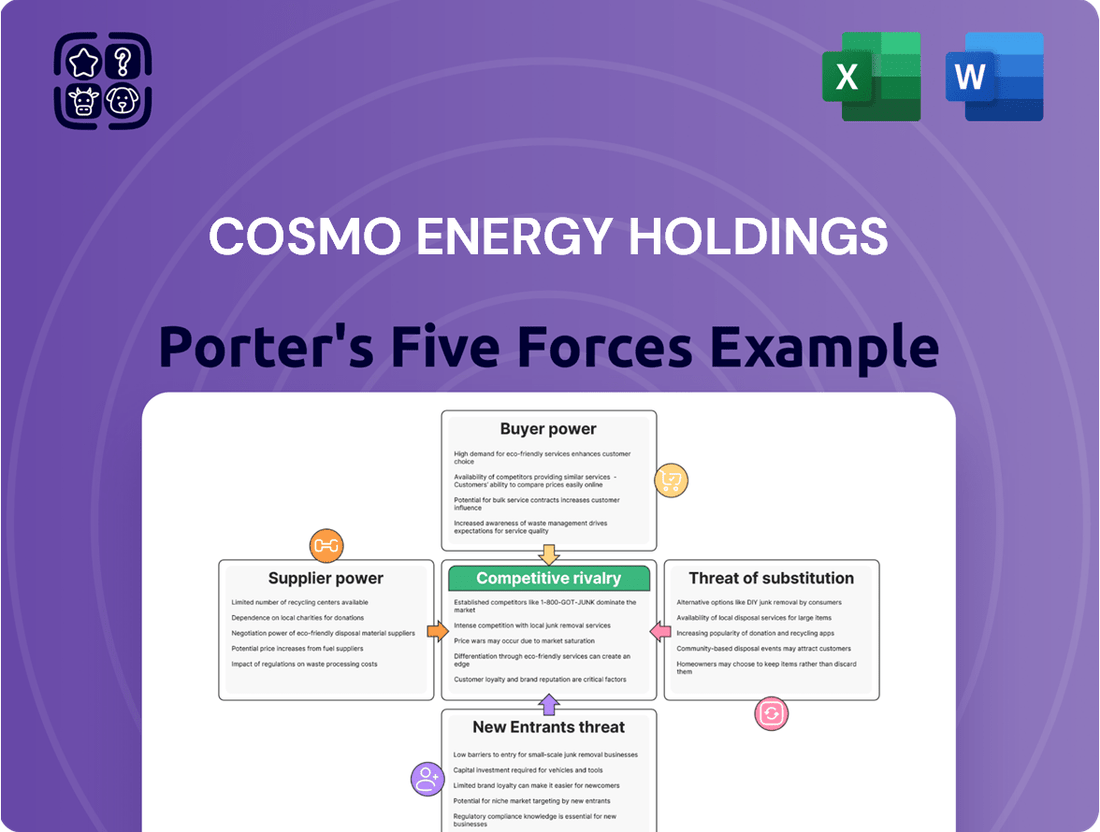

Cosmo Energy Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cosmo Energy Holdings Bundle

Cosmo Energy Holdings navigates a dynamic energy landscape shaped by intense competition, fluctuating supplier power, and the growing threat of substitutes. Understanding these forces is crucial for any stakeholder looking to grasp their strategic position.

The complete report reveals the real forces shaping Cosmo Energy Holdings’s industry—from buyer power to the threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Cosmo Energy Holdings, a significant player in Japan's refining sector, faces substantial bargaining power from its crude oil suppliers. The company's reliance on imported crude oil means that suppliers can exert considerable influence over pricing and availability, directly affecting Cosmo's production costs and overall financial health.

Global events, such as geopolitical tensions and decisions made by organizations like OPEC+, play a crucial role in shaping crude oil markets. These factors can lead to price volatility and impact the stability of supply chains, posing a direct challenge to Cosmo's operational efficiency and profitability. For instance, in early 2024, Brent crude oil prices fluctuated significantly, trading in a range that impacted refiners globally.

To mitigate these risks, Cosmo Energy Holdings actively pursues strategies to ensure a stable supply of crude oil. This includes investing in independent oil development projects and establishing long-term procurement agreements with various oil-producing nations, aiming to diversify its sources and secure more predictable access to essential raw materials.

The bargaining power of technology and equipment suppliers for refining and petrochemicals is significant due to the highly specialized nature of the industry. A limited number of global manufacturers produce critical components and proprietary technologies essential for these complex operations. This concentration of expertise means suppliers can command higher prices, especially for unique or advanced equipment.

Cosmo Energy Holdings' strategic shift towards digitizing its refineries and embracing low-carbon technologies, such as advanced catalysts or specialized processing units, amplifies this reliance. For instance, investments in carbon capture utilization and storage (CCUS) technologies often involve bespoke solutions from a select few providers. In 2024, the global market for petrochemical processing equipment was valued at approximately $150 billion, with specialized segments experiencing even tighter supply chains and higher price premiums.

As Cosmo Energy Holdings expands its renewable energy portfolio, especially in wind power, its dependence on suppliers for turbines and critical components increases. While the renewable sector is growing, certain specialized parts or advanced turbine technologies might be available from a limited number of manufacturers, potentially impacting costs and project schedules.

The global wind turbine market, for instance, saw significant activity in 2023, with major players like Vestas and Siemens Gamesa dominating installations. Cosmo Energy's strategy to bolster its green electricity supply chain suggests a proactive approach to navigating these supplier dynamics and securing favorable terms.

Used Cooking Oil (UCO) Suppliers for SAF Production

Cosmo Energy Holdings is venturing into large-scale Sustainable Aviation Fuel (SAF) production using used cooking oil (UCO), establishing a novel supply chain in Japan. The reliability and consistent quality of UCO are paramount for this operation. As the SAF market expands, the bargaining power of UCO collectors and aggregators is likely to strengthen, potentially impacting feedstock costs.

To mitigate this, Cosmo Energy is forging strategic alliances with local governments to bolster UCO recycling initiatives, aiming to secure a stable and predictable supply. This proactive approach is essential for managing supplier relationships in a nascent but rapidly growing sector.

- UCO Supply Chain Development: Cosmo Energy's focus on UCO for SAF production highlights the critical nature of feedstock availability in emerging green fuel markets.

- Supplier Bargaining Power: As demand for SAF increases, the leverage held by UCO suppliers is expected to rise, influencing procurement strategies.

- Government Partnerships: Collaborations with local authorities are key to enhancing UCO collection and ensuring supply chain resilience for SAF production.

Labor and Specialized Services

The energy sector, especially refining and exploration, relies heavily on specialized skills and technical services. A scarcity of qualified professionals or the presence of strong labor unions significantly bolsters the bargaining power of employees and service providers. Cosmo Energy Holdings' focus on human resource transformation, or HRX, highlights their recognition of the critical role their workforce plays in operations and their strategic importance in managing supplier power.

In 2024, the demand for skilled labor in the energy sector remained robust, driven by ongoing projects and the transition towards cleaner energy sources, which often require new skill sets. For instance, the International Energy Agency (IEA) reported in its 2024 outlook that the clean energy transition would necessitate millions of new jobs, many requiring specialized technical training, thus increasing the leverage of those possessing these in-demand skills.

- High Demand for Specialized Skills: The energy industry, particularly in refining and upstream operations, requires a deep pool of engineers, geoscientists, and specialized technicians.

- Union Influence: Where labor unions are well-established, they can negotiate favorable wages, benefits, and working conditions, directly impacting labor costs for companies like Cosmo Energy.

- Cosmo's HR Strategy: Cosmo Energy's HRX initiative aims to develop and retain talent, potentially mitigating the impact of external labor market pressures and strengthening their internal capabilities.

Cosmo Energy Holdings faces significant bargaining power from its crude oil suppliers due to its reliance on imported feedstock. Global oil market dynamics, influenced by events like OPEC+ decisions and geopolitical tensions, directly impact pricing and supply stability. For example, Brent crude oil prices experienced considerable volatility in early 2024, affecting refiners worldwide.

The company mitigates this by diversifying supply sources through investments in independent oil development and long-term procurement agreements with various oil-producing nations, aiming for more predictable access to essential raw materials.

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Cosmo Energy Holdings' position in the Japanese energy sector.

Quickly identify and address competitive threats by visualizing the intensity of each of Porter's Five Forces impacting Cosmo Energy Holdings.

Customers Bargaining Power

Large industrial and commercial customers wield considerable bargaining power, especially when purchasing significant volumes of products like Sustainable Aviation Fuel (SAF) or green electricity. Their ability to switch suppliers or negotiate favorable terms means Cosmo Energy must actively manage these relationships. For example, Cosmo Energy's commitment to developing SAF, with agreements like the one with DHL Express for supply, demonstrates a strategy to foster strong ties and provide tailored solutions to these high-volume clients, thereby mitigating their inherent bargaining leverage.

Individual consumers typically have low bargaining power when purchasing petroleum products at a service station. Their ability to influence prices is minimal on an individual basis. However, collectively, consumer choices regarding fuel efficiency, electric vehicle adoption, and public transportation can significantly impact overall demand for gasoline, indirectly affecting service station operators and refiners like Cosmo Energy Holdings.

Service station operators, acting as intermediaries between refiners and end consumers, possess some bargaining power. They negotiate terms with suppliers like Cosmo Oil Marketing, influencing aspects like product pricing and delivery schedules. Cosmo's strategy to improve customer satisfaction and offer diverse payment options aims to strengthen its relationships with these operators and retain their business.

Petrochemical customers, particularly large-volume buyers in industries like plastics and textiles, can exert significant bargaining power. This power stems from their ability to switch between suppliers, especially when alternative sources are readily available. For instance, a major tire manufacturer might leverage its substantial order volume to negotiate better pricing from Cosmo Energy Holdings, knowing other petrochemical producers can supply similar raw materials.

Green Electricity Consumers

As Cosmo Energy Holdings increases its green electricity offerings, consumers focused on renewables, such as businesses aiming to lower their carbon emissions, will wield some influence. The expanding green electricity sector in Japan, supported by government promotions, indicates rising demand. For instance, in fiscal year 2023, Japan's renewable energy capacity reached approximately 254 GW, with solar power being the dominant source. Customers can compare pricing and service plans from various green energy suppliers, creating a competitive landscape that allows them to negotiate better terms or switch providers if unsatisfied.

The bargaining power of green electricity consumers is influenced by several factors:

- Availability of Alternatives: A wider array of green energy providers in the market increases consumer choice and their ability to switch.

- Price Sensitivity: Customers actively seeking the most cost-effective green energy solutions can leverage price competition among suppliers.

- Switching Costs: Low costs associated with changing electricity providers empower consumers to move to more favorable offers.

- Information Availability: Transparent pricing and performance data enable consumers to make informed decisions and exert greater influence.

Government and Regulatory Bodies

Government and regulatory bodies in Japan wield significant influence over Cosmo Energy Holdings, acting as powerful stakeholders even if not direct customers. Their policy decisions, such as setting renewable energy mandates or carbon pricing mechanisms, directly shape the demand for various energy products and the overall operating landscape. For instance, Japan's commitment to achieving carbon neutrality by 2050, with interim targets for emissions reductions, necessitates a strategic shift in energy production and consumption, impacting companies like Cosmo Energy.

These bodies also control pricing regulations, tariffs, and licensing, which are critical for profitability in the energy sector. In 2023, Japan's government continued to implement measures aimed at stabilizing energy prices and ensuring supply security, often through subsidies or price caps, directly affecting Cosmo Energy's revenue streams and cost structures. The push for Sustainable Aviation Fuel (SAF) blending targets, for example, creates both opportunities and compliance challenges, highlighting the bargaining power of regulators in dictating market direction.

- Regulatory Influence: Japanese government policies dictate operational frameworks and market access for energy companies.

- Pricing Control: Tariffs and price regulations directly impact Cosmo Energy's revenue and cost management.

- Mandate Impact: Government mandates, such as SAF blending targets, shape product demand and strategic investment.

- Environmental Policies: National climate goals influence the long-term viability of different energy sources and require adaptation.

Cosmo Energy Holdings faces significant bargaining power from large industrial and commercial clients, particularly for high-volume products like green electricity. These customers can negotiate favorable terms due to their purchasing scale and the availability of alternative suppliers. For instance, a major corporation seeking to meet its sustainability goals might leverage its demand for renewable energy to secure competitive pricing from Cosmo Energy, influencing contract specifics and supply reliability.

Individual consumers have minimal direct bargaining power with Cosmo Energy's retail fuel operations. However, their collective shift towards electric vehicles or more fuel-efficient cars, influenced by factors like government incentives and rising gasoline prices, indirectly impacts demand. This trend, evident in the increasing adoption rates of EVs in Japan, forces energy companies to adapt their product mix and service offerings.

Service station operators, as intermediaries, possess moderate bargaining power with Cosmo Oil Marketing. They negotiate supply agreements, pricing, and delivery schedules. Cosmo's efforts to enhance its brand loyalty programs and offer digital payment solutions aim to strengthen these relationships and mitigate the operators' ability to switch to other distributors.

The bargaining power of petrochemical customers, especially large-scale industrial users, is substantial. Their ability to source raw materials from multiple suppliers means they can negotiate price and contract terms effectively. For example, a large plastics manufacturer might compare offers from various petrochemical producers, including Cosmo Energy, to secure the most advantageous supply agreement.

| Customer Segment | Bargaining Power Level | Key Influencing Factors | Cosmo Energy's Mitigation Strategy |

|---|---|---|---|

| Large Industrial/Commercial (Green Electricity) | High | Volume purchases, availability of alternatives, sustainability goals | Tailored solutions, long-term contracts, relationship management |

| Individual Consumers (Fuel) | Low (individually) | Limited purchase volume, high switching costs for fuel | Brand loyalty programs, convenience, competitive pricing |

| Service Station Operators | Moderate | Negotiation of supply terms, volume commitments | Partnership programs, digital services, consistent supply |

| Petrochemical Customers (Large Volume) | High | Ability to switch suppliers, volume discounts, alternative sourcing | Competitive pricing, product quality, supply chain reliability |

Preview Before You Purchase

Cosmo Energy Holdings Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Cosmo Energy Holdings' competitive landscape through Porter's Five Forces, examining threats from new entrants, buyer and supplier power, and the intensity of rivalry within the energy sector. Understand the strategic implications of each force to inform your own business decisions.

Rivalry Among Competitors

Cosmo Energy Holdings faces formidable competition in Japan's mature energy sector, particularly from giants like Eneos and Idemitsu Kosan, which boast significantly larger refining capacities and sales volumes. This intense rivalry in the petroleum market, a segment characterized by slow growth, compels companies to constantly innovate in operational efficiency, strengthen brand loyalty, and aggressively pursue customer retention strategies to maintain market share.

The global push towards decarbonization intensifies competition within the energy sector, as traditional players like Cosmo Energy Holdings and specialized renewable firms battle for dominance in green energy markets. Cosmo's strategic diversification into wind power and sustainable aviation fuel (SAF) positions it directly against other energy giants and emerging clean-tech companies also investing heavily in these areas.

In 2024, the renewable energy sector saw significant capital inflows, with global investment in clean energy reaching record highs, creating a highly competitive landscape. For instance, companies are increasingly focusing on offshore wind projects, a segment where Cosmo Energy is also expanding its footprint, leading to direct rivalry for development rights, technology, and talent.

Petrochemical competition is fierce, with numerous domestic and international companies vying for market share. This intense rivalry is often exacerbated by volatile raw material costs, such as crude oil and natural gas, which directly impact production expenses and pricing strategies. For instance, in 2024, the fluctuating price of Brent crude oil, which saw significant swings throughout the year, directly influenced the cost competitiveness of petrochemical producers globally.

Technological advancements also play a crucial role in shaping the competitive landscape. Companies that invest in and adopt more efficient production processes or develop innovative new materials can gain a significant edge. This creates a dynamic environment where continuous improvement and R&D are essential to maintain or enhance market position. The ongoing development of advanced catalysts and more sustainable production methods in 2024 exemplifies this trend, pushing companies to adapt or risk falling behind.

Global Energy Transition and Decarbonization Trends

The global push for decarbonization and the energy transition significantly intensifies competition, forcing energy companies like Cosmo Energy to innovate or risk obsolescence. This shift necessitates substantial investment in new technologies and business models to align with evolving environmental regulations and consumer demands. For instance, by 2024, renewable energy sources are projected to account for a larger share of global electricity generation, putting pressure on traditional fossil fuel providers to adapt their strategies.

Cosmo Energy's Vision 2030, with its explicit commitment to green transformation (GX), directly addresses this heightened competitive landscape. This strategy aims to pivot the company towards more sustainable energy solutions, including renewable power generation and the development of hydrogen and ammonia as fuel sources. Such a proactive approach is crucial for maintaining market share and attracting investment in an era increasingly defined by climate consciousness.

- Global Decarbonization Drive: The world is actively pursuing lower carbon emissions, creating a dynamic competitive environment for energy firms.

- Energy Transition Imperative: Companies must adapt to shifting energy sources and technologies to remain competitive and relevant.

- Cosmo Energy's GX Strategy: Vision 2030's focus on green transformation is a direct response to these overarching competitive pressures.

- Market Adaptation: Successful adaptation involves investing in renewables, hydrogen, and ammonia to meet future energy demands and regulatory requirements.

Innovation and Technology Adoption

Competitive rivalry within Cosmo Energy Holdings is significantly fueled by ongoing innovation in refining processes and the strategic adoption of digital transformation (DX) initiatives. These advancements are crucial for enhancing operational efficiency and cost competitiveness in a dynamic energy landscape. For instance, in 2024, the global refining sector saw continued investment in technologies aimed at improving yield and reducing emissions, a trend Cosmo Energy is actively participating in.

The development and integration of new energy solutions, particularly in areas like hydrogen, are also intensifying competition. Companies that demonstrate agility in scaling these emerging technologies are poised to capture future market share. Cosmo Energy's commitment to exploring hydrogen as a key future energy source places it in direct competition with other major energy players who are similarly investing in this nascent but promising sector.

The ability to quickly adopt and effectively scale new technologies provides a distinct competitive advantage. This includes not only process innovations but also advancements in data analytics and AI for predictive maintenance and optimized resource allocation. In 2023, investments in industrial digitalization across the energy sector reached hundreds of billions of dollars globally, underscoring the importance of technological prowess.

- Innovation in refining processes: Companies are investing in advanced catalytic converters and separation technologies to improve product yield and reduce environmental impact.

- Digital Transformation (DX): Adoption of AI, IoT, and big data analytics for optimizing plant operations, supply chains, and customer engagement.

- New Energy Solutions: Focus on hydrogen production, carbon capture utilization and storage (CCUS), and renewable energy integration to diversify portfolios.

- Technological Scaling: The capacity to rapidly deploy and integrate new technologies across operations to achieve economies of scale and market leadership.

Competitive rivalry is intense across Cosmo Energy Holdings' business segments, driven by established players and the global energy transition. The petroleum refining and marketing sector sees fierce competition from domestic giants like Eneos and Idemitsu Kosan, necessitating a focus on efficiency and customer retention. In renewable energy, Cosmo faces competition from both traditional energy firms and specialized clean-tech companies vying for dominance in areas like offshore wind and sustainable fuels, with global investment in clean energy reaching record highs in 2024.

| Company | 2023 Revenue (USD Billion) | 2023 Net Income (USD Billion) | Renewable Energy Capacity (GW) |

|---|---|---|---|

| Cosmo Energy Holdings | 17.3 | 0.6 | 0.4 |

| Eneos Holdings | 58.9 | 1.8 | 1.5 |

| Idemitsu Kosan | 32.1 | 0.9 | 0.8 |

SSubstitutes Threaten

The growing adoption of electric vehicles (EVs) presents a substantial threat to Cosmo Energy's core business of selling gasoline and diesel. As more consumers switch to EVs, demand for traditional fuels will inevitably decline.

Japan's commitment to decarbonization, with ambitious targets for reducing carbon emissions, is a key driver behind this shift. This policy environment actively encourages EV adoption, which is projected to accelerate significantly from 2030 onwards, directly impacting fossil fuel consumption.

In 2023, EV sales in Japan accounted for approximately 2.4% of the total new car market, a notable increase from previous years. Projections suggest this figure could reach 20-30% by 2030, underscoring the escalating competitive pressure on Cosmo Energy's fuel segment.

While Cosmo Energy Holdings is actively investing in Sustainable Aviation Fuel (SAF), the threat of substitutes for traditional jet fuel, and by extension SAF derived from sources like used cooking oil (UCO), remains a significant consideration. Emerging alternative aviation fuels or entirely new propulsion technologies could offer competitive solutions that bypass the need for SAF as we currently understand it.

For instance, advancements in hydrogen-electric or battery-electric propulsion systems, while still in early development for long-haul flights, represent potential substitutes that could fundamentally alter the aviation fuel landscape. The International Energy Agency reported in 2024 that while SAF production is growing, reaching the ~10% SAF blend target for many regions by 2030 will require substantial investment and policy support, highlighting the ongoing race for viable decarbonization pathways.

The growing availability and decreasing cost of renewable electricity sources, such as solar and geothermal power, present a significant threat of substitution for traditional fossil fuel-based energy. This shift is driven by global environmental concerns and technological advancements. For instance, by the end of 2023, renewable energy capacity additions reached a record high, with solar PV alone accounting for a substantial portion of this growth, demonstrating the increasing viability of these alternatives.

Cosmo Energy Holdings' strategic investment and expansion into wind power, including offshore wind projects, directly addresses this threat by positioning the company to benefit from the transition to green electricity. This diversification allows Cosmo to capture a share of the market for substitute energy sources, mitigating the risk posed by competitors solely focused on fossil fuels.

Hydrogen as an Energy Carrier

Hydrogen, especially green hydrogen produced from renewable sources, is increasingly viewed as a viable substitute across multiple energy sectors. This includes powering vehicles, from cars to heavy-duty trucks, and serving as a clean alternative in industrial applications like steel and ammonia production. For instance, by 2024, several countries have set ambitious targets for hydrogen production and adoption, with Germany aiming for 10 GW of electrolyzer capacity by 2030, signaling a significant shift in the energy landscape.

Cosmo Energy Holdings' strategic investments and exploration into the hydrogen supply chain, including partnerships for hydrogen production and distribution, demonstrate a clear acknowledgment of this growing threat. Their involvement in projects like the development of hydrogen refueling stations and potential use in power generation highlights their proactive approach to integrating this substitute into their business model. This strategic pivot is crucial as the global energy market seeks decarbonization solutions.

- Green Hydrogen Production Growth: Global green hydrogen production capacity is projected to reach over 130 million tonnes per annum by 2030, up from a much smaller base in the early 2020s.

- Transportation Sector Adoption: By mid-2024, the number of hydrogen fuel cell electric vehicles (FCEVs) on the road globally is expected to surpass 50,000, with significant growth anticipated in commercial fleets.

- Industrial Decarbonization Efforts: Major industrial players are investing billions in hydrogen-based decarbonization projects, with over $500 billion in global investment announced by 2024 for hydrogen technologies and infrastructure.

Energy Efficiency and Conservation

Improvements in energy efficiency and a growing consumer focus on conservation can significantly curb demand for traditional energy sources. This trend directly impacts companies like Cosmo Energy Holdings by reducing the volume of petroleum products and electricity they can sell, effectively acting as a substitute for their core offerings.

For instance, advancements in building insulation and smart home technology in 2024 are projected to further decrease residential energy consumption. Similarly, the automotive sector's push towards more fuel-efficient internal combustion engines and the accelerating adoption of electric vehicles (EVs) directly substitute demand for gasoline and diesel. By 2024, it’s estimated that over 20% of new vehicle sales in many developed markets could be EVs, a substantial shift impacting fossil fuel demand.

- Reduced Demand: Energy efficiency measures can lower the overall need for energy, impacting sales volumes for companies like Cosmo.

- Technological Advancements: Innovations in smart homes and efficient appliances are making energy consumption more deliberate.

- EV Adoption: The increasing market share of electric vehicles directly substitutes demand for traditional gasoline and diesel fuels.

The rise of electric vehicles (EVs) and advancements in renewable energy sources like solar and wind power represent significant substitutes for Cosmo Energy's traditional fossil fuel business. Japan's decarbonization goals are accelerating EV adoption, with sales projected to reach 20-30% of new cars by 2030, up from 2.4% in 2023.

Hydrogen, particularly green hydrogen, is emerging as a key substitute across transportation and industry. Global green hydrogen production capacity is expected to exceed 130 million tonnes per annum by 2030, with over $500 billion in global investment announced by 2024 for hydrogen technologies.

Furthermore, enhanced energy efficiency in buildings and vehicles directly reduces demand for energy products. By 2024, over 20% of new vehicle sales in many developed markets are anticipated to be EVs, directly substituting gasoline and diesel demand.

| Substitute | Impact on Cosmo Energy | Key Drivers/Data (as of mid-2024) |

| Electric Vehicles (EVs) | Reduces demand for gasoline and diesel. | EV sales ~2.4% of new cars in Japan (2023); projected 20-30% by 2030. |

| Renewable Electricity (Solar, Wind) | Decreases demand for fossil fuel-based electricity generation. | Record renewable capacity additions by end of 2023; solar PV a major contributor. |

| Green Hydrogen | Potential substitute for transportation fuels and industrial energy. | Global green hydrogen capacity projected >130M tonnes/annum by 2030; $500B+ global investment in hydrogen tech announced by 2024. |

| Energy Efficiency | Lowers overall energy consumption, impacting sales volumes. | Smart home tech and efficient building insulation reducing residential energy use; >20% new vehicle sales in developed markets could be EVs by 2024. |

Entrants Threaten

The oil refining sector presents a formidable challenge for newcomers due to its exceptionally high capital expenditure requirements. Building a new refinery can easily cost billions of dollars, a sum that deters most potential entrants. For instance, the construction of a modern, large-scale refinery often runs into the $10 billion to $20 billion range, a significant barrier.

Beyond the initial investment, new entrants must navigate a complex web of regulatory approvals. Obtaining environmental permits, adhering to stringent safety standards, and complying with evolving emissions regulations add considerable time and cost to any new venture. These hurdles mean that even well-funded companies find it difficult to establish a foothold in the traditional refining market, thereby lowering the threat of new entrants.

The oil exploration and production sector presents a formidable barrier to entry for newcomers. This is largely due to the immense need for highly specialized technical expertise, cutting-edge technology, and significant capital investment. For instance, in 2024, the average cost for a deepwater exploration well can easily exceed $100 million, a sum that deters many potential entrants.

Furthermore, the inherent risks associated with discovering and extracting oil mean that only well-capitalized and experienced companies can realistically participate. These high upfront costs and the technical complexities involved significantly limit the threat of new entrants challenging established players like Cosmo Energy Holdings.

The renewable energy sector, especially wind power in Japan, presents a growing opportunity, but it's also quite capital-intensive. Developing new wind farms requires substantial upfront investment in turbines, infrastructure, and land acquisition. For instance, offshore wind projects can easily run into hundreds of billions of yen.

Beyond the financial hurdle, new entrants must possess specialized technical knowledge for project design, installation, and maintenance. Navigating Japan's complex regulatory environment, including obtaining permits and securing grid connection agreements, also adds significant complexity and time. These factors collectively establish moderate to high barriers to entry, though perhaps less daunting than those in the established oil and gas industry.

Emerging SAF and Hydrogen Markets

The emerging markets for Sustainable Aviation Fuel (SAF) and hydrogen, while promising, face substantial hurdles for newcomers. These include the considerable investment required for technology maturation, building robust supply chains, and navigating evolving regulatory landscapes. For instance, the global SAF market is projected to grow significantly, with some estimates suggesting it could reach tens of billions of dollars by the early 2030s, but this growth is contingent on overcoming these entry barriers.

Cosmo Energy Holdings, by actively engaging in pilot projects and forging strategic alliances within these sectors, is establishing a degree of first-mover advantage. This early engagement can create a competitive moat, making it more challenging for subsequent entrants to replicate their established infrastructure and market access. For example, by 2024, several major airlines have committed to increasing their SAF usage, signaling a growing demand that early players are better positioned to meet.

- High Capital Requirements: Significant upfront investment is needed for R&D, production facilities, and infrastructure development in SAF and hydrogen.

- Technological Uncertainty: The efficiency and scalability of various SAF and hydrogen production methods are still being refined, posing risks for new entrants.

- Supply Chain Development: Establishing reliable feedstock sourcing and distribution networks is complex and time-consuming, a challenge for those entering late.

- Regulatory and Policy Dependence: The growth of these markets relies heavily on government incentives and supportive policies, which can be unpredictable for new players.

Government Support and Incumbent Advantages

Cosmo Energy Holdings, like other established energy players, benefits significantly from existing infrastructure and distribution networks. This deep-rooted presence creates substantial hurdles for newcomers. For instance, the sheer scale of investment required to replicate Cosmo's extensive network of refineries, pipelines, and retail stations is immense, effectively deterring many potential entrants.

Government support and regulatory frameworks often favor incumbent companies, further solidifying their market position. Policies focused on energy security or the stability of the existing energy supply chain can inadvertently create barriers to entry. In 2024, Japan's continued emphasis on stable energy provision means that companies like Cosmo, with proven track records and established operational capacities, are often viewed more favorably in licensing and development opportunities compared to nascent competitors.

- Established Infrastructure: Cosmo Energy Holdings possesses extensive physical assets, including refineries and a widespread retail network, which are costly and time-consuming for new companies to replicate.

- Regulatory Advantages: Existing players often navigate regulatory landscapes more efficiently due to established relationships and compliance history, which can be a significant barrier for new entrants.

- Economies of Scale: Incumbents benefit from lower per-unit costs due to their large-scale operations, making it difficult for smaller, new entrants to compete on price.

- Customer Loyalty and Brand Recognition: Long-standing presence fosters customer trust and brand loyalty, requiring new entrants to invest heavily in marketing and customer acquisition.

The threat of new entrants for Cosmo Energy Holdings is generally low across its core business segments, primarily due to significant capital requirements, established infrastructure, and regulatory hurdles.

In the oil refining and exploration sectors, the sheer cost of building new facilities, often in the billions of dollars, acts as a major deterrent. For example, a new large-scale refinery can cost $10 billion to $20 billion. Furthermore, navigating complex environmental and safety regulations adds substantial time and expense, making it difficult for newcomers to compete.

Even in growing areas like renewable energy, particularly wind power in Japan, high upfront investments for projects like offshore wind farms, potentially running into hundreds of billions of yen, coupled with specialized technical knowledge requirements and regulatory complexities, create moderate to high barriers. Emerging markets like Sustainable Aviation Fuel (SAF) and hydrogen also face substantial entry challenges due to technology maturation costs and supply chain development needs.

Cosmo Energy Holdings leverages its extensive existing infrastructure, including refineries and retail networks, which would be prohibitively expensive for new entrants to replicate. In 2024, Japan's focus on energy security often favors established companies like Cosmo with proven operational capacities, offering them advantages in licensing and development opportunities.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Cosmo Energy Holdings is built upon a foundation of verified data, including the company's annual reports, investor relations disclosures, and relevant industry publications. We also incorporate insights from market research reports and government regulatory filings to provide a comprehensive understanding of the competitive landscape.