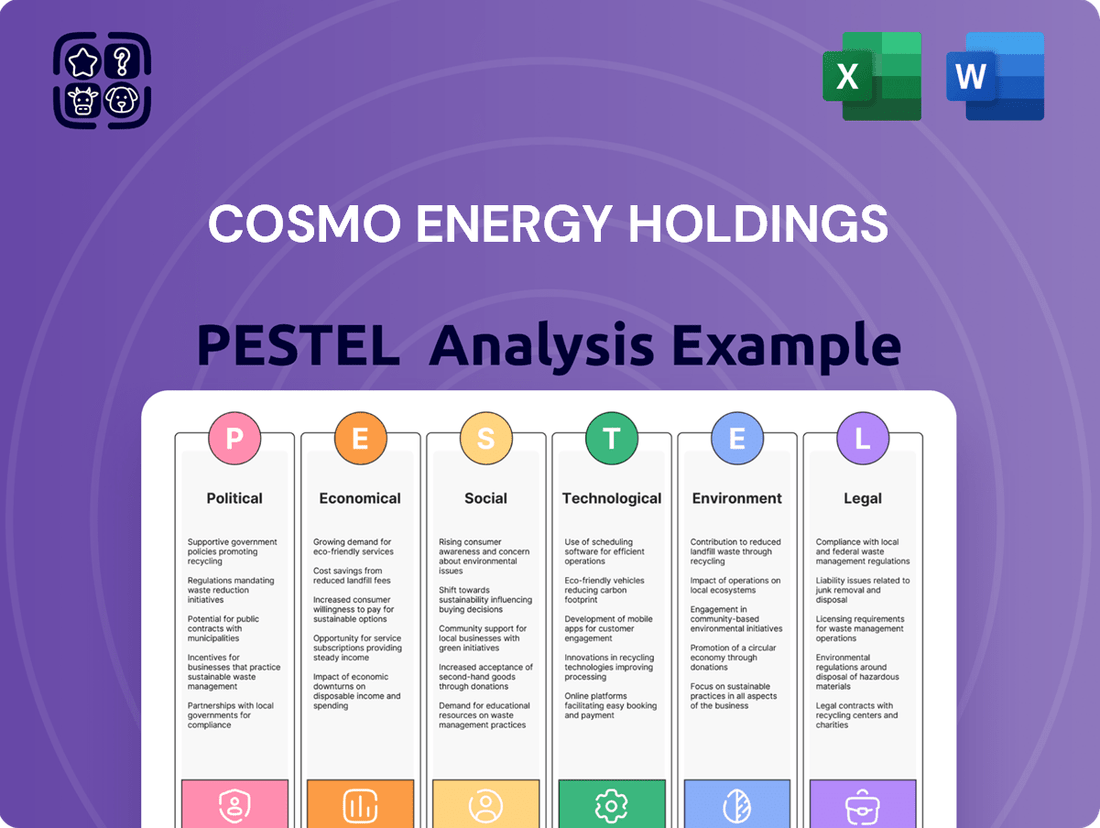

Cosmo Energy Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cosmo Energy Holdings Bundle

Navigate the complex external forces shaping Cosmo Energy Holdings's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors impacting their operations and strategic direction. Gain a critical edge in your market analysis and investment decisions.

Unlock actionable intelligence on Cosmo Energy Holdings's operating environment. Our expert-crafted PESTLE analysis provides deep insights into the trends that matter most, from evolving energy policies to technological advancements. Download the full version now to empower your strategic planning.

Political factors

Japan's commitment to energy security and decarbonization, as evidenced by its Sixth Strategic Energy Plan aiming for 36-38% renewable energy by 2030, directly shapes Cosmo Energy's investment in wind power and other sustainable initiatives. Government subsidies and potential carbon pricing mechanisms, like the voluntary carbon market, will be critical in determining the financial viability of these green ventures.

Fluctuations in import/export regulations for crude oil and refined petroleum products, a core segment for Cosmo Energy, are also heavily influenced by government policy. For instance, Japan's efforts to diversify energy sources away from reliance on specific regions can impact supply chains and pricing for Cosmo's refining operations.

Global geopolitical tensions, especially in key energy-producing areas, can significantly disrupt crude oil supply chains and influence price volatility. This directly impacts Cosmo Energy's refining and marketing segments. For instance, ongoing conflicts in the Middle East or shifts in major oil-producing nations' policies create uncertainty, as seen with fluctuating Brent crude prices, which averaged around $82 per barrel in early 2024.

Japan's substantial dependence on imported energy underscores the critical importance of stable international relations and secure shipping lanes for Cosmo Energy. Any disruption to maritime trade routes, such as those in the South China Sea or the Strait of Hormuz, poses a direct threat to the company's ability to secure necessary fuel supplies. Japan imported approximately 90% of its total energy supply in 2023, highlighting this vulnerability.

Cosmo Energy must also adeptly navigate a complex web of international trade policies and the potential imposition of sanctions. These can affect its sourcing strategies for crude oil and refined products, as well as its distribution networks in various global markets. Changes in trade agreements or the implementation of new tariffs can alter cost structures and market access, requiring continuous strategic adjustments.

Japan's commitment to the Paris Agreement, aiming for a 46% reduction in greenhouse gas emissions by fiscal year 2030 compared to 2013 levels, directly influences domestic energy policy. This global imperative drives the push for decarbonization and the expansion of renewable energy sources within Japan.

Cosmo Energy Holdings must strategically pivot towards low-carbon solutions, such as offshore wind power, to align with these national emission reduction targets. For instance, by the end of fiscal year 2023, Cosmo Energy had invested in several offshore wind projects, signaling a tangible shift in its business portfolio.

Meeting these international climate commitments necessitates substantial capital expenditure and operational restructuring for Cosmo Energy. This includes upgrading infrastructure and integrating new, cleaner energy technologies throughout its operations to ensure compliance with evolving environmental regulations.

Political Support for Renewable Energy Transition

The Japanese government's commitment to decarbonization, particularly through initiatives like the Green Growth Strategy, provides a supportive environment for Cosmo Energy's renewable energy ventures. This strategy aims to achieve carbon neutrality by 2050, with significant emphasis on offshore wind power development. For instance, Japan has set ambitious targets, aiming to install 10 GW of offshore wind capacity by 2030 and 30-45 GW by 2040, creating substantial opportunities for companies like Cosmo Energy.

Favorable policies, including feed-in tariffs (FIT) and feed-in premiums (FIP) for renewable energy, along with tax incentives and subsidies, directly reduce the financial risk and improve the economic viability of new wind power projects. These governmental supports are crucial for Cosmo Energy as they navigate the significant capital investments required for offshore wind farm development and operation.

- Government Targets: Japan aims for 10 GW of offshore wind by 2030 and 30-45 GW by 2040.

- Policy Support: FIT and FIP schemes, alongside tax breaks, enhance renewable project profitability.

- Decarbonization Drive: The Green Growth Strategy underscores a national commitment to renewable energy expansion.

Energy Security and Self-Sufficiency Directives

Japan's push for energy security significantly shapes Cosmo Energy's strategic direction. Government directives are pushing for a reduction in imported fossil fuels, encouraging diversification into renewables and domestic energy sources. For instance, the Strategic Energy Plan aims to increase the share of renewable energy in the power generation mix to 36-38% by 2030, a target that directly impacts investment decisions for companies like Cosmo Energy.

These national security objectives translate into tangible operational priorities for Cosmo Energy. The company is increasingly focused on investing in areas that bolster Japan's energy independence, such as:

- Renewable energy development: Expanding solar, wind, and potentially geothermal power generation.

- Energy storage solutions: Investing in battery technology and other storage methods to ensure grid stability.

- Domestic resource exploration: Evaluating opportunities for increasing domestic oil and gas production, where feasible.

Cosmo Energy's commitment to maintaining a stable energy supply for Japan is paramount. The company's investments in these areas not only align with government policy but also reinforce its role as a critical infrastructure provider, ensuring national energy resilience.

Japan's national energy policy, emphasizing security and decarbonization, directly guides Cosmo Energy's strategic investments, particularly in renewable energy like offshore wind. The government's ambitious targets, such as achieving 36-38% renewable energy by 2030, create a supportive regulatory environment for companies like Cosmo Energy to expand their green energy portfolios. Furthermore, international climate commitments, including the Paris Agreement, necessitate significant shifts in energy production, pushing companies to adopt cleaner technologies and reduce emissions.

Government support through feed-in tariffs (FIT) and feed-in premiums (FIP) for renewables, alongside tax incentives, significantly de-risks and enhances the profitability of new projects for Cosmo Energy. These policies are crucial for funding the substantial capital required for developing offshore wind farms. The Green Growth Strategy, aiming for carbon neutrality by 2050, further bolsters the expansion of renewable energy, with specific goals for offshore wind capacity, presenting clear opportunities for Cosmo Energy.

Global geopolitical stability and secure shipping lanes are critical for Cosmo Energy, given Japan's high dependence on imported energy, with around 90% of its total energy supply being imported in 2023. Disruptions in key energy-producing regions or trade routes, such as the Strait of Hormuz, directly impact the company's ability to secure fuel supplies and influence price volatility, as seen with Brent crude prices averaging around $82 per barrel in early 2024.

Cosmo Energy must also navigate international trade policies and potential sanctions, which can affect crude oil sourcing and product distribution. Changes in trade agreements or tariffs can alter cost structures and market access, requiring continuous strategic adjustments to maintain competitiveness and operational efficiency.

What is included in the product

This PESTLE analysis of Cosmo Energy Holdings provides a comprehensive examination of how political, economic, social, technological, environmental, and legal factors influence its operations and strategic direction.

It offers actionable insights for stakeholders to navigate the complex external landscape and capitalize on emerging opportunities within the energy sector.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of the external factors impacting Cosmo Energy Holdings.

Helps support discussions on external risk and market positioning during planning sessions by highlighting key political, economic, social, technological, environmental, and legal influences on Cosmo Energy Holdings.

Economic factors

Global oil price volatility significantly affects Cosmo Energy Holdings. Fluctuations in crude oil prices directly impact the profitability of its upstream exploration and production, as well as its refining and marketing operations. For instance, during 2024, Brent crude oil prices have ranged from approximately $75 to $90 per barrel, creating a challenging environment for revenue predictability.

This price instability necessitates robust risk management. High volatility can lead to unpredictable revenues, forcing companies like Cosmo Energy to adopt agile strategies to mitigate potential losses and capitalize on market swings. Continuous monitoring of global supply and demand, geopolitical events, and decisions by groups like OPEC+ is crucial for navigating these price movements effectively.

For Cosmo Energy Holdings, a Japanese firm deeply engaged in international energy markets, fluctuations in the Yen's exchange rate are a critical economic factor. As of mid-2024, the Yen has experienced significant volatility against the US Dollar, impacting the cost of essential imports like crude oil. For instance, if the Yen weakens considerably against the dollar, the cost of purchasing oil denominated in dollars rises, directly squeezing refining margins and overall profitability for Cosmo Energy.

This currency exposure means that a weaker Yen can translate into higher operational expenses. In early 2024, the Yen traded around 150-155 per US Dollar, a level that already presented challenges for energy importers. Further depreciation in the latter half of 2024 or into 2025 could exacerbate these costs, making it imperative for Cosmo Energy to employ robust currency hedging strategies to protect its financial performance against adverse exchange rate movements.

Japan's economic growth is a key driver for Cosmo Energy. In the first quarter of 2024, Japan's GDP saw a revised 1.7% annualized growth, a rebound from a previous contraction, indicating a potentially healthier consumer environment. This growth directly impacts demand for petroleum products and electricity, Cosmo Energy's core businesses.

Consumer spending patterns are crucial. While inflation has been a concern, wage growth in early 2024 showed some positive signs, which could bolster discretionary spending on energy-intensive goods and services. However, any economic slowdown or persistent inflation could dampen consumer demand, leading to lower sales volumes for Cosmo Energy's refined products.

Conversely, a sustained period of economic expansion would likely translate into increased industrial activity and higher overall energy consumption. This scenario would benefit Cosmo Energy's refining and marketing operations, potentially boosting sales volumes and profitability as businesses and households increase their energy usage.

Interest Rate Environment and Investment Costs

Changes in interest rates significantly impact Cosmo Energy Holdings. For instance, the Bank of Japan maintained its negative interest rate policy for an extended period, but began a shift in early 2024, ending negative rates and yield curve control. This move, with the policy rate moving from -0.1% to 0-0.1% in March 2024, signals a move towards higher borrowing costs for capital-intensive projects like renewable energy installations and refinery modernization.

Higher interest rates directly translate to increased financing expenses for Cosmo Energy. This can make the economic viability of new investments, particularly in long-term projects such as offshore wind farms or hydrogen production facilities, more challenging. Consequently, this could lead to a slowdown in the pace of investment or a re-evaluation of project profitability.

Access to affordable capital is a cornerstone of Cosmo Energy's strategy to diversify its energy portfolio beyond traditional oil and gas.

- Increased Borrowing Costs: The shift away from negative interest rates in Japan, with the policy rate moving to 0-0.1% in March 2024, means higher borrowing costs for Cosmo Energy's capital expenditures.

- Impact on Project Viability: Elevated interest rates can reduce the net present value of future cash flows, potentially making large-scale renewable energy projects less attractive.

- Diversification Strategy: Cosmo Energy's diversification into areas like renewable energy and petrochemicals relies heavily on securing financing at competitive rates.

- International Rate Environment: Global interest rate trends, particularly in major economies, also influence Cosmo Energy's international financing options and the overall cost of capital.

Competition and Market Dynamics

The Japanese energy sector is highly competitive, with established players like ENEOS Holdings and Idemitsu Kosan vying for market share alongside emerging renewable energy companies. Cosmo Energy Holdings faces pressure on its refining margins due to this intense rivalry, a situation exacerbated by fluctuating crude oil prices and evolving demand patterns. For instance, in fiscal year 2023, the company reported a significant increase in its net profit, reaching ¥145.5 billion, partly driven by improved refining margins, but the competitive environment remains a constant factor influencing strategic decisions.

New entrants focusing on solar, wind, and other renewable sources are increasingly challenging traditional oil and gas companies. This shift necessitates continuous innovation and operational optimization for Cosmo Energy to maintain its competitive edge. Strategic alliances or potential consolidation within the industry could further reshape market dynamics, requiring agile responses to preserve market share and profitability.

- Intense competition from major oil refiners and renewable energy providers.

- Pressure on refining margins due to market rivalry and fluctuating oil prices.

- Need for continuous innovation and operational optimization to stay competitive.

- Potential for industry consolidation to reshape market dynamics.

Global oil price volatility significantly impacts Cosmo Energy Holdings, with Brent crude prices fluctuating between $75-$90 per barrel in 2024, affecting revenue predictability. Currency exchange rates, particularly the Yen's volatility against the US Dollar (trading around 150-155 in early 2024), directly influence the cost of imported crude oil, impacting refining margins. Japan's economic growth, showing a 1.7% annualized GDP increase in Q1 2024, positively influences demand for petroleum products and electricity, while interest rate shifts, with Japan moving from negative rates to 0-0.1% in March 2024, increase borrowing costs for capital-intensive projects.

| Economic Factor | Impact on Cosmo Energy Holdings | 2024/2025 Data/Trend |

| Oil Price Volatility | Affects upstream profitability and refining margins. | Brent crude: $75-$90/barrel (early-mid 2024). |

| Currency Exchange Rates (JPY/USD) | Weak Yen increases cost of imported crude oil. | JPY 150-155/USD (early 2024). |

| Japan's Economic Growth (GDP) | Drives demand for petroleum products and electricity. | Q1 2024: 1.7% annualized growth. |

| Interest Rates (Bank of Japan) | Increases borrowing costs for capital expenditures. | Policy rate: 0-0.1% (from March 2024). |

Preview the Actual Deliverable

Cosmo Energy Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Cosmo Energy Holdings delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the energy sector. It provides crucial insights for strategic planning and risk assessment.

Sociological factors

Public awareness of climate change is significantly impacting consumer choices, pushing companies like Cosmo Energy to prioritize sustainability. Surveys in late 2024 indicated that over 70% of consumers consider a company's environmental impact when making purchasing decisions.

Cosmo Energy's substantial reliance on fossil fuels means it faces considerable public scrutiny over its environmental impact. This societal pressure is a key driver for the company to demonstrably invest in decarbonization strategies and bolster its renewable energy offerings to ensure its continued social acceptance.

Societal shifts are strongly favoring sustainable and green energy. Consumers and industries alike are increasingly seeking out cleaner energy options and environmentally friendly products. This growing demand directly influences how companies like Cosmo Energy Holdings operate and plan for the future.

This trend is a significant driver for investment in renewable energy sources, such as wind power. For instance, global investment in renewable energy reached an estimated $590 billion in 2023, a significant increase from previous years, highlighting this societal push. Cosmo Energy must therefore adapt its business model to capitalize on these opportunities and develop lower-carbon petroleum products to meet evolving market expectations.

Meeting these evolving societal values is crucial for Cosmo Energy's long-term success. The company's ability to align its offerings with a growing preference for environmental responsibility will be key to maintaining competitiveness and relevance in the energy sector.

Japan's aging population, with a median age of 48.7 years as of 2023, poses a significant hurdle for Cosmo Energy Holdings in securing a robust workforce. This demographic trend directly impacts talent acquisition, making it harder to find and keep skilled individuals, especially those with expertise in newer fields like renewable energy and digitalization.

Cosmo Energy must actively pursue strategies to attract and retain talent, focusing on areas critical for future growth, such as advanced energy technologies and digital transformation initiatives. This includes fostering an environment that appeals to younger generations and those seeking careers in evolving sectors.

Furthermore, adapting to evolving workforce expectations, including a greater emphasis on work-life balance and career development, is crucial. Promoting diversity and inclusion within the company will be vital for long-term operational sustainability and for tapping into a wider pool of talent.

Corporate Social Responsibility (CSR) Expectations

Societal expectations for companies to demonstrate strong corporate social responsibility (CSR) are on the rise, pushing beyond mere profit generation. Cosmo Energy Holdings is increasingly expected to actively contribute to the well-being of the communities it operates within, maintain ethical labor practices throughout its supply chain, and prioritize operational safety. For instance, in fiscal year 2023, Cosmo Energy reported a total of 1,237,000 hours of employee training, with a significant portion dedicated to safety and environmental compliance, underscoring their commitment to operational integrity.

Proactive engagement in CSR initiatives is crucial for enhancing Cosmo Energy's reputation and fostering trust among its diverse stakeholders. This includes not only local communities but also investors who increasingly factor ESG (Environmental, Social, and Governance) performance into their investment decisions. In 2024, the company's sustainability report highlighted a 15% increase in community engagement programs compared to the previous year, demonstrating a tangible effort to meet these evolving expectations.

Key areas of CSR focus for Cosmo Energy include:

- Environmental Stewardship: Reducing carbon emissions and promoting renewable energy sources. Cosmo Energy aims to achieve carbon neutrality by 2050, with interim targets set for significant emission reductions by 2030.

- Social Contribution: Supporting local communities through various initiatives, including disaster relief and educational programs. In 2023, the company invested over ¥500 million in social contribution activities.

- Ethical Governance: Upholding high standards of corporate governance and transparency. This includes robust compliance frameworks and fair labor practices, with a zero-tolerance policy for human rights violations.

- Employee Well-being: Ensuring a safe and healthy work environment and promoting diversity and inclusion. The company reported a 98% employee satisfaction rate in its latest internal survey.

Urbanization and Infrastructure Development

Japan's ongoing urbanization continues to reshape energy consumption. As more people move to cities, energy demand becomes more concentrated, requiring robust infrastructure. Cosmo Energy, with its extensive service station network, must strategically position these facilities to serve burgeoning urban populations and evolving commuting patterns. For instance, by the end of 2024, over 90% of Japan's population is projected to reside in urban areas, a trend that directly influences the density of service station needs and the efficiency of fuel delivery logistics.

The push towards smart cities and the increasing adoption of electric vehicles present significant shifts for traditional energy providers. This transition could reduce demand for conventional petroleum products, prompting companies like Cosmo Energy to innovate. By 2025, it's anticipated that electric vehicle sales will account for a substantial portion of new car registrations in major Japanese cities, necessitating investments in charging infrastructure and alternative fuel solutions. This strategic adaptation is crucial for maintaining market relevance.

- Urban Population Growth: Japan's urban population is projected to reach approximately 90% by the close of 2024, impacting energy demand density.

- EV Adoption: By 2025, electric vehicles are expected to capture a significant share of new vehicle sales in urban centers, signaling a shift away from traditional fuels.

- Infrastructure Adaptation: Cosmo Energy's logistics and service station placement must align with demographic shifts and the rise of smart city initiatives.

- Innovation Drivers: Smart city development and electrified transport are key drivers for innovation in fuel types and the expansion of charging solutions.

Public concern over climate change is a major force influencing consumer behavior, with over 70% of individuals in late 2024 surveys indicating that a company's environmental record impacts their purchasing choices. This societal shift compels companies like Cosmo Energy to intensify their focus on sustainability and decarbonization, directly affecting their operational strategies and investment priorities in renewable energy sources.

Japan's demographic landscape, marked by a median age of 48.7 in 2023, presents workforce challenges for Cosmo Energy, particularly in acquiring talent for emerging sectors like renewable energy. Simultaneously, evolving workforce expectations, emphasizing work-life balance and diversity, necessitate strategic human resource management to ensure long-term operational capacity and innovation.

Cosmo Energy is increasingly expected to demonstrate robust corporate social responsibility (CSR), going beyond profit to actively contribute to community well-being and uphold ethical labor practices. The company's increased investment in community engagement programs, up 15% in 2023, and a reported 98% employee satisfaction rate in its latest survey highlight its efforts to meet these rising societal expectations and bolster its reputation.

Urbanization in Japan, with over 90% of the population projected to be urban by the end of 2024, is concentrating energy demand and influencing infrastructure needs. The anticipated rise in electric vehicle adoption by 2025, capturing a significant share of new car sales in cities, signals a critical need for Cosmo Energy to adapt by investing in charging infrastructure and alternative fuel solutions to remain competitive.

| Sociological Factor | Impact on Cosmo Energy | Supporting Data (2023-2025) |

| Climate Change Awareness | Drives demand for sustainable energy and influences purchasing decisions. | 70%+ consumers consider environmental impact (late 2024). |

| Aging Population | Creates workforce challenges, especially in new energy sectors. | Japan's median age: 48.7 years (2023). |

| CSR Expectations | Requires active community contribution and ethical practices. | 15% increase in community programs (2023); 98% employee satisfaction. |

| Urbanization & EV Adoption | Shifts energy demand and necessitates investment in new infrastructure. | 90%+ urban population projected (end of 2024); significant EV share by 2025. |

Technological factors

Continuous innovation in wind turbine technology, featuring larger and more efficient designs, directly influences the feasibility and expansion of Cosmo Energy's wind power ventures. For instance, advancements in offshore wind turbines, with capacities reaching 15 MW and beyond, are significantly improving energy capture and reducing the levelized cost of energy (LCOE), making wind power increasingly competitive.

Improvements in energy storage solutions, such as enhanced battery technologies and grid-scale storage systems, are critical for addressing the intermittency of wind power. As of early 2025, battery storage costs have continued to decline, with lithium-ion battery pack prices projected to fall by an additional 5-10% in 2025, further bolstering the economic case for renewable energy integration.

These technological leaps reduce the LCOE for renewables, making them more attractive compared to conventional fossil fuels. This trend is vital for Cosmo Energy's strategic green energy expansion, as it directly impacts the profitability and scalability of their renewable energy portfolio.

Technological advancements are significantly refining Cosmo Energy's operations. Innovations like advanced catalysts and digitalized process control are boosting efficiency and cutting costs. For instance, waste heat recovery systems, increasingly adopted in the industry, can improve energy utilization by an estimated 5-10%, directly impacting profitability.

Cosmo Energy's strategic adoption of these technologies is crucial for its competitiveness in the petroleum sector. By integrating digitalization, the company can achieve more precise operational oversight, leading to better yield optimization. This focus on technological upgrades also aids in the production of cleaner fuels and higher-value petrochemicals, aligning with evolving market demands and environmental standards.

Cosmo Energy is increasingly leveraging digitalization and automation to boost efficiency. For instance, in 2024, the company continued to invest in AI-powered predictive maintenance systems for its refining facilities, aiming to reduce unplanned downtime and optimize energy consumption. This focus on smart operations is crucial for maintaining a competitive edge in a dynamic energy market.

The integration of artificial intelligence is particularly impactful in optimizing resource allocation and enhancing safety. By analyzing vast datasets from exploration and production activities, AI can identify potential risks and optimize drilling parameters, leading to improved yields and safer working environments. This analytical capability is vital for navigating the complexities of the energy sector.

Furthermore, advancements in automation are streamlining Cosmo Energy's logistics and supply chain management. In 2025, the company is expected to implement more automated inventory tracking and distribution systems, ensuring timely delivery of refined products and reducing operational costs. These technological upgrades are key to enhancing overall business performance.

Carbon Capture, Utilization, and Storage (CCUS)

The development and deployment of Carbon Capture, Utilization, and Storage (CCUS) technologies represent a significant technological factor for Cosmo Energy Holdings, offering a potential route to mitigate emissions from its current fossil fuel operations. Advancements in CCUS, though still in early stages, could provide a crucial method for decarbonizing sectors that are difficult to electrify, thereby enabling a more sustainable use of fossil fuels.

Cosmo Energy's strategic approach includes monitoring and potentially investing in these evolving CCUS technologies as a component of its broader decarbonization strategy. For instance, by 2024, global investment in CCUS projects was projected to reach tens of billions of dollars, highlighting the growing industry focus.

- Technological Advancement: CCUS technologies are maturing, with ongoing research into more efficient capture methods and diverse utilization pathways.

- Decarbonization Pathway: CCUS offers a way for Cosmo Energy to reduce Scope 1 and Scope 2 emissions from its existing infrastructure.

- Hard-to-Abate Sectors: CCUS is seen as a vital tool for sectors like heavy industry and potentially some forms of power generation where direct electrification is challenging.

- Investment and Monitoring: Cosmo Energy's commitment involves tracking CCUS progress and considering strategic investments to leverage these solutions.

Electric Vehicle (EV) and Hydrogen Fuel Cell Technology

The accelerating shift towards electric vehicles (EVs) and hydrogen fuel cell technology presents a significant technological factor for Cosmo Energy Holdings. By the end of 2024, global EV sales are projected to surpass 17 million units, a substantial increase from previous years, directly impacting demand for traditional gasoline. This trend necessitates that Cosmo Energy evaluate how its extensive service station network can adapt to support EV charging infrastructure or the distribution of hydrogen as a fuel source.

The company faces a dual challenge: a potential decline in revenue from its core gasoline sales while simultaneously exploring new business models. For instance, expanding into EV charging solutions could offer a new revenue stream. By mid-2025, it's anticipated that over 50% of new vehicle sales in select developed markets could be electric, underscoring the urgency of this strategic pivot.

- EV Adoption Growth: Global EV sales are expected to reach approximately 17.5 million units by the end of 2024, indicating a significant market shift away from internal combustion engines.

- Hydrogen Fuel Cell Potential: While still nascent, hydrogen fuel cell technology is gaining traction, with investments in production and distribution infrastructure increasing, offering a long-term diversification opportunity.

- Infrastructure Adaptation: Cosmo Energy must consider retrofitting its existing service stations to accommodate EV charging points and potentially hydrogen refueling capabilities to remain competitive.

- Market Diversification: The company has an opportunity to diversify its energy offerings beyond traditional fuels by investing in renewable energy sources that power EVs or produce green hydrogen.

Cosmo Energy's technological landscape is rapidly evolving, driven by innovations in renewable energy generation and storage. Advancements in offshore wind turbine technology, with capacities exceeding 15 MW by early 2025, are making wind power more cost-effective, directly impacting the feasibility of Cosmo Energy's wind energy projects.

The company is also benefiting from improvements in energy storage, as battery costs continue to decline, with lithium-ion pack prices projected to fall an additional 5-10% in 2025. This trend enhances the economic viability of integrating renewable sources into their portfolio.

Furthermore, digitalization and AI are optimizing operations across Cosmo Energy's value chain. Predictive maintenance systems, implemented in 2024, aim to reduce downtime and energy consumption in refining facilities, while AI is enhancing safety and yield in exploration and production.

The growing adoption of electric vehicles (EVs) presents a significant challenge and opportunity. With global EV sales projected to reach approximately 17.5 million units by the end of 2024, Cosmo Energy is exploring adaptations to its service station network, including EV charging infrastructure and potentially hydrogen refueling.

Legal factors

Cosmo Energy Holdings faces rigorous environmental regulations in Japan, including strict air and water quality standards, waste management protocols, and greenhouse gas emission limits. These laws directly affect its refining, petrochemical, and exploration activities, demanding substantial capital for pollution control systems and meticulous reporting. For instance, Japan's commitment to carbon neutrality by 2050, reinforced by its 2030 emissions reduction target of 46%, compels energy companies like Cosmo to invest heavily in cleaner technologies and explore decarbonization strategies.

Japan's ongoing energy market reforms, aiming for increased liberalization, present a dynamic landscape for Cosmo Energy. The gradual unwinding of regulations, particularly in the electricity sector, could intensify competition, potentially impacting Cosmo Energy's market share in both its traditional petroleum business and its expanding electricity ventures. For instance, the full retail liberalization implemented in 2016 has already seen a surge in new entrants, and further deregulation could accelerate this trend.

Cosmo Energy Holdings must adhere to stringent safety and occupational health regulations, especially given its operations in high-risk sectors such as refineries and offshore platforms. These regulations are designed to safeguard employees and prevent catastrophic incidents, with non-compliance leading to significant fines and operational disruptions.

For instance, in Japan, the Industrial Safety and Health Act mandates comprehensive safety management systems. Cosmo Energy's ongoing commitment to meeting these legal requirements is evident in its continuous investment in advanced safety technologies and rigorous training programs for its workforce, ensuring operational integrity and worker protection.

Land Use and Permitting for Renewable Projects

Legal frameworks governing land use, environmental impact assessments, and permitting processes for large-scale renewable energy projects, such as wind farms, directly affect Cosmo Energy's expansion. These regulations dictate where and how projects can be developed, influencing site selection and operational feasibility.

Navigating complex local and national regulations for site selection and construction can be time-consuming and costly for Cosmo Energy. For example, Japan's stringent environmental review processes can add years to project timelines, impacting the return on investment for new wind farms. The average permitting time for a large renewable project in Japan can range from 2 to 5 years, depending on the specific region and project scale.

Streamlined permitting processes are crucial for accelerating project development and ensuring Cosmo Energy can meet its renewable energy targets. Efforts to simplify these procedures, such as the proposed reforms in 2024 aimed at reducing approval times for offshore wind projects, could significantly boost development speed.

- Land Use Regulations: Cosmo Energy must adhere to zoning laws and land acquisition procedures, which vary significantly by prefecture in Japan.

- Environmental Impact Assessments (EIAs): Projects require thorough EIAs, with recent updates in 2024 focusing on biodiversity protection and marine ecosystem impacts for offshore developments.

- Permitting Timelines: The average time to secure all necessary permits for a major renewable project in Japan was estimated at 3-4 years as of late 2023, a key factor in project planning.

- Regulatory Reform: Ongoing discussions in the Diet aim to standardize and expedite permitting for renewable energy infrastructure, potentially reducing timelines by up to 30% for qualifying projects.

Antitrust and Competition Law

Cosmo Energy Holdings operates in a highly competitive energy sector, necessitating strict adherence to antitrust and competition laws. These regulations are designed to prevent monopolistic practices and ensure a level playing field for all market participants. For instance, in 2023, Japan's Fair Trade Commission (FTC) continued its scrutiny of various industries to uphold fair competition, a trend expected to persist through 2024 and 2025.

Any proposed mergers, acquisitions, or significant strategic alliances undertaken by Cosmo Energy would undergo rigorous review by regulatory bodies. This oversight aims to guarantee that such actions do not stifle competition or lead to unfair market advantages. The company's ability to navigate these reviews successfully is crucial for its growth and operational continuity.

- Regulatory Scrutiny: Japan's FTC actively monitors market activities to prevent anti-competitive behavior.

- Merger & Acquisition Oversight: Significant corporate actions by Cosmo Energy are subject to competition law review.

- Fair Market Conduct: Compliance is vital for maintaining a healthy business environment and avoiding legal repercussions.

- Ongoing Compliance: Continuous adherence to evolving competition laws is a core operational requirement for Cosmo Energy.

Cosmo Energy Holdings must navigate Japan's evolving energy market regulations, including those promoting renewable energy adoption and grid modernization. Compliance with these legal frameworks is essential for the company's strategic investments in areas like offshore wind, where recent policy shifts in 2024 aim to streamline development. For example, Japan's target to install 10 GW of offshore wind capacity by 2030 necessitates clear legal pathways for project approval and operation, impacting Cosmo's long-term energy mix strategy.

Environmental factors

Climate change is a major driver for Cosmo Energy, pushing it to significantly cut its carbon emissions and shift towards cleaner energy sources. This means setting aggressive decarbonization goals, like those aligned with the Paris Agreement, and channeling substantial investments into renewable projects such as solar and wind power. The company is also exploring advanced solutions like carbon capture, utilization, and storage (CCUS) to mitigate its environmental impact.

Cosmo Energy's commitment to sustainability is reflected in its financial planning. For fiscal year 2023, the company allocated ¥100 billion towards its "Cosmo Energy Transformation Plan," with a significant portion earmarked for renewable energy development and carbon reduction initiatives. Failing to meet these evolving environmental expectations could result in a damaged brand image, stricter government regulations, and potential financial penalties, impacting its overall market position.

The finite nature of fossil fuels, particularly crude oil, is a significant environmental factor driving Cosmo Energy Holdings to diversify. Global efforts toward an energy transition are pushing companies like Cosmo Energy to invest more heavily in sustainable alternatives. For instance, while crude oil reserves are not immediately threatened, the long-term outlook necessitates a strategic shift.

Cosmo Energy's focus on expanding into renewable energy sources, such as wind power, directly addresses these resource depletion concerns. This strategic pivot is crucial for long-term viability and aligns with global environmental goals. The company is actively working to increase its renewable energy capacity, aiming to reduce reliance on finite fossil fuels.

Cosmo Energy Holdings' offshore activities, including exploration and wind farm construction, present direct challenges to marine biodiversity. For instance, the ongoing development of offshore wind projects necessitates careful management to avoid disruption to sensitive marine habitats and migratory routes.

Addressing biodiversity loss is paramount, requiring rigorous environmental impact assessments (EIAs) for all new projects. In 2024, regulatory bodies are increasingly scrutinizing these assessments, pushing for more comprehensive data on species populations and ecosystem health. Cosmo Energy must integrate findings from these EIAs into its operational plans to implement effective mitigation strategies.

The company's commitment to responsible development is key to minimizing ecological footprints. This includes adopting best practices in construction and operation, such as using low-impact technologies and establishing protected zones around sensitive areas. By prioritizing ecosystem protection, Cosmo Energy can enhance its long-term sustainability and social license to operate.

Extreme Weather Events and Climate Resilience

The increasing frequency and intensity of extreme weather events, a direct consequence of climate change, present significant physical risks to Cosmo Energy's diverse infrastructure. This includes their refineries, service stations, and renewable energy assets like wind farms, all of which are vulnerable to damage from events such as typhoons, heavy rainfall, and heatwaves. For example, Japan experienced record-breaking heat in 2023, impacting energy demand and potentially straining infrastructure.

To mitigate these risks and ensure operational continuity, Cosmo Energy must continue to invest strategically in climate-resilient infrastructure. This involves fortifying existing facilities and incorporating robust disaster preparedness plans. Such measures are crucial for protecting assets and minimizing potential disruptions. The company's commitment to sustainability, as highlighted in their 2024 financial reporting, includes ongoing assessments of climate-related risks.

Furthermore, climate events can trigger significant supply chain disruptions, affecting the availability of raw materials and the efficient distribution of energy products. Cosmo Energy's proactive approach to supply chain management needs to incorporate contingency planning for climate-related disruptions. This is particularly relevant given the global nature of energy markets and the interconnectedness of supply chains.

- Physical Risks: Extreme weather events like typhoons and heatwaves directly threaten Cosmo Energy's physical assets, including refineries and wind farms.

- Resilience Investments: Continued investment in climate-resilient infrastructure and disaster preparedness is essential for operational continuity.

- Supply Chain Vulnerability: Climate-induced disruptions pose a growing threat to the company's supply chain, impacting material availability and product distribution.

- 2023 Heat Impact: Japan's record heat in 2023 underscored the vulnerability of energy infrastructure to extreme temperatures.

Pollution and Waste Management

Cosmo Energy Holdings faces significant environmental challenges in managing pollution from its refining and petrochemical operations. This includes controlling air emissions, treating wastewater discharges, and handling hazardous waste effectively. For instance, in fiscal year 2023, Cosmo Oil reported efforts to reduce CO2 emissions intensity, aiming for continuous improvement in environmental performance across its facilities.

Adherence to increasingly stringent environmental regulations and a proactive approach to waste reduction are paramount. The company must invest in advanced technologies for waste treatment and explore circular economy principles to minimize its environmental footprint. Public and regulatory bodies maintain a watchful eye on pollution incidents, necessitating robust environmental management systems and transparent reporting.

Key areas of focus for Cosmo Energy include:

- Air Emission Control: Implementing technologies to reduce sulfur oxides (SOx), nitrogen oxides (NOx), and particulate matter from refinery stacks.

- Wastewater Treatment: Ensuring treated water discharged meets or exceeds regulatory standards for chemical oxygen demand (COD) and other pollutants.

- Hazardous Waste Management: Proper disposal and treatment of hazardous materials generated during refining processes, often involving specialized contractors.

- Waste Reduction Initiatives: Exploring opportunities for recycling, reuse, and process optimization to minimize overall waste generation.

Cosmo Energy's environmental strategy is heavily influenced by climate change, driving a push for decarbonization and renewable energy investments. The company is committed to reducing its carbon footprint, aiming for net-zero emissions by 2050. This transition involves significant capital allocation towards solar and wind power projects, alongside exploring carbon capture technologies.

The finite nature of fossil fuels necessitates a strategic diversification into sustainable alternatives, with a focus on expanding renewable energy capacity. For fiscal year 2023, Cosmo Energy allocated ¥100 billion towards its energy transformation plan, emphasizing renewable development.

Cosmo Energy's offshore wind projects require careful management to protect marine biodiversity, with environmental impact assessments becoming increasingly stringent in 2024. The company must integrate these findings into its operational plans to implement effective mitigation strategies and minimize ecological disruption.

Extreme weather events, exacerbated by climate change, pose physical risks to Cosmo Energy's infrastructure, including refineries and wind farms. Japan's record heat in 2023 highlighted the vulnerability of energy assets to temperature fluctuations, necessitating continued investment in climate-resilient infrastructure and robust disaster preparedness.

| Environmental Factor | Impact on Cosmo Energy | Key Initiatives/Data |

| Climate Change & Decarbonization | Pressure to reduce emissions, shift to renewables | Net-zero by 2050 goal; ¥100 billion allocated in FY2023 for transformation plan |

| Resource Depletion (Fossil Fuels) | Need for diversification and increased renewable capacity | Focus on expanding solar and wind power generation |

| Biodiversity Loss | Risk to offshore operations (wind farms) | Emphasis on rigorous Environmental Impact Assessments (EIAs) for new projects |

| Extreme Weather Events | Physical risks to infrastructure, supply chain disruptions | Investment in climate-resilient infrastructure; 2023 heatwave impact noted |

| Pollution Management | Strict regulations on emissions and waste | Efforts to reduce CO2 emission intensity in refining operations (FY2023) |

PESTLE Analysis Data Sources

Our Cosmo Energy Holdings PESTLE analysis is grounded in data from reputable sources including government energy agencies, international financial institutions, and leading market research firms. We incorporate official statistics on economic performance, environmental regulations, technological advancements, and socio-political trends to provide a comprehensive overview.