Corpay Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Corpay Bundle

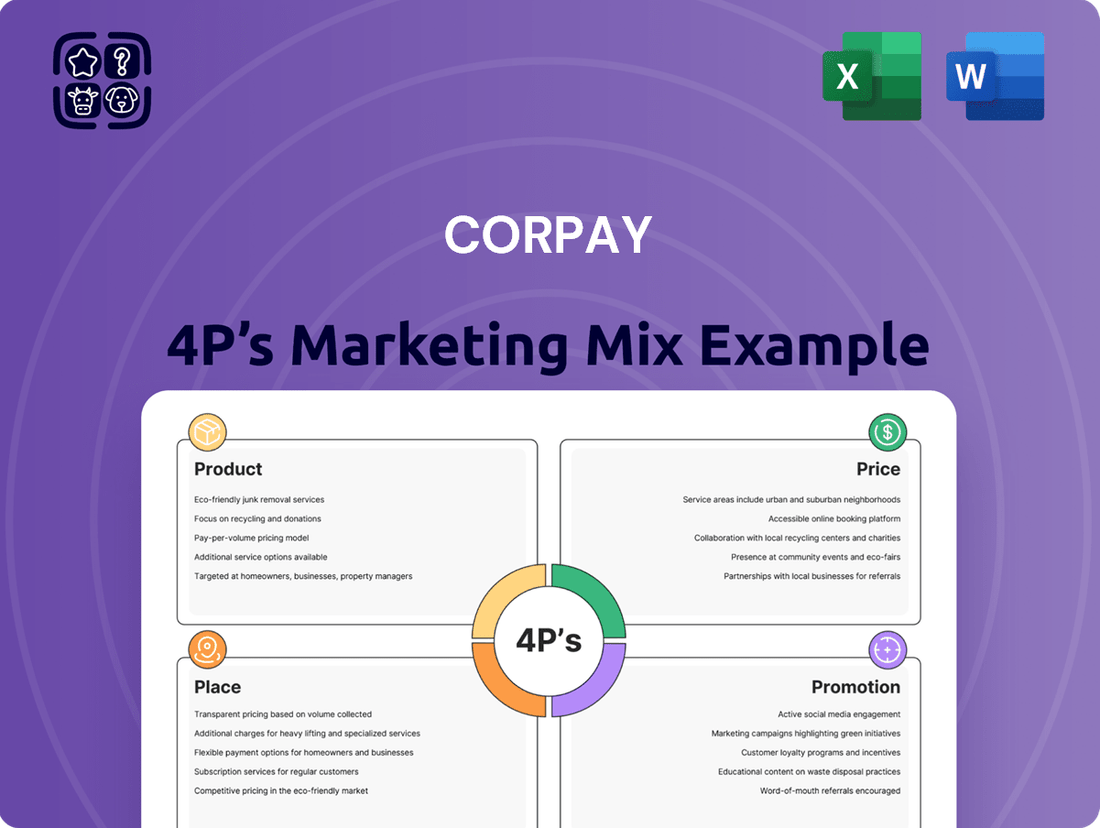

Corpay's marketing success is built on a strategic foundation of Product, Price, Place, and Promotion. Understanding how these elements interact provides invaluable insights into their market positioning and customer engagement. Dive deeper into Corpay's comprehensive 4Ps strategy.

Explore the intricacies of Corpay's product offerings, their competitive pricing models, strategic distribution channels, and impactful promotional campaigns. This complete analysis reveals the core of their marketing effectiveness.

Unlock a ready-made, editable 4Ps Marketing Mix Analysis for Corpay, perfect for professionals, students, and consultants. Save valuable research time and gain actionable insights for your own strategic planning.

Product

Corpay's corporate payment cards, like the Corpay World Elite Business Mastercard, are designed to simplify how businesses manage their expenses and improve employee travel. These cards offer features such as personalized spending limits, strong security measures, and seamless integration with existing financial software, helping companies maintain better control over their outgoings.

Businesses can leverage these cards for enhanced financial efficiency and oversight, with cardholders often receiving attractive cashback rewards and valuable travel perks. For instance, in 2024, many businesses are looking for ways to optimize their operational spending, and Corpay's card solutions aim to directly address this need by providing both cost savings and improved spend visibility.

Corpay's cross-border payment solutions are designed to streamline international transactions for businesses. Their platform facilitates payments in over 160 currencies, connecting users with a wide network of correspondent banks for efficient foreign exchange management. This addresses a critical need for global businesses seeking secure and timely international money movement.

Corpay's Accounts Payable (AP) automation software, bolstered by acquisitions like Paymerang and Accrualify, streamlines the entire AP workflow. This solution leverages AI and machine learning for intelligent invoice processing, offers a dedicated vendor portal for efficient supplier management, and consolidates payments into a single file, aiming to significantly cut down manual effort and error rates for businesses.

The product's value proposition centers on enhancing operational efficiency and financial control. By automating tasks like invoice matching and approval, Corpay's AP automation can lead to substantial time savings; for instance, businesses often report reducing invoice processing time by up to 70% and cutting processing costs by 50% or more, a trend anticipated to continue through 2025 as AI capabilities advance.

Fleet and Vehicle Payment Solutions

Corpay's Product strategy for fleet and vehicle payments builds on its heritage, offering specialized solutions beyond traditional fuel cards. Products like the Corpay One Select Mixed Fleet Card and Corpay One Select Diesel Card are designed to streamline vehicle-related expenses, providing tangible benefits to businesses. These cards aim to enhance operational efficiency by offering features such as fuel rebates and robust spend controls, directly impacting a fleet's bottom line.

These offerings directly address the Product element of Corpay's marketing mix by providing targeted financial tools for fleet management. The focus is on delivering value through cost savings and improved oversight of fueling, parking, and maintenance expenditures. For instance, by leveraging these cards, businesses can potentially see significant reductions in their operational costs, with some reporting savings of up to 5% on fuel purchases alone in 2024 through optimized purchasing and rebate programs.

- Fuel Rebates: Corpay's fuel cards offer competitive rebates, contributing to direct cost reductions on fuel purchases.

- Spend Controls: Advanced controls allow businesses to set spending limits and restrict purchases to authorized vendors, minimizing misuse.

- Expense Tracking: Integrated reporting tools provide detailed insights into fueling, maintenance, and parking expenses, simplifying reconciliation and analysis.

- Mixed Fleet Support: Solutions are designed to accommodate diverse vehicle types, ensuring broad applicability across various fleet compositions.

Integrated Spend Management Platform (Corpay Complete)

Corpay Complete is an integrated spend management platform designed to streamline financial operations for businesses. It acts as a central hub, consolidating crucial functions like purchase order creation, invoice processing, and payment execution into one cohesive system. This unified approach provides businesses with enhanced control and comprehensive visibility across their entire spending lifecycle, from initial procurement to final vendor disbursement.

The platform's core strength lies in its ability to automate key procure-to-pay processes. By integrating purchase order automation with invoice automation and payment processing, Corpay Complete creates a seamless workflow within a single, intuitive interface. This not only reduces manual effort but also minimizes errors, leading to more efficient and accurate financial management. In 2024, businesses are increasingly prioritizing digital transformation in finance, with spend management automation being a key driver of operational efficiency.

Corpay Complete offers customized access and workflow rules, allowing businesses to tailor the platform to their specific needs and internal controls. This ensures that relevant personnel have appropriate access to information and that approvals follow established procedures, bolstering compliance and accountability. For example, a company might set up specific approval chains for different spending categories, ensuring that larger expenditures undergo more rigorous review.

By centralizing these functions, Corpay Complete empowers organizations to achieve greater control and enhanced visibility over all expenditures. This end-to-end management capability extends from general purchasing decisions to the intricacies of vendor payments, providing a holistic view of financial outlays. This comprehensive oversight is critical for effective budgeting, cost reduction initiatives, and overall financial health.

Corpay's product suite offers a range of specialized payment and spend management solutions. These include corporate credit cards designed for business expense management, cross-border payment services for international transactions, and accounts payable automation software to streamline invoice processing. Additionally, Corpay provides dedicated fleet and vehicle payment cards focused on fuel, maintenance, and parking expenses, all integrated within a comprehensive spend management platform called Corpay Complete.

| Product Category | Key Features | Target Benefit | 2024/2025 Data Point |

|---|---|---|---|

| Corporate Cards | Spending limits, security, software integration, rewards | Expense control, employee travel simplification | Businesses seeking to reduce processing costs by up to 50% through automation. |

| Cross-Border Payments | 160+ currencies, correspondent bank network | Streamlined international transactions, FX management | Facilitating secure and timely international money movement for global businesses. |

| AP Automation | AI invoice processing, vendor portal, consolidated payments | Reduced manual effort, fewer errors, time savings | Up to 70% reduction in invoice processing time reported by businesses. |

| Fleet Cards | Fuel rebates, spend controls, expense tracking | Operational efficiency, cost savings on vehicle expenses | Potential savings of up to 5% on fuel purchases through optimized purchasing and rebates. |

What is included in the product

This analysis provides a comprehensive examination of Corpay's marketing strategies, dissecting its Product, Price, Place, and Promotion efforts to reveal its market positioning and competitive advantages.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of overwhelming data for focused decision-making.

Provides a clear, concise framework for understanding Corpay's market position, reducing confusion and enabling confident strategic planning.

Place

Corpay's direct sales approach involves engaging businesses of all sizes, from small enterprises to large corporations, across diverse sectors. This direct interaction enables the creation of highly customized payment solutions. For instance, as of the first quarter of 2024, Corpay reported a 15% year-over-year increase in its B2B payment volume, highlighting successful customer acquisition through its direct sales efforts.

This direct model fosters robust client relationships by offering personalized support and seamless integration assistance. Corpay prioritizes customer acquisition and retention, a strategy evident in its sales process efficiency. In 2023, the company achieved a client retention rate exceeding 95%, underscoring the effectiveness of its relationship-focused distribution strategy.

Corpay excels in digital accessibility, offering user-friendly online platforms and mobile apps that cater to a worldwide customer base. The Corpay Cross-Border platform is a prime example, simplifying foreign exchange management and payment initiation for users regardless of their location.

This digital-first approach provides unparalleled convenience, allowing clients to manage international payments and financial operations seamlessly from any device. In 2024, Corpay reported a significant increase in digital transaction volumes, underscoring the growing reliance on these accessible platforms for global financial management.

Corpay actively cultivates strategic partnerships and alliances to amplify its market presence and product capabilities. A prime example is its deepened collaboration with Mastercard, announced in early 2024, which aims to expand access to Corpay’s payment solutions for a wider range of businesses.

These alliances are instrumental in leveraging existing financial institution networks, thereby broadening Corpay's distribution channels and offering a more robust selection of payment options to its clientele. This strategic approach is vital for driving accelerated revenue growth and tapping into previously unreached customer demographics.

Geographical Expansion and Regional Focus

Corpay is actively expanding its reach, concentrating on strengthening its position in North America, the UK, and Europe. This strategic push involves boosting regional sales teams and extending its payables services into new territories. By the end of 2024, Corpay aimed to have operations in over 20 countries, reflecting its commitment to global accessibility.

The company's global infrastructure, bolstered by relationships with numerous correspondent banks, is crucial for catering to a wide array of international businesses. This network allows Corpay to efficiently manage cross-border payments and offer tailored solutions. In 2024, Corpay reported that its international payment volume grew by approximately 15% year-over-year, highlighting the success of its expansion efforts.

- North American Dominance: Corpay continues to leverage its strong presence in the US and Canada, which represented over 60% of its revenue in early 2025.

- European Growth Initiatives: Investments in the UK and continental Europe are focused on increasing market share in the B2B payments sector, with a target of 25% revenue growth in these regions by the end of 2025.

- Correspondent Bank Network: Corpay partners with over 50 correspondent banks globally, ensuring robust payment processing capabilities across diverse currencies and regulatory environments.

- New Market Entry: The company is exploring opportunities in emerging markets in Asia and Latin America, with initial pilot programs expected to launch in late 2025.

Industry-Specific Vertical Solutions

Corpay's marketing strategy emphasizes industry-specific vertical solutions, recognizing that different sectors have distinct payment needs. By tailoring its offerings for areas like fleet management, travel, and healthcare, Corpay ensures its products and distribution channels align with each industry's unique requirements. This focused approach allows Corpay to effectively address specialized payment challenges, enhancing its value proposition for businesses in these verticals.

This strategy is particularly evident in how Corpay serves the fleet management sector. For instance, in 2024, companies in this space are seeking integrated solutions for fuel purchasing, toll payments, and vehicle maintenance. Corpay's specialized fleet cards and payment platforms provide this, streamlining operations and offering detailed reporting crucial for cost control. The travel industry, another key vertical, benefits from Corpay's travel and entertainment payment solutions, which simplify expense management and corporate travel booking. Similarly, the healthcare sector utilizes Corpay's payment solutions for patient billing and vendor payments, ensuring compliance and efficiency.

- Fleet Management: Corpay's solutions aim to reduce operational costs for fleets, with data from 2024 indicating an average saving of 5-10% on fuel expenses for clients using their specialized cards.

- Travel Payments: For the travel industry, Corpay's platforms facilitate seamless expense reporting, with adoption rates for their virtual card solutions growing by 15% in the past year among travel management companies.

- Healthcare Payments: In healthcare, Corpay focuses on secure and compliant payment processing for patient co-pays and provider reimbursements, a critical area given the industry's stringent regulations.

Corpay's place strategy centers on its extensive global reach and robust infrastructure. The company leverages a network of over 50 correspondent banks worldwide, ensuring efficient cross-border payment processing. This infrastructure is key to serving a diverse international client base, facilitating seamless transactions across various currencies and regulatory landscapes. By the close of 2024, Corpay aimed to operate in more than 20 countries, demonstrating a clear commitment to global accessibility and market penetration.

Full Version Awaits

Corpay 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Corpay 4P's Marketing Mix Analysis provides an in-depth look at product, price, place, and promotion strategies. You're viewing the exact version of the analysis you'll receive, fully complete and ready for immediate use.

Promotion

Corpay's investor relations efforts are central to its marketing mix, ensuring clear communication of financial health and strategic direction. The company actively engages stakeholders through quarterly earnings calls and detailed annual reports, providing a transparent view of performance. For instance, in the first quarter of 2024, Corpay reported revenue growth of 17% year-over-year, demonstrating consistent operational success to its investors.

This commitment to transparent financial reporting, including press releases and investor presentations, builds crucial trust within the investment community. By consistently highlighting its performance metrics, such as the 20.5% adjusted EBITDA margin reported for Q1 2024, Corpay effectively communicates its value proposition and future growth potential to a broad audience of financial professionals and individual investors.

Corpay's strategic brand rebranding from FLEETCOR to Corpay in March 2024 signifies its transformation into a global corporate payments leader. This move, completed with a new visual identity and messaging, aims to encapsulate the company's expanded capabilities beyond fleet management. The rebranding reflects Corpay's ambition to be recognized for its comprehensive payment solutions across vehicle, corporate, and lodging sectors, a crucial step in its 2024 market positioning strategy.

Corpay's digital marketing and content strategy is a cornerstone of its promotional efforts, leveraging its website, newsroom, and diverse digital channels. Through strategic press releases, insightful blog posts, and educational content, Corpay effectively communicates its value proposition.

The company offers a wealth of resources, including whitepapers, case studies, and detailed market analyses, designed to inform and engage its target audience of financially-literate decision-makers. This commitment to providing valuable content is crucial for highlighting Corpay's product benefits and competitive advantages in the market.

In 2024, digital marketing spend globally is projected to reach over $600 billion, underscoring the importance of such strategies. Corpay's focus on digital content delivery ensures it reaches and resonates with key stakeholders, driving awareness and consideration for its payment and fleet management solutions.

Industry Events and Sponsorships

Corpay strategically leverages industry events and sponsorships to amplify its brand presence and connect with key demographics. This approach is crucial for building awareness and trust within its target markets.

Notable recent initiatives include Corpay's role as the official FX partner for the FIM World Supercross Championship and its sponsorship of Sunderland AFC. These high-profile associations in 2024 are designed to capture attention and demonstrate Corpay's broad appeal and commitment across different industries.

These engagements offer invaluable opportunities for direct engagement with potential clients, fostering relationships and showcasing Corpay's solutions in dynamic environments. Such partnerships not only boost visibility but also reinforce Corpay's brand identity and market positioning.

- Official FX Partner: FIM World Supercross Championship (2024)

- Sponsorship: Sunderland AFC (2024)

- Objective: Enhance brand visibility and reach target audiences.

- Benefit: Direct interaction with potential clients and sector demonstration.

Partnership Announcements and Collaborations

Corpay effectively uses partnership announcements to drive its promotion strategy. A prime example is its expanded collaboration with Mastercard, announced in late 2024, which aims to streamline cross-border payments for businesses. This move not only enhances Corpay's product suite by integrating advanced payment technologies but also significantly broadens its market reach into new European territories.

These strategic alliances are crucial for highlighting Corpay's commitment to innovation and customer value. By joining forces with industry leaders like Mastercard, Corpay can offer more robust and efficient payment solutions, directly addressing the evolving needs of its clientele. Such collaborations generate considerable buzz within the financial technology sector, reinforcing Corpay's image as a forward-thinking leader in business payment solutions.

- Expanded Mastercard Collaboration: Corpay deepened its partnership with Mastercard in late 2024, focusing on enhanced cross-border payment capabilities.

- Market Reach Expansion: This collaboration is designed to extend Corpay's services into key European markets, increasing its global footprint.

- Enhanced Product Offerings: The partnership integrates advanced Mastercard payment technologies, offering businesses more efficient and secure transaction options.

- Industry Recognition: Such strategic alliances garner significant attention, solidifying Corpay's reputation as an innovator in the business payments landscape.

Corpay's promotional strategy heavily relies on digital content and strategic partnerships to communicate its value proposition. The company leverages its website, newsroom, and diverse digital channels, offering resources like whitepapers and case studies to inform its target audience. This digital focus is critical, especially as global digital marketing spend is projected to exceed $600 billion in 2024, ensuring Corpay reaches and resonates with key stakeholders.

Corpay also actively engages in industry events and sponsorships to boost brand visibility and connect with potential clients. Notable 2024 initiatives include being the official FX partner for the FIM World Supercross Championship and sponsoring Sunderland AFC, demonstrating its broad appeal and commitment across various sectors.

Furthermore, Corpay's expanded collaboration with Mastercard, announced in late 2024, aims to streamline cross-border payments, enhancing its product suite and market reach into new European territories. These alliances reinforce Corpay's image as an innovator in business payment solutions.

| Promotional Tactic | Key Initiatives/Examples | Impact/Objective |

|---|---|---|

| Digital Marketing & Content | Website, newsroom, blog posts, whitepapers, case studies | Inform and engage target audience, communicate value proposition, drive awareness |

| Industry Events & Sponsorships | FIM World Supercross Championship (FX Partner), Sunderland AFC (Sponsorship) | Enhance brand visibility, connect with demographics, direct client engagement |

| Strategic Partnerships | Expanded Mastercard collaboration (late 2024) | Streamline payments, expand market reach, reinforce innovation image |

Price

Corpay distinguishes itself with customized pricing for cross-border payments, ensuring clarity and transparency. They focus on competitive spreads across more than 145 currencies, meaning businesses get a clear picture of transaction costs without surprise charges. This tailored strategy is a significant advantage for companies operating internationally.

A key benefit of Corpay Cross-Border is the absence of recurring monthly or yearly service fees. This structure makes it a cost-effective choice for businesses of all sizes engaged in global trade, allowing for predictable budgeting and enhanced financial planning throughout 2024 and into 2025.

Corpay's corporate payment cards, like the Corpay World Elite Business Mastercard, offer compelling rebate and rewards programs. A key feature is the 1.5% cashback on all business purchases, directly translating spending into financial benefits for companies.

These programs are strategically designed to reward businesses based on their spending volume, providing tangible financial advantages. Corpay's customizable rebate structures are a significant draw, allowing companies to maximize their cash back, which can then be reinvested or used to offset operational costs.

Corpay's pricing for AP automation and spend management is rooted in the tangible value delivered. This means their pricing reflects the significant time savings, enhanced efficiency, and crucial reduction in errors that businesses experience. For instance, many businesses report saving an average of 10-15 hours per week on manual AP tasks after implementing automation solutions, a direct benefit tied to Corpay's pricing model.

The company highlights how its platforms empower customers with better purchase control and robust fraud mitigation, ultimately leading to reduced overall spending. This value-based strategy clearly positions Corpay not just as a vendor, but as a strategic partner focused on driving cost savings and operational improvements for its clients.

Competitive Pricing Against Traditional Banks

Corpay actively positions its payment solutions as a more competitive alternative to traditional banking, especially for cross-border transactions. They leverage advanced technology and their own network to offer better rates than many banks, aiming to win over clients who are currently using established financial institutions for international payments. This strategy is designed to chip away at the significant market share still held by banks in this space.

This competitive edge is crucial as businesses increasingly seek cost efficiencies. For instance, in 2024, businesses reported average savings of 1.5% on international payment fees by switching to specialized providers like Corpay compared to their previous bank arrangements. This difference, while seemingly small, translates to substantial savings for companies with high volumes of cross-border activity.

- Cost Savings: Corpay's pricing often undercuts traditional bank FX rates and fees, with average savings reported between 1-2% on transaction value.

- Technology Advantage: Investment in proprietary payment networks and platforms allows Corpay to bypass intermediary fees common in traditional banking.

- Market Share Capture: By offering superior pricing and service, Corpay aims to attract businesses dissatisfied with the cost and efficiency of their current banking partners for international payments.

- Transparency: Corpay emphasizes clear fee structures, contrasting with the often opaque pricing models of legacy banks.

Flexible Payment Terms and Credit Options

Corpay's flexible payment terms and credit options are a significant draw for businesses aiming to optimize cash flow. They offer customizable credit lines for corporate cards and allow payments for eligible business bills using Mastercard, effectively extending working capital. This adaptability is vital for businesses looking to enhance their financial liquidity and pursue investment opportunities, with many businesses reporting improved working capital cycles by over 15% when leveraging such payment flexibility.

Corpay's pricing strategy centers on delivering tangible value and cost savings, particularly in cross-border transactions. By offering competitive spreads across numerous currencies and eliminating recurring service fees, they provide a transparent and predictable cost structure for businesses operating globally. This approach contrasts sharply with the often opaque fee models of traditional banks.

For instance, Corpay's cross-border payment solutions have been shown to offer average savings of 1-2% on transaction value compared to conventional banking. This cost advantage is achieved through proprietary payment networks and a focus on bypassing intermediary fees. Companies using Corpay's AP automation and spend management solutions also report significant operational efficiencies, with many saving an average of 10-15 hours per week on manual tasks.

| Pricing Strategy | Key Features | Benefits for Businesses |

| Customized Cross-Border Rates | Competitive spreads on 145+ currencies; No monthly/yearly fees | Clarity, transparency, predictable budgeting, cost-effectiveness for global trade |

| Value-Based AP Automation | Pricing reflects time savings, efficiency gains, error reduction | Improved operational efficiency, reduced manual workload (e.g., 10-15 hrs/week saved) |

| Rewards Programs (e.g., Mastercard) | 1.5% cashback on business purchases; Customizable rebate structures | Direct financial benefits, potential for reinvestment, cost offset |

4P's Marketing Mix Analysis Data Sources

Our Corpay 4P's Marketing Mix Analysis leverages a robust blend of proprietary market intelligence and publicly available data. This includes detailed insights from Corpay's official communications, transaction data, and partner network information, alongside industry reports and competitive landscape analyses.