately $1.1 billion, highlighting the significant financial implications of raw material sourcing and the potential impact of high switching costs.

The uniqueness of the minerals and materials Covia sources significantly impacts supplier bargaining power. For instance, high-purity quartz and specialized grades of frac sand have properties crucial for specific industrial uses, giving their suppliers more leverage.

When Covia's suppliers provide highly specialized or proprietary mineral solutions that are challenging to substitute, their bargaining power is amplified. This is particularly relevant in markets where specific material characteristics, like those found in certain industrial minerals, are paramount for end-product performance.

Threat of Forward Integration by Suppliers

Suppliers might leverage forward integration, moving into Covia's processing and distribution, effectively becoming rivals. For instance, major mineral suppliers could explore adding value through further processing or direct sales if profitability beckons. This potential shift would undoubtedly bolster their leverage.

The threat of forward integration by suppliers is a significant factor influencing Covia's operational landscape. While direct forward integration by raw material extractors into finished product distribution is less common, the possibility exists, particularly for larger, diversified mining entities. Should these suppliers find the margins in Covia's value chain sufficiently attractive, they could indeed enter these segments, transforming from mere input providers to direct competitors. This scenario would dramatically elevate their bargaining power, as Covia would face increased competition not only from its existing suppliers but also from these integrated entities.

- Forward Integration Risk: Suppliers could enter Covia's processing and distribution stages, becoming direct competitors.

- Margin Incentive: Attractive profit margins within Covia's value chain could drive supplier forward integration.

- Increased Supplier Power: Successful integration by suppliers would significantly enhance their bargaining position against Covia.

Importance of Covia to Supplier Revenue

The degree to which Covia's business contributes to a supplier's total revenue directly influences that supplier's bargaining power. If Covia is a significant customer, a supplier may be more amenable to negotiating favorable terms to secure continued business. For instance, in 2024, Covia's substantial procurement from key industrial mineral suppliers, who often cater to a diverse client base, means that while Covia is a major player, its share of a large supplier's revenue might still allow for negotiation.

Conversely, if Covia represents a minor portion of a supplier's sales, the supplier holds greater leverage in price and contract negotiations. This dynamic is particularly relevant as Covia operates as a crucial supplier of minerals essential for industrial and energy sectors, meaning its demand is significant but its customer base among suppliers can vary in its reliance on Covia.

- Covia's reliance on specific suppliers: If a supplier's revenue is heavily dependent on Covia, the supplier's bargaining power is diminished.

- Supplier diversification: Suppliers with a broad customer base beyond Covia are less susceptible to Covia's demands.

- Market share of suppliers: Larger suppliers with significant market share may have less incentive to concede to Covia's terms compared to smaller, niche providers.

- Strategic importance of Covia's business: For suppliers whose core business aligns with Covia's needs, the relationship is inherently more significant, potentially impacting negotiation outcomes.

The bargaining power of suppliers to Covia is influenced by the concentration of providers for essential industrial minerals. When few companies can supply specific grades of silica sand, vital for sectors like oil and gas proppants and advanced manufacturing, these suppliers gain considerable leverage over pricing and contract terms. The limited availability of high-purity quartz reserves in specific regions further amplifies the power of suppliers controlling these critical resources.

Switching costs for Covia, such as the expenses related to re-certifying new material sources or adapting processing equipment for different mineral compositions, empower suppliers. In 2023, Covia’s cost of goods sold reached approximately $1.1 billion, underscoring the financial impact of raw material sourcing and the leverage high switching costs afford suppliers.

Suppliers of unique or proprietary mineral solutions, like high-purity quartz and specialized frac sand, possess amplified bargaining power due to the difficulty in finding substitutes. This is especially true when specific material characteristics are crucial for end-product performance in industrial applications.

| Factor | Impact on Supplier Bargaining Power | Example/Data Point |

|---|---|---|

| Supplier Concentration | High for specialized minerals | Limited providers for high-purity quartz |

| Switching Costs | High for Covia | Potential investment in new equipment (2023 COGS: $1.1B) |

| Uniqueness of Inputs | Increases power | Specialized frac sand properties critical for performance |

What is included in the product

This analysis unpacks the competitive landscape for Covia, examining the power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within its industry.

Quickly identify and address competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

Customer concentration significantly impacts bargaining power. If a few major clients account for a substantial share of Covia's revenue, particularly in sectors like oil and gas where large-volume proppant purchases are common, these customers can leverage their purchasing power to negotiate lower prices. For instance, a single major oil producer could represent a significant percentage of Covia's sales in a specific region, giving them considerable leverage.

Customer switching costs significantly influence Covia's customers' bargaining power. If customers can easily find and transition to alternative suppliers of industrial minerals and sand with similar product quality and delivery, their ability to negotiate better terms with Covia increases.

In 2024, the industrial minerals market is characterized by a wide array of suppliers, many offering standardized products. This generally leads to lower switching costs for many of Covia's customers, particularly those in sectors like construction or basic manufacturing where product specifications might be less stringent.

However, for customers with highly specialized industrial mineral needs or those deeply integrated into Covia's existing supply chain and logistics, the cost and effort to switch suppliers can be substantial. This complexity can diminish their bargaining power, as the disruption and potential quality variations associated with a new supplier outweigh the benefits of seeking lower prices.

Customer price sensitivity is a major driver of their bargaining power. In markets for basic materials, like construction aggregates, customers tend to be very focused on cost, which gives them more leverage. For instance, in 2024, the construction industry's demand for aggregates remained strong, but intense competition among suppliers meant that price was a primary deciding factor for most buyers.

Conversely, when a company like Covia offers specialized industrial minerals or advanced proppants designed for specific performance enhancements, customers may be less sensitive to price. These specialized products can offer significant value, leading customers to prioritize performance and reliability over the lowest cost. This was evident in the oil and gas sector in 2024, where operators using premium proppants reported improved well productivity, justifying higher upfront costs.

Availability of Substitute Products for Customers

The availability of substitute products significantly amplifies customer bargaining power. If customers can readily switch to alternative materials or solutions that fulfill a similar need, Covia faces pressure to offer competitive pricing and favorable terms. This dynamic is a core component of the threat of substitutes.

For instance, in the industrial minerals sector where Covia operates, customers often have choices between different types of proppants for hydraulic fracturing, such as ceramic proppants or resin-coated sand, alongside Covia's own offerings. The performance characteristics and cost-effectiveness of these alternatives directly impact Covia's ability to dictate terms.

- Substitute Availability: The presence of readily available and cost-effective alternatives grants customers leverage.

- Price Sensitivity: When substitutes exist, customers are more sensitive to price increases from Covia.

- Performance Parity: If substitutes offer comparable performance, customer switching costs are reduced, enhancing their bargaining power.

- Market Dynamics: In 2024, the energy sector's focus on cost optimization means that customers are actively seeking the most economical proppant solutions, increasing the importance of substitute availability.

Threat of Backward Integration by Customers

The threat of backward integration by Covia's customers is a significant factor influencing its bargaining power. Large consumers, like major construction firms or integrated oil and gas companies, possess the financial muscle and technical expertise to consider developing their own mineral mining and processing facilities. This capability directly translates into stronger negotiation leverage when dealing with Covia, as they can credibly threaten to bring production in-house if terms are not favorable.

For instance, a substantial construction materials supplier might evaluate the cost-benefit of acquiring a silica sand or industrial minerals quarry. If the capital investment and operational risks are deemed manageable, and the potential cost savings or supply chain control are attractive, this customer could indeed pursue backward integration. This possibility forces Covia to remain competitive on pricing and service to retain its key accounts.

The scale of a customer's consumption is a primary driver of this threat. Companies with very high annual demand for specific industrial minerals are more likely to find backward integration economically viable. Such customers represent a concentrated portion of Covia's revenue, making their potential shift to self-sufficiency a material concern for Covia's market position and profitability.

Consider the following scenarios illustrating this threat:

- Large-scale construction material producers: A company supplying concrete for major infrastructure projects might investigate owning its own aggregate sources.

- Integrated energy companies: Firms involved in hydraulic fracturing could explore owning proppant (like frac sand) mining operations.

- Major glass manufacturers: Those with significant silica requirements might assess the feasibility of captive sand mining.

The bargaining power of Covia's customers is significant, driven by factors like customer concentration, low switching costs, and high price sensitivity. In 2024, the industrial minerals market, particularly for proppants used in oil and gas, saw customers actively seeking cost-effective solutions due to market pressures. The availability of substitutes further empowers customers to negotiate favorable terms.

The threat of backward integration by large customers, such as major construction firms or integrated energy companies, also plays a crucial role. If these entities can economically produce their own industrial minerals, they gain substantial leverage over suppliers like Covia. This is especially true for customers with high consumption volumes, making their potential self-sufficiency a key consideration for Covia's pricing and service strategies.

| Factor | Impact on Covia's Customer Bargaining Power | 2024 Market Context |

|---|---|---|

| Customer Concentration | High if few large clients dominate revenue | Significant for oil & gas proppant buyers |

| Switching Costs | Low for standardized products | Facilitates customer negotiation |

| Price Sensitivity | High for basic materials, lower for specialized products | Cost optimization was key in energy sector |

| Substitute Availability | Increases customer leverage | Multiple proppant alternatives exist |

| Backward Integration Threat | High for large, financially capable customers | Feasible for integrated energy and construction firms |

What You See Is What You Get

Covia Porter's Five Forces Analysis

This preview displays the complete Covia Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the industry. The document you see here is the exact, professionally formatted report you'll receive immediately after purchase, ensuring no discrepancies or missing information. You can confidently rely on this preview as it represents the final, ready-to-use analysis for your strategic decision-making.

Rivalry Among Competitors

Covia competes in markets with several substantial players, including U.S. Silica Holdings and Sibelco, its former parent company. The presence of these significant competitors means the rivalry is quite intense, as each company strives to gain market share and secure lucrative contracts.

The growth rate within the industrial minerals and frac sand sectors significantly shapes how intensely companies compete. While the broader industrial silica sand market is poised for robust expansion, fueled by construction and hydraulic fracturing, any slowdown in particular niches can intensify rivalry as firms vie more fiercely for the available business.

Covia's competitive rivalry is significantly influenced by product differentiation. In markets where sand and other materials are largely commoditized, like many industrial sands, low differentiation forces companies into intense price competition. This means that if Covia's offerings are seen as interchangeable with competitors', rivalry escalates, potentially squeezing profit margins.

However, Covia also deals in specialized or high-purity minerals, such as those used in advanced manufacturing or specific industrial applications. For these products, a higher degree of differentiation can reduce direct price-based rivalry. This allows Covia to potentially command premium pricing, as customers value the unique properties or consistent quality that set Covia's products apart from standard offerings.

Exit Barriers

High exit barriers in the industrial minerals sector, like those faced by Covia, can significantly fuel competitive rivalry. Companies might choose to soldier on even with minimal profits because shutting down operations is prohibitively expensive. This reluctance to exit keeps more players in the market, intensifying competition.

These barriers are often rooted in massive investments in fixed assets. Think about the costs associated with mines, processing plants, and highly specialized equipment. For instance, the mining industry typically involves substantial capital expenditure; in 2024, the global mining industry saw capital expenditures exceeding $200 billion, underscoring the scale of these investments.

- Substantial Fixed Assets: Mines and processing facilities represent significant, often illiquid, investments.

- Long-Term Contracts: Commitments to supply customers can obligate companies to continue operations.

- Specialized Equipment: Assets are often tailored to specific mineral extraction and processing, limiting resale value.

- Decommissioning Costs: Environmental regulations and site restoration requirements add to exit expenses.

Cost Structure of Competitors

The cost structures of Covia's competitors, especially their operational efficiency and access to cost-effective reserves, are crucial in shaping competitive rivalry. Businesses with lower production and logistics expenses can apply more significant price pressure, compelling others to either trim their profit margins or enhance their own operational efficiencies. For instance, if a competitor can extract and transport frac sand for 15% less than Covia, they gain a distinct advantage in pricing negotiations.

Companies that have successfully optimized their supply chains and secured access to high-quality, low-cost silica sand reserves are better positioned to withstand market downturns and compete aggressively on price. This can lead to a price war, eroding profitability across the industry. Covia's own restructuring efforts in 2020, following its bankruptcy, were largely driven by the need to fundamentally improve its cost structure and regain competitiveness.

- Operational Efficiency: Competitors with streamlined mining, processing, and transportation operations can achieve lower per-unit costs, directly impacting pricing power.

- Access to Reserves: Companies with long-term contracts for low-cost silica sand deposits or ownership of premium reserves have a significant cost advantage.

- Transportation Costs: Proximity to end-users or efficient rail and trucking networks can dramatically reduce delivered costs, a key differentiator.

- Economies of Scale: Larger competitors can often spread fixed costs over a greater volume of production, leading to lower average costs.

The competitive rivalry within Covia's markets is substantial, with key players like U.S. Silica Holdings and Sibelco actively vying for market share. This intensity is amplified by the commoditized nature of many industrial sands, forcing companies into price-driven competition where product differentiation is minimal. However, Covia's focus on specialized, high-purity minerals offers a path to reduced rivalry through premium pricing based on unique product attributes.

High exit barriers, stemming from significant fixed asset investments like mines and processing plants, keep companies engaged even during periods of low profitability, thereby sustaining rivalry. For example, the global mining sector's capital expenditures in 2024, exceeding $200 billion, highlight the scale of these commitments. Competitors' cost structures, particularly their operational efficiencies and access to cost-effective reserves, directly influence pricing pressure and the likelihood of price wars, as seen in Covia's own 2020 restructuring efforts aimed at improving cost competitiveness.

SSubstitutes Threaten

The threat of substitutes for frac sand, a key component in hydraulic fracturing, is a significant concern for companies like Covia. While traditional frac sand remains prevalent, alternative materials such as ceramic proppants and resin-coated sand offer distinct advantages, including enhanced conductivity and crush resistance. The growing market share of these alternatives, which accounted for a notable portion of proppant demand in 2024, directly challenges the dominance of silica sand and pressures pricing for Covia's core product.

Technological advancements in end-use industries present a significant threat of substitutes for Covia. For instance, innovations in construction materials, such as high-performance recycled aggregates or novel composite materials, could directly displace Covia's traditional mineral solutions, reducing demand.

The growing focus on sustainability and circular economy principles is accelerating the development of these alternatives. By 2024, the global construction market's emphasis on green building practices means that materials offering lower environmental impact or enhanced performance characteristics are gaining traction, potentially eroding Covia's market share.

The threat of substitutes for Covia's offerings hinges significantly on the price-performance trade-off. If alternative products can deliver comparable or even better performance at a more attractive price point, customers will naturally consider switching.

For example, in the industrial minerals sector where Covia operates, if a substitute material like a synthetic alternative becomes significantly cheaper to produce or procure while meeting essential performance criteria, it poses a direct threat. This is especially true in markets where cost is a primary driver for purchasing decisions.

As of early 2024, the global industrial minerals market is experiencing price volatility due to energy costs and supply chain disruptions, making the cost comparison between Covia's products and potential substitutes even more critical for customers.

Customer Acceptance of Substitutes

Customer acceptance is a key factor in how readily substitutes can impact Covia. If end-users are hesitant to switch to alternative materials or technologies, even if they are technically sound, the threat posed by these substitutes is significantly reduced. This reluctance can stem from established industry norms, the need for new regulatory approvals, or deeply ingrained customer preferences for existing solutions.

For instance, in industries where Covia operates, such as construction or manufacturing, the integration of new materials often requires extensive testing and certification processes. This can create a substantial barrier to entry for substitutes, giving Covia a window to adapt or innovate. In 2024, for example, the adoption rate of novel composite materials in certain industrial applications saw a slower-than-anticipated uptake due to these very factors, highlighting the inertia that can protect incumbent suppliers.

The perceived performance and reliability of substitutes also play a vital role. If customers doubt whether a substitute can match the quality, durability, or specific functional attributes of Covia's offerings, they are less likely to make the switch. This is particularly true in sectors where failure can have significant safety or economic consequences. Covia's established reputation and proven track record can therefore act as a strong deterrent against the immediate threat of substitution.

Furthermore, switching costs for customers can be a significant impediment to substitute adoption. These costs might include:

- Re-tooling and equipment upgrades: New materials may require different manufacturing processes or machinery.

- Training and skill development: Workforce adaptation to new technologies or materials.

- Supply chain adjustments: Integrating new suppliers and managing logistics.

- Product redesign: Modifying existing products to accommodate substitute materials.

Regulatory and Environmental Shifts Favoring Substitutes

Heightened environmental regulations and a global push for sustainability present a significant threat to Covia. As governments worldwide implement stricter rules on mining and resource extraction, materials perceived as greener alternatives gain traction. This shift could accelerate the adoption of substitutes, directly impacting Covia's market share and profitability.

For instance, the increasing focus on circular economy principles and the demand for recycled or bio-based materials could lead industries to re-evaluate their reliance on conventionally sourced minerals. Companies are actively seeking ways to reduce their carbon footprint, making sustainable substitutes more appealing. This trend is not just hypothetical; by 2024, many industries are already reporting increased investment in research and development for these alternative materials.

- Shifting Consumer Preferences: Growing consumer awareness regarding environmental impact drives demand for products made with sustainable materials, pushing manufacturers to seek alternatives to traditional mined minerals.

- Government Incentives for Green Technologies: Policies and subsidies aimed at promoting renewable energy and sustainable manufacturing often favor materials with lower environmental footprints, indirectly supporting substitutes.

- Technological Advancements in Material Science: Innovations are continuously yielding new, high-performance substitutes that can match or exceed the properties of conventional minerals, often with a reduced environmental cost.

The threat of substitutes for Covia's products, particularly in the frac sand market, is a dynamic factor. While silica sand has been the industry standard, alternatives like ceramic proppants and resin-coated sand offer performance advantages, capturing a notable market share by 2024. This trend pressures pricing and necessitates innovation from Covia to maintain its competitive edge.

Technological advancements and a growing emphasis on sustainability are fueling the development and adoption of substitute materials across various industries Covia serves. For example, in construction, innovative recycled aggregates and composites are gaining traction, driven by green building initiatives and a desire to reduce environmental impact. By 2024, the market's embrace of these eco-friendlier options directly challenges traditional mineral solutions.

The economic viability of substitutes, measured by their price-performance ratio, is a critical determinant of their threat level. If alternatives can deliver comparable or superior results at a lower cost, customer adoption accelerates. The industrial minerals market in early 2024, marked by energy cost volatility, amplifies this price sensitivity, making the cost-benefit analysis for customers even more crucial.

Customer inertia, stemming from high switching costs and a preference for proven reliability, can mitigate the immediate threat of substitutes. However, as new materials undergo rigorous testing and gain regulatory approval, and as industries adapt their processes, the competitive landscape evolves. By 2024, the slower-than-expected uptake of some novel composite materials in certain sectors highlights how established norms can initially protect incumbent suppliers like Covia.

| Substitute Material | Key Advantages | Market Share (Estimated 2024) | Potential Impact on Covia |

|---|---|---|---|

| Ceramic Proppants | Higher crush resistance, better conductivity | Significant portion of proppant demand | Direct competition for frac sand market |

| Resin-Coated Sand | Improved flowback control, reduced fines | Growing adoption in specific applications | Niche market competition |

| Recycled Aggregates (Construction) | Lower environmental impact, cost savings | Increasingly favored in green building | Reduced demand for traditional construction aggregates |

| Novel Composite Materials (Industrial) | High strength-to-weight ratio, customizability | Emerging in specialized applications | Potential displacement in specific industrial uses |

Entrants Threaten

The industrial minerals and mining sector, particularly for sand and aggregates, demands significant upfront capital. Newcomers must budget for land acquisition, heavy mining machinery, processing facilities, and robust transportation networks. For instance, establishing a new quarry operation can easily require tens of millions of dollars in initial investment, making it a formidable hurdle for potential entrants.

Access to high-quality, economically viable raw material reserves acts as a significant barrier for new companies entering the industrial minerals sector. Established players, such as Covia, frequently possess extensive mineral rights and permits, creating a substantial hurdle for newcomers seeking to secure comparable resources. For instance, in 2024, the global market for industrial minerals like frac sand, a key product for companies in this space, continued to be dominated by a few large suppliers who control significant reserves, making it challenging for smaller entities to compete on cost and supply reliability.

Existing players in the industrial minerals sector, like Covia, leverage significant economies of scale. This means their per-unit production, processing, and distribution costs decrease as their output increases. For instance, Covia's extensive network of mines and processing facilities allows for optimized logistics and bulk purchasing power.

New entrants face a substantial hurdle in matching these cost efficiencies. To compete effectively, a new company would need to invest heavily to achieve a comparable scale of operations. This high initial capital requirement, coupled with the need for rapid market penetration to realize those economies, acts as a strong deterrent against new competition.

Distribution Channels and Network

The threat of new entrants for Covia, particularly concerning its distribution channels and network, is significantly mitigated by the substantial investment required to replicate its infrastructure. Establishing efficient and extensive distribution channels, including crucial rail and terminal networks for bulk materials like industrial sand, presents a major hurdle. Covia benefits from its legacy companies, Unimin and Fairmount Santrol, which have cultivated a robust and long-standing distribution system over decades.

This established network is not easily replicated. For instance, in 2024, the cost of building a new transload facility or securing dedicated railcar capacity can run into millions of dollars, depending on the location and scale. New entrants would face considerable capital expenditure and time delays in developing comparable logistical capabilities. Covia's existing footprint allows for cost-effective and reliable delivery to a wide customer base, a competitive advantage that is difficult for newcomers to overcome.

- High Capital Investment: Replicating Covia's extensive rail and terminal infrastructure requires significant upfront capital, deterring many potential new entrants.

- Established Network Advantage: Covia's legacy from Unimin and Fairmount Santrol provides a proven and efficient distribution system, offering a competitive edge in delivery and logistics.

- Logistical Expertise: Decades of experience in managing bulk material transportation translate into operational efficiencies and cost savings that new players would struggle to match.

- Market Access: The existing network facilitates access to key industrial markets, a critical factor for success that new entrants would find challenging to penetrate quickly.

Regulatory Hurdles and Permitting

The industrial mining sector, including operations like those of Covia, faces a formidable barrier to entry due to extensive and rigorous environmental regulations. These rules, often enforced by agencies like the EPA in the United States, dictate everything from land reclamation to water discharge, demanding significant upfront investment and ongoing compliance efforts. For instance, obtaining the necessary permits for a new mining operation can take years and cost millions, effectively deterring many potential competitors.

Navigating these complex regulatory landscapes is a significant challenge. New entrants must not only understand but also adhere to a web of federal, state, and local laws, which can vary considerably by region. This process requires specialized legal and environmental expertise, adding to the already substantial capital required to start operations. For example, in 2024, the average time to secure all necessary permits for a new large-scale mining project in North America was estimated to be between 3 to 7 years, with associated costs often exceeding $5 million.

- Stringent Environmental Compliance: Mining operations must meet strict standards for air and water quality, waste disposal, and habitat protection.

- Lengthy Permitting Processes: Obtaining all required federal, state, and local permits can be a multi-year endeavor, involving extensive environmental impact assessments.

- High Associated Costs: The financial burden of compliance and permitting can run into millions of dollars, creating a significant barrier for smaller or less capitalized entrants.

- Evolving Regulatory Landscape: Changes in environmental policy and enforcement can introduce further uncertainty and costs for new market participants.

The threat of new entrants in the industrial minerals sector, where Covia operates, is generally low. This is primarily due to the substantial capital required to establish operations, including land acquisition, heavy machinery, and processing facilities. For example, in 2024, the cost to build a new frac sand processing plant could easily exceed $50 million, a significant barrier for new players.

Furthermore, securing access to high-quality mineral reserves is a critical challenge, as established companies like Covia often control significant, long-term mineral rights. The extensive and rigorous environmental regulations also pose a considerable hurdle, with permitting processes for new mining operations in 2024 often taking 3-7 years and costing millions in compliance and assessments.

Finally, Covia benefits from established economies of scale and a robust, decades-old distribution network, making it difficult for newcomers to compete on cost and delivery efficiency. Replicating this logistical infrastructure, which might involve millions in new terminal or railcar investments, further deters potential entrants.

Porter's Five Forces Analysis Data Sources

Our Covia Porter's Five Forces analysis leverages data from industry-specific trade publications, company annual reports, and market research databases. This ensures a comprehensive understanding of competitive dynamics within the silica and related industries.