Cosmo Energy Holdings Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cosmo Energy Holdings Bundle

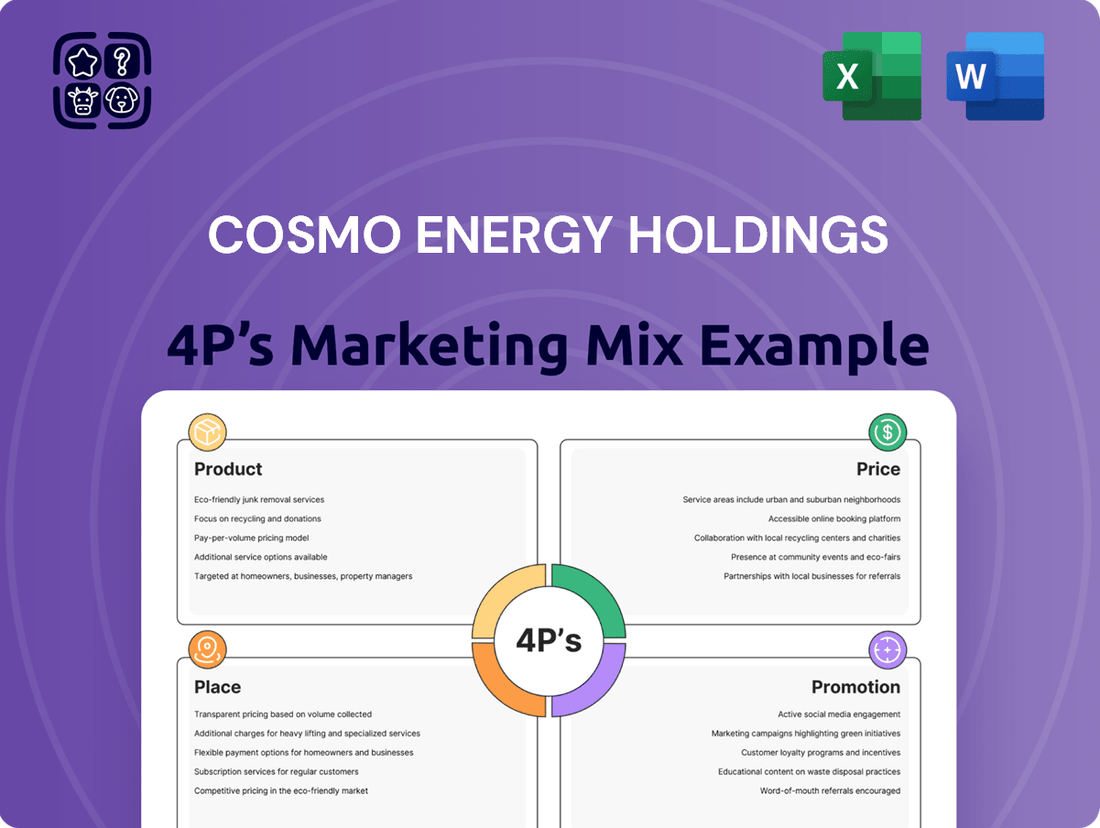

Cosmo Energy Holdings leverages a dynamic marketing mix, with its product strategy focusing on diversified energy solutions and its pricing reflecting market competitiveness. Their distribution channels are extensive, ensuring broad reach across Japan, while promotional efforts highlight innovation and sustainability.

Ready to uncover the strategic brilliance behind Cosmo Energy Holdings' success? Dive deeper into their product innovations, pricing structures, distribution networks, and promotional campaigns with our comprehensive 4Ps Marketing Mix Analysis.

Gain instant access to an in-depth, professionally written analysis that breaks down Cosmo Energy Holdings' Product, Price, Place, and Promotion strategies. This editable report is perfect for business professionals, students, and consultants seeking actionable market insights.

Product

Cosmo Energy Holdings provides a full spectrum of traditional petroleum products, such as gasoline, kerosene, naphtha, fuel oil, diesel, LPG, lubricants, and asphalt. These are foundational to their petroleum operations, guaranteeing a consistent energy flow for diverse industries.

In 2023, Cosmo Energy Holdings reported revenue of ¥2,667.9 billion, with a significant portion stemming from its petroleum segment, highlighting the enduring demand for these essential products in Japan's energy landscape.

The company's integrated approach spans the entire petroleum value chain, from upstream exploration and production to downstream refining and marketing, ensuring efficient delivery of these vital energy sources.

Cosmo Energy Holdings' Petrochemicals Manufacturing segment is a cornerstone of its operations, producing vital chemicals like ethylene, mixed-xylene, benzene, paraxylene, and toluene. Maruzen Petrochemical, a key subsidiary, functions as an ethylene center, ensuring a consistent and reliable supply of these foundational materials for various industries.

This division is strategically expanding into high-value specialty chemicals, particularly those integral to semiconductor manufacturing processes. This move reflects a commitment to innovation and capturing growth in technologically advanced markets, aligning with the increasing global demand for sophisticated electronic components.

Cosmo Energy Holdings is significantly investing in renewable energy generation, particularly wind power, to diversify its energy portfolio. This strategic move includes operating both wind and solar power facilities, aiming for a fully integrated green electricity supply chain.

The company's commitment is evident in its ongoing projects, such as the planned commencement of operations at the New-Mutsu-Ogawara Wind Farm in 2025. This expansion aligns with Japan's national goal to increase renewable energy's share in the energy mix, which stood at approximately 22% in fiscal year 2023, with a target of 36-38% by 2030.

Sustainable Aviation Fuel (SAF)

Cosmo Energy Holdings is making a significant push into Sustainable Aviation Fuel (SAF), positioning it as a key new product. Their strategy centers on mass domestic production, starting with used cooking oil at their Sakai refinery. This move directly addresses the growing demand for environmentally friendly aviation solutions.

The company has ambitious targets for SAF, aiming to reach a supply of 300,000 kiloliters annually by 2030. This will be achieved through a combination of domestic production and strategic imports, ensuring a robust supply chain. This aligns with Japan's national objective to substitute 10% of conventional jet fuel with cleaner alternatives.

- Product: Sustainable Aviation Fuel (SAF)

- Production Focus: Mass domestic production from used cooking oil at Sakai refinery.

- Supply Target: 300,000 kiloliters by 2030 (domestic production and imports).

- Market Alignment: Supports Japan's goal to replace 10% of jet fuel with cleaner alternatives.

Hydrogen Energy Solutions

Cosmo Energy Holdings is actively developing its hydrogen energy solutions, focusing on expanding its network of hydrogen refueling stations. This strategic move is a core component of their product offering in the burgeoning clean energy market.

Their product strategy includes building a robust hydrogen supply chain, from production to retail. Collaborations are key, with partnerships like the one with Iwatani Corporation demonstrating a commitment to creating the necessary infrastructure for hydrogen distribution and sales.

These initiatives are directly aligned with the global push for decarbonization, positioning Cosmo Energy's hydrogen solutions as a vital part of a cleaner energy future. For instance, by 2030, Japan aims to have 900 hydrogen refueling stations operational, a target Cosmo Energy's expansion directly supports.

- Product Development: Establishment and expansion of hydrogen refueling stations.

- Supply Chain Integration: Creation of a comprehensive hydrogen supply network.

- Strategic Partnerships: Collaborations with entities like Iwatani Corporation for infrastructure and production.

- Market Alignment: Contributing to the transition towards a decarbonized society.

Cosmo Energy Holdings' product strategy encompasses a broad range of energy solutions, from traditional petroleum products like gasoline and lubricants to forward-looking offerings such as Sustainable Aviation Fuel (SAF) and hydrogen. Their commitment to innovation is evident in their expansion into specialty chemicals for semiconductor manufacturing and significant investments in renewable energy, particularly wind power, with projects like the New-Mutsu-Ogawara Wind Farm slated for operation in 2025.

The company is actively developing its hydrogen energy solutions by expanding its network of refueling stations and building a comprehensive supply chain, supported by strategic partnerships. This aligns with Japan's decarbonization goals and the national objective to increase the use of cleaner energy alternatives.

Cosmo Energy's SAF initiative focuses on mass domestic production using used cooking oil, aiming to supply 300,000 kiloliters annually by 2030, which supports Japan's target of substituting 10% of conventional jet fuel.

The company's diverse product portfolio reflects a strategic pivot towards sustainability and advanced technologies, aiming to meet evolving market demands and contribute to a greener energy future.

| Product Category | Key Products/Initiatives | 2023/2025 Data/Targets | Strategic Focus |

|---|---|---|---|

| Traditional Petroleum | Gasoline, kerosene, naphtha, fuel oil, diesel, LPG, lubricants, asphalt | ¥2,667.9 billion revenue (2023) from petroleum segment | Consistent energy flow for diverse industries |

| Petrochemicals | Ethylene, mixed-xylene, benzene, paraxylene, toluene; specialty chemicals for semiconductors | Ethylene center via Maruzen Petrochemical | Expansion into high-value specialty chemicals |

| Renewable Energy | Wind and solar power facilities | New-Mutsu-Ogawara Wind Farm commencement in 2025; Japan's renewable share ~22% (FY2023) | Diversification, integrated green electricity supply |

| Sustainable Aviation Fuel (SAF) | Production from used cooking oil | Target: 300,000 kl/year by 2030; Japan's goal to substitute 10% jet fuel | Mass domestic production, environmentally friendly aviation |

| Hydrogen Energy | Hydrogen refueling stations, supply chain development | Japan's goal: 900 hydrogen refueling stations by 2030 | Decarbonization, cleaner energy future |

What is included in the product

This analysis delves into Cosmo Energy Holdings' marketing mix, examining their product offerings, pricing strategies, distribution channels, and promotional activities to understand their market positioning.

It provides a comprehensive overview of how Cosmo Energy Holdings leverages its 4Ps to compete effectively in the energy sector, offering insights for strategic planning.

Simplifies the complex 4Ps analysis of Cosmo Energy Holdings' marketing strategy, offering a clear roadmap to address customer pain points and drive engagement.

Place

Cosmo Energy Holdings leverages its extensive network of Cosmo brand service stations across Japan, ensuring widespread consumer access to its petroleum products. This robust physical footprint is a cornerstone of their distribution strategy.

A significant development is Cosmo Energy's commitment to sustainability, with a reported achievement of operating these stations using virtually 100% renewable energy. This aligns with growing environmental consciousness among consumers and stakeholders.

Cosmo Energy Holdings' upstream segment, focused on crude oil exploration and production, operates on a global scale. Key international sites include Abu Dhabi in the United Arab Emirates and the State of Qatar, vital for securing essential raw materials.

This strategic international footprint, encompassing assets in regions like the Middle East, is crucial for the company's integrated business model. For instance, in 2023, their exploration and production segment contributed approximately 19.7% to total revenue, highlighting the significance of these global sites.

By diversifying its exploration and production locations, Cosmo Energy Holdings effectively mitigates supply chain risks and ensures a stable foundation for its downstream refining and petrochemical operations. This global diversification strategy is a cornerstone of their operational resilience and long-term stability.

Cosmo Energy Holdings excels in integrated supply chain management, covering the full petroleum spectrum from crude oil acquisition to the delivery of refined products and petrochemicals. This end-to-end control, as evidenced by their substantial refining capacity, ensures consistent product availability and operational efficiency. For example, in fiscal year 2023, Cosmo Oil's refining segment processed approximately 250,000 barrels of crude oil per day, showcasing their robust operational scale.

Beyond traditional energy, Cosmo Energy is actively developing high-value-added supply chains for green electricity. This forward-thinking approach includes managing renewable power generation, sophisticated supply-demand adjustments, and direct sales to consumers, demonstrating a commitment to diversification and sustainability in their product offering.

Strategic Alliances and Joint Ventures for New Energy

Cosmo Energy Holdings leverages strategic alliances and joint ventures to build out distribution channels for new energy products such as hydrogen and sustainable aviation fuel (SAF). These collaborations are essential for overcoming the infrastructure challenges associated with these nascent markets. For example, partnerships with companies like Iwatani Corporation are instrumental in expanding the hydrogen refueling station network, often by integrating these new facilities into Cosmo's existing service station footprint. This strategy significantly speeds up market entry and adoption for these cleaner energy alternatives.

These partnerships are vital for scaling new energy solutions efficiently. By sharing resources and expertise, Cosmo Energy can accelerate the development and deployment of hydrogen fueling infrastructure. As of early 2024, the push for hydrogen mobility continues, with ongoing investments in expanding the number of hydrogen stations across Japan, aiming to support a growing fleet of fuel cell vehicles. This collaborative model allows for quicker market penetration than a solely in-house approach.

- Distribution Expansion: Alliances facilitate the rollout of hydrogen and SAF, leveraging existing service station networks.

- Infrastructure Development: Partnerships, like with Iwatani, are key to building out hydrogen station infrastructure.

- Market Penetration: Collaborative efforts accelerate the adoption of new energy solutions.

- Resource Sharing: Joint ventures enable shared investment and expertise for infrastructure projects.

Direct Supply to Businesses and Municipalities

Cosmo Energy Holdings extends its reach beyond consumer-facing retail by directly supplying petroleum and petrochemical products in bulk to industrial customers. This B2B segment is crucial for securing substantial, long-term contracts and diversifying revenue streams.

The company's commitment to renewable energy is also evident in its direct supply to businesses and public entities. For instance, Cosmo Energy provides electricity to municipal elementary and junior high schools, such as those located in Tokyo's Adachi City. This initiative not only supports the transition to green energy but also solidifies the company's role in public infrastructure and community development.

- Direct Sales: Bulk petroleum and petrochemical supply to industrial clients.

- Renewable Energy: Electricity provision to businesses and municipal facilities.

- Key Markets: Including educational institutions like schools in Tokyo's Adachi City.

- Strategic Impact: Securing large contracts and driving green energy adoption.

Cosmo Energy Holdings' place strategy is multifaceted, encompassing a vast network of physical service stations across Japan and strategic global upstream operations. Their commitment to sustainability is evident in powering these stations with nearly 100% renewable energy, a move that resonates with environmentally conscious consumers. The company also maintains a significant global presence for crude oil exploration and production, with key assets in regions like the Middle East, which contributed approximately 19.7% to their total revenue in 2023.

This integrated approach extends to their supply chain, managing everything from raw material acquisition to the delivery of refined products and petrochemicals, processing around 250,000 barrels of crude oil daily in fiscal year 2023. Furthermore, Cosmo Energy is actively developing new energy supply chains, including green electricity and hydrogen, often through strategic alliances to overcome infrastructure hurdles.

Their distribution also includes direct bulk sales to industrial clients and providing renewable electricity to businesses and public entities, such as schools in Tokyo's Adachi City, diversifying revenue and supporting green energy adoption.

| Aspect | Description | Key Data/Example |

|---|---|---|

| Domestic Retail Network | Extensive service station presence across Japan. | Nearly 100% renewable energy usage in stations. |

| Global Upstream Operations | Crude oil exploration and production. | Assets in UAE, Qatar; contributed 19.7% to FY2023 revenue. |

| Integrated Supply Chain | End-to-end management from crude to refined products. | Processed ~250,000 barrels/day in FY2023. |

| New Energy Distribution | Developing supply chains for green electricity and hydrogen. | Partnerships with Iwatani for hydrogen stations. |

| B2B and Public Sector Supply | Direct bulk sales and renewable energy provision. | Supplies electricity to schools in Tokyo's Adachi City. |

What You Preview Is What You Download

Cosmo Energy Holdings 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Cosmo Energy Holdings' 4P's Marketing Mix is fully complete and ready for your immediate use. You can trust that the insights and details you see are exactly what you'll get.

Promotion

Cosmo Energy Holdings actively engages in investor relations, offering detailed financial data and integrated reports. For instance, their fiscal year 2024 (ending March 2024) saw a net income attributable to owners of the parent of ¥105.5 billion, showcasing their financial performance transparently.

The company prioritizes clear communication through quarterly earnings briefings and publications like the COSMO REPORT. This commitment ensures investors and financial professionals receive timely insights into Cosmo Energy's strategy and future vision.

Cosmo Energy Holdings actively promotes its dedication to sustainability and Environmental, Social, and Governance (ESG) principles. This commitment is a core element of their 'Promotion' strategy, aiming to resonate with increasingly conscious consumers and investors.

The company regularly publishes detailed sustainability reports, offering transparency into their environmental impact, social contributions, and governance structures. For instance, their 2023 sustainability report highlighted a 15% reduction in Scope 1 and 2 greenhouse gas emissions compared to their 2019 baseline, demonstrating tangible progress.

By integrating ESG insights into their public communications, Cosmo Energy Holdings seeks to foster trust and build long-term relationships with stakeholders. This proactive approach to responsible business practices is a significant differentiator in their market positioning.

Cosmo Energy Holdings is actively integrating digital transformation (DX) into its core operations, which indirectly bolsters its promotional strategies by boosting efficiency and enabling more insightful, data-backed decisions. For instance, their DX efforts involve consolidating data from refinery facilities and equipment to anticipate potential failures, a move that ensures operational reliability and minimizes disruptions that could impact promotional messaging.

Further illustrating their commitment, Cosmo Energy is developing virtual replicas of their refineries. This technological advancement not only aids in risk mitigation but also projects an image of innovation and forward-thinking to the market, a crucial element in modern promotional campaigns. By investing in these advanced digital solutions, Cosmo Energy is reinforcing its brand as a leader in technological adoption within the energy sector.

Public Relations and Corporate Announcements

Cosmo Energy Holdings leverages public relations to communicate key business milestones, such as the development of new wind power projects and advancements in sustainable aviation fuel (SAF) production. For instance, by the end of fiscal year 2024 (ending March 2025), the company aims to increase its renewable energy capacity, underscoring its commitment to decarbonization through strategic announcements.

These corporate announcements serve to inform stakeholders about significant events, including capital alliances and the progress of major initiatives. For example, in 2024, Cosmo Energy actively pursued partnerships to bolster its renewable energy portfolio, with details often shared via press releases to maintain transparency and build investor confidence.

The company's PR strategy highlights its forward-looking approach, covering:

- Commencement of new wind farm operations: Keeping the public informed about the expansion of their renewable energy infrastructure.

- Strategic capital alliances: Announcing partnerships that strengthen their market position and financial capabilities.

- Sustainable Aviation Fuel (SAF) production milestones: Publicizing progress in the development of environmentally friendly fuels.

Brand Building through Green Initiatives

Cosmo Energy Holdings actively builds its brand by championing green initiatives and a commitment to carbon neutrality, striving to be a company society values. This focus on sustainability is central to their marketing efforts, aiming to resonate with environmentally conscious consumers and stakeholders.

Key initiatives bolster this brand image. For instance, supplying 100% renewable energy to schools demonstrates a tangible commitment to future generations and clean energy adoption. Furthermore, their advancements in developing Sustainable Aviation Fuel (SAF) and expanding their hydrogen business showcase a forward-looking approach to decarbonization.

Cosmo Energy's corporate philosophy, emphasizing harmony and symbiosis with the planet, is woven into their brand narrative. This underlying principle guides their actions and communications, reinforcing their dedication to environmental stewardship.

These efforts are supported by concrete actions and targets. For example, Cosmo Energy aims to achieve net zero emissions by 2050, a significant undertaking that underpins their green branding. Their investment in renewable energy sources, such as offshore wind and solar power, is crucial to meeting these ambitious goals and solidifying their position as an environmentally responsible energy provider.

- Brand Positioning: Cosmo Energy positions itself as a leader in the energy transition, prioritizing environmental responsibility.

- Key Green Initiatives: Supplying 100% renewable energy to schools, developing SAF, and expanding hydrogen businesses.

- Corporate Philosophy: Emphasizing harmony and symbiosis with the planet as a core value.

- Sustainability Targets: Aiming for net zero emissions by 2050 and significant investments in renewable energy projects.

Cosmo Energy Holdings' promotion strategy heavily emphasizes its commitment to sustainability and green initiatives, aiming to build a brand recognized for environmental responsibility. This includes tangible actions like supplying 100% renewable energy to schools and advancing the development of Sustainable Aviation Fuel (SAF) and hydrogen businesses.

The company’s corporate philosophy, centered on harmony with the planet, is integrated into its communications, reinforcing its dedication to environmental stewardship. This is further supported by ambitious targets, such as achieving net zero emissions by 2050, backed by substantial investments in renewable energy projects like offshore wind and solar power.

Cosmo Energy actively utilizes public relations to announce key milestones, such as the commencement of new wind farm operations and strategic capital alliances, all contributing to its forward-looking image. Their fiscal year 2024 performance, with a net income of ¥105.5 billion, provides a solid financial foundation for these promotional activities.

| Key Promotional Focus | Initiative Example | Data/Target |

|---|---|---|

| Sustainability & ESG | Supplying 100% renewable energy to schools | Demonstrates commitment to future generations |

| Green Energy Development | SAF production and Hydrogen business expansion | Forward-looking decarbonization efforts |

| Corporate Philosophy | Harmony and symbiosis with the planet | Core value guiding communications |

| Net Zero Target | Achieve net zero emissions by 2050 | Underpins green branding |

| Financial Performance (FY2024) | Net income attributable to owners of the parent | ¥105.5 billion |

Price

Cosmo Energy Holdings navigates a fiercely competitive petroleum landscape, where strategic pricing of gasoline, diesel, and other refined products is paramount to attracting both individual consumers and commercial clients. This requires a keen eye on market demand fluctuations, competitor price points, and prevailing economic conditions to effectively defend and grow their market share.

In 2024, the global average gasoline price hovered around $1.30 per liter, with significant regional variations impacting Cosmo Energy's pricing decisions. Their strategy aims to capture value across the entire oil supply chain, from upstream exploration to downstream retail, ensuring competitive yet profitable pricing at the pump.

Cosmo Energy Holdings likely employs value-based pricing for its petrochemicals, such as ethylene and paraxylene. This strategy considers the critical role these chemicals play in various manufacturing processes, aligning prices with the value they deliver to industrial customers. For instance, ethylene is a fundamental building block for plastics, impacting countless consumer goods.

The pricing also takes into account the competitive dynamics within the global petrochemical market. Cosmo Energy Holdings aims to offer a stable supply of these essential materials, which is a significant value proposition for its B2B clients. This reliability can justify pricing that reflects consistent availability and quality, especially in volatile commodity markets.

Cosmo Energy Holdings' pricing for renewable energy, like wind power, reflects substantial upfront capital investments in turbines and grid infrastructure. The company targets stable energy pricing while ensuring a competitive long-term return on these significant development costs, navigating the dynamic green electricity market.

In 2023, global offshore wind project costs averaged around $3,500 per kilowatt, a figure Cosmo Energy would consider. Pricing strategies must balance the need for project viability with government incentives, such as tax credits or feed-in tariffs, which are crucial for making large-scale renewable projects financially sound in the 2024-2025 period.

Subsidies and Cost Management for New Fuels

For emerging fuels like Sustainable Aviation Fuel (SAF) and hydrogen, Cosmo Energy Holdings acknowledges their current higher price points compared to traditional options. To bridge this gap and foster market adoption, the company actively leverages government subsidies, which are crucial for making these greener alternatives economically feasible in the near term. Cosmo Energy is focused on driving down production costs through scaling up output, a key strategy to achieve price parity over time.

The company's approach to pricing these new fuels is a delicate balance. They aim to manage the inherent high production costs by strategically aligning prices with market willingness to pay, supported by these vital subsidy programs. For instance, in 2024, Japan's Ministry of Economy, Trade and Industry (METI) continued its support for hydrogen supply chains, with specific allocations for demonstration projects that could lower production costs. Cosmo Energy's strategy anticipates that as production volumes increase, economies of scale will naturally lead to cost reductions, further enhancing the competitiveness of SAF and hydrogen.

Cosmo Energy's cost management for new fuels is underpinned by several key initiatives:

- Government Subsidies: Actively seeking and utilizing national and international financial support to offset initial high production costs for SAF and hydrogen.

- Production Scale-Up: Investing in expanding manufacturing capacity to benefit from economies of scale, a critical factor in reducing per-unit costs.

- Technological Advancement: Collaborating on and adopting new technologies that improve production efficiency and lower energy inputs.

- Strategic Pricing: Implementing pricing models that reflect both production realities and market demand, often phased to accommodate increasing adoption.

Financial Performance and Shareholder Returns

Cosmo Energy Holdings' financial performance, marked by revenue and net income trends, directly impacts its ability to set prices and allocate capital effectively. For instance, in the fiscal year ending March 2024, the company reported consolidated revenue of ¥2,464.4 billion and a net income attributable to owners of the parent of ¥120.5 billion, reflecting a robust operational base that supports strategic pricing decisions.

The company's capital policy is geared towards sustained growth, with a significant focus on realizing a hydrogen energy-based society. This forward-looking investment strategy shapes how financial resources are deployed, potentially influencing pricing by supporting innovative, albeit initially higher-cost, energy solutions.

Shareholder returns and financial targets are integral to Cosmo Energy's broader pricing strategy and investment capacity. The company aims for a consolidated dividend payout ratio of 30% and has set targets for return on equity (ROE) of 8% or higher, demonstrating a commitment to shareholder value that must be balanced with long-term capital expenditure plans.

- Fiscal Year 2024 Revenue: ¥2,464.4 billion

- Fiscal Year 2024 Net Income: ¥120.5 billion

- Target Dividend Payout Ratio: 30%

- Target Return on Equity (ROE): 8% or higher

Cosmo Energy Holdings strategically prices its diverse product portfolio, from gasoline to advanced fuels, balancing market competitiveness with profitability. For refined petroleum products, prices are dynamic, reacting to global benchmarks and local demand, ensuring they remain attractive to consumers while reflecting operational costs.

For petrochemicals like ethylene, value-based pricing is key, aligning with the critical inputs they provide to manufacturing sectors. Renewable energy, such as wind power, sees pricing influenced by substantial upfront investment and the need for long-term project viability, often supported by government incentives to ensure competitiveness.

Emerging fuels like SAF and hydrogen are priced considering high initial production costs, with government subsidies playing a crucial role in market adoption and driving towards price parity as production scales up. This multifaceted approach ensures Cosmo Energy can navigate different market segments effectively.

Cosmo Energy's financial health, demonstrated by its FY2024 results of ¥2,464.4 billion in revenue and ¥120.5 billion in net income, underpins its pricing flexibility and investment capacity. The company's commitment to shareholder returns, targeting a 30% dividend payout ratio and an ROE of 8% or higher, further informs its financial strategies, including pricing decisions.

| Product Category | Pricing Strategy Focus | Key Influences | Relevant FY2024 Data |

|---|---|---|---|

| Refined Petroleum Products | Market-driven, competitive | Global oil prices, local demand, competitor pricing | Revenue: ¥2,464.4 billion (consolidated) |

| Petrochemicals | Value-based | Industrial demand, manufacturing input value, global market dynamics | Net Income: ¥120.5 billion (attributable to owners) |

| Renewable Energy (e.g., Wind) | Long-term viability, cost recovery | Capital investment, government incentives, project costs (e.g., ~$3,500/kW offshore wind in 2023) | Target ROE: 8%+ |

| Emerging Fuels (SAF, Hydrogen) | Cost-plus with subsidy support, phased adoption | Production costs, government subsidies (e.g., METI support in Japan), economies of scale | Target Dividend Payout Ratio: 30% |

4P's Marketing Mix Analysis Data Sources

Our Cosmo Energy Holdings 4P's Marketing Mix Analysis is meticulously constructed using a robust blend of public company disclosures, including annual reports and investor presentations, alongside industry-specific market research and competitive intelligence. This ensures a comprehensive understanding of their product offerings, pricing strategies, distribution channels, and promotional activities.