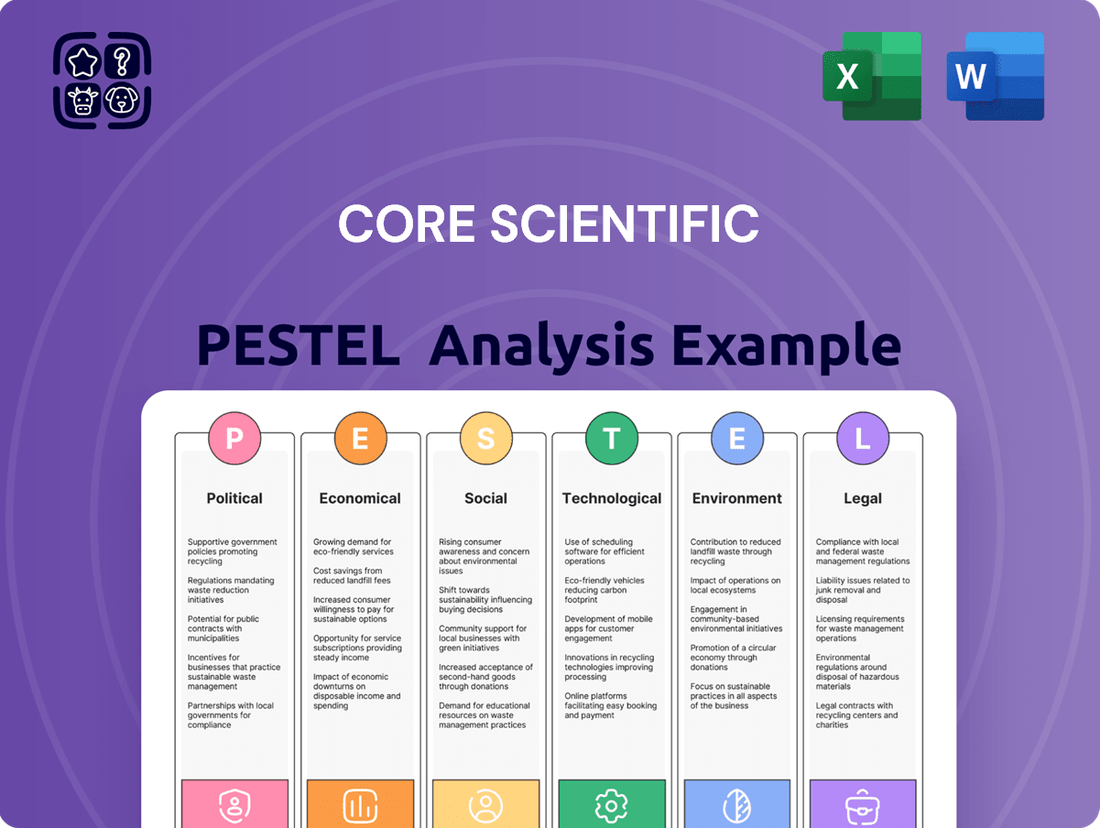

Core Scientific PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Core Scientific Bundle

Unlock the full picture of Core Scientific's operating environment with our comprehensive PESTLE analysis. Understand the intricate web of political, economic, social, technological, legal, and environmental factors shaping its future. Equip yourself with expert-level insights to anticipate challenges and seize opportunities. Download the complete analysis now to gain a decisive strategic advantage.

Political factors

The regulatory environment for digital assets, including Bitcoin, is a dynamic global concern that directly affects companies like Core Scientific. New rules, such as the SEC's ongoing scrutiny of crypto assets or potential changes to tax laws impacting mining operations, can create significant uncertainty. For example, the U.S. Treasury's focus on digital asset taxation and reporting in 2024 and 2025 highlights the increasing governmental oversight.

Core Scientific's significant investment in large-scale data centers makes its operations highly sensitive to geopolitical stability in its host regions. For instance, disruptions stemming from political unrest or conflicts can directly impact energy supply, a critical input for their energy-intensive operations. In 2024, the global landscape continues to present challenges, with ongoing geopolitical tensions in various regions where data center infrastructure might be located.

Government energy policies, such as subsidies for renewable energy sources or taxes levied on fossil fuels, significantly impact Core Scientific's operational expenses given its substantial energy consumption. For instance, in 2024, the US government continued to offer tax credits for renewable energy projects, which could potentially lower electricity procurement costs for mining operations. Conversely, any imposition of carbon taxes or reduction in existing energy subsidies would directly increase Core Scientific's cost base.

These policy shifts directly influence Core Scientific's profitability and strategic decisions, including where to locate new facilities. Favorable energy policies can reduce overhead, bolster sustainability initiatives, and make certain regions more attractive for investment. For example, states offering lower industrial electricity rates or renewable energy incentives might be prioritized over those with higher energy costs or less supportive regulatory environments, impacting capital allocation and expansion plans throughout 2024 and into 2025.

Trade Policies and Import/Export Regulations

Core Scientific's reliance on specialized mining hardware, like ASICs, means international trade policies directly affect its operational costs and expansion plans. For instance, tariffs imposed on electronics can significantly inflate the price of new equipment, as seen with various trade disputes impacting global supply chains in recent years.

Trade sanctions or restrictions on technology transfers pose a substantial risk, potentially delaying critical infrastructure upgrades or even preventing access to necessary components. This can hinder Core Scientific's ability to scale its operations efficiently and maintain its competitive edge in the rapidly evolving digital asset mining landscape.

- Tariff Impact: Increased tariffs on imported ASICs could raise capital expenditure for new mining rigs by an estimated 10-25% in affected regions.

- Supply Chain Disruptions: Geopolitical tensions in 2024 have led to longer lead times for specialized semiconductor manufacturing, impacting equipment availability.

- Export Controls: Restrictions on exporting advanced computing hardware could limit Core Scientific's access to the latest generation of mining technology.

National Security Concerns and Critical Infrastructure Designation

As blockchain technology integrates more deeply into financial systems, governments are increasingly scrutinizing its infrastructure. For instance, in 2024, several nations, including the United States and members of the European Union, began exploring frameworks to classify certain blockchain nodes and large-scale mining facilities as critical infrastructure. This designation stems from concerns about the potential impact of disruptions on financial stability and national security.

This heightened oversight could translate into significant operational changes for blockchain entities. Expect more stringent security mandates, detailed reporting obligations on network activity, and potential government intervention during national emergencies. Such measures, while aimed at safeguarding national interests, could impose substantial compliance costs and limit operational flexibility for businesses involved in blockchain infrastructure development and operation.

- Critical Infrastructure Designation: Governments are evaluating the classification of significant blockchain operations, like major mining farms, as critical infrastructure.

- Increased Oversight: This designation will likely lead to stricter security protocols and reporting requirements for blockchain entities.

- National Security Implications: Concerns over the resilience of financial systems reliant on blockchain are driving these policy considerations.

- Operational Impact: Businesses may face direct intervention or new compliance burdens, affecting their autonomy.

Governmental policies regarding digital asset regulation and taxation continue to evolve, directly impacting Core Scientific's operational landscape. For instance, the U.S. Treasury's ongoing focus on digital asset reporting and taxation through 2024 and 2025 underscores increased governmental oversight, potentially affecting mining profitability and compliance costs.

Geopolitical stability is paramount for Core Scientific's data center operations, as political unrest can disrupt essential energy supplies. The global political climate in 2024 presents ongoing challenges, with tensions in various regions potentially affecting infrastructure locations and energy access.

Energy policies, including renewable energy incentives and fossil fuel taxes, significantly influence Core Scientific's substantial energy expenditures. The continuation of U.S. tax credits for renewable energy in 2024 could mitigate electricity procurement costs, while potential carbon taxes would directly increase operational expenses.

International trade policies, such as tariffs on specialized hardware like ASICs, directly impact Core Scientific's capital expenditure for new equipment. Trade sanctions and export controls on advanced computing hardware also pose risks, potentially hindering access to the latest mining technology and impacting expansion plans through 2024 and 2025.

| Policy Area | Impact on Core Scientific | 2024/2025 Relevance |

|---|---|---|

| Digital Asset Regulation | Compliance costs, operational uncertainty | Increased SEC scrutiny, evolving tax laws |

| Geopolitical Stability | Energy supply disruption risk | Ongoing regional tensions impacting infrastructure |

| Energy Policy | Operational expenses, cost of electricity | Renewable energy credits vs. potential carbon taxes |

| Trade Policy | Hardware costs, technology access | Tariffs on ASICs, export controls on semiconductors |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Core Scientific, detailing how Political, Economic, Social, Technological, Environmental, and Legal forces shape its operational landscape and strategic opportunities.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for immediate strategic application.

Economic factors

Core Scientific's core operation, Bitcoin mining, is inherently linked to the significant price swings of Bitcoin. For instance, in early 2024, Bitcoin experienced a substantial rally, reaching new all-time highs, which directly boosted the revenue potential for miners like Core Scientific. However, this volatility means that sharp downturns, as seen in previous years, can severely compress profit margins and cash flow.

The revenue Core Scientific generates from mining new Bitcoin is directly proportional to Bitcoin's market price. When Bitcoin's value increases, the dollar amount of newly mined coins rises, enhancing profitability. Conversely, a price drop directly reduces the value of their mined assets, posing a challenge to maintaining consistent financial performance.

Effectively managing this Bitcoin price volatility is paramount for Core Scientific's financial health. Strategies such as hedging, optimizing energy costs, and maintaining efficient mining operations are crucial to mitigate the impact of price fluctuations and ensure operational stability.

Energy costs represent a significant hurdle for Bitcoin miners like Core Scientific, with electricity being their primary operational expense. For instance, during 2023, Core Scientific's energy costs averaged around $0.05 per kilowatt-hour (kWh), a figure that directly impacts their profitability.

Global energy market dynamics, including geopolitical events and shifts in supply and demand, cause considerable price volatility. This fluctuation, coupled with regional weather patterns affecting power generation, can significantly squeeze Core Scientific's profit margins.

Securing consistent access to affordable and scalable energy is crucial for Core Scientific to maintain its competitive edge. As of the first quarter of 2024, the company reported having secured approximately 70% of its energy needs through fixed-price agreements, aiming to mitigate some of these price risks.

Rising inflation presents a significant challenge for Core Scientific, potentially increasing operational costs. For instance, the Consumer Price Index (CPI) in the US saw a 3.3% increase year-over-year in May 2024, indicating upward pressure on expenses like electricity, hardware, and employee compensation. This directly impacts a company heavily reliant on energy and infrastructure.

Furthermore, the Federal Reserve's monetary policy, which includes adjusting interest rates to combat inflation, directly affects Core Scientific's financial strategy. With the Federal Funds Rate holding steady in the 5.25%-5.50% range through mid-2024, the cost of borrowing remains elevated. This makes it more expensive for Core Scientific to secure capital for growth initiatives or to manage its existing debt, influencing decisions on capital expenditures and overall investment.

Global Economic Growth and Investment Climate

The global economic landscape significantly shapes the investment climate for digital assets and their supporting infrastructure. A robust global economy, characterized by steady GDP growth and low inflation, generally fuels investor confidence, leading to increased capital allocation towards technology-driven sectors, including blockchain and cryptocurrency. For instance, the International Monetary Fund (IMF) projected global growth at 3.2% for both 2024 and 2025 in its April 2024 World Economic Outlook, indicating a generally supportive environment for investment.

Conversely, economic downturns, marked by recessions, high interest rates, or geopolitical instability, tend to dampen investor appetite. During such periods, capital becomes scarcer, and investors often shift towards safer, less volatile assets, reducing demand for speculative or growth-oriented investments like digital assets. This can directly impact the demand for colocation services, which are essential for the physical infrastructure supporting digital asset operations, as overall IT spending may contract.

The prevailing investment climate is also influenced by factors such as interest rate policies set by major central banks. For example, the US Federal Reserve's decisions on interest rates in 2024 and anticipated moves in 2025 will continue to affect the cost of capital and the attractiveness of riskier investments. Higher interest rates can make traditional fixed-income investments more appealing, potentially drawing capital away from digital assets.

- Global GDP Growth Projections: The IMF's forecast of 3.2% global growth for 2024 and 2025 suggests a generally favorable economic backdrop for investment in innovative sectors.

- Interest Rate Environment: Central bank policies, particularly regarding interest rates in major economies like the US and Europe, directly influence the cost of capital and investor risk appetite.

- Inflationary Pressures: Persistent inflation can lead to tighter monetary policy, potentially increasing borrowing costs and reducing disposable income available for investment.

- Investor Sentiment: Overall market confidence, driven by economic stability and future growth prospects, is a key determinant of capital flow into digital asset infrastructure and related technologies.

Competition in Digital Asset Mining and Hosting

The digital asset mining and hosting sector is intensely competitive. Core Scientific contends with many entities seeking to capture market share, from massive established miners to agile newcomers.

This dynamic necessitates ongoing capital allocation towards cutting-edge, energy-efficient hardware. Maintaining a competitive edge also means offering attractive pricing for hosting solutions and distinguishing its services through superior operational quality and reliability to secure and retain its market standing.

- Increased Competition: The number of digital asset mining operations has significantly grown, intensifying price wars and reducing profit margins for all participants.

- Hardware Advancements: Rapid improvements in Application-Specific Integrated Circuits (ASICs) require frequent hardware upgrades, a substantial ongoing cost for miners like Core Scientific.

- Hosting Market Saturation: The demand for hosting services is high, but so is the supply of data center capacity, putting pressure on pricing and service level agreements.

- Energy Cost Sensitivity: Competitors with access to cheaper electricity sources gain a significant cost advantage, impacting Core Scientific's ability to compete on price.

Core Scientific's financial performance is intrinsically tied to the volatile price of Bitcoin. As of early 2024, Bitcoin's surge to new all-time highs provided a significant revenue uplift for miners. However, the inherent price swings mean that sharp declines, as seen historically, can severely impact profit margins and cash flow, making effective risk management strategies essential.

Energy costs remain a primary operational expense for Core Scientific, with electricity prices directly impacting profitability. The company's average energy cost in 2023 was approximately $0.05 per kWh. To mitigate price volatility, Core Scientific secured about 70% of its energy needs through fixed-price agreements by Q1 2024.

Inflationary pressures, evidenced by the US CPI rising 3.3% year-over-year in May 2024, increase operational costs for Core Scientific, affecting everything from hardware to labor. Elevated interest rates, with the US Federal Funds Rate at 5.25%-5.50% through mid-2024, also increase the cost of capital for expansion and debt management.

The global economic outlook, with the IMF projecting 3.2% global GDP growth for 2024 and 2025, generally supports investment in technology sectors like digital assets. However, economic downturns and higher interest rates can reduce investor appetite for riskier assets, impacting demand for digital asset infrastructure services.

Preview Before You Purchase

Core Scientific PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the Core Scientific PESTLE Analysis you’re buying—delivered exactly as shown, no surprises.

The content and structure shown in the preview is the same document you’ll download after payment, providing a comprehensive overview of the external factors influencing Core Scientific.

Sociological factors

Public understanding of cryptocurrencies is growing, but significant knowledge gaps persist. For instance, a 2024 survey indicated that while awareness of Bitcoin is high, only about 30% of respondents felt they understood how it works. This societal acceptance directly impacts market sentiment; positive views can drive adoption, as seen with the increasing number of businesses accepting crypto payments.

Conversely, negative perceptions, often stemming from volatility or security concerns, can hinder growth. Reports from 2024 highlighted that a significant portion of the public still associates cryptocurrencies with scams or environmental damage, partly due to the energy consumption of some mining processes. This perception influences regulatory bodies, potentially leading to more restrictive policies that could dampen demand.

Core Scientific's operations, particularly its large-scale data centers for high-density computing, depend heavily on a specialized workforce. This includes professionals skilled in electrical engineering, network management, and cybersecurity. The company's success hinges on having access to this talent pool.

The availability and concentration of these skilled workers in Core Scientific's operating regions are critical. For instance, in 2023, the demand for cloud computing specialists saw a significant increase, with job postings rising by an estimated 15% year-over-year, highlighting the competitive landscape for such talent.

Furthermore, Core Scientific's ability to attract and retain these highly sought-after employees directly impacts its operational efficiency and capacity for technological innovation. A stable, skilled workforce is fundamental to maintaining and advancing its high-density computing infrastructure.

Large data centers can significantly affect local communities, bringing both opportunities and challenges. For instance, the construction and operation of these facilities can lead to increased noise levels and substantial energy demands. However, they also create new employment opportunities, with some projects aiming for a significant percentage of local hires. For example, in 2024, a new hyperscale data center development in Northern Virginia projected the creation of over 1,000 construction jobs and 150 permanent operational roles, with a stated commitment to prioritize local workforce development.

Building and keeping good relationships with the surrounding community is crucial for data center success. This involves being open about their operations, actively seeking to hire locally, and making sure environmental worries are addressed. In 2025, a data center company in the Pacific Northwest successfully navigated its permitting process by hosting multiple public forums, detailing its water conservation efforts, and contributing to a local renewable energy initiative, which helped secure community support and expedited approvals.

Consumer Trust in Digital Asset Ecosystem

Consumer trust in the digital asset ecosystem is a critical sociological factor influencing Core Scientific's business. When the broader public perceives digital assets as secure and reliable, it bolsters demand for the infrastructure supporting them. Conversely, negative events can create significant headwinds.

High-profile security breaches and scams within the cryptocurrency space can severely damage consumer confidence. For instance, the collapse of FTX in late 2022, which involved allegations of fraud and mismanagement, significantly impacted trust across the industry. Such events can lead potential clients to hesitate in adopting digital asset technologies, directly affecting Core Scientific's client acquisition and retention.

Furthermore, the perceived stability and regulatory clarity of blockchain technology play a crucial role. As of early 2024, regulatory bodies worldwide are still developing frameworks for digital assets, creating an environment of uncertainty. This uncertainty can deter institutional adoption and individual investment, indirectly limiting the growth of the digital asset market that Core Scientific serves.

- Erosion of Trust: Incidents like the FTX collapse in November 2022 led to widespread concern about the security and transparency of digital asset exchanges.

- Regulatory Uncertainty: Ongoing efforts by global regulators to define and oversee digital assets create a cautious environment for both consumers and businesses.

- Impact on Demand: A decline in consumer trust and increased regulatory scrutiny can directly reduce the demand for digital asset infrastructure services like those provided by Core Scientific.

Ethical Considerations of Energy Consumption

Societal expectations are increasingly focused on the environmental impact of energy use, and Bitcoin mining is under particular scrutiny. Core Scientific, being a significant energy consumer, must proactively showcase its commitment to sustainable energy practices. This includes a strong emphasis on utilizing renewable energy sources to meet public demand and mitigate potential reputational risks, which can directly affect investor confidence and client relationships.

As of Q1 2024, Core Scientific reported utilizing approximately 84% of its energy from zero-carbon sources, a figure they aim to increase. This commitment is crucial for maintaining a positive public image and attracting environmentally conscious investors. The company's public disclosures highlight ongoing efforts to secure power purchase agreements with renewable energy providers, demonstrating a tangible strategy to address these ethical considerations.

- Growing public awareness of Bitcoin's energy footprint.

- Core Scientific's reliance on energy necessitates responsible sourcing.

- Pressure to adopt and demonstrate renewable energy usage.

- Reputational impact on investor and client perception.

Public perception of digital assets significantly influences the demand for Core Scientific's infrastructure. Negative sentiment, often fueled by volatility and security concerns, can deter adoption. For example, a late 2023 survey indicated that while Bitcoin awareness was high, only about 30% of respondents felt they understood its underlying technology, highlighting a persistent knowledge gap that can breed mistrust.

Consumer trust is paramount, and events like the FTX collapse in November 2022, which involved allegations of fraud, severely eroded confidence in the digital asset ecosystem. This erosion directly impacts Core Scientific by potentially reducing client acquisition and retention, as businesses and individuals become more hesitant to engage with digital asset technologies.

Societal concern over energy consumption, particularly for Bitcoin mining, also plays a critical role. Core Scientific, as a major energy user, faces pressure to demonstrate a commitment to sustainability. By Q1 2024, the company reported using approximately 84% zero-carbon energy sources, a figure it aims to increase, signaling a strategic response to these environmental expectations.

| Sociological Factor | Impact on Core Scientific | Supporting Data/Event |

|---|---|---|

| Public Understanding & Perception | Influences demand for digital asset infrastructure. | 30% understanding of Bitcoin (late 2023 survey). |

| Consumer Trust & Security Concerns | Affects client acquisition and retention. | FTX collapse (Nov 2022) led to widespread trust erosion. |

| Environmental Awareness & Energy Use | Pressures responsible energy sourcing and impacts reputation. | 84% zero-carbon energy use (Q1 2024), aiming for increase. |

Technological factors

The relentless evolution of Bitcoin mining hardware, particularly Application-Specific Integrated Circuits (ASICs), is a critical technological factor for Core Scientific. The efficiency gains from these specialized chips directly translate to lower energy consumption per hash, a key driver of profitability. For instance, while older ASICs might offer around 100 terahashes per second (TH/s), the latest models available in 2024 and anticipated for 2025 are pushing towards 200 TH/s and beyond, with significantly improved power efficiency ratios.

This rapid technological advancement creates a constant need for hardware upgrades. Core Scientific must strategically invest in newer ASIC generations to remain competitive and avoid being left with less efficient, more costly-to-operate equipment. Failure to do so can quickly erode market share and profitability as competitors leverage superior hardware.

Blockchain network developments, particularly Bitcoin's halving events, directly impact mining profitability. The halving reduces the block reward for miners, a significant revenue stream. For instance, the most recent halving occurred in April 2024, cutting the reward from 6.25 BTC to 3.125 BTC per block. This necessitates operational efficiency to maintain profitability.

Difficulty adjustments are another crucial technological factor. The Bitcoin network automatically adjusts the mining difficulty roughly every two weeks to ensure a consistent block creation time of about 10 minutes. As more hash power joins the network, difficulty increases, making it harder to find a block. Core Scientific must manage its hashrate and energy consumption effectively to navigate these fluctuations and secure its share of rewards.

Maintaining optimal operating temperatures is paramount for Core Scientific's high-density computing infrastructure, directly impacting equipment performance and lifespan. Emerging cooling technologies, like liquid immersion cooling, offer substantial gains in energy efficiency, potentially lowering operational expenditures and enhancing Core Scientific's competitive positioning in the market.

The global data center cooling market is projected to reach $21.6 billion by 2027, indicating significant investment and innovation in this area. Core Scientific's adoption of advanced cooling solutions, such as those utilizing free cooling or more efficient liquid cooling systems, could lead to a reduction in Power Usage Effectiveness (PUE) ratios, a key metric for data center efficiency, potentially improving from current industry averages around 1.5 to closer to 1.1 or lower.

Cybersecurity Threats and Innovations

Core Scientific, as a provider of blockchain infrastructure, faces significant cybersecurity risks. Sophisticated cyberattacks could target its operations or its clients' digital assets, potentially leading to disruptions or theft. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the scale of the threat landscape.

To mitigate these risks, Core Scientific must continually invest in advanced cybersecurity. This includes implementing robust intrusion detection systems, employing strong encryption protocols, and maintaining secure network architectures. These measures are crucial not only for safeguarding its own infrastructure but also for protecting the digital assets of its colocation clients.

The company's proactive approach to cybersecurity is a critical factor in maintaining trust and operational integrity. Recent reports indicate that the average cost of a data breach in 2024 was around $4.73 million, underscoring the financial implications of security failures.

- Cyberattack Vulnerability: Core Scientific's role as a blockchain infrastructure provider makes it a prime target for cyber threats aiming to disrupt services or steal digital assets.

- Investment in Security: Continuous investment in advanced cybersecurity measures like intrusion detection, encryption, and secure network architectures is vital.

- Client Asset Protection: Robust security is essential to protect both Core Scientific's own assets and the digital assets held by its colocation clients.

- Industry Cost of Breaches: The significant financial impact of cyber incidents, with average data breach costs escalating, emphasizes the need for strong defenses.

Development of Alternative Consensus Mechanisms

The blockchain industry is seeing significant shifts with the rise of alternative consensus mechanisms like Proof-of-Stake (PoS). This trend could impact infrastructure demand, potentially reducing the need for the energy-intensive Proof-of-Work (PoW) mining that Core Scientific specializes in. While Bitcoin, a major PoW player, continues its operations, the broader ecosystem's move towards energy efficiency presents a strategic consideration for Core Scientific's long-term planning and diversification.

For instance, Ethereum's successful transition to PoS in September 2022 marked a major milestone, drastically cutting its energy consumption. This shift highlights a growing preference for more sustainable blockchain technologies, which could influence investment decisions and the competitive landscape for PoW-focused companies like Core Scientific. The total value locked in PoS protocols has seen substantial growth, indicating increasing adoption and developer interest.

- Growing PoS Adoption: Ethereum's move to PoS is a prime example of this technological shift.

- Energy Efficiency Focus: The industry is increasingly prioritizing energy-efficient consensus models.

- Impact on Infrastructure: Alternative mechanisms may reduce demand for traditional PoW mining hardware.

- Diversification Opportunities: Core Scientific may need to explore new strategies to adapt to these evolving trends.

Technological advancements in Artificial Intelligence (AI) and machine learning are increasingly being integrated into data center operations, including those managed by Core Scientific. These technologies can optimize energy consumption, predict hardware failures, and enhance overall operational efficiency. For example, AI-driven predictive maintenance can reduce downtime by identifying potential issues before they impact operations, a crucial factor for a company managing large-scale mining infrastructure.

The development of more energy-efficient computing hardware, beyond just ASICs, is also a significant technological factor. Innovations in chip design and data center architecture aim to reduce the power footprint of digital operations. This trend is driven by both cost considerations and increasing environmental regulations, pushing companies like Core Scientific to adopt greener technologies.

The cybersecurity landscape is constantly evolving, with new threats emerging regularly. Core Scientific must stay ahead of these threats by continuously updating its security protocols and infrastructure. The increasing sophistication of ransomware and other cyberattacks, which cost the global economy trillions annually, necessitates robust and adaptive defense mechanisms to protect its operations and client data.

The ongoing evolution of blockchain technology itself, including potential upgrades to the Bitcoin protocol or the emergence of new, more efficient blockchain solutions, presents both opportunities and challenges. Core Scientific needs to monitor these developments to ensure its infrastructure remains compatible and competitive within the broader digital asset ecosystem.

| Technology Area | Advancement/Trend | Impact on Core Scientific | Example Data/Projection |

|---|---|---|---|

| ASIC Mining Hardware | Increased Hashrate & Efficiency | Lower operational costs, improved competitiveness | Next-gen ASICs targeting >200 TH/s with improved power efficiency (2024-2025) |

| Data Center Cooling | Liquid Immersion & Free Cooling | Reduced energy consumption (PUE), lower operating expenses | Potential PUE reduction from ~1.5 to ~1.1; Global cooling market projected at $21.6B by 2027 |

| Cybersecurity | Sophisticated Threat Landscape | Need for continuous investment in advanced security measures | Global cost of cybercrime projected at $10.5T annually by 2025; Average data breach cost ~$4.73M (2024) |

| Blockchain Consensus | Shift towards Proof-of-Stake (PoS) | Potential impact on demand for Proof-of-Work (PoW) infrastructure | Ethereum's successful PoS transition reducing energy use by >99% |

Legal factors

The legal landscape for cryptocurrencies and mining is in constant flux worldwide. Many jurisdictions are pushing for more defined rules and licensing procedures, creating a dynamic environment for companies like Core Scientific. This evolving framework directly impacts how they operate and manage their digital assets.

Core Scientific faces the challenge of adhering to a patchwork of compliance requirements. These include regulations for safeguarding digital assets, as well as stringent anti-money laundering (AML) and know-your-customer (KYC) protocols. The specific rules differ significantly from one country to another, influencing the company's ability to conduct business across various markets.

Core Scientific's operations, involving sensitive client data and extensive network infrastructure, necessitate strict adherence to data privacy and security laws. Regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) are paramount for protecting client information.

Failure to comply can result in significant financial penalties; for instance, GDPR violations can lead to fines of up to 4% of global annual revenue or €20 million, whichever is higher. For Core Scientific, maintaining robust security measures and transparent data handling practices is crucial for client trust and avoiding these substantial legal and financial repercussions.

Governments globally are tightening regulations on energy consumption and environmental impact, directly affecting energy-intensive industries like Bitcoin mining. Core Scientific, as a major player, must navigate these evolving legal landscapes, which could mandate specific energy efficiency standards or the adoption of renewable energy sources. For instance, some jurisdictions are exploring or have implemented carbon taxes that could increase operational expenses for mining facilities not utilizing cleaner energy.

These regulatory pressures can translate into significant capital expenditures for Core Scientific. Investing in more energy-efficient hardware or securing power purchase agreements for renewable energy, such as solar or wind, might become legal necessities rather than voluntary choices. Failure to comply could result in penalties, operational limitations, or reputational damage, impacting the company's long-term viability and profitability.

Taxation Policies on Digital Assets and Mining Income

The tax landscape for digital assets and cryptocurrency mining is continuously evolving. For Core Scientific, this means navigating varying regulations concerning capital gains on asset appreciation and income tax on block rewards. For instance, the U.S. Internal Revenue Service (IRS) continues to clarify its stance, with guidance issued in prior years treating virtual currency as property. This classification has implications for how gains and losses are reported.

Specific tax treatments can significantly influence Core Scientific's profitability. For example, if mining income (block rewards) is classified as ordinary income, it faces different tax rates than capital gains. Furthermore, some jurisdictions are exploring or implementing specific taxes on the energy consumption of mining operations, a factor that directly impacts the cost structure of energy-intensive businesses like Core Scientific. As of early 2024, the U.S. has not enacted a federal digital asset mining tax, but proposals have been discussed.

Core Scientific's financial planning must account for these legal factors. This includes:

- Monitoring legislative changes: Staying abreast of proposed and enacted tax laws related to digital assets and mining globally and in key operational jurisdictions.

- Compliance strategies: Developing robust systems for accurate tracking and reporting of mining income and digital asset transactions to meet tax obligations.

- Energy tax implications: Assessing the potential impact of any new or existing taxes levied on energy usage for mining operations.

- Cross-border tax considerations: Understanding how different national tax regimes affect international mining activities and digital asset holdings.

International Legal Frameworks for Blockchain Operations

Core Scientific's global reach in blockchain and digital asset markets necessitates navigating a complex web of international legal frameworks. Cross-border regulatory cooperation is crucial, yet significant discrepancies in laws across nations present substantial compliance challenges for companies operating internationally, as seen with varying data privacy regulations like GDPR versus other national standards.

These legal disparities can impact everything from how Core Scientific handles client data to the very legality of certain digital asset transactions in different jurisdictions. For instance, the evolving stance of countries like China and the United States on cryptocurrency mining and trading creates a dynamic and often unpredictable legal landscape that Core Scientific must actively monitor and adapt to.

- Jurisdictional Ambiguity: Differing legal interpretations of blockchain technology and digital assets across countries can lead to uncertainty in enforcement and compliance.

- Cross-Border Data Flows: International regulations on data privacy and security, such as the EU's GDPR, directly affect how Core Scientific can manage and transfer data globally.

- Regulatory Arbitrage Risk: Companies may face pressure to operate in jurisdictions with more lenient regulations, creating ethical and reputational risks.

- Evolving International Standards: The lack of uniform global standards for blockchain operations means Core Scientific must stay abreast of emerging best practices and potential future harmonizations.

Navigating the evolving legal environment is critical for Core Scientific, especially concerning digital asset regulations and data privacy. Compliance with varying international laws, such as GDPR and CCPA, is paramount, with potential fines for violations reaching up to 4% of global annual revenue. The company must also adapt to new energy consumption and tax regulations impacting its mining operations.

Environmental factors

Core Scientific's extensive Bitcoin mining operations demand substantial electricity, directly impacting its carbon footprint, especially when relying on fossil fuels. In 2023, the company reported consuming approximately 14.7 exahashes (EH) of energy, a figure that underscores the scale of its environmental considerations.

Growing pressure from investors and regulators is pushing Core Scientific to adopt more sustainable practices. This includes a strategic shift towards renewable energy sources and enhanced energy efficiency measures to meet global sustainability targets and investor expectations for environmental, social, and governance (ESG) performance.

Core Scientific's operational costs and sustainability goals are heavily influenced by the availability and cost of renewable energy. In 2024, the company continued its focus on securing power purchase agreements (PPAs) for renewable sources to mitigate energy price volatility and meet its environmental commitments.

The feasibility of sourcing solar, wind, and hydroelectric power directly impacts Core Scientific's ability to operate its energy-intensive data centers cost-effectively. As of early 2025, the ongoing expansion of renewable energy infrastructure across the United States, particularly in regions where Core Scientific operates, is expected to further improve access to cleaner and potentially more stable energy pricing.

The rapid evolution of mining hardware, particularly ASICs, leads to frequent upgrades and a significant volume of electronic waste. Core Scientific faces the challenge of managing this obsolescence responsibly. For instance, the lifespan of ASICs can be as short as 18-24 months before newer, more efficient models emerge, creating a continuous cycle of hardware turnover.

Implementing comprehensive e-waste management and recycling programs is crucial for Core Scientific. This involves not only proper disposal but also exploring opportunities for repurposing or refurbishing older equipment. Failure to do so could result in environmental penalties and reputational damage, especially as regulatory bodies increasingly focus on sustainable tech practices.

Water Usage for Cooling Systems

Core Scientific's reliance on cooling systems for its data centers presents a significant environmental consideration, particularly concerning water usage. Traditional cooling methods, such as evaporative cooling towers, can consume substantial volumes of water, a resource that is increasingly strained in many regions. This water intensity is a critical factor for Core Scientific to manage, especially as global water scarcity becomes a more pressing issue and regulatory bodies implement stricter water conservation policies.

The company must actively assess the water footprint of its existing and planned cooling infrastructure. Exploring and adopting water-efficient technologies is paramount to minimizing environmental impact. For instance, advancements in liquid cooling solutions or closed-loop systems can drastically reduce water consumption compared to older technologies. This proactive approach not only addresses environmental concerns but also mitigates operational risks associated with water availability and cost.

As of early 2024, the global data center industry's water consumption is a growing concern. Some reports indicate that large data centers can use millions of gallons of water per day. Core Scientific, as a major player, needs to be at the forefront of adopting more sustainable cooling practices. For example, initiatives focused on water reuse and recycling within their facilities could significantly offset their direct water intake.

- Water Consumption: Traditional cooling systems can be highly water-intensive, posing challenges in water-scarce regions.

- Efficiency Measures: Core Scientific should prioritize water-efficient cooling technologies and operational strategies.

- Regulatory Impact: Water conservation policies and regulations directly influence the operational costs and feasibility of water-dependent cooling systems.

- Sustainability Goals: Minimizing water usage aligns with broader corporate sustainability objectives and enhances brand reputation.

Environmental Impact Assessments for New Sites

Core Scientific's expansion and new data center development necessitate thorough environmental impact assessments. These studies are crucial for understanding how new sites might affect local ecosystems, water availability, air quality, and noise pollution. For instance, in 2024, the company likely faced stringent review processes for any new facility, ensuring compliance with evolving environmental regulations.

The outcomes of these assessments directly shape site selection, data center design, and the implementation of necessary mitigation strategies. Adherence to environmental protection standards is paramount, potentially involving significant investments in technologies to minimize ecological footprints. By 2025, expect continued focus on sustainable practices, with assessments detailing energy efficiency and waste management plans.

- Site Selection: Assessments guide the choice of locations to minimize disruption to sensitive habitats and water sources.

- Design Modifications: Findings can lead to design changes, such as incorporating advanced cooling systems to reduce water usage.

- Mitigation Measures: Requirements may include noise reduction barriers or air filtration systems to protect local communities.

- Regulatory Compliance: Ensuring all projects meet or exceed environmental protection standards is a key outcome.

Core Scientific's environmental performance is intrinsically linked to its energy consumption and hardware lifecycle. The company's substantial energy needs, measured in exahashes, highlight the importance of sustainable energy sourcing. Furthermore, the rapid obsolescence of mining hardware, with ASICs often lasting only 18-24 months, creates a significant e-waste challenge that requires responsible management.

Water usage for cooling data centers is another critical environmental factor. Traditional cooling methods can be highly water-intensive, prompting a need for Core Scientific to adopt water-efficient technologies and explore water reuse initiatives. By 2025, regulatory bodies and investors will continue to scrutinize water footprints, making sustainable cooling practices essential for operational viability and corporate reputation.

Environmental impact assessments are vital for Core Scientific's expansion plans, influencing site selection and data center design to minimize ecological disruption. These assessments ensure compliance with evolving environmental regulations and may necessitate investments in technologies that reduce noise pollution and improve air quality. Proactive environmental stewardship is key to long-term success.

PESTLE Analysis Data Sources

Our Core Scientific PESTLE Analysis is meticulously constructed using data from leading scientific journals, governmental environmental protection agencies, and reputable industry associations. This ensures that all insights into technological advancements, regulatory changes, and societal impacts are grounded in peer-reviewed research and official reports.