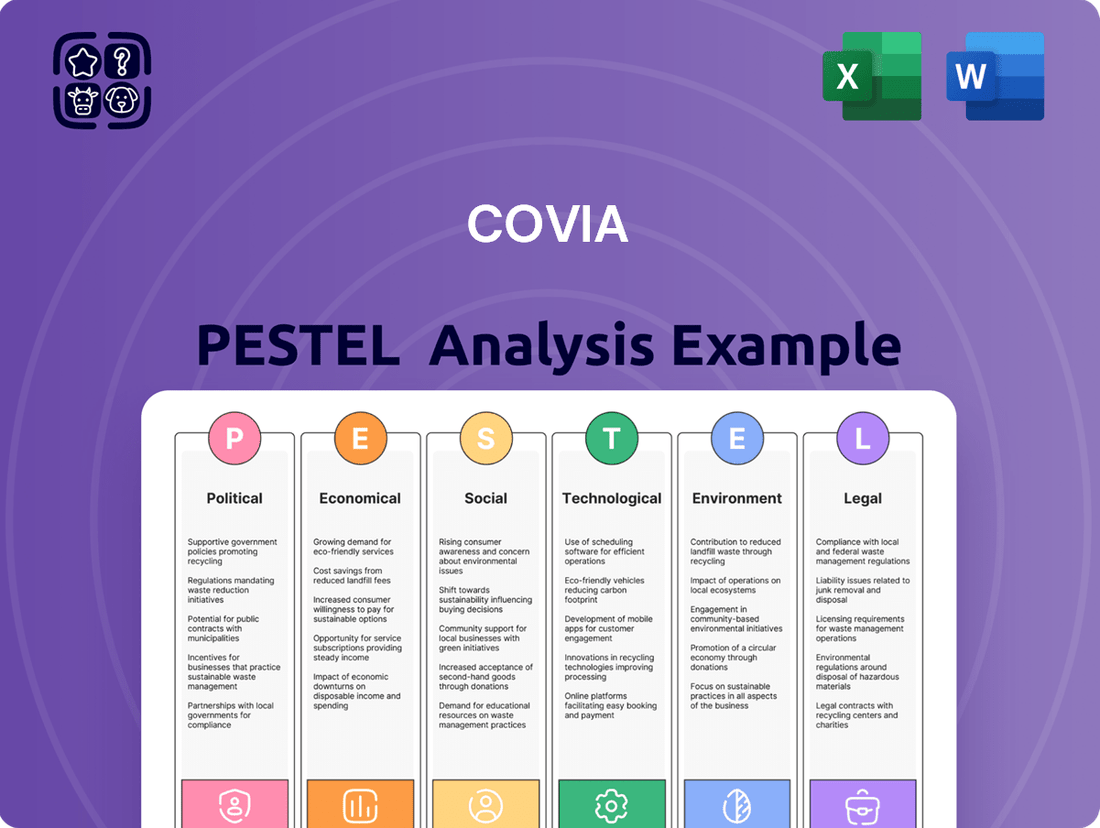

Covia PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Covia Bundle

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping Covia's landscape. Our expert-crafted PESTLE analysis provides the deep-dive insights you need to anticipate challenges and seize opportunities. Download the full version now to gain a strategic advantage and make informed decisions.

Political factors

Government policies and regulations significantly shape Covia's mining operations, covering everything from necessary permits and land use to stringent environmental standards. These rules directly influence operational costs and the feasibility of new projects.

Stricter environmental mandates, particularly concerning emissions and waste disposal, can lead to increased capital expenditures and potentially delay project approvals, impacting Covia's expansion plans and ongoing operations.

Anticipated changes in mining laws, such as the U.S. Energy Permitting Reform Act of 2024, aim to streamline federal authorizations for mineral projects. This legislation could potentially reduce project timelines and create more favorable conditions for companies like Covia.

International trade policies and tariffs significantly impact Covia's ability to access global markets and remain competitive. For example, the United States' imposition of tariffs on certain imported industrial goods in 2018-2019, while not directly targeting Covia's core products, created broader economic uncertainty that could affect demand for its services. Navigating these evolving trade landscapes is essential for maintaining stable supply chains and market share.

Geopolitical instability and resource nationalism pose significant risks to Covia's operations. Tensions in regions where Covia or its parent company, SCR-Sibelco NV, source materials can disrupt supply chains. For instance, in 2024, ongoing conflicts in Eastern Europe have already impacted global commodity flows, potentially affecting raw material availability and pricing for industries reliant on specialized minerals.

By 2025, mining companies like Covia will face heightened scrutiny regarding their environmental and human rights impacts, exacerbated by geopolitical friction and ideological divides. This global trend will likely translate into stricter regulations and increased operational challenges, particularly in nations with a history of resource nationalism, demanding greater transparency and ethical sourcing practices.

Government Support for Infrastructure

Government support for infrastructure projects significantly boosts demand for construction aggregates, a core market for Covia. For instance, the United States' Infrastructure Investment and Jobs Act, enacted in 2021, allocates over $1.2 trillion for infrastructure improvements through 2029, directly benefiting companies supplying materials for these projects.

Initiatives like India's National Infrastructure Pipeline, targeting $1.4 trillion in infrastructure investment by 2025, are crucial drivers for construction material demand. This focus on upgrading roads, bridges, and public transit systems creates sustained opportunities for aggregate suppliers like Covia.

Further bolstering this sector, the European Union's NextGenerationEU recovery plan, with a significant portion dedicated to green and digital transitions, includes substantial funding for sustainable infrastructure development. This multi-year investment strategy is expected to continue driving demand for essential construction materials through 2025 and beyond.

- Government infrastructure spending directly correlates with aggregate demand.

- US Infrastructure Investment and Jobs Act provides substantial funding through 2029.

- India's National Infrastructure Pipeline targets $1.4 trillion by 2025.

- EU's NextGenerationEU supports sustainable infrastructure, increasing material needs.

Energy Policies and Hydraulic Fracturing Regulations

Government policies concerning the energy sector, especially those affecting hydraulic fracturing, have a direct impact on the demand for frac sand. As of early 2025, the U.S. remains a primary driver for hydraulic fracturing, fueling the need for silica sand.

The global frac sand market is experiencing robust growth, largely propelled by the increasing adoption of hydraulic fracturing in shale gas and tight oil extraction. This trend is expected to continue, with projections indicating significant expansion through 2025 and beyond.

- U.S. Energy Dominance: The United States continues to lead in hydraulic fracturing, a key factor driving demand for frac sand.

- Market Growth: The global frac sand market is anticipated to see substantial growth, with projections suggesting a compound annual growth rate (CAGR) of over 5% between 2024 and 2029.

- Shale Oil and Gas: Increased exploration and production in shale formations worldwide are directly correlated with higher frac sand consumption.

- Regulatory Landscape: Evolving environmental regulations surrounding fracking can influence operational costs and, consequently, the demand for frac sand.

Government policies directly influence Covia's operational landscape, from environmental regulations to infrastructure spending. For instance, the U.S. Infrastructure Investment and Jobs Act, allocating over $1.2 trillion through 2029, fuels demand for construction aggregates. Conversely, evolving environmental mandates can increase capital expenditures, impacting project timelines and feasibility.

The political climate also shapes market access; international trade policies and tariffs can affect Covia's competitiveness and supply chains. Geopolitical instability poses risks, potentially disrupting raw material sourcing and increasing operational challenges, especially in regions with resource nationalism trends, which are expected to intensify scrutiny on ethical sourcing by 2025.

Government support for the energy sector, particularly concerning hydraulic fracturing, directly impacts frac sand demand. The U.S. remains a key driver for this market, with projections indicating a compound annual growth rate of over 5% for the global frac sand market between 2024 and 2029, underscoring the importance of energy policy.

What is included in the product

This Covia PESTLE analysis examines how external macro-environmental factors influence the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by identifying market opportunities and potential threats within Covia's operating landscape.

A Covia PESTLE analysis provides a structured framework to identify and understand external factors impacting the business, thereby alleviating the pain of uncertainty and enabling more informed strategic decision-making.

Economic factors

The global construction market is a significant driver for Covia, as its aggregates and industrial sands are fundamental to building projects. This sector is projected for robust expansion, fueled by ongoing urbanization and substantial investments in infrastructure across many nations.

In 2024, the global construction market size was valued at approximately $12.5 trillion, with projections indicating a compound annual growth rate (CAGR) of around 4.5% through 2029, reaching an estimated $15.6 trillion. This growth is largely attributed to increased government spending on infrastructure and a rebound in residential construction activity in key regions like North America and Asia-Pacific.

The oil and gas market's inherent volatility directly affects the demand for frac sand, a key component in hydraulic fracturing. For instance, if oil prices dip significantly, as they did in early 2020, exploration and production (E&P) companies may scale back their drilling activities, leading to a reduced need for proppants like frac sand.

Despite this, the broader proppant market, including frac sand, is expected to see growth, with some projections indicating a compound annual growth rate (CAGR) of around 5-7% through 2027. However, sharp fluctuations in crude oil prices, such as the West Texas Intermediate (WTI) price swings seen throughout 2024, can create uncertainty for E&P investment, thereby impacting the predictable demand for frac sand.

Fluctuations in the cost of extracting, processing, and transporting essential minerals and materials directly impact Covia's bottom line. For instance, the price of silica sand, a key component in their offerings, can be significantly influenced by energy costs and mining expenses.

In 2024, the U.S. frac sand market has seen a notable trend towards in-basin sourcing. This strategic shift aims to reduce transportation expenses, a substantial cost driver, by locating sand mines closer to end-users in key oil and gas producing regions, thereby improving overall operational efficiency and potentially lowering per-unit costs for Covia.

Industrial Manufacturing Demand

Covia's economic performance is closely tied to demand from key industrial manufacturing sectors like glass, ceramics, and foundries, which rely on its specialty minerals. The global industrial minerals market is experiencing robust growth, with projections indicating a compound annual growth rate (CAGR) of around 4.5% through 2028, fueled by these very industries.

This expansion is underpinned by several factors:

- Construction Boom: Increased infrastructure development and housing projects globally drive demand for materials like silica, essential for concrete and glass.

- Ceramics and Glass Production: Growing consumer demand for tiles, sanitaryware, and specialized glass products directly impacts the need for Covia's offerings.

- Automotive and Electronics: The manufacturing of vehicles and electronic devices also requires specific minerals for components and coatings, contributing to overall demand.

- Foundry Applications: The automotive and heavy machinery sectors' need for castings supports demand for foundry sands, a core Covia product.

Inflation and Economic Growth

Inflation and economic growth are crucial factors for Covia. Rising inflation can increase the cost of raw materials, energy, and labor, directly impacting Covia's operational expenses and potentially squeezing profit margins. Conversely, robust economic growth typically translates to higher demand for industrial products, which could benefit Covia's sales volumes.

For instance, while many European economies faced headwinds in 2024, Sibelco, a company with operations similar to Covia in the industrial minerals sector, managed to boost its revenue by 5.7%. This suggests that even in challenging economic environments, companies can find avenues for growth, possibly through strategic pricing or increased market share.

- Inflationary Pressures: Higher inflation can increase Covia's input costs for materials, energy, and transportation, potentially impacting profitability.

- Economic Growth Impact: Strong economic growth generally leads to increased demand for industrial minerals, benefiting Covia's sales volume.

- Market Resilience: Sibelco's 5.7% revenue growth in 2024, despite difficult European business conditions, highlights the potential for resilience in the industrial minerals sector.

- Consumer and Industrial Spending: Fluctuations in consumer and industrial spending, driven by economic conditions and inflation, directly affect demand for Covia's products.

Economic factors significantly influence Covia's operational costs and revenue streams, particularly through commodity prices and overall economic health. The global construction market, a major consumer of aggregates and industrial sands, was valued at approximately $12.5 trillion in 2024 and is expected to grow at a 4.5% CAGR through 2029, indicating strong demand for Covia's materials. Conversely, the oil and gas sector's volatility directly impacts the demand for frac sand, with the market projected to grow at a 5-7% CAGR through 2027, though oil price fluctuations introduce uncertainty.

Inflationary pressures in 2024 directly affected input costs for Covia, including energy and transportation, as seen with Sibelco's 5.7% revenue growth in challenging European markets, suggesting potential for strategic pricing and market share gains. The industrial minerals market, crucial for sectors like glass and ceramics, is also experiencing robust growth, with a projected CAGR of around 4.5% through 2028, driven by construction, manufacturing, and consumer demand.

| Economic Factor | Impact on Covia | 2024/2025 Data/Projection |

| Global Construction Market Growth | Increased demand for aggregates and industrial sands | Valued at $12.5 trillion in 2024; projected 4.5% CAGR through 2029 |

| Oil & Gas Market Volatility | Affects demand for frac sand | Proppant market projected 5-7% CAGR through 2027; WTI price fluctuations create uncertainty |

| Inflation | Increases operational costs (energy, materials, labor) | General inflationary pressures impacting input costs across industries in 2024 |

| Industrial Minerals Market Growth | Drives demand for specialty minerals | Projected 4.5% CAGR through 2028 for industrial minerals |

Preview the Actual Deliverable

Covia PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Covia PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company, providing a robust strategic overview.

Sociological factors

Covia’s ability to maintain positive relationships with communities surrounding its mining and processing operations is paramount to securing its social license to operate. This involves consistent engagement and addressing local concerns directly.

Stakeholder expectations regarding corporate accountability across the entire value chain are escalating, with legislative actions in various regions emphasizing the significance of robust community relations and respect for indigenous rights. For instance, ongoing discussions around ESG (Environmental, Social, and Governance) reporting in 2024 and 2025 highlight this trend.

Ensuring the health and safety of employees in mining and processing operations is a paramount sociological consideration for companies like Covia. This extends beyond basic duty of care to encompass the well-being and morale of the workforce, directly impacting productivity and operational continuity.

As of 2025, regulatory compliance in the mining sector places a significant emphasis on occupational health and safety. This focus is often intertwined with broader sustainability mandates, pushing companies to implement more rigorous safety protocols and environmental management systems. For instance, the U.S. Mine Safety and Health Administration (MSHA) continues to enforce strict standards, with citations for safety violations remaining a key metric for operational oversight.

Public sentiment towards mining and fracking significantly shapes the regulatory landscape and market acceptance of Covia's offerings. Growing environmental activism, fueled by concerns over water contamination and seismic activity, has led to increased scrutiny and stricter regulations, impacting operational costs and market access for companies like Covia.

The frac sand industry, a core market for Covia, faces direct pressure from these environmental concerns. For instance, in 2024, reports indicated that over 60% of Americans expressed concern about the environmental impact of fracking, a sentiment that directly translates into demand for more sustainable practices and innovative proppant alternatives, pushing companies to invest in research and development.

Urbanization and Population Growth

Urbanization and population growth are significant drivers for Covia, directly impacting the demand for its industrial minerals. As more people move into cities and populations expand, there's a heightened need for construction materials to build homes, offices, and essential infrastructure like roads and utilities. This trend is particularly pronounced in emerging economies where rapid development is underway.

The global urban population continues to climb, with projections indicating that by 2050, approximately 68% of the world's population will reside in urban areas, according to the United Nations. This sustained growth fuels a consistent demand for materials like sand, gravel, and specialty minerals that Covia supplies. For instance, the infrastructure spending in major developing nations, such as India and China, reached trillions of dollars in recent years, translating into substantial orders for construction aggregates.

- Increased demand for housing and commercial spaces due to urbanization.

- Infrastructure development, including transportation and utilities, relies heavily on industrial minerals.

- Emerging economies are experiencing rapid urban growth, boosting construction material needs.

- Population growth directly correlates with higher consumption of goods requiring industrial mineral inputs.

Demand for Sustainable Products

There's a clear upward trend in consumer and industry desire for products made with sustainability in mind, impacting how companies like Covia approach their product lines and day-to-day operations. This shift is particularly evident in the construction sector, where eco-friendly materials and methods are becoming increasingly important.

The aggregates market, a core area for Covia, is seeing significant investment. This surge is directly linked to the growing need for sustainable building materials and environmentally conscious construction practices. For instance, the global green building materials market was valued at approximately $250 billion in 2023 and is projected to grow substantially, reaching over $450 billion by 2030, indicating a strong market pull for sustainable solutions.

- Growing Consumer Preference: Consumers are increasingly prioritizing environmentally friendly products, influencing purchasing decisions across various sectors, including construction materials.

- Industry Demand for Sustainability: Businesses are actively seeking sustainable sourcing and production methods to meet regulatory requirements, corporate social responsibility goals, and market expectations.

- Investment in Eco-Friendly Solutions: The aggregates market is attracting investment as companies develop and promote greener alternatives, such as recycled aggregates and low-carbon concrete components.

- Market Growth Projections: The increasing focus on sustainability signals a robust future market for materials and services that align with environmental stewardship, presenting opportunities for companies like Covia to innovate and adapt.

Sociological factors significantly influence Covia's operations, particularly community relations and workforce well-being. Public perception of mining, especially regarding environmental impact, directly affects regulatory scrutiny and market acceptance, as evidenced by over 60% of Americans expressing concern about fracking's environmental impact in 2024. Furthermore, growing urbanization and population expansion, with 68% of the global population projected to live in urban areas by 2050, drive demand for construction materials, a core market for Covia.

| Sociological Factor | Impact on Covia | Supporting Data/Trend (2024-2025) |

|---|---|---|

| Community Relations & Social License | Essential for operational continuity and permits. | Escalating stakeholder expectations for ESG reporting and accountability. |

| Workforce Health & Safety | Directly impacts productivity and operational stability. | Continued strict enforcement of occupational health and safety standards by bodies like MSHA. |

| Public Sentiment on Mining/Fracking | Shapes regulatory environment and market access. | Over 60% of Americans concerned about fracking's environmental impact (2024). |

| Urbanization & Population Growth | Drives demand for construction aggregates. | 68% of global population projected urban by 2050; significant infrastructure spending in developing nations. |

| Consumer Preference for Sustainability | Influences product development and market positioning. | Global green building materials market valued at ~$250 billion (2023), with strong growth projections. |

Technological factors

Covia's operations are significantly influenced by advancements in mining, processing, and material handling technologies. Innovations in these areas can directly boost efficiency, lower operational expenses, and elevate the quality of their industrial sand products. For instance, during 2024, companies in the mining sector saw an average increase in productivity of 5-10% through targeted technology adoption.

The integration of automation and artificial intelligence (AI) is a key trend reshaping sand processing. AI-powered systems are enabling greater accuracy in grading and sorting, streamlining complex processes, and enhancing the effectiveness of predictive maintenance schedules, thereby minimizing downtime.

Covia's integration of automation and AI in its operations is a significant technological driver. By embracing robotics and artificial intelligence, the company can expect substantial gains in productivity, enhanced safety protocols, and more efficient use of its resources. For instance, advancements in AI are set to revolutionize mining ESG practices by 2025, impacting everything from day-to-day efficiency to the rigorous collection and analysis of environmental, social, and governance data.

Covia's commitment to research and development in material science is pivotal for creating novel applications for its diverse mineral and material portfolio, as well as enhancing the efficacy of its current offerings.

Innovations in proppant technology, particularly in advanced ceramic and resin-coated proppants, directly translate to superior performance in hydraulic fracturing operations, a core market for Covia.

For instance, the 2024 market for proppants is projected to reach $12.5 billion, with a compound annual growth rate of 5.2% through 2030, underscoring the demand for performance-driven solutions that Covia's material science advancements can address.

Digitalization and Data Analytics

Covia is leveraging digitalization and data analytics to gain a competitive edge in industrial sand processing. The implementation of digital tools, coupled with IoT connectivity, allows for real-time insights into production parameters, leading to optimized supply chains and enhanced quality control. This digital transformation is crucial for the future of industrial sand processing, enabling greater customization and improved operational responsiveness through real-time analytics.

The company's focus on data analytics supports more informed decision-making across its operations. For instance, by analyzing production data, Covia can identify inefficiencies and implement targeted improvements. This data-driven approach is becoming increasingly vital for industries that rely on precise material specifications and consistent quality, such as the oil and gas sector, where Covia is a significant supplier.

- Real-time Production Monitoring: Digital tools provide immediate feedback on key performance indicators, allowing for swift adjustments to maintain optimal output.

- Supply Chain Optimization: Data analytics helps in forecasting demand, managing inventory, and streamlining logistics, reducing costs and improving delivery times.

- Enhanced Quality Control: Continuous data collection and analysis ensure that industrial sand products meet stringent customer specifications.

- Increased Operational Efficiency: By automating processes and providing actionable data, digitalization boosts overall productivity and reduces waste.

Sustainable Technologies and Practices

Covia's operations are significantly influenced by technological advancements in sustainability. The development and widespread adoption of technologies designed to minimize environmental impact, such as sophisticated water recycling systems and advanced emissions control equipment, are becoming paramount. These innovations are not just about compliance; they represent a growing strategic imperative for companies in the industrial minerals sector.

The drive for sustainability has directly fueled innovation in sand processing technologies. This has led to the creation of more environmentally friendly equipment and processes. For instance, by 2024, the global market for environmental technologies was projected to reach over $1.5 trillion, highlighting the significant investment and focus in this area, which directly impacts how companies like Covia must operate and innovate.

- Water Recycling: Technologies that enable higher rates of water recycling in mining and processing operations are crucial for reducing freshwater consumption and managing wastewater discharge.

- Emissions Control: Advanced filtration and scrubbing systems are vital for minimizing air pollutants, such as particulate matter and greenhouse gases, from processing plants.

- Energy Efficiency: Innovations in equipment design and operational processes aim to reduce energy consumption, often through the use of more efficient motors, optimized material handling, and renewable energy integration.

- Sustainable Material Sourcing: Technological advancements are also enabling the more efficient extraction and processing of lower-grade or previously uneconomical mineral reserves, potentially reducing the need for new land disturbance.

Technological advancements are reshaping Covia's operational landscape, driving efficiency and product quality. Innovations in automation and AI are streamlining processes, enhancing predictive maintenance, and improving grading accuracy, as seen with a projected 5-10% productivity increase in mining through targeted tech adoption in 2024. Covia's investment in material science, particularly in advanced proppant technologies, addresses the growing demand in the oil and gas sector, with the proppant market expected to reach $12.5 billion in 2024.

Digitalization and data analytics are key to Covia's competitive edge, enabling real-time production monitoring and supply chain optimization. This digital transformation is critical for meeting stringent quality specifications in industries like oil and gas. Furthermore, technological innovation is crucial for sustainability, with advancements in water recycling, emissions control, and energy efficiency becoming strategic imperatives for the industrial minerals sector.

| Technology Area | Impact on Covia | Relevant Data/Trends (2024-2025) |

|---|---|---|

| Automation & AI | Increased productivity, improved predictive maintenance, enhanced sorting accuracy | Mining productivity gains of 5-10% expected with tech adoption (2024) |

| Material Science | Development of advanced proppants, enhanced product performance | Proppant market projected at $12.5 billion (2024), growing at 5.2% CAGR |

| Digitalization & Data Analytics | Real-time monitoring, supply chain optimization, enhanced quality control | Growing adoption of IoT for real-time operational insights |

| Sustainability Technologies | Reduced environmental impact, efficient resource utilization | Global environmental technologies market exceeding $1.5 trillion (2024) |

Legal factors

Covia navigates a landscape of stringent environmental regulations, encompassing air emissions, water discharge, waste management, and land reclamation. These rules are not static; they are constantly evolving, demanding continuous adaptation. For instance, in 2024, many jurisdictions are implementing stricter emission standards for industrial processes, directly impacting operational costs and requiring investment in cleaner technologies.

The global trend is towards more rigorous environmental oversight. Mandatory environmental impact assessments are now a prerequisite for project approvals in most major markets. This means Covia must thoroughly evaluate and mitigate potential environmental consequences of its operations and new ventures, a process that can add significant time and expense to development cycles.

Covia operates under stringent health and safety regulations, a critical aspect of its 2025 operational landscape. These rules mandate robust safety protocols and comprehensive training for all personnel involved in mining and industrial activities. The focus on occupational health and safety remains a paramount regulatory concern for the mining sector.

Covia's operations are significantly shaped by land use regulations and permitting processes. Laws dictating mineral rights and the procedures for obtaining permits for both new and existing mining sites directly influence the company's capacity for expansion and ongoing operations. These legal frameworks are crucial for securing access to resources and maintaining operational continuity.

The Energy Permitting Reform Act of 2024 represents a notable development, as it seeks to streamline the federal authorization timelines for energy and mineral projects. This legislation could potentially accelerate future development plans for companies like Covia, impacting project timelines and investment decisions.

Bankruptcy and Merger Laws (Historical Context)

Covia's emergence from Chapter 11 bankruptcy in 2020, a process governed by strict legal frameworks, significantly reshaped its corporate structure. This legal maneuver was crucial for its survival and subsequent strategic moves.

The merger with Unimin Corporation, also navigating relevant merger and acquisition laws, further solidified its position within the industry. This consolidation, completed in 2020, created a larger entity now operating under the SCR-Sibelco NV umbrella.

- Bankruptcy Filing: Covia Holdings Corporation filed for Chapter 11 bankruptcy protection in March 2020, citing financial distress.

- Merger Completion: The merger with Unimin Corporation was completed in July 2020, forming a new entity under SCR-Sibelco NV.

- Regulatory Scrutiny: Both bankruptcy proceedings and mergers are subject to significant legal and regulatory oversight, ensuring compliance and fair treatment of stakeholders.

International Trade Laws and Agreements

Covia's operations in international markets necessitate adherence to a complex web of international trade laws, agreements, and sanctions. These regulations directly impact Covia's capacity to import essential raw materials and export its finished products, potentially influencing supply chain stability and market access. For instance, trade disputes or the imposition of tariffs, such as those seen in recent years impacting global commodity flows, could significantly alter Covia's cost structures and competitive positioning.

The evolving landscape of regional accords and multilateral trade agreements, like the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) or potential updates to existing agreements, aims to harmonize regulatory environments and reduce trade barriers. This trend offers opportunities for companies like Covia to expand their global reach more efficiently. However, it also requires continuous monitoring and adaptation to ensure compliance with varying national implementations and evolving trade policies.

- Impact of Tariffs: Recent global trade tensions have seen tariffs imposed on various industrial materials, potentially increasing import costs for Covia's key inputs.

- Sanctions Compliance: Covia must navigate sanctions regimes, such as those affecting certain countries or entities, to avoid disruptions to its international trade activities.

- Trade Agreement Benefits: Favorable trade agreements can reduce duties and streamline customs procedures, enhancing Covia's competitiveness in export markets.

- Regulatory Harmonization: Efforts to harmonize trade regulations across blocs can simplify compliance but require staying abreast of evolving standards.

Covia's legal framework is heavily influenced by environmental protection laws, with ongoing updates in 2024 and 2025 mandating stricter controls on emissions and waste. The company must also comply with health and safety regulations, ensuring worker protection in its mining operations, a focus that intensified in 2024. Furthermore, land use and permitting laws are critical for operational continuity and expansion, with recent legislative efforts like the Energy Permitting Reform Act of 2024 aiming to expedite project approvals.

International trade laws and sanctions present a complex legal challenge for Covia, impacting its ability to manage supply chains and market access. Recent trade disputes and tariff impositions, such as those affecting industrial materials, have demonstrably increased import costs. For example, in 2024, the global supply chain experienced disruptions due to geopolitical tensions, impacting raw material availability and pricing for the industrial minerals sector.

| Legal Factor | Description | Impact on Covia | 2024/2025 Relevance |

|---|---|---|---|

| Environmental Regulations | Laws governing emissions, waste, and land reclamation. | Increased operational costs, need for cleaner tech investment. | Stricter emission standards implemented in 2024; ongoing focus on sustainability. |

| Health & Safety Laws | Mandates for worker protection and safe operating procedures. | Requirement for robust safety protocols and training. | Continued emphasis on occupational health in 2025; zero-tolerance policies are common. |

| Land Use & Permitting | Regulations on mineral rights and project approvals. | Affects expansion capacity and operational continuity. | Energy Permitting Reform Act of 2024 aims to streamline approvals for energy/mineral projects. |

| International Trade Law | Rules governing imports, exports, tariffs, and sanctions. | Influences supply chain stability and market access. | Global trade tensions in 2024 led to increased tariffs on industrial inputs; sanctions compliance is critical. |

Environmental factors

Covia, like the broader mining sector, is navigating heightened scrutiny regarding its environmental impact, particularly concerning climate change and carbon emissions. Investor sentiment in 2024 and projected into 2025 strongly favors companies demonstrating tangible climate commitments and actionable plans for emissions reduction. This pressure translates into a demand for greater transparency and investment in cleaner operational practices.

The regulatory landscape is evolving rapidly, with governments worldwide implementing stricter emission controls and setting mandatory reduction targets for industrial sectors, including mining. For 2025, we anticipate a continuation of this trend, with potential for increased carbon pricing mechanisms and enhanced reporting requirements. Companies that proactively integrate renewable energy sources and invest in carbon capture technologies will likely gain a competitive advantage.

Water is a vital input for Covia's operations, particularly in mining and processing. As environmental awareness grows, so do the regulations surrounding water usage. For instance, in 2024, many regions saw updated directives on water discharge quality, pushing companies like Covia to invest in sophisticated treatment technologies to meet these stricter standards.

The increasing stringency of water management regulations directly impacts operational costs and continuity. Covia, like its peers, must demonstrate robust water management plans that prioritize freshwater reduction and maximize recycling. Failure to do so can lead to significant penalties or even temporary operational halts, as seen in some mining jurisdictions where water scarcity issues intensified in early 2025.

Effective management of mining waste, especially tailings, is a critical environmental consideration for companies like Covia, with stringent regulations governing these practices. The GRI 14: Mining Sector 2024 standard, for instance, emphasizes enhanced disclosures on tailings management, pushing for greater transparency and accountability in the industry. This heightened focus means companies must demonstrate robust strategies for minimizing environmental impact and ensuring the long-term stability of tailings facilities.

Biodiversity and Land Stewardship

Covia's mining activities can significantly affect local ecosystems and biodiversity. This necessitates robust land stewardship and rehabilitation efforts, often drawing increased regulatory attention and specific requirements. For instance, in 2024, the U.S. Fish and Wildlife Service reported that mining operations in certain regions are under heightened review for their impact on endangered species habitats.

To address these concerns, comprehensive Environmental Impact Assessments (EIAs) are a mandatory prerequisite for project approvals. These EIAs involve a detailed analysis of potential consequences for biodiversity, ensuring that mitigation strategies are identified and implemented. The 2025 regulatory landscape continues to emphasize data-driven biodiversity impact studies as a key component of permitting processes.

- Regulatory Scrutiny: Increased focus on mining's ecological footprint drives stricter land stewardship mandates.

- Biodiversity Impact: Operations must carefully assess and mitigate potential harm to local flora and fauna.

- Environmental Impact Assessments: EIAs are crucial for project approval, detailing biodiversity considerations.

- Rehabilitation Efforts: Post-mining land restoration and biodiversity recovery are key components of responsible operations.

Resource Depletion and Circular Economy

Growing concerns over resource depletion are significantly reshaping industries like construction and industrial minerals. This is leading to a greater emphasis on sustainable practices, such as incorporating recycled aggregates into projects. The push for a circular economy, where materials are reused and recycled to minimize waste, is gaining momentum.

Governments and corporations are actively revising mining laws and implementing comprehensive resource management standards to support these circularity goals. For instance, in 2024, the EU's Circular Economy Action Plan continued to drive policy changes aimed at reducing raw material consumption. Covia, as a provider of industrial minerals, is impacted by these shifts as they seek to integrate more recycled content and efficient resource utilization into their operations.

- Resource Scarcity Impact: The increasing scarcity of virgin raw materials, a trend expected to continue through 2025, puts pressure on companies to find alternative, recycled sources.

- Circular Economy Adoption: By 2024, over 30% of major industrial companies reported having a defined circular economy strategy, a figure projected to rise as regulatory frameworks strengthen.

- Regulatory Alignment: Mining and resource management regulations are increasingly incorporating principles of circularity, requiring companies like Covia to adapt their extraction and processing methods.

- Investment in Recycling: Significant investments, estimated in the billions globally by 2024, are being channeled into recycling technologies and infrastructure, creating opportunities for businesses that can leverage these advancements.

Covia faces increasing pressure regarding its environmental footprint, particularly concerning climate change and emissions. Investor sentiment in 2024 and into 2025 favors companies with clear climate commitments, driving demand for transparency and cleaner operations. Stricter global regulations on emissions and water management are also reshaping operational requirements.

The company must navigate evolving water usage regulations, with a focus on reducing freshwater consumption and maximizing recycling. Effective waste management, especially tailings, is critical, with enhanced disclosure standards like GRI 14: Mining Sector 2024 emphasizing accountability. Biodiversity protection and land rehabilitation efforts are also under heightened regulatory scrutiny, requiring robust Environmental Impact Assessments.

The trend towards resource scarcity is pushing for circular economy principles, impacting how Covia sources and utilizes materials. By 2024, a significant portion of major industrial companies had adopted circular economy strategies, a number expected to grow as regulations tighten through 2025. Investments in recycling technologies are also on the rise, creating opportunities for adaptation.

PESTLE Analysis Data Sources

Our Covia PESTLE Analysis is meticulously constructed using data from a diverse range of reputable sources, including governmental bodies, international organizations, and leading market research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the industry.