Cosmo Energy Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cosmo Energy Holdings Bundle

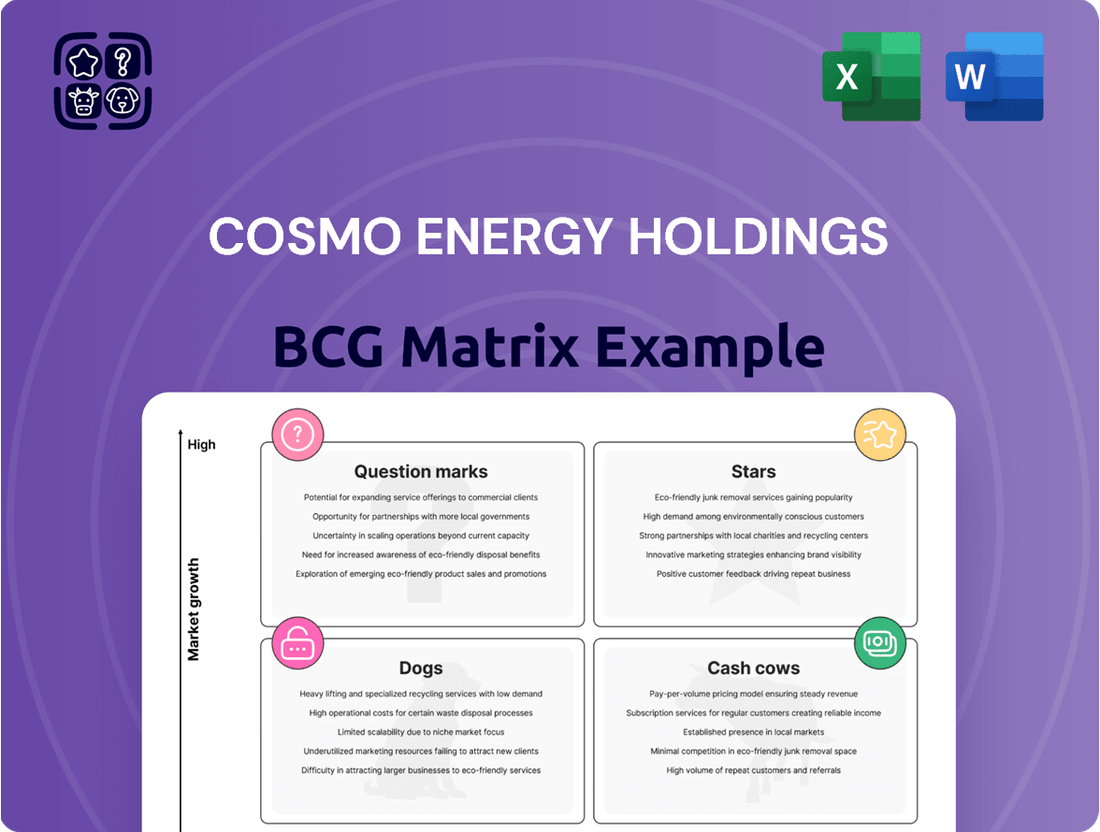

Curious about Cosmo Energy Holdings' strategic product portfolio? Our BCG Matrix analysis reveals which ventures are fueling growth, which are generating steady income, and which might need a closer look. This preview offers a glimpse into their market positioning, but the real power lies in the full report.

Unlock a comprehensive understanding of Cosmo Energy Holdings' competitive landscape. The full BCG Matrix provides detailed quadrant placements, actionable insights, and a clear roadmap for optimizing your investment and product strategies. Don't miss out on the complete picture – purchase the full version today!

Stars

Wind Power Generation is a significant growth area for Cosmo Energy Holdings, reflecting Japan's push towards renewables. The company is actively developing its wind portfolio, exemplified by the New-Mutsu-Ogawara Wind Farm, which began operations in July 2025.

Cosmo Eco Power's strategic expansion includes substantial onshore and offshore wind projects. A prime example is the planned 525MW Akita City Offshore project, underscoring Cosmo's commitment to capturing market share in this expanding sector.

Cosmo Energy Holdings is aggressively pursuing leadership in Sustainable Aviation Fuel (SAF) production, with mass production from used cooking oil slated to begin in 2025. This strategic move positions them to capitalize on the surging demand for environmentally friendly aviation solutions.

By 2030, Cosmo Energy aims to substantially increase its SAF supply, incorporating advanced technologies such as Alcohol-to-Jet. This expansion is crucial for meeting the evolving needs of the aviation industry as it strives for decarbonization.

The SAF market represents a high-growth, high-potential area, driven by global efforts to reduce carbon emissions in air travel. For instance, the International Air Transport Association (IATA) has set a goal for net-zero carbon emissions by 2050, with SAF being a key enabler.

Cosmo Energy Holdings is aggressively developing its green electricity supply chain, focusing on wind power generation and sales, alongside comprehensive solution services. This strategic move is designed to tap into the expanding green energy market.

The company's plan involves establishing robust power storage and demand-adjustment capabilities to optimize the value derived from green electricity. This integrated strategy is key to their market penetration efforts.

Cosmo Energy Holdings has set ambitious profit targets, aiming for substantial growth by FY2025 and continuing through FY2030, underscoring their commitment to this sector.

Strategic Green Investments

Cosmo Energy Holdings is strategically channeling significant capital into green investments, identifying wind power and sustainable aviation fuel (SAF) as key growth areas. This forward-looking approach positions them to capture future market share in the evolving energy landscape.

The company plans to allocate roughly 30% of its $3.2 billion capital expenditure over the next three years to these green initiatives. This substantial commitment, totaling approximately $960 million, highlights their dedication to transitioning towards a more sustainable energy portfolio.

- Wind Power Expansion: Investments are being made to scale up wind energy generation capacity, a critical component of decarbonization efforts.

- SAF Development: Cosmo Energy is actively investing in the production and supply chain for sustainable aviation fuel, a vital area for reducing aviation emissions.

- Market Leadership Ambition: The scale of these investments signals an intent to establish and maintain leading positions within these burgeoning green energy sectors.

- Capital Allocation: Approximately $960 million of the $3.2 billion three-year capex budget is earmarked for these strategic green power and energy initiatives.

Hydrogen Business Partnerships

Cosmo Energy Holdings is strategically positioning its hydrogen business, a key growth area, through a significant capital and business alliance with Iwatani Corporation. This partnership is crucial for developing a robust hydrogen ecosystem.

The collaboration focuses on establishing hydrogen stations, a vital component of the hydrogen economy. Cosmo Energy opened its first hydrogen station in April 2024, marking a tangible step into this emerging market. Further expansion with additional stations planned for 2025 and beyond underscores their commitment to building a comprehensive hydrogen supply network.

- Capital and Business Alliance: Partnership with Iwatani Corporation to accelerate hydrogen business development.

- Hydrogen Station Network: Launched first station in April 2024, with plans for continued expansion in 2025 and beyond.

- Supply Chain Focus: Aiming to build a comprehensive hydrogen supply network through strategic collaborations.

Stars in Cosmo Energy Holdings' portfolio, like wind power and Sustainable Aviation Fuel (SAF), represent high-growth, high-potential opportunities. The company is making substantial investments, allocating approximately $960 million of its $3.2 billion three-year capital expenditure to these areas. This aggressive expansion, exemplified by the New-Mutsu-Ogawara Wind Farm and SAF production slated for 2025, aims to capture leadership in these burgeoning green energy sectors.

| Business Segment | Growth Potential | Cosmo Energy's Investment | Key Initiatives | Market Outlook |

|---|---|---|---|---|

| Wind Power Generation | High | Significant portion of green capex | New-Mutsu-Ogawara Wind Farm (operational July 2025), Akita City Offshore project (525MW) | Japan's renewable energy push, global decarbonization trends |

| Sustainable Aviation Fuel (SAF) | Very High | Significant portion of green capex | Mass production from used cooking oil (2025), Alcohol-to-Jet technology | Growing demand for eco-friendly aviation, IATA net-zero goal by 2050 |

What is included in the product

Cosmo Energy Holdings' BCG Matrix showcases its diverse business units, categorizing them to guide strategic investment and resource allocation.

The Cosmo Energy Holdings BCG Matrix provides a clear, one-page overview of each business unit's market position, alleviating the pain of strategic confusion.

Cash Cows

Cosmo Energy's petroleum refining operations are a clear Cash Cow, boasting a significant presence with three refineries in Japan and a total refining capacity of 363,000 barrels per day. This makes them the third-largest refiner in the nation, a position that underpins consistent revenue generation from processing crude oil into essential products.

The company's commitment to maintaining this substantial refining capacity until at least 2030 highlights its strategic intent to leverage this segment as a core profit driver. This long-term outlook suggests a stable and predictable income stream, characteristic of a mature business unit with high market share and low growth prospects.

Cosmo Energy Holdings operates an extensive service station network throughout Japan, acting as a crucial distribution channel for its refined petroleum products. This robust retail footprint consistently secures a high market share in fuel sales, generating reliable cash flow from everyday consumer demand.

In fiscal year 2024, Cosmo Oil, a key subsidiary, reported approximately 2,200 service stations nationwide. This vast network is instrumental in maintaining a stable revenue stream, even within the mature Japanese fuel market, underscoring its role as a Cash Cow.

Cosmo Energy Holdings' petrochemical manufacturing segment, producing ethylene, mixed xylene, and benzene, functions as a Cash Cow within its BCG Matrix. This division benefits from integrated operations with the company's refining business, offering a stable, diversified revenue stream despite potential market volatility.

In fiscal year 2023, Cosmo Energy reported that its Energy business segment, which includes petrochemicals, generated operating revenue of ¥2,174.7 billion. This segment is characterized by its established market share and consistent profitability, underscoring its role as a reliable contributor to the company's overall financial health.

Crude Oil Exploration & Production (E&P)

Cosmo Energy's Crude Oil Exploration & Production (E&P) segment acts as a significant cash cow, underpinning the company's financial stability. This upstream business provides a consistent and cost-effective supply of crude oil directly to its refining operations, a crucial element for managing feedstock expenses and ensuring supply chain resilience.

The strategic importance of E&P is further highlighted by contributions like the Hail Oil Field. This field has been instrumental in boosting overall production volumes, directly enhancing the segment's capacity to generate substantial cash flow. This reliable income stream supports other ventures within Cosmo Energy's portfolio.

- Foundational Supply: E&P ensures a steady inflow of crude oil for refining.

- Cost Management: Upstream integration helps control feedstock costs.

- Production Growth: The Hail Oil Field example demonstrates increased output.

- Cash Generation: The segment reliably contributes to overall earnings.

Established Domestic Petroleum Market Share

Cosmo Energy Holdings maintains a robust position in Japan's domestic petroleum market, even with projected decreases in overall gasoline consumption. This stability is a key strength.

The company's extensive refining capacity and well-established distribution network are crucial. These assets enable Cosmo Energy to consistently generate significant and reliable cash flows from its petroleum operations.

- Market Share: Cosmo Energy holds a substantial share of the Japanese petroleum market.

- Cash Flow Generation: The established market position translates into predictable and strong cash flows.

- Operational Focus: The strategy centers on maximizing efficiency and profitability within existing operations.

- 2024 Outlook: Despite market shifts, the domestic petroleum segment is expected to remain a vital cash generator for the company.

Cosmo Energy's petroleum refining and marketing operations are firmly established as Cash Cows. Their substantial refining capacity, ranking third in Japan with 363,000 barrels per day, ensures consistent revenue. Furthermore, a vast network of approximately 2,200 service stations across Japan, as of fiscal year 2024, solidifies their market share in fuel sales, generating reliable cash flow from everyday demand.

| Segment | Role in BCG Matrix | Key Strengths | Financial Contribution (FY2023) |

|---|---|---|---|

| Petroleum Refining | Cash Cow | Third-largest refining capacity in Japan (363,000 bpd) | Contributes significantly to operating revenue |

| Petroleum Marketing (Service Stations) | Cash Cow | Extensive network of ~2,200 stations nationwide | Ensures stable revenue from consumer fuel sales |

| Petrochemicals | Cash Cow | Integrated with refining operations, diverse product portfolio | Part of the ¥2,174.7 billion Energy business segment revenue |

Delivered as Shown

Cosmo Energy Holdings BCG Matrix

The Cosmo Energy Holdings BCG Matrix preview you are seeing is the complete, final document you will receive upon purchase. This means no watermarks or demo content will obscure the strategic insights; you'll get the fully formatted, ready-to-use report designed for clear business analysis.

Rest assured, the BCG Matrix report you are previewing is the exact same comprehensive analysis that will be delivered to you after your purchase. It's been meticulously crafted to provide actionable intelligence, ensuring you receive a polished, professional document ready for immediate strategic application.

What you are viewing right now is the actual BCG Matrix file for Cosmo Energy Holdings that will be yours once you complete the purchase. This means you'll instantly unlock the full, unwatermarked version, prepared for seamless integration into your strategic planning or presentations.

The preview you are currently examining represents the definitive Cosmo Energy Holdings BCG Matrix report that you will download after your purchase. This ensures that the professional design and in-depth analysis you see are precisely what you'll be working with, without any hidden surprises.

Dogs

Cosmo Energy Holdings' less efficient refinery units, particularly older crude distillation units (CDUs), can be seen as potential 'Dogs' in its BCG Matrix. These units often come with higher operational costs and thinner profit margins compared to their more modern counterparts.

For instance, an unplanned shutdown at Cosmo's Chiba refinery's No. 2 CDU in early 2024, which lasted for a significant period, underscored the operational risks and inefficiencies associated with aging infrastructure. Such disruptions not only impact immediate production but also highlight the capital expenditure required for maintenance and potential upgrades.

These less efficient assets might be tying up valuable capital and resources that could otherwise be directed towards more profitable ventures or investments in newer, more efficient technologies. The ongoing costs of maintaining these units without generating proportionally high returns positions them as candidates for strategic review within the company's portfolio.

Cosmo Energy Holdings faces headwinds in segments reliant on declining gasoline demand, particularly in Japan. The nation's aging demographic and the accelerating adoption of electric vehicles are projected to shrink the market for traditional fuel. This directly impacts retail operations and distribution networks whose revenue streams are predominantly tied to gasoline sales.

Within Cosmo Energy Holdings' portfolio, non-strategic legacy assets represent older, potentially less profitable ventures that may not fit the company's forward-looking 'Oil & New' strategy. These could include aging refining facilities or exploration rights in mature, low-yield regions.

These legacy holdings often exhibit low market growth and may have limited competitive advantage, thus contributing minimally to Cosmo Energy's overall value creation. For instance, as of the fiscal year ending March 2024, while Cosmo Energy reported robust performance in its core petroleum refining and marketing segments, certain older infrastructure might show declining operational efficiency or face increasing environmental compliance costs.

Considering divestiture for these non-strategic assets is a prudent move. It allows Cosmo Energy to unlock capital that can be redirected towards high-growth areas, such as renewable energy development or advanced petrochemicals, aligning better with their strategic objectives and potentially boosting shareholder returns.

High-Cost Petrochemical Product Lines

High-cost petrochemical product lines within Cosmo Energy Holdings' portfolio could be classified as Dogs. These are segments that struggle with profitability due to factors like intense competition, elevated production expenses, or markets experiencing stagnation. For instance, if Cosmo Energy has specific chemical products facing global oversupply, as seen in certain plastics markets throughout 2024, their margins would likely be squeezed.

These product lines may only manage to break even or, worse, become cash drains. This situation arises when the revenue generated doesn't sufficiently cover the high operational costs, and there are limited avenues for significant future growth. The petrochemical industry in 2024 continued to grapple with these dynamics, with some commodity chemicals seeing price volatility impacting profitability.

- Low Market Share: These product lines likely hold a small portion of their respective markets.

- High Production Costs: Operational expenses may be significantly above industry averages.

- Stagnant or Declining Demand: The markets these products serve might not be growing or could be shrinking.

- Low Profitability: Margins are thin or negative, indicating a struggle to generate consistent profits.

Underperforming Retail Outlets

Within Cosmo Energy Holdings' vast network of service stations, certain retail outlets are identified as underperforming. These locations often operate in markets with intense competition or in geographically isolated areas, which can significantly impact their sales volumes and profitability. The challenge lies in their struggle to draw in customers, especially as consumer habits evolve and demand shifts.

These underperforming outlets can be viewed as cash traps. They necessitate continuous investment for upkeep and operational costs, yet they yield minimal returns. For instance, in 2024, Cosmo Energy reported that a portion of its service stations experienced declining revenue streams due to these market pressures.

- Underperforming Outlets: Located in competitive or remote regions.

- Key Indicators: Low sales volumes and profitability.

- Challenges: Difficulty attracting customers amid changing consumption patterns.

- Financial Impact: Potential cash traps requiring ongoing investment with limited returns.

Cosmo Energy Holdings' 'Dogs' are typically its less efficient refining units and certain legacy petrochemical product lines. These segments often face high operational costs and stagnant or declining market demand, leading to low profitability. For example, older crude distillation units (CDUs) might require significant investment for upgrades or maintenance, while some commodity chemicals could be impacted by global oversupply, as observed in various plastics markets throughout 2024.

These underperforming assets, such as specific retail service stations in competitive or remote areas, represent a drag on resources. They may require ongoing investment with limited returns, acting as cash traps. The fiscal year ending March 2024 highlighted that while overall performance was strong, certain older infrastructure and retail locations faced declining efficiency and revenue streams due to market pressures and evolving consumer habits.

The strategic implication for these 'Dog' assets is often divestiture or a significant overhaul. By identifying and addressing these low-growth, low-market-share segments, Cosmo Energy can reallocate capital towards more promising areas like renewable energy or advanced petrochemicals, thereby enhancing overall portfolio performance and shareholder value.

| Segment/Asset Type | Characteristics | Potential Issues | Example (FY ending Mar 2024 Context) |

|---|---|---|---|

| Aging Refinery Units (e.g., older CDUs) | Lower operational efficiency, higher maintenance costs | Risk of unplanned shutdowns, capital expenditure needs | Unplanned shutdown at Chiba refinery's No. 2 CDU impacting production |

| Legacy Petrochemical Products | High production costs, stagnant or declining demand | Low profit margins, potential cash drain | Specific commodity chemicals facing global oversupply and price volatility |

| Underperforming Service Stations | Low sales volumes, weak profitability | Intense competition, remote locations, evolving consumer habits | Portion of stations experiencing declining revenue streams |

Question Marks

Cosmo Energy Holdings is strategically entering the hydrogen station market, partnering with Iwatani to build and expand this infrastructure. This move positions them in a sector poised for substantial growth, fueled by global decarbonization efforts. The Japanese government, for instance, has set ambitious targets, aiming for 900 hydrogen refueling stations nationwide by 2030.

While the long-term potential is significant, the early-stage nature of this network presents challenges. Cosmo Energy's current market share in hydrogen refueling is nascent, and the substantial capital expenditure required for infrastructure development means profitability is not yet assured. This uncertainty, coupled with the need for widespread consumer adoption, firmly places this venture in the Question Mark quadrant of the BCG Matrix.

Cosmo Energy Holdings' development of advanced Sustainable Aviation Fuel (SAF) technologies, such as Alcohol-to-Jet (ATJ), positions it within a high-growth, but currently low-market-share segment of the BCG matrix. While existing production from used cooking oil is underway, the significant scaling envisioned by 2030 relies on these emerging technologies.

These advanced SAF pathways, including ATJ, are still maturing in terms of commercial viability, demanding considerable investment in research and development. The success of this strategic push is contingent upon future technological advancements and the broader market's acceptance and adoption of these new SAF sources.

Cosmo Energy Holdings' large-scale offshore wind projects, like the Akita City Offshore Power Generation project aiming for 525MW, are currently in the environmental review phase. These ventures, while holding substantial growth prospects, demand considerable initial investment and navigate lengthy development cycles with intricate regulatory hurdles.

The significant capital outlay and extended timelines, coupled with the uncertainty surrounding market share and profitability realization, firmly place these initiatives in the question marks category of the BCG matrix. For instance, the Akita project, a key component of Cosmo Eco Power's strategy, exemplifies this classification by being in a nascent development stage with high potential but unproven returns.

Carbon Capture, Utilization, and Storage (CCUS) Initiatives

Cosmo Energy Holdings is actively investing in Carbon Capture, Utilization, and Storage (CCUS) as a key component of its decarbonization efforts. This aligns with global trends and the company's commitment to a low-carbon future.

CCUS technologies, while vital for net-zero goals, represent an area of significant research and development for Cosmo Energy. The company is likely investing in pilot projects to test and refine these complex processes. For instance, the global CCUS market was valued at approximately USD 2.7 billion in 2023 and is projected to grow significantly, indicating the scale of investment required.

- Emerging Technology: CCUS is a nascent field requiring substantial R&D and pilot projects, positioning it as a potential 'Question Mark' in the BCG matrix due to high investment needs and uncertain future returns.

- Strategic Importance: Despite current market limitations, CCUS is strategically crucial for Cosmo Energy's long-term sustainability and net-zero targets, justifying ongoing investment.

- Market Potential: The nascent CCUS market, while requiring significant capital, holds considerable future potential for market share and profitability as technology matures and regulatory frameworks evolve.

- Investment Focus: Cosmo Energy's exploration and investment in CCUS reflect a forward-looking strategy to build capabilities in a critical low-carbon technology, even if immediate market contribution is limited.

Digital Transformation (DX) for Operations

Cosmo Energy Holdings is strategically channeling significant investments into Digital Transformation (DX) initiatives, aiming to bolster the efficiency and competitive edge of its refining operations and broader business functions. This commitment extends to cultivating specialized digital talent and fundamentally reshaping business models by integrating advanced digital capabilities.

While DX is recognized as a crucial driver for future operational enhancements and growth, its impact on immediate market share is indirect. The substantial returns from these digital investments are anticipated over the long term and are not yet fully quantifiable in current financial reporting.

- Investment Focus: Cosmo's DX strategy prioritizes enhancing refinery efficiency and overall operational competitiveness through digital technologies.

- Talent Development: A key component of their DX is building a core team of digital personnel capable of driving transformation.

- Business Model Evolution: DX is seen as a catalyst for transforming existing business models by leveraging new digital capabilities.

- Long-Term Returns: The direct impact on market share is indirect, with the full financial benefits of DX expected to materialize over an extended period.

Cosmo Energy's ventures into hydrogen refueling stations and advanced Sustainable Aviation Fuel (SAF) represent significant investments in high-growth potential markets. However, these initiatives are in their early stages, requiring substantial capital and facing uncertainties regarding market adoption and technological maturity. The company is also exploring Carbon Capture, Utilization, and Storage (CCUS) and undertaking digital transformation (DX) to enhance efficiency and competitiveness, both of which are long-term plays with unproven immediate market impact.

These initiatives, while strategically vital for Cosmo Energy's future, are characterized by high investment needs and uncertain near-term returns, placing them squarely in the Question Mark quadrant of the BCG Matrix. For example, the global CCUS market, valued at approximately USD 2.7 billion in 2023, highlights the scale of investment required in this developing sector.

| Initiative | Market Growth Potential | Current Market Share | Investment/Risk Profile | BCG Quadrant |

| Hydrogen Refueling Stations | High | Low | High Investment, Regulatory Uncertainty | Question Mark |

| Advanced SAF (e.g., ATJ) | High | Low | High R&D, Technological Uncertainty | Question Mark |

| CCUS | High | Low | High Investment, Technological Maturity Needed | Question Mark |

| Digital Transformation (DX) | Indirect/Operational | N/A | High Investment, Long-Term ROI | Question Mark |

BCG Matrix Data Sources

Our Cosmo Energy Holdings BCG Matrix is built on verified market intelligence, combining financial data from annual reports, industry research on market share, and official reports on energy trends to ensure reliable insights.