Corpay Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Corpay Bundle

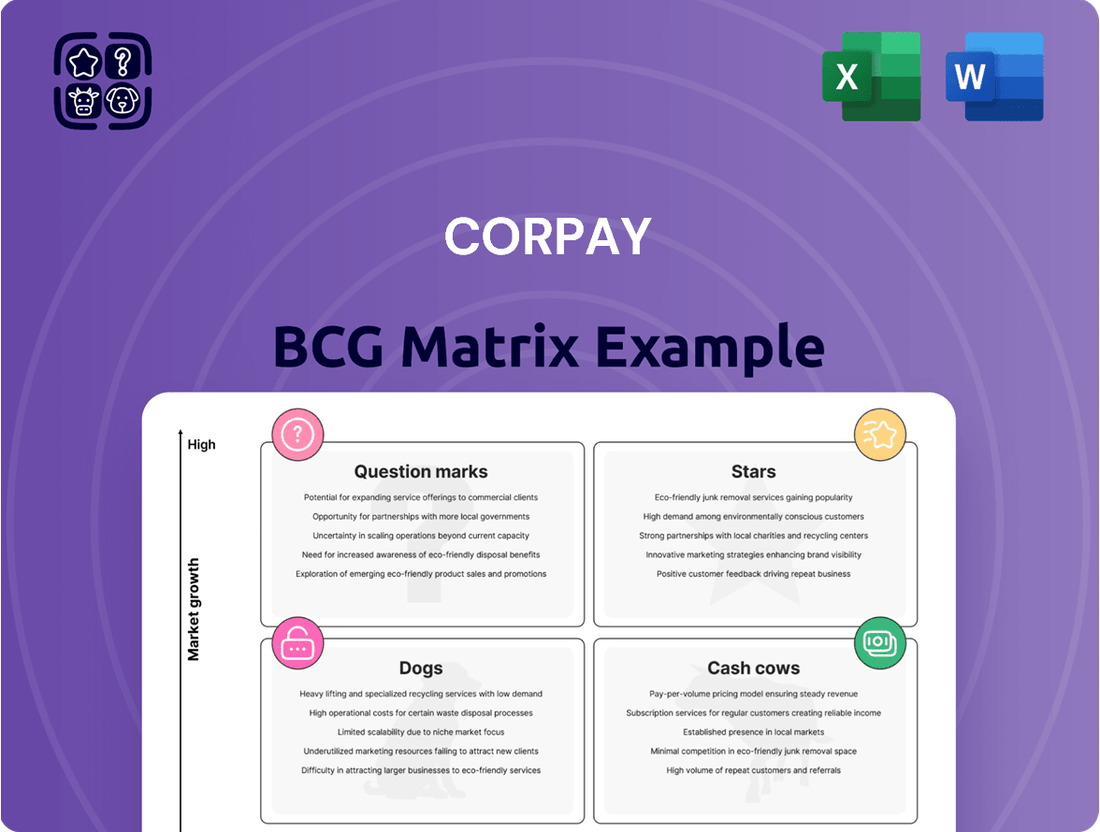

Unlock the strategic potential of Corpay's product portfolio with our comprehensive BCG Matrix analysis. Understand which offerings are driving growth and which require a closer look to optimize your investment strategy.

This preview offers a glimpse into Corpay's market position, but the full BCG Matrix delivers a detailed breakdown of Stars, Cash Cows, Dogs, and Question Marks, along with actionable insights for each quadrant.

Elevate your decision-making by purchasing the complete Corpay BCG Matrix. Gain a clear roadmap to capitalize on market leaders and strategically manage underperformers for maximum business impact.

Stars

Corpay's Corporate Payments segment shines as a Star in its BCG Matrix. This segment achieved a remarkable 19% organic revenue growth in the first quarter of fiscal year 2025, building on a strong full-year 2024 performance of 26% growth.

The impressive growth is fueled by a surging demand for Corpay's accounts payable automation and international payment solutions. The company's strategic approach, including key acquisitions and partnerships, has effectively cemented its high market share within this dynamic and expanding sector.

Cross-border payment solutions represent a significant growth area within Corpay's Corporate Payments division. Revenue saw a robust 20% increase year-over-year in both Q4 2024 and the full fiscal year 2024, with sales experiencing a substantial 43% surge in Q4 2024.

Corpay's strategic acquisition of Alpha Group in July 2025 for $2.2 billion is poised to further bolster this segment. This move is expected to contribute an additional $2 billion to the corporate payments revenue next year, significantly enhancing Corpay's presence in the B2B foreign exchange and investment funds markets.

The Accounts Payable (AP) automation software market is booming, with Corpay making significant strategic moves to capture a larger slice of this expanding pie. Its acquisition of Paymerang in May 2024 and the planned $500 million investment in AvidXchange are clear indicators of its aggressive growth strategy.

These acquisitions bolster Corpay's ability to offer comprehensive solutions for invoice processing and expense management, appealing to a wide business spectrum. The company’s focus on integrated, end-to-end platforms signals strong potential for continued market penetration and increased revenue streams.

Strategic Partnerships (e.g., Mastercard)

Corpay's strategic partnership with Mastercard, announced in late 2023, is a significant move that positions the company favorably within the BCG matrix. This collaboration involves a substantial $300 million investment from Mastercard and designates Corpay as the exclusive provider of commercial cross-border payment services for Mastercard's bank clients.

This alliance is designed to capitalize on high-growth opportunities by leveraging Mastercard's vast global network. The aim is to significantly expand Corpay's market reach and share within the commercial payments sector, a key driver for its growth trajectory.

- Mastercard's $300 million investment underscores the strategic importance of this partnership.

- Exclusive provider status for Mastercard's bank clients grants Corpay access to a substantial customer base.

- Leveraging Mastercard's network is expected to drive significant expansion in Corpay's cross-border payment services.

- This collaboration is a prime example of how strategic alliances can accelerate growth in competitive markets.

Global Expansion of Corporate Payments

Corpay is strategically broadening its corporate payments offerings beyond the United States, with a notable example being the introduction of Corpay Complete in the United Kingdom in July 2025. This move is designed to cater to mid-to-large businesses aiming for consolidated financial operations in expanding international markets.

The company's intensified focus on regional penetration and its ambition to compete with established banks for commercial clients underscore a significant push to capture greater market share in these burgeoning economic zones.

- Global Reach: Corpay's expansion into markets like the UK signifies a commitment to serving a wider international client base.

- Target Market: The focus on mid-to-large enterprises highlights a strategy to address the needs of businesses with complex financial workflows.

- Competitive Landscape: By challenging traditional banking institutions, Corpay aims to offer specialized, integrated payment solutions.

- Market Share Growth: This international push is a key driver for increasing Corpay's overall presence and revenue in high-growth regions.

Corpay's Corporate Payments segment is a clear Star, exhibiting robust growth driven by strong demand for its AP automation and international payment solutions. The segment saw 19% organic revenue growth in Q1 FY2025, following a remarkable 26% in FY2024.

Key acquisitions like Paymerang and strategic partnerships, such as the one with Mastercard, are fueling this upward trajectory. The latter, involving a $300 million Mastercard investment, positions Corpay as an exclusive provider of commercial cross-border payment services for Mastercard's bank clients, significantly expanding its market reach.

Corpay's expansion into new markets, like the UK with Corpay Complete in July 2025, further solidifies its Star status. This global push targets mid-to-large businesses and aims to capture market share from traditional banking institutions.

| Metric | FY2024 | Q1 FY2025 | Key Drivers |

|---|---|---|---|

| Corporate Payments Organic Revenue Growth | 26% | 19% | AP Automation, International Payments |

| Cross-Border Payment Revenue Growth | 20% (FY24 & Q4) | N/A | Strong demand, strategic partnerships |

| Alpha Group Acquisition (July 2025) | N/A | N/A | $2.2B, expected $2B revenue contribution |

What is included in the product

The Corpay BCG Matrix analyzes business units based on market share and growth, guiding investment decisions.

Corpay BCG Matrix: a clear, visual tool to identify strategic growth opportunities and resource allocation pain points.

Cash Cows

Corpay's established fleet card programs, including brands like Fuelman and Comdata, are strong cash cows. These programs boast a high market share in a mature segment. Despite a 1% revenue dip in the Vehicle Payments segment in Q1 2025, attributed to economic factors like fuel prices, these core offerings continue to be reliable revenue generators and cash flow producers.

Corpay's core vehicle payments infrastructure, encompassing toll and maintenance services, represents a classic cash cow. This segment benefits from a robust and widely adopted network, consistently generating significant cash flow even amidst market challenges. In 2023, Corpay reported that its Fleet Solutions segment, heavily reliant on this infrastructure, saw revenue growth, underscoring its stability.

Corpay's managed lodging programs, like CLC Lodging and TA Connections, serve a crucial niche by providing streamlined accommodation solutions for businesses, particularly for workforce travel and airline crews. These services operate within a mature and steady market, indicating a stable demand for their specialized offerings.

Despite a slight 1% revenue decrease in Lodging Payments during Q1 2025, attributed to ongoing pricing pressures, these segments continue to be a dependable source of cash flow for Corpay. The strategy here is centered on nurturing existing client partnerships and optimizing operational processes to ensure consistent financial contribution.

Large, Mature Client Base Across Segments

Corpay's extensive reach, serving over 800,000 business clients worldwide, establishes a robust and mature customer base. This broad adoption across diverse market segments, from fleet management to corporate payments, ensures a steady stream of recurring revenue.

The company's deep-rooted relationships in sectors like lodging and established corporate payments contribute significantly to its consistent cash flow. These established partnerships minimize the need for high customer acquisition costs, further solidifying their position as a cash cow.

- Global Client Reach: Exceeding 800,000 business clients.

- Recurring Revenue: Driven by long-term client relationships.

- Low Acquisition Costs: Benefiting from established presence in key industries.

- Industry Diversification: Including fleet, lodging, and corporate payments.

Proprietary Payment Network and Technology

Corpay's proprietary payment network and technology represent a significant cash cow. This deeply entrenched infrastructure, built over years, provides a robust competitive moat. Its operational efficiencies and scale allow for high profit margins across its diverse payment solutions.

The continuous refinement of this network translates directly into substantial cash generation. Corpay can achieve this high cash flow while maintaining controlled reinvestment, ensuring sustained profitability. For instance, in the first quarter of 2024, Corpay reported a revenue of $784.9 million, a notable increase driven by its payment solutions.

- Proprietary Network: Corpay's established payment infrastructure offers a distinct competitive edge.

- Operational Efficiencies: Scale and optimization of the network lead to high profit margins.

- Cash Generation: The technology facilitates strong, consistent cash flow with manageable reinvestment needs.

- Q1 2024 Performance: Revenue reached $784.9 million, underscoring the strength of its payment segment.

Corpay's established fleet card programs, like Fuelman and Comdata, are prime examples of cash cows. These programs dominate a mature market segment, consistently generating substantial cash flow. Despite minor revenue fluctuations in broader segments due to economic conditions, these core offerings remain stable revenue engines.

The company's managed lodging solutions, including CLC Lodging and TA Connections, also function as cash cows. Operating in a steady market, they provide essential services for workforce and airline travel, ensuring a reliable income stream. Even with slight revenue dips in Q1 2025 due to pricing pressures, these segments continue to be dependable cash generators.

| Corpay Cash Cow Segments | Market Position | Revenue Contribution (Illustrative) | Key Strengths |

|---|---|---|---|

| Fleet Card Programs (Fuelman, Comdata) | High Market Share (Mature Segment) | Consistent, High Cash Flow | Established Brand, Wide Adoption |

| Vehicle Payments Infrastructure (Tolls, Maintenance) | Robust Network, Widely Adopted | Significant Cash Flow Generation | Strong Infrastructure, Market Stability |

| Managed Lodging Programs (CLC Lodging, TA Connections) | Niche Market Dominance | Dependable Cash Flow | Streamlined Solutions, Steady Demand |

Full Transparency, Always

Corpay BCG Matrix

The Corpay BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately upon purchase. This means no watermarks, no demo content, and no hidden surprises – just the complete, analysis-ready report designed for strategic decision-making.

Dogs

Corpay's divestiture of its Comdata Merchant POS Solutions business to PDI Technologies in December 2024 signals a strategic move to streamline operations and concentrate on its core competencies. This action suggests the Comdata unit likely occupied a low-growth, low-market-share position within Corpay's portfolio, making it a candidate for divestiture according to the BCG matrix.

The sale of Comdata Merchant POS Solutions aligns with the BCG matrix's recommendation for assets in the "Dogs" quadrant. These are businesses with low market share and low growth prospects, often characterized by declining demand or intense competition, where continued investment may not yield significant returns. Corpay's decision to exit this segment reflects a prioritization of capital and resources towards more promising ventures.

Corpay's 'Other' segment, encompassing its legacy gift and payroll card offerings, has seen a substantial downturn. In the first quarter of 2025, revenue within this segment plummeted by 14%. Furthermore, the revenue generated per transaction experienced an even steeper decline of 23%.

This sharp contraction in performance strongly suggests that these legacy products are operating in markets with minimal growth potential. Their declining revenue per transaction further indicates a likely low market share, positioning them as potential cash traps within Corpay's portfolio.

Corpay's strategic review in 2025 includes the potential divestiture of 2-3 non-core vehicle payment units. These segments, likely those with lower growth prospects or a less direct alignment with Corpay's core corporate payments business, are being considered for sale. This move is designed to streamline operations and reallocate resources towards more promising areas.

Underperforming Regional/Niche Fuel Card Programs

Underperforming regional or niche fuel card programs can be categorized as Dogs within the Corpay BCG Matrix. These segments, while part of a larger, successful fleet card business, are not generating sufficient returns or growth. For example, a specific regional program that has seen its market share erode due to intense local competition or shifts in local fuel purchasing habits might fit this description.

Corpay's strategic adjustments in 2022, particularly the pivot away from small micro accounts in North American fleet fuel sales due to disappointing performance, highlight potential candidates for this category. These smaller, less profitable accounts, or older program structures that haven't adapted to changing market needs, represent areas of low growth and low market share.

- Low Market Share: These programs struggle to capture a significant portion of their target regional or niche market.

- Low Growth: The market segment itself may be stagnant or declining, limiting expansion opportunities.

- Strategic Divestment Potential: Corpay might consider divesting or restructuring these underperforming assets to reallocate resources.

- Example Scenario: A fuel card program focused on a specific industrial niche that has been disrupted by new technologies or alternative fuel sources could be a prime example.

Outdated Technology Platforms Not Integrated into Core Offerings

Legacy technology platforms that are not integrated into Corpay's core cloud-based offerings represent a significant challenge. These isolated solutions often come with high maintenance costs, as seen in the broader fintech industry where maintaining older systems can consume a substantial portion of IT budgets, sometimes exceeding 50% for critical legacy systems. Without significant client adoption or growth, these platforms become resource drains, diverting funds and attention from more strategic, growth-oriented initiatives. For instance, a 2024 report by Gartner indicated that companies spend an average of $1.5 million annually on maintaining legacy IT systems.

These outdated systems can hinder innovation and create operational inefficiencies. If Corpay has platforms with declining user engagement or minimal contribution to new revenue streams, they would fall into this category. Such assets require careful evaluation for potential divestiture or a substantial overhaul to align with the company's future direction. The risk is that they continue to consume resources without delivering commensurate value, impacting overall profitability and competitive positioning.

- High Maintenance Costs: Legacy systems often incur disproportionately high costs for upkeep and support compared to modern, integrated solutions.

- Low Client Adoption/Growth: Platforms with minimal new user acquisition or declining active usage are prime candidates for re-evaluation.

- Resource Drain: These technologies consume valuable financial and human resources that could be allocated to more promising areas.

- Strategic Distraction: Maintaining outdated platforms can divert management focus from core business growth and innovation.

Corpay's "Dogs" likely represent business units with low market share and low growth, such as the legacy gift and payroll card offerings. The significant revenue decline of 14% in Corpay's 'Other' segment during Q1 2025, coupled with a 23% drop in revenue per transaction, strongly indicates these legacy products operate in stagnant markets and have minimal market share.

These underperforming segments, including potentially specific regional fuel card programs or older, non-integrated technology platforms, are candidates for divestiture or restructuring. Corpay's strategic review in 2025, which includes considering the sale of 2-3 non-core vehicle payment units, further supports this classification. Such assets often incur high maintenance costs and can divert resources from more promising growth areas.

The divestiture of the Comdata Merchant POS Solutions business in December 2024 also aligns with the BCG matrix's approach to "Dogs." This move suggests the unit had low growth and low market share, making it a strategic decision to exit and focus capital on core competencies.

Corpay's pivot away from small micro accounts in North American fleet fuel sales in 2022 also points to areas that may have become "Dogs." These less profitable accounts or outdated program structures struggle with low growth and market share.

Question Marks

Newly acquired companies like GPS Capital Markets and Paymerang, while strategically positioned to become Stars in Corpay's portfolio, are currently in their nascent integration stages. This means they are functioning more like Question Marks, demanding substantial investment to unlock their full potential and achieve anticipated synergies.

Corpay is channeling significant resources into these integrations, with a clear objective: to achieve over $200 million in revenue and $0.50 EPS accretion by 2025 from these specific deals. This substantial investment underscores the belief in their future Star status, but the immediate returns remain uncertain until full integration and market share expansion are realized.

Corpay is strategically targeting digital currency providers as a new client segment, recognizing this as a burgeoning, high-potential market. While the future outlook is promising, Corpay's current penetration within this specific niche is likely minimal, placing these clients in the 'Question Mark' category of the BCG matrix.

Significant investment in developing specialized solutions and aggressive market outreach will be crucial to transform these nascent relationships into 'Stars.' For instance, the global digital currency market is projected to reach over $5 trillion by 2030, indicating substantial growth opportunities for payment providers that can cater to its unique needs.

Corpay's Complete UK launch in July 2025 positions it within a burgeoning market for unified financial management tools. The UK's demand for both accounts payable (AP) automation and streamlined cross-border payments is significant, with the AP automation market alone projected to reach approximately $1.5 billion by 2027, growing at a CAGR of over 10%.

Corpay's current market share for its integrated platform in the UK is nascent, necessitating a focused strategy to capture this opportunity. This venture is a strategic investment, anticipating substantial marketing spend and dedicated adoption initiatives to establish a strong foothold against established competitors, many of whom have already seen double-digit growth in their UK operations within the fintech sector.

Emerging AI-Powered Solutions and SaaS Investments

Corpay is actively investing in artificial intelligence, both to streamline its own operations and to develop more advanced solutions for its customers. This strategic focus places emerging AI-powered technologies within the Corpay BCG Matrix. Specifically, these investments are positioned as Question Marks, reflecting their high-growth potential in a rapidly evolving technological landscape, yet with market adoption and revenue generation still needing to be firmly established.

The increasing expense of Software as a Service (SaaS) solutions adds another layer to this strategic consideration. Corpay must carefully weigh how much to allocate to AI development amidst these rising SaaS costs. This dynamic highlights the uncertainty surrounding the exact market penetration and financial returns these nascent AI technologies will ultimately deliver.

- High Growth Potential: AI technologies are in a sector experiencing rapid advancement and adoption across industries.

- Unproven Market Adoption: While promising, the specific success and widespread uptake of Corpay's AI solutions are yet to be fully demonstrated.

- Revenue Contribution Uncertainty: The direct financial impact and revenue generation capabilities of these AI investments are still being quantified.

- Strategic Investment Dilemma: Balancing AI investment against rising SaaS costs presents a key strategic decision for Corpay.

Specific Niche Verticals within Corporate Payments

Corpay's strategic push into niche verticals like real estate and Homeowners Associations (HOAs), notably through acquisitions such as AvidXchange, signifies a move beyond its traditional mid-market focus. While these sectors represent substantial growth opportunities, Corpay's initial market share within these specific segments is likely to be modest, demanding focused investment to establish leadership.

These new areas, while promising, require tailored strategies to penetrate effectively. For instance, the real estate sector's payment complexities, involving escrow, property management fees, and tenant payments, differ significantly from general corporate payables. Similarly, HOAs have unique needs related to dues collection, vendor payments for maintenance, and member communication, all of which necessitate specialized solutions.

- Real Estate Payments: This vertical involves managing diverse payment flows, from rent collection and security deposits to property management fees and vendor disbursements. Corpay's expansion here aims to streamline these often fragmented processes for property managers and owners.

- HOA Payments: Homeowners Associations require efficient systems for collecting dues, paying contractors for landscaping or repairs, and managing budgets. Corpay's entry targets the simplification of these administrative burdens for HOA boards and management companies.

- Market Penetration Strategy: Gaining traction in these specialized verticals will likely involve building out dedicated sales teams with industry expertise and developing payment solutions that directly address the unique pain points of real estate firms and HOAs.

- Growth Potential: The addressable market for corporate payments within real estate and HOAs is considerable, offering Corpay a significant runway for growth as it deepens its penetration and expands its service offerings in these targeted niches.

Question Marks in Corpay's portfolio represent areas with high growth potential but uncertain market share and revenue. These are typically new ventures or emerging technologies that require significant investment to develop and capture market share.

Corpay's investment in AI technologies and its expansion into niche verticals like real estate and HOAs exemplify this category. The company is channeling resources into these segments, anticipating substantial future returns, but the immediate success and profitability are yet to be fully realized, making them classic Question Marks.

BCG Matrix Data Sources

Our BCG Matrix is constructed using a blend of primary and secondary data, including sales figures, market share data, industry growth rates, and competitor analysis to provide a comprehensive view.