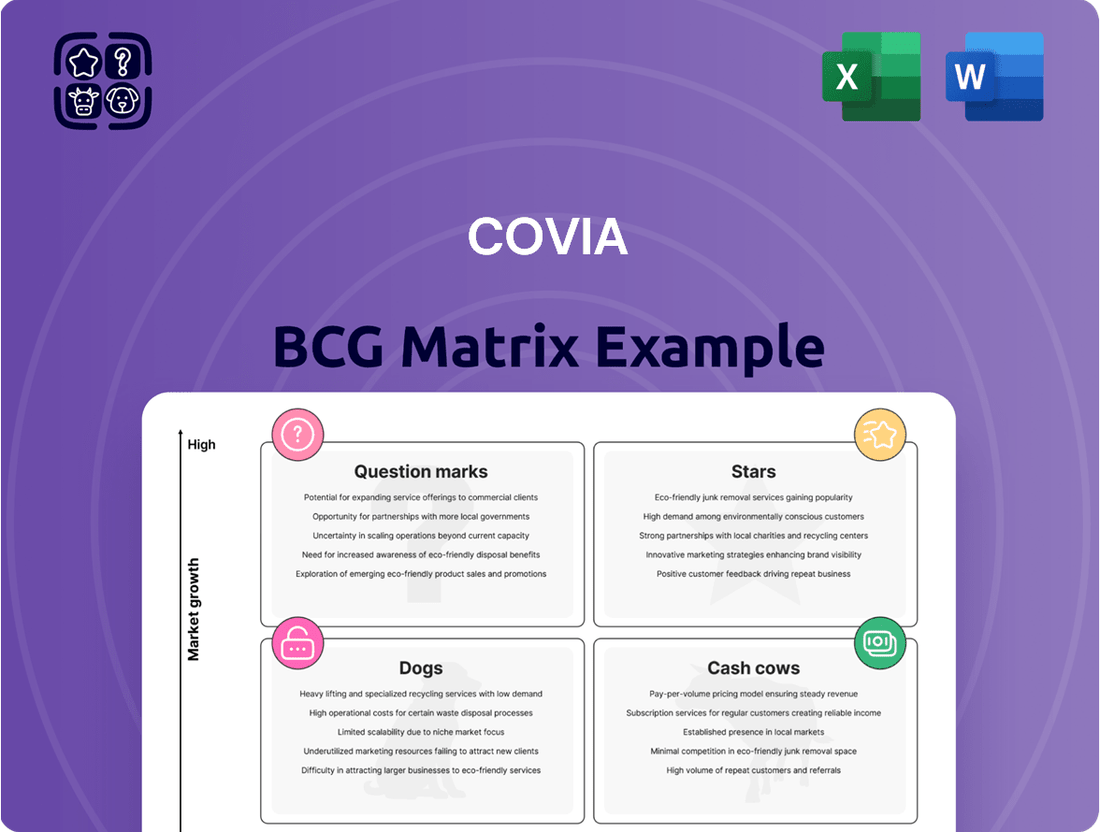

Covia Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Covia Bundle

Curious about how this company navigates market dynamics? Our BCG Matrix analysis pinpoints its Stars, Cash Cows, Dogs, and Question Marks, offering a crucial snapshot of its product portfolio's health. Don't settle for a glimpse; unlock the full strategic advantage by purchasing the complete BCG Matrix for actionable insights and a clearer path to growth.

Stars

Sibelco, now managing Covia's former operations, is significantly boosting its high purity quartz (HPQ) production, specifically targeting the booming solar photovoltaic (PV) sector. This strategic move positions them to capitalize on the accelerating global energy transition, a clear indicator of a high-growth market where Sibelco already holds a leading position.

Frac sand for oil and gas exploration in North America represents a significant growth opportunity. Despite market volatility, increased drilling and multi-stage fracturing operations are driving demand. Covia's legacy assets, now part of Sibelco, hold a strong position in this sector, making it a star performer in a dynamic market.

The market for specialty industrial minerals, crucial for advanced technologies like electric vehicles and renewable energy, is booming. This sector, distinct from traditional materials like frac sand, saw global demand for critical minerals reach an estimated $250 billion in 2023, with projections indicating continued strong growth through 2030.

Sibelco's broad range of industrial minerals, including high-purity quartz (HPQ) and other specialized materials, positions it favorably to capitalize on this trend. For instance, the demand for HPQ, a key component in semiconductors and solar panels, is expected to grow at a compound annual growth rate (CAGR) of over 8% in the coming years.

Recycled Glass in North America

Sibelco's acquisition of Strategic Materials Inc. (SMI) signifies a major expansion into the North American recycled glass market, reinforcing its global commitment to circular economy principles. This strategic move diversifies Sibelco's portfolio and strengthens its position as a leader in sustainable material solutions.

The North American glass recycling sector is experiencing robust growth, driven by increasing consumer demand for eco-friendly products and stringent environmental regulations. This trend makes recycled glass a promising product line within Sibelco's business model.

- Market Growth: The U.S. recycled glass market was valued at approximately $1.8 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.5% through 2030.

- Sibelco's Expansion: SMI, now part of Sibelco, processed over 800,000 tons of glass in North America in 2023, contributing significantly to the circular economy.

- Demand Drivers: Key drivers include the beverage industry's push for recycled content in packaging and the construction sector's use of recycled glass in aggregates and insulation.

Aggregates for Infrastructure Development

The global construction aggregates market, a foundational element for infrastructure, is seeing robust expansion. This growth is fueled by escalating urbanization and substantial global investments in infrastructure development. For instance, the market was valued at approximately $360 billion in 2023 and is projected to reach over $480 billion by 2028, demonstrating a compound annual growth rate of around 6%.

Sibelco's strategic position within this vital sector is noteworthy. Their participation in the aggregates market implies a significant market share in an industry characterized by steady and predictable growth. This fundamental market provides the essential building blocks for nearly all construction activities.

- Market Size: Global construction aggregates market valued at roughly $360 billion in 2023.

- Growth Projection: Expected to exceed $480 billion by 2028.

- CAGR: Anticipated compound annual growth rate of approximately 6%.

- Key Drivers: Urbanization and increased global infrastructure spending.

Stars in the Covia BCG Matrix represent high-growth, high-market-share segments. Sibelco's expansion into high-purity quartz (HPQ) for the solar PV sector exemplifies this, tapping into a rapidly growing renewable energy market. Similarly, their strong position in frac sand for North American oil and gas, despite market fluctuations, showcases a star performer in a dynamic industry.

| Segment | Market Growth | Market Share | Covia BCG Category |

| High Purity Quartz (HPQ) for Solar PV | High (CAGR > 8%) | Leading | Star |

| Frac Sand (North America) | High (driven by drilling activity) | Strong | Star |

| Specialty Industrial Minerals | High (global demand ~$250B in 2023) | Growing | Potential Star |

What is included in the product

The Covia BCG Matrix analyzes business units based on market share and growth, guiding strategic decisions.

Covia's BCG Matrix offers a clear, visual snapshot of your portfolio, relieving the pain of complex data analysis.

Cash Cows

Traditional construction aggregates like sand, gravel, and crushed stone are the bedrock of mature construction markets. Demand here is steady, fueled by the constant need for infrastructure upkeep and routine building projects.

Sibelco, a significant player, likely commands a substantial market share in these segments. These are classic cash cow businesses, characterized by low growth but consistent, high cash generation.

Industrial sands for glass and foundry applications are considered Covia's Cash Cows. This segment serves established industries with mature, low-growth markets. In 2024, the global glass manufacturing market was valued at approximately $170 billion, with foundry applications adding significant demand.

Sibelco's deep expertise and established market position in these areas allow for consistent, reliable cash flow generation. These products require less investment in research and development or aggressive marketing, contributing to their strong profitability.

Basic silica products for general industrial use, like those Sibelco mines and processes, operate in a low-growth market. These are your standard materials used in everything from glassmaking to construction, sectors that tend to expand steadily rather than rapidly. Think of them as the reliable workhorses of industry.

Sibelco's established infrastructure for extracting and refining these silica products positions them firmly as cash cows within the BCG matrix. Their significant mining operations and processing expertise ensure a consistent and dependable revenue stream from these mature, stable markets. This reliability is key to their financial strength.

For instance, the global industrial silica market was valued at approximately $10.5 billion in 2023 and is projected to grow at a modest CAGR of around 3.5% through 2030, according to market research reports. This steady, predictable demand underscores the cash cow status of Sibelco's basic silica offerings.

Feldspathic Minerals for Ceramics

Feldspathic minerals are fundamental to the ceramics sector, a market characterized by its maturity and consistent demand. Sibelco's involvement in supplying these minerals aligns with the attributes of a cash cow within the BCG matrix, generating reliable profits with minimal need for significant market expansion investment.

The global ceramics market, a key consumer of feldspar, was valued at approximately $290 billion in 2023 and is projected to grow steadily, underscoring the stable revenue potential. For instance, the construction industry's ongoing demand for tiles and sanitaryware, major applications for feldspar, ensures a predictable income stream.

- Stable Demand: The ceramics industry, a mature market, provides a consistent and predictable demand for feldspathic minerals.

- Low Investment Needs: As a cash cow, Sibelco's feldspar operations require limited capital for market development or innovation, focusing instead on efficient production.

- Profit Generation: These operations are expected to generate substantial and consistent profits that can be reinvested in other business units or distributed to shareholders.

- Market Size: The global ceramics market, a primary outlet for feldspar, demonstrates a robust valuation, reinforcing the cash cow status of its suppliers.

Certain Clay Products for Traditional Applications

Certain clay products used in traditional applications, like those found in basic building materials or established manufacturing processes, are likely positioned as cash cows for Sibelco. These products typically operate within mature markets where demand is stable, and Sibelco can capitalize on its established market share and efficient production capabilities.

For instance, common clays like kaolin and bentonite, widely used in ceramics, refractories, and as fillers, represent stable revenue streams. In 2024, the global industrial minerals market, which includes these clays, was projected to continue its steady growth, driven by construction and manufacturing sectors. Sibelco's expertise in extracting and processing these materials allows for consistent, low-cost production, generating reliable cash flow.

- Kaolin: Essential for ceramics, paper, and paints, with a global market valued in the billions.

- Bentonite: Used in drilling fluids, foundry binders, and cat litter, demonstrating consistent demand.

- Mature Markets: These applications have well-defined demand patterns, allowing for predictable revenue generation.

- Operational Efficiency: Sibelco's established infrastructure and expertise minimize production costs, maximizing cash flow from these products.

Covia's industrial sands for glass and foundry applications are prime examples of cash cows. These segments serve established industries with mature, low-growth markets, ensuring consistent cash generation. In 2024, the global glass manufacturing market was valued at approximately $170 billion, with foundry applications adding significant demand.

Basic silica products for general industrial use also operate in low-growth markets, acting as reliable workhorses. The global industrial silica market was valued at approximately $10.5 billion in 2023 and is projected to grow at a modest CAGR of around 3.5% through 2030.

Feldspathic minerals, crucial for the mature ceramics sector, also represent cash cow businesses. The global ceramics market was valued at approximately $290 billion in 2023, providing stable revenue potential for suppliers like Covia.

Certain clay products, such as kaolin and bentonite, used in traditional applications like ceramics and drilling fluids, are also cash cows. These materials benefit from stable demand in well-defined markets, allowing for predictable revenue generation and efficient production.

| Product Segment | Market Characteristic | 2024 Market Value (Approx.) | Projected CAGR (through 2030) | BCG Status |

|---|---|---|---|---|

| Industrial Sands (Glass & Foundry) | Mature, Low Growth | $170 Billion (Glass Mfg.) | Moderate | Cash Cow |

| Basic Silica Products | Mature, Low Growth | $10.5 Billion (Industrial Silica, 2023) | 3.5% | Cash Cow |

| Feldspathic Minerals (Ceramics) | Mature, Steady Demand | $290 Billion (Ceramics, 2023) | Steady Growth | Cash Cow |

| Clay Products (Kaolin, Bentonite) | Mature, Stable Demand | N/A (Part of Industrial Minerals) | Steady Growth (Industrial Minerals) | Cash Cow |

Preview = Final Product

Covia BCG Matrix

The Covia BCG Matrix preview you are currently viewing is the exact, complete document you will receive upon purchase. This means you get the fully populated and professionally formatted strategic analysis without any watermarks or demo content. You can confidently assess the quality and relevance of this tool, knowing the final version will be identical and ready for immediate implementation in your business planning.

Dogs

Legacy high-cost, non-strategic mineral assets within Covia's portfolio, particularly those inherited from Unimin, would likely be classified as Dogs in the BCG matrix. These are assets that no longer fit Sibelco's core strategic direction and operate in markets characterized by decline or intense competition, where Covia holds a negligible market share.

Such operations are typically characterized by low profitability and inefficient capital utilization, essentially draining resources without contributing significantly to overall growth or strategic objectives. For instance, if a legacy silica sand operation, previously vital for automotive glass, now faces competition from newer, more cost-effective synthetic materials and has a market share below 5%, it would fit this description.

Covia's historical portfolio might have included older proppant technologies that are now less favored due to advancements in efficiency and cost. For instance, if they offered basic Ottawa White sand in the past, its market share would likely be declining as higher-strength ceramic or resin-coated sands gain traction.

These legacy products, facing limited demand and minimal growth prospects, would fall into the Dogs category of the BCG matrix. Their low market share and low growth rate make them prime candidates for divestiture to streamline Covia's operations and focus on more promising segments.

Geographically isolated or inefficient mining operations often fall into the Dogs category of the BCG Matrix. These are mines where high transportation costs, due to remote locations, significantly eat into profits. For instance, a mine located hundreds of miles from the nearest processing facility or port will inherently have higher logistical expenses compared to a well-situated operation.

Diminishing reserves also contribute to a mining operation becoming a Dog. As the easily accessible ore bodies are depleted, extraction becomes more complex and expensive. This can lead to a decline in production volume and an increase in the cost per ton of extracted material, making the operation less competitive.

Outdated extraction methods further exacerbate the inefficiency. Mines still relying on labor-intensive or less technologically advanced techniques struggle to compete with modern, automated operations. In 2024, many such legacy mines face challenges in achieving profitability, with their low market share and high operational costs making them a drain on resources and unlikely to see significant future potential.

Products with Declining Demand Due to Industry Shifts

Products categorized as Dogs in Covia's BCG Matrix, particularly within Sibelco's portfolio, would represent mineral solutions catering to industries facing significant structural decline or a fundamental shift away from their use. These offerings are characterized by minimal growth potential and a shrinking market presence.

For instance, consider silica sand used in industries that have seen a substantial reduction in demand. While specific figures for Sibelco's silica sand sales tied to declining sectors are proprietary, the broader market trends illustrate this challenge. The global demand for certain types of glass, historically a major consumer of silica sand, has stagnated or declined in specific applications due to material substitution and evolving consumer preferences. This directly impacts products like high-purity silica sand if its primary end markets are contracting.

The strategic implication for Sibelco is clear: these Dog products require careful management. The focus would likely be on minimizing investment, extracting remaining value, and potentially divesting if a viable exit strategy exists.

- Declining End-Market Demand: Mineral solutions supplying sectors like traditional print media or certain types of consumer electronics packaging may fall into this category as these industries contract.

- Technological Obsolescence: If a specific mineral's properties are no longer competitive due to new material innovations or manufacturing processes, its demand will wane.

- Environmental Regulations: Stricter environmental policies can render certain mineral extraction or processing methods uneconomical, pushing related products into the Dog quadrant.

Non-Core Businesses with Limited Synergies

Segments within Covia, particularly those acquired from Unimin, that don't align well with Sibelco's core strengths or strategic direction could be classified as dogs. These are typically businesses with low market share and limited growth prospects.

Divesting these non-core assets allows Sibelco to focus resources on its primary, high-potential operations. For instance, if a specific industrial mineral segment acquired from Unimin, like certain specialty sands, shows minimal overlap with Sibelco's established silica or kaolin markets and has seen stagnant demand, it fits the dog profile.

- Limited Synergy: Acquired businesses that do not complement Sibelco's core competencies or market strategies.

- Low Market Share: These segments typically hold a small portion of their respective markets.

- Low Growth Prospects: The markets for these businesses are not expected to expand significantly.

- Potential Divestment: Such units are candidates for sale to streamline operations and improve overall portfolio performance.

Within Covia's portfolio, "Dogs" represent legacy mineral assets or product lines that are no longer strategically aligned or competitive. These often stem from older acquisitions, like those from Unimin, and operate in markets with low growth and where Covia holds a negligible market share. For example, if a specific type of industrial sand used in a declining manufacturing sector saw its market share drop to below 3% by 2024, it would be a prime candidate for this classification.

These operations typically suffer from low profitability and inefficient capital use, acting as resource drains rather than growth drivers. Consider a legacy silica sand mine in a geographically isolated area with high transportation costs; by 2024, such a mine might have operational costs exceeding its revenue, especially if its primary end-user industries have significantly shrunk.

The key characteristics are low market share and low market growth, making them candidates for divestment. For instance, older proppant technologies that have been superseded by more efficient ceramic or resin-coated alternatives would fall into this category, with their market share likely diminishing rapidly as the industry shifts.

These segments require minimal investment and are managed to extract any remaining value, with divestiture being a common strategy to improve overall portfolio performance and focus on more promising areas.

Question Marks

While solar photovoltaic (PV) panels remain a significant driver for high-purity quartz, emerging applications in advanced electronics and semiconductors present exciting growth avenues. These niche sectors, driven by rapid technological evolution, could become future stars for high-purity quartz suppliers like Sibelco. For instance, the demand for quartz in semiconductor manufacturing, particularly for wafer processing and epitaxy, is projected to grow substantially.

The semiconductor industry's need for ultra-pure quartz components, such as crucibles and tubes, is fueled by the increasing complexity and miniaturization of microchips. This sector, while currently smaller than solar, offers significant potential for high-margin growth. Analysts project the global semiconductor materials market, which includes high-purity quartz, to reach over $70 billion by 2027, indicating a strong upward trend for these specialized applications.

Sibelco's commitment to sustainability and circular economy principles positions its new mineral solutions as potential question marks within the BCG matrix. These innovations, especially those targeting emerging markets for eco-friendly materials, represent areas of high growth potential but currently hold a small market share.

Significant investment is required to scale these nascent technologies, mirroring the characteristics of question mark products. For instance, advancements in mineral processing that reduce waste or enable the use of recycled materials could fall into this category, aiming to capture future market demand driven by environmental regulations and consumer preferences.

Developing or acquiring advanced ceramic materials for high-tech sectors, like semiconductors and aerospace, presents a significant opportunity for Sibelco. These markets are characterized by rapid innovation and demand for specialized, high-performance materials, indicating high-growth potential.

Currently, Sibelco's market share in these specific advanced ceramic niches is likely low, positioning such products as question marks within the BCG matrix. This requires substantial strategic investment in research and development, manufacturing capabilities, and market penetration to capitalize on their potential.

For instance, the global advanced ceramics market was valued at approximately $13.4 billion in 2023 and is projected to reach over $24 billion by 2030, growing at a CAGR of around 8.7%. This growth is driven by demand in electronics, automotive, and healthcare, areas where Sibelco could expand its footprint with targeted advanced ceramic offerings.

Digital and AI-driven Mining Technologies

Investments in digital and AI-driven mining technologies are indeed a significant growth area within the industry. Companies are pouring resources into automation and advanced analytics to improve efficiency and safety. For instance, in 2024, the global mining technology market was projected to reach over $25 billion, with a substantial portion dedicated to digital transformation initiatives.

While Covia, like many in the sector, is likely investing in these technologies for its own operations, positioning them as distinct commercial offerings presents a classic question mark scenario. This means they have the potential for high growth but also carry significant risk and uncertainty.

- High Investment Needs: Developing and commercializing proprietary AI and digital solutions requires substantial R&D expenditure, often in the tens or hundreds of millions of dollars.

- Market Penetration Challenges: Gaining traction in a competitive technology market, even within the mining sector, demands robust sales, marketing, and support infrastructure.

- Uncertain Revenue Streams: The profitability of these ventures is not guaranteed, as it depends on market adoption rates and the ability to differentiate from existing solutions.

- Technological Evolution: The rapid pace of AI development means continuous investment is needed to stay relevant and competitive.

Expansion into New Geographic Markets for Existing Products

Expanding Sibelco's existing product lines into new, high-growth geographic markets where its current market share is minimal would be classified as question marks within the BCG Matrix framework. These strategic moves require substantial capital for market penetration and establishing a presence.

For instance, consider Sibelco's potential expansion into rapidly developing economies in Southeast Asia or Africa for its specialty silica products. These regions often exhibit robust industrial growth, driving demand for materials used in construction, electronics, and manufacturing.

- High Growth Potential: Markets like Vietnam or Nigeria are projected to see significant GDP growth in the coming years, indicating strong underlying demand for industrial minerals.

- Low Existing Market Share: Sibelco may have limited distribution networks or brand recognition in these nascent markets, presenting an opportunity for early-stage market capture.

- Significant Investment Required: Establishing new production facilities, logistics, and sales teams in these regions necessitates considerable upfront investment, typical of question mark strategies.

- Market Development Focus: Success hinges on understanding local customer needs, navigating regulatory landscapes, and building a competitive advantage from the ground up.

Question Marks in Covia's BCG Matrix represent business units or product lines with low market share in high-growth industries. These are often new ventures or products that require significant investment to gain market traction. For example, Covia's potential expansion into specialized industrial sands for emerging 3D printing applications could be a question mark. While the 3D printing materials market is experiencing rapid growth, projected to exceed $3.5 billion by 2025, Covia's current share in this specific niche is likely minimal.

These ventures demand substantial capital for research, development, and market entry, mirroring the high investment needs characteristic of question marks. The uncertainty of success means these investments carry higher risk compared to established products. Covia must carefully evaluate the market potential and competitive landscape before committing significant resources to these nascent areas.

The success of these question marks hinges on strategic investment and effective market penetration. Companies must be prepared for the long haul, as it can take time and considerable resources to convert a question mark into a star performer. Failure to adequately invest or adapt to market dynamics can lead to these ventures becoming dogs, or even being divested.

For instance, Covia's development of advanced proppants for the burgeoning geothermal energy sector, which saw global investment reach over $50 billion in 2023, could also be categorized as a question mark. The sector has high growth potential, but Covia's market share in this specialized application is likely nascent, requiring significant investment to establish a competitive position.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, growth rates, and competitive landscape analysis, to accurately position each business unit.