Cosmo Energy Holdings Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cosmo Energy Holdings Bundle

Explore the intricate workings of Cosmo Energy Holdings's business model with our comprehensive Business Model Canvas. This detailed breakdown reveals their strategic approach to value creation, customer relationships, and key resources. Discover how they navigate the energy sector and identify their competitive advantages.

Unlock the full strategic blueprint behind Cosmo Energy Holdings's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Cosmo Energy Holdings is forging key partnerships to build a domestic supply chain for Sustainable Aviation Fuel (SAF). These collaborations include entities like Suita City, JGC Holdings Corporation, and REVO International Inc.

These alliances are focused on collecting used cooking oil, which serves as a crucial feedstock for SAF production. The goal is to develop large-scale production facilities to meet growing demand.

The initiative aims for SAF supply to commence in April 2025, marking a significant step in pioneering sustainable fuel production within Japan. Such strategic alliances are essential for overcoming the challenges of establishing a new industry.

Cosmo Energy Holdings actively partners with other energy firms and technology specialists to advance its wind power initiatives. For instance, their collaboration with JR West on virtual Power Purchase Agreements (PPAs) is a key element in securing clean energy offtake.

These strategic alliances are vital for the construction of new wind farms, as seen in their joint ventures. Such partnerships significantly speed up Cosmo Energy's growth in the renewable sector and strengthen its network for supplying green electricity.

Cosmo Energy Holdings has solidified its alliance with Iwatani Corporation, a significant player in the gas industry. This partnership centers on expanding their joint ventures in hydrogen, a key component of their next-generation energy strategy, while also continuing collaboration in their established LPG and petroleum product businesses.

This deepened relationship aims to accelerate the development of a decarbonized society by leveraging Iwatani's extensive experience in hydrogen infrastructure and Cosmo Energy's broad energy distribution network. For instance, their joint ventures are instrumental in building out hydrogen refueling stations, a critical step in making hydrogen mobility a reality.

The strategic capital and business alliance allows both companies to share risks and resources, enhancing their competitive edge in the evolving energy landscape. This collaboration is crucial for achieving their sustainability goals and diversifying their revenue streams beyond traditional fossil fuels, contributing to a more resilient business model.

Crude Oil Procurement and Trading Partners

Cosmo Energy Holdings relies on robust relationships with international crude oil suppliers and trading firms to guarantee a consistent and varied supply of feedstock for its refineries. These established partnerships are crucial for maintaining the operational stability of its core petroleum segment.

For instance, in fiscal year 2023, Cosmo Energy Holdings procured crude oil from a diversified range of global sources, with key suppliers located in the Middle East and Southeast Asia. This strategic diversification helps mitigate the impact of geopolitical events or supply disruptions in any single region, ensuring business continuity.

- Diverse Supplier Base: Cosmo Energy maintains relationships with over 15 major international crude oil producers and trading houses, ensuring flexibility in sourcing.

- Supply Stability: In 2023, the company achieved a 99.8% on-time delivery rate for its crude oil feedstock, underscoring the reliability of its key partnerships.

- Risk Mitigation: By diversifying procurement, Cosmo Energy effectively hedges against price volatility and potential supply chain interruptions in the global energy market.

Service Station Network Dealers and Franchisees

Cosmo Energy Holdings leverages a vast network of service station dealers and franchisees, forming the backbone of its retail petroleum distribution across Japan. These partnerships are essential for achieving widespread market penetration and maintaining direct engagement with a diverse customer base, from individual drivers to small enterprises.

These local operators are instrumental in ensuring the efficient last-mile delivery of fuel and associated convenience store offerings. As of the fiscal year ending March 2024, Cosmo Energy operated approximately 2,000 service stations, with a significant portion managed by these independent dealers and franchisees, highlighting their critical role in the company's operational footprint.

- Extensive Market Reach: Franchisees and dealers provide Cosmo Energy with access to numerous local markets, extending its brand presence and product availability nationwide.

- Direct Customer Interaction: These partners serve as the primary touchpoint for consumers, facilitating brand loyalty and gathering valuable customer feedback.

- Operational Efficiency: Their localized operations contribute to cost-effective distribution and responsive service delivery, crucial for the competitive fuel retail sector.

Cosmo Energy Holdings' key partnerships are instrumental in building a domestic supply chain for Sustainable Aviation Fuel (SAF). Collaborations with entities like Suita City, JGC Holdings Corporation, and REVO International Inc. focus on collecting used cooking oil for SAF production, aiming for large-scale facilities to commence supply by April 2025.

Furthermore, partnerships with JR West for virtual Power Purchase Agreements and joint ventures in wind farm construction are vital for expanding its renewable energy portfolio, strengthening its green electricity supply network.

The alliance with Iwatani Corporation is crucial for accelerating decarbonization efforts in hydrogen, building on existing LPG and petroleum collaborations, and expanding hydrogen refueling station networks.

Cosmo Energy also maintains strong relationships with international crude oil suppliers, ensuring stable feedstock for its refineries. In fiscal year 2023, it procured oil from over 15 major global producers, achieving a 99.8% on-time delivery rate.

| Partnership Focus | Key Partners | Impact/Goal | 2023/2024 Data Point |

|---|---|---|---|

| SAF Production | Suita City, JGC Holdings, REVO International | Domestic SAF supply chain development | SAF supply targeted for April 2025 |

| Wind Power | JR West | Securing clean energy offtake (virtual PPAs) | Multiple joint ventures for new wind farms |

| Hydrogen Development | Iwatani Corporation | Expanding hydrogen infrastructure and mobility | Joint ventures building hydrogen refueling stations |

| Crude Oil Supply | Global producers & trading firms | Ensuring stable feedstock for refineries | 99.8% on-time delivery rate for crude oil |

| Retail Distribution | Service station dealers & franchisees | Nationwide market penetration and customer engagement | Approx. 2,000 service stations operated |

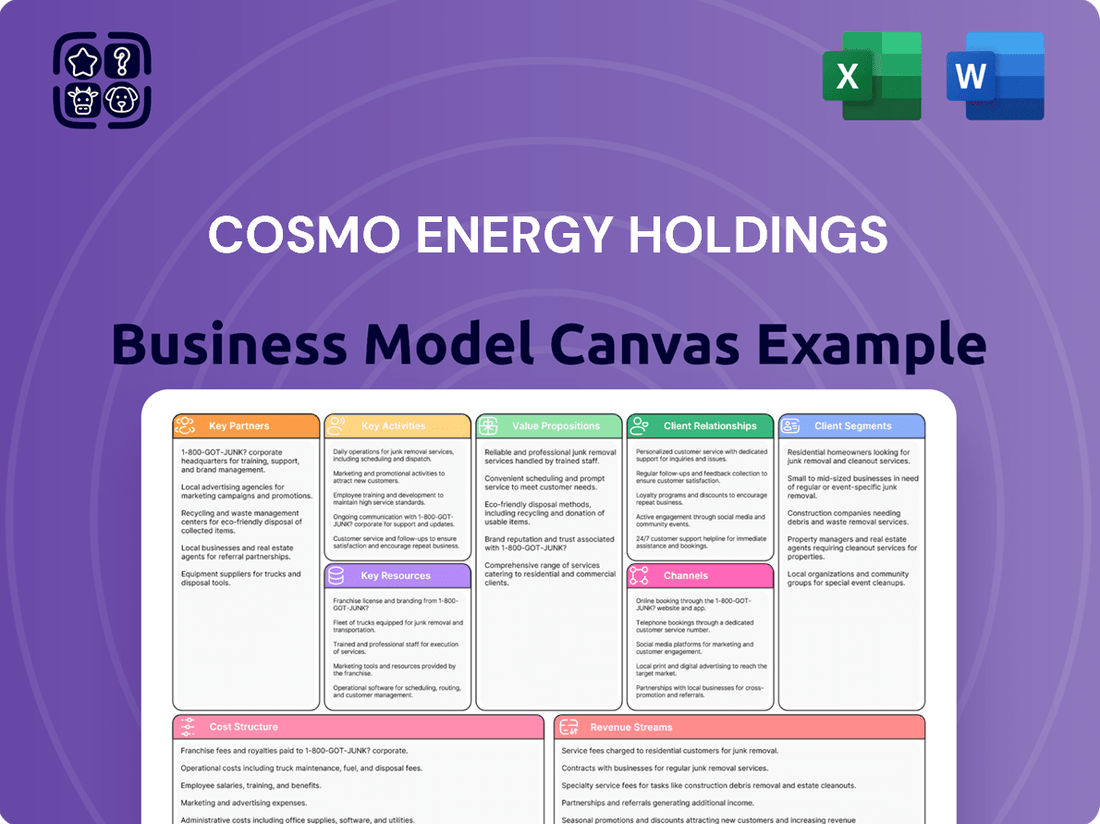

What is included in the product

This Cosmo Energy Holdings Business Model Canvas outlines a strategy focused on integrated energy solutions, from upstream exploration to downstream retail, serving diverse customer segments with a commitment to sustainability.

It details key partnerships, revenue streams, and cost structures essential for achieving their vision of a decarbonized society through innovative energy services.

Cosmo Energy Holdings' Business Model Canvas offers a high-level, editable view of their operations, allowing for quick identification of core components and effective brainstorming for strategic adaptation.

This one-page snapshot condenses Cosmo Energy's strategy into a digestible format, saving hours of formatting and enabling fast deliverables for executive review and team collaboration.

Activities

Cosmo Energy Holdings' primary activities revolve around the upstream segment, focusing on the exploration and production of crude oil. This is complemented by their downstream operations, which involve refining crude oil into a range of essential petroleum products like gasoline and diesel.

This integrated model is crucial for Cosmo Energy, as it allows them to manage the entire value chain, from sourcing raw materials to delivering finished goods. In fiscal year 2023, Cosmo Oil, a key subsidiary, processed approximately 1.2 million kiloliters of crude oil monthly, highlighting the scale of their refining operations.

The company's refineries are the linchpin in this process, transforming crude oil into marketable fuels and other petrochemicals. This ensures a consistent and reliable supply of products to meet market demand.

Cosmo Energy Holdings' key activity in petroleum products marketing and distribution centers on leveraging its vast network of service stations for retail sales. This also encompasses direct sales to industrial and commercial customers, ensuring broad market reach.

The company manages complex logistics and retail operations to efficiently deliver refined petroleum products. In 2023, Cosmo Oil, a subsidiary, operated approximately 1,500 service stations across Japan, contributing significantly to their distribution strategy and market penetration.

Cosmo Energy Holdings is deeply involved in building and running renewable energy facilities, with a strong focus on wind power. This includes everything from finding the right spots and putting up wind turbines to keeping everything running smoothly day-to-day.

A significant recent milestone was the start of commercial operations at their Shin-Iwaya Wind Park in March 2025, showcasing their commitment to expanding their renewable energy portfolio.

Sustainable Aviation Fuel (SAF) Production

Cosmo Energy Holdings is actively engaged in the production of Sustainable Aviation Fuel (SAF). This new key activity centers on transforming waste materials, such as used cooking oil, into a greener alternative for aviation. The company is making a strategic move into next-generation energy sources through this venture.

The Sakai Refinery is a crucial facility for this SAF production, with initial supply expected to begin in April 2025. This timeline positions Cosmo Energy to meet the growing demand for sustainable aviation solutions. The process involves meticulous collection and processing of various feedstocks to ensure high-quality SAF.

- SAF Production Facility: Sakai Refinery

- Supply Commencement: April 2025

- Feedstock: Used cooking oil and other sustainable materials

- Strategic Focus: Diversification into next-generation energy solutions

Petrochemicals Manufacturing and Sales

Cosmo Energy Holdings actively manufactures a diverse array of petrochemical products, utilizing petroleum feedstocks as its primary raw material. These manufactured goods are then supplied to various other industries, forming a critical link in their integrated petroleum value chain.

This manufacturing and sales segment significantly enhances Cosmo Energy's product portfolio, extending its reach beyond conventional fuel sales and creating additional revenue streams. The petrochemicals produced are essential building blocks for numerous industrial applications, underscoring their importance.

- Petrochemical Production Volume: Cosmo Oil, a subsidiary, reported a production volume of 1,423 thousand kiloliters of petrochemicals in fiscal year 2023.

- Key Petrochemical Products: The company's petrochemical offerings include olefins like ethylene and propylene, and aromatics such as benzene and xylene.

- Market Reach: These petrochemicals are sold domestically and internationally, serving as raw materials for plastics, synthetic fibers, solvents, and other chemical intermediates.

- Value Chain Integration: This activity leverages the refining operations, transforming byproducts into higher-value chemical products.

Cosmo Energy Holdings' key activities span the entire energy value chain, from exploring and producing crude oil to refining it into essential products like gasoline and diesel. They also focus on marketing and distributing these products through an extensive network of service stations.

The company is actively expanding into renewable energy, particularly wind power, and is a significant player in producing Sustainable Aviation Fuel (SAF) from waste materials, with initial SAF supply expected in April 2025.

Furthermore, Cosmo Energy manufactures and sells a diverse range of petrochemical products, utilizing its refining operations to create higher-value chemical outputs, with 1,423 thousand kiloliters of petrochemicals produced by Cosmo Oil in fiscal year 2023.

| Key Activity | Description | Fiscal Year 2023 Data/Key Milestone |

| Upstream (Exploration & Production) | Focus on crude oil exploration and production. | N/A (Data not specified for FY23) |

| Downstream (Refining) | Processing crude oil into petroleum products. | Cosmo Oil processed approx. 1.2 million kl of crude oil monthly. |

| Marketing & Distribution | Retail sales via service stations and direct industrial sales. | Operated approx. 1,500 service stations in Japan. |

| Renewable Energy | Building and operating renewable energy facilities, especially wind power. | Shin-Iwaya Wind Park commenced commercial operations in March 2025. |

| SAF Production | Manufacturing Sustainable Aviation Fuel from waste materials. | Initial SAF supply from Sakai Refinery expected April 2025. |

| Petrochemical Manufacturing | Producing and selling petrochemicals from petroleum feedstocks. | Produced 1,423 thousand kiloliters of petrochemicals. |

What You See Is What You Get

Business Model Canvas

The Cosmo Energy Holdings Business Model Canvas you are previewing is the exact document you will receive upon purchase, offering a comprehensive overview of their strategic framework. This isn't a sample; it's a direct snapshot of the complete analysis, allowing you to see the depth and detail of the business model before committing. Upon completion of your order, you will gain full access to this meticulously prepared document, ready for your review and application.

Resources

Cosmo Energy's refining and petrochemical facilities are the backbone of its operations, representing significant capital investment and advanced technological capabilities. These large-scale plants are crucial for transforming crude oil into essential energy products and valuable petrochemicals, forming the core of their production capacity.

In fiscal year 2023, Cosmo Energy Holdings reported revenue of ¥3,436.8 billion, with its refining segment playing a pivotal role. The company operates refineries with a combined crude oil processing capacity of approximately 220,000 barrels per day, enabling the efficient production of gasoline, kerosene, and other petroleum products that meet market demand.

Cosmo Energy Holdings leverages an extensive service station and distribution network, comprising both owned and franchised locations. This vast infrastructure, including pipelines and storage terminals, is fundamental to its market reach across Japan, ensuring efficient delivery of petroleum products.

This network serves as a critical resource, enabling Cosmo Energy to penetrate diverse markets and maintain direct engagement with its end-consumers and business clients. In fiscal year 2023, Cosmo Oil, a key subsidiary, operated approximately 2,080 service stations nationwide, underscoring the scale of this asset.

Cosmo Energy Holdings' wind power generation assets are crucial. Their portfolio includes recently operational sites like Shin-Iwaya Wind Park, which are key physical resources generating clean electricity. These growing wind farm assets are central to their renewable energy segment.

These operational wind farms directly contribute to Cosmo Energy's diversified energy mix and their commitment to sustainability. The physical infrastructure is the engine driving their renewable energy business forward, enabling the generation of zero-emission power.

The company's strategic investment in these renewable energy infrastructure assets, like their wind farms, underscores their clear shift towards a low-carbon future. This focus on tangible assets demonstrates their dedication to building a sustainable energy business.

Intellectual Property and Technical Expertise

Cosmo Energy Holdings' intellectual property and technical expertise are cornerstones of its business model. This includes proprietary refining processes that enhance efficiency and proprietary technologies for advanced SAF production, positioning them at the forefront of sustainable aviation fuel development. Their deep technical knowledge spans the entire energy value chain, from exploration and production to the burgeoning field of renewable energy project development.

This specialized knowledge base directly fuels operational efficiency and innovation. For instance, their expertise in optimizing refining operations contributes to cost savings and improved product yields. In 2023, Cosmo Energy reported significant investments in research and development aimed at advancing these very technologies, underscoring their commitment to leveraging technical prowess for future growth and sustainability.

- Proprietary Refining Processes: Enhancing operational efficiency and product quality in their core refining business.

- Advanced SAF Production Technologies: Enabling innovation and leadership in the development of sustainable aviation fuels.

- Specialized Technical Expertise: Covering exploration, production, and renewable energy project development, crucial for their strategic transition.

- Skilled Workforce: The embodiment of this critical expertise, driving both current operations and future innovation.

Human Capital and Strategic Leadership

Cosmo Energy Holdings’ human capital, a cornerstone of its operations, encompasses a diverse and highly skilled workforce. This includes engineers who design and maintain complex energy infrastructure, researchers driving innovation in new energy technologies, skilled operators ensuring the safe and efficient running of facilities, and experienced management guiding the company’s strategic direction. Their collective expertise is indispensable for navigating the intricacies of integrated energy operations and the evolving energy landscape.

The company's success in innovation and operational excellence hinges directly on the capabilities of its human capital. For instance, in 2023, Cosmo Energy Holdings reported significant investments in research and development, focusing on areas like carbon capture utilization and storage (CCUS) and renewable energy solutions, which directly leverage the skills of its specialized workforce. This commitment to R&D underscores the critical role of their engineers and researchers in future-proofing the business.

Effective strategic leadership and a motivated workforce are paramount for executing Cosmo Energy Holdings' long-term vision, particularly its commitment to achieving carbon neutrality by 2050. The company’s leadership fosters a culture that encourages continuous learning and adaptation, essential for managing the challenges and opportunities presented by the energy transition. This focus on people ensures the strategic plans are not only well-formulated but also effectively implemented across the organization.

- Highly Skilled Workforce: Engineers, researchers, operators, and management form the backbone of Cosmo Energy's complex integrated energy operations.

- Innovation and Operational Excellence: The expertise of this human capital is crucial for developing new energy solutions and maintaining high operational standards.

- Strategic Leadership: Effective leadership is vital for guiding the company through the energy transition and achieving long-term strategic goals.

- Workforce Motivation: A motivated workforce is key to successfully executing the company's vision and adapting to market changes.

Cosmo Energy's key resources include its extensive refining and petrochemical facilities, a robust service station and distribution network, and growing renewable energy assets like wind farms. These tangible assets are complemented by significant intellectual property, including proprietary refining processes and advanced SAF production technologies, alongside a highly skilled and motivated workforce.

| Resource Category | Key Resources | Fiscal Year 2023 Data/Notes |

|---|---|---|

| Physical Resources | Refining & Petrochemical Facilities | Combined crude oil processing capacity of approx. 220,000 barrels/day. |

| Physical Resources | Service Station Network | Approx. 2,080 service stations operated by Cosmo Oil nationwide. |

| Physical Resources | Renewable Energy Assets | Operational wind power generation sites (e.g., Shin-Iwaya Wind Park). |

| Intellectual Resources | Proprietary Technologies | Advanced SAF production technologies, efficient refining processes. |

| Human Resources | Skilled Workforce | Engineers, researchers, operators, and management driving operations and innovation. |

Value Propositions

Cosmo Energy Holdings delivers a consistent and dependable supply of essential petroleum products like gasoline, diesel, and kerosene, directly addressing Japan's significant energy needs. This commitment is fundamental to energy security, underpinning stable industrial operations and everyday consumer life.

In 2023, Cosmo Oil, a key subsidiary, processed an average of 382,000 barrels of crude oil per day, highlighting their substantial refining capacity and ability to meet demand. This operational scale is crucial for maintaining a reliable energy flow across Japan, a nation heavily reliant on energy imports.

Cosmo Energy Holdings is actively expanding its sustainable energy offerings, with a significant focus on wind power development and the production of Sustainable Aviation Fuel (SAF). This strategic direction directly tackles pressing environmental issues and aims to provide cleaner energy alternatives essential for a decarbonized future.

The company's dedication to a future-oriented energy landscape is evident in its substantial investments in green electricity generation and the development of next-generation fuels. For instance, in fiscal year 2023, Cosmo Energy Holdings reported a significant increase in its renewable energy capacity, contributing to its overarching goal of reducing carbon emissions.

Cosmo Energy Holdings emphasizes high-quality petroleum and petrochemical products, achieved through sophisticated refining and manufacturing. These products consistently meet rigorous industry benchmarks, ensuring superior performance for a wide range of applications.

Their commitment to product excellence translates into optimal functionality for vehicles and industrial equipment, as well as reliable raw materials for diverse manufacturing industries. For instance, Cosmo Oil, a key subsidiary, reported sales of refined products totaling approximately ¥2,780 billion in the fiscal year ending March 2024, underscoring the scale of their high-quality output.

This unwavering focus on quality assurance fosters strong customer trust and satisfaction, a critical component of their value proposition in a competitive market.

Extensive and Convenient Retail Network

Cosmo Energy Holdings boasts an extensive and convenient retail network, primarily through its widespread service stations across Japan. This vast presence ensures that individual vehicle owners and small businesses have easy access to fuel, lubricants, and a range of other automotive services. In 2023, Cosmo Oil, a subsidiary, operated approximately 2,100 service stations nationwide, highlighting the scale of this convenient retail footprint.

This extensive network serves as a critical touchpoint for meeting daily energy needs, offering more than just fuel. Customers can often find convenience stores, car washes, and other essential services at these locations, enhancing the overall value proposition. The sheer accessibility across Japan solidifies this network as a cornerstone of Cosmo Energy's customer engagement strategy.

- Widespread Coverage: Approximately 2,100 service stations operated by Cosmo Oil across Japan as of 2023.

- Customer Convenience: Provides easy access to fuel and related services nationwide.

- Daily Energy Needs: Serves as a primary point for refueling and essential automotive services.

Contribution to Environmental Responsibility and Decarbonization

Cosmo Energy Holdings actively contributes to environmental responsibility by investing in renewable energy sources and developing sustainable aviation fuel (SAF). This focus on decarbonization appeals to a growing segment of environmentally aware customers and investors, aligning with global efforts to curb carbon emissions.

Their Vision 2030 outlines ambitious targets for CO2 emission reductions, demonstrating a clear strategic direction towards a lower-carbon future. For instance, as of fiscal year 2023, Cosmo Energy reported progress in its renewable energy portfolio, aiming to expand its capacity.

- Renewable Energy Investment: Cosmo Energy is increasing its stake in solar and wind power projects, contributing to a cleaner energy mix.

- SAF Development: The company is actively involved in research and development for sustainable aviation fuels, a key area for decarbonizing the aviation sector.

- Low-Carbon Initiatives: Within its existing oil business, Cosmo Energy is implementing measures to reduce its operational carbon footprint.

- Vision 2030 Targets: The company has set specific goals for CO2 emission reductions by 2030, underscoring its commitment to environmental stewardship.

Cosmo Energy Holdings offers a reliable supply of essential petroleum products, crucial for Japan's industrial and daily life. In fiscal year 2023, Cosmo Oil's refining operations processed substantial volumes, ensuring consistent energy availability across the nation, which relies heavily on energy imports.

The company is actively growing its renewable energy portfolio, including wind power, and developing Sustainable Aviation Fuel (SAF). This strategic push addresses environmental concerns and provides cleaner energy alternatives for a decarbonized future, with investments in green electricity generation showing positive growth in fiscal year 2023.

Cosmo Energy Holdings provides high-quality petroleum and petrochemical products through advanced refining, meeting stringent industry standards. This commitment ensures optimal performance for vehicles and industrial applications, as evidenced by Cosmo Oil's significant sales of refined products, reaching approximately ¥2,780 billion in fiscal year ending March 2024.

Customer Relationships

Cosmo Energy Holdings cultivates robust relationships with major industrial, commercial, and governmental clients. This is achieved through dedicated account managers who understand and cater to their unique energy and petrochemical requirements.

These partnerships are built on providing customized bulk supply solutions and competitive pricing. Crucially, ongoing technical support is a cornerstone, ensuring clients receive the assistance needed to optimize their operations and meet evolving demands.

This strategic focus on personalized service and consistent support aims to foster long-term, stable partnerships, driving customer satisfaction and loyalty within Cosmo Energy's key client segments.

Cosmo Energy Holdings focuses on fostering loyalty among its retail customers through programs like membership cards and dedicated mobile applications. These digital tools are designed to provide personalized benefits and create convenient interaction points, aiming to keep customers coming back.

In 2024, a significant portion of Cosmo Oil’s retail revenue is expected to be influenced by the effectiveness of these loyalty initiatives. The company is investing in enhancing its digital platforms to offer a more seamless and rewarding experience, directly impacting customer retention rates and overall engagement at their service stations.

Cosmo Energy Holdings prioritizes robust community engagement, particularly near its operational hubs and emerging renewable energy installations. In 2024, the company continued its focus on transparent communication regarding project timelines, environmental stewardship, and local economic contributions, fostering essential goodwill.

Building trust with local stakeholders is paramount for Cosmo Energy's long-term operational success. This is especially true for initiatives like their wind farm developments and sustainable aviation fuel (SAF) feedstock collection programs, where community acceptance directly impacts project viability and expansion.

Transparent Investor Relations and Sustainability Reporting

Cosmo Energy Holdings prioritizes clear and consistent communication with its investors. They achieve this through timely financial result announcements, dedicated investor briefings, and detailed sustainability reports. This approach builds confidence by offering stakeholders a transparent view of the company's financial health, strategic objectives, and environmental, social, and governance (ESG) efforts.

- Financial Transparency: Cosmo Energy regularly publishes financial results, providing stakeholders with up-to-date performance data. For the fiscal year ending March 2024, the company reported net sales of ¥1,400.3 billion and operating income of ¥190.9 billion, demonstrating a solid financial footing.

- Investor Briefings: The company conducts investor briefings to discuss performance and future strategies, ensuring stakeholders are well-informed about the business direction.

- Sustainability Reporting: Comprehensive sustainability reports detail Cosmo Energy's commitment to ESG initiatives, aligning business practices with long-term societal and environmental goals. These reports are crucial for understanding the company's broader impact and future resilience.

- IR News Portal: An accessible IR news portal serves as a central hub for all investor-related information, including press releases and financial disclosures, facilitating easy access to critical updates.

Corporate Social Responsibility (CSR) Initiatives

Cosmo Energy Holdings actively engages in corporate social responsibility (CSR) initiatives that extend beyond its core energy business. These activities prioritize environmental protection, community engagement, and upholding ethical standards, reinforcing their role as a responsible corporate citizen. For instance, in fiscal year 2023, the company reported a total of 32,400 volunteer hours contributed by employees to various social and environmental causes, underscoring their commitment to societal well-being.

These CSR efforts are designed to bolster brand reputation and foster trust among stakeholders, including customers, employees, and investors. By investing in initiatives aligned with their Group Management Vision of 'Harmony and Symbiosis', Cosmo Energy Holdings aims to create shared value and build sustainable relationships. Their commitment is further demonstrated by the 2023 launch of a new biodiversity conservation project aimed at protecting coastal ecosystems, receiving a ¥50 million grant from the government.

- Environmental Stewardship: Cosmo Energy Holdings focuses on reducing its environmental footprint through initiatives like promoting renewable energy and investing in carbon capture technologies, with a target to reduce greenhouse gas emissions by 46% by 2030 compared to 2013 levels.

- Social Contributions: The company supports local communities through various programs, including educational sponsorships and disaster relief efforts. In 2023, they donated ¥20 million to support educational programs for underprivileged children in areas where they operate.

- Ethical Governance: Upholding high standards of corporate governance and business ethics is central to their operations, ensuring transparency and accountability in all business dealings.

- Stakeholder Engagement: Actively engaging with stakeholders to understand and address their concerns is a key aspect of their CSR strategy, fostering long-term partnerships and mutual benefit.

Cosmo Energy Holdings nurtures its relationships with industrial, commercial, and governmental clients through dedicated account managers who provide tailored bulk supply solutions and competitive pricing. Ongoing technical support is crucial for these long-term, stable partnerships, fostering customer satisfaction and loyalty.

Channels

Cosmo Energy Holdings' extensive service station network acts as its main retail arm, directly selling gasoline, diesel, and lubricants throughout Japan. This physical footprint is crucial for reaching individual drivers and small businesses, ensuring their petroleum products are readily available and highly visible. In 2024, Cosmo Oil, a key subsidiary, continued to operate a significant number of these stations, reinforcing their accessibility.

Cosmo Energy Holdings leverages direct sales teams and robust supply contracts to serve major industrial clients, including power plants and large commercial fleets. This approach is crucial for high-volume transactions of petroleum products, petrochemicals, and bulk fuels, allowing for tailored energy solutions. In 2024, Cosmo Energy continued to solidify these B2B relationships, a key component of their revenue generation.

Cosmo Energy Holdings utilizes wholesale distributors and trading partners to expand its market presence beyond direct retail and industrial sales, effectively reaching niche segments. This strategy optimizes the supply chain for refined products and petrochemicals, ensuring efficient delivery and broad market penetration.

Power Grids and Utility Connections

Cosmo Energy Holdings leverages its power grids and utility connections as a critical channel for its expanding renewable energy portfolio, especially wind power. Electricity generated from their wind farms is directly channeled into national and regional power grids, supplying clean energy to utilities and end-users.

This direct grid connection is fundamental to their value delivery for renewable assets. Furthermore, Corporate Power Purchase Agreements (PPAs) serve as a key channel, establishing direct relationships with businesses for the sale of renewable electricity.

- Grid Connection: Direct integration of wind farm output into national and regional electricity transmission networks.

- Corporate PPAs: Agreements with businesses to purchase renewable energy directly from Cosmo Energy's generation facilities.

- Value Delivery: Facilitates the supply of clean energy to utilities and end-consumers, monetizing renewable generation.

Digital Platforms and Mobile Applications

Cosmo Energy Holdings leverages its official website and dedicated mobile applications as key touchpoints for customer interaction and service delivery. These digital platforms are instrumental in managing loyalty programs, offering convenient access to account information, and communicating important company updates and promotions.

The company's investment in these digital channels reflects a broader strategy of digital transformation, aiming to improve customer experience and operational efficiency. For instance, in fiscal year 2024, Cosmo Oil’s app saw continued growth in user engagement, facilitating easier access to services like fuel purchasing and point redemption.

- Website and App as Engagement Hubs: Facilitating customer interaction and loyalty program management.

- Enhanced Customer Convenience: Streamlining services and providing modern interfaces for interaction.

- Digital Transformation Support: Underpinning the company's efforts to modernize operations and customer outreach.

- Data-Driven Insights: Utilizing platform usage to understand customer behavior and refine service offerings.

Cosmo Energy Holdings utilizes its extensive network of service stations as a primary channel for retail sales of petroleum products, directly reaching individual consumers and small businesses across Japan. This physical presence ensures accessibility and visibility for their gasoline, diesel, and lubricant offerings. In 2024, Cosmo Oil maintained a substantial number of these strategically located stations, underscoring their commitment to widespread availability.

Beyond retail, Cosmo Energy Holdings employs direct sales teams and established supply contracts to serve large industrial clients, including power generation facilities and commercial fleets, facilitating high-volume transactions of fuels and petrochemicals. This B2B approach is vital for providing tailored energy solutions to major consumers. The company continued to nurture these critical business relationships throughout 2024, a cornerstone of its revenue strategy.

Wholesale distributors and trading partners form another key channel, enabling Cosmo Energy Holdings to extend its market reach and serve niche segments beyond its direct sales efforts. This strategy optimizes the distribution of refined products and petrochemicals, ensuring efficient delivery and broad market penetration. The company's digital platforms, including its website and mobile applications, are increasingly important for customer engagement, loyalty program management, and information dissemination, enhancing customer convenience and providing valuable data insights in 2024.

| Channel | Primary Function | Key Segments Served | 2024 Focus/Data Point |

|---|---|---|---|

| Service Stations | Retail sales of petroleum products | Individual consumers, small businesses | Continued operation of a significant number of stations by Cosmo Oil |

| Direct Sales & Contracts | High-volume B2B sales of fuels and petrochemicals | Industrial clients (power plants), commercial fleets | Strengthening B2B relationships |

| Wholesale & Trading Partners | Market expansion, niche segment reach | Various industries requiring refined products and petrochemicals | Optimizing supply chain for broad penetration |

| Digital Platforms (Website/App) | Customer engagement, loyalty programs, information | All customer segments | Increased user engagement on Cosmo Oil's app |

Customer Segments

Individual vehicle owners and daily commuters form the bedrock of Cosmo Energy's customer base, relying on their service stations for essential automotive fuels like gasoline and diesel. These customers typically seek out convenient locations and consistent fuel quality for their everyday transportation needs.

For this segment, loyalty programs and ongoing promotions play a significant role in their purchasing decisions, encouraging repeat business. In 2024, the automotive fuel market in Japan, where Cosmo Energy operates, continued to see robust demand from this demographic, representing a stable revenue stream for the company's core operations.

Industrial and commercial enterprises, encompassing manufacturing plants, transportation firms, and power generators, represent a core customer segment for Cosmo Energy Holdings. These businesses have substantial needs for bulk petroleum products like heavy oil and naphtha, as well as various petrochemicals essential for their operational continuity.

This segment prioritizes secure and consistent supply chains, alongside competitive pricing structures. They also value robust technical support to optimize their use of energy and chemical inputs. Cosmo Energy Holdings' ability to secure high-volume, long-term contracts with these enterprises is a significant driver of revenue and market stability.

For instance, in fiscal year 2023, Cosmo Oil, a key subsidiary, reported that its petroleum product sales volume to industrial clients remained a substantial portion of its total sales, reflecting the ongoing demand from this sector for essential energy resources.

Electric utilities and grid operators are crucial customers for Cosmo Energy's renewable electricity, particularly from its expanding wind farm portfolio. These entities are actively seeking reliable, clean energy sources to ensure grid stability and comply with their own decarbonization mandates and regulatory obligations. In 2024, the demand for such power continues to rise as more regions set ambitious renewable energy targets.

Logistics and Aviation Companies

Logistics and aviation firms are becoming key customers for Cosmo Energy, particularly with the rise of Sustainable Aviation Fuel (SAF). Companies like DHL Express are actively seeking SAF to achieve their ambitious sustainability targets and lower the environmental impact of air cargo operations. This evolving demand positions these companies as a crucial new market for Cosmo Energy's expanding portfolio.

The aviation industry, a significant contributor to global emissions, is under increasing pressure to decarbonize. By 2024, the International Air Transport Association (IATA) had set a goal for the industry to achieve net-zero carbon emissions by 2050, with SAF playing a pivotal role. This makes the demand for SAF from major players like logistics providers a strategic imperative.

- Growing SAF Demand: Airlines and logistics companies are increasingly investing in SAF to meet regulatory requirements and corporate sustainability mandates.

- Carbon Footprint Reduction: These customers are driven by the need to significantly reduce their carbon footprint in air transport operations.

- Strategic Partnership Opportunities: Cosmo Energy can forge strategic alliances with these industry leaders to supply essential SAF, fostering long-term growth.

Government and Public Sector Entities

Government agencies, municipalities, and public transport operators are key customers needing reliable fuel supplies for their vehicle fleets and operational needs. These entities typically engage through competitive tenders and secure long-term supply agreements, prioritizing consistent delivery and adherence to stringent environmental regulations.

Cosmo Energy Holdings, like other major energy providers, likely serves this segment by offering a range of fuel products, potentially including those that meet specific emissions standards. The emphasis on environmental compliance aligns with broader governmental sustainability goals, making this a strategically important customer base.

- Fleet Fueling: Supplying gasoline, diesel, and potentially alternative fuels for government vehicles, including police cars, public buses, and municipal service trucks.

- Public Transport Contracts: Providing fuel for bus and train operators, often under multi-year contracts that ensure stable demand.

- Environmental Initiatives: Participating in programs that may involve the collection of used cooking oil for the production of Sustainable Aviation Fuel (SAF), a growing area of interest for public sector sustainability efforts.

- Regulatory Compliance: Ensuring all fuel products and services meet national and local environmental standards and reporting requirements.

Cosmo Energy Holdings serves a diverse customer base, from individual drivers seeking convenient and quality fuel to large industrial clients requiring bulk petroleum products and petrochemicals for their operations. The company also supplies renewable electricity to electric utilities and grid operators, catering to the growing demand for clean energy sources. Furthermore, the aviation sector, particularly logistics and aviation firms, represents a key emerging market for Sustainable Aviation Fuel (SAF), driven by the industry's decarbonization efforts.

Government agencies and public transport operators are also significant customers, relying on Cosmo Energy for consistent fuel supplies for their fleets and operations, often through long-term contracts that emphasize environmental compliance. In 2024, the company's strategy likely involves strengthening relationships across these segments, leveraging its integrated energy offerings and expanding into new, sustainable fuel markets like SAF.

| Customer Segment | Key Needs | Cosmo Energy's Offering | 2024 Market Trend/Data |

|---|---|---|---|

| Individual Vehicle Owners | Convenience, fuel quality, loyalty programs | Gasoline, diesel, service stations | Stable demand in Japan's automotive fuel market. |

| Industrial/Commercial Enterprises | Bulk products, supply chain security, competitive pricing | Heavy oil, naphtha, petrochemicals, technical support | Continued strong demand for essential energy resources. |

| Electric Utilities/Grid Operators | Reliable clean energy, grid stability | Renewable electricity (wind power) | Increasing demand driven by decarbonization mandates. |

| Logistics/Aviation Firms | Sustainable fuels, carbon footprint reduction | Sustainable Aviation Fuel (SAF) | Growing investment in SAF to meet sustainability targets. |

| Government/Public Transport | Reliable fuel, environmental compliance | Various fuels, potential SAF initiatives | Emphasis on environmental regulations and sustainability goals. |

Cost Structure

Crude oil acquisition represents the most substantial cost for Cosmo Energy, directly tied to unpredictable global market fluctuations. This encompasses the purchase price of oil, alongside expenses for shipping, insurance, and risk management through hedging. For the fiscal year ending March 31, 2024, Cosmo Energy reported procurement costs for crude oil and raw materials amounting to approximately ¥1,528.4 billion.

Cosmo Energy Holdings faces significant refining, manufacturing, and operating expenses. These include substantial energy consumption, labor, and ongoing maintenance for their complex industrial facilities, particularly their refineries and petrochemical plants.

These costs are largely fixed, reflecting the capital-intensive nature of their operations. For instance, in the fiscal year ending March 2024, Cosmo Energy reported significant operating expenses related to their energy and petrochemical segments, underscoring the ongoing investment required to maintain and run these plants efficiently.

Cosmo Energy Holdings incurs significant expenses in distributing its refined petroleum products. These costs encompass the transportation of fuel to a vast network of service stations and other delivery points. For instance, in the fiscal year ending March 2024, the company's selling, general, and administrative expenses, which include these distribution costs, were substantial, reflecting the scale of their operations.

Operating the extensive service station network is another major cost driver. This includes expenses like land leases for station locations, salaries and benefits for station staff, and utility costs to keep facilities running. Managing these widespread operational expenditures efficiently is key to maintaining profitability.

Marketing and advertising activities also represent a notable portion of Cosmo Energy's cost structure. These expenditures are aimed at building brand awareness, promoting products, and attracting customers to their service stations. The company invests in various campaigns to stay competitive in the energy market.

Capital Expenditures for New Projects and Maintenance

Cosmo Energy Holdings makes significant capital investments across its diverse business segments. These outlays are essential for maintaining operational efficiency and pursuing strategic growth initiatives, particularly in the energy transition.

In fiscal year 2023, Cosmo Energy Holdings reported capital expenditures of approximately ¥166.9 billion. This figure reflects substantial investments in both maintaining existing infrastructure and developing new energy sources.

- Upstream Operations: Investments in exploration and production activities to secure future energy supplies.

- Refining and Petrochemicals: Upgrades to existing facilities to enhance efficiency and meet evolving market demands.

- Renewable Energy: Significant outlays for wind farm development and the construction of Sustainable Aviation Fuel (SAF) plants, aligning with their decarbonization goals.

- Maintenance: Ongoing expenditures to ensure the reliability and safety of all operational assets.

Research and Development (R&D) and Environmental Compliance Costs

Cosmo Energy Holdings dedicates significant resources to Research and Development (R&D), focusing on pioneering new energy technologies. This includes substantial investments in areas like hydrogen production and the development of advanced sustainable aviation fuel (SAF). For instance, in fiscal year 2023, Cosmo Energy Holdings reported R&D expenses that reflect this commitment to innovation, although specific figures are often embedded within broader operational costs. These forward-looking investments are vital for maintaining a competitive edge and driving future growth.

Furthermore, the company incurs considerable expenses related to environmental compliance and sustainability initiatives. These costs encompass efforts to reduce emissions, adhere to stringent environmental regulations, and fulfill increasing demands for transparent sustainability reporting. In 2024, the energy sector, including Cosmo Energy, faces growing pressure to meet decarbonization targets, necessitating ongoing financial commitments to green technologies and operational improvements.

- R&D Investment: Funding for emerging technologies like hydrogen and SAF production.

- Environmental Compliance: Costs associated with emission reduction and regulatory adherence.

- Sustainability Reporting: Expenses for transparently communicating environmental performance.

- Decarbonization Goals: Financial commitment to achieving long-term sustainability targets.

Cosmo Energy's cost structure is dominated by the procurement of crude oil and raw materials, which reached approximately ¥1.53 trillion for the fiscal year ending March 2024. Refining and manufacturing expenses, including energy, labor, and maintenance for their industrial facilities, represent another significant outlay. Distribution costs for refined products and the operational expenses of their extensive service station network also contribute heavily.

| Cost Category | Description | Fiscal Year Ending March 2024 (Approximate) |

|---|---|---|

| Crude Oil & Raw Materials Procurement | Purchase price of oil, shipping, insurance, hedging | ¥1,528.4 billion |

| Refining, Manufacturing & Operating Expenses | Energy consumption, labor, plant maintenance | Significant ongoing investment |

| Distribution Costs | Transportation of refined products to service stations | Included in substantial SG&A expenses |

| Service Station Operations | Land leases, staff salaries, utilities | Key operational expenditure |

| Capital Expenditures | Investments in infrastructure and new energy sources | ¥166.9 billion (FY2023) |

Revenue Streams

Cosmo Energy Holdings generates significant revenue from the retail sale of refined petroleum products. This includes gasoline, diesel, kerosene, and lubricants sold directly to consumers at their widespread network of service stations. This is a core part of their business, driven by consistent demand from everyday drivers. For the fiscal year ending March 2024, Cosmo Energy reported total revenue of approximately ¥2.9 trillion, with a substantial portion attributed to these retail fuel sales.

Cosmo Energy Holdings generates substantial revenue through the wholesale and industrial sales of refined petroleum products. These bulk transactions with large industrial clients, commercial businesses, and other distributors represent a significant portion of their income, ensuring consistent cash flow from diverse sectors dependent on these essential fuels.

Cosmo Energy Holdings generates revenue by manufacturing and selling a range of petrochemical products, utilizing petroleum as their primary feedstock. This segment is crucial for their diversified income strategy, transforming refined products into valuable materials for other industries.

In the fiscal year ending March 2024, Cosmo Energy Holdings reported that its petrochemical business played a significant role in its overall performance, contributing to the company's integrated value chain. The company's ability to leverage its refining assets allows it to efficiently produce and market these essential industrial inputs.

Electricity Sales from Renewable Energy

Cosmo Energy Holdings is increasingly generating revenue from selling electricity produced by its wind power operations. These sales are typically made to larger electric utility companies or directly to the national grid through long-term Power Purchase Agreements (PPAs). This revenue stream highlights their successful expansion into sustainable energy and their dedication to supplying green electricity.

This segment is a crucial element of Cosmo Energy Holdings' forward-looking growth strategy. For instance, in fiscal year 2023, renewable energy sources contributed significantly to their overall portfolio. The company aims to further expand its renewable energy capacity, with a target of increasing its total renewable energy generation capacity to approximately 2.4 GW by fiscal year 2030, underscoring the growing importance of electricity sales from renewables.

- Growing Revenue from Wind Power: Electricity sales from wind farms are a developing income source.

- Power Purchase Agreements (PPAs): Revenue is secured through agreements with utilities and direct grid sales.

- Commitment to Sustainability: This stream reflects diversification into green energy solutions.

- Future Growth Driver: Renewable electricity sales are central to the company's expansion plans.

Sales of Sustainable Aviation Fuel (SAF)

Cosmo Energy Holdings is increasingly generating revenue from the sale of domestically produced Sustainable Aviation Fuel (SAF) as its production facilities become operational. This new revenue stream is crucial, supporting global decarbonization goals within the aviation industry and establishing Cosmo Energy as a significant provider of advanced fuels.

This strategic move into SAF sales is particularly noteworthy given the growing demand for environmentally friendly aviation solutions. For instance, by 2024, the global SAF market was projected to reach over $2.5 billion, with significant growth expected in the coming years as airlines commit to reducing their carbon footprint.

- Domestic SAF Production: Revenue directly tied to the output of Cosmo Energy's SAF facilities.

- Target Market: Sales are directed towards aviation companies and logistics providers seeking sustainable fuel alternatives.

- Strategic Importance: Aligns with global decarbonization mandates and positions Cosmo Energy in the future of aviation fuels.

- Market Growth: Capitalizes on the expanding market for SAF, driven by environmental regulations and corporate sustainability targets.

Cosmo Energy Holdings also generates revenue from the sale of electricity produced from its solar power generation facilities. These sales contribute to their diversified energy portfolio and support the increasing demand for renewable energy sources.

The company's commitment to expanding its renewable energy footprint, including solar, is a key aspect of its long-term strategy. This diversification not only broadens their revenue base but also aligns with global efforts towards energy transition and sustainability.

For the fiscal year ending March 2024, Cosmo Energy Holdings continued to see contributions from its various energy segments, including both fossil fuels and growing renewable sources.

| Revenue Segment | Fiscal Year Ending March 2024 (Approximate Contribution) |

| Refined Petroleum Products (Retail) | Significant Portion of ¥2.9 Trillion Total Revenue |

| Refined Petroleum Products (Wholesale/Industrial) | Substantial Contribution |

| Petrochemicals | Key Contributor to Integrated Value Chain |

| Electricity Sales (Wind Power) | Growing Revenue Stream |

| Electricity Sales (Solar Power) | Diversifying Revenue Base |

| Sustainable Aviation Fuel (SAF) | Emerging Revenue Source |

Business Model Canvas Data Sources

The Cosmo Energy Holdings Business Model Canvas is built upon a foundation of extensive market research, internal financial disclosures, and strategic analysis of the energy sector. These data sources ensure each component, from value propositions to cost structures, is grounded in accurate and relevant information.