Corpay Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Corpay Bundle

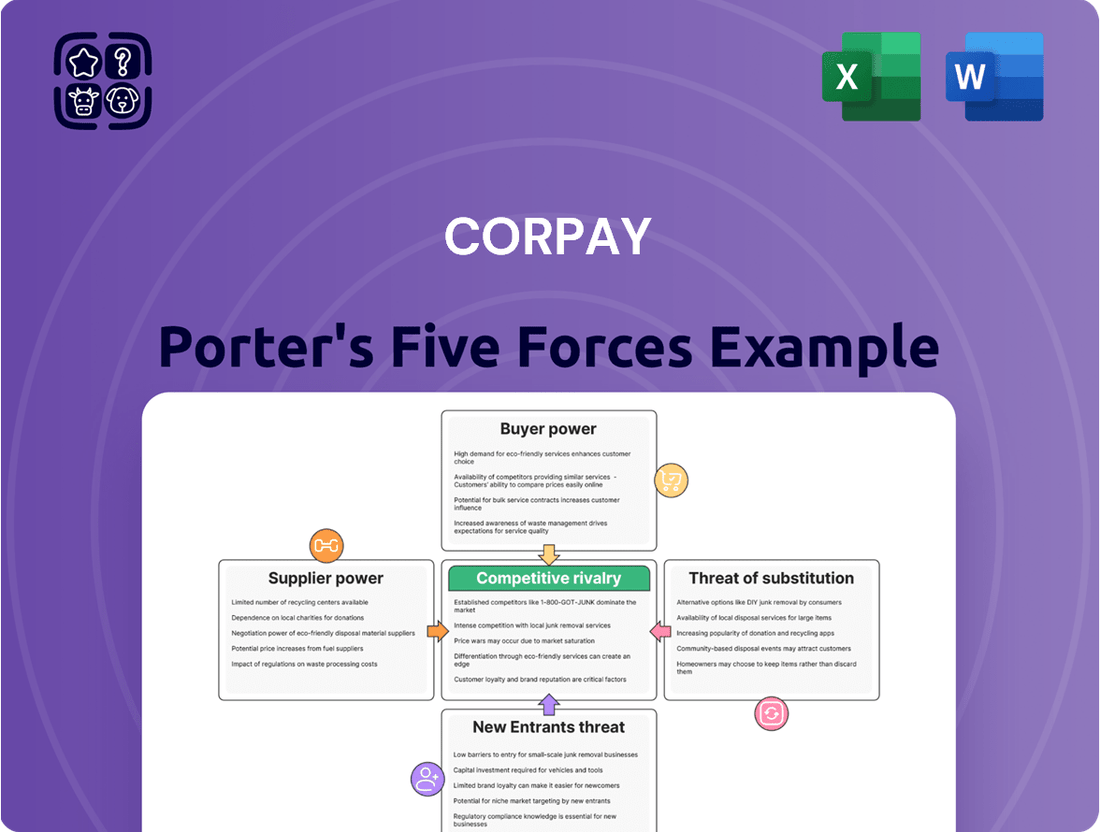

Corpay's competitive landscape is shaped by five key forces, revealing the intensity of rivalry, the power of buyers and suppliers, and the ever-present threats of new entrants and substitutes. Understanding these dynamics is crucial for any stakeholder looking to navigate this market effectively.

The complete report reveals the real forces shaping Corpay’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Corpay, a major player in payment processing, leverages a diverse array of technologies and platforms. The company's scale and strategic approach mean that no single technology provider possesses substantial leverage. Corpay can readily switch or integrate alternative solutions, effectively mitigating the bargaining power of any individual vendor. This built-in flexibility ensures Corpay maintains operational resilience and avoids over-dependence on a solitary technology partner.

Financial institution partnerships are vital for Corpay's payment processing and cross-border solutions. These collaborations, however, are generally balanced due to Corpay's significant transaction volumes and extensive client network, which offer substantial value to financial partners like banks and card networks.

For example, Mastercard's strategic investment in Corpay's cross-border operations and their exclusive partnership highlight a mutually beneficial arrangement. This symbiotic relationship helps to mitigate the suppliers' bargaining power, as Corpay's scale makes it an attractive and important partner for these institutions.

Corpay's access to capital and talent, while competitive, is not a significant barrier. The company's robust financial health, evidenced by nearly $4 billion in revenue for 2024 and a projected $1.5 billion in free cash flow for 2025, allows for strategic investments in both areas.

Data and analytics providers have moderate power

Data and analytics providers hold moderate power over Corpay. Corpay leverages these services for crucial expense tracking and client insights. While specialized data can be valuable, Corpay's ability to work with multiple vendors and its own internal data processing limits the influence of any single supplier.

Corpay's strategic focus on advanced foreign exchange (FX) tools and data for its clients indicates a dual approach: developing capabilities internally while also forming external partnerships. This internal development further moderates the bargaining power of external data providers.

- Corpay's reliance on data for expense management and client insights is significant.

- The availability of multiple data vendors and Corpay's internal processing capabilities limit supplier power.

- Corpay's investment in internal FX data tools suggests a strategy to reduce dependence on external providers.

- Overall, the bargaining power of data and analytics suppliers is assessed as moderate due to these mitigating factors.

Acquisition strategy mitigates supplier power in niche areas

Corpay's acquisition strategy directly addresses the bargaining power of suppliers, particularly in niche technology areas. By acquiring companies like Paymerang in 2024 and Alpha Group in 2025, Corpay integrates specialized accounts payable automation capabilities in-house. This vertical integration lessens dependence on third-party providers for these critical functions, thereby reducing supplier leverage.

This strategic move allows Corpay to gain greater control over its service offerings and costs. For instance, the 2024 acquisition of Paymerang, a significant player in AP automation, brought substantial expertise and client relationships under the Corpay umbrella. This integration is projected to streamline operations and potentially improve margins by internalizing processes previously outsourced.

The ongoing pursuit of acquisitions, such as the planned 2025 acquisition of Alpha Group, further solidifies this strategy. These moves are designed to build a comprehensive suite of financial automation tools, diminishing the need for external suppliers and consequently weakening their bargaining power within Corpay's operational ecosystem.

- Acquisition of Paymerang (2024): Bolstered in-house AP automation capabilities.

- Planned Acquisition of Alpha Group (2025): Further strengthens integrated service offerings.

- Strategic Impact: Reduces reliance on external suppliers, mitigating their bargaining power.

Corpay's bargaining power with its suppliers is generally low, meaning suppliers can exert significant influence. This is largely due to Corpay's reliance on specialized software and data providers, where switching costs can be high and unique offerings are scarce. For instance, the company's extensive use of third-party payment processing platforms and financial data feeds means that these providers hold considerable sway.

Corpay's significant transaction volumes, exceeding $100 billion annually, do provide some leverage, particularly with financial institutions. However, the specialized nature of many technology and data services means that Corpay often faces suppliers with strong market positions. The company's 2024 revenue of nearly $4 billion underscores its scale, but this doesn't always translate into dominant supplier negotiation power for essential, specialized inputs.

The company's strategy to mitigate this includes acquiring capabilities, as seen with the 2024 Paymerang acquisition, to bring certain functions in-house. However, for many core services, Corpay remains dependent on external entities, making supplier bargaining power a persistent factor.

| Supplier Type | Corpay's Reliance | Supplier Bargaining Power | Mitigation Strategy |

|---|---|---|---|

| Technology Providers (Software, Platforms) | High | High | Acquisitions, Internal Development |

| Data & Analytics Providers | Significant | Moderate to High | Multiple Vendors, Internal Processing |

| Financial Institutions (Banks, Networks) | Essential | Moderate | High Transaction Volumes, Client Network |

What is included in the product

Corpay's Porter's Five Forces analysis dissects the competitive intensity within its operating environment, examining threats from new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the rivalry among existing competitors.

Instantly visualize competitive intensity across all five forces, enabling rapid identification of key threats and opportunities.

Customers Bargaining Power

Corpay's integrated payment solutions, encompassing corporate cards, cross-border payments, and AP automation, create substantial switching costs for its clients. Businesses that embed these services deep within their financial workflows face considerable expense and operational hurdles if they consider a change. For instance, migrating vast amounts of historical payment data to a new system can be a complex and time-consuming undertaking. Furthermore, retraining staff on entirely new software and processes adds another layer of difficulty, potentially impacting operational efficiency during the transition. This integration makes customers less likely to switch, thereby increasing Corpay's bargaining power.

Corpay's diverse customer base significantly dilutes individual customer bargaining power. The company serves a wide array of businesses, from small enterprises to large corporations, operating in sectors like fleet management, travel, and healthcare. This broad reach ensures that no single client or cluster of clients represents a dominant portion of Corpay's revenue stream.

Corpay's core value proposition centers on enhancing operational efficiency and delivering substantial cost savings for its clients. By automating and streamlining complex financial processes, such as accounts payable and travel expense management, Corpay empowers businesses to reduce manual labor, minimize errors, and gain greater control over their spending. This direct impact on the bottom line, translating into tangible savings, significantly influences how customers perceive the value of Corpay's services.

The efficiency and cost-saving benefits offered by Corpay directly diminish the bargaining power of customers. When clients experience a clear and measurable return on investment through reduced operational costs and improved financial visibility, their focus shifts from aggressive price negotiation to maximizing the value derived from the service. For instance, businesses utilizing Corpay's solutions for cross-border payments can see significant reductions in transaction fees and foreign exchange costs, making the overall service fee a secondary consideration compared to the substantial savings achieved.

Standardization and ease of use enhance customer stickiness

Corpay's commitment to simplifying payments through intuitive platforms like Corpay Complete significantly bolsters customer loyalty. When solutions are straightforward to implement and manage, users experience greater satisfaction, making them less likely to seek out competitors, even when other options are available.

This ease of use directly translates into a reduced bargaining power for customers. By making their payment processes seamless, Corpay creates a "stickiness" that discourages customers from switching, even if they could find slightly different features elsewhere.

- Simplified Payment Processes: Corpay's focus on user-friendly interfaces reduces the friction associated with financial transactions.

- High Customer Satisfaction: Easy-to-use solutions lead to increased customer contentment, a key factor in retention.

- Reduced Propensity to Switch: When adoption and management are simple, customers are less inclined to explore alternative payment providers.

- Enhanced Customer Stickiness: Corpay's platforms create a strong incentive for customers to remain with the service due to its inherent ease of use.

Access to rebates and financial incentives creates loyalty

Corpay's provision of financial benefits, including substantial rebates, directly influences customer loyalty. In 2024, Corpay managed over $400 billion in payments and distributed more than $800 million in annual rebates. These incentives make switching to competitors less appealing due to the immediate cost savings and added value customers receive, thereby diminishing their bargaining power.

The financial incentives offered by Corpay act as a significant retention tool. By providing tangible economic advantages, such as the $800 million in rebates distributed in 2024, Corpay builds a strong cost-based relationship with its clients. This makes it more difficult for customers to justify the potential disruption and loss of benefits associated with seeking alternative payment solutions.

Corpay's strategy of offering rebates and financial incentives effectively locks in customers. With over $400 billion in payments processed and over $800 million in rebates paid out in 2024, the financial commitment to these incentives is substantial. This creates a sticky environment where the cost of switching outweighs the perceived benefits of alternative providers, thus reducing the customers' leverage.

- Customer Loyalty Through Financial Incentives: Corpay's distribution of over $800 million in annual rebates in 2024, on top of managing over $400 billion in payments, fosters significant customer loyalty.

- Reduced Bargaining Power: These substantial financial benefits make alternative solutions less attractive from a cost perspective, thereby lowering the bargaining power of customers.

- Cost-Benefit Analysis for Customers: The ongoing financial advantages provided by Corpay create a strong incentive for customers to remain with the service, as the cost savings from rebates outweigh the potential benefits of switching.

Corpay's ability to offer substantial financial benefits, such as the over $800 million in annual rebates distributed in 2024 on more than $400 billion in managed payments, significantly reduces customer bargaining power. These direct cost savings make switching to competitors financially disadvantageous for clients. The tangible economic value provided by Corpay creates a strong incentive for customers to remain loyal, as the perceived benefits of alternative solutions are diminished by the ongoing financial advantages they receive.

| Corpay's Financial Impact on Customer Bargaining Power | 2024 Data |

| Total Payments Managed | Over $400 billion |

| Annual Rebates Distributed | Over $800 million |

| Impact on Bargaining Power | Reduced; customers prioritize continued cost savings over price negotiation. |

Full Version Awaits

Corpay Porter's Five Forces Analysis

This preview showcases the complete Corpay Porter's Five Forces Analysis, offering a detailed examination of competitive forces impacting the company. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and immediate access to this professionally formatted strategic tool.

Rivalry Among Competitors

The business payments and accounts payable (AP) automation market is a bustling arena with a multitude of competitors. This includes established giants like PayPal, WEX, and Fiserv, alongside innovative fintech startups such as Tipalti, AvidXchange, SAP Concur, and Bill.com, all vying for market share.

This fragmentation, while offering choice, also signifies intense rivalry. For instance, Bill.com reported a 27% year-over-year increase in total revenue for their fiscal third quarter of 2024, reaching $304.4 million, demonstrating the growth potential and the aggressive pursuit of customers in this space.

Corpay, a global S&P 500 corporate payments company, reported revenues approaching $4 billion in 2024, underscoring its significant market presence. Its diversified business, encompassing vehicle payments, corporate payments, and lodging payments, provides a robust foundation against competitors.

The company's strategic approach, including targeted acquisitions, further solidifies its competitive position. This expansion and integration of services allow Corpay to offer a comprehensive suite of payment solutions, thereby enhancing its appeal to a broad customer base and strengthening its rivalry with other players in the corporate payments sector.

Corpay's competitive rivalry is significantly shaped by its aggressive acquisition strategy. In 2024, the company made notable moves, including the acquisition of Paymerang, a leader in Accounts Payable (AP) automation. This acquisition, valued at $450 million, immediately bolstered Corpay's offerings in a critical area of financial operations.

Further demonstrating this strategy, Corpay acquired Alpha Group in early 2025, a move that expanded its expertise and market presence in cross-border foreign exchange (FX) services. These acquisitions are not just about growth; they are strategic maneuvers to consolidate market positions and enhance its integrated payments platform, directly impacting its competitive standing.

Focus on specific B2B payment verticals

Corpay's strategic focus on specific B2B payment verticals, such as travel and entertainment expense management, has cultivated a strong competitive advantage. This specialization fosters deep domain expertise and allows for the development of highly tailored solutions, setting Corpay apart from broader payment providers.

This niche approach contributes to a recurring and profitable revenue model, as clients often rely on specialized platforms for ongoing operational needs. For instance, in 2024, the B2B payments market continued its robust growth, with digital solutions becoming increasingly indispensable for businesses seeking efficiency and cost savings.

- Specialization enhances customer retention: By offering deep expertise in specific B2B payment areas, Corpay builds stickier customer relationships.

- Recurring revenue streams: A focus on verticals like expense management naturally leads to predictable, recurring revenue.

- Differentiation from generalists: Corpay's targeted solutions allow it to stand out against competitors offering more commoditized payment services.

- Market growth in B2B payments: The overall B2B payments market is expanding, providing ample opportunity for specialized players like Corpay.

Strategic partnerships to expand reach and offerings

Corpay's strategic partnership with Mastercard, which includes an investment in its cross-border business and an exclusive provider agreement, significantly expands its distribution network. This collaboration strengthens Corpay's competitive position in the cross-border payments segment, allowing it to reach a broader customer base.

This alliance is particularly impactful as it positions Corpay to leverage Mastercard's extensive global reach. For instance, in 2024, Mastercard reported a substantial increase in transaction volumes, highlighting the potential for Corpay to tap into this growing market. The exclusivity aspect of the agreement further solidifies Corpay's advantage over rivals who may not have similar direct access to Mastercard's infrastructure.

- Enhanced Distribution: Access to Mastercard's vast network amplifies Corpay's market penetration.

- Competitive Advantage: Exclusivity provides a distinct edge in the cross-border payments arena.

- Market Growth: Corpay is well-positioned to capitalize on the increasing global demand for cross-border transactions, a trend evident in 2024 market data.

The competitive landscape for Corpay is intense, featuring a mix of large, established players and agile fintech disruptors. This dynamic market demands constant innovation and strategic positioning to maintain an edge. Corpay's approach, marked by significant acquisitions and strategic partnerships, aims to consolidate its market share and enhance its service offerings.

The company's aggressive acquisition strategy, including the 2024 acquisition of Paymerang for $450 million and the early 2025 acquisition of Alpha Group, directly addresses competitive pressures by expanding its capabilities in AP automation and FX services. These moves are designed to strengthen its integrated payments platform against rivals.

Corpay's specialization in key B2B payment verticals, such as travel and entertainment expense management, creates a strong differentiator. This focus allows for deeper client relationships and recurring revenue streams, setting it apart from more generalized payment providers in a market that saw continued robust growth in digital B2B solutions throughout 2024.

Furthermore, Corpay's strategic partnership with Mastercard, including an exclusive provider agreement for cross-border business, significantly bolsters its distribution network and competitive advantage. This alliance allows Corpay to leverage Mastercard's extensive global reach, particularly as global demand for cross-border transactions showed substantial growth in 2024.

| Competitor | Key Offerings | 2024/2025 Strategic Moves |

|---|---|---|

| PayPal | Consumer & Business Payments | Continued expansion of Braintree for businesses |

| WEX | Fleet, Corporate Payments | Focus on digital solutions and fleet management efficiency |

| Fiserv | Payment Processing, Financial Tech | Acquisitions and integrations to broaden service portfolio |

| Tipalti | AP Automation, Global Payments | Growth in mid-market AP solutions |

| AvidXchange | AP Automation for Mid-Market | Expansion of invoice automation and payment capabilities |

| Bill.com | AP/AR Automation, Payments | Reported 27% YoY revenue growth in Q3 FY24 |

| SAP Concur | Expense Management, Travel | Integration of AI for expense reporting |

SSubstitutes Threaten

While Corpay is a leader in automating accounts payable, traditional manual processes still represent a substitute, particularly for smaller businesses that may not have fully embraced digital transformation. These manual methods, though increasingly inefficient and costly, persist as an alternative for some organizations. For instance, in 2024, it's estimated that a significant percentage of small businesses still handle invoice processing manually, leading to higher error rates and slower payment cycles compared to automated solutions.

Large enterprises with substantial financial and technical capabilities may choose to build their own payment and expense management systems. This is particularly true for companies with highly specialized workflows or unique integration requirements that off-the-shelf solutions don't perfectly address. For example, a global e-commerce giant might invest in developing an in-house platform to handle its vast transaction volume and diverse currency needs, bypassing third-party providers.

Basic accounting software, like QuickBooks or Xero, can function as a substitute for businesses with straightforward payment requirements. These platforms offer features for invoicing and basic expense management, fulfilling some of the needs that might otherwise be met by more specialized solutions. For instance, in 2024, QuickBooks reported over 3.8 million customers, highlighting the widespread adoption of these general-purpose tools.

While these alternatives lack the advanced payment processing, international capabilities, and integrated workflow automation found in Corpay's offerings, they can be sufficient for smaller businesses or those with minimal cross-border transactions. The lower cost and familiar interface of these accounting packages make them an accessible substitute, particularly for companies prioritizing cost savings over sophisticated payment functionalities.

Direct bank services and traditional wire transfers

Direct bank services and traditional wire transfers represent a significant threat of substitutes for Corpay, especially for businesses prioritizing established banking relationships or those with sporadic international payment requirements. Banks offer familiar channels, and for some, the perceived security and direct control of these methods outweigh the potential efficiencies of specialized providers.

Corpay actively seeks to dislodge banks from this position by offering competitive pricing and enhanced features for cross-border transactions. For instance, while traditional wire transfer fees can vary, many banks charge upwards of $25-$50 per international transfer, a cost Corpay aims to undercut with its streamlined platform.

The threat is amplified by the fact that many businesses already maintain robust relationships with their primary banks for a wide array of financial services. This existing infrastructure makes it convenient to continue using bank-provided international payment solutions, even if they are less technologically advanced or more costly than alternatives.

Key considerations regarding this threat include:

- Established Banking Relationships: Many businesses have long-standing ties with their banks, fostering trust and inertia.

- Perceived Security and Control: Direct bank services can be viewed as inherently more secure and offering greater direct control over funds.

- Cost of Traditional Wires: While convenient, traditional wire transfers can incur significant fees, often ranging from $25 to $50 or more per transaction, presenting an opportunity for Corpay.

- Infrequent Usage: Businesses with low volumes of international payments may not see the need to adopt new platforms if their current banking method suffices.

Emerging decentralized finance (DeFi) solutions

While still in early stages for widespread business-to-business payments, decentralized finance (DeFi) presents a potential long-term threat. These platforms enable direct peer-to-peer transactions, bypassing traditional financial intermediaries. This could significantly alter the landscape of payment processing, though substantial regulatory and adoption challenges need to be overcome.

DeFi's ability to facilitate cross-border payments with potentially lower fees and faster settlement times makes it an attractive alternative, especially as the technology matures. For instance, the total value locked in DeFi protocols, a key indicator of its growth, reached over $100 billion in early 2024, demonstrating increasing investor confidence and development.

The threat of substitutes from DeFi is currently moderate but has the potential to grow substantially. Key considerations include:

- Scalability: Current DeFi transaction speeds and costs can be a barrier for high-volume B2B payments.

- Regulatory Uncertainty: The evolving regulatory environment for cryptocurrencies and DeFi creates significant risk for widespread adoption.

- User Experience: The technical complexity of using DeFi platforms remains a hurdle for mainstream business users.

- Security Concerns: While improving, DeFi platforms have experienced exploits and hacks, impacting trust.

Manual payment processes, basic accounting software like QuickBooks, and in-house developed systems represent significant substitutes for Corpay's specialized services. While these alternatives may suffice for smaller businesses or those with simpler needs, they often lack the efficiency, international capabilities, and integrated workflow automation that Corpay provides. In 2024, the continued prevalence of manual invoice processing among small businesses, estimated to affect a substantial portion, highlights the ongoing, albeit diminishing, threat from these less sophisticated methods.

Entrants Threaten

Entering the global business payments market, particularly in specialized areas like cross-border transactions and corporate cards, demands substantial capital. Companies need to invest heavily in robust technology platforms, secure payment infrastructure, and comprehensive compliance systems. For instance, establishing the necessary compliance for global operations can easily run into millions of dollars before a single transaction is processed.

Furthermore, navigating the complex and ever-evolving regulatory landscape across different countries presents a significant barrier. Obtaining licenses, adhering to anti-money laundering (AML) and know-your-customer (KYC) regulations, and meeting data privacy standards like GDPR require extensive legal and operational resources. These stringent requirements act as a powerful deterrent for potential new players, effectively limiting the threat of new entrants.

Network effects are a significant barrier for new entrants looking to compete with Corpay. In 2024, Corpay served over 800,000 business clients and managed more than $400 billion in payments, creating a powerful ecosystem where more users attract more services and vice versa.

Building a client base of this magnitude and fostering trust in the financial services sector is an immense hurdle for any new competitor. The established customer relationships Corpay has cultivated over time also represent a formidable challenge, as businesses are often hesitant to switch payment providers due to the inherent risks and complexities involved.

The threat of new entrants in the payment solutions space is significantly mitigated by the high technological complexity and the relentless pace of innovation required. Developing and maintaining advanced platforms, such as those offering automated accounts payable, robust fraud detection, and seamless multi-currency processing, necessitates substantial ongoing investment in cutting-edge technology and specialized talent. For instance, in 2024, the global fintech market saw continued investment, with companies like Corpay needing to consistently upgrade their infrastructure to stay ahead of evolving customer demands and regulatory landscapes.

Brand recognition and reputation in a trust-based industry

Corpay, formerly FLEETCOR, has cultivated a strong brand recognition and a reputation for reliability in the business payments sector. This established trust is a significant barrier for new entrants aiming to handle sensitive financial transactions for businesses.

New companies face the challenge of building credibility in an industry where trust is paramount, making it difficult to attract and retain customers who are wary of unproven payment providers.

For instance, in 2024, the financial services industry continued to emphasize security and compliance, making it harder for newcomers without a proven track record to gain market traction.

- Brand Loyalty: Established brands like Corpay benefit from existing customer relationships, making it harder for new entrants to poach clients.

- Trust Deficit: New entrants must overcome a natural skepticism regarding the security and reliability of their financial services.

- Regulatory Hurdles: Navigating complex financial regulations requires significant investment and expertise, which new companies may lack.

- Reputational Risk: Any perceived misstep by a new entrant in handling funds can severely damage its reputation, deterring future business.

Access to talent and specialized expertise

The fintech industry, including payment solutions, demands specialized talent in areas such as cybersecurity, payment systems engineering, and complex regulatory compliance. New entrants face a significant hurdle in attracting and retaining these highly sought-after professionals, as competition for such expertise is fierce.

Established companies like Corpay, with their existing infrastructure and proven track record, often have a distinct advantage. They benefit from established recruitment channels and employer branding, making it easier to onboard skilled individuals. For instance, in 2023, the global cybersecurity market alone was valued at over $200 billion, highlighting the intense competition for talent in this critical area.

- High Demand for Specialized Skills: Fintech requires experts in cybersecurity, payment processing, and regulatory compliance.

- Talent Acquisition Challenges for New Entrants: New companies struggle to attract and retain top talent due to existing competition.

- Established Players' Advantage: Companies like Corpay benefit from existing recruitment pipelines and brand recognition.

- Market Value of Key Expertise: The cybersecurity market exceeding $200 billion in 2023 underscores the intense competition for specialized skills.

The threat of new entrants into the business payments market, where Corpay operates, is considerably low. Significant capital investment is required for technology, infrastructure, and compliance, with global operations alone potentially costing millions. New players must also navigate intricate international regulations, including AML and KYC, which demand substantial legal and operational resources, acting as a strong deterrent.

Established network effects, driven by large client bases and transaction volumes, present a formidable barrier. Corpay's 2024 figures, serving over 800,000 clients and managing over $400 billion in payments, exemplify this. Building similar trust and scale is a monumental task for newcomers.

The high technological complexity and the need for continuous innovation in areas like fraud detection and multi-currency processing require ongoing, substantial investment. In 2024, the competitive fintech landscape means companies like Corpay must constantly upgrade their platforms to meet evolving demands and regulations.

Brand recognition and a proven track record of reliability are critical in financial services, creating a trust deficit for new entrants. In 2024, the emphasis on security and compliance further solidified this advantage for established players like Corpay, making it difficult for unproven providers to gain market traction.

Porter's Five Forces Analysis Data Sources

Our Corpay Porter's Five Forces analysis is built upon a foundation of comprehensive data, including Corpay's own financial statements, investor relations materials, and public filings. We supplement this with industry-wide reports from reputable sources like IBISWorld and market research firms to provide a robust competitive landscape assessment.