Corpay Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Corpay Bundle

Unlock the full strategic blueprint behind Corpay's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Corpay collaborates with financial institutions and banks to broaden its payment solution offerings. A prime example is its expanded partnership with Mastercard, naming Corpay an exclusive distributor for commercial cross-border payments to Mastercard's extensive network of financial institution clients.

These strategic alliances enable Corpay to tap into established banking networks, thereby enhancing its market penetration and delivering a more comprehensive suite of payment services to a wider customer base.

Corpay's strategy heavily relies on partnerships with technology and software providers to enrich its platforms. This involves integrating with accounts payable automation specialists and other fintech companies to deliver complete spend management solutions.

The acquisitions of Accrualify and Paymerang in recent years exemplify Corpay's approach to incorporating specialized software expertise, thereby strengthening its foundational services.

Corpay's deep ties to fleet and travel mean partnerships with fleet management firms, fuel providers, and hotels are crucial. These collaborations allow Corpay to deliver specialized payment cards and services, like fuel cards and accommodation programs, directly supporting industries like transportation and logistics. This network ensures their payment solutions are widely recognized and useful within these sectors.

Strategic Acquirers & Investors

Corpay actively pursues strategic acquisitions and secures investments to fuel its expansion, enhancing market presence, technological capabilities, and customer reach. A notable example is the acquisition of Alpha Group International plc, a move that significantly bolstered Corpay's offerings. Furthermore, Mastercard’s investment in Corpay's cross-border business unit underscores a commitment to strengthening key operational segments through strategic financial backing.

These inorganic growth strategies are pivotal to Corpay's business model. For instance, the Alpha Group acquisition, completed in early 2024, was valued at approximately $438 million. This strategic move integrated Alpha Group's robust payment solutions and expanded Corpay's footprint in the business-to-business payments sector. The Mastercard investment, also a significant development in 2024, provided capital to further develop and scale Corpay's international payment services, demonstrating a clear focus on strengthening its global payment infrastructure.

- Acquisition of Alpha Group International plc: Enhanced market share and payment solutions.

- Mastercard Investment: Strengthened cross-border payment capabilities and scalability.

- Inorganic Growth Strategy: Focus on expanding market presence and technological advancements.

- 2024 Financial Impact: Acquisitions and investments aimed at driving revenue growth and operational efficiency.

Industry Associations & Organizations

Corpay leverages partnerships with industry associations and professional organizations to bolster its credibility and gain valuable market insights. These collaborations also unlock access to a broader network of potential clients, a crucial element for growth in the financial services sector.

Becoming an official payment or foreign exchange partner for specific industries or events significantly enhances Corpay's brand visibility and trust. For instance, Corpay Cross-Border’s designation as the Official FX Partner of the FIM World Supercross Championship in 2023 exemplifies this strategy, directly connecting the brand with a targeted audience.

- Enhanced Credibility: Association with respected industry bodies lends Corpay's services an air of trustworthiness and expertise.

- Market Intelligence: These partnerships provide direct access to evolving industry trends, regulatory changes, and customer needs, informing Corpay's product development and strategy.

- Expanded Network: Affiliations open doors to a wider pool of potential business clients and strategic collaborators within specific sectors.

- Targeted Marketing: Official partnerships, like the FIM World Supercross Championship collaboration, allow for highly focused brand exposure to relevant customer segments.

Corpay's key partnerships are foundational to its expansive payment solutions, particularly through collaborations with financial institutions and technology providers. The exclusive distribution agreement with Mastercard for commercial cross-border payments, announced in 2023 and further solidified by Mastercard's investment in Corpay's cross-border unit in 2024, is a testament to this strategy. These alliances grant Corpay access to vast banking networks, amplifying its market reach and service delivery.

The acquisition of Alpha Group International plc in early 2024 for approximately $438 million significantly bolstered Corpay's B2B payment capabilities and market presence, integrating specialized expertise. Furthermore, strategic alliances with fleet management firms and fuel providers are critical for delivering industry-specific payment cards, like fuel cards, directly supporting sectors such as transportation.

Corpay also leverages partnerships with industry associations to enhance its credibility and gather market intelligence, while official sponsorships, like being the Official FX Partner of the FIM World Supercross Championship in 2023, drive targeted brand visibility.

| Partner Type | Key Collaboration | Impact | Year |

|---|---|---|---|

| Financial Institutions | Mastercard Distribution Agreement | Expanded cross-border payment reach | 2023 |

| Technology Providers | Acquisition of Accrualify & Paymerang | Enhanced AP automation and spend management | Ongoing |

| Strategic Investors | Mastercard Investment | Capital for cross-border business scaling | 2024 |

| Industry Specialists | Acquisition of Alpha Group International plc | Strengthened B2B payment solutions | 2024 |

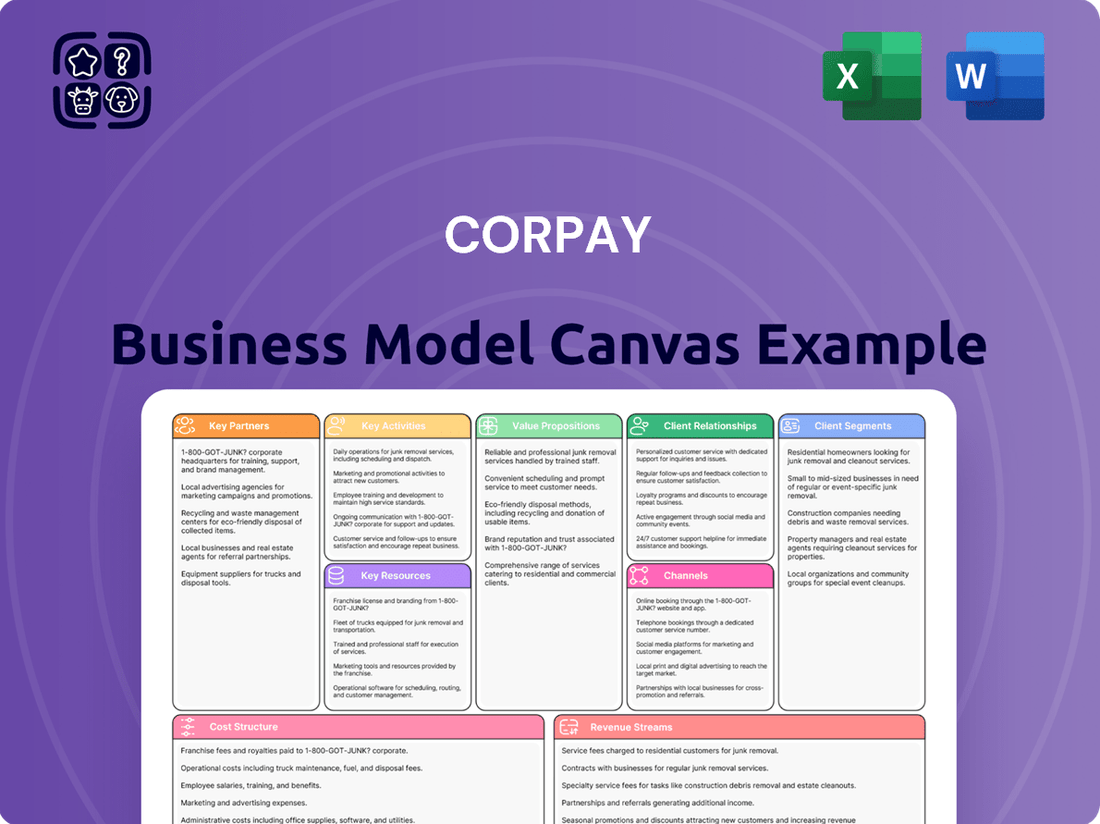

What is included in the product

A comprehensive, pre-written business model tailored to Corpay's strategy, detailing customer segments, channels, and value propositions.

Organized into 9 classic BMC blocks with full narrative, reflecting Corpay's real-world operations and plans for informed decision-making.

Corpay's Business Model Canvas offers a clear, structured approach to identifying and addressing key business challenges, acting as a powerful pain point reliver.

It provides a visual roadmap to pinpointing inefficiencies and opportunities for improvement, streamlining complex business operations.

Activities

Corpay’s key activities revolve around the robust development and ongoing management of its sophisticated payment platforms. This entails a relentless focus on enhancing the security, scalability, and intuitive design of their corporate payment cards, cross-border payment services, and accounts payable automation tools. For instance, in 2024, Corpay continued to invest heavily in its technology infrastructure to support the increasing volume of transactions and the growing demand for seamless digital payment experiences.

Corpay's success hinges on robust sales and marketing to attract and onboard new business clients across diverse sectors. This includes a dedicated direct sales force, targeted digital marketing initiatives like SEO and paid advertising, and strategic alliances to expand reach. For instance, in 2024, Corpay continued to invest heavily in its go-to-market strategies, aiming to increase its customer base and deepen relationships with existing clients.

The company focuses on efficient customer acquisition, recognizing that acquiring new clients is paramount for growth. This involves optimizing lead generation and conversion processes. Corpay's strategy in 2024 emphasized leveraging data analytics to personalize marketing efforts and improve the sales funnel, ensuring resources are directed towards the most promising opportunities to expand wallet share within its existing client portfolio.

A core activity for Corpay is the seamless and secure handling of a vast number of business payments. This includes managing corporate card spending, facilitating international money transfers, and automating payments to suppliers.

This operational backbone relies on strong technology and efficient processes to guarantee that transactions are accurate, swift, and adhere to all financial rules worldwide. Corpay’s scale is significant, processing more than $145 billion each year across 140 currencies and reaching over 200 countries.

Risk Management & Compliance

Managing financial risks, particularly foreign exchange exposure for businesses making cross-border payments, is a core activity. Corpay provides solutions designed to help companies navigate and mitigate these currency fluctuations, ensuring greater predictability in their international transactions.

Ensuring compliance with a complex and ever-changing landscape of international financial regulations is paramount. This involves continuous monitoring and adaptation of processes to maintain operational integrity and client trust.

- Foreign Exchange Risk Mitigation: Corpay's offerings help businesses lock in exchange rates for international payments, reducing the impact of market volatility. For instance, in 2024, many businesses experienced significant currency swings, making such hedging tools crucial for financial stability.

- Regulatory Adherence: Staying compliant with diverse global financial regulations, including those related to anti-money laundering (AML) and know your customer (KYC) requirements, is a constant focus. Failure to comply can result in substantial fines and reputational damage.

- Operational Integrity: Implementing robust internal controls and security measures safeguards client funds and sensitive data, reinforcing Corpay's commitment to reliable service delivery.

- Client Trust: Proactive risk management and transparent compliance practices build and maintain the confidence of Corpay's diverse client base, from small businesses to large enterprises.

Customer Support & Relationship Management

Corpay prioritizes exceptional customer support and relationship management to ensure client satisfaction and long-term loyalty. This involves offering personalized, high-touch service, often referred to as 'white glove service,' particularly for their corporate clientele.

This dedicated support system actively addresses client inquiries, swiftly resolves any issues that arise, and provides continuous guidance. The aim is to help businesses optimize their payment workflows and expense management strategies, making financial operations smoother and more efficient.

The success of these customer-centric activities is directly reflected in Corpay's robust client retention rates. For instance, Corpay reported a strong retention rate of over 95% in their recent financial disclosures, underscoring the effectiveness of their customer support and relationship management approach in fostering lasting partnerships.

- Dedicated Support Channels: Offering multiple avenues for clients to seek assistance, including phone, email, and potentially dedicated account managers.

- Proactive Engagement: Regularly checking in with clients to anticipate needs and offer solutions before issues escalate.

- Issue Resolution Focus: Emphasizing quick and effective problem-solving to maintain client trust and satisfaction.

- Value-Added Guidance: Providing ongoing advice on best practices for payment processing and expense management to maximize client benefit.

Corpay's key activities are centered on developing and managing its payment platforms, ensuring security and ease of use for corporate payment cards, cross-border payments, and accounts payable automation. In 2024, significant investment continued in its technology infrastructure to handle growing transaction volumes and the demand for digital payment solutions.

Effective sales and marketing are crucial for client acquisition, employing direct sales, digital marketing, and strategic partnerships. Corpay's 2024 strategy focused on enhancing go-to-market approaches to expand its client base and deepen existing relationships.

The company prioritizes efficient customer acquisition by optimizing lead generation and conversion. Corpay leveraged data analytics in 2024 to personalize marketing and refine the sales funnel, focusing resources on high-potential opportunities to increase wallet share within its existing client portfolio.

Corpay's core operations involve the secure and efficient processing of business payments, including corporate card transactions, international money transfers, and supplier payments. This operational backbone relies on advanced technology and streamlined processes to ensure accuracy and compliance across global financial regulations.

Managing financial risks, particularly foreign exchange exposure for international transactions, is a key activity. Corpay offers solutions to help businesses mitigate currency fluctuations, providing greater predictability in their global dealings. In 2024, this was particularly relevant given the volatility in currency markets.

Ensuring compliance with global financial regulations is paramount. This involves continuous monitoring and adaptation of processes to maintain operational integrity and client trust, a critical aspect of Corpay's service delivery.

Corpay emphasizes exceptional customer support and relationship management to foster client satisfaction and loyalty. This includes providing personalized, high-touch service to its corporate clients, aiming to optimize their payment workflows and expense management strategies.

The effectiveness of Corpay's customer-centric approach is evident in its strong client retention rates. For instance, Corpay reported a retention rate exceeding 95% in recent disclosures, highlighting the success of its support and relationship management in building lasting client partnerships.

| Key Activity | Description | 2024 Focus/Data Point |

| Platform Development & Management | Building and maintaining secure, scalable payment platforms. | Continued investment in technology infrastructure to support transaction growth. |

| Sales & Marketing | Client acquisition through direct sales, digital marketing, and partnerships. | Enhancing go-to-market strategies to expand client base and deepen relationships. |

| Customer Acquisition | Optimizing lead generation and conversion processes. | Leveraging data analytics for personalized marketing and improved sales funnel efficiency. |

| Payment Processing | Secure and efficient handling of business payments. | Processing over $145 billion annually across 140 currencies in over 200 countries. |

| Risk Management | Mitigating financial risks, especially foreign exchange exposure. | Providing hedging tools crucial for financial stability amidst currency volatility. |

| Compliance | Adhering to global financial regulations. | Continuous monitoring and adaptation of processes for operational integrity. |

| Customer Support & Relationship Management | Ensuring client satisfaction and loyalty through dedicated service. | Maintaining client retention rates above 95%, reflecting effective support. |

Delivered as Displayed

Business Model Canvas

The Corpay Business Model Canvas you are currently previewing is the exact, unedited document you will receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the comprehensive analysis you'll gain access to. You can be confident that the structure, content, and detail displayed here will be identical to the final deliverable, ready for your immediate use.

Resources

Corpay's proprietary technology, encompassing its advanced corporate card systems, robust cross-border payment infrastructure, and sophisticated AP automation software, forms the backbone of its business model. These platforms are not just tools; they are the engine driving efficiency and security for businesses worldwide. In 2024, Corpay continued to invest heavily in these technologies, aiming to further enhance user experience and expand service offerings.

This technological foundation provides Corpay with a significant competitive advantage, allowing for highly efficient, secure, and streamlined payment processes. Businesses rely on these capabilities to manage their financial operations effectively. The integration of these proprietary platforms is a key driver of customer loyalty, making it harder for clients to switch to competitors due to the embedded nature of Corpay's solutions in their daily workflows.

Corpay's access to an extensive global payment network, built on strong relationships with numerous banks and financial institutions worldwide, is a foundational resource. This network is crucial for its ability to process transactions efficiently and reliably across borders.

Holding the requisite payment licenses in various jurisdictions is another vital resource. These licenses grant Corpay the legal authority to operate and facilitate payments in different countries, ensuring compliance with local regulations and enabling its cross-border payment solutions.

Corpay's operational reach, spanning over 150 countries and managing payments in more than 140 currencies, underscores the breadth and depth of its global payment network and licensing infrastructure. This extensive capability directly supports its core business of facilitating seamless international transactions for its clients.

Corpay's operational backbone is its highly skilled workforce, exceeding 10,000 employees globally. This team includes specialized payment professionals, adept software engineers, driven sales teams, and dedicated customer service representatives.

Their collective expertise is crucial, covering financial technology advancements, understanding intricate market dynamics, and anticipating evolving customer needs. This deep knowledge fuels Corpay's innovation pipeline, ensures smooth operations, and directly impacts client satisfaction.

Strong Brand Reputation & Customer Base

Corpay’s strong brand reputation as a global leader in business payments is a critical resource. This is underscored by its position as the #1 B2B commercial Mastercard issuer in North America. This market leadership builds significant trust among businesses.

The company boasts an extensive customer base, serving over 800,000 business clients. This vast network is a testament to their established market presence and the loyalty they have cultivated.

This robust client base and trusted brand provide a solid foundation for Corpay’s continued expansion and ability to penetrate new markets effectively.

- Global Leader in Business Payments

- Over 800,000 Business Clients

- #1 B2B Commercial Mastercard Issuer in North America

- Foundation for Growth and Market Penetration

Capital & Financial Strength

Corpay's robust financial strength is a cornerstone of its business model, enabling the company to fund its operations and pursue strategic growth initiatives. The ability to generate substantial free cash flow is critical for reinvesting in technology and executing acquisitions, which are key drivers of its expansion strategy.

In 2024, Corpay demonstrated its financial prowess by reporting $4.0 billion in revenue. Looking ahead, the company projected an impressive $1.5 billion in free cash flow for 2025, highlighting its capacity to self-fund growth and maintain a strong financial position.

- Capital for Operations: Sufficient capital ensures seamless day-to-day business activities and the ability to meet financial obligations.

- Acquisition Funding: Strong financial health allows Corpay to acquire complementary businesses, expanding its market reach and service offerings.

- Investment in Technology: Financial strength supports continuous investment in technological advancements, crucial for staying competitive in the payments industry.

- Free Cash Flow Generation: Corpay's projected $1.5 billion in free cash flow for 2025 underscores its financial robustness and capacity for strategic deployment.

Corpay's key resources are its proprietary technology, extensive global payment network, necessary licenses, skilled workforce, strong brand, large customer base, and robust financial health. These elements collectively enable Corpay to provide efficient, secure, and comprehensive payment solutions to businesses worldwide.

| Resource Category | Key Components | 2024/2025 Data/Significance |

| Proprietary Technology | Corporate card systems, cross-border payment infrastructure, AP automation software | Continued investment in 2024 for enhanced user experience and service expansion. |

| Global Payment Network & Licenses | Relationships with banks, financial institutions, payment licenses in various jurisdictions | Operational reach in over 150 countries, processing payments in over 140 currencies. |

| Human Capital | Over 10,000 employees globally: payment professionals, engineers, sales, customer service | Expertise in fintech, market dynamics, and customer needs driving innovation and satisfaction. |

| Brand & Customer Base | #1 B2B Commercial Mastercard Issuer in North America, over 800,000 business clients | Establishes trust and provides a foundation for market penetration and growth. |

| Financial Strength | Revenue, free cash flow generation | Reported $4.0 billion in revenue for 2024; projected $1.5 billion in free cash flow for 2025. |

Value Propositions

Corpay provides businesses with a streamlined approach to managing diverse expenses, from vehicle costs to travel and accounts payable. Their solutions are designed to automate tedious tasks, cutting down on manual work and boosting financial efficiency across the board.

By simplifying and automating these processes, Corpay helps companies of all sizes reclaim valuable time and reduce operational costs. For instance, in 2024, businesses utilizing Corpay's automated accounts payable solutions reported an average reduction of 30% in processing time per invoice, directly translating to significant labor savings.

Corpay offers businesses enhanced spend control and visibility, a critical value proposition. Through corporate payment solutions and accounts payable automation, companies gain real-time oversight of expenditures. This allows for the enforcement of spending policies and provides valuable insights into financial performance via integrated reporting and analytics.

Corpay tackles the complexities of international business by simplifying cross-border payments. For companies dealing with over 160 currencies, Corpay offers robust solutions to manage these transactions efficiently and reduce foreign exchange risk. This is crucial for businesses aiming to expand globally.

The platform and extensive network facilitate the smooth processing of both large individual payments and high volumes of mass payments worldwide. This ensures international transactions are not only easier but also significantly more secure, a key concern for any business operating across borders.

In 2024, the global cross-border payments market was valued at an estimated $37.7 trillion, highlighting the immense scale and importance of these services. Corpay's ability to navigate this complex landscape provides a vital value proposition for businesses seeking to streamline their international financial operations.

Cost Savings & Rebates

Corpay directly translates into tangible cost savings for businesses. A significant portion of this is achieved through their commercial card programs, where clients earn substantial rebates on their spending. In fact, Corpay facilitates over $800 million in annual rebates to its customers, directly impacting their bottom line.

Beyond rebates, Corpay's integrated solutions optimize critical operational expenses. By providing enhanced tracking and management for fuel and travel, businesses can identify and eliminate inefficiencies, leading to reduced overall operational costs and improved financial performance.

- Rebates on Commercial Card Spending: Corpay returns over $800 million annually to customers through card program rebates.

- Fuel Expense Optimization: Streamlined fuel purchasing and tracking reduce waste and control costs.

- Travel Expense Management: Improved visibility and control over travel spending lead to significant savings.

- Reduced Operational Costs: By automating and simplifying expense management, Corpay lowers administrative overhead.

Tailored Solutions for Specific Industries

Corpay offers payment solutions crafted for specific industries, recognizing that each sector has unique operational demands. For instance, in fleet management, they provide specialized fuel card programs that help businesses control expenses and track driver behavior. This focus on industry-specific needs is a key part of their value proposition.

The company's approach ensures that businesses in sectors like healthcare can manage complex billing cycles and patient payments efficiently, while construction firms benefit from streamlined payment processes for subcontractors and suppliers. By understanding these nuances, Corpay delivers optimized financial tools.

Corpay's commitment to tailored solutions is evident in their offerings for sectors such as travel, where they facilitate efficient booking and expense management, and education, supporting tuition payments and vendor disbursements. This specialization allows businesses to leverage payment systems that directly address their operational challenges.

- Fleet Management: Corpay's solutions aim to reduce fuel costs and improve driver accountability, a critical need for companies operating large vehicle fleets.

- Travel Industry: They provide tools to simplify travel payments, manage agent commissions, and streamline reconciliation processes for travel agencies and corporate travel departments.

- Healthcare: Corpay supports healthcare providers with efficient patient payment collection and streamlined medical billing, addressing the sector's complex financial workflows.

- Construction: For construction businesses, Corpay offers solutions to manage payments to subcontractors and suppliers, improving cash flow and project financial management.

Corpay offers businesses enhanced spend control and visibility through its corporate payment solutions and accounts payable automation. This allows for real-time oversight of expenditures, enabling the enforcement of spending policies and providing valuable insights into financial performance via integrated reporting and analytics.

Corpay directly translates into tangible cost savings for businesses, largely through its commercial card programs where clients earn substantial rebates. In 2024, Corpay facilitated over $800 million in annual rebates to its customers, directly impacting their bottom line.

Corpay provides tailored payment solutions for specific industries, recognizing unique operational demands. For instance, in fleet management, specialized fuel card programs help control expenses and track driver behavior, a critical need for companies operating large vehicle fleets.

Corpay simplifies cross-border payments for businesses dealing with over 160 currencies, offering robust solutions to manage transactions efficiently and reduce foreign exchange risk, crucial for global expansion.

| Value Proposition | Description | Impact |

|---|---|---|

| Streamlined Expense Management | Automates tasks like accounts payable and vehicle expenses, reducing manual work. | Boosts financial efficiency and reclaims valuable time. In 2024, AP automation reduced processing time by an average of 30%. |

| Enhanced Spend Control & Visibility | Provides real-time oversight of expenditures and integrated reporting. | Enforces spending policies and offers insights into financial performance. |

| Cost Savings & Rebates | Offers commercial card programs with significant rebates on spending. | Corpay facilitated over $800 million in annual rebates to customers in 2024. |

| Industry-Specific Solutions | Develops tailored programs for sectors like fleet management and healthcare. | Optimizes operational expenses and addresses unique sector challenges. |

| Simplified Cross-Border Payments | Manages international transactions across over 160 currencies. | Reduces foreign exchange risk and facilitates efficient global business. The global cross-border payments market was valued at $37.7 trillion in 2024. |

Customer Relationships

Corpay prioritizes a high-touch approach with dedicated account management, often described as 'white glove service,' for its corporate clients. This personalized attention is key to fostering robust, enduring partnerships by directly addressing unique client requirements and offering strategic guidance.

This focus on bespoke support ensures clients maximize the value derived from Corpay's offerings, directly contributing to elevated customer retention rates. For instance, in 2024, Corpay reported a significant increase in customer satisfaction scores, directly attributed to their proactive account management initiatives.

Corpay enhances customer relationships through robust self-service portals and digital tools. These platforms allow clients to independently manage accounts, track expenses, and initiate payments, offering significant convenience and efficiency. This digital empowerment caters to businesses that value autonomy in their financial operations.

Corpay invests in its clients' success by offering comprehensive training programs and a wealth of resources. This includes access to educational materials, webinars, and expert guidance designed to help users fully leverage Corpay's payment solutions.

By providing ongoing market insights and platform updates, Corpay ensures its customers remain ahead of industry trends and payment best practices. This commitment fosters a strong partnership, driving continuous improvement and maximizing the value derived from Corpay's services.

Community Building & Feedback Mechanisms

Corpay actively cultivates customer communities and employs robust feedback mechanisms to gain crucial insights into evolving client needs. This proactive approach ensures their payment solutions remain highly relevant and responsive to market demands. For instance, in 2024, Corpay reported a 15% increase in customer-initiated feature requests, directly influencing their product development roadmap.

- Community Engagement: Corpay fosters online forums and user groups where clients can share best practices and provide direct input.

- Feedback Channels: Dedicated channels like surveys, in-app feedback tools, and direct account manager consultations are utilized.

- Impact on Development: Customer feedback directly informs the prioritization of new features and service enhancements.

- Client Retention: By actively listening and responding, Corpay aims to build a strong sense of belonging and loyalty among its user base.

Strategic Partnerships with Customers

Corpay aims to move beyond simple transactional engagements by fostering strategic partnerships with its clients. This means deeply understanding their unique business objectives and then tailoring Corpay's payment and expense management solutions to directly support those goals. This collaborative approach leads to more integrated services and shared growth opportunities.

This strategic alignment is crucial for addressing complex payment and expense management hurdles. For instance, by understanding a client's expansion plans, Corpay can proactively offer solutions that facilitate international payments or streamline cross-border expense reporting, thereby becoming an integral part of the client's operational success.

- Deep Understanding: Corpay invests in understanding client business goals, not just payment needs.

- Solution Alignment: Services are customized to support strategic objectives, fostering mutual growth.

- Problem Solving: Focuses on solving complex payment and expense management challenges.

- Integration: Drives deeper integration of Corpay's solutions into client operations.

Corpay cultivates strong client relationships through a blend of personalized service and digital empowerment. Dedicated account management provides a high-touch experience, while self-service portals offer convenience and autonomy. This dual approach, reinforced by educational resources and a commitment to understanding client objectives, aims to build strategic partnerships rather than just transactional ones.

| Customer Relationship Strategy | Key Features | Impact/Benefit | 2024 Data Point |

|---|---|---|---|

| High-Touch Service | Dedicated account management, 'white glove service' | Fosters enduring partnerships, addresses unique needs | Increased customer satisfaction scores |

| Digital Self-Service | Online portals, expense tracking, payment initiation | Offers convenience, efficiency, and client autonomy | N/A (focus on feature adoption) |

| Client Education & Resources | Training programs, webinars, expert guidance | Ensures clients maximize value from solutions | N/A (focus on resource utilization) |

| Strategic Partnership | Understanding business goals, tailoring solutions | Solves complex challenges, drives mutual growth | 15% increase in customer-initiated feature requests |

Channels

Corpay leverages a dedicated direct sales force to cultivate relationships with corporate clients, especially those requiring intricate payment solutions or managing substantial transaction volumes. This hands-on approach enables in-depth needs assessment and the presentation of customized strategies, proving vital for closing large enterprise deals.

In 2024, Corpay's direct sales team has been instrumental in expanding its reach within the B2B payments sector, focusing on sectors like manufacturing and logistics where complex payment flows are common. This direct engagement allows for the effective demonstration of Corpay's integrated platform, highlighting benefits such as enhanced cash flow management and reduced processing costs.

Corpay actively utilizes its corporate website and a suite of digital marketing channels to educate and attract businesses to its payment solutions. These platforms are crucial for generating leads, providing detailed product information, and initiating customer interactions, ensuring a wide audience can discover Corpay's offerings.

In 2024, digital marketing spend by businesses is projected to reach over $600 billion globally, highlighting the importance of these channels for customer acquisition. Corpay's investment in these areas allows it to efficiently reach a broad spectrum of potential clients seeking streamlined payment processing.

Corpay leverages strategic alliances with financial institutions, technology firms, and industry groups to drive customer acquisition. These partnerships facilitate referrals and enable integrated service offerings, expanding Corpay's reach into new markets and customer segments.

A prime example is Corpay's collaboration with Mastercard, which provides access to a broad network of financial institutions and their commercial clientele. This type of alliance is crucial for scaling customer acquisition efforts efficiently.

In 2024, Corpay continued to build upon these foundational partnerships, recognizing their significant contribution to its growth trajectory. The company actively seeks collaborations that enhance its value proposition and extend its market presence.

Mobile Applications

Corpay leverages mobile applications to extend the reach and convenience of its services. For instance, Corpay Lodging introduced a new mobile app designed for employees needing to manage travel expenses and book accommodations while on the move. This digital channel is crucial for enhancing user experience, particularly for a mobile workforce.

These mobile platforms provide critical functionality, allowing users to access and manage expense reports, process payments, and book services directly from their smartphones. This on-the-go capability streamlines operations and improves efficiency for businesses and their employees. In 2024, the adoption of mobile expense management solutions continued to climb, with many companies reporting significant time savings and improved data accuracy through such tools.

- Corpay Lodging Mobile App: Offers on-the-go expense management and booking capabilities.

- Enhanced Accessibility: Provides convenient access for employees regardless of location.

- Streamlined Operations: Facilitates efficient expense processing and payment management.

- User Experience: Improves overall user satisfaction through easy-to-use mobile interfaces.

Customer Service & Support Centers

Customer service and support centers are vital for Corpay, acting as a primary channel for relationship management and ongoing client engagement. These centers are crucial for resolving issues promptly, thereby fostering client trust and ensuring satisfaction with Corpay's comprehensive payment solutions.

These support hubs are designed to provide clients with immediate assistance, reinforcing the value proposition of Corpay's services. By offering accessible help, Corpay builds stronger client relationships and encourages continued loyalty.

- Client Retention: In 2023, companies with robust customer support saw an average increase of 10% in customer retention rates compared to those with weaker support systems.

- Problem Resolution: Effective support centers can resolve over 85% of customer inquiries on the first contact, significantly improving client experience.

- Brand Loyalty: A positive support interaction can boost a customer's likelihood to recommend a service by up to 70%.

- Operational Efficiency: Corpay's investment in advanced support technologies aims to reduce average handling time by 15% in 2024, improving overall service delivery.

Corpay utilizes a multi-faceted channel strategy to reach its diverse customer base. This includes a direct sales force for enterprise clients, digital marketing for broad lead generation, strategic partnerships for market expansion, and mobile applications for enhanced user convenience. Customer service centers are also a key channel for ongoing client engagement and support.

In 2024, Corpay's direct sales efforts are targeting sectors with complex payment needs, while digital channels are being optimized to capture a wider audience. Partnerships with entities like Mastercard continue to be a significant driver for scaling customer acquisition, and mobile platforms are being enhanced to improve user experience for a mobile workforce.

The company's commitment to customer support is evident in its investment in advanced technologies aimed at improving response times and first-contact resolution rates. This focus on service delivery is crucial for client retention and fostering brand loyalty.

| Channel | Description | 2024 Focus/Data |

|---|---|---|

| Direct Sales | B2B sales force for complex payment solutions and large enterprises. | Targeting manufacturing and logistics sectors; customized strategy presentations. |

| Digital Marketing | Website and online campaigns for lead generation and product education. | Global digital marketing spend projected over $600 billion; efficient broad reach. |

| Strategic Alliances | Partnerships with financial institutions, tech firms, and industry groups. | Collaborations with Mastercard for network access; scaling customer acquisition. |

| Mobile Applications | On-the-go expense management and booking for employees. | Corpay Lodging app launch; enhancing user experience for mobile workforce. |

| Customer Service | Support centers for relationship management and issue resolution. | Investment in tech to reduce handling time by 15%; improving client experience. |

Customer Segments

Small to medium-sized businesses (SMBs) represent a significant customer segment for Corpay, with the company serving over 800,000 business clients. These businesses, spanning numerous industries, often grapple with the complexities of financial management and expense control. They are actively looking for solutions that simplify payments, reduce the time spent on administrative tasks, and offer clearer insights into their expenditures.

Corpay actively courts large enterprises and corporations. These businesses typically need advanced payment solutions, such as full accounts payable automation, intricate international payment handling, and tailored corporate card programs. For instance, in 2024, many large corporations are seeking to streamline their procure-to-pay processes, with an estimated 70% of large enterprises looking to enhance their AP automation capabilities to reduce manual work and improve accuracy.

These high-volume clients, often with layered organizational hierarchies, find significant value in Corpay's adaptable and scalable product suite. The sheer volume of transactions processed by these entities, sometimes running into billions of dollars annually, necessitates robust and efficient payment infrastructure that Corpay is designed to provide.

Corpay offers highly specialized expense management solutions for diverse industries, recognizing that sectors like fleet management, travel, and healthcare have distinct operational demands. For instance, fleet businesses benefit from tailored fuel card programs and expense tracking designed to optimize fuel efficiency and manage driver spending, a critical area as fuel costs can represent a significant portion of operational expenditure.

In the travel sector, Corpay provides solutions for managing lodging payments and travel-related expenses, streamlining the complex booking and reimbursement processes inherent in this industry. This focus on vertical-specific needs is crucial, as demonstrated by the continued growth in business travel, which saw a notable rebound in 2024, indicating a strong demand for efficient payment and reconciliation tools.

The healthcare industry, with its intricate billing and vendor payment structures, also finds value in Corpay's industry-specific Accounts Payable (AP) automation. This allows healthcare providers to manage payments to suppliers and service providers more effectively, ensuring compliance and improving cash flow in a sector where timely payments are paramount for maintaining operations and patient care.

Financial Institutions & Asset Managers

Corpay is actively broadening its appeal to financial institutions and asset managers by providing sophisticated foreign exchange (FX) risk management solutions and multi-currency account capabilities. This strategic push leverages Corpay's established proficiency in international payments, positioning it as a competitive alternative to incumbent banking services.

This segment values Corpay's ability to streamline complex cross-border transactions and mitigate FX volatility. For instance, in 2024, the global FX market continued to see significant activity, with average daily volumes in the trillions, underscoring the demand for robust risk management tools. Corpay's offerings address this need directly.

- FX Risk Management: Corpay provides advanced tools to hedge against currency fluctuations, crucial for institutions managing international investments and operations.

- Multi-Currency Accounts: Facilitates easier management of funds across different currencies, simplifying international trade and investment for financial entities.

- Competitive Edge: Corpay differentiates itself by offering specialized services that traditional banks may not prioritize or deliver as efficiently.

- Market Growth: The increasing globalization of finance means more institutions require specialized cross-border payment and FX solutions, a trend expected to continue through 2025.

Government & Non-Profit Organizations

Corpay serves government and non-profit organizations, recognizing their unique needs for stringent expense control, regulatory compliance, and clear financial accountability. These entities often grapple with managing public funds or donor contributions, making efficient payment processing and robust reporting paramount.

Corpay's offerings are tailored to assist these sectors in optimizing their financial operations. For instance, government agencies can leverage Corpay's solutions to streamline procurement card programs, ensuring better oversight and reducing administrative burdens. Non-profits benefit from tools that facilitate secure and timely disbursement of funds, crucial for program delivery and maintaining donor trust. In 2023, the non-profit sector in the US saw over $4.5 trillion in assets, highlighting the scale of financial management required.

- Streamlined Procurement: Corpay's solutions help government bodies manage purchasing power more effectively, reducing fraud and waste.

- Enhanced Compliance: Tools are available to ensure adherence to public sector financial regulations and reporting standards.

- Efficient Fund Disbursement: Non-profits can manage grants and payments to vendors and beneficiaries with greater transparency and control.

- Budgetary Oversight: Corpay provides features that aid in tracking expenses against allocated budgets, crucial for public and charitable entities.

Corpay caters to a broad spectrum of businesses, from small to medium-sized enterprises (SMBs) seeking simplified payment solutions to large corporations requiring advanced accounts payable automation and international payment capabilities. These diverse clients, including those in specialized sectors like fleet management, travel, and healthcare, benefit from tailored expense management and AP automation tools.

Financial institutions and asset managers are also a key segment, leveraging Corpay's foreign exchange risk management and multi-currency account features to navigate global markets. Furthermore, government and non-profit organizations utilize Corpay's solutions for stringent expense control, compliance, and efficient fund disbursement, managing significant financial assets.

| Customer Segment | Key Needs | Corpay Solution Examples | 2024/2025 Relevance |

| SMBs | Simplified payments, expense control, administrative efficiency | Payment processing, expense tracking tools | Continued demand for cost-effective financial management solutions. |

| Large Enterprises | AP automation, international payments, procure-to-pay streamlining | Full AP automation, corporate card programs, global payment networks | 70% of large enterprises focused on enhancing AP automation in 2024. |

| Specialized Industries (Fleet, Travel, Healthcare) | Industry-specific expense management, optimized operations | Tailored fuel cards, travel payment solutions, healthcare AP automation | Business travel rebound in 2024 highlights need for efficient travel payment tools. |

| Financial Institutions/Asset Managers | FX risk management, multi-currency accounts, cross-border efficiency | Advanced FX hedging tools, multi-currency account management | Trillions in daily FX market activity underscore demand for risk management. |

| Government/Non-Profits | Expense control, compliance, fund disbursement, budget oversight | Procurement card programs, secure fund disbursement, reporting tools | US non-profit sector held over $4.5 trillion in assets in 2023. |

Cost Structure

Corpay invests heavily in creating and maintaining its advanced payment technology. This encompasses the ongoing research and development of their proprietary software and IT systems, ensuring they remain cutting-edge and efficient.

A substantial portion of these costs goes towards robust cybersecurity measures and the upkeep of their data centers. For instance, in 2023, the global spending on cybersecurity solutions reached an estimated $215 billion, highlighting the critical nature of such investments in the financial technology sector.

Staying ahead of technological advancements is paramount for Corpay to offer secure, reliable, and innovative payment solutions. This continuous investment ensures their platforms are not only functional but also protected against evolving digital threats.

Corpay dedicates a significant portion of its resources to sales and marketing, crucial for acquiring new customers and strengthening its brand presence worldwide. This investment covers essential areas like compensation for its sales force, widespread advertising initiatives, participation in promotional events, and the creation of compelling marketing collateral designed to connect with a diverse global clientele.

Corpay's largest expense is its personnel, with over 10,000 employees globally. This includes salaries and benefits for customer service, administrative, and operational teams. In 2024, the company continued to invest heavily in its workforce to support its expanding service offerings and global reach.

Beyond staffing, operational costs are significant. These encompass expenses like office rentals, utilities, and general administrative overhead necessary to maintain its worldwide operations. These costs are crucial for the day-to-day functioning and infrastructure supporting Corpay's business model.

Acquisition & Integration Costs

Corpay's aggressive growth hinges on strategic acquisitions, a process that naturally brings substantial acquisition and integration costs. These aren't just the purchase price; they encompass extensive due diligence to vet potential targets and the complex work of merging acquired entities into Corpay's existing framework. For instance, in 2023, Corpay completed several acquisitions, contributing to their reported $2.7 billion in revenue, with integration expenses being a key component of their operational spend.

These costs often involve significant outlays for professional services, such as legal and accounting fees, essential for navigating the complexities of M&A. Furthermore, the technical side of integration, including migrating disparate IT systems and operational platforms, represents another substantial financial commitment. These investments are crucial for realizing the full synergy and efficiency gains expected from each acquisition.

- Due Diligence Expenses: Costs associated with legal, financial, and operational reviews of acquisition targets.

- Professional Services Fees: Payments to external advisors like lawyers, accountants, and investment bankers.

- System Integration Costs: Expenses related to merging IT infrastructure, software, and data management systems.

- Personnel Integration: Costs for aligning HR policies, benefits, and onboarding new employees.

Payment Network & Compliance Fees

Corpay incurs significant costs to operate within global payment networks. These include transaction processing fees, interchange fees charged by card networks, and various regulatory compliance costs essential for cross-border transactions. For instance, in 2024, the global fintech market, which heavily influences these operational costs, was projected to reach trillions, with a substantial portion dedicated to transaction processing and compliance infrastructure.

These fees are fundamental to Corpay's ability to facilitate payments across diverse currencies and international markets. Adherence to stringent financial regulations in multiple jurisdictions also adds to these expenses, ensuring secure and lawful transactions for its clients.

- Transaction Processing Fees: Costs associated with the infrastructure and services that enable the movement of funds.

- Interchange Fees: Fees paid by merchants' banks to cardholders' banks for each transaction.

- Regulatory Compliance: Expenses related to adhering to financial laws, anti-money laundering (AML) regulations, and Know Your Customer (KYC) requirements globally.

- Network Access Fees: Costs for maintaining connectivity and participation in global payment systems like Visa and Mastercard.

Corpay’s cost structure is heavily influenced by its investment in technology and personnel. Significant expenses are allocated to research and development for its payment platforms, alongside robust cybersecurity measures. As of 2024, the company continued to prioritize its global workforce, which exceeds 10,000 employees, covering salaries, benefits, and operational support.

Strategic acquisitions are a notable cost driver, encompassing due diligence, professional services, and intricate system integration. Furthermore, operational costs, including office rentals and utilities, are essential for maintaining its worldwide presence. In 2023, Corpay reported $2.7 billion in revenue, with integration and operational expenses forming a substantial part of its overall spend.

| Cost Category | Key Components | Estimated Impact (Illustrative) |

| Technology & R&D | Software development, IT infrastructure, cybersecurity | Significant ongoing investment |

| Personnel | Salaries, benefits for 10,000+ employees | Largest expense category |

| Sales & Marketing | Compensation, advertising, events | Crucial for customer acquisition |

| Acquisitions & Integration | Due diligence, professional fees, system merging | Variable, tied to M&A activity |

| Operational Costs | Office space, utilities, administrative overhead | Essential for day-to-day functioning |

| Payment Network Fees | Transaction processing, interchange, compliance | Necessary for global payment facilitation |

Revenue Streams

Corpay's revenue heavily relies on transaction fees from its payment processing platforms. These fees are dynamic, adjusting based on transaction volume, type, and complexity, encompassing corporate card payments, international transfers, and accounts payable automation.

Corpay generates revenue from foreign exchange margins, also known as spreads, on its cross-border payment solutions. This involves the difference between the buying and selling rates of various currencies, a critical component for clients engaged in international trade and transactions.

In 2024, the global foreign exchange market saw substantial activity, with average daily trading volumes reaching trillions of dollars. Corpay leverages this market by facilitating currency conversions for its clients, earning a percentage on each transaction through these spreads.

This revenue stream is particularly vital for businesses looking to manage and mitigate the inherent risks associated with currency fluctuations. By offering competitive exchange rates and transparent pricing, Corpay aims to capture a significant share of this market.

Corpay generates consistent income through subscription and platform fees, offering advanced features and specialized services. This model is particularly effective for their accounts payable automation software, ensuring a predictable revenue base.

Interchange & Rebates from Card Programs

Corpay generates significant revenue through interchange fees. These are fees merchants pay when Corpay's corporate cards are used for transactions. In 2024, the total value of card transactions processed globally reached trillions of dollars, with interchange fees forming a key revenue component for card issuers and networks.

Beyond interchange, Corpay also earns revenue from arrangements with major card networks. These partnerships allow Corpay to leverage the extensive reach and infrastructure of these networks, further solidifying its position in the payment processing landscape. For instance, Visa and Mastercard reported substantial growth in their payment volumes in 2024, directly benefiting companies like Corpay.

A strategic aspect of Corpay's model involves sharing a portion of these earnings back with its clients as rebates. This practice is designed to incentivize increased usage of Corpay's corporate card programs. By offering attractive rebate structures, Corpay encourages greater adoption and loyalty among its business customers, driving higher transaction volumes and, consequently, more interchange revenue.

- Interchange Fees: Merchants pay these fees when Corpay corporate cards are used, a primary revenue driver.

- Card Network Partnerships: Revenue is also derived from agreements with major card networks, enhancing service capabilities.

- Client Rebates: A portion of interchange earnings is returned to clients as rebates, promoting card program usage.

- 2024 Market Context: Global card transaction volumes in 2024 underscored the potential scale of interchange revenue for payment providers.

Interest Income on Funds in Transit/Float

Corpay can generate revenue from the interest earned on funds that are temporarily held during payment processing, a concept often referred to as float. This is especially significant in cross-border transactions where funds might be in transit for a duration before final settlement, allowing Corpay to earn a return on these temporarily held assets.

- Interest Income on Float: Corpay leverages the time lag in payment processing, particularly for international transfers, to earn interest on funds held.

- Cross-Border Payment Advantage: The extended settlement times inherent in cross-border transactions amplify the potential for float income.

- 2024 Data Insight: While specific float income figures for Corpay are not publicly itemized in detail, the broader payments industry saw continued growth in transaction volumes in 2024, suggesting a stable or increasing opportunity for such revenue streams. For instance, global cross-border payment volumes were projected to continue their upward trajectory, driven by e-commerce and business-to-business transactions.

Corpay's revenue streams are diversified, primarily driven by transaction fees across its payment processing platforms, including corporate card payments and international transfers.

Foreign exchange margins, or spreads on currency conversions, form another significant revenue source, particularly for clients engaged in global trade.

Additionally, Corpay benefits from interchange fees generated when its corporate cards are used, alongside revenue from partnerships with major card networks and interest earned on funds held during transaction processing (float).

Predictable income is also secured through subscription and platform fees for services like accounts payable automation.

| Revenue Stream | Description | 2024 Market Relevance/Data |

| Transaction Fees | Fees charged per payment processed (corporate cards, international transfers, AP automation). | Global digital payment transaction volumes continued to surge in 2024, with estimates indicating growth in the double digits year-over-year. |

| Foreign Exchange Margins (Spreads) | Profit earned from the difference between buying and selling currency rates. | The global FX market saw average daily trading volumes exceeding $7.5 trillion in early 2024, highlighting the scale of currency conversion opportunities. |

| Interchange Fees | Fees paid by merchants when Corpay corporate cards are utilized. | Card-present and card-not-present transaction volumes in 2024 remained robust, with interchange fees being a core revenue component for payment facilitators. |

| Subscription & Platform Fees | Recurring fees for access to software and advanced features (e.g., AP automation). | The adoption of financial automation software saw continued acceleration in 2024, with many businesses investing in solutions for efficiency. |

| Interest Income (Float) | Earnings from holding funds temporarily during payment settlement. | Cross-border payment volumes continued to expand in 2024, offering extended periods for funds to be held and generate interest. |

Business Model Canvas Data Sources

The Corpay Business Model Canvas is built using a blend of internal financial data, customer feedback, and market intelligence. These sources provide a comprehensive view of our operations and market position.