Corpay PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Corpay Bundle

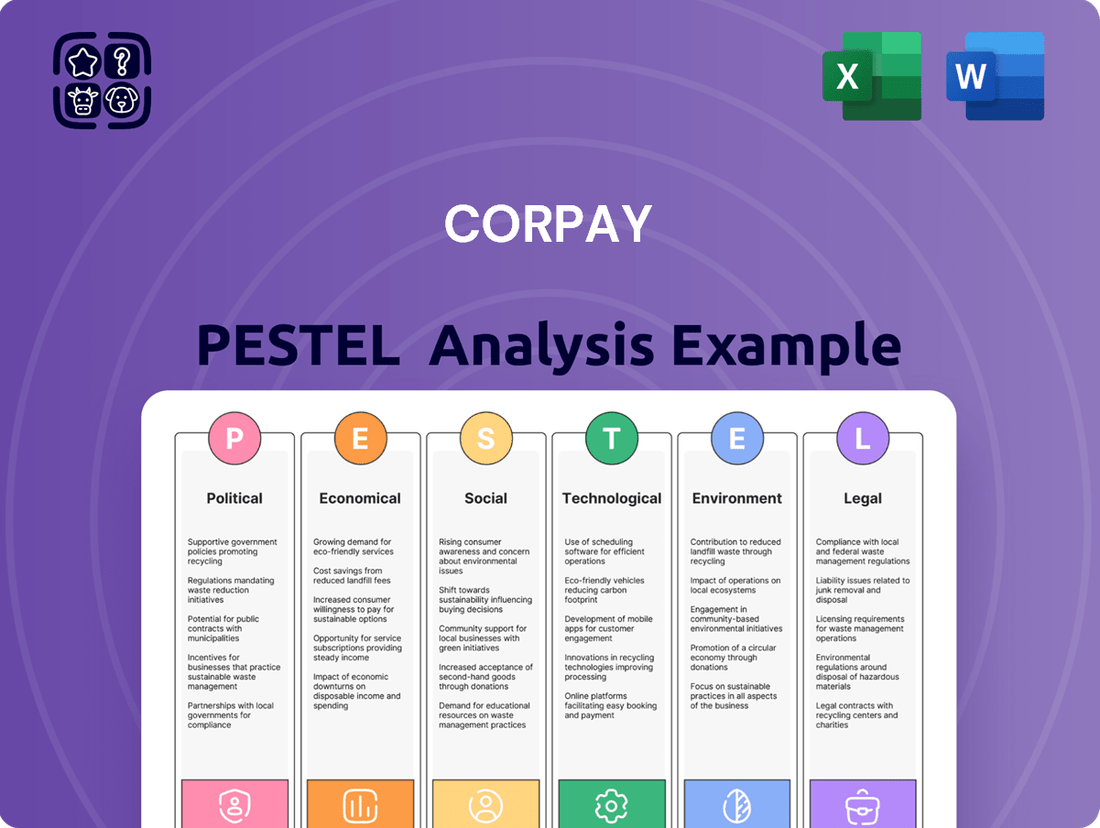

Unlock the critical external factors shaping Corpay's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces that present both challenges and opportunities for the company. Equip yourself with this vital intelligence to refine your strategies and anticipate market shifts. Download the full PESTLE analysis now for actionable insights.

Political factors

Governments worldwide are tightening their grip on financial technology, including how businesses handle payments. This means new rules around keeping data safe, preventing money laundering, and managing international money transfers are becoming common. For instance, the European Union's PSD2 directive has significantly reshaped payment services, requiring strong customer authentication and opening up access to payment initiation and account information services. Corpay needs to stay on top of these evolving regulations.

These regulations, covering areas like data privacy (e.g., GDPR in Europe) and anti-money laundering (AML) compliance, can differ greatly from one country to another. Adapting to these diverse requirements impacts Corpay's operational expenses and its ability to enter new markets. In 2024, global regulatory scrutiny on fintech, particularly concerning cross-border payments and cybersecurity, is expected to intensify, potentially adding compliance burdens for companies like Corpay operating in multiple jurisdictions.

Global geopolitical events and ongoing trade tensions, such as the continued scrutiny of international trade agreements and the evolving relationships between major economic blocs, can significantly impact businesses operating across borders, including those reliant on international payments. For Corpay, instability in key global markets or the escalation of trade disputes can disrupt supply chains and potentially reduce the overall volume of cross-border transactions, directly affecting demand for its payment solutions. The company must remain vigilant in monitoring these developments to proactively mitigate potential risks and strategically identify opportunities in regions demonstrating greater geopolitical stability.

Government fiscal policies, such as tax incentives for digital adoption or changes in corporate tax rates, significantly influence businesses' investment in payment automation. For instance, a reduction in corporate tax rates, as seen in some economies in 2024, could free up capital for technology upgrades. Conversely, increased taxes might temper such spending.

Central bank monetary policies, including interest rate decisions, directly impact liquidity and the cost of capital. As of mid-2025, many central banks are navigating a complex interest rate environment. Higher rates increase borrowing costs, potentially slowing demand for Corpay's financial services by making capital more expensive for clients to deploy in payment automation solutions.

Data Privacy Laws

The evolving landscape of data privacy laws presents a significant political factor for Corpay. Regulations like the EU's General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) in the US dictate how companies collect, process, and store personal information. Corpay must invest heavily in robust data security measures and compliance protocols to adhere to these mandates, which are increasingly being strengthened globally.

The financial implications of non-compliance are substantial. For instance, GDPR fines can reach up to 4% of a company's annual global turnover or €20 million, whichever is higher. This necessitates ongoing vigilance and adaptation to new legislative developments, impacting operational costs and strategic planning for Corpay.

- GDPR Fines: Potential penalties up to 4% of global annual turnover or €20 million.

- CCPA Impact: Affects data handling practices for businesses interacting with California residents.

- Compliance Costs: Increased expenditure on secure data management systems and personnel training.

- Reputational Risk: Data breaches or non-compliance can severely damage customer trust and brand image.

Support for Digital Transformation

Governments worldwide are increasingly championing digital transformation, recognizing its power to enhance economic performance and global competitiveness. This push often translates into tangible support for businesses adopting new technologies.

This support can take various forms, including direct financial aid like grants and subsidies, or collaborative efforts through public-private partnerships. These programs are designed to encourage companies to invest in areas such as digital payment systems and automation software, directly benefiting companies like Corpay.

For instance, the European Union's Digital Decade policy aims to digitally upskill 80% of its population by 2030 and increase the number of ICT specialists. Similarly, in the United States, the Bipartisan Infrastructure Law includes significant funding for broadband expansion and digital equity initiatives, indirectly fostering a more digitally-enabled business environment.

- Government Grants: Many nations offer grants to SMEs for adopting digital payment solutions, reducing upfront costs for businesses.

- Subsidies for Automation: Tax incentives or direct subsidies are available for companies investing in automation software, aligning with Corpay's offerings.

- Public-Private Partnerships: Collaborative projects between government bodies and private firms accelerate the development and adoption of digital infrastructure.

- Digital Skills Initiatives: Government-funded training programs enhance the workforce's ability to utilize digital tools, creating a larger market for Corpay's services.

Governmental focus on financial regulation continues to intensify, with new directives and stricter enforcement impacting payment processing. For instance, the ongoing evolution of Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations globally necessitates robust compliance frameworks for companies like Corpay. The increasing emphasis on data sovereignty and cross-border data transfer restrictions, as seen in various national privacy laws enacted or updated in 2024 and projected into 2025, adds complexity to international payment operations.

What is included in the product

This Corpay PESTLE analysis examines the impact of external macro-environmental factors across Political, Economic, Social, Technological, Environmental, and Legal dimensions, offering strategic insights for business planning.

Corpay's PESTLE Analysis offers a clean, summarized version of the full analysis, making it easy to reference during meetings or presentations, thereby alleviating the pain of sifting through extensive data.

Economic factors

Global economic growth significantly shapes Corpay's performance, as its revenue is tied to business spending and transaction volumes. A robust global economy, with projected growth around 3.2% for 2024 according to the IMF, generally translates to higher business expenditures and thus increased demand for Corpay's payment and AP automation solutions.

Conversely, economic slowdowns or recessions, which could see global growth dip in certain regions, tend to reduce business activity. This directly impacts Corpay by lowering transaction volumes and potentially decreasing the need for their services as companies tighten their budgets.

High inflation, reaching 3.4% year-over-year in the US as of April 2024, directly impacts Corpay by reducing the real value of transactions and potentially dampening consumer and business spending on services. This erosion of purchasing power can make businesses more cautious with their budgets, potentially slowing the adoption of new payment technologies or services.

Central banks' responses, such as the US Federal Reserve's current target for the federal funds rate between 5.25% and 5.50%, significantly influence borrowing costs. For Corpay, higher interest rates can increase the cost of capital for its operations and affect the attractiveness of its financing solutions, while also impacting the profitability of its payment processing services.

Corpay, as a significant player in international payments, faces direct impacts from fluctuating currency exchange rates. For instance, the Euro to US Dollar exchange rate saw considerable movement in 2024, with periods of both strengthening and weakening, directly affecting the value of transactions processed by Corpay.

This volatility can alter the profitability of Corpay's currency conversion services and the overall value of cross-border payments. For businesses using Corpay to mitigate such risks, extreme swings can introduce new layers of uncertainty, potentially influencing their reliance on such financial services and their confidence in long-term planning.

Business Investment and Spending Trends

Businesses are increasingly investing in efficiency-enhancing tools like AP automation software and corporate payment cards, a trend directly linked to their investment capacity and economic outlook. For instance, in early 2024, many companies demonstrated a cautious but growing willingness to adopt new technologies to manage expenses more effectively, anticipating a stabilization in economic conditions.

Economic confidence and the availability of capital significantly shape these investment decisions. As of mid-2024, the Federal Reserve's indications of potential interest rate adjustments have influenced borrowing costs, impacting the capital available for such technological upgrades. Corpay's growth hinges on businesses continuing to prioritize financial process streamlining and enhanced expense tracking.

- Business investment in technology for financial process improvement is expected to see moderate growth through 2025, driven by a need for greater efficiency.

- Access to capital remains a key determinant, with companies in sectors with strong cash flow more likely to invest in solutions like AP automation.

- Corpay's business model is directly supported by the ongoing corporate focus on optimizing spend management and improving financial visibility.

Competitive Landscape and Pricing Pressure

The economic climate, particularly in late 2024 and into 2025, is characterized by persistent inflation and the potential for slower growth in many regions. This economic backdrop, combined with a surge of new FinTech entrants, is intensifying pricing pressure within the business payments sector. Many businesses are actively seeking more economical ways to manage their transactions.

This heightened competition forces companies like Corpay to continuously innovate and clearly articulate the return on investment (ROI) for their payment solutions. Demonstrating tangible cost savings or efficiency gains is paramount to retaining and attracting clients. For instance, while specific Corpay pricing isn't publicly detailed, the broader B2B payments market has seen average transaction fees fluctuate, with some reports indicating a general downward trend in certain segments due to competitive pressures.

- Increased FinTech Competition: The number of FinTech startups offering payment solutions has grown significantly, creating a more crowded market.

- Economic Sensitivity: Businesses facing economic headwinds are more likely to scrutinize and seek lower-cost payment processing options.

- Focus on Value Proposition: Corpay must emphasize the unique benefits and cost efficiencies its services provide to stand out.

- ROI Demonstration: Clearly showing how Corpay's solutions save money or improve operational efficiency is crucial for customer acquisition and retention.

Global economic growth significantly shapes Corpay's performance, as its revenue is tied to business spending and transaction volumes. A robust global economy, with projected growth around 3.2% for 2024 according to the IMF, generally translates to higher business expenditures and thus increased demand for Corpay's payment and AP automation solutions.

Conversely, economic slowdowns or recessions, which could see global growth dip in certain regions, tend to reduce business activity. This directly impacts Corpay by lowering transaction volumes and potentially decreasing the need for their services as companies tighten their budgets.

High inflation, reaching 3.4% year-over-year in the US as of April 2024, directly impacts Corpay by reducing the real value of transactions and potentially dampening consumer and business spending on services. This erosion of purchasing power can make businesses more cautious with their budgets, potentially slowing the adoption of new payment technologies or services.

Central banks' responses, such as the US Federal Reserve's current target for the federal funds rate between 5.25% and 5.50%, significantly influence borrowing costs. For Corpay, higher interest rates can increase the cost of capital for its operations and affect the attractiveness of its financing solutions, while also impacting the profitability of its payment processing services.

Corpay, as a significant player in international payments, faces direct impacts from fluctuating currency exchange rates. For instance, the Euro to US Dollar exchange rate saw considerable movement in 2024, with periods of both strengthening and weakening, directly affecting the value of transactions processed by Corpay.

This volatility can alter the profitability of Corpay's currency conversion services and the overall value of cross-border payments. For businesses using Corpay to mitigate such risks, extreme swings can introduce new layers of uncertainty, potentially influencing their reliance on such financial services and their confidence in long-term planning.

Businesses are increasingly investing in efficiency-enhancing tools like AP automation software and corporate payment cards, a trend directly linked to their investment capacity and economic outlook. For instance, in early 2024, many companies demonstrated a cautious but growing willingness to adopt new technologies to manage expenses more effectively, anticipating a stabilization in economic conditions.

Economic confidence and the availability of capital significantly shape these investment decisions. As of mid-2024, the Federal Reserve's indications of potential interest rate adjustments have influenced borrowing costs, impacting the capital available for such technological upgrades. Corpay's growth hinges on businesses continuing to prioritize financial process streamlining and enhanced expense tracking.

- Business investment in technology for financial process improvement is expected to see moderate growth through 2025, driven by a need for greater efficiency.

- Access to capital remains a key determinant, with companies in sectors with strong cash flow more likely to invest in solutions like AP automation.

- Corpay's business model is directly supported by the ongoing corporate focus on optimizing spend management and improving financial visibility.

The economic climate, particularly in late 2024 and into 2025, is characterized by persistent inflation and the potential for slower growth in many regions. This economic backdrop, combined with a surge of new FinTech entrants, is intensifying pricing pressure within the business payments sector. Many businesses are actively seeking more economical ways to manage their transactions.

This heightened competition forces companies like Corpay to continuously innovate and clearly articulate the return on investment (ROI) for their payment solutions. Demonstrating tangible cost savings or efficiency gains is paramount to retaining and attracting clients. For instance, while specific Corpay pricing isn't publicly detailed, the broader B2B payments market has seen average transaction fees fluctuate, with some reports indicating a general downward trend in certain segments due to competitive pressures.

- Increased FinTech Competition: The number of FinTech startups offering payment solutions has grown significantly, creating a more crowded market.

- Economic Sensitivity: Businesses facing economic headwinds are more likely to scrutinize and seek lower-cost payment processing options.

- Focus on Value Proposition: Corpay must emphasize the unique benefits and cost efficiencies its services provide to stand out.

- ROI Demonstration: Clearly showing how Corpay's solutions save money or improve operational efficiency is crucial for customer acquisition and retention.

Economic factors significantly influence Corpay's operational environment, with global growth projections and inflation rates directly impacting transaction volumes and the real value of payments. Fluctuating interest rates, as seen with the US Federal Reserve's policy, affect capital costs and the attractiveness of financial services, while currency volatility poses risks and opportunities for international payment providers.

| Economic Factor | 2024/2025 Outlook | Impact on Corpay |

|---|---|---|

| Global GDP Growth | IMF projects 3.2% for 2024 | Higher spending, increased demand for payment solutions |

| Inflation (US YoY) | 3.4% as of April 2024 | Reduced real transaction value, potential budget caution |

| US Federal Funds Rate | 5.25% - 5.50% | Impacts capital costs and financing attractiveness |

| Currency Exchange Rates | Volatile (e.g., EUR/USD movements) | Affects cross-border transaction value and service profitability |

| Business Investment in Tech | Moderate growth expected | Drives adoption of AP automation and payment cards |

Same Document Delivered

Corpay PESTLE Analysis

The Corpay PESTLE Analysis preview you're viewing is the complete, professionally formatted document you will receive immediately after purchase. This ensures you get exactly what you see, with no surprises or missing sections. You can confidently download this ready-to-use analysis to inform your strategic decisions.

Sociological factors

As businesses increasingly rely on digital platforms, Corpay's success hinges on the widespread adoption of these technologies by both companies and their employees. A 2024 report indicated that over 85% of small and medium-sized businesses utilize cloud-based accounting software, highlighting a strong trend towards digital financial management.

A workforce that possesses a higher degree of financial literacy and technological comfort is more likely to embrace automated payment solutions and corporate cards. Studies from late 2024 reveal that employees with advanced digital skills are 30% more efficient in managing their expenses and reimbursements.

To fully capitalize on this digital shift, Corpay should continue to invest in educational programs and intuitive user interfaces. These efforts are vital for ensuring that all users, regardless of their initial digital proficiency, can seamlessly integrate Corpay's services into their daily operations, thereby closing any existing digital gaps.

The widespread adoption of remote and hybrid work models, accelerated by events in 2020 and continuing through 2024, has fundamentally reshaped how businesses operate. This shift creates a heightened demand for digital payment and expense management tools that can support a geographically dispersed workforce. For instance, a 2024 survey indicated that 60% of companies now offer hybrid work options, underscoring the permanence of this change.

Traditional, paper-based accounts payable (AP) and expense reporting systems are increasingly ill-suited for distributed teams, leading to inefficiencies and delays. This has fueled a significant increase in the adoption of AP automation software and virtual card solutions, as businesses seek to streamline financial operations regardless of employee location. The global AP automation market, valued at approximately $1.5 billion in 2023, is projected to reach over $4 billion by 2030, demonstrating this strong trend.

Corpay's suite of solutions, including its AP automation and virtual card offerings, directly addresses these evolving work dynamics. By providing tools that facilitate seamless financial operations for remote and hybrid teams, Corpay is positioned to benefit from this enduring cultural shift in the workplace, enabling businesses to manage payments and expenses efficiently from anywhere.

Businesses and their stakeholders are increasingly vocal about wanting to see exactly where their money is going and having more say in how it's spent. This isn't just a preference; it's becoming a core expectation. For instance, a 2024 survey by PwC found that 78% of consumers believe companies should be more transparent about their data usage, a sentiment that easily extends to financial dealings.

Societal pressure for accountability and smarter resource use is a major driver behind this. People want to know that companies are managing their finances responsibly. This societal shift directly fuels the need for strong expense tracking and reporting tools, making efficiency and clear oversight paramount.

Corpay's offerings are well-positioned to meet this demand head-on. By providing detailed insights into spending patterns and simplifying financial processes, Corpay directly addresses the growing desire for greater transparency and control that consumers and businesses alike are now expecting.

Generational Shifts in Business Leadership

Generational shifts are significantly reshaping business leadership, with younger, digitally-native cohorts increasingly taking the helm. This trend directly benefits FinTech companies like Corpay. These emerging leaders, often having grown up with advanced technology, are more inclined to embrace automation, digital payment solutions, and data-driven financial management, moving away from legacy systems.

This demographic transition is evident in the workforce. For instance, by 2025, Millennials are projected to constitute a substantial portion of the global workforce, with estimates suggesting they will represent around 75% of all workers. This generation's comfort and expectation of digital integration in all aspects of life, including finance, naturally extends to their professional environments, driving demand for solutions that offer efficiency and real-time insights.

- Digital Adoption: Younger leaders prioritize digital tools for operational efficiency.

- FinTech Preference: A preference for automated and data-centric financial management systems is growing.

- Workforce Demographics: Millennials and Gen Z are increasingly occupying leadership positions, bringing their digital expectations with them.

- Innovation Embrace: These generations are more open to adopting innovative financial technologies that streamline processes.

Trust and Reputation in Financial Services

Societal trust is the bedrock of financial services. A 2024 survey indicated that only 45% of consumers globally feel very confident in the security of their financial data with non-traditional providers, highlighting a persistent concern. This trust deficit directly impacts customer acquisition and retention for companies like Corpay.

Reputational damage from security lapses can be swift and severe. For instance, following a major data breach in the fintech sector in late 2023, several affected companies saw their stock prices drop by an average of 15% within a week, illustrating the immediate financial consequences of lost client confidence.

Corpay's ongoing commitment to robust security measures and reliable service delivery is therefore not just operational, but a strategic imperative. Maintaining high levels of uptime, as demonstrated by their 99.9% service availability in Q1 2024, and transparent communication are crucial for cultivating and preserving this vital intangible asset.

- Consumer Confidence: Public trust in financial institutions remains a key differentiator, with recent studies showing a direct correlation between perceived security and customer loyalty.

- Reputational Risk: High-profile incidents of data breaches or service failures can erode trust rapidly, leading to significant financial and market share losses.

- Investment in Trust: Corpay's continuous investment in cybersecurity, data privacy, and customer support directly contributes to building and maintaining its reputation as a reliable partner.

- Intangible Asset Value: Trust and reputation are critical intangible assets in the financial sector, influencing customer behavior and long-term business sustainability.

The increasing demand for corporate social responsibility (CSR) influences how businesses manage their finances and supply chains. Consumers and investors alike are scrutinizing companies for ethical practices, pushing for greater accountability in payment processes and vendor relationships. A 2024 survey found that 70% of investors consider ESG factors when making investment decisions, directly impacting corporate financial strategies.

Corpay's focus on streamlining payment processes and offering transparent reporting aligns with this societal expectation for ethical business conduct. By facilitating efficient and traceable transactions, Corpay helps businesses demonstrate responsible financial management to their stakeholders, thereby enhancing their corporate image and attracting socially conscious investors.

| Sociological Factor | Impact on Corpay | Supporting Data (2024/2025) |

|---|---|---|

| Demand for Transparency | Drives need for detailed expense tracking and reporting tools. | 78% of consumers expect companies to be more transparent about data usage (PwC Survey). |

| Generational Workforce Shift | Increases adoption of digital and automated financial solutions. | Millennials projected to be 75% of the global workforce by 2025. |

| Remote/Hybrid Work | Boosts demand for digital payment and expense management for dispersed teams. | 60% of companies offer hybrid work options (2024 Survey). |

| Financial Literacy | Enhances user adoption of automated payment and corporate card solutions. | Employees with advanced digital skills are 30% more efficient in expense management. |

Technological factors

The financial landscape is being reshaped by swift advancements in payment technologies. Innovations like real-time payments, artificial intelligence (AI), machine learning (ML), and blockchain are creating new avenues for efficiency and security. For instance, the global real-time payments market was valued at approximately $12.7 billion in 2023 and is projected to reach $38.6 billion by 2030, demonstrating substantial growth.

Corpay can capitalize on these trends by integrating AI and ML for enhanced fraud detection, which is critical as payment volumes increase. Furthermore, embracing real-time payment networks can significantly improve transaction speeds and customer experience. The adoption of blockchain technology also offers potential for more secure and transparent cross-border transactions, a key area for Corpay's operations.

Corpay, as a financial payment solutions provider, faces significant risks from evolving cyber threats. The company must continually invest in advanced cybersecurity measures to protect its infrastructure and client data from increasingly sophisticated attacks. In 2024, global spending on cybersecurity solutions is projected to reach over $200 billion, highlighting the scale of this challenge.

The integrity of financial transactions and the protection of sensitive customer information are critical for Corpay's operations. A breach could lead to substantial financial losses, regulatory penalties, and severe damage to its reputation, impacting customer trust and future business prospects.

Corpay's technological strength hinges on its integration capabilities, particularly its Application Programming Interfaces (APIs). The ability to seamlessly connect with existing enterprise resource planning (ERP) systems, accounting software, and other critical business applications is a significant differentiator. This allows businesses to embed Corpay's payment solutions directly into their daily operations.

Corpay's success is directly tied to offering flexible, API-driven solutions. This approach empowers businesses to easily incorporate payment services into their current workflows, enhancing user experience and broadening market reach. For instance, by Q1 2025, Corpay reported a 15% increase in new client integrations facilitated by its robust API offerings.

Cloud Computing and Scalability

Corpay's strategic use of cloud computing is a significant technological enabler, allowing for unparalleled scalability. This means they can seamlessly serve businesses ranging from small startups to massive corporations, adapting their service levels instantly to meet demand. By leveraging cloud infrastructure, Corpay effectively reduces the IT burden for their clients, offering a more cost-effective and agile solution.

The benefits extend to faster service deployment and continuous improvement. Cloud technology allows Corpay to roll out new features and updates rapidly, ensuring clients always have access to the latest capabilities. This agility is crucial for maintaining a competitive edge and supporting a global clientele with diverse and evolving needs.

In 2024, the global cloud computing market was valued at over $600 billion, with significant growth projected. This trend underscores the importance of cloud adoption for companies like Corpay, who rely on it for:

- Enhanced Scalability: Ability to handle fluctuating transaction volumes and client growth without significant infrastructure investment.

- Reduced Client IT Overhead: Offering accessible, subscription-based services that minimize client-side hardware and maintenance costs.

- Agile Service Delivery: Facilitating rapid deployment of new payment solutions and continuous feature updates for a dynamic market.

- Global Accessibility: Ensuring reliable and consistent service delivery across different geographical regions for their international customer base.

Automation and Artificial Intelligence

The relentless pursuit of efficiency and cost savings within financial operations is a major catalyst for adopting advanced automation and AI. Businesses are increasingly looking for ways to streamline their back-office functions, and technology offers a clear path forward.

Corpay is well-positioned to capitalize on this trend by integrating AI and machine learning into its service offerings. These capabilities can transform critical areas like intelligent invoice processing, where AI can automatically extract data and verify information, significantly reducing manual effort. Furthermore, AI excels at sophisticated expense categorization, ensuring accuracy and compliance. Fraud detection is another area where AI's pattern recognition abilities can identify anomalies that might escape human review, protecting businesses from financial losses. Predictive analytics powered by AI can also offer valuable insights into spending trends and cash flow, enabling better financial planning.

The impact of these technologies is substantial. For instance, studies indicate that companies leveraging AI in accounts payable can see a reduction in processing costs by as much as 50%. Gartner predicted in 2024 that AI adoption would continue to accelerate across finance departments, with a focus on automating repetitive tasks. This automation not only speeds up processes but also minimizes human error, leading to more reliable financial data and improved decision-making for businesses.

Key benefits for Corpay's clients include:

- Accelerated invoice processing times, with some AI solutions reducing processing cycles by up to 70%.

- Enhanced accuracy in expense reporting, minimizing compliance risks and audit exceptions.

- Improved fraud detection rates, with AI systems identifying potentially fraudulent transactions with greater precision than traditional methods.

- Deeper financial insights through predictive analytics, enabling more strategic resource allocation and forecasting.

Technological advancements are fundamentally reshaping payment processing, with real-time payments and AI driving significant operational efficiencies. Corpay's integration of these technologies, particularly through robust APIs, enhances its ability to connect with client systems, a key factor in its 2025 growth strategy. The company's reliance on cloud computing further bolsters its scalability and service delivery capabilities, crucial in the rapidly expanding global cloud market valued at over $600 billion in 2024.

Corpay's strategic adoption of AI and automation is transforming financial operations, with AI-powered invoice processing alone capable of reducing costs by up to 50%. This focus on automation, predicted by Gartner in 2024 to accelerate in finance departments, minimizes errors and improves data reliability. Key client benefits include accelerated processing times, enhanced accuracy, and improved fraud detection rates, underscoring the tangible value of these technological investments.

| Technology Area | Market Context (2024/2025 Data) | Corpay's Strategic Advantage |

|---|---|---|

| Real-Time Payments | Global market projected to reach $38.6 billion by 2030 (from $12.7 billion in 2023) | Improves transaction speed and customer experience. |

| AI & Machine Learning | AI adoption accelerating in finance departments (Gartner, 2024) | Enhances fraud detection, intelligent invoice processing, and predictive analytics. |

| Cloud Computing | Global market valued over $600 billion (2024) | Provides scalability, agile service delivery, and reduced client IT overhead. |

| APIs | 15% increase in client integrations via APIs (Q1 2025) | Facilitates seamless integration with client ERP and accounting systems. |

Legal factors

Corpay navigates a complex web of global financial services regulations, demanding strict adherence to licensing, operational standards, and oversight from bodies like the Financial Conduct Authority (FCA) in the UK and the Securities and Exchange Commission (SEC) in the US. Failure to comply with these varied rules, which can differ substantially by jurisdiction, directly impacts Corpay's capacity to provide its payment and cross-border services. For instance, in 2024, the European Union's Payment Services Directive 3 (PSD3) continues to shape operational requirements for payment providers across member states, underscoring the need for ongoing regulatory adaptation.

Corpay operates within a stringent legal landscape, particularly concerning Anti-Money Laundering (AML) and Know Your Customer (KYC) laws. These regulations are critical for financial institutions to prevent illicit financial activities, with global efforts intensifying. For instance, the Financial Action Task Force (FATF) continues to update its recommendations, impacting how companies like Corpay must verify customer identities and monitor transactions.

Implementing robust AML and KYC procedures is non-negotiable for Corpay. This involves thorough client due diligence, ongoing transaction monitoring for suspicious patterns, and timely reporting to regulatory authorities. Failure to comply can result in significant penalties, as seen in various enforcement actions against financial firms globally.

The evolving nature of these legal frameworks necessitates continuous adaptation and investment in compliance technology. Corpay's commitment to adhering to these complex and dynamic laws is fundamental to its operational integrity and its ability to operate within the global financial system, thereby mitigating risks associated with financial crime.

Corpay must navigate a complex web of data privacy and security laws, extending beyond general data protection to encompass specific financial data regulations. Frameworks like the Payment Card Industry Data Security Standard (PCI DSS) are critical for handling card payments securely. Furthermore, national data residency requirements mandate where sensitive financial information can be stored and processed, impacting Corpay's global operations.

Compliance with these stringent standards is paramount. Failure to protect sensitive financial information can lead to severe legal repercussions, including substantial fines. For instance, under GDPR, non-compliance can result in penalties of up to 4% of annual global turnover or €20 million, whichever is higher. Beyond financial penalties, such breaches can cause significant reputational damage, eroding customer trust and impacting business relationships.

Consumer Protection Laws

While Corpay primarily focuses on business-to-business transactions, its corporate payment card services can still be influenced by regulations designed to protect commercial clients. These protections often mirror consumer safeguards, emphasizing fair practices and transparency. For instance, clear terms and conditions for corporate cards, including fee structures and liability limits, are essential. Dispute resolution processes must also be robust and accessible to business users, ensuring trust and operational continuity. As of early 2024, regulatory bodies continue to scrutinize payment service providers for adherence to these principles, particularly concerning data privacy and fraud prevention in commercial transactions.

Key legal considerations for Corpay include:

- Compliance with Business-to-Business Payment Regulations: Adhering to directives that govern commercial transactions, ensuring fair dealing and preventing predatory practices.

- Data Privacy and Security Laws: Protecting sensitive business financial data in line with regulations like GDPR or CCPA, which are increasingly relevant even for B2B services.

- Contractual Law and Dispute Resolution: Maintaining legally sound agreements with clients and providing clear, efficient mechanisms for resolving any payment-related disputes.

- Anti-Money Laundering (AML) and Know Your Customer (KYC) Requirements: Implementing stringent checks to prevent financial crime and maintain regulatory compliance in all payment processing activities.

Intellectual Property Rights

Protecting Corpay's proprietary software, payment algorithms, and business processes through patents, trademarks, and copyrights is essential for maintaining its competitive edge. For instance, as of early 2024, the global software market continues to see significant investment in IP protection, with companies dedicating substantial resources to secure their innovations. Corpay's legal strategy must ensure these assets are safeguarded.

Conversely, Corpay must also maintain rigorous vigilance to ensure its operations do not infringe upon the intellectual property rights of other companies. The increasing complexity of financial technology means a higher risk of unintentional infringement. Legal counsel plays a critical role in navigating these potential pitfalls, especially as new payment technologies emerge and existing ones evolve.

Legal frameworks surrounding intellectual property are constantly adapting to technological advancements. Corpay's proactive approach to understanding and complying with these evolving regulations is vital for its sustained innovation and market position. This includes monitoring changes in patent law and copyright protections globally, particularly in key operating regions.

- Patent Protection: Securing patents for unique payment processing technologies and software functionalities safeguards Corpay's core innovations.

- Trademark Safeguarding: Protecting Corpay's brand name and logos through trademarks prevents brand dilution and ensures customer trust.

- Copyright Compliance: Ensuring all software code and proprietary content are protected by copyright, while also verifying that no third-party copyrighted material is used without authorization.

- IP Due Diligence: Conducting thorough due diligence on any acquired technologies or partnerships to avoid potential IP infringement claims.

Corpay's legal obligations extend to compliance with various international and national laws governing financial transactions and data handling. These include stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, crucial for preventing illicit financial activities. Failure to adhere to these, as well as data privacy laws like GDPR, can result in substantial fines, potentially up to 4% of global annual turnover.

Environmental factors

Businesses are increasingly expected to show strong corporate social responsibility, particularly concerning environmental stewardship. In 2024, a significant majority of consumers indicated they are more likely to purchase from brands that demonstrate a commitment to sustainability, with some reports suggesting over 70% consider it a key factor in their purchasing decisions.

While Corpay's core operations are digital, clients are increasingly seeking partners who align with their own corporate social responsibility objectives. This trend is amplified as companies aim to meet their own Environmental, Social, and Governance (ESG) targets, often scrutinizing their supply chains and vendor practices.

Corpay can effectively contribute to these expectations by actively promoting paperless transactions, a move that directly reduces paper waste and its associated environmental impact. Furthermore, demonstrating efficient energy usage within its data centers, a critical component of its digital infrastructure, can significantly enhance its appeal to environmentally conscious clients and investors alike.

There's a significant and accelerating shift towards sustainable business practices across industries. Consumers and business partners increasingly favor companies demonstrating environmental responsibility, influencing purchasing and partnership decisions. This trend is driven by growing awareness of climate change and resource scarcity, pushing businesses to re-evaluate their environmental footprint.

Corpay's digital payment solutions directly contribute to this demand by facilitating paperless transactions. This inherently reduces paper waste, a tangible environmental benefit that resonates with sustainability-focused clients. For instance, in 2023, businesses globally processed trillions of dollars through digital payment platforms, a substantial portion of which could have otherwise involved paper checks, highlighting the scale of potential waste reduction.

By emphasizing its role in enabling eco-friendly operations, Corpay can gain a competitive edge. This is particularly true when partnering with sectors like retail, manufacturing, and logistics, which often have ambitious sustainability targets and are actively seeking vendors that align with their environmental, social, and governance (ESG) goals. Companies are increasingly scrutinizing their supply chains for sustainability, making digital payment providers like Corpay valuable allies.

Governments worldwide are increasingly implementing regulations to foster environmental sustainability. While these measures might not directly target digital payment processors like Corpay as intensely as they do heavy industries, the indirect effects are notable. For instance, a growing emphasis on energy efficiency within data centers, a core component of Corpay's operations, is becoming a significant consideration.

Furthermore, the push for greater corporate transparency regarding environmental footprints means companies like Corpay may face increasing demands for reporting on their sustainability metrics. This could involve detailing energy consumption, waste management, and carbon emissions associated with their digital infrastructure and business practices, potentially influencing operational strategies and reporting requirements in the coming years.

Climate Change Impact on Supply Chains

Climate change poses a significant indirect risk to Corpay through its client base. Industries like transportation and logistics, which rely heavily on Corpay's fleet payment solutions, are directly vulnerable to extreme weather events that can disrupt operations and fuel supply. For instance, in 2024, severe weather events across North America led to widespread transportation delays, impacting delivery schedules and increasing operational costs for many fleet operators. This can translate into reduced transaction volumes for Corpay.

Corpay's travel payment services also face indirect impacts. Increased frequency of natural disasters can affect business travel patterns, potentially leading to cancellations or shifts in travel plans. The economic fallout from climate-related events can also dampen corporate spending on travel. Understanding the climate resilience of its diverse client portfolio is crucial for Corpay to anticipate potential fluctuations in service demand.

- Supply Chain Disruptions: Extreme weather events in 2024, such as hurricanes and floods, caused an estimated $100 billion in economic losses in the US alone, disrupting transportation networks vital for Corpay’s fleet clients.

- Impact on Travel: A 2025 report indicated that climate-related travel disruptions could cost the global tourism industry billions, potentially affecting Corpay’s travel payment volumes.

- Client Resilience: Corpay’s analysis of client sectors should assess their exposure to climate risks and their ability to maintain operational continuity, which directly influences demand for Corpay’s financial services.

Resource Scarcity and Energy Consumption

Corpay's digital operations, while efficient, still necessitate substantial energy for data centers and IT infrastructure. As global awareness of resource scarcity and technology's carbon footprint escalates, Corpay may face increased scrutiny regarding its environmental impact. For instance, the global IT sector's energy consumption is projected to reach 6% of total electricity use by 2025, a figure that underscores the importance of sustainable practices.

To mitigate these environmental concerns and bolster its sustainability profile, Corpay can focus on optimizing energy efficiency across its operations. Furthermore, exploring and adopting renewable energy sources for its data centers and offices presents a significant opportunity. Companies that prioritize these initiatives are increasingly seen as more resilient and attractive investments, reflecting a growing market demand for environmentally conscious businesses.

- Energy Consumption: Digital infrastructure, including data centers, requires significant power, contributing to the overall energy footprint.

- Resource Scarcity Awareness: Growing global concern over limited natural resources can lead to increased pressure on technology companies to demonstrate responsible resource management.

- Sustainability Initiatives: Corpay's investment in energy efficiency and renewable energy sources can enhance its environmental credentials and long-term operational viability.

- Market Perception: Demonstrating a commitment to sustainability can positively influence investor and customer perception, aligning with broader market trends favoring ESG (Environmental, Social, and Governance) principles.

Businesses increasingly prioritize environmental responsibility, with a significant portion of consumers favoring sustainable brands. Corpay's digital payment solutions directly support this trend by reducing paper waste through paperless transactions, a move that resonated with over 70% of consumers who consider sustainability in 2024 purchasing decisions.

Corpay's digital infrastructure, while efficient, requires energy for data centers. As global awareness of technology's carbon footprint grows, optimizing energy use and exploring renewable sources for its operations is crucial. This aligns with market trends favoring environmentally conscious businesses, potentially attracting investors and clients focused on ESG principles.

Climate change poses indirect risks to Corpay's client base. For instance, extreme weather events in 2024 disrupted transportation for fleet operators, impacting Corpay's transaction volumes. Similarly, climate-related travel disruptions could affect Corpay’s travel payment services, highlighting the need to assess client resilience to climate risks.

PESTLE Analysis Data Sources

Our Corpay PESTLE Analysis is built on a robust foundation of data, drawing from official government publications, reputable financial institutions, and leading market research firms. We meticulously gather insights on political stability, economic indicators, social trends, technological advancements, environmental regulations, and legal frameworks to ensure comprehensive and accurate analysis.